Global Well Intervention Market

Market Size in USD Billion

CAGR :

%

USD

8.90 Billion

USD

12.78 Billion

2024

2032

USD

8.90 Billion

USD

12.78 Billion

2024

2032

| 2025 –2032 | |

| USD 8.90 Billion | |

| USD 12.78 Billion | |

|

|

|

|

Well Intervention Market Size

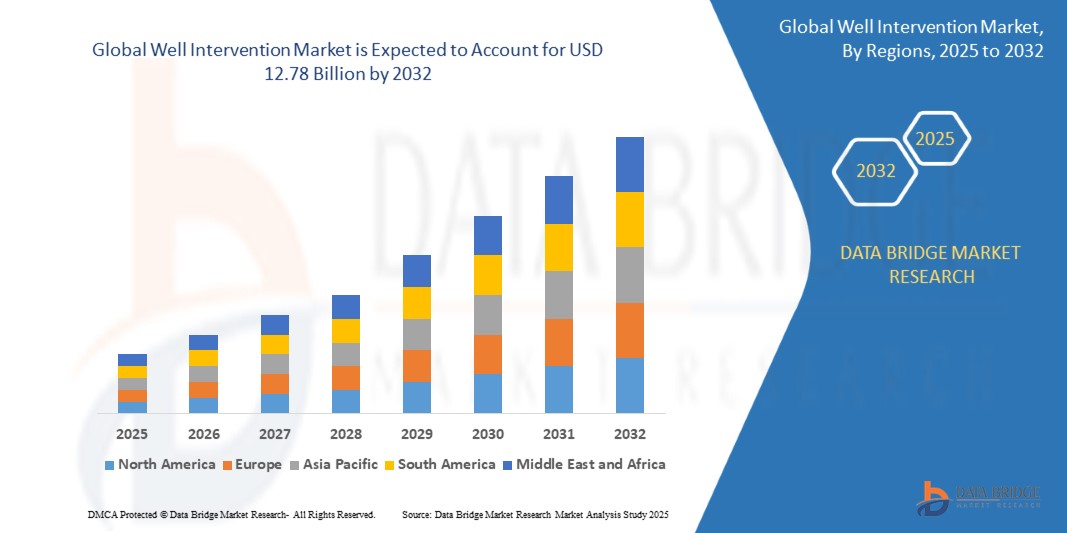

- The global Well Intervention market size was valued at USD 8.90 billion in 2024 and is expected to reach USD 12.78 billion by 2032, at a CAGR of 4.10% during the forecast period

- The growth of the market is primarily fueled by the rising demand for energy, which necessitates enhanced well productivity and prolonged well life across mature oilfields. As reservoirs deplete, oil & gas companies increasingly turn to intervention techniques—such as logging, perforation, stimulation, and zonal isolation—to optimize production efficiency without the need for new drilling.

- Additionally, the increased focus on cost-efficient recovery solutions, especially in mature onshore and offshore fields in regions like North America and the Middle East, is encouraging greater deployment of well intervention technologies.

Well Intervention Market Analysis

- Well Intervention solutions are vital in the oil & gas sector, offering a suite of services including logging & bottomhole surveys, stimulation, zonal isolation, sand control, and fishing, which collectively aim to improve or restore well productivity. These services are increasingly being used throughout the life cycle of oil and gas wells—from exploration to abandonment.

- The demand for well intervention is driven by the growing need to maintain aging oilfields and extract remaining reserves in a cost-effective manner. As global energy demand rises, operators are prioritizing maximizing recovery from existing assets instead of undertaking costly drilling of new wells.

- Digital transformation in the oilfield, including the integration of real-time data acquisition systems, machine learning, and remote operation capabilities, is enhancing the efficiency, safety, and precision of well intervention activities. These advancements allow for predictive maintenance and better reservoir understanding, thereby reducing operational risks.

- North America dominates the Well Intervention market with the largest revenue share of 36.2% in 2024, owing to the presence of a large number of mature wells in the U.S. and Canada. The U.S. shale boom and growing offshore activity in the Gulf of Mexico are major contributors. Operators in the region are heavily investing in intervention services to maintain and enhance production from declining wells.

- Asia-Pacific is expected to be the fastest-growing region in the Well Intervention market during the forecast period, supported by increased offshore exploration activities, especially in Malaysia, India, and China. Additionally, rising energy demand, national oil company investments, and a focus on energy security are accelerating the adoption of well intervention techniques in the region.

- The Logging & Bottomhole Survey segment leads the market with a 43.2% share in 2024, driven by its critical role in evaluating well conditions, diagnosing production problems, and informing operational decisions. These services are cost-effective and widely adopted in both onshore and offshore settings, enabling operators to make timely and accurate interventions to sustain production.

Report Scope and Well Intervention Market Segmentation

|

Attributes |

Well Intervention Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Well Intervention Market Trends

“Integration of Digital Oilfield Technologies and Real-Time Data Analytics”

- A prevailing trend in the global Well Intervention market is the adoption of digital oilfield technologies, including real-time data analytics, automation, and remote monitoring systems. These technologies are revolutionizing how operators perform interventions, optimize productivity, and reduce non-productive time.

- For instance, in November 2023, Schlumberger (SLB) launched its Ora intelligent wireline formation testing platform, which integrates real-time pressure, fluid sampling, and digital interpretation to enhance reservoir evaluation during intervention. This supports better decision-making and reduces operational delays.

- In July 2023, Halliburton introduced a new digital coiled tubing solution using its iEnergy® digital ecosystem, enabling predictive diagnostics and remote job planning for well interventions. This marks a significant step towards automated, low-risk well servicing.

- Similarly, Baker Hughes, in March 2023, announced the successful deployment of its GaugePro Echo real-time downhole data system in the Middle East, enabling improved zonal isolation and fluid identification during logging operations. The system provides acoustic-based telemetry for better data acquisition in real-time.

- The push for digital innovation is enabling AI-powered condition monitoring, real-time diagnostics, and predictive maintenance, making interventions more proactive, cost-efficient, and accurate. These trends are especially critical in high-stakes offshore and mature field operations.

- This trend is fundamentally reshaping how industries collect and utilize aerial imagery, shifting from static image capture to dynamic, real-time, AI-enhanced decision ecosystems.

Well Intervention Market Dynamics

Driver

“Increasing Focus on Enhancing Recovery from Aging Wells”

- A major driver of the Well Intervention market is the surging demand to enhance oil recovery from aging wells, especially in mature basins across North America, the North Sea, and parts of Asia-Pacific. As exploration for new reserves becomes costlier and riskier, intervention technologies are vital for sustaining output.

- For example, in April 2023, Expro Group secured a long-term contract from PTTEP in Thailand to deliver well intervention and integrity services to extend the life of offshore wells in the Gulf of Thailand. The company will deploy mechanical and slickline services to help maximize asset recovery.

- Likewise, TechnipFMC, in June 2023, was awarded a significant contract by Petrobras to provide subsea well intervention services using its light well intervention vessel (LWIV) fleet. The contract reflects the growing trend of revitalizing declining offshore wells in Brazil.

- National oil companies and independent operators are focusing on stimulation, water shut-off, and re-perforation services to prolong well life and reduce dependence on new drilling. These recovery-centric efforts are fueling steady demand for intervention solutions globally

Restraint/Challenge

“High Operational Complexity and Well Integrity Risks”

- A significant restraint in the Well Intervention market is the technical complexity and risk associated with high-pressure, high-temperature (HPHT) environments, aging well integrity, and challenging offshore conditions. These factors can compromise the safety and effectiveness of intervention operations.

- For instance, in February 2023, the UK’s Health and Safety Executive (HSE) reported a temporary shutdown at an offshore platform in the North Sea due to a well integrity failure during a wireline intervention, underscoring the potential hazards and associated downtime.

- Moreover, deepwater interventions require specialized equipment and skilled personnel, increasing operational costs and limiting participation to a few experienced players. Any failure during interventions in such settings can lead to environmental hazards, production loss, or equipment damage.

- To address these concerns, companies like Helix Energy Solutions and Altus Intervention are investing in modular, remotely operated intervention systems that reduce human exposure and improve risk mitigation. However, the capital-intensive nature of these technologies can be a barrier for small and mid-sized service providers.

Well Intervention Market Scope

The market is segmented on the basis of service, intervention type, well type, and application.

- By Service

On the basis of service, the Well Intervention market is segmented into Logging & Bottomhole Survey, Tubing/Packer Failure & Repair, Stimulation, Remedial Cementing, Zonal Isolation, Sand Control, Artificial Lift, Re-perforation, Fishing, and Others.

The Logging & Bottomhole Survey segment held the largest market share in 2024, driven by its critical role in reservoir evaluation and production optimization. The demand for advanced formation evaluation tools is rising as operators aim to maximize hydrocarbon recovery.

The Stimulation and Artificial Lift segments are projected to experience the highest CAGR during the forecast period due to the increasing focus on production enhancement in aging wells.

- By Intervention Type

On the basis of intervention type, the market is segmented into Light Intervention, Medium Intervention, and Heavy Intervention.

The Light Intervention segment dominated the market in 2024, supported by its cost-effectiveness and rapid deployment. Techniques such as slickline and wireline are widely used for diagnostics and simple maintenance tasks.

The Heavy Intervention segment is projected to witness notable growth, particularly in offshore environments where complex issues such as tubing repair and recompletions require heavier equipment and longer mobilization

- By Well Type

On the basis of well type, the Well Intervention market is divided into Horizontal Well and Vertical Well.

Horizontal Wells accounted for the largest revenue share in 2024 due to their widespread use in unconventional reservoirs such as shale formations. These wells often require periodic re-stimulation and clean-out operations

The Vertical Well segment continues to show steady demand, particularly in conventional oilfields in regions such as the Middle East, Southeast Asia, and parts of Africa, where well structures are simpler and interventions focus on extending field life with cost-effective services.

- By Application

On the basis of application, the market is segmented into Onshore and Offshore. The Onshore segment led the global Well Intervention market in 2024, supported by the high concentration of mature oilfields requiring frequent maintenance and enhanced oil recovery operations.

The Offshore segment is anticipated to register the fastest growth from 2025 to 2032. This growth is driven by increased subsea intervention activities in deepwater and ultra-deepwater fields, particularly in regions like the North Sea, Brazil, and West Africa.

Well Intervention Market Regional Analysis

- North America dominates the global Well Intervention market with the largest revenue share of 39.7% in 2024, attributed to a mature oil & gas sector, increasing shale operations, and widespread deployment of advanced well stimulation and intervention services. The region benefits from the presence of major service providers like Schlumberger, Halliburton, and Baker Hughes, who continue to innovate in real-time data logging, coiled tubing services, and remote well monitoring systems.

- The shale revolution in the U.S., particularly across the Permian Basin and Eagle Ford, continues to drive demand for cost-efficient, light and medium interventions. In March 2024, Halliburton launched its ExpressFiber™ service for rapid and affordable downhole data acquisition during interventions, highlighting the region’s shift toward digital well optimization.

U.S. Well Intervention Market Insight

The U.S. accounted for over 85% of the North American Well Intervention market in 2024. Strong drilling activity in onshore basins, coupled with increased focus on extending the life of mature wells, supports the market. The U.S. Department of Energy (DOE) has introduced incentives for revitalizing legacy oilfields using enhanced oil recovery (EOR) techniques, stimulating service demand.

Companies such as Nine Energy Service and Expro Group continue to deploy advanced logging and stimulation tools across Texas and North Dakota. Additionally, offshore regions like the Gulf of Mexico are seeing renewed investment in subsea intervention campaigns.

Europe Well Intervention Market Insight

The European Well Intervention market is poised for steady growth, driven by increased activity in mature offshore fields in the North Sea, as well as rising interest in geothermal and CO₂ storage well services. In January 2024, TechnipFMC expanded its well intervention capabilities through contracts in Norway for deepwater well remediation and heavy intervention services.

Regulatory pressure to reduce methane emissions is pushing operators to implement regular well integrity checks and diagnostics, especially in older production wells. Regions such as Norway and the U.K. are leading in offshore plug & abandonment (P&A) and zonal isolation activities.

U.K. Well Intervention Market Insight

The U.K. market is benefiting from government-backed decommissioning initiatives in the North Sea and investments in carbon capture and storage (CCS) wells. In February 2023, Petrofac secured a contract for well P&A services for multiple platforms, reinforcing the shift towards environmentally responsible intervention practices.

Digital well surveillance and cost-effective light intervention services are gaining momentum amid tighter profit margins in the North Sea.

Norway Well Intervention Market Insight

Norway is experiencing growing demand for wireline and coiled tubing services, with operators like Equinor prioritizing sustainable well enhancement. In 2024, Archer Limited announced the deployment of its new hydraulic intervention units for offshore campaigns on the Norwegian Continental Shelf.

Asia-Pacific Well Intervention Market Insight

The Asia-Pacific region is projected to register the fastest CAGR of 26.1% during 2025 to 2032, driven by increasing offshore exploration, redevelopment of mature fields, and investment in national energy security.

Countries such as India, Indonesia, and Malaysia are actively investing in onshore and shallow offshore interventions to boost production. For instance, in June 2023, ONGC (India) announced new contracts for remedial cementing and stimulation services in its western offshore fields.

China Well Intervention Market Insight

China held the largest market share in Asia-Pacific in 2024. National oil companies like CNPC and Sinopec are ramping up interventions in tight oil and gas reservoirs using zonal isolation, artificial lift optimization, and coiled tubing cleanouts. In 2023, Sinopec initiated AI-enabled diagnostic tools to improve re-perforation targeting and extend production from aging vertical wells.

India Well Intervention Market Insight

India’s well intervention market is expanding due to government initiatives to revive aging onshore wells in Rajasthan and Assam. In April 2024, Cairn Oil & Gas initiated a new campaign using advanced slickline and stimulation techniques to enhance output from its Barmer block. The country is also emphasizing digital well diagnostics and logging to optimize reservoir performance.

Middle East & Africa Well Intervention Market Insight

The Middle East continues to be a lucrative market, supported by massive mature fields in Saudi Arabia, the UAE, and Kuwait. In October 2023, Saudi Aramco signed multiple contracts for remedial cementing and zonal isolation services for its Ghawar field operations. Long-term well integrity and enhanced recovery are central to regional upstream strategies.

Africa, particularly Nigeria and Angola, is experiencing renewed interest in offshore heavy intervention projects as international oil companies return to the continent. TotalEnergies and ENI are actively expanding interventions to revitalize offshore assets.

Latin America Well Intervention Market Insight

Latin America’s market is primarily driven by Brazil and Argentina. Brazil is a hub for deepwater interventions, with Petrobras focusing on pre-salt field maintenance. In March 2024, Helix Energy Solutions began deepwater campaigns involving fishing and heavy interventions in the Campos Basin. Argentina’s Vaca Muerta shale play is also spurring demand for slickline and stimulation services to manage horizontal well output.

Well Intervention Market Share

The Well Intervention industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Halliburton Company (U.S.)

- Baker Hughes Company (U.S.)

- Weatherford International Plc. (Switzerland)

- TechnipFMC Plc. (U.K.)

- Oceaneering International, Inc. (U.S.)

- Archer Limited (U.K.)

- Expro Group (U.K.)

- National Oilwell Varco, Inc. (U.S.)

- China Oilfield Services Limited (China)

Latest Developments in Global Well Intervention Market

- In April 2024, Expro Group, a global energy services company, announced the successful deployment of its proprietary Octopoda™ annular intervention system in the North Sea. This innovative technology provides enhanced zonal isolation during well intervention campaigns and supports the growing demand for cost-effective and environmentally safe operations in mature offshore fields.

- In March 2024, Halliburton launched the ExpressFiber™ distributed acoustic sensing system, a single-use fiber solution designed to enable real-time data acquisition during well intervention and stimulation activities. This launch supports industry efforts toward digital well optimization and enhanced reservoir understanding, particularly in unconventional plays.

- In February 2024, Schlumberger (now SLB) announced a strategic collaboration with Petronas to deploy digital well intervention tools in Malaysia, leveraging cloud-based analytics and real-time coiled tubing services. The move aligns with Southeast Asia’s increasing focus on revitalizing brownfield assets and offshore productivity.

- In December 2023, Baker Hughes introduced its Integrated Well Intervention Services package, combining wireline, fishing, and remedial cementing operations. The offering is tailored to optimize well recovery while minimizing non-productive time (NPT), especially in high-cost offshore environments such as Brazil and the Gulf of Mexico.

- In October 2023, TechnipFMC was awarded a contract by Equinor to provide subsea well intervention services for the Njord field in Norway. The scope includes heavy intervention operations using advanced ROV-based tooling systems, marking a shift toward remote and robotics-enhanced subsea well access in the region.

- In August 2023, Archer Limited, a key well integrity and intervention services provider, announced the expansion of its modular hydraulic intervention units in the North Sea, enabling safer and more cost-efficient interventions on aging platforms. The development supports the region's plug and abandonment (P&A) and late-life asset strategies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.