Global Wet Laid Fiberglass Mat Market

Market Size in USD Million

CAGR :

%

USD

424.26 Million

USD

686.49 Million

2024

2032

USD

424.26 Million

USD

686.49 Million

2024

2032

| 2025 –2032 | |

| USD 424.26 Million | |

| USD 686.49 Million | |

|

|

|

|

Wet-Laid Fiberglass Mat Market Size

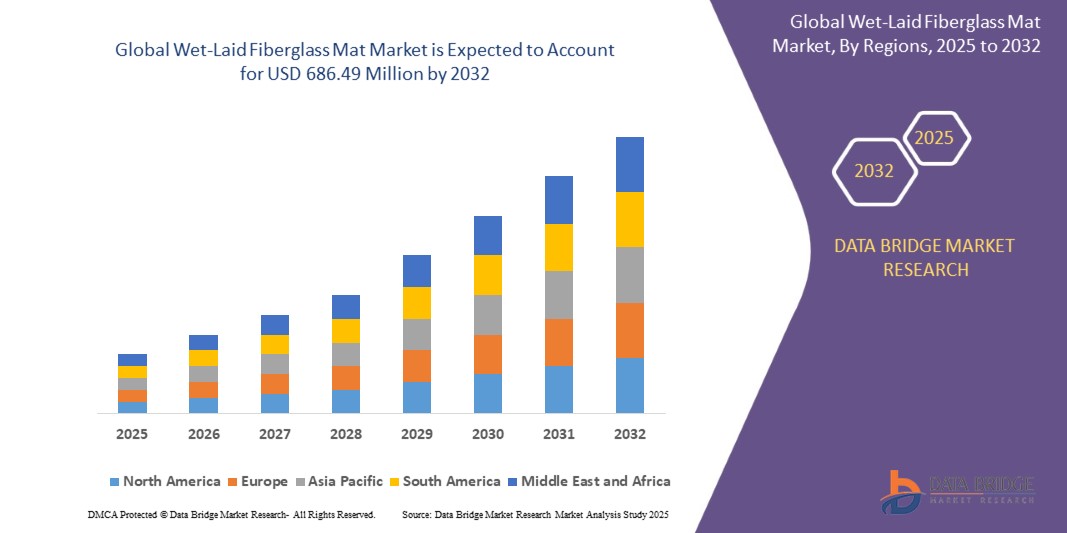

- The global wet-laid fiberglass mat market size was valued at USD 424.26 million in 2024 and is expected to reach USD 686.49 million by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is largely fueled by increasing demand for high-performance composite materials in construction, automotive, industrial filtration, and electronics sectors, where wet-laid fiberglass mats provide strength, durability, and fire resistance

- Furthermore, rising emphasis on sustainable and energy-efficient building materials, lightweight automotive components, and advanced industrial applications is driving manufacturers to adopt wet-laid fiberglass mats. These converging factors are accelerating market penetration, thereby significantly boosting industry growth

Wet-Laid Fiberglass Mat Market Analysis

- Wet-laid fiberglass mats are non-woven mats made from glass fibers bonded with a resin or binder, widely used for reinforcement in composites, insulation, and filtration applications. They provide uniform thickness, high tensile strength, and excellent chemical and thermal resistance, making them suitable for diverse industrial and construction applications

- The escalating demand for wet-laid fiberglass mats is primarily fueled by rapid urbanization, increasing automotive production, growing infrastructure projects, and the rising need for lightweight, durable, and eco-friendly composite materials across global markets

- North America dominated wet-laid fiberglass mat market with a share of 24.5% in 2024, due to strong demand from construction, automotive, and industrial sectors

- Asia-Pacific is expected to be the fastest growing region in the wet-laid fiberglass mat market during the forecast period due to rapid urbanization, rising infrastructure investments, and increasing adoption of automotive and industrial composites in countries such as China, Japan, and India

- Conventional products segment dominated the market with a market share of 55.7% in 2024, due to widespread use in traditional construction, automotive, and industrial applications. These mats provide reliable performance, strength, and cost efficiency, making them the standard choice for established manufacturing processes

Report Scope and Wet-Laid Fiberglass Mat Market Segmentation

|

Attributes |

Wet-Laid Fiberglass Mat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wet-Laid Fiberglass Mat Market Trends

Increasing Demand in Construction Industry

- The expansion of the global construction industry is significantly driving the demand for wet-laid fiberglass mats due to their widespread use in roofing, flooring, wall coverings, and insulation applications. Their durability, moisture resistance, and reinforcement qualities make them attractive for both residential and commercial construction projects

- For instance, Owens Corning has strengthened its product portfolio with advanced fiberglass mats designed for construction applications, ensuring improved fire resistance and dimensional stability. These mats are being increasingly utilized in roofing assemblies and laminate flooring, demonstrating how key manufacturers respond directly to heightened demand in building and infrastructure projects

- The growth of urbanization and infrastructure development in emerging economies is accelerating the adoption of wet-laid fiberglass mats. Mega infrastructure projects such as metro rail systems, highways, and high-rise residential complexes create consistent demand for high-performance building materials with enhanced strength and durability

- The rising focus on energy-efficient and sustainable buildings is influencing product adoption. With heightened interest in green construction, fiberglass mats are being used as insulation reinforcements and sustainable roofing components that support energy conservation while maintaining performance

- In addition, the trend of composite material usage in the construction industry is boosting growth opportunities for wet-laid fiberglass mats. These mats are increasingly incorporated into composites that are used for structural reinforcement, promoting lightweight construction without compromising strength

- The demand for durable, fire-retardant, and weather-resistant materials is spurring innovation in manufacturing processes. Manufacturers are developing customized fiberglass mats with higher tensile strength, improved thermal resistance, and user-friendly applications to better align with evolving construction requirements globally

Wet-Laid Fiberglass Mat Market Dynamics

Driver

Increasing Demand in the Automotive Sector

- The automotive industry is becoming a significant driver for the wet-laid fiberglass mat market due to the growing need for lightweight, durable, and heat-resistant components. Fiberglass mats are essential in headliners, interior panels, trunk liners, and flooring structures to enhance vehicle performance and passenger comfort

- For instance, Johns Manville supplies advanced fiberglass mats that are widely used in the interior applications of both passenger and commercial vehicles. These products provide acoustic insulation, lightweight reinforcement, and fire resistance, aligning with the global trend of automotive lightweighting and enhanced cabin comfort

- The shift toward electric vehicles is further strengthening demand, as fiberglass mats enhance thermal insulation and noise reduction in battery compartments and EV interiors. This has opened new opportunities for suppliers targeting automotive OEMs and component manufacturers

- In addition, stringent regulatory requirements on fuel efficiency and emission reduction have increased demand for lightweight materials. Wet-laid fiberglass mats help automakers reduce vehicle weight without sacrificing strength and safety, thereby supporting compliance with global automotive standards

- The growth of shared mobility services and increased urban transportation demand is also driving higher vehicle production volumes. With rising manufacturing needs, automotive suppliers are increasingly relying on fiberglass mats to produce cost-effective, lightweight, and durable components at industrial scale

Restraint/Challenge

Environmental Regulations and Compliance Costs

- Stringent environmental regulations associated with manufacturing fiberglass mats pose a major challenge to market growth. Compliance with laws related to emissions, waste management, and energy efficiency significantly increases operational costs for producers in this segment

- For instance, companies such as Saint-Gobain have faced regulatory pressures regarding emissions from fiberglass mat manufacturing plants in Europe, requiring them to invest heavily in cleaner technologies and waste management systems. These compliance requirements often impact profitability and increase product costs for end users

- The challenge is further amplified by the growing global emphasis on sustainability, prompting manufacturers to reassess their supply chains and raw material sourcing. Meeting eco-friendly standards requires continuous R&D investment and may slow down expansion in regions with strict environmental laws

- In addition, rising costs associated with treatment of industrial effluents and the installation of advanced filtration and emission control systems place a heavy financial burden on smaller manufacturers, making it difficult for them to compete with larger international players

- Uncertainties around evolving regulatory frameworks at both regional and international levels create additional risks for manufacturers. Companies must consistently adapt their production processes, which can delay innovation cycles and increase approval times for new product launches

Wet-Laid Fiberglass Mat Market Scope

The market is segmented on the basis of application, product type, fiber type, manufacturing process, environmental certification, and distribution channel.

• By Application

On the basis of application, the Wet-Laid Fiberglass Mat market is segmented into construction, automotive, industrial filtration, electronics, and others. The construction segment dominated the largest market revenue share in 2024, owing to the extensive use of fiberglass mats in roofing, insulation, and reinforcement of concrete structures. Builders and contractors prioritize wet-laid fiberglass mats for their strength, durability, and fire-resistant properties, which improve the overall longevity and safety of structures. In addition, their compatibility with other construction materials and ease of installation contribute to their widespread adoption in residential, commercial, and infrastructure projects. The growing focus on sustainable and resilient building materials further drives the demand for these mats in the construction sector.

The automotive segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing use in lightweight composite components to enhance vehicle fuel efficiency and safety. Fiberglass mats are increasingly incorporated in car body panels, interior components, and battery enclosures in electric vehicles. Their high strength-to-weight ratio, corrosion resistance, and adaptability to molding processes make them an ideal choice for automakers. The shift toward advanced, lightweight materials in automotive design is a key factor driving the rapid uptake of wet-laid fiberglass mats in this sector.

• By Product Type

On the basis of product type, the market is segmented into glass wool, glass mat, glass roving, and others. The glass mat segment held the largest market revenue share in 2024, supported by its versatility in providing reinforcement for composites used across construction, automotive, and industrial applications. Glass mats offer superior uniformity, tensile strength, and surface finish, making them a preferred material for manufacturers seeking consistent quality in laminated and molded products. The ease of integration with resins and coatings enhances their performance in demanding environments, driving continued adoption across industries.

The glass roving segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing use in high-performance composites and customized industrial applications. Glass rovings provide flexibility in weaving and molding, allowing manufacturers to create lightweight, durable, and complex-shaped components. Rising demand in sectors such as aerospace, automotive, and marine, where high-strength composite materials are essential, is fueling the rapid growth of this product type.

• By Fiber Type

On the basis of fiber type, the market is segmented into E-glass, S-glass, and others. The E-glass segment dominated the largest market revenue share in 2024, driven by its cost-effectiveness, high tensile strength, and wide availability. E-glass fibers are widely used in reinforcement applications across construction, automotive, and industrial filtration, making them a reliable and preferred choice for manufacturers. Their excellent chemical resistance, electrical insulation properties, and compatibility with various resins further support their broad adoption in composite production.

The S-glass segment is anticipated to witness the fastest CAGR from 2025 to 2032 due to its superior mechanical properties, including higher tensile strength, impact resistance, and thermal stability. S-glass is increasingly used in high-performance and specialty applications, such as aerospace, defense, and advanced automotive components, where reliability under extreme conditions is critical. The growing focus on lightweight, high-strength composites is accelerating the adoption of S-glass fibers.

• By Manufacturing Process

On the basis of manufacturing process, the market is segmented into continuous filament process, chopped strand process, and others. The continuous filament process segment held the largest market revenue share in 2024 due to its ability to produce uniform mats with consistent mechanical properties. Manufacturers prefer this process for applications requiring high strength, dimensional stability, and seamless integration into composite laminates. Continuous filament mats also reduce material wastage and improve production efficiency, making them a cost-effective choice for large-scale industrial applications.

The chopped strand process segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its suitability for versatile molding and complex composite designs. Chopped strand mats offer excellent conformability to molds and are widely used in automotive, construction, and marine applications. The increasing demand for lightweight and customizable composite components is contributing to the rapid growth of this manufacturing process segment.

• By Environmental Certification

On the basis of environmental certification, the market is segmented into eco-friendly products and conventional products. The conventional products segment dominated the largest market revenue share of 55.7% in 2024, supported by widespread use in traditional construction, automotive, and industrial applications. These mats provide reliable performance, strength, and cost efficiency, making them the standard choice for established manufacturing processes.

The eco-friendly products segment is anticipated to witness the fastest CAGR from 2025 to 2032 due to rising awareness about sustainability and regulations favoring low-emission, recyclable, and non-toxic materials. Manufacturers are increasingly adopting eco-friendly wet-laid fiberglass mats to meet green building certifications and reduce environmental impact. The growing trend of environmentally responsible construction and production practices is significantly driving the adoption of certified sustainable fiberglass mats.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and indirect sales. The direct sales segment held the largest market revenue share in 2024, driven by strong relationships between manufacturers and industrial buyers, enabling bulk supply and customized solutions. Direct distribution ensures reliable delivery schedules, technical support, and tailored offerings for large-scale construction, automotive, and industrial applications, strengthening its dominance in the market.

The indirect sales segment is expected to witness the fastest growth rate from 2025 to 2032 due to the increasing role of distributors, e-commerce platforms, and retail networks in expanding market reach. Indirect channels provide manufacturers access to smaller businesses, regional markets, and emerging economies. The convenience, accessibility, and competitive pricing offered through indirect channels are boosting their adoption in the global wet-laid fiberglass mat market.

Wet-Laid Fiberglass Mat Market Regional Analysis

- North America dominated the wet-laid fiberglass mat market with the largest revenue share of 24.5% in 2024, driven by strong demand from construction, automotive, and industrial sectors

- Manufacturers and end-users in the region prioritize high-quality fiberglass mats for their durability, strength, and fire-resistant properties. The widespread adoption is supported by advanced manufacturing capabilities, favorable regulatory frameworks, and a focus on sustainable and energy-efficient materials

- The U.S., as the largest contributor within North America, captured 81% of the regional market share, fueled by the growing use of composites in automotive lightweighting, insulation, and industrial applications. The presence of major fiberglass manufacturers and rising investment in infrastructure projects further bolster market growth

U.S. Wet-Laid Fiberglass Mat Market Insight

The U.S. wet-laid fiberglass mat market captured the largest revenue share in North America in 2024, driven by increasing adoption in construction, automotive, and industrial applications. Manufacturers and end-users prioritize fiberglass mats for their high tensile strength, durability, and fire-resistant properties, making them ideal for insulation, composite components, and industrial filtration systems. The market growth is further supported by the rising trend of lightweight automotive components, energy-efficient construction, and industrial modernization. In addition, robust R&D capabilities, strong manufacturing infrastructure, and favorable government initiatives promoting sustainable materials contribute to the widespread use of wet-laid fiberglass mats. The integration of advanced manufacturing technologies and growing investments in infrastructure projects are expected to continue propelling the U.S. market during the forecast period.

Europe Wet-Laid Fiberglass Mat Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent environmental and safety regulations and the increasing use of composites across construction and automotive sectors. Urbanization, coupled with a growing emphasis on energy-efficient buildings and lightweight vehicles, is fostering demand for fiberglass mats. Countries such as Germany, France, and Italy are witnessing high adoption due to investments in industrial modernization and sustainable manufacturing practices. The region is seeing significant growth across residential, commercial, and industrial applications, with fiberglass mats incorporated into both new constructions and retrofitting projects.

U.K. Wet-Laid Fiberglass Mat Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising construction activities, demand for lightweight automotive components, and the adoption of industrial filtration systems. The country’s focus on sustainable building practices, coupled with strong e-commerce and distribution channels, is supporting market expansion. Increasing awareness of fire-resistant and high-strength composite materials among manufacturers and builders is further stimulating the uptake of wet-laid fiberglass mats.

Germany Wet-Laid Fiberglass Mat Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by technological advancements in composite manufacturing and strong industrial applications. German manufacturers emphasize high-quality and eco-friendly fiberglass mats to meet local environmental regulations and sustainability goals. The integration of fiberglass mats in automotive, electronics, and industrial filtration applications, combined with the country’s well-developed infrastructure, supports consistent market growth.

Asia-Pacific Wet-Laid Fiberglass Mat Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising infrastructure investments, and increasing adoption of automotive and industrial composites in countries such as China, Japan, and India. Government initiatives promoting industrial modernization and digitalization are encouraging the use of high-performance fiberglass mats. The region is emerging as a manufacturing hub for composite materials, making fiberglass mats more affordable and accessible to a broader consumer base.

Japan Wet-Laid Fiberglass Mat Market Insight

The Japan market is gaining momentum due to the country’s advanced manufacturing sector, high-quality standards, and demand for durable, fire-resistant, and lightweight composite materials. The adoption of wet-laid fiberglass mats is driven by industrial applications in automotive, electronics, and filtration systems. Aging infrastructure replacement projects and an emphasis on energy-efficient construction further support growth in residential and commercial segments.

China Wet-Laid Fiberglass Mat Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid industrialization, expanding automotive production, and increased construction activities. China is a key manufacturing and consumption hub for fiberglass mats, with strong demand across automotive lightweighting, insulation, and industrial filtration sectors. Rising awareness of high-performance composite materials and government incentives for sustainable construction and industrial practices are further propelling market growth.

Wet-Laid Fiberglass Mat Market Share

The wet-laid fiberglass mat industry is primarily led by well-established companies, including:

- Owens Corning (U.S.)

- China Jushi Co., Ltd. (China)

- Nippon Electric Glass Co.,Ltd. (Japan)

- Saint-Gobain Vetrotex (France)

- Syna Publicidade (China)

- Binani Industries Ltd. (India)

- Johns Manville (U.S.)

- China Beihai Fiberglass Co., Ltd. (China)

- Taiwan Glass Ind. Corp. (Taiwan)

Latest Developments in Global Wet-Laid Fiberglass Mat Market

- In May 2024, 3B Fibreglass, a prominent fiberglass manufacturer, launched a new line of high-performance wet-laid fiberglass mats designed for wind energy applications. The mats feature enhanced mechanical properties to meet the specific requirements of wind turbine blade production. By introducing this product, 3B Fibreglass aims to support renewable energy initiatives and expand its presence in the high-performance composites market

- In April 2024, Johns Manville, a subsidiary of Berkshire Hathaway, unveiled plans to establish a new wet-laid fiberglass mat manufacturing plant in Vietnam. The facility will cater to the rapidly growing construction and automotive sectors in the Asia-Pacific region. By localizing production, Johns Manville aims to reduce lead times, cut transportation costs, and meet increasing demand for high-performance insulation materials in the regional market

- In March 2024, Saint-Gobain, a global leader in building materials, announced a €50 million investment to enhance its wet-laid fiberglass mat production capabilities in Europe. The project will involve upgrading existing facilities with energy-efficient technologies and expanding production capacity to meet the growing demand for sustainable construction materials. By implementing these improvements, Saint-Gobain aims to strengthen its market presence and support green building initiatives across the region

- In February 2024, Jushi Group Co., Ltd., a major player in the fiberglass industry, revealed plans to expand its production capacity for wet-laid fiberglass mats to meet increasing market demand. The expansion project, set to be completed by the end of 2024, will involve the construction of a new manufacturing facility equipped with state-of-the-art production lines and advanced technology. By ramping up production capacity, Jushi Group aims to strengthen its position in the global market and capitalize on growing opportunities in sectors such as construction, automotive, and infrastructure development

- In January 2024, Owens Corning, a leading manufacturer of fiberglass products, announced the launch of a new eco-friendly wet-laid fiberglass mat. This innovative product is made from recycled glass fibers and features a binder system with reduced VOC emissions, aligning with the company's sustainability goals. Introducing this environmentally conscious fiberglass mat reflects Owens Corning's commitment to reducing its environmental footprint and meeting the growing demand for sustainable construction materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.