Global Whole Grain Foods Market

Market Size in USD Billion

CAGR :

%

USD

44.72 Billion

USD

74.58 Billion

2025

2033

USD

44.72 Billion

USD

74.58 Billion

2025

2033

| 2026 –2033 | |

| USD 44.72 Billion | |

| USD 74.58 Billion | |

|

|

|

|

Whole Grain Foods Market Size

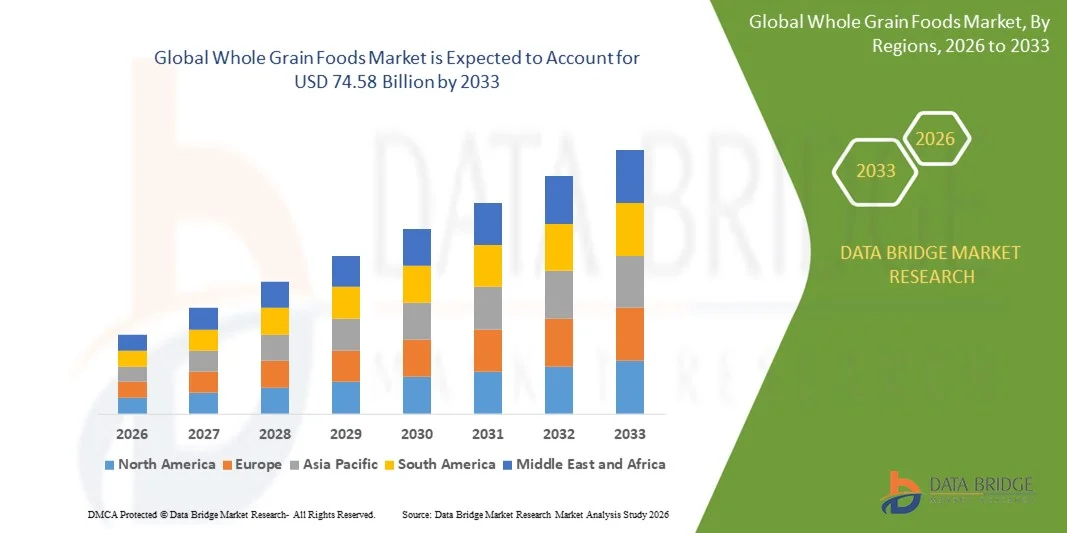

- The global whole grain foods market size was valued at USD 44.72 billion in 2025 and is expected to reach USD 74.58 billion by 2033, at a CAGR of 6.60% during the forecast period

- The market growth is primarily driven by the rising consumer inclination toward healthier eating habits and the increasing preference for nutrient-rich food options, as whole grain foods offer higher fiber, vitamins, and minerals compared to refined grain products

- Moreover, growing health consciousness and the rising prevalence of lifestyle-related conditions are motivating consumers to shift toward whole-grain-based diets. These combined factors are steadily strengthening the demand for whole grain products and contributing to consistent market expansion

Whole Grain Foods Market Analysis

- Whole grain foods, comprising products made from grains that retain their bran, germ, and endosperm, are becoming essential components of balanced diets across global households due to their superior nutritional value, digestive health benefits, and association with reduced risks of chronic diseases

- The growing demand for whole grain foods is strongly supported by increasing awareness of clean-label ingredients, shifting consumer preferences toward natural and minimally processed foods, and expanding availability of whole-grain variants across bakery, snacks, cereals, and ready-to-eat categories

- North America dominated the whole grain foods market with a share of 43.70% in 2025, due to increasing consumer preference for healthier diets, strong retail penetration, and extensive product innovation in bakery and breakfast categories

- Asia-Pacific is expected to be the fastest growing region in the whole grain foods market during the forecast period due to rapid urbanization, rising disposable incomes, and shifting dietary habits toward healthier food options in major economies such as China, India, and Japan

- Conventional segment dominated the market with a market share of 72.6% in 2025, due to its wide availability, competitive pricing, and established consumer base across developed and emerging markets. Conventional whole grain products are easily manufactured at scale and are stocked across supermarkets, hypermarkets, and online platforms, ensuring steady supply and demand. For instance, Nestlé offers a wide range of conventional whole grain breakfast cereals that are widely consumed globally. The segment benefits from extensive brand recognition, affordability, and consistent quality, making it the default choice for a large segment of consumers. In addition, convenience in preparation and long shelf life further support its dominance. Conventional whole grain foods continue to witness strong traction among families and general consumers who prioritize health benefits along with cost-effectiveness

Report Scope and Whole Grain Foods Market Segmentation

|

Attributes |

Whole Grain Foods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Whole Grain Foods Market Trends

Rising Demand for Nutrient-Dense and Clean-Label Whole Grain Products

- A major trend in the whole grain foods market is the increasing consumer shift toward nutrient-dense, minimally processed grain-based products that support digestive health and long-term wellness, with whole grains gaining preference due to their superior fiber, vitamin, and mineral content compared to refined grains. This rising inclination toward clean-label and naturally sourced ingredients is reinforcing whole grains as an essential part of everyday diets

- For instance, Kellogg Co. continues expanding its whole-grain-rich cereal and snack offerings, supporting the growing consumer preference for products made with recognizable, wholesome ingredients. Such developments are reinforcing awareness of whole-grain health benefits and encouraging broader adoption across key product categories

- Consumers are increasingly valuing whole grain foods for their role in supporting sustained energy, digestive balance, and overall wellness, which has strengthened demand for whole-grain bakery, snacks, and breakfast products. This trend is reinforced by growing interest in holistic nutrition and plant-forward eating habits

- A growing focus on clean-label transparency is influencing purchasing decisions, as consumers seek products with simple formulations free from artificial additives and unnecessary processing steps. Whole grain foods align well with this preference, supporting their rising penetration in mainstream and premium product lines

- The market is also observing higher adoption of innovative whole grain blends such as multi-grain combinations that offer varied textures, flavors, and nutritional profiles, allowing manufacturers to meet evolving consumer expectations. These innovations support differentiation while keeping whole grains at the center of product development

- This expanding demand for nutrient-dense, transparent, and naturally derived grain-based products continues to reinforce whole grains as a preferred ingredient across global food categories, solidifying their importance in shaping future nutritional trends

Whole Grain Foods Market Dynamics

Driver

Growing Consumer Shift Toward Preventive Health and High-Fiber Diets

- The rising consumer awareness of preventive health is significantly driving the adoption of whole grain foods, as individuals increasingly prioritize fiber-rich diets that support digestive health, metabolic balance, and reduced risk of chronic illnesses. This shift is strengthening demand for whole-grain-based bakery items, cereals, snacks, and ready-to-eat foods across global markets

- For instance, General Mills Inc. has expanded its portfolio of high-fiber whole-grain cereals to cater to consumers looking for daily functional nutrition, reinforcing the role of whole grains in supporting preventive wellness. Such strategic expansions by major brands continue to stimulate product uptake

- Whole grains are being increasingly incorporated into everyday meals due to their benefits in supporting weight management, heart health, and gut function, making them a preferred choice for households seeking long-term dietary improvements. This rising integration of whole grains into regular diets is boosting market growth

- The growing influence of nutrition education campaigns, wellness-focused marketing, and health-oriented food labeling is further encouraging consumers to choose whole grain alternatives over refined options. These factors are strengthening the market’s foundation within both developed and emerging economies

- The continued emphasis on preventive health, combined with rising self-driven nutritional awareness, is positioning whole grains as a core component of modern diets, concluding the driver section with sustained momentum for market expansion

Restraint/Challenge

Higher Product Costs and Limited Consumer Awareness

- The market faces challenges due to the higher production and processing costs associated with whole grain foods, which often leads to elevated retail pricing compared to refined grain products. These cost disparities can reduce adoption among price-sensitive consumer segments, particularly in emerging regions

- For instance, several smaller manufacturers report difficulty in scaling whole-grain formulations due to higher ingredient costs and specialized processing needs, which limits affordability and consumer reach across mass-market categories

- Limited awareness in certain regions regarding the nutritional value of whole grains continues to hinder broader market penetration, as many consumers still lack clarity about the health differences between whole grain and refined grain products. This information gap slows decision-making in favor of whole grain alternatives

- The taste and texture preferences of consumers accustomed to refined grains present an additional barrier, as some may perceive whole grain products as denser or less palatable, impacting repeat purchase behavior. Addressing these sensory preferences remains essential for expanding acceptance

- Overcoming these challenges through increased consumer education, improved product reformulations, and cost-optimized manufacturing approaches will be crucial for enhancing market adoption and ensuring long-term sustainability of whole grain foods across global markets

Whole Grain Foods Market Scope

The market is segmented on the basis of product, nature, flavors, source, packaging format, and distribution channel.

- By Product

On the basis of product, the whole grain foods market is segmented into bakery, snack bars, crisps and crackers, pastas and noodles, and breakfast cereals. The bakery segment dominated the market with the largest market revenue share in 2025, driven by the high consumer preference for whole grain bread, rolls, and buns as staple foods. Consumers increasingly perceive whole grain bakery products as healthier alternatives to refined flour products, contributing to consistent demand. For instance, companies such as Grupo Bimbo have expanded their whole grain bakery lines to cater to rising health-conscious consumer demand. The segment benefits from easy availability across retail stores, supermarkets, and e-commerce platforms, and strong marketing campaigns highlighting fiber content and health benefits. The bakery category also sees sustained growth due to its versatility in flavors, ingredients, and ready-to-eat convenience. In addition, bakery products are often recommended by nutritionists for daily consumption, reinforcing their dominant position.

The snack bars segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing on-the-go lifestyles and the growing popularity of functional snacks enriched with whole grains. Snack bars offer convenient nutrition for busy consumers and serve as healthy alternatives to traditional high-calorie snacks. Brands are innovating with flavors, protein enrichment, and clean-label ingredients to appeal to health-conscious millennials and Gen Z consumers. For instance, KIND Snacks has introduced multiple whole grain snack bars that combine taste with functional health benefits. The rising trend of fitness-oriented diets and protein-packed snacks further accelerates growth. In addition, strategic partnerships with gyms, health stores, and online marketplaces enhance their accessibility and adoption. The segment’s growth is reinforced by strong social media promotion emphasizing wellness and convenience.

- By Nature

On the basis of nature, the whole grain foods market is segmented into conventional and organic. The conventional segment dominated the market with the largest share of 72.6% in 2025 due to its wide availability, competitive pricing, and established consumer base across developed and emerging markets. Conventional whole grain products are easily manufactured at scale and are stocked across supermarkets, hypermarkets, and online platforms, ensuring steady supply and demand. For instance, Nestlé offers a wide range of conventional whole grain breakfast cereals that are widely consumed globally. The segment benefits from extensive brand recognition, affordability, and consistent quality, making it the default choice for a large segment of consumers. In addition, convenience in preparation and long shelf life further support its dominance. Conventional whole grain foods continue to witness strong traction among families and general consumers who prioritize health benefits along with cost-effectiveness.

The organic segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer awareness of health, sustainability, and chemical-free food consumption. Organic whole grain foods are perceived as safer and more nutritious, aligning with wellness trends and eco-conscious purchasing behaviors. For instance, Bob’s Red Mill has expanded its organic whole grain range to meet rising consumer demand for organic options. The growth is further supported by premium pricing strategies, niche retail channels, and certifications that assure product authenticity. In addition, online platforms and specialty stores facilitate easy access to organic whole grain products for urban and health-conscious consumers. The segment is expected to gain momentum due to increased interest in plant-based and holistic nutrition trends.

- By Flavors

On the basis of flavors, the whole grain foods market is segmented into vanilla, honey, chocolate, nuts, fruits, and chocolates. The nuts-flavored segment dominated the market in 2025 due to its combination of taste and functional nutrition, appealing to health-conscious consumers who seek added protein, fiber, and essential micronutrients. Nut-based whole grain products are widely incorporated in breakfast cereals, snack bars, and bakery items, enhancing both flavor and satiety. For instance, Nature Valley offers whole grain granola bars enriched with almonds and peanuts to cater to nutritional needs and taste preferences. The segment benefits from increasing consumer interest in functional and indulgent nutrition options. In addition, nuts provide a natural taste and texture enhancement, making products more desirable among adults and children alike. Marketing campaigns highlighting antioxidant content and heart health further strengthen consumer preference.

The honey-flavored segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing popularity of naturally sweetened whole grain products. Honey adds flavor while maintaining clean-label and health-oriented positioning, which resonates with the health-conscious consumer base. For instance, Kellogg’s has introduced honey-flavored whole grain cereals and bars targeting families seeking healthier alternatives to sugar-laden products. The segment benefits from natural sweetness, functional appeal, and compatibility with multiple product forms. In addition, honey-flavored products align with rising demand for immunity-boosting and antioxidant-rich diets. Easy incorporation into snacks, bakery, and breakfast items contributes to rapid adoption. The growth trajectory is reinforced by promotional efforts emphasizing natural and functional ingredients.

- By Source

On the basis of source, the whole grain foods market is segmented into multi-grain, rye, maize, quinoa, wheat, oats, brown rice, and barley. The wheat segment dominated the market in 2025, driven by its staple status in many regions, versatility in product applications, and wide availability of wheat-based whole grain foods. Consumers favor wheat for its balanced nutritional profile, including fiber, protein, and essential vitamins. For instance, Arrowhead Mills produces a variety of wheat-based whole grain cereals and flours catering to health-conscious households. The segment benefits from strong distribution networks across supermarkets, hypermarkets, and online channels, enhancing accessibility. In addition, wheat-based products are compatible with various flavors, textures, and food forms, ensuring consumer preference. Its long-standing presence in bakery, snack, and breakfast categories reinforces its market dominance.

The quinoa segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of superfoods, gluten-free diets, and plant-based nutrition. Quinoa is increasingly adopted in breakfast cereals, snack bars, and pasta alternatives due to its high protein content, essential amino acids, and dietary fiber. For instance, Ancient Harvest has expanded its quinoa product portfolio to cater to health-conscious and gluten-sensitive consumers. The segment benefits from global superfood trends and the rising demand for novel and nutrient-rich grains. In addition, quinoa aligns with vegan, fitness, and wellness-oriented diets, enhancing its appeal. Rapid adoption is further supported by convenient packaging and increasing e-commerce availability.

- By Packaging Format

On the basis of packaging format, the whole grain foods market is segmented into cans, bags and pouches, trays and containers, and folding cartons. The bags and pouches segment dominated the market in 2025 due to their convenience, portability, and suitability for maintaining product freshness over time. Consumers prefer resealable pouches for snacks, cereals, and bakery items as they facilitate storage, portion control, and extended shelf life. For instance, Bob’s Red Mill and Quaker extensively utilize flexible bags and pouches for whole grain cereals and flours. The segment benefits from lightweight packaging that reduces logistics costs and supports eco-friendly packaging initiatives. In addition, bags and pouches offer design flexibility for branding and nutrition information, enhancing consumer engagement. Retailers and e-commerce platforms favor this format for ease of stocking and shipping.

The trays and containers segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising demand for ready-to-eat, convenience-oriented whole grain products. Trays and containers are ideal for pre-portioned meals, bakery products, and snack assortments, aligning with urban lifestyles and on-the-go consumption trends. For instance, Kellogg’s has introduced whole grain breakfast kits and snack assortments in tray packaging to attract working professionals and students. The segment benefits from tamper-evident, visually appealing packaging that enhances consumer trust. In addition, trays and containers support portion control and meal-prep convenience, driving adoption. The format is increasingly used in subscription meal kits and e-commerce channels, further propelling growth.

- By Distribution Channel

On the basis of distribution channel, the whole grain foods market is segmented into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. The supermarkets/hypermarkets segment dominated the market in 2025 due to their extensive reach, wide product assortment, and competitive pricing strategies. Consumers prefer purchasing whole grain foods from these channels for bulk buying, variety, and promotional offers. For instance, Walmart and Carrefour feature comprehensive whole grain sections, increasing visibility and accessibility of products. The segment benefits from strong distribution networks, reliable stock availability, and brand partnerships. In addition, in-store promotions and sampling campaigns strengthen consumer awareness and trust. Supermarkets and hypermarkets continue to serve as the primary purchase point for families and health-conscious individuals.

The online retail segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing digital adoption, convenience, and doorstep delivery services. Consumers are increasingly purchasing whole grain foods through e-commerce platforms due to easy comparison, subscription options, and home delivery convenience. For instance, Amazon and BigBasket have expanded their whole grain product offerings with exclusive bundles and promotions. The segment benefits from personalized recommendations, subscription models, and access to niche products that may not be available locally. In addition, online retail supports direct-to-consumer marketing and faster adoption of new product launches. Growth is further propelled by mobile commerce and increasing awareness of healthy diets.

Whole Grain Foods Market Regional Analysis

- North America dominated the whole grain foods market with the largest revenue share of 43.70% in 2025, driven by increasing consumer preference for healthier diets, strong retail penetration, and extensive product innovation in bakery and breakfast categories

- Consumers in the region highly value the nutritional benefits, convenient ready-to-eat formats, and clear labeling offered by whole grain foods, which supports repeated purchases and brand loyalty

- This widespread adoption is further supported by high disposable incomes, a health-conscious population, and strong presence of major food manufacturers and private-label offerings, establishing whole grain foods as a staple across households and foodservice channels

U.S. Whole Grain Foods Market Insight

The U.S. whole grain foods market captured the largest revenue share in 2025 within North America, fueled by growing awareness of heart health, digestive wellness, and the benefits of high-fiber diets. Consumers are increasingly choosing whole grain bakery products, cereals, and snack bars due to clean-label claims and the emphasis on functional nutrition. The widespread use of online grocery platforms, expansion of subscription-based whole grain meal kits, and strong private-label offerings have further accelerated adoption, supported by promotional campaigns and reformulation initiatives aimed at increasing whole grain content in mainstream packaged foods.

Europe Whole Grain Foods Market Insight

The Europe whole grain foods market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent nutritional regulations, health advocacy programs, and rising consumer inclination toward fiber-rich and minimally processed food products. Growing adoption of whole grain bakery items, cereals, and ready-to-eat meals is supported by urban lifestyles and increasing availability through supermarkets and specialty stores. Manufacturers in the region are introducing taste-enhanced variants and regionally adapted products to improve acceptance, fostering widespread adoption across residential and institutional consumption.

U.K. Whole Grain Foods Market Insight

The U.K. whole grain foods market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing consumer awareness of cardiovascular health and government dietary guidelines encouraging higher whole grain intake. Whole grain cereals, breads, and convenience snacks continue to gain popularity as consumers seek healthier everyday options, while strong engagement from retail chains and online grocery platforms enhances product visibility and accessibility. Reformulation initiatives and targeted promotional campaigns by leading brands further strengthen the growth trajectory of whole grain foods in the U.K.

Germany Whole Grain Foods Market Insight

The Germany whole grain foods market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s long-standing preference for wholesome, grain-based bakery products and the rising demand for clean-label, sustainably sourced ingredients. Whole grain breads, cereals, and pasta products remain highly favored as consumers prioritize functional nutrition and balanced diets. Strong retail penetration, product innovation focusing on texture and flavor enhancement, and Germany’s emphasis on high-quality food standards contribute to sustained market expansion across both household and commercial consumption.

Asia-Pacific Whole Grain Foods Market Insight

The Asia-Pacific whole grain foods market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, supported by rapid urbanization, rising disposable incomes, and shifting dietary habits toward healthier food options in major economies such as China, India, and Japan. Increasing awareness of lifestyle disease prevention and expanding modern retail and e-commerce channels are boosting access to whole grain cereals, snacks, and ready meals. Local manufacturers are introducing affordable, region-specific whole grain products, enhancing acceptance across diverse consumer groups and accelerating overall market growth.

Japan Whole Grain Foods Market Insight

The Japan whole grain foods market is gaining momentum due to strong consumer interest in functional and fortified foods, an aging population seeking fiber-rich diets, and increasing integration of whole grains into traditional and convenience meal formats. Demand is growing for whole grain rice blends, cereals, and bakery products that offer mild flavors and premium quality. Product innovation that aligns with Japanese taste preferences, combined with high adoption of packaged and ready-to-eat foods, is driving steady expansion of whole grain consumption in urban and suburban households.

China Whole Grain Foods Market Insight

The China whole grain foods market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rising health consciousness among the expanding middle class, rapid urbanization, and significant product availability through modern retail and e-commerce platforms. Whole grain bakery products, cereals, noodles, and snacks are gaining strong traction as consumers shift toward balanced diets, while domestic manufacturers offer competitively priced options to appeal to a wide customer base. Government-led nutritional awareness programs and the fast-growing packaged food sector continue to propel the adoption of whole grain foods across urban and semi-urban regions.

Whole Grain Foods Market Share

The whole grain foods industry is primarily led by well-established companies, including:

- Allied Bakeries (U.K.)

- ARDENT MILLS (U.S.)

- Nature Foods Company, LLC (U.S.)

- BENEO (Germany)

- Britannia Industries (India)

- Cargill, Incorporated (U.S.)

- Cereal Ingredients, Inc. (U.S.)

- CreaFill Fibers Corporation (U.S.)

- Roberts Bakery (U.K.)

- General Mills Inc. (U.S.)

- Todos los Derechos Reservados (Mexico)

- Harry Brot GmbH (Germany)

- Hodgson Mill (U.S.)

- Hovis (U.K.)

- Kellogg Co. (U.S.)

- La Brea Bakery (U.S.)

- Lieken AG (Germany)

- MGP (U.S.)

- Nestlé (Switzerland)

- PepsiCo (U.S.)

Latest Developments in Global Whole Grain Foods Market

- In July 2025, Kellanova expanded its K-12 nutrition portfolio by introducing a range of whole-grain-rich items, including crackers, breaded formats, and snackable solutions tailored to school meal requirements, and this development is projected to accelerate whole-grain adoption at the institutional level. By integrating whole-grain options into daily school menus, the company is shaping early dietary habits, stimulating long-term demand, and strengthening its leadership in the child-nutrition segment, where whole-grain compliance standards continue to rise across multiple regions

- In March 2025, Bob’s Red Mill launched its new Overnight Protein Oats combining whole-grain oats with added plant-based protein to cater to rising consumer demand for nutrient-dense, quick-preparation breakfast options, and this introduction is expected to significantly influence the market by elevating the appeal of whole-grain convenience foods. The product strengthens the company’s position in the functional breakfast category, encourages higher consumption among busy consumers, and contributes to expanding the premium segment where protein-fortified whole-grain innovations are becoming a key differentiator for brands seeking competitive advantage

- In November 2024, Flowers Foods unveiled its Organic Rock ’N’ Rolls featuring whole wheat, oats, barley, and flax seeds, designed to appeal to consumers seeking organic, fiber-rich, and clean-label bakery alternatives, and this launch is poised to enhance the brand’s share in the organic bread and rolls category. The introduction supports growing demand for premium multi-grain bakery products, reinforces the market shift toward minimally processed grain blends, and increases consumer engagement in the high-value organic whole-grain segment

- In October 2024, the European Food Information Council (EUFIC), in collaboration with the Whole Grain Initiative, launched the Switch to Whole Grains campaign to run through November 2024, aiming to increase public awareness of the nutritional advantages of whole grains, which can provide up to 75% more nutrients than refined grains. Despite these benefits, whole-grain consumption in Europe remains below the recommended daily intake, heightening the risk of chronic conditions such as heart disease, type 2 diabetes, and certain cancers. The evidence-based campaign encourages consumers to include more whole grains in their everyday diets to support improved long-term health outcomes

- In April 2024, Bridor completed the acquisition of Pandriks Holding B.V., a key manufacturer of organic and artisanal bakery items offering a strong portfolio of whole-grain breads, and this acquisition is expected to substantially enhance Bridor’s production capacity and geographic reach. The move strengthens the company’s foothold in the European market, expands its ability to meet surging demand for natural whole-grain bakery formats, and positions Bridor as a more dominant supplier to both retail and foodservice channels seeking high-quality, authentic whole-grain baked goods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Whole Grain Foods Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Whole Grain Foods Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Whole Grain Foods Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.