Global White Fused Alumina Market

Market Size in USD Million

CAGR :

%

USD

919.21 Million

USD

1,198.83 Million

2025

2033

USD

919.21 Million

USD

1,198.83 Million

2025

2033

| 2026 –2033 | |

| USD 919.21 Million | |

| USD 1,198.83 Million | |

|

|

|

|

White Fused Alumina Market Size

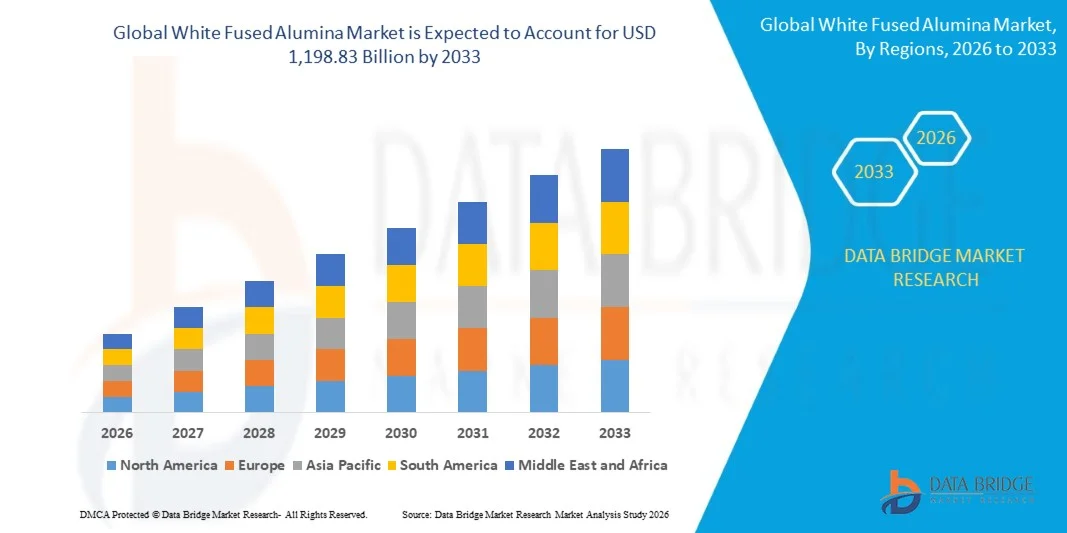

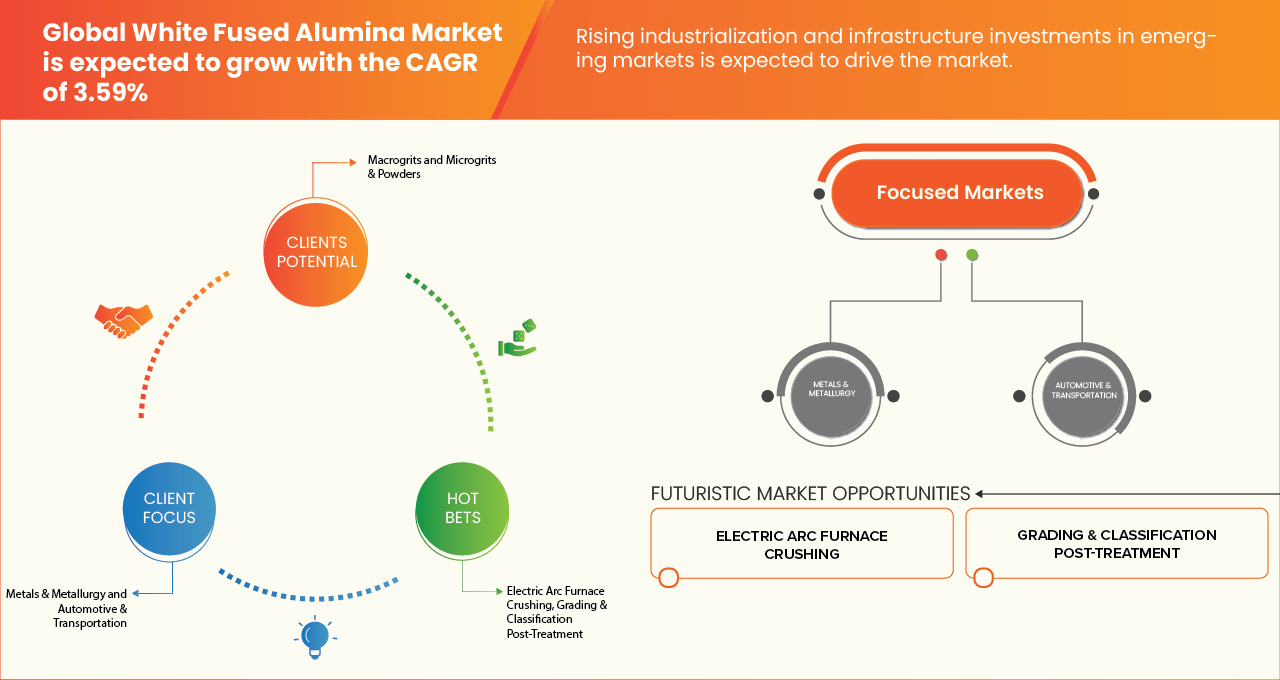

- The global white fused alumina market size was valued at USD 919.21 million in 2025 and is expected to reach USD 1,198.83 million by 2033, at a CAGR of 3.59% during the forecast period

- The global white fused alumina market refers to the market for a high-purity, synthetic form of aluminum oxide produced by melting high-quality alumina in an electric arc furnace at extremely high temperatures. White fused alumina is characterized by its hardness, thermal stability, and chemical inertness, making it suitable for abrasive applications, refractory materials, ceramics, polishing, and surface finishing. It is widely used across industries such as metals and metallurgy, automotive, construction, electronics, and aerospace, serving functions like cutting, grinding, lapping, and thermal or wear resistance enhancement.

- The growth of the global white fused alumina market is fueled by rising demand from key sectors such as construction, automotive, and industrial manufacturing, where high-quality abrasives, refractory materials, and polishing agents are essential. These industries depend on durable and efficient alumina-based solutions for applications like cutting, grinding, surface finishing, and thermal or wear resistance, driving widespread adoption and market expansion globally.

White Fused Alumina Market Analysis

- Technological advancements such as energy-efficient electric arc furnaces, improved calcination and fusion processes, advanced impurity-removal techniques, and tighter particle-size control—are enhancing product purity, whiteness index, and consistency. These improvements are strengthening adoption across abrasives, refractories, ceramics, and precision polishing applications.

- Challenges remain, including volatility in alumina and energy prices, high power consumption during fusion, and stricter environmental and emissions regulations that increase operating costs. Dependence on reliable electricity infrastructure and competition from alternative abrasives such as brown fused alumina and synthetic substitutes also constrain growth.

- The Asia-Pacific region is expected to dominate with 50.43% market share and is expected to grow with the highest CAGR of 3.79% in the forecast period of 2026 to 2033 due to strong manufacturing growth, large abrasives and refractories demand, expanding construction and metallurgy sectors, cost-competitive production, abundant raw materials, and rapid capacity expansion in China and India.

- In 2026, the macrogrits segment is expected to dominate with 52.59% market share due to its extensive use in heavy-duty grinding, cutting, blasting, and refractory applications, where high strength, thermal stability, and consistent particle size are essential for industrial performance.

Report Scope and White Fused Alumina Market Segmentation

|

Attributes |

White Fused Alumina Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

White Fused Alumina Market Trends

“Adoption of advanced process automation and high-purity production technologies”

- Manufacturers are increasingly integrating automated electric arc furnace control systems, real-time process monitoring, and AI-assisted quality analytics to achieve consistent fusion temperatures, tighter grain-size distribution, and higher alumina purity, reducing batch variability and defects.

- This trend is driven by growing demand from abrasives, refractories, ceramics, and electronics industries for uniform, high-performance White Fused Alumina grades that meet stricter technical and regulatory specifications.AI-powered reconstruction algorithms are significantly lowering radiation dose while improving image quality, making PET-CT services safer and more accessible for a wider patient population.

- Advanced cooling, crushing, and classification technologies are improving yield efficiency and enabling the production of application-specific macrogrits and microgrits, enhancing overall product performance.

- Additionally, digitalized production planning, automated material handling, and predictive maintenance systems are helping producers manage energy-intensive operations, minimize downtime, and control operating costs.

White Fused Alumina Market Dynamics

Driver

“Increasing Demand from Iron & Steel Industry”

- Growing demand from the iron and steel industry is being recognized as one of the most influential drivers of the global white fused alumina market. White fused alumina is extensively utilized in refractory applications essential for steelmaking processes, including ladle linings, slide gate refractories, tundish nozzles and high-temperature wear-resistant components. As production volumes of crude steel continue to increase in major manufacturing economies and new capacity additions are announced across Asia, the Middle East and emerging regions, consumption of high-performance refractory raw materials is being reinforced. The shift toward higher-quality steel grades, extended furnace campaign life and reduced downtime has further intensified reliance on premium alumina-based refractories.

- For instance- in January 2024, Reuters reported that China’s 2023 crude steel output halted a two-year downturn with total annual output of about 1.02 billion tonnes, thereby implying sustained demand for materials used in steel plant maintenance and grinding applications.

- It is concluded that the upward trajectory of global crude steel production has played a decisive role in reinforcing white fused alumina consumption. As steel output expands, refractory wear rates rise proportionally, resulting in elevated replacement cycles for alumina-based refractories essential to furnace, ladle and tundish operations. Policy-driven capacity expansion, modernisation of older steel mills and higher operational intensities have collectively strengthened the pull-through demand for WFA.

- The persistence of production growth in leading steelmaking economies indicates that refractory requirements will remain structurally anchored to the steel sector’s expansion path. Consequently, rising steel output is expected to continue sustaining strong and predictable long-term demand for white fused alumina in global metallurgical applications.

Restraint/Challenge

“Environmental Regulations and Compliance Costs”

- Environmental regulations and the associated compliance costs represent a key restraint on the growth of the global white fused alumina market, particularly given the material’s production through energy-intensive high-temperature processes and its link to mining raw bauxite and alumina feedstocks. Across jurisdictions, governments are tightening emission controls, water management standards, waste handling rules, and environmental impact assessment requirements, which increases operational expenditure for producers, elongates project approval timelines, and raises barriers to entry. Compliance requires installation of advanced emission control systems, continuous monitoring technologies, and adherence to stringent environmental clearances, all of which raise fixed and ongoing costs.

- For instance- in September 2025, Business Standard reported that India’s Ministry of Environment, Forest and Climate Change amended forest conservation rules to simplify mining approvals for critical minerals, requiring enhanced environmental monitoring and auditing frameworks that affect mining and mineral supply operations.

- Environmental regulations and compliance costs exert a significant restraining influence on the global white fused alumina market by increasing operational expenditures, prolonging permitting timelines, and introducing regulatory uncertainties. Governments worldwide are tightening environmental safeguards, imposing remediation obligations, and enforcing penalties that directly affect refineries, smelters, and mining operations tied to fused alumina production.

White Fused Alumina Market Scope

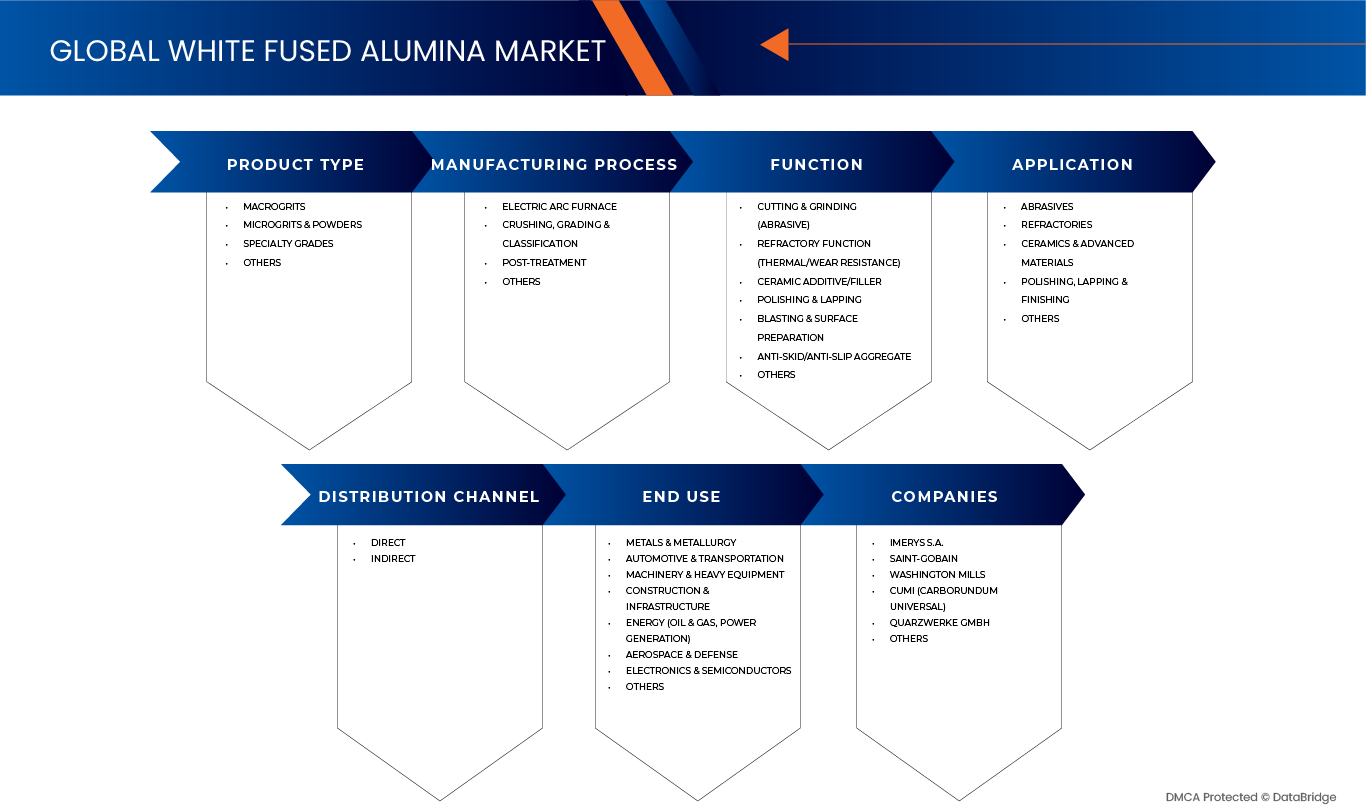

Global white fused alumina market is categorized into six segments based on product type, manufacturing process, function, application end use, distribution channel

- By Product Type

On the basis of product type, global white fused alumina market is segmented into macrogrits, microgrits & powders, specialty grades, and others. In 2026, the macrogrits segment is expected to dominate with 52.59% market share due to its extensive use in heavy-duty applications such as refractories, bonded abrasives, and metallurgical processes that require high hardness and thermal stability.

The microgrits & powders segment is expected to grow at a CAGR of 4.2% due to rising demand for precision finishing, polishing, lapping, and advanced ceramic applications, where fine particle size, uniformity, and superior surface quality are critical.

- By Manufacturing Process

On the basis of manufacturing process, the global white fused alumina market is segmented into electric arc furnace, crushing, grading & classification, post-treatment, and others. In 2026, the electric arc furnace segment is expected to dominate with 52.91% market share due to its ability to produce high-purity and consistent-grade white fused alumina with superior mechanical and thermal properties.

The post-treatment segment is expected to grow at a CAGR of 4.4% due to increasing focus on particle size optimization, surface treatment, impurity removal, and customized material specifications required for high-end abrasives, ceramics, and electronics applications.

- By Function

On the basis of function, the global white fused alumina market is segmented into cutting & grinding (abrasive), polishing & lapping, blasting & surface preparation, refractory function (thermal/wear resistance), ceramic additive/filler, anti-skid/anti-slip aggregate, and others. In 2026, the cutting & grinding segment is expected to dominate with 39.69% market share due to its widespread adoption in metal fabrication, automotive manufacturing, and precision engineering applications.

The polishing & lapping segment is expected to grow at a CAGR of 4.5% due to increasing demand for ultra-fine surface finishing in electronics, optics, automotive components, and precision machinery, where tight tolerances and smooth surface quality are essential.

- By Application

On the basis of application, the global white fused alumina market is segmented into abrasives, refractories, ceramics & advanced materials, polishing, lapping & finishing, and others. In 2026, abrasive’s segment is expected to dominate with 53.20% market share due to extensive utilization in grinding, cutting, and surface finishing operations across multiple industries.

The refractories segment is expected to grow at a CAGR of 3.9% due to increasing demand from steel, cement, glass, and non-ferrous metal industries for high-temperature-resistant materials used in furnaces, kilns, and thermal processing units.

- By End User

On the basis of end user, the global white fused alumina market is segmented into metals & metallurgy, automotive & transportation, aerospace & defense, electronics & semiconductors, machinery & heavy equipment, construction & infrastructure, energy (oil & gas, power generation), and others. In 2026, metals & metallurgy segment is expected to dominate with 26.85% market share due to its extensive consumption in steelmaking, aluminum processing, and foundry operations.

The electronics & semiconductors segment is expected to grow at a CAGR of 5.0% due to increasing use of high-purity white fused alumina in wafer polishing, electronic substrates, insulation components, and precision manufacturing processes that demand minimal contamination and superior material consistency.

- By Distribution Channel

On the basis of distribution channel, the global white fused alumina market is segmented into direct, indirect. In 2026, the direct segment is expected to dominate the with 66.98% market share due to large industrial buyers preferring direct procurement from manufacturers for assured quality, bulk pricing advantages, and customized product specifications.

The direct segment is expected to grow at the highest CAGR of 3.7% due to increasing long-term supply contracts, closer manufacturer–end-user collaboration, and growing demand for stable supply chains supporting large-scale industrial production.

White Fused Alumina Market Regional Analysis

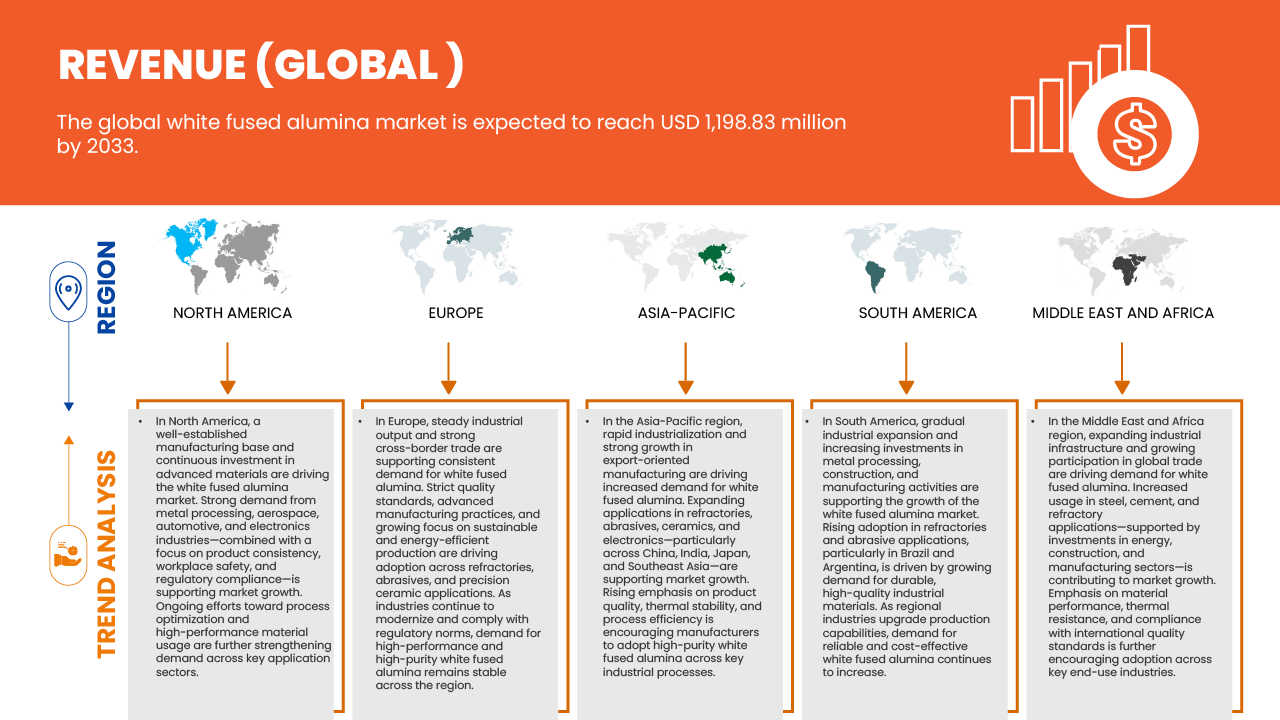

- Asia-Pacific dominates the global white fused alumina market, accounting for 50.43% of the total share in 2026, and the region’s leadership is driven by its strong industrial base, large-scale manufacturing capacity, and cost-efficient production ecosystem. The region benefits from abundant availability of raw materials, widespread adoption of electric arc furnace technology, and a high concentration of producers across China, India, and Southeast Asia. Rapid growth in end-use industries such as refractories, abrasives, ceramics, electronics, and metallurgy further supports market expansion. Additionally, increasing infrastructure development, rising steel and aluminum production, and continuous investments in capacity expansion and process optimization enhance regional competitiveness. Strong export orientation, government support for manufacturing, and rising demand for high-purity alumina products reinforce Asia-Pacific’s dominant position in the global market during the forecast period.

North America White Fused Alumina Market Insight

The North America white fused alumina market is experiencing steady and strong growth, driven by its well-established industrial base, advanced manufacturing capabilities, and early adoption of high-performance materials across key end-use industries. The region benefits from widespread use of white fused alumina in abrasives, refractories, and metallurgical applications, supported by strong demand from steel, aerospace, automotive, and precision machining sectors. Continuous technological advancements in electric arc furnace processes, strict quality standards, and emphasis on high-purity materials further enhance market development. Additionally, ongoing infrastructure modernization, investments in energy-efficient production, rising demand for advanced ceramics, and strong participation from major manufacturers reinforce North America’s competitive and stable market position during the forecast period.

U.S. White Fused Alumina Market Insight

The U.S. is the dominant country in the North American white fused alumina market, accounting for 83.07% of the region’s share in 2026, and is projected to grow at a strong CAGR of 3.86% from 2026 to 2033, due to its strong steel and manufacturing industries, advanced abrasive and refractory production, and high demand from aerospace, automotive, and construction sectors. Robust infrastructure investment, technological leadership, and presence of major producers further support market leadership.

Canada White Fused Alumina Market Insights

Canada holds 10.72% of the North America white fused alumina market in 2026 and is expected to grow at a CAGR of 3.19% from 2026 to 2033, due to its strong metallurgical and mining base, reliable access to high-quality alumina and energy resources, and well-developed industrial infrastructure. The country supports consistent production of high-purity white fused alumina for abrasives and refractories, driven by demand from metals processing, construction, and manufacturing industries. Additionally, stable regulatory frameworks, advanced processing technologies, and strong trade linkages with the United States enhance Canada’s leadership and supply reliability across the regional market.

Europe White Fused Alumina Market Insight

Europe in the global white fused alumina market, accounting for 21.59% of the total share in 2026 and growing at a robust CAGR of 3.20%, and the region’s strength is driven by its well-established industrial base, advanced manufacturing standards, and strong demand from abrasives, refractories, and specialty ceramics industries. The region benefits from continuous process innovation, including energy-efficient electric arc furnace technologies, strict quality and environmental regulations, and high adoption of premium-grade alumina products across Germany, the U.K., France, and Italy. Additionally, steady steel and automotive production, rising investments in infrastructure modernization, growing use of white fused alumina in precision machining and advanced materials, and strong collaboration between manufacturers, research institutions, and end-use industries reinforce Europe’s stable market position and sustained growth trajectory.

Germany White Fused Alumina Market Insight

Germany holds the largest share of the European white fused alumina market at 25.62% in 2026 and is also the region’s fastest-growing country, with a projected CAGR of 3.02% from 2026 to 2033. This strong performance is driven by Germany’s advanced industrial manufacturing ecosystem, strong presence of high-precision abrasives and refractory producers, and early adoption of energy-efficient electric arc furnace technologies supported by substantial public and private investments. The country benefits from robust demand from steelmaking, automotive, machinery, and advanced ceramics industries, alongside strict quality standards and process automation. Additionally, continuous modernization of production facilities, rising use of high-purity alumina in precision machining, expanding exports, and close collaboration between manufacturers, research institutes, and end-use industries further strengthen Germany’s leadership and growth momentum within the European white fused alumina market.

Asia-Pacific White Fused Alumina Market Insight

Asia-Pacific accounts for 50.43% of the global market in 2026, recording the highest CAGR of 3.79% among all regions, and rapid industrialization, expanding manufacturing capacity, and rising demand for white fused alumina across abrasives, refractories, ceramics, and metallurgical applications in major countries such as China, India, Japan, and South Korea. The region’s strong momentum is further supported by abundant raw material availability, cost-effective production, expansion of steel and aluminum industries, and increasing investments in electric arc furnace capacity, supported by favorable government policies and growing export demand.

China White Fused Alumina Market Insight

China accounts for 40.35% of the Asia-Pacific white fused alumina market in 2026 and is projected to grow at a strong CAGR of 2.4% throughout the forecast period, driven by its large-scale industrial base, extensive production capacity, and dominant role in global abrasives and refractory manufacturing. The country benefits from abundant availability of alumina raw materials, cost-efficient electric arc furnace operations, and strong demand from steelmaking, construction, and heavy machinery industries. Additionally, continuous capacity expansions, export-oriented production, and supportive government policies for manufacturing and infrastructure development further reinforce China’s leadership in the regional white fused alumina market.

India White Fused Alumina Market Insight

India is the fastest-growing market in the Asia-Pacific white fused alumina sector, holding 10.31% of the regional share in 2026 and registering the highest projected CAGR of 5.7% from 2026 to 2033, , fueled by rapid industrialization, expanding manufacturing capacity, and rising demand from abrasives, refractories, and metallurgical industries. Growth is further supported by increasing infrastructure development, expansion of steel and automotive production, availability of skilled labor, improving production technologies, and government initiatives such as “Make in India” that encourage domestic manufacturing and export-oriented growth.

White Fused Alumina Market Share

The global white fused alumina market is primarily led by well-established companies, including:

- Washington Mills (USA)

- Motim (Slovakia)

- CUMI (India)

- Henan Ruishi Renewable Resources Group Co.,Ltd. (China)

- U.S. Electrofused Minerals, Inc. (USA)

- Qinai New Materials (China)

- Zhengzhou Yufa Abrasive Group Co., Ltd. (China)

- Fused Minerals Industries LLP (India)

- HarbisonWalker International (HWI) (USA)

- Henan Hongtai Kiln Refractory Co., Ltd. (China)

- Algrain Products Private Limited (India)

- Imerys (France)

- LP Impex (India)

- Shandong Zhongji Metal Products Co., Ltd. (China)

- Alteo Alumina (France)

- Orient Abrasives Ltd. (India)

- Shandong Bosheng New Materials Co., Ltd. (China)

- JSR International (India) Pvt. Ltd. (India)

- Luoyang Hongfeng Abrasives Co., Ltd. (China)

- Zhengzhou Xinli Wear-resistant Materials Co., Ltd. (China)

- Nanping Yi Ze Abrasives & Tools Tech Co (China)

- RUSAL Group (Russia)

- Shandong Honrel Co., Ltd. (China)

- Saint-Gobain (France)

- Cerablast (Germany)

- Sunrise Refractory (Yingkou) Co., Ltd. (China)

- Quarzwerke GmbH (Germany)

- Kuhmichel Abrasiv GmbH (Germany)

- Wedge India (India)

- Zibo Jucos Co., Ltd. (China)

Latest Developments in Global White Fused Alumina Market

- In December 2025, HWI, a member of Calderys, completed construction of its new lightweight monolithics production facility at the Rotary Kiln complex in Fulton, Missouri. The state-of-the-art plant increases lightweight monolithics output capacity by nearly 60%, incorporates advanced automation (new furnace, robotic packaging and material-handling systems), and is expected to enhance product availability and shorten lead times for customers across the Americas.

- In July 2025, HWI entered a strategic manufacturing partnership with Electrified Thermal Solutions to co-develop and produce electrically conductive firebricks (E-bricks) for Electrified Thermal’s Joule Hive Thermal Battery. The collaboration combines Electrified Thermal’s high-temperature thermal-storage technology with HWI’s refractory expertise to support decarbonized industrial heat applications; the first commercial-scale demonstration was projected for 2025 with a longer-term goal of deploying 2 GW of electrified thermal power by 2030.

- In October 2024, Niche Fused Alumina was acquired by Alteo and integrated into the group as “Alteo Fused Alumina,” following approval of Alteo’s takeover bid by the Commercial Court of Chambéry. The acquisition was positioned as a strategic expansion of Alteo’s specialty alumina operations, reinforcing its global leadership and supporting sustainable industrial growth with a continued focus on innovation and environmental responsibility.

- In February 2024, Alteo has officially joined the European Cluster of Ceramics based in Limoges, France. This collaboration aims to strengthen Alteo’s presence across key high-tech and industrial sectors — including aerospace, defence, electronics, energy, luxury goods and healthcare — by leveraging the cluster’s network for innovation and industrial development in specialty alumina and technical ceramics markets.

- In September 2024, CUMI completed the acquisition of 100% equity in Silicon Carbide Products LLC (SCP), a U.S.-based firm specializing in advanced ceramics and silicon‑carbide materials. This strategic move strengthens CUMI’s global presence in the high-performance ceramics and abrasives market, enhancing its technological capabilities and access to North American customers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE ANALYSIS

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 RISK ASSESSMENT AND MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PRICING ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7.4 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENTS

4.9 VALUE CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL PROCUREMENT

4.9.3 PRODUCTION / FUSION

4.9.4 PROCESSING & SURFACE TREATMENT

4.9.5 PACKAGING

4.9.6 LOGISTICS & DISTRIBUTION

4.9.7 INDUSTRIAL APPLICATIONS/ END USER DEMAND

4.9.8 CONCLUSION

4.1 VENDOR SELECTION CRITERIA

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEMAND FROM IRON & STEEL INDUSTRY

7.1.2 EXPANDING INDUSTRIAL END USE DEMAND OF WHITE FUSED ALUMINA

7.1.3 RISING INDUSTRIALIZATION AND INFRASTRUCTURE INVESTMENTS IN EMERGING MARKETS

7.1.4 RISING DEMAND FROM THE ELECTRONICS SECTOR

7.2 RESTRAINTS

7.2.1 ENVIRONMENTAL REGULATIONS AND COMPLIANCE COSTS

7.2.2 VOLATILITY IN RAW MATERIAL AND ENERGY COST

7.3 OPPORTUNITIES

7.3.1 GROWTH IN NON-FERROUS METALS AND GLASS INDUSTRIES

7.3.2 TECHNOLOGICAL ADVANCEMENTS IN REFRACTORY MANUFACTURING

7.3.3 DEVELOPMENT OF ADVANCED AND SPECIALIZED GRADES

7.4 CHALLENGES

7.4.1 SUPPLY CHAIN DISRUPTIONS AND LOGISTICS CONSTRAINTS

7.4.2 INTENSE COMPETITION AMONG REGIONAL MANUFACTURERS

8 GLOBAL WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 GLOBAL WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

8.2.1 MACROGRITS

8.2.2 MICROGRITS & POWDERS

8.2.3 SPECIALTY GRADES

8.2.4 OTHERS

8.3 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.3.1 FEPA F

8.3.2 FEPA P

8.3.3 ANSI

8.4 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

8.4.1 COARSE GRADES (F12–F46)

8.4.2 MEDIUM GRADES (F54–F80)

8.4.3 FINE GRADES (F90–F220)

8.5 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

8.5.1 UNTREATED

8.5.2 SILANE/COATED

8.6 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.6.1 ASIA-PACIFIC

8.6.2 EUROPE

8.6.3 NORTH AMERICA

8.6.4 SOUTH AMERICA

8.6.5 MIDDLE EAST & AFRICA

8.7 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.7.1 FEPA F MICRO

8.7.2 JIS

8.8 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

8.8.1 10–60 ΜM

8.8.2 1–10 ΜM

8.8.3 SUB-MICRON (D50 < 1 ΜM)

8.9 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

8.9.1 LAPPING

8.9.2 CMP/POLISHING

8.1 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 EUROPE

8.10.3 NORTH AMERICA

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

8.11.1 ≥ 99.5% AL2O3

8.11.2 99.0%–99.4% AL2O3

8.11.3 98.0%–98.9% AL2O3

8.12 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

8.12.1 LOW-SODA (NA2O ≤ 0.05%)

8.12.2 ULTRA-LOW-SODA (NA2O ≤ 0.02%)

8.13 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

8.13.1 HIGH-WHITENESS

8.13.2 STANDARD-WHITENESS

8.14 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 EUROPE

8.15.3 NORTH AMERICA

8.15.4 SOUTH AMERICA

8.15.5 MIDDLE EAST & AFRICA

9 GLOBAL WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 GLOBAL WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

9.2.1 ELECTRIC ARC FURNACE

9.2.2 CRUSHING, GRADING & CLASSIFICATION

9.2.3 POST-TREATMENT

9.2.4 OTHERS

9.3 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

9.3.1 FIXED/STATIONARY FURNACE

9.3.2 TILTING FURNACE

9.4 GLOBAL FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.4.2 RAPID QUENCH (MORE FRIABLE)

9.5 GLOBAL TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.5.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.5.2 RAPID QUENCH (MORE FRIABLE)

9.6 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

9.6.1 HIGH-PURITY CALCINED ALUMINA

9.6.2 TABULAR/SEEDING ADDITIVES

9.7 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 GLOBAL CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 SECONDARY PROCESSING

9.8.2 PRIMARY CRUSHING

9.9 GLOBAL SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.9.1 AIR CLASSIFICATION

9.9.2 BALL MILLING

9.9.3 MAGNETIC SEPARATION

9.1 GLOBAL PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 JAW/IMPACT CRUSHING

9.10.2 ROLLER MILLING

9.11 GLOBAL CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

9.12 GLOBAL POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 ACID WASHING/IMPURITY REMOVAL

9.12.2 HEAT TREATMENT/ANNEALING

9.12.3 SURFACE MODIFICATION/COATING

9.13 GLOBAL POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 EUROPE

9.13.3 NORTH AMERICA

9.13.4 SOUTH AMERICA

9.13.5 MIDDLE EAST & AFRICA

9.14 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.14.1 ASIA-PACIFIC

9.14.2 EUROPE

9.14.3 NORTH AMERICA

9.14.4 SOUTH AMERICA

9.14.5 MIDDLE EAST & AFRICA

10 GLOBAL WHITE FUSED ALUMINA MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 GLOBAL WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

10.2.1 CUTTING & GRINDING (ABRASIVE)

10.2.2 REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)

10.2.3 CERAMIC ADDITIVE/FILLER

10.2.4 POLISHING & LAPPING

10.2.5 BLASTING & SURFACE PREPARATION

10.2.6 ANTI-SKID/ANTI-SLIP AGGREGATE

10.2.7 OTHERS

10.3 GLOBAL CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 GLOBAL REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 GLOBAL CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 EUROPE

10.5.3 NORTH AMERICA

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 GLOBAL POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

10.7 GLOBAL BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 EUROPE

10.7.3 NORTH AMERICA

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 GLOBAL ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 EUROPE

10.8.3 NORTH AMERICA

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 EUROPE

10.9.3 NORTH AMERICA

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

11 GLOBAL WHITE FUSED ALUMINA MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 GLOBAL WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 ABRASIVES

11.2.2 REFRACTORIES

11.2.3 CERAMICS & ADVANCED MATERIALS

11.2.4 POLISHING, LAPPING & FINISHING

11.2.5 OTHERS

11.3 GLOBAL ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 BONDED ABRASIVES

11.3.2 COATED ABRASIVES

11.3.3 BLASTING MEDIA

11.4 GLOBAL BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 VITRIFIED BONDED

11.4.2 RESINOID BONDED

11.5 GLOBAL COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 BELTS/DISCS/SHEETS

11.5.2 SANDPAPER

11.6 GLOBAL BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 DRY BLASTING

11.6.2 WET/SLURRY BLASTING

11.7 GLOBAL BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.7.1 ASIA-PACIFIC

11.7.2 EUROPE

11.7.3 NORTH AMERICA

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST & AFRICA

11.8 GLOBAL REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 UN-SHAPED/CASTABLES

11.8.2 SHAPED REFRACTORIES

11.9 GLOBAL UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 LOW-CEMENT / ULTRA-LOW CEMENT (LCC/ULCC)

11.9.2 GUNNABLE/RAMMABLE

11.1 GLOBAL SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.10.1 BRICKS

11.10.2 PREFORMS

11.11 GLOBAL REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 EUROPE

11.11.3 NORTH AMERICA

11.11.4 SOUTH AMERICA

11.11.5 MIDDLE EAST & AFRICA

11.12 GLOBAL CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.12.1 TECHNICAL CERAMICS

11.12.2 THERMAL SPRAY/PLASMA SPRAY POWDERS

11.13 GLOBAL CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 EUROPE

11.13.3 NORTH AMERICA

11.13.4 SOUTH AMERICA

11.13.5 MIDDLE EAST & AFRICA

11.14 GLOBAL POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.14.1 METALS & ALLOYS

11.14.2 GLASS, CRYSTAL, STONE

11.15 GLOBAL POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.15.1 ASIA-PACIFIC

11.15.2 EUROPE

11.15.3 NORTH AMERICA

11.15.4 SOUTH AMERICA

11.15.5 MIDDLE EAST & AFRICA

12 GLOBAL WHITE FUSED ALUMINA MARKET, BY END USE

12.1 OVERVIEW

12.2 GLOBAL WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 METALS & METALLURGY

12.2.2 AUTOMOTIVE & TRANSPORTATION

12.2.3 MACHINERY & HEAVY EQUIPMENT

12.2.4 CONSTRUCTION & INFRASTRUCTURE

12.2.5 ENERGY (OIL & GAS, POWER GENERATION)

12.2.6 AEROSPACE & DEFENSE

12.2.7 ELECTRONICS & SEMICONDUCTORS

12.2.8 OTHERS

12.3 GLOBAL METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.3.1 STEEL & FOUNDRY

12.3.2 NON-FERROUS METALS

12.4 GLOBAL METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 GLOBAL AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.5.1 AFTERMARKET/MAINTENANCE

12.5.2 OEM

12.6 GLOBAL AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 GLOBAL MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

12.8 GLOBAL CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.8.1 ASIA-PACIFIC

12.8.2 EUROPE

12.8.3 NORTH AMERICA

12.8.4 SOUTH AMERICA

12.8.5 MIDDLE EAST & AFRICA

12.9 GLOBAL ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.9.1 ASIA-PACIFIC

12.9.2 EUROPE

12.9.3 NORTH AMERICA

12.9.4 SOUTH AMERICA

12.9.5 MIDDLE EAST & AFRICA

12.1 GLOBAL AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 EUROPE

12.10.3 NORTH AMERICA

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 GLOBAL ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.11.1 ASIA-PACIFIC

12.11.2 EUROPE

12.11.3 NORTH AMERICA

12.11.4 SOUTH AMERICA

12.11.5 MIDDLE EAST & AFRICA

12.12 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 EUROPE

12.12.3 NORTH AMERICA

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

13 GLOBAL WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 GLOBAL WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.2.1 DIRECT

13.2.2 INDIRECT

13.3 GLOBAL DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 MANUFACTURER TO END-USER

13.3.2 MANUFACTURER TO REFRACTORY INSTALLATION COMPANIES

13.3.3 MANUFACTURER TO EPC / ENGINEERING FIRMS

13.4 GLOBAL DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 EUROPE

13.4.3 NORTH AMERICA

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 GLOBAL INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.5.1 DISTRIBUTORS / WHOLESALERS

13.5.2 RETAILERS / DEALERS

13.5.3 ONLINE SALES / E-COMMERCE PLATFORMS

13.6 GLOBAL INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 EUROPE

13.6.3 NORTH AMERICA

13.6.4 SOUTH AMERICA

13.6.5 MIDDLE EAST & AFRICA

14 GLOBAL WHITE FUSED ALUMINA MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 FRANCE

14.3.3 ITALY

14.3.4 U.K.

14.3.5 RUSSIA

14.3.6 SPAIN

14.3.7 TURKEY

14.3.8 SWEDEN

14.3.9 NETHERLANDS

14.3.10 SWITZERLAND

14.3.11 FINLAND

14.3.12 NORWAY

14.3.13 BELGIUM

14.3.14 DENMARK

14.3.15 REST OF EUROPE

14.4 ASIA PACIFIC

14.4.1 CHINA

14.4.2 INDIA

14.4.3 JAPAN

14.4.4 SOUTH KOREA

14.4.5 TAIWAN

14.4.6 AUSTRALIA

14.4.7 THAILAND

14.4.8 INDONESIA

14.4.9 MALAYSIA

14.4.10 PHILIPPINES

14.4.11 SINGAPORE

14.4.12 HONG KONG

14.4.13 NEW ZEALAND

14.4.14 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 COLOMBIA

14.5.4 PERU

14.5.5 CHILE

14.5.6 VENEZUELA

14.5.7 ECUADOR

14.5.8 BOLIVIA

14.5.9 URUGUAY

14.5.10 PARAGUAY

14.5.11 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SAUDI ARABIA

14.6.2 SOUTH AFRICA

14.6.3 UNITED ARAB EMIRATES

14.6.4 EGYPT

14.6.5 ISRAEL

14.6.6 KUWAIT

14.6.7 OMAN

14.6.8 QATAR

14.6.9 BAHRAIN

14.6.10 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL WHITE FUSED ALUMINA MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: APAC

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: NA

16 COMPANY PROFILES

16.1 MANUFACTURER

16.1.1 IMERYS S.A.

16.1.1.1 COMPANY SNAPSHOT

16.1.1.2 REVENUE ANALYSIS

16.1.1.3 COMPANY SHARE ANALYSIS

16.1.1.4 PRODUCT PORTFOLIO

16.1.1.5 RECENT DEVELOPMENT

16.1.2 WASHINGTON MILLS

16.1.2.1 COMPANY SNAPSHOT

16.1.2.2 COMPANY SHARE ANALYSIS

16.1.2.3 PRODUCT PORTFOLIO

16.1.2.4 RECENT DEVELOPMENT

16.1.3 SAINT-GOBAIN

16.1.3.1 COMPANY SNAPSHOT

16.1.3.2 REVENUE ANALYSIS

16.1.3.3 COMPANY SHARE ANALYSIS

16.1.3.4 PRODUCT PORTFOLIO

16.1.3.5 RECENT DEVELOPMENT

16.1.4 RUSAL

16.1.4.1 COMPANY SNAPSHOT

16.1.4.2 REVENUE ANALYSIS

16.1.4.3 PRODUCT PORTFOLIO

16.1.4.4 RECENT DEVELOPMENT

16.1.5 HWI

16.1.5.1 COMPANY SNAPSHOT

16.1.5.2 PRODUCT PORTFOLIO

16.1.5.3 RECENT DEVELOPMENT

16.1.6 ALGRAIN

16.1.6.1 COMPANY SNAPSHOT

16.1.6.2 PRODUCT PORTFOLIO

16.1.6.3 RECENT DEVELOPMENT

16.1.7 ALTEO FUSED ALUMINA

16.1.7.1 COMPANY SNAPSHOT

16.1.7.2 PRODUCT PORTFOLIO

16.1.7.3 RECENT DEVELOPMENT

16.1.8 CERABLAST

16.1.8.1 COMPANY SNAPSHOT

16.1.8.2 PRODUCT PORTFOLIO

16.1.8.3 RECENT DEVELOPMENT

16.1.9 CUMI

16.1.9.1 COMPANY SNAPSHOT

16.1.9.2 REVENUE ANALYSIS

16.1.9.3 PRODUCT PORTFOLIO

16.1.9.4 RECENT DEVELOPMENT

16.1.10 FUSED MINERALS INTERNATIONAL

16.1.10.1 COMPANY SNAPSHOT

16.1.10.2 PRODUCT PORTFOLIO

16.1.10.3 RECENT DEVELOPMENT

16.1.11 HENAN HONGTAI KILN REFRACTORY CO.,LTD.

16.1.11.1 COMPANY SNAPSHOT

16.1.11.2 PRODUCT PORTFOLIO

16.1.11.3 RECENT DEVELOPMENT

16.1.12 HENAN RUISHI RENEWABLE RESOURCES GROUP CO., LTD.

16.1.12.1 COMPANY SNAPSHOT

16.1.12.2 PRODUCT PORTFOLIO

16.1.12.3 RECENT DEVELOPMENT

16.1.13 JSR INTERNATIONAL(INDIA) PRIVATE LIMITED

16.1.13.1 COMPANY SNAPSHOT

16.1.13.2 PRODUCT PORTFOLIO

16.1.13.3 RECENT DEVELOPMENT

16.1.14 KUHMICHEL ABRASIV GMBH

16.1.14.1 COMPANY SNAPSHOT

16.1.14.2 PRODUCT PORTFOLIO

16.1.14.3 RECENT DEVELOPMENT

16.1.15 LP IMPEX

16.1.15.1 COMPANY SNAPSHOT

16.1.15.2 PRODUCT PORTFOLIO

16.1.15.3 RECENT DEVELOPMENT

16.1.16 LUOYANG HONGFENG ABRASIVES CO., LTD

16.1.16.1 COMPANY SNAPSHOT

16.1.16.2 PRODUCT PORTFOLIO

16.1.16.3 RECENT DEVELOPMENT

16.1.17 LUOYANG SUNRISE ABRASIVES CO., LTD.

16.1.17.1 COMPANY SNAPSHOT

16.1.17.2 PRODUCT PORTFOLIO

16.1.17.3 RECENT DEVELOPMENT

16.1.18 MOTIM

16.1.18.1 COMPANY SNAPSHOT

16.1.18.2 PRODUCT PORTFOLIO

16.1.18.3 RECENT DEVELOPMENT

16.1.19 NANPING YI ZE ABRASIVES & TOOLS TECH CO., LTD.

16.1.19.1 COMPANY SNAPSHOT

16.1.19.2 PRODUCT PORTFOLIO

16.1.19.3 RECENT DEVELOPMENT

16.1.20 ORIENT CERATECH LIMITED

16.1.20.1 COMPANY SNAPSHOT

16.1.20.2 REVENUE ANALYSIS

16.1.20.3 PRODUCT PORTFOLIO

16.1.20.4 RECENT DEVELOPMENT

16.1.21 QUARZWERKE GMBH

16.1.21.1 COMPANY SNAPSHOT

16.1.21.2 PRODUCT PORTFOLIO

16.1.21.3 RECENT DEVELOPMENT

16.1.22 QINAI NEW MATERIALS CO. LTD.

16.1.22.1 COMPANY SNAPSHOT

16.1.22.2 PRODUCT PORTFOLIO

16.1.22.3 RECENT DEVELOPMENT

16.1.23 SHANDONG BOSHENG NEW MATERIALS CO., LTD.

16.1.23.1 COMPANY SNAPSHOT

16.1.23.2 PRODUCT PORTFOLIO

16.1.23.3 RECENT DEVELOPMENT

16.1.24 SHANDONG HONREL CO., LTD

16.1.24.1 COMPANY SNAPSHOT

16.1.24.2 PRODUCT PORTFOLIO

16.1.24.3 RECENT DEVELOPMENT

16.1.25 SHANDONG ZHONGJI METAL PRODUCTS CO., LTD

16.1.25.1 COMPANY SNAPSHOT

16.1.25.2 PRODUCT PORTFOLIO

16.1.25.3 RECENT DEVELOPMENT

16.1.26 U.S. ELECTROFUSED MINERALS, INC.

16.1.26.1 COMPANY SNAPSHOT

16.1.26.2 PRODUCT PORTFOLIO

16.1.26.3 RECENT DEVELOPMENT

16.1.27 WEDGE INDIA

16.1.27.1 COMPANY SNAPSHOT

16.1.27.2 PRODUCT PORTFOLIO

16.1.27.3 RECENT DEVELOPMENT

16.1.28 ZHENGZHOU XINLI WEAR-RESISTANT MATERIALS CO. LTD.

16.1.28.1 COMPANY SNAPSHOT

16.1.28.2 PRODUCT PORTFOLIO

16.1.28.3 RECENT DEVELOPMENT

16.1.29 ZHENGZHOU YUFA ABRASIVE GROUP CO., LTD.

16.1.29.1 COMPANY SNAPSHOT

16.1.29.2 PRODUCT PORTFOLIO

16.1.29.3 RECENT DEVELOPMENT

16.1.30 ZIBO JUCOS CO.,LTD.

16.1.30.1 COMPANY SNAPSHOT

16.1.30.2 PRODUCT PORTFOLIO

16.1.30.3 RECENT DEVELOPMENT

16.2 DISTRIBUTOR

16.2.1 CALDERYS DISTRIBUTION.

16.2.1.1 COMPANY SNAPSHOT

16.2.1.2 PRODUCT PORTFOLIO

16.2.1.3 RECENT DEVELOPMENT

16.2.2 HWI DISTRIBUTION GROUP.

16.2.2.1 COMPANY SNAPSHOT

16.2.2.2 PRODUCT PORTFOLIO

16.2.2.3 RECENT DEVELOPMENT

16.2.3 LUOYANG ZHONGSEN REFRACTORY CO., LTD.

16.2.3.1 COMPANY SNAPSHOT

16.2.3.2 PRODUCT PORTFOLIO

16.2.3.3 RECENT DEVELOPMENT

16.2.4 PRATAP CORPORATION

16.2.4.1 COMPANY SNAPSHOT

16.2.4.2 PRODUCT PORTFOLIO

16.2.4.3 RECENT DEVELOPMENT

16.2.5 VESAVIUS

16.2.5.1 COMPANY SNAPSHOT

16.2.5.2 REVENUE ANALYSIS

16.2.5.3 PRODUCT PORTFOLIO

16.2.5.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTSR

List of Table

TABLE 1 PRICING ANALYSIS

TABLE 2 GLOBAL WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 4 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 8 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 10 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 13 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 14 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 17 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 GLOBAL FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 GLOBAL TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 21 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 GLOBAL CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 GLOBAL SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 GLOBAL PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 GLOBAL CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 GLOBAL POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 GLOBAL POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 GLOBAL WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 30 GLOBAL CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 GLOBAL REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 GLOBAL CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 GLOBAL POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 GLOBAL BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 GLOBAL ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 GLOBAL WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 38 GLOBAL ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 GLOBAL BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 GLOBAL COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 GLOBAL BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 GLOBAL BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 GLOBAL REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 GLOBAL UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 GLOBAL SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 GLOBAL REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 GLOBAL CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 GLOBAL CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 GLOBAL POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 GLOBAL POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 GLOBAL WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 52 GLOBAL METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 GLOBAL METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 GLOBAL AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 GLOBAL AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 GLOBAL MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 GLOBAL CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 GLOBAL ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 GLOBAL AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 GLOBAL ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 61 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 GLOBAL WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 63 GLOBAL DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 GLOBAL DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 GLOBAL INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 GLOBAL INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 GLOBAL WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 68 GLOBAL

TABLE 69 GLOBAL WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 71 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 72 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 73 GLOBAL MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 75 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 76 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 77 GLOBAL MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 79 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 80 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 81 GLOBAL SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 GLOBAL WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 84 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 GLOBAL FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 GLOBAL TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 88 GLOBAL ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 89 GLOBAL CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 GLOBAL SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 GLOBAL PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 GLOBAL CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 93 GLOBAL POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 GLOBAL POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 95 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 96 GLOBAL WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 97 GLOBAL CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 98 GLOBAL REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 99 GLOBAL CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 100 GLOBAL POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 101 GLOBAL BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 102 GLOBAL ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 103 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 104 GLOBAL WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 105 GLOBAL ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 GLOBAL BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 GLOBAL COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 GLOBAL BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 GLOBAL BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 110 GLOBAL REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 GLOBAL UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 GLOBAL SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 GLOBAL REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 114 GLOBAL CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 GLOBAL CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 116 GLOBAL POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 GLOBAL POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 118 GLOBAL WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 119 GLOBAL METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 GLOBAL METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 121 GLOBAL AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 GLOBAL AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 123 GLOBAL MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 124 GLOBAL CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 125 GLOBAL ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 126 GLOBAL AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 127 GLOBAL ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 128 GLOBAL OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 129 GLOBAL WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 130 GLOBAL DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 GLOBAL DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 132 GLOBAL INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 GLOBAL INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 134 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 135 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 136 NORTH AMERICA

TABLE 137 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 139 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 140 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 141 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 142 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 143 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 144 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 145 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 146 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 147 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 148 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 NORTH AMERICA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 NORTH AMERICA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 152 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 NORTH AMERICA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 NORTH AMERICA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 157 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 158 NORTH AMERICA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 NORTH AMERICA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 NORTH AMERICA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 NORTH AMERICA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 NORTH AMERICA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 168 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 171 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 U.S. WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 175 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 176 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 177 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 178 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 179 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 180 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 181 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 182 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 183 U.S. WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 184 U.S. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 U.S. FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 U.S. TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 U.S. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 188 U.S. CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 U.S. SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 U.S. PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 U.S. POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 U.S. WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 193 U.S. WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 194 U.S. ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 U.S. BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 U.S. COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 U.S. BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 U.S. REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 U.S. UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 U.S. SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 U.S. CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 U.S. POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 U.S. WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 204 U.S. METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 U.S. AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 U.S. WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 207 U.S. DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 U.S. INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 CANADA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 211 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 212 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 213 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 214 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 215 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 216 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 217 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 218 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 219 CANADA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 220 CANADA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 CANADA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 CANADA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 CANADA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 224 CANADA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 CANADA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 CANADA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 CANADA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 CANADA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 229 CANADA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 230 CANADA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 CANADA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 CANADA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 CANADA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 CANADA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 CANADA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 CANADA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 CANADA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 CANADA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 CANADA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 240 CANADA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 CANADA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 CANADA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 243 CANADA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 CANADA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 MEXICO WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 247 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 248 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 249 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 250 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 251 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 252 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 253 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 254 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 255 MEXICO WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 256 MEXICO ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 MEXICO FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 MEXICO TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 MEXICO ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 260 MEXICO CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 MEXICO SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 MEXICO PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 MEXICO POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 MEXICO WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 265 MEXICO WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 266 MEXICO ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 MEXICO BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 MEXICO COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 MEXICO BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 MEXICO REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 MEXICO UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)