Global Wheel And Tire Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.32 Billion

USD

4.55 Billion

2024

2032

USD

3.32 Billion

USD

4.55 Billion

2024

2032

| 2025 –2032 | |

| USD 3.32 Billion | |

| USD 4.55 Billion | |

|

|

|

|

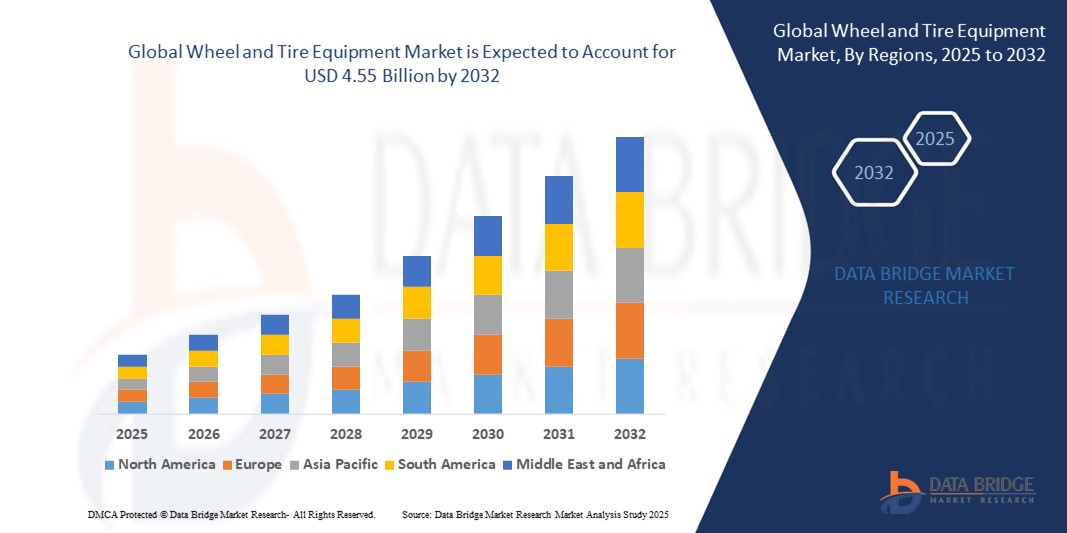

What is the Global Wheel and Tire Equipment Market Size and Growth Rate?

- The global wheel and tire equipment market size was valued at USD 3.32 billion in 2024 and is expected to reach USD 4.55 billion by 2032, at a CAGR of 4.00% during the forecast period

- The wheels and tire equipment market encompasses a wide range of products and services related to the manufacturing, distribution, and maintenance of automotive wheels and tires. With the global automotive industry experiencing steady growth, the demand for wheels and tire equipment continues to rise

- This market includes components such as rims, tires, tire pressure monitoring systems (TPMS), tire changers, wheel alignment machines, and balancing equipment. Key drivers of market growth include increasing vehicle production, technological advancements in tire design and manufacturing, and growing aftermarket sales. The market is competitive, with leading players focusing on innovation, sustainability, and customer-centric solutions

What are the Major Takeaways of Wheel and Tire Equipment Market?

- The rising demand for passenger vehicles serves as a significant catalyst for the expansion of the global wheel and tire equipment market. As more consumers purchase cars for personal and commercial use, the need for high-quality tires and efficient wheel equipment increases. This trend is fueled by factors such as urbanization, improving economic conditions, and technological advancements in the automotive industry

- Manufacturers in this sector are poised to benefit from the growing market opportunities, leading to innovations in tire designs, enhanced durability, and advanced wheel equipment to meet the evolving demands of vehicle owners worldwide

- North America dominated the wheel and tire equipment market with the largest revenue share of 36.78% in 2024, driven by strong demand from the automotive aftermarket, robust vehicle ownership rates, and the growing trend of advanced tire service automation

- Asia-Pacific wheel and tire equipment market is projected to grow at the fastest CAGR of 7.25% from 2025 to 2032, driven by surging vehicle ownership, expanding automotive production, and rapid workshop modernization in China, India, and Southeast Asia

- The wheel balancer segment dominated the market with the largest revenue share of 34.6% in 2024, driven by the increasing need for precise wheel balancing to improve vehicle safety, extend tire life, and enhance driving comfort

Report Scope and Wheel and Tire Equipment Market Segmentation

|

Attributes |

Wheel and Tire Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wheel and Tire Equipment Market?

Automation and Digital Integration in Wheel and Tire Servicing

- A significant trend in the global wheel and tire equipment market is the increasing adoption of automation, digital diagnostics, and connected service technologies in tire changers, wheel balancers, alignment machines, and inflation systems. These advancements are transforming workshop efficiency, accuracy, and safety

- For instance, Hunter Engineering offers fully automated alignment systems that integrate with vehicle ADAS calibration tools, reducing service times and ensuring precise adjustments. Similarly, Corghi’s “Artiglio” range of tire changers uses automatic bead-breaking and leverless mounting to minimize operator effort and prevent tire damage

- IoT integration allows equipment to send performance data, service alerts, and calibration reminders directly to technicians’ dashboards or mobile apps. This connectivity ensures proactive maintenance, reducing downtime. Some systems even feature AI-powered diagnostics to recommend optimal service settings for specific vehicle models

- The integration of touchscreen interfaces and remote operation capabilities is streamlining workflow in both independent garages and OEM-authorized service centers. Technicians can access vehicle specifications, service histories, and real-time training videos without leaving the workstation

- Leading manufacturers such as Snap-on and John Bean are investing in digital ecosystems that link wheel and tire service data with customer management platforms, enabling workshops to offer faster, more transparent, and personalized services

- This trend is driving a shift towards smarter, connected, and operator-friendly equipment, positioning advanced wheel and tire tools as essential components in modern automotive service operations

What are the Key Drivers of Wheel and Tire Equipment Market?

- The rising global vehicle parc, coupled with increasing demand for high-performance and fuel-efficient tires, is a major driver for wheel and tire equipment adoption

- For instance, in March 2024, Bosch Automotive Service Solutions expanded its workshop equipment portfolio with new high-speed wheel balancers and ADAS-ready alignment systems, catering to the growing need for precision servicing

- The shift towards larger and low-profile tires in passenger cars and SUVs is pushing workshops to invest in advanced changers and balancers capable of handling more complex wheel assemblies

- Regulatory standards on tire safety and periodic vehicle inspections in regions such as Europe and Asia-Pacific are creating sustained demand for alignment, balancing, and tread depth measurement equipment

- The surge in electric vehicle (EV) adoption is also boosting the market, as EVs require more frequent tire maintenance due to higher torque loads, prompting workshops to adopt equipment specifically designed for EV-compatible wheels and tires

- In addition, the rise of automated service centers and franchise-based quick-fit chains is accelerating equipment upgrades to improve service speed, accuracy, and customer satisfaction

Which Factor is challenging the Growth of the Wheel and Tire Equipment Market?

- High initial investment costs for advanced wheel and tire equipment remain a major barrier, particularly for small and independent workshops in developing markets

- For instance, fully automated alignment systems with ADAS integration can cost significantly more than basic setups, making ROI slower for low-volume service providers

- The need for skilled operators to handle modern equipment also poses a challenge, as improper usage can lead to inaccurate servicing or equipment damage, deterring some businesses from upgrading

- In addition, the rapid pace of technological advancement means equipment can become outdated within a few years, leading to concerns over long-term value and the cost of continual upgrades

- Fluctuations in raw material prices, particularly steel and electronic components, can increase manufacturing costs and, in turn, equipment prices

- Overcoming these challenges will require manufacturers to offer flexible financing options, modular upgrade paths, and comprehensive training programs to make advanced servicing solutions accessible to a broader market

How is the Wheel and Tire Equipment Market Segmented?

The market is segmented on the basis of equipment type, vehicle type, and end user.

- By Equipment Type

On the basis of equipment type, the wheel and tire equipment market is segmented into wheel balancer, tire changer, tire inflator, wheel alignment systems, and lifting equipment. The wheel balancer segment dominated the market with the largest revenue share of 34.6% in 2024, driven by the increasing need for precise wheel balancing to improve vehicle safety, extend tire life, and enhance driving comfort. Automotive service centers prioritize wheel balancers due to their ability to minimize vibration, reduce uneven tire wear, and improve fuel efficiency.

The wheel alignment systems segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by rising adoption in professional garages and OEM service centers. Growing demand for advanced, computer-assisted alignment systems to meet modern vehicle specifications and reduce tire replacement costs further accelerates market growth.

- By Vehicle Type

On the basis of vehicle type, the wheel and tire equipment market is segmented into two wheelers, passenger vehicles, and commercial vehicles. The passenger vehicle segment held the largest revenue share of 47.8% in 2024, attributed to the rising global car ownership rates, regular maintenance requirements, and the growing emphasis on ride comfort and fuel economy. The segment benefits from a higher service frequency compared to commercial and two-wheeler categories.

The commercial vehicle segment is expected to register the fastest CAGR from 2025 to 2032, driven by the increasing adoption of heavy-duty trucks and buses in logistics, construction, and transportation industries. The need for specialized tire-changing and balancing equipment for large wheels is a major growth driver.

- By End User

On the basis of end user, the wheel and tire equipment market is segmented into automotive repair shops, tire service centers, motorcycle repair shops, and automotive OEM dealerships. The automotive repair shops segment dominated the market with the largest revenue share of 39.2% in 2024, owing to the widespread presence of independent repair shops offering cost-effective and timely wheel and tire maintenance services. Their versatility in servicing multiple vehicle types and brands makes them the preferred choice for many customers.

The automotive OEM dealerships segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the trust factor associated with authorized service centers, use of genuine spare parts, and integration of advanced diagnostic and maintenance technologies.

Which Region Holds the Largest Share of the Wheel and Tire Equipment Market?

- North America dominated the wheel and tire equipment market with the largest revenue share of 36.78% in 2024, driven by strong demand from the automotive aftermarket, robust vehicle ownership rates, and the growing trend of advanced tire service automation

- The region benefits from a mature automotive service infrastructure, widespread use of high-performance and specialty tires, and a rising preference for precision wheel balancing and alignment technologies

- In addition, increasing investments in commercial fleet maintenance and the adoption of advanced diagnostic and repair tools are further propelling market demand

U.S. Wheel and Tire Equipment Market Insight

The U.S. wheel and tire equipment market captured the largest revenue share in 2024 within North America, fueled by the presence of a vast automotive service network, high replacement rates for tires, and rapid adoption of automated tire changers and wheel balancers. A growing DIY maintenance culture, combined with the strong presence of global equipment manufacturers, supports market expansion. Moreover, demand for specialized equipment for electric vehicles (EVs) and performance tires is gaining momentum, enhancing the industry's growth potential.

Europe Wheel and Tire Equipment Market Insight

The Europe wheel and tire equipment market is projected to witness substantial growth over the forecast period, driven by stringent vehicle safety regulations, periodic vehicle inspection mandates, and a growing focus on fuel efficiency through proper tire maintenance. Rising vehicle production, especially in Germany, France, and Italy, along with the shift toward advanced workshop automation, is boosting demand. Wheel and tire equipment adoption is also increasing in both independent garages and OEM-authorized service centers.

U.K. Wheel and Tire Equipment Market Insight

The U.K. market is anticipated to grow steadily due to expanding vehicle fleets, rising adoption of EVs, and the need for specialized tire handling equipment. Increasing safety awareness among consumers, coupled with the country’s focus on MOT compliance, is driving demand for advanced wheel alignment and balancing systems.

Germany Wheel and Tire Equipment Market Insight

Germany’s market is fueled by its position as a leading automotive manufacturing hub, high workshop automation levels, and the growing demand for precision tire service equipment. The emphasis on performance and efficiency is prompting the adoption of premium-grade equipment in both OEM and aftermarket facilities.

Which Region is the Fastest Growing Region in the Wheel and Tire Equipment Market?

Asia-Pacific wheel and tire equipment market is projected to grow at the fastest CAGR of 7.25% from 2025 to 2032, driven by surging vehicle ownership, expanding automotive production, and rapid workshop modernization in China, India, and Southeast Asia. Rising disposable incomes, combined with government initiatives to enhance road safety, are fostering the adoption of modern wheel and tire service solutions.

Japan Wheel and Tire Equipment Market Insight

Japan’s market growth is supported by its advanced automotive technology landscape, high vehicle maintenance standards, and increasing adoption of automated tire changing and balancing machines. The prevalence of compact urban workshops is fueling demand for space-efficient, multi-functional service equipment.

China Wheel and Tire Equipment Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its vast automotive aftermarket, booming vehicle sales, and expanding network of tire service centers. Government-backed smart workshop initiatives and the availability of cost-effective, locally manufactured equipment are further driving adoption.

Which are the Top Companies in Wheel and Tire Equipment Market?

The wheel and tire equipment industry is primarily led by well-established companies, including:

- Bridgestone Corporation (Japan)

- Michelin Group (France)

- Continental AG (Germany)

- Goodyear Tire & Rubber Company (U.S.)

- Pirelli & C. S.p.A (Italy)

- Sumitomo Rubber Industries (Japan)

- Hankook (South Korea)

- Yokohama Rubber Company (Japan)

- Toyo Tires (Japan)

- Giti Tire (Singapore)

- Maxxis (Taiwan)

- ZC Rubber (China)

- MRF Tires (India)

- Apollo Tyres (India)

What are the Recent Developments in Global Wheel and Tire Equipment Market?

- In August 2024, BORBET GmbH, a leading global manufacturer of light alloy wheels, announced its acquisition of Dymag Technologies Limited, including the Dymag brand, patents, and production facilities. Dymag, based in Chippenham, England, is well-known for producing carbon and magnesium wheels for cars and motorcycles, supplying BX-F wheels to aftermarket customers in the U.S. and Asia, as well as Tier 1 manufacturers worldwide. CEO Burkhard Plett stated that this acquisition would expand BORBET’s portfolio to include advanced carbon and magnesium rims, strengthening its position in the global wheel market. This move strategically positions BORBET to cater to both high-performance and mainstream market demands

- In December 2023, Enkei International, Inc. launched three new automotive wheel designs, namely the Enkei Vanquish, Enkei Adventurer, and Enkei Giotto. The Vanquish, featuring a distinctive 8-spoke design, is crafted for performance models such as the Toyota GR86, Subaru BRZ, and WRX. The Adventurer, designed for off-road enthusiasts, boasts a robust 10-spoke build with intricate detailing for durability and style. The Giotto offers a refined 5-spoke design in gloss black or gunmetal, available in 18 or 19 inches. These new launches diversify Enkei’s offerings, catering to both performance and lifestyle-oriented drivers

- In October 2022, Continental AG expanded its agricultural tire portfolio by introducing new sizes in its TractorMaster and CompactMaster AG/EM product lines. This expansion responds to the growing trend of larger, more powerful agricultural machinery and the rising demand for bigger, technologically advanced tires. This development enables Continental to better serve the evolving needs of the agricultural sector

- In November 2022, Ronal Group of Switzerland introduced the R70-blue aluminum wheel, manufactured with a neutral product carbon emission footprint. The company also committed to reducing its CO₂ emissions in its own production processes by 50% by 2030. This initiative reinforces Ronal Group’s commitment to sustainable manufacturing in the wheel industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.