Global White Oil Market

Market Size in USD Billion

CAGR :

%

USD

3.12 Billion

USD

4.30 Billion

2024

2032

USD

3.12 Billion

USD

4.30 Billion

2024

2032

| 2025 –2032 | |

| USD 3.12 Billion | |

| USD 4.30 Billion | |

|

|

|

|

Global White Oil Market Size

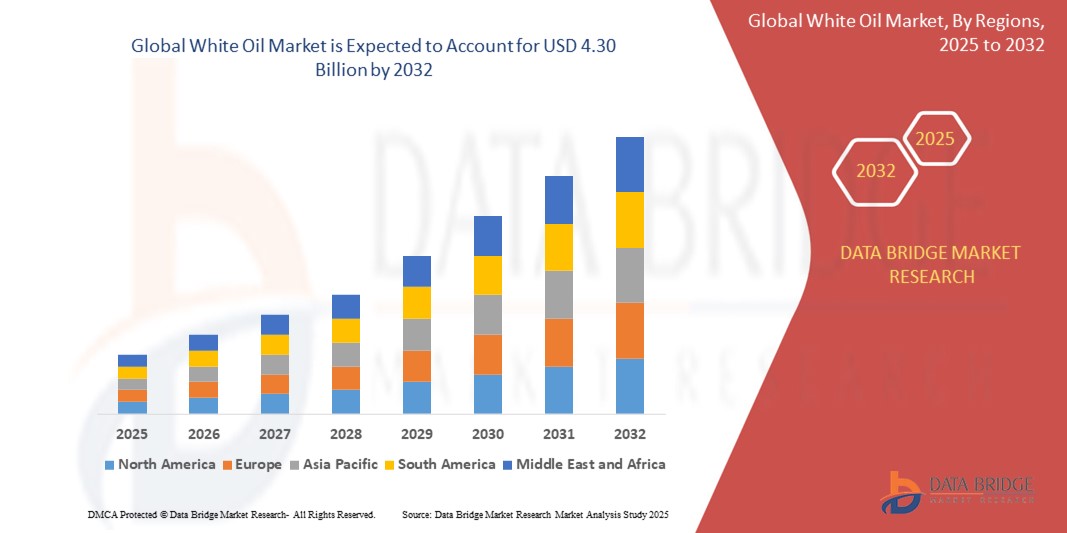

- The Global White Oil Market size was valued at USD 3.12 billion in 2024 and is expected to reach USD 4.30 billion by 2032, at a CAGR of 4.1 % during the forecast period

- The market growth is primarily driven by the increasing demand for white oil across various industries, notably pharmaceuticals, cosmetics, and personal care. White oil's purity, stability, and non-toxic nature make it an indispensable ingredient in formulations for ointments, lotions, makeup, and baby products.

- Furthermore, the expanding plastics and polymer industry, where white oil is used as an extender and plasticizer, and its growing application in the food industry as food-grade lubricants and release agents, are significant factors contributing to the market's acceleration. Continuous advancements in refining technologies are also enhancing the quality and performance of white oil, thereby boosting industry growth.

Global White Oil Market Analysis

- White oil, a highly refined and pure mineral oil, is a versatile component widely utilized across various industries, including pharmaceuticals, cosmetics, personal care, plastics, textiles, and food & beverages. Its appeal stems from its colorless, odorless, tasteless, non-toxic, and chemically inert properties, making it essential for applications requiring high purity and stability

- The escalating demand for white oil is primarily fueled by the expanding pharmaceutical and personal care industries, driven by increasing health consciousness and a preference for high-purity ingredients. Furthermore, the growth of the plastics and polymer sector and the rising need for food-grade lubricants and release agents in the food industry are significant growth drivers

- Asia-Pacific dominates the white oil market with the largest market share, approximately 49% in 2024, primarily due to the rapid growth of the pharmaceutical, personal care, and plastics industries in countries like China and India, coupled with increasing disposable incomes and rising consumer awareness. The region's robust industrial expansion and growing demand for high-purity ingredients contribute to its leading position

- Europe is expected to be a fast-growing region in the white oil market during the forecast period, driven by advancements in industrial applications and healthcare, along with a strong emphasis on food safety and quality standards

- The pharmaceutical segment dominates the white oil market, holding a significant market share and expected to maintain its lead. This is attributed to the critical role of pharmaceutical-grade white oil in producing various medicinal formulations, ointments, and creams, coupled with increased R&D activities and healthcare spending globally

Report Scope and Global White Oil Market Segmentation

|

Attributes |

Smart Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Global White Oil Market Trends

“Enhanced Purity and Specialization for Critical Applications"

- A significant and accelerating trend in the global white oil market is the increasing focus on ultra-high purity grades and specialized formulations to meet the stringent requirements of industries such as pharmaceuticals, cosmetics, and food processing. This emphasis is driven by growing regulatory demands for product safety and quality, as well as rising consumer awareness of ingredients in personal care and food items

- For instance, manufacturers are investing in advanced refining technologies like high-pressure hydrogenation and hydrocracking to remove even the most minute impurities, aromatic compounds, and sulfur, resulting in white oils that meet or exceed pharmacopoeia standards (e.g., USP, EP). This allows for their safe and effective use in sensitive applications such as oral medications, topical creams, baby oils, and food-grade lubricants

- Specialized white oil variants are being developed for niche applications. For example, in the plastics and polymer industry, low-volatility white oils are crucial as extenders and plasticizers to enhance melt flow rates and modify physical properties. Similarly, in the food industry, specific grades are formulated as release agents for baking and food packaging, ensuring non-toxic and compliant solutions

- This trend also involves innovations in product formulation and stability, allowing for longer shelf life and improved performance of end products. Companies are investing in R&D to develop white oils that offer superior stability, better absorption properties for personal care products, and enhanced compatibility with other ingredients

- The market is also seeing a growing emphasis on sustainable practices and eco-friendly production methods. While white oil is petroleum-derived, there's increasing pressure from regulators and consumers for manufacturers to minimize their environmental footprint during production, and research into bio-based alternatives is gaining traction

- This trend towards more refined, specialized, and quality-controlled white oil solutions is fundamentally reshaping product development and market offerings. Consequently, companies are differentiating themselves by offering a diverse portfolio of high-purity and application-specific white oils, catering to the evolving needs of their diverse industrial clientele.

- The demand for white oils that offer enhanced purity and specialized functionalities is growing rapidly across critical sectors, as industries increasingly prioritize product safety, performance, and regulatory compliance

Global White Oil Market Dynamics

Driver

"Growing Demand from Pharmaceutical, Cosmetics, and Food Industries"

- The increasing demand for high-purity white oil from the rapidly expanding pharmaceutical, cosmetics, personal care, and food & beverage industries is a primary driver for market growth. These sectors require white oil for its inert, non-toxic, colorless, and odorless properties, making it an ideal base for a wide range of products

- For instance, the surging global population and rising health awareness are driving the demand for pharmaceutical formulations like ointments, laxatives, and emollients, where white oil serves as a crucial inactive ingredient. Similarly, the personal care and cosmetics industries utilize white oil extensively in lotions, creams, makeup, and baby products due to its emollient and moisturizing qualities

- The stringent safety regulations in the food industry also contribute significantly, as food-grade white oil is essential for lubricants in food processing machinery, release agents, and protective coatings for food packaging. The consistent expansion of these end-use industries directly translates into heightened demand for white oil

- Furthermore, growing disposable incomes, particularly in emerging economies, lead to increased consumer spending on personal care and packaged food products, further accelerating the adoption of white oil as a key ingredient

Restraint/Challenge

"Volatility in Raw Material Prices and Stringent Regulations"

- The white oil market faces significant challenges from the volatility of crude oil prices, which is the primary raw material for white oil production. Fluctuations in crude oil prices, influenced by geopolitical tensions, supply-demand dynamics, and global economic conditions, directly impact the manufacturing costs of white oil, leading to pricing instability and affecting profit margins for producers

- For example, sudden spikes in crude oil prices can increase production expenses, making it difficult for white oil manufacturers to maintain competitive pricing, especially in price-sensitive markets

- Additionally, the increasingly stringent regulatory landscape across various end-use industries poses a significant hurdle. White oil used in pharmaceuticals, cosmetics, and food must meet exceptionally high purity and safety standards (e.g., USP, EP, FDA compliance). Adhering to these rigorous quality control measures and obtaining necessary certifications involves complex and costly refining processes, advanced testing, and continuous compliance efforts

- Non-compliance can lead to product recalls, legal penalties, and reputational damage, which can be particularly challenging for smaller manufacturers. While these regulations ensure product safety, they also add to operational costs and can slow down market entry for new products or players

- The presence of alternative products like vegetable oils or synthetic oils, which might offer similar properties at competitive prices for certain applications, further contributes to market competition and acts as a restraint on white oil's market expansion. Overcoming these challenges requires strategic raw material procurement, continuous investment in advanced refining technologies, and robust regulatory compliance frameworks

Global White Oil Market Scope

The market is segmented on the basis of application, product, grade, and viscosity-

- By Application

On the basis of application, the white oil market is segmented into Adhesives, Agriculture, Food, Pharmaceutical, Personal Care, Textile, Polymers, and Others. The Pharmaceutical segment held the largest market revenue share in 2024, driven by the increasing use of white oil as a base for various medicinal formulations, ointments, and laxatives due to its high purity, inertness, and non-toxic properties. The growing global healthcare expenditure and the rising demand for high-quality pharmaceutical products significantly contribute to this segment's dominance.

The Personal Care segment is anticipated to witness the fastest growth rate from 2025 to 2034, fueled by the expanding cosmetics and personal care industry. White oil is a crucial ingredient in lotions, creams, baby oils, and makeup, offering moisturizing, emollient, and protective properties. The rising consumer awareness regarding skin and hair care, coupled with an increasing demand for gentle and hypoallergenic products, is driving its rapid adoption in this sector.

- By Product

On the basis of product, the white oil market is segmented into Light Paraffinic, Heavy Paraffinic, and Naphthenic. The Light Paraffinic segment held the largest market revenue share in 2024, attributed to its widespread use in pharmaceutical and personal care applications due to its high purity and excellent chemical stability. Its lower viscosity makes it suitable for various formulations where a lighter consistency is preferred.

The Heavy Paraffinic segment is expected to witness the fastest CAGR from 2025 to 2034, driven by its increasing demand in industrial applications such as lubricants, textile processing, and rubber industries. Its higher viscosity and thermal stability make it ideal for demanding industrial environments and applications requiring enhanced lubrication properties.

- By Grade

On the basis of grade, the white oil market is segmented into 65/75 (ISO VG 10/15), 50/60 (ISO VG 7), 200/215 (ISO VG 32/46), 80/90 (ISO VG 15), and 340/365 (ISO VG 68). The 200/215 (ISO VG 32/46) segment held the largest market revenue share in 2024, primarily due to its balanced properties that make it suitable for a wide range of industrial, food-grade, and general lubrication applications. Its versatility and widespread acceptance across various sectors contribute to its leading position.

The 340/365 (ISO VG 68) segment is expected to witness the fastest CAGR from 2025 to 2034, driven by the increasing demand for high-viscosity white oils in specialized industrial lubricants, hydraulic fluids, and textile industries where higher film strength and thermal stability are required.

- By Viscosity

On the basis of viscosity, the white oil market is segmented into Low, Medium, and High. The Medium viscosity segment held the largest market revenue share in 2024, owing to its balanced properties that cater to a broad spectrum of applications across pharmaceutical, cosmetic, and industrial sectors. This viscosity range offers a good balance of flowability and film strength, making it highly versatile.

The High viscosity segment is expected to witness the fastest CAGR from 2025 to 2034, propelled by the growing demand from industries requiring heavy-duty lubricants, plasticizers, and process oils. These applications often benefit from the enhanced film strength and thermal stability offered by higher viscosity white oils, particularly in demanding operational environments.

Global White Oil Market Regional Analysis

- Asia-Pacific dominates the white oil market with the largest market share of approximately 49% in 2024, driven by the rapid expansion of key end-use industries such as pharmaceuticals, personal care, and plastics in countries like China and India.

- The region benefits from a large and growing population, leading to increased demand for consumer goods and healthcare products, which are major consumers of white oil.

- This dominance is further supported by significant industrialization, rising disposable incomes, and increasing consumer awareness regarding the quality and safety of products, which drives the adoption of high-purity white oil

- Europe is expected to expand at the fastest CAGR during the forecast period, primarily due to continuous advancements in industrial applications and healthcare, coupled with a strong emphasis on regulatory compliance and high-quality standards for ingredients in the pharmaceutical, cosmetic, and food sectors. The region's focus on sustainable and safe formulations also contributes to the rising demand for high-purity white oils

China White Oil Market Insight

The China white oil market accounted for the largest revenue share in Asia-Pacific in 2024, driven by strong demand from the cosmetics, plastics, and pharmaceutical industries. China’s position as a major manufacturing hub and the government's supportive industrial policies enhances production efficiency and product adoption. Rapid urbanization, consumer lifestyle shifts, and the rise of e-commerce platforms further accelerate the growth of white oil applications in personal care and healthcare products.

India White Oil Market Insight

India’s white oil market is witnessing significant growth due to increasing consumption in pharmaceutical, personal care, and polymer processing industries. The expanding middle-class population, rising health and hygiene awareness, and booming domestic pharmaceutical production are key growth drivers. Additionally, the Make in India initiative and favorable investment climate are encouraging both domestic and international players to expand their presence.

Japan White Oil Market Insight

The Japan white oil market is growing steadily, supported by the country's focus on high-quality personal care products and stringent pharmaceutical standards. Japan’s mature healthcare system and preference for premium skincare and cosmetic products are driving demand for highly refined white oils. The nation’s emphasis on product safety, quality, and innovation aligns well with the adoption of white oil in various regulated applications.

North America White Oil Market Insight

North America holds a significant share of the global white oil market, driven by advanced pharmaceutical and personal care industries. The presence of well-established manufacturers, coupled with high consumer awareness of product quality and regulatory compliance, sustains demand across the US and Canada. Moreover, increasing usage of white oil in polymers, adhesives, and food processing is further expanding the market.

U.S. White Oil Market Insight

The U.S. white oil market captured a dominant share in North America in 2024, owing to the high adoption of white oil in pharmaceutical, personal care, and industrial applications. The country’s robust regulatory framework, well-established healthcare sector, and demand for safe, non-toxic ingredients are major contributors. Additionally, technological advancements and innovation in formulation are driving the development of specialty white oil products.

Europe White Oil Market Insight

The Europe white oil market is projected to grow at a moderate CAGR during the forecast period, supported by increasing applications in cosmetics, pharmaceuticals, and polymer processing. Countries across Western Europe, especially Germany, France, and the UK, are investing in high-quality personal care and pharmaceutical manufacturing, enhancing market opportunities. Strict EU regulations on product purity and environmental impact further encourage the use of highly refined white oil.

U.K. White Oil Market Insight

The UK white oil market is anticipated to grow at a stable pace, driven by the demand for pharmaceutical-grade and cosmetic-grade oils. Consumer preference for clean-label, safe, and high-purity products is pushing companies to adopt high-quality white oil formulations. Additionally, the UK's robust cosmetics and healthcare sectors, combined with its focus on regulatory compliance, support market expansion.

Germany White Oil Market Insight

Germany's white oil market is supported by its leadership in engineering, healthcare, and cosmetics manufacturing. With a strong focus on sustainability and high technical standards, the country is promoting the adoption of environmentally safe and high-purity white oils in multiple sectors. Demand is particularly strong in the polymer processing and pharmaceutical segments, where consistent quality and regulatory alignment are critical.

Global White Oil Market Share

The Global White Oil Market industry is primarily led by well-established companies, including:

- Calumet Specialty Products Partners, L.P. (US)

- Chevron Corporation (US)

- Exxon Mobil Corporation (US)

- Royal Dutch Shell plc (UK/Netherlands)

- SEOJINCORP.CO.LTD. (South Korea)

- FUCHS (Germany)

- H&R GROUP (Germany)

- Savita Oil Technologies Ltd. (savita.com) (India)

- Panama Petrochem Ltd. (India)

- Apar Industries (India)

- C.J. Robinson Co Inc (US)

- Morris Lubricants (UK)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- Raj Petro Specialities Pvt. Ltd. (India)

- Kerax Limited (UK)

- Petro-Canada Lubricants Inc. (Canada)

- LubLine (US)

- Sonneborn LLC. (US)

- Sasol Limited (South Africa)

- JX Nippon & Energy Exploration Corporation (Japan)

Latest Developments in Global White Oil Market

- In January 2024, Chevron Lummus Global LLC successfully commissioned the world's largest white oil hydroprocessing unit at Hongrun Petrochemical Co., Ltd. in Shandong Province, China. This facility is designed to enhance the conversion of heavy hydrocarbons into high-value products, showcasing CLG's advanced refining technology and increasing the global supply of high-purity white oils

- In February 2023, Shell introduced a new ultra-pure white oil range specifically designed for use in cosmetic and pharmaceutical applications. This launch highlights the industry's continuous efforts to meet the stringent quality and safety demands of highly regulated sectors, offering specialized solutions for sensitive formulations

- In August 2022, Palmer Holland, a North American specialty chemical distributor, entered into a distribution agreement with Petro-Canada Lubricants. This agreement positions Palmer Holland as the U.S. distributor for Petro-Canada's PURETOL and KRYSTOL lines of high-purity white mineral oils, expanding the reach and availability of these specialized products in the North American market

- In May 2023, Hemisphere Ltd. LLC completed the acquisition of White Oil Co., indicating a trend of consolidation within the fragmented white oil market. Such acquisitions aim to streamline value chains, expand market presence, and enhance competitive positions among key players

- Leading industry players are increasingly investing in research and development to enhance product performance while embracing eco-friendly manufacturing practices. This shift towards sustainability is driven by both regulatory pressures and a growing consumer preference for environmentally responsible products, pushing innovations in biodegradable and bio-based white oil alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global White Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global White Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global White Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.