Global Wet Pet Food Market

Market Size in USD Billion

CAGR :

%

USD

25.20 Billion

USD

37.50 Billion

2025

2033

USD

25.20 Billion

USD

37.50 Billion

2025

2033

| 2026 –2033 | |

| USD 25.20 Billion | |

| USD 37.50 Billion | |

|

|

|

|

Wet Pet Food Market Size

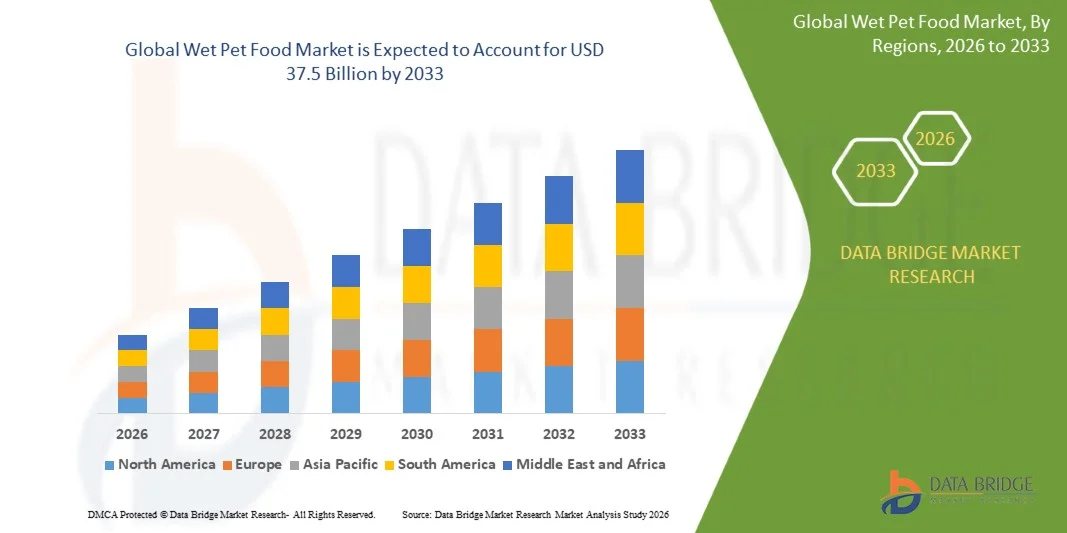

- The global wet pet food market size was valued at USD 25.2 billion in 2025 and is expected to reach USD 37.5 billion by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely driven by rising pet humanization and increasing awareness of pet nutrition, leading owners to prioritize high-quality, moisture-rich diets for their pets across both developed and emerging markets

- Furthermore, growing demand for premium, functional, and condition-specific wet pet food products, supported by higher disposable incomes and expanding retail and e-commerce availability, is accelerating adoption and strengthening overall market expansion

Wet Pet Food Market Analysis

- Wet pet food, offering high palatability, improved hydration, and enhanced digestibility, has become a crucial component of modern pet nutrition for both dogs and cats, particularly among aging pets and those with specific health needs

- The escalating demand for wet pet food is primarily fueled by increasing pet ownership, shifting consumer preference toward premium and natural formulations, and continuous product innovation by leading manufacturers focused on health, wellness, and convenience

- North America dominated the wet pet food market with a share of 42.2% in 2025, due to high pet ownership rates and strong consumer spending on premium pet nutrition

- Asia-Pacific is expected to be the fastest growing region in the wet pet food market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing pet adoption across major economies

- Dogs segment dominated the market with a market share of 62.5% in 2025, due to the higher global dog population and greater per-pet food consumption compared to cats. Dog owners increasingly prefer wet food due to its palatability, higher moisture content, and suitability for pets with dental or digestion issues. The rising trend of premiumization and humanization of dog food further strengthens demand for nutritionally enriched wet formulations tailored to different breeds and life stages

Report Scope and Wet Pet Food Market Segmentation

|

Attributes |

Wet Pet Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wet Pet Food Market Trends

“Premiumization of Wet Pet Food Products”

- A key trend shaping the wet pet food market is the growing premiumization of products, driven by pet owners increasingly treating pets as family members and seeking high-quality nutrition comparable to human food standards. This shift is encouraging manufacturers to focus on high-protein recipes, natural ingredients, and clean-label formulations that emphasize transparency and nutritional value

- For instance, Nestlé Purina PetCare has expanded its Pro Plan and Fancy Feast portfolios with premium wet food offerings that highlight grain-free formulations and functional health benefits. These launches reinforce consumer trust and strengthen brand positioning in the premium segment

- Leading players are increasingly emphasizing meat-first, high-moisture recipes to improve palatability and hydration, particularly for cats and senior pets. This trend supports demand for specialized wet food variants addressing digestion, urinary health, and weight management

- The premiumization trend is also evident in the growing availability of gourmet-style wet pet food, featuring novel proteins and texture-focused recipes. These products appeal to urban and higher-income consumers seeking differentiated feeding experiences for their pets

- Packaging innovations such as single-serve trays and portion-controlled packs are being adopted to enhance convenience and freshness perception. This evolution in product design is reinforcing premium brand appeal and encouraging repeat purchases

- Overall, premiumization is reshaping competitive dynamics by increasing average selling prices and driving manufacturers to invest in innovation, quality assurance, and brand storytelling to capture value-focused consumers

Wet Pet Food Market Dynamics

Driver

“Rising Pet Humanization and Focus on Pet Health”

- Rising pet humanization is a primary driver of the wet pet food market, as owners increasingly prioritize nutrition, wellness, and preventive healthcare for their pets. This shift is accelerating demand for wet food due to its perceived health benefits, including higher moisture content and improved digestibility

- For instance, Mars Petcare has expanded its wet pet food portfolio across brands such as Royal Canin and Pedigree to address specific breed, age, and health requirements. These offerings support tailored nutrition strategies aligned with veterinary recommendations

- Growing awareness of obesity, dental issues, and urinary health problems in pets is encouraging owners to choose wet food as part of balanced diets. Veterinary endorsements and clinical nutrition research are further reinforcing this preference

- The driver is strengthened by increasing disposable incomes and willingness to spend on premium pet care products, particularly in North America and Europe. Consumers are actively seeking nutritionally complete and functional wet food solutions

- Collectively, pet humanization and health awareness are transforming feeding habits and positioning wet pet food as a core component of modern pet nutrition

Restraint/Challenge

“High Production and Packaging Costs of Wet Pet Food”

- The wet pet food market faces notable challenges due to high production and packaging costs associated with moisture-rich formulations and strict safety standards. Wet pet food requires advanced processing methods, including sterilization and controlled sealing, which increase operational complexity

- For instance, Freshpet relies on refrigerated production and distribution infrastructure to maintain product freshness, significantly raising manufacturing and logistics costs. These requirements limit cost flexibility and impact pricing strategies

- Packaging materials such as cans, trays, and pouches add to overall expenses, particularly amid fluctuations in metal and plastic prices. Compliance with food safety and shelf-life regulations further elevates cost pressures for manufacturers

- Smaller producers face difficulties in scaling operations while maintaining quality and affordability, creating barriers to entry and expansion. This challenge is more pronounced in price-sensitive markets where consumers may prefer dry food alternatives

- Overall, high production and packaging costs remain a key restraint, influencing pricing, scalability, and long-term profitability within the wet pet food market

Wet Pet Food Market Scope

The market is segmented on the basis of pet, distribution channel, and source.

• By Pet

On the basis of pet, the wet pet food market is segmented into dogs and cats. The dogs segment dominated the market with the largest revenue share of 62.5% in 2025, driven by the higher global dog population and greater per-pet food consumption compared to cats. Dog owners increasingly prefer wet food due to its palatability, higher moisture content, and suitability for pets with dental or digestion issues. The rising trend of premiumization and humanization of dog food further strengthens demand for nutritionally enriched wet formulations tailored to different breeds and life stages.

The cats segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing cat adoption in urban households and smaller living spaces. Wet pet food is particularly favored for cats due to its high protein content and moisture levels that support urinary tract health. Growing awareness of feline-specific nutritional needs and the launch of gourmet and functional wet cat food variants continue to accelerate segment growth.

• By Distribution Channel

On the basis of distribution channel, the wet pet food market is segmented into pet specialty stores, supermarkets/hypermarkets, convenience stores, and online. Pet specialty stores dominated the market in 2025, owing to their wide assortment of premium and therapeutic wet pet food brands along with expert staff guidance. These stores are preferred by pet owners seeking specialized nutrition, vet-recommended products, and trusted brand portfolios. Strong supplier relationships and in-store promotions further reinforce their leading position.

The online segment is projected to register the fastest growth rate from 2026 to 2033, driven by rising e-commerce penetration and the convenience of home delivery. Subscription models, competitive pricing, and access to a broader range of international and niche brands attract digitally savvy pet owners. Increasing use of mobile apps and direct-to-consumer platforms by pet food manufacturers also supports rapid expansion.

• By Source

On the basis of source, the wet pet food market is segmented into animal-based, plant derivatives, and synthetic. The animal-based segment accounted for the largest market revenue share in 2025, supported by its high protein content and closer alignment with the natural dietary preferences of dogs and cats. Consumers perceive animal-based wet food as more nutritious and palatable, particularly for pets with higher energy and muscle maintenance needs. The dominance of meat, fish, and poultry-based formulations across premium and mass categories sustains strong demand.

The plant derivatives segment is anticipated to grow at the fastest pace during the forecast period, fueled by increasing interest in sustainable and ethically sourced pet food options. Pet owners are gradually adopting plant-inclusive formulations for specific dietary requirements and allergy management. Innovation in plant protein processing and balanced nutrition formulations further enhances acceptance of this segment.

Wet Pet Food Market Regional Analysis

- North America dominated the wet pet food market with the largest revenue share of 42.2% in 2025, driven by high pet ownership rates and strong consumer spending on premium pet nutrition

- Pet owners in the region increasingly prioritize high-protein, natural, and functional wet pet food products that support digestive health, hydration, and overall wellness

- This strong adoption is supported by well-established pet care infrastructure, high awareness of pet humanization trends, and the presence of leading global pet food brands, positioning wet pet food as a preferred choice across households

U.S. Wet Pet Food Market Insight

The U.S. wet pet food market accounted for the largest revenue share within North America in 2025, fueled by a large dog and cat population and growing preference for premium and specialized diets. Consumers are increasingly opting for grain-free, organic, and vet-recommended wet food formulations to address specific health needs. The strong presence of e-commerce platforms, subscription-based delivery models, and continuous product innovation further supports sustained market growth.

Europe Wet Pet Food Market Insight

The Europe wet pet food market is expected to grow at a steady CAGR during the forecast period, driven by rising awareness of pet nutrition and increasing adoption of premium pet food products. European consumers show strong interest in clean-label, sustainably sourced, and ethically produced wet pet food. Growth is supported by increasing pet adoption, particularly among younger households, and a strong retail presence across both offline and online channels.

U.K. Wet Pet Food Market Insight

The U.K. wet pet food market is projected to witness notable growth during the forecast period, supported by high pet ownership and strong demand for natural and high-meat-content pet food. Concerns related to pet obesity and digestive health are encouraging owners to shift toward nutritionally balanced wet food options. The country’s mature retail ecosystem and rising penetration of premium private-label brands continue to stimulate market expansion.

Germany Wet Pet Food Market Insight

The Germany wet pet food market is anticipated to expand at a considerable CAGR, driven by increasing focus on pet health, sustainability, and product transparency. German consumers favor high-quality, additive-free wet pet food with clear ingredient labeling. The market benefits from strong demand across both dogs and cats, along with growing acceptance of functional and veterinary-recommended formulations.

Asia-Pacific Wet Pet Food Market Insight

The Asia-Pacific wet pet food market is expected to register the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing pet adoption across major economies. Changing lifestyles and growing awareness of pet nutrition are accelerating the shift from homemade food to commercial wet pet food. Expanding retail networks and growing penetration of international pet food brands further boost regional growth.

Japan Wet Pet Food Market Insight

The Japan wet pet food market is gaining traction due to the country’s aging pet population and strong emphasis on convenience and quality nutrition. Wet pet food is widely preferred for its ease of consumption and suitability for older pets with dental or health issues. High demand for premium, portion-controlled, and functional wet food products continues to drive market momentum.

China Wet Pet Food Market Insight

The China wet pet food market held the largest revenue share in Asia Pacific in 2025, driven by rapid growth in pet ownership and increasing disposable income among urban households. Rising awareness of pet health and strong influence of Western pet care trends are accelerating adoption of commercial wet pet food. The presence of domestic manufacturers, competitive pricing, and rapid expansion of online sales channels significantly support market growth in China.

Wet Pet Food Market Share

The wet pet food industry is primarily led by well-established companies, including:

- VAFO Group a.s. (Czech Republic)

- Freshpet Inc. (U.S.)

- Tiernahrung Deuerer GmbH (Germany)

- Blue Buffalo Co. Ltd. (U.S.)

- Harringtons Pet Food (U.K.)

- Darling Ingredients Inc. (U.S.)

- Champion Petfoods Holding Inc. (Canada)

- Phelps Pet Products (U.S.)

- Nestle SA (Switzerland)

- De Haan Petfood (Netherlands)

- Mars Inc. (U.S.)

- FirstMate Pet Foods (Canada)

- Schell and Kampeter Inc. (U.S.)

- Beaphar Beheer BV (Netherlands)

- Spectrum Brands Inc. (U.S.)

- C and D Foods Ltd. (Ireland)

- Simmons Foods Inc. (U.S.)

- Evangers Dog and Cat Food Co. Inc. (U.S.)

- Colgate Palmolive Co. (U.S.)

- Clearlake Capital Group L.P. (U.S.)

Latest Developments in Global Wet Pet Food Market

- In February 2025, Royal Canin completed the acquisition of Aguas Frescas, a Mexico-based wet pet food producer, significantly strengthening its footprint in Latin America. This move enables Royal Canin to localize production, improve supply chain efficiency, and better respond to rising regional demand for wet pet food. The acquisition enhances its competitive positioning by expanding access to emerging consumer bases and reinforcing its leadership in premium pet nutrition across developing markets

- In January 2024, Nestlé Purina PetCare launched a new range of grain-free, high-protein wet cat food under its Pro Plan label, addressing the growing shift toward premium and health-focused pet diets. This product expansion strengthens Purina’s presence in the premium wet pet food segment by appealing to pet owners seeking functional nutrition solutions. The launch supports market growth by driving innovation and reinforcing premiumization trends within the wet pet food category

- In July 2023, Champion Petfoods, under Mars, Incorporated, introduced the ACANA Premium Pâté wet cat food line, emphasizing prey-based nutrition and hydration benefits. This launch broadens the company’s wet food portfolio and enhances its appeal among consumers prioritizing natural and biologically appropriate diets. The development strengthens Champion Petfoods’ competitive stance by expanding choice in the premium wet cat food market and supporting long-term brand differentiation

- In April 2023, Mars Petcare expanded its SHEBA portfolio with the introduction of PERFECT PORTIONS Wet Kitten Food, targeting early-life nutrition needs. This product introduction allows the company to capture demand across different cat life stages while reinforcing brand loyalty among new pet owners. The move supports market expansion by increasing product depth in the kitten nutrition segment and strengthening Mars Petcare’s overall wet pet food offering

- In March 2023, Hill’s Pet Nutrition, a subsidiary of Colgate-Palmolive, launched Prescription Diet ONC Care, a specialized wet food line for pets diagnosed with cancer. This development enhances Hill’s presence in the therapeutic and veterinary-recommended wet pet food segment, reinforcing its role in clinical nutrition. The gradual global rollout of this range strengthens the company’s market position by addressing unmet medical nutrition needs and deepening relationships with veterinary channels worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.