Global Wheelbarrow Market

Market Size in USD Million

CAGR :

%

USD

802.90 Million

USD

970.65 Million

2024

2032

USD

802.90 Million

USD

970.65 Million

2024

2032

| 2025 –2032 | |

| USD 802.90 Million | |

| USD 970.65 Million | |

|

|

|

|

Wheelbarrow Market Size

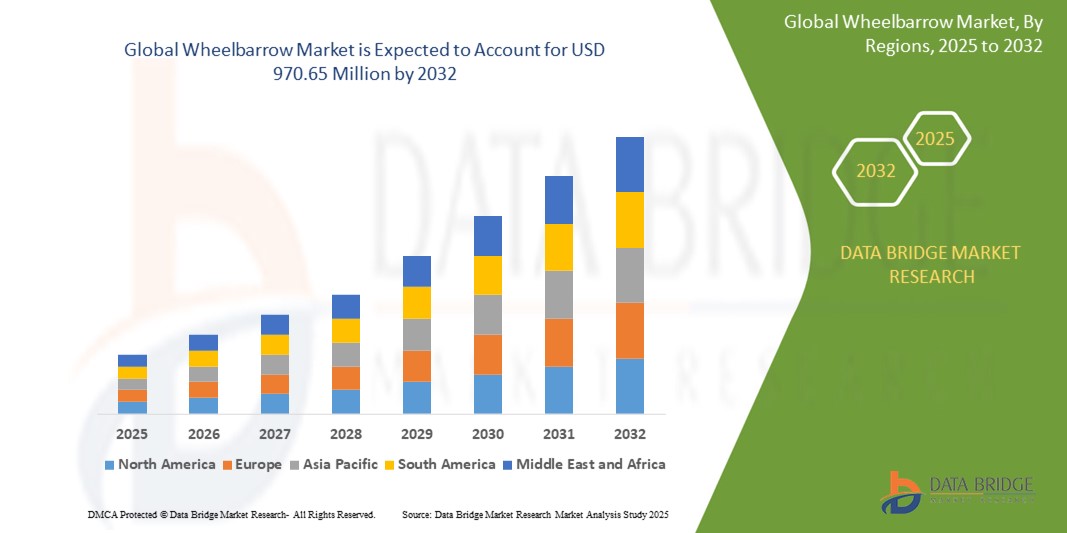

- The global wheelbarrow market size was valued at USD 802.9 million in 2024 and is expected to reach USD 970.65 million by 2032, at a CAGR of 2.4% during the forecast period

- This growth is driven by factors such as the increasing demand for gardening and landscaping activities, expanding construction and agricultural sectors, and growing DIY culture among consumers globally

Wheelbarrow Market Analysis

- Wheelbarrows are essential manual or semi-automated tools used across various sectors including construction, agriculture, gardening, and landscaping, offering efficient transport of materials such as soil, gravel, and debris

- The demand for wheelbarrows is significantly driven by expanding infrastructure projects, growth in residential landscaping activities, and rising adoption of DIY home improvement trends

- Asia-Pacific is expected to dominate the wheelbarrow market with largest market share of approximately 33%, due to rapid urbanization, booming construction industries, and strong agricultural activity in countries such as China and India

- North America is expected to be the fastest growing region in the wheelbarrow market during the forecast period due to increasing interest in backyard gardening, rising renovation projects, and the presence of key manufacturers

- Industrial segment is expected to dominate the market with a largest market share of approximately 40% due to the widespread use of wheelbarrows and hand trucks in warehouses, factories, and manufacturing plants, where they are essential for transporting heavy materials and equipment efficiently. The increasing demand for durable, high-capacity wheelbarrows in industrial settings, coupled with advancements in ergonomic designs, is driving the growth of this segment

Report Scope and Wheelbarrow Market Segmentation

|

Attributes |

Wheelbarrow Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wheelbarrow Market Trends

“Rising Demand for Ergonomic & Multi-Utility Wheelbarrows in Construction and Gardening Applications”

- One prominent trend in the global wheelbarrow market is the growing emphasis on ergonomic designs and multifunctionality to cater to both professional and household users

- These innovations improve user comfort, reduce physical strain, and enhance productivity in tasks ranging from construction to landscaping and gardening

- For instance, modern wheelbarrows are being equipped with features like pneumatic tires for better maneuverability, lightweight yet durable materials, and modular compartments for carrying varied loads, benefiting both industrial and DIY users

- These advancements are redefining the utility of wheelbarrows, expanding their market scope, and fueling demand across residential, agricultural, and commercial sectors

Wheelbarrow Market Dynamics

Driver

“Growing Demand from Construction, Agriculture, and Landscaping Activities”

- The increasing scale of construction, agriculture, and landscaping projects globally is a major driver for the wheelbarrow market, as these sectors rely heavily on manual transport tools for material handling

- Urbanization and infrastructure development, especially in emerging economies, are accelerating the need for durable and efficient wheelbarrows in both commercial and residential settings

- As the demand for cost-effective and labor-saving solutions increases, wheelbarrows remain a fundamental tool across various industries due to their simplicity and versatility

For instance,

- The surge in urban gardening and small-scale farming in countries like India, China, and parts of Africa is boosting the demand for lightweight and easy-to-operate wheelbarrows for daily tasks

- As a result of the expanding activities in construction, agriculture, and landscaping, the global wheelbarrow market is experiencing steady growth driven by its practical application and adaptability across diverse sectors.

Opportunity

“Product Innovation and Eco-Friendly Materials Creating New Growth Opportunities”

- Innovations in wheelbarrow design, including electric-assist features, foldable frames, and multipurpose compartments, are opening new avenues for market growth by addressing evolving user needs across residential, commercial, and industrial segments

- Increasing consumer preference for sustainable and eco-friendly tools is also encouraging manufacturers to explore recyclable and lightweight materials, such as high-density polyethylene and composite alloys

- These advancements not only improve usability and reduce fatigue but also appeal to environmentally conscious consumers seeking durable yet sustainable products

For instance,

- Several manufacturers are now introducing electric wheelbarrows with lithium-ion batteries that provide power-assisted lifting and transport, significantly improving efficiency in hilly or uneven terrains—particularly useful in vineyards, construction sites, and large-scale gardens

- As consumers continue to seek innovative, ergonomic, and eco-friendly solutions, the global wheelbarrow market is poised to capitalize on this trend, offering substantial growth opportunities through product diversification and green technology adoption

Restraint/Challenge

“High Raw Material and Manufacturing Costs Impacting Profit Margins”

- The rising cost of raw materials, such as steel, rubber, and plastic, significantly impacts the manufacturing costs of wheelbarrows, posing a challenge for manufacturers, especially in competitive markets

- These higher production costs can translate into increased prices for end consumers, potentially reducing the affordability and demand for wheelbarrows, particularly in price-sensitive markets

- Fluctuations in material costs, coupled with logistical challenges in sourcing and transportation, can further strain the profit margins of manufacturers and suppliers

For instance,

- In 2024, the global steel shortage due to supply chain disruptions led to higher production costs for wheelbarrow frames, impacting the pricing structure in key markets like the U.S. and Europe

- As a result, the rising cost of raw materials and manufacturing challenges present a significant restraint for the growth of the global wheelbarrow market, especially in regions where cost-effectiveness is crucial for market expansion

Wheelbarrow Market Scope

The market is segmented on the basis of product, material, operation, wheel, application, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Material |

|

|

By Operation |

|

|

By Wheel |

|

|

By Application |

|

|

By Distribution Channel

|

|

In 2025, the industrial is projected to dominate the market with a largest share in application segment

The industrial segment is expected to dominate the wheelbarrow market with the largest share of approximately 40% due to the widespread use of wheelbarrows and hand trucks in warehouses, factories, and manufacturing plants, where they are essential for transporting heavy materials and equipment efficiently. The increasing demand for durable, high-capacity wheelbarrows in industrial settings, coupled with advancements in ergonomic designs, is driving the growth of this segment

The electric is expected to account for the largest share during the forecast period in product segment

In 2025, the electric segment is expected to dominate the market with the largest market share of 51.35% due to the increasing demand for more efficient, labor-saving, and ergonomically designed tools in various sectors such as construction, landscaping, and agriculture. Electric wheelbarrows, equipped with battery-assisted motors, offer significant advantages, including the ability to transport heavier loads with less physical effort, making them particularly valuable for workers on large sites or in terrains that require more maneuverability

Wheelbarrow Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Wheelbarrow Market”

- The Asia-Pacific region is expected to dominate the global wheelbarrow market with largest market share of approximately 33%, due to its rapid industrialization, urbanization, and the increasing demand for durable and efficient wheelbarrows across sectors like construction, agriculture, and landscaping

- Countries such as China, India, and Japan are key players in the market, driven by their growing infrastructure development, large agricultural sectors, and increasing adoption of modern tools in commercial and residential settings

- China, with its booming construction and industrial sectors, leads and dominate the wheelbarrows market with largest market share of over 35%, while India and Japan are experiencing growth due to rising urbanization, agricultural activities, and a shift towards more ergonomic and multi-functional wheelbarrow designs

“North America is Projected to Register the Highest CAGR in the Wheelbarrow Market”

- The North American market is projected to register the highest growth rate in the wheelbarrow market, fueled by ongoing construction projects, home improvement trends, and the growing demand for high-quality, heavy-duty wheelbarrows in both residential and industrial applications

- The U.S. holds a significant share, with an expanding focus on sustainable and efficient tools for construction and landscaping industries. Furthermore, there is a growing trend toward lightweight and ergonomic wheelbarrows in the region, catering to both professionals and DIY consumers

- The increasing popularity of home gardening, landscape projects, and the rising demand for high-performance wheelbarrows further contribute to market growth in this region

Wheelbarrow Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Qingdao Taifa Group (China)

- Qingdao Huatian Hand Truck Co., Ltd. (China)

- Qingdao Xinjiang Group Co., Ltd. (China)

- Qingdao Runda Wheel Barrow Co., Ltd. (China)

- Qingdao Zhenhua Barrow Manufacturing Co., Ltd. (China)

- Haemmerlin SAS (France)

- The Walsall Wheelbarrow Company Ltd. (U.K.)

- Bullbarrow Products (U.K.)

- Stanley Black & Decker, Inc. (U.S.)

- Gorilla Carts (U.S.)

- Worx (U.S.)

- Wolverine Products (U.S.)

- Griffin Bros Truck & Equipment (U.S.)

- Silvan Australia Pty Ltd (Australia)

- TUNALI (Turkey)

- Linyi Tianli (China)

- Qingdao Giant Industry & Trading Co., Ltd. (China)

- Qingdao Longwin Industry Co., Ltd. (China)

- Matador Industrial Limited (Netherlands)

- Zhejiang Qingqing Industry & Trade Co., Ltd. (China)

Latest Developments in Global Wheelbarrow Market

- In April 2021 Advancements in industrial development are expected to drive the innovation of specialized wheelbarrows engineered for specific applications. This includes the development of purpose-built wheelbarrows tailored to meet the distinct demands of sectors such as construction, landscaping, and agriculture—each equipped with features that enhance efficiency and performance for their respective use cases. This trend is highly relevant to the global wheelbarrow market, as the rising demand for task-specific tools across industries is anticipated to stimulate product diversification, improve user productivity, and drive market expansion through the adoption of high-performance, sector-oriented wheelbarrows

- In April 2024 Onewheel, in collaboration with Gorilla, unveiled the world’s first electric balance-assisted wheelbarrow OnewheelBarrow marking a significant milestone in the construction, home improvement, and gardening industries. This cutting-edge innovation is designed to enhance operational efficiency by modernizing the traditional approach to transporting heavy materials. This development signifies a shift towards intelligent material handling solutions

- In February 2024 Technovos, a leading name in sustainable mobility solutions, made a notable impact in the Cleantech and Agritech sectors with the launch of its latest innovation the GaadE Electric Wheelbarrow. This advancement represents a transformative step forward in manual material handling, aimed at optimizing labor-intensive operations across multiple industries. The introduction of the GaadE Electric Wheelbarrow underscores a growing trend in the global wheelbarrow market toward electrification and sustainability

- In January 2022 Fuji Electric Co., Ltd. announced the expansion of its Tokyo Factory’s Plant Systems Centre, adding 13,030 square meters of space to strengthen its production capabilities and support advanced plant system development. The expansion is particularly anticipated increase in infrastructure and industrial activities driven by Fuji Electric’s enhanced operations is expected to stimulate higher demand for material handling equipment, including wheelbarrows

- In November 2021 The city of Curitiba, Brazil, commenced the construction of its first public smart building, followed by the launch of a large-scale housing development project in December 2021, which includes the construction of 788 new residential units under a government program, with an estimated investment of USD 10 million. This substantial construction initiative underscores the growing demand for efficient material handling tools such as wheelbarrows on construction sites

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.