Global White Line Chipboard Market

Market Size in USD Billion

CAGR :

%

USD

3.20 Billion

USD

4.87 Billion

2024

2032

USD

3.20 Billion

USD

4.87 Billion

2024

2032

| 2025 –2032 | |

| USD 3.20 Billion | |

| USD 4.87 Billion | |

|

|

|

|

Global White Line Chipboard Market Size

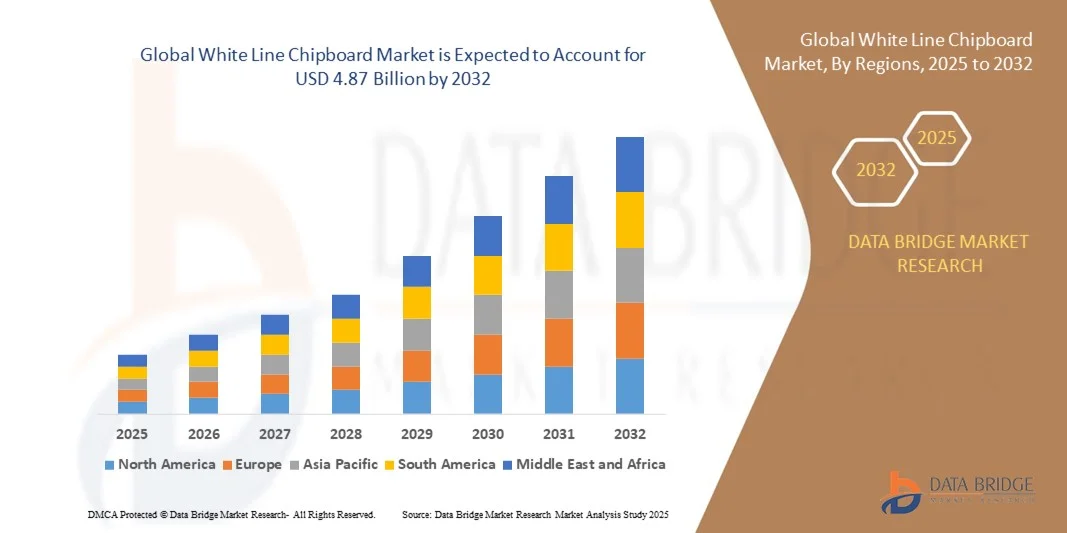

- The Global White Line Chipboard Market size was valued at USD 3.20 billion in 2024 and is projected to reach USD 4.87 billion by 2032, growing at a CAGR of 5.40% during the forecast period.

- The market expansion is primarily driven by the rising demand for sustainable, cost-effective, and high-quality furniture materials, along with increasing use in interior design, packaging, and construction applications.

- Additionally, growing emphasis on eco-friendly manufacturing practices, coupled with advancements in recycling technologies and surface finishing, is enhancing product appeal. These trends are collectively accelerating the adoption of white line chipboard, thereby fueling the overall market growth.

Global White Line Chipboard Market Analysis

- White line chipboard, a premium-grade laminated particleboard, is becoming an essential material in modern furniture, interior décor, and construction applications due to its smooth finish, durability, and versatility across residential and commercial projects.

- The growing demand for white line chipboard is primarily driven by increasing emphasis on sustainable materials, rising furniture production, and expanding renovation and remodeling activities across emerging economies.

- Asia-Pacific dominated the Global White Line Chipboard Market with the largest revenue share of 32.2% in 2024, supported by strong furniture manufacturing industries, stringent environmental regulations, and high consumer preference for eco-friendly and engineered wood products, with Germany and Italy leading production and innovation in chipboard technology.

- North America is expected to be the fastest-growing region in the Global White Line Chipboard Market during the forecast period, driven by rapid urbanization, rising disposable incomes, and expanding construction and interior design sectors in countries such as China, India, and Indonesia.

- The Surface Pigment Coated Folding Boxboard segment dominated the market with the largest revenue share of 38.6% in 2024, attributed to its superior printability, smooth surface, and high stiffness, making it ideal for premium packaging and graphical applications

Report Scope and Global White Line Chipboard Market Segmentation

|

Attributes |

White Line Chipboard Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global White Line Chipboard Market Trends

Advancements in Surface Finishing and Design Customization

- A significant and accelerating trend in the Global White Line Chipboard Market is the continuous innovation in surface finishing technologies and custom design options, enabling manufacturers to deliver products that combine aesthetic appeal, durability, and sustainability. These advancements are transforming the way chipboard is used in furniture, interior design, and architectural applications.

- For instance, Egger Group and Kronospan have introduced advanced melamine-coated and high-gloss finishes that replicate natural wood textures and patterns with exceptional realism. Similarly, Finsa offers customizable decorative surfaces in matte, embossed, and digital-print variants to cater to evolving consumer tastes and design requirements.

- New digital printing and lamination technologies allow precise color matching and pattern replication, enhancing creative flexibility for furniture makers and interior designers. Additionally, protective coatings are being developed to improve resistance to scratches, moisture, and UV exposure, extending the product’s lifespan and usability in both residential and commercial settings.

- The growing integration of eco-friendly resins and recyclable overlays aligns with global sustainability goals, allowing manufacturers to meet stringent environmental standards while maintaining superior quality and visual appeal.

- This shift toward technologically advanced, customizable, and eco-conscious chipboard solutions is redefining industry standards and consumer expectations. Consequently, leading companies such as Pfleiderer Group and Sonae Arauco are investing in R&D for innovative surface textures and finishes, strengthening their competitive edge in the premium and design-driven segments.

- The demand for high-quality, design-flexible white line chipboard is rapidly increasing across the furniture, construction, and interior décor sectors, as consumers and businesses alike prioritize aesthetic value, durability, and sustainability in modern living and working spaces.

Global White Line Chipboard Market Dynamics

Driver

Growing Demand Driven by Sustainability and Expanding Furniture Production

- The rising emphasis on sustainability, coupled with the expanding global furniture and interior design industries, is a major factor driving the growth of the Global White Line Chipboard Market. Increasing environmental awareness among consumers and stricter regulations on deforestation are pushing manufacturers toward eco-friendly engineered wood alternatives like white line chipboard.

- For instance, in March 2024, Kronospan announced the expansion of its recycled wood-based production line in Europe to meet the growing demand for sustainable decorative panels. Similarly, Egger Group introduced new low-emission, formaldehyde-free chipboard panels, aligning with global sustainability standards. These initiatives by key players are expected to accelerate market growth throughout the forecast period.

- As consumers and commercial builders increasingly seek cost-effective, durable, and environmentally responsible materials, white line chipboard provides an attractive substitute for natural wood. Its versatility, smooth finish, and customizable surface designs make it a preferred choice in furniture manufacturing, modular kitchens, and interior décor projects.

- Furthermore, the growth of e-commerce furniture brands and the rising trend of modular and ready-to-assemble furniture are fueling the adoption of chipboard materials across emerging markets. Its balance of affordability, aesthetics, and environmental performance continues to strengthen its position in the global furniture supply chain.

- The demand for premium, high-density, and recyclable chipboard is rapidly increasing in both residential and commercial sectors, as the industry prioritizes sustainable design, reduced waste, and innovative finishes to meet evolving consumer and regulatory expectations.

Restraint/Challenge

Fluctuating Raw Material Prices and Competition from Alternatives

- The volatility of raw material prices, particularly wood particles and resins, presents a significant challenge for the Global White Line Chipboard Market. These materials are subject to fluctuations due to changes in timber supply, environmental regulations, and transportation costs, directly impacting production expenses and profit margins.

- For instance, supply chain disruptions in 2023–2024 led to increased prices for wood-based materials across Europe and North America, compelling several manufacturers to adjust pricing or temporarily reduce production.

- In addition, growing competition from medium-density fiberboard (MDF), plywood, and oriented strand board (OSB) products limits the market potential for chipboard in certain applications. These materials often offer superior moisture resistance or mechanical strength, which may influence buyer preferences in specific use cases.

- To mitigate these challenges, industry leaders such as Pfleiderer Group and Sonae Arauco are investing in innovative manufacturing processes, including recycled material sourcing and bio-based adhesives, to stabilize costs and enhance product competitiveness.

- Moreover, consumer education regarding the durability, sustainability, and cost-effectiveness of modern chipboard products will be essential to counter misconceptions and maintain growth momentum. Strengthening supply chain resilience and developing value-added, high-performance chipboard variants will remain critical strategies for overcoming market restraints and ensuring long-term sustainability.

Global White Line Chipboard Market Scope

White line chipboard market is segmented on the basis of product type and end use industry.

- By Product Type

On the basis of product type, the Global White Line Chipboard Market is segmented into Surface and Reverse Pigment Coated Folding Boxboard, Surface Pigment Coated Folding Boxboard, Pigment Coated Recycled Cartonboard, Uncoated Recycled Cartonboard, Clay Coated News, and Coated News Back. The Surface Pigment Coated Folding Boxboard segment dominated the market with the largest revenue share of 38.6% in 2024, attributed to its superior printability, smooth surface, and high stiffness, making it ideal for premium packaging and graphical applications. It is widely used across food, cosmetics, and consumer goods packaging due to its strong visual appeal and recyclability.

The Pigment Coated Recycled Cartonboard segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing sustainability awareness, government regulations on recycled materials, and the growing use of eco-friendly packaging in both developed and emerging markets, supporting circular economy initiatives globally.

- By End Use Industry

On the basis of end use industry, the Global White Line Chipboard Market is segmented into Food and Beverage Industry, Pharmaceutical and Healthcare Industry, Personal Care and Cosmetics Industry, Electrical and Electronics Industry, and Others. The Food and Beverage Industry segment held the largest market revenue share of 42.3% in 2024, owing to the growing demand for durable, food-safe, and visually appealing packaging materials. White line chipboard is widely used for packaging cereals, frozen foods, beverages, and ready-to-eat products due to its printability and recyclability.

The Personal Care and Cosmetics Industry segment is expected to record the fastest growth rate from 2025 to 2032, fueled by the rising popularity of premium cosmetic packaging, increasing brand focus on sustainability, and consumer preference for elegant, recyclable cartonboard solutions that enhance product presentation while aligning with eco-conscious values.

Global White Line Chipboard Market Regional Analysis

- Asia-Pacific dominated the Global White Line Chipboard Market with the largest revenue share of 32.2% in 2024, driven by the region’s strong furniture manufacturing base, sustainability-focused regulations, and high consumer preference for eco-friendly and engineered wood products.

- Consumers in Europe increasingly value durable, recyclable, and aesthetically refined materials for use in furniture, packaging, and interior design applications. The region’s leading manufacturers emphasize low-emission production processes and innovative surface finishes, aligning with the EU’s circular economy goals.

- This widespread adoption is further supported by advancements in wood recycling technologies, high disposable incomes, and the presence of established players such as Egger Group, Kronospan, and Pfleiderer. Together, these factors have positioned Europe as a key hub for white line chipboard production and innovation, catering to both domestic and export markets in residential and commercial applications.

U.S. White Line Chipboard Market Insight

The U.S. white line chipboard market captured the largest revenue share of 78% in 2024 within North America, driven by the steady growth of the furniture, packaging, and interior design industries. The market is fueled by the rising preference for sustainable and recyclable materials in manufacturing, supported by stringent environmental regulations and increasing awareness of eco-friendly alternatives. Demand is particularly strong from ready-to-assemble furniture brands and e-commerce packaging providers. Additionally, innovations in surface coating and digital printing technologies are enhancing design versatility, further boosting adoption in both residential and commercial applications.

Europe White Line Chipboard Market Insight

The Europe white line chipboard market is projected to expand at a notable CAGR throughout the forecast period, driven by the region’s strong commitment to sustainability, recycling, and advanced wood processing technologies. Europe’s well-established furniture and construction sectors are the primary consumers, with growing utilization in decorative panels and packaging. Strict EU environmental directives promoting circular economy practices have accelerated the transition toward recycled and low-emission chipboard. Moreover, ongoing investments in innovation and automation by leading players such as Egger Group, Kronospan, and Pfleiderer are strengthening Europe’s dominance in the global market.

U.K. White Line Chipboard Market Insight

The U.K. white line chipboard market is anticipated to grow at a significant CAGR during the forecast period, driven by the increasing demand for cost-effective, high-quality materials in furniture and interior applications. The rising trend of modular furniture and home renovation projects is fueling product demand across residential and commercial sectors. Additionally, a strong focus on sustainability and local manufacturing supports the use of recycled and FSC-certified chipboard materials. The country’s booming e-commerce packaging industry and growing investments in customizable decorative panels are also contributing to market expansion.

Germany White Line Chipboard Market Insight

The Germany white line chipboard market is expected to expand at a steady CAGR during the forecast period, supported by the country’s reputation for engineering precision and sustainable production practices. German consumers and manufacturers emphasize quality, eco-efficiency, and material innovation, driving demand for low-formaldehyde, moisture-resistant chipboard products. The country’s robust furniture and construction industries, combined with technological advancements in surface lamination and digital printing, are key contributors to growth. Germany’s leadership in sustainable building materials further positions it as a core production and innovation hub within Europe.

Asia-Pacific White Line Chipboard Market Insight

The Asia-Pacific white line chipboard market is poised to grow at the fastest CAGR of 23.6% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and expanding furniture manufacturing across China, India, and Southeast Asia. The region’s growing focus on affordable, sustainable housing and modern interiors is spurring demand for chipboard in furniture and decorative applications. Furthermore, the expansion of local manufacturing capabilities and government support for sustainable wood alternatives are enhancing product accessibility and cost efficiency, making Asia-Pacific a key growth engine for the global market.

Japan White Line Chipboard Market Insight

The Japan white line chipboard market is gaining traction due to the country’s emphasis on high-quality craftsmanship, space-efficient furniture, and eco-friendly materials. With a focus on minimalistic and sustainable design trends, Japan’s furniture and construction sectors are increasingly incorporating engineered wood and laminated chipboard. The country’s aging population and limited living spaces are also driving demand for lightweight, versatile, and durable materials. Moreover, Japan’s ongoing technological innovations in surface finishing and moisture-resistant coatings are further supporting market expansion in residential and commercial projects.

China White Line Chipboard Market Insight

The China white line chipboard market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by the country’s thriving furniture manufacturing industry, rapid industrialization, and rising focus on sustainable production. China’s vast consumer base, expanding middle class, and booming construction and packaging sectors are key growth drivers. Domestic manufacturers are increasingly investing in automated production lines and recycled material utilization, enhancing both efficiency and environmental compliance. Additionally, China’s role as a global exporter of chipboard-based furniture and packaging products continues to solidify its leadership position in the regional market.

Global White Line Chipboard Market Share

The White Line Chipboard industry is primarily led by well-established companies, including:

• Kronospan (Austria)

• Egger Group (Austria)

• Arauco (Chile)

• Pfleiderer Group (Germany)

• Sonae Arauco (Portugal)

• Sweetwood (U.S.)

• Interprint (Germany)

• Finsa (Spain)

• West Fraser (Canada)

• Norbord (Canada)

• UPM-Kymmene (Finland)

• Rehau Group (Germany)

• Swiss Krono (Switzerland)

• Metsa Wood (Finland)

• Schattdecor (Germany)

• Unilin (Belgium)

• Stora Enso (Finland)

• Glunz & Jensen (Denmark)

• Holzwerk (Germany)

• Durelis (France)

What are the Recent Developments in Global White Line Chipboard Market?

- In April 2023, Kronospan, a global leader in wood-based panel products, launched a new production facility in South Carolina, U.S., aimed at expanding its manufacturing capacity for white line chipboard and decorative panels. This strategic investment underscores Kronospan’s commitment to sustainable production, local sourcing, and serving the growing demand from North American furniture and interior design industries. The facility integrates energy-efficient processes and recycled wood utilization, reinforcing the company’s leadership in eco-friendly engineered wood manufacturing.

- In March 2023, Egger Group introduced its NextGen Decorative Chipboard Collection in Europe, featuring advanced surface textures and improved durability. The collection focuses on low-emission, FSC-certified chipboard panels, designed for high-end furniture and architectural applications. This product line reflects Egger’s dedication to innovation, sustainability, and design versatility, addressing the rising global demand for eco-conscious, aesthetically refined materials in both residential and commercial spaces.

- In March 2023, Arauco announced the expansion of its sustainable chipboard production facility in Chile, aimed at boosting the supply of white line chipboard panels to both domestic and international markets. The expansion incorporates renewable energy systems and waste optimization technologies, demonstrating Arauco’s ongoing efforts to reduce carbon emissions and strengthen its role in responsible forestry and green manufacturing across Latin America.

- In February 2023, Pfleiderer Group, a leading European wood-based materials producer, entered a strategic partnership with IKEA to co-develop a range of premium white line chipboard products for modular furniture applications. This collaboration focuses on creating cost-efficient, durable, and environmentally responsible chipboard solutions, combining Pfleiderer’s technological expertise with IKEA’s commitment to sustainable furniture design and circular production practices.

- In January 2023, Sonae Arauco unveiled its Innovus Coloured Core Board Series at the IMM Cologne Furniture Fair, marking a major advancement in decorative chipboard technology. These new products feature enhanced color depth, surface consistency, and edge durability, enabling superior finishing quality for designers and manufacturers. The launch reinforces Sonae Arauco’s commitment to innovation and aesthetic excellence, while supporting the industry’s shift toward high-performance and sustainable decorative materials.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global White Line Chipboard Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global White Line Chipboard Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global White Line Chipboard Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.