Global Wi Fi 7 Market

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

46.79 Billion

2024

2032

USD

1.38 Billion

USD

46.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 46.79 Billion | |

|

|

|

|

Wi-Fi 7 Market Size

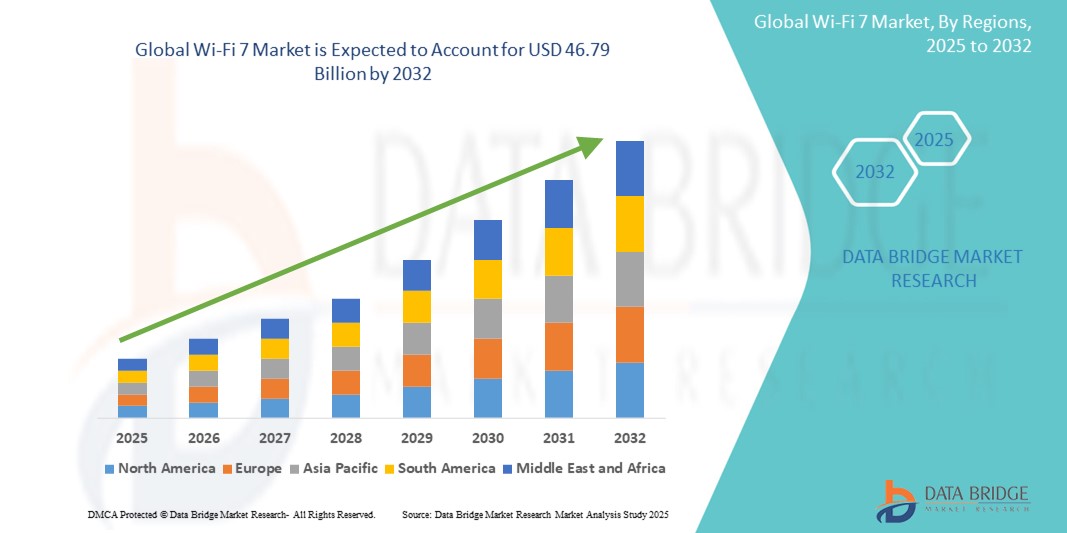

- The global wi-fi 7 market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 46.79 billion by 2032, at a CAGR of 55.34% during the forecast period

- The market growth is largely fuelled by the rising demand for ultra-high-speed internet, increasing deployment of smart devices, and the emergence of bandwidth-heavy applications such as 4K/8K streaming, AR/VR, and cloud gaming

- The proliferation of smart homes, connected workplaces, and the growing need for faster, more stable wireless communication in industrial automation are further accelerating the adoption of Wi-Fi 7

Wi-Fi 7 Market Analysis

- Growing investments in 5G and Wi-Fi convergence by telecom providers and enterprises are creating a synergistic environment for Wi-Fi 7 deployment

- Continuous advancements in chipset technologies and the introduction of compatible routers and access points are enabling rapid commercialization

- North America dominated the Wi-Fi 7 market with the largest revenue share of 41.25% in 2024, driven by strong demand for high-speed internet and the rapid adoption of next-generation wireless standards across residential and commercial sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global wi-fi 7 market, driven by rapid urbanization, rising demand for smart devices, and the presence of major consumer electronics and semiconductor manufacturing hubs across countries such as China, Japan, and South Korea

- The hardware segment dominated the market with the largest revenue share of 59.8% in 2024, driven by growing demand for routers, chipsets, and access points compatible with Wi-Fi 7 technology. The introduction of advanced features such as 320 MHz channels, Multi-Link Operation (MLO), and 4K QAM has accelerated the need for upgraded hardware to meet increasing data consumption and speed requirements. Hardware solutions are also gaining popularity across consumer electronics and enterprise-grade network infrastructure, supporting immersive streaming, gaming, and smart home connectivity

Report Scope and Wi-Fi 7 Market Segmentation

|

Attributes |

Wi-Fi 7 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Wi-Fi 7 in Smart City Infrastructure Projects • Rising Demand for Ultra-Low Latency Networks in AR/VR And Cloud |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Wi-Fi 7 Market Trends

“Surging Integration Of Wi-Fi 7 In Consumer Electronics”

- Consumer electronics manufacturers are increasingly adopting Wi-Fi 7 to meet the rising need for ultra-fast and stable wireless connectivity across devices such as smartphones, tablets, laptops, and smart TVs

- The ability of Wi-Fi 7 to handle bandwidth-intensive tasks such as 8K streaming, real-time gaming, and AR/VR applications is driving its integration into premium product lines

- Wi-Fi 7 offers advanced features such as 320 MHz channels, Multi-Link Operation (MLO), and 4K QAM, delivering enhanced performance and reduced latency

- Companies such as Qualcomm and MediaTek have introduced Wi-Fi 7 chipsets for integration into flagship devices, accelerating market readiness

- For instance, Qualcomm launched the FastConnect 7800 chipset in 2023 to support Wi-Fi 7, which has since been adopted in several high-end smartphones

Wi-Fi 7 Market Dynamics

Driver

“Rising Demand For High-Speed Connectivity In Smart Homes And Enterprises”

- The growing deployment of smart home devices and IoT applications is pushing the demand for high-throughput, low-latency wireless communication, which Wi-Fi 7 delivers effectively

- Enterprises require advanced wireless infrastructure to support collaborative tools, cloud services, and real-time video conferencing, areas where Wi-Fi 7 excels

- Wi-Fi 7’s ability to operate across multiple bands simultaneously improves spectrum efficiency and device capacity in crowded networks

- Smart manufacturing setups, healthcare systems, and education institutions benefit from the technology’s reliability and enhanced Quality of Service (QoS)

- For instance, Google deployed Wi-Fi 7 routers in several of its campuses to manage growing enterprise bandwidth demands and hybrid work environments

Restraint/Challenge

“High Initial Costs And Infrastructure Upgrade Barriers”

- Upgrading to Wi-Fi 7 requires costly new routers, access points, and compatible devices, which can be a significant financial hurdle for consumers and businesses

- Legacy systems, especially those on Wi-Fi 5 or earlier, may not support Wi-Fi 7’s advanced features, necessitating complete infrastructure overhauls

- Small and medium-sized enterprises often lack the capital and technical resources required for smooth migration to Wi-Fi 7

- Additional costs associated with professional installation, staff training, and network optimization further delay adoption

- For instance, in Southeast Asia, many small ISPs and enterprises have reported difficulty in accessing Wi-Fi 7-compatible infrastructure due to high import costs and limited vendor support

Wi-Fi 7 Market Scope

The market is segmented on the basis of offering, location type, application, and vertical.

- By Offering

On the basis of offering, the Wi-Fi 7 market is segmented into hardware, solutions, and services. The hardware segment dominated the market with the largest revenue share of 59.8% in 2024, driven by growing demand for routers, chipsets, and access points compatible with Wi-Fi 7 technology. The introduction of advanced features such as 320 MHz channels, Multi-Link Operation (MLO), and 4K QAM has accelerated the need for upgraded hardware to meet increasing data consumption and speed requirements. Hardware solutions are also gaining popularity across consumer electronics and enterprise-grade network infrastructure, supporting immersive streaming, gaming, and smart home connectivity.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising demand for deployment, integration, and maintenance of Wi-Fi 7 networks. As businesses and institutions modernize their digital ecosystems, the need for specialized support services grows, including consulting, system integration, and managed network services. Service providers are also capitalizing on the trend toward digital transformation by offering tailored Wi-Fi 7 upgrades to schools, healthcare facilities, and remote work environments.

- By Location Type

On the basis of location type, the Wi-Fi 7 market is segmented into outdoor and indoor. The indoor segment accounted for the largest revenue share in 2024, fuelled by the increasing demand for high-speed internet in homes, enterprises, retail spaces, and educational institutions. Indoor Wi-Fi 7 deployments enable seamless device connectivity, enhance streaming experiences, and support modern office needs such as high-resolution video conferencing and cloud computing.

The outdoor segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for robust public Wi-Fi infrastructure across smart cities, campuses, and large event venues. Outdoor Wi-Fi 7 access points provide faster, more reliable coverage in high-density environments, supporting real-time navigation, surveillance, and connectivity in transportation hubs and urban hotspots.

- By Application

On the basis of application, the Wi-Fi 7 market is segmented into immersive technologies, IoT & Industry 4.0, and telemedicine. In 2024, the IoT & Industry 4.0 segment held the largest share due to growing integration of wireless connectivity in industrial automation, smart factories, and logistics operations. Wi-Fi 7's low latency and enhanced throughput make it ideal for data-intensive industrial applications such as autonomous robotics, predictive maintenance, and digital twins.

The immersive technologies segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of virtual reality (VR), augmented reality (AR), and mixed reality (MR) in gaming, education, and remote collaboration. Wi-Fi 7 supports ultra-high-definition content and real-time interactions, eliminating latency issues and enhancing user experiences across immersive platforms.

- By Vertical

On the basis of vertical, the Wi-Fi 7 market is segmented into media & entertainment, education, residential, and retail. The residential segment dominated the market in 2024, led by increasing consumer demand for smart home connectivity, remote work setups, and uninterrupted video streaming. Wi-Fi 7-enabled routers are gaining traction among households for their superior coverage, reliability, and compatibility with next-gen devices.

The media & entertainment segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the surge in cloud-based gaming, live streaming, and content creation. Wi-Fi 7 enables creators and consumers to handle larger files, upload high-resolution content, and enjoy high-bandwidth experiences without buffering, driving innovation across entertainment ecosystems.

Wi-Fi 7 Market Regional Analysis

- North America dominated the Wi-Fi 7 market with the largest revenue share of 41.25% in 2024, driven by strong demand for high-speed internet and the rapid adoption of next-generation wireless standards across residential and commercial sectors

- The widespread rollout of advanced connected devices and streaming platforms, alongside enterprise investments in bandwidth-intensive applications such as cloud computing and AR/VR, is accelerating the transition to Wi-Fi 7

- Furthermore, robust infrastructure, the presence of leading semiconductor companies, and increasing emphasis on immersive and real-time applications continue to support regional growth in both urban and rural areas

U.S. Wi-Fi 7 Market Insight

The U.S. Wi-Fi 7 market accounted for the largest share of 79% in 2024 within North America, attributed to early technology adoption, extensive digital transformation across industries, and rising demand for ultra-low latency connectivity. With the proliferation of smart homes, 8K streaming, and AI-driven applications, consumers and enterprises are prioritizing Wi-Fi 7 routers and devices for improved network performance. In addition, major telecom providers are increasingly bundling Wi-Fi 7-enabled hardware with their internet plans, expanding market accessibility and accelerating upgrade cycles.

Europe Wi-Fi 7 Market Insight

The Europe Wi-Fi 7 market is expected to witness the fastest growth rate from 2025 to 2032, bolstered by supportive digital infrastructure policies and the need for higher connectivity standards across urban and semi-urban regions. Rising deployment of smart buildings, industrial IoT, and e-learning platforms is fuelling demand for enhanced network speeds and reliability. Several EU-funded initiatives targeting digital inclusion and green technology integration are also encouraging the adoption of energy-efficient, high-performance Wi-Fi 7 equipment across residential and enterprise segments.

U.K. Wi-Fi 7 Market Insight

The U.K. Wi-Fi 7 market is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing need for higher bandwidth in residential and commercial spaces. The growing use of remote collaboration tools, online gaming, and digital entertainment is pushing households and businesses to upgrade to Wi-Fi 7 networks. Government-backed broadband programs and private sector partnerships are also accelerating the rollout of compatible infrastructure, particularly in underserved regions. Furthermore, U.K.-based tech hubs are exploring Wi-Fi 7 for smart mobility and connected health projects.

Germany Wi-Fi 7 Market Insight

The Germany Wi-Fi 7 market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s emphasis on industrial automation, green tech, and digital sovereignty. As manufacturing firms adopt AI, robotics, and real-time analytics, the demand for ultra-reliable wireless communication is rising. Public-private investments into digital infrastructure and smart city frameworks are further boosting the market. In addition, German consumers are showing strong interest in premium connectivity for hybrid work, virtual learning, and home entertainment, encouraging faster hardware upgrades.

Asia-Pacific Wi-Fi 7 Market Insight

The Asia-Pacific Wi-Fi 7 market is expected to witness the fastest growth rate from 2025 to 2032, owing to the surge in mobile devices, smart electronics production, and 5G adoption across emerging economies. Countries such as China, Japan, South Korea, and India are experiencing robust demand for ultra-fast wireless networking in both consumer and enterprise applications. APAC’s position as a global semiconductor and electronics manufacturing hub also supports cost-effective deployment of Wi-Fi 7 solutions. In addition, educational digitization, telemedicine expansion, and e-governance initiatives are boosting market traction.

Japan Wi-Fi 7 Market Insight

The Japan Wi-Fi 7 market is expected to witness the fastest growth rate from 2025 to 2032, supported by high consumer tech penetration, early government backing for 6 GHz spectrum use, and strong demand from urban smart infrastructure projects. Japan’s high concentration of tech-savvy consumers and 4K/8K content consumption patterns are accelerating Wi-Fi 7 adoption in households. Moreover, the integration of Wi-Fi 7 with IoT ecosystems in transportation, robotics, and elder care is creating new growth avenues. Telecom providers are also piloting Wi-Fi 7-enabled services across metro cities and business parks.

China Wi-Fi 7 Market Insight

The China Wi-Fi 7 market held the largest revenue share within Asia-Pacific in 2024, driven by its vast internet user base, booming smart home market, and widespread 5G backbone deployment. Leading Chinese firms are aggressively rolling out Wi-Fi 7-enabled routers, smartphones, and laptops, making the technology more accessible. Smart city projects and nationwide investments in industrial IoT are further reinforcing the demand for ultra-high-speed, low-latency wireless connectivity. With strong local manufacturing capabilities and favorable regulatory support, China is emerging as a global leader in Wi-Fi 7 innovation and deployment.

Wi-Fi 7 Market Share

The Wi-Fi 7 industry is primarily led by well-established companies, including:

- Qualcomm (U.S.)

- Broadcom (U.S.)

- TP-Link (China)

- ZTE (China)

- Mediatek (Taiwan)

- Keysight Technologies (U.S.)

- MaxLinear (U.S.)

- Huawei (China)

- Commscope (U.S.)

- Vantiva (France)

- LitePoint (U.S.)

- Rohde & Schwarz (Germany)

- Intel (U.S.)

- HFCL (India)

- Netgear (U.S.)

- SDMC Technology (China)

- Senscomm Semiconductor (China)

- H3C (China)

- VVDN Technologies (India)

- Actiontec Electronics (U.S.)

- SDMC Technology (China)

Latest Developments in Global Wi-Fi 7 Market

- In December 2022, Rohde & Schwarz collaborated with Broadcom to launch an automated test solution tailored for Broadcom’s Wi-Fi 7 chipsets. This development aims to accelerate chipset validation and device certification, enhancing reliability and performance standards across the industry, which is expected to boost the adoption of Wi-Fi 7 technologies in both consumer and enterprise devices

- In January 2023, MediaTek introduced a wide range of consumer-ready Wi-Fi 7 products at CES 2023. The launch includes solutions for residential gateways, mesh routers, smart TVs, smartphones, laptops, and other connected devices. This move is set to expand the availability of Wi-Fi 7 in mainstream markets, driving greater adoption and competitive innovation

- In March 2023, Lounea entered into a partnership with TP-Link to become the first operator in Finland to deliver Wi-Fi 7 services for home wireless networks. This strategic collaboration is designed to improve network speed and reliability for residential users, setting a benchmark in home internet performance and positioning Finland as an early adopter of next-gen connectivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.