Global Wicketed Bags Market

Market Size in USD Million

CAGR :

%

USD

896.66 Million

USD

1,275.14 Million

2024

2032

USD

896.66 Million

USD

1,275.14 Million

2024

2032

| 2025 –2032 | |

| USD 896.66 Million | |

| USD 1,275.14 Million | |

|

|

|

|

Global Wicketed Bags Market Size

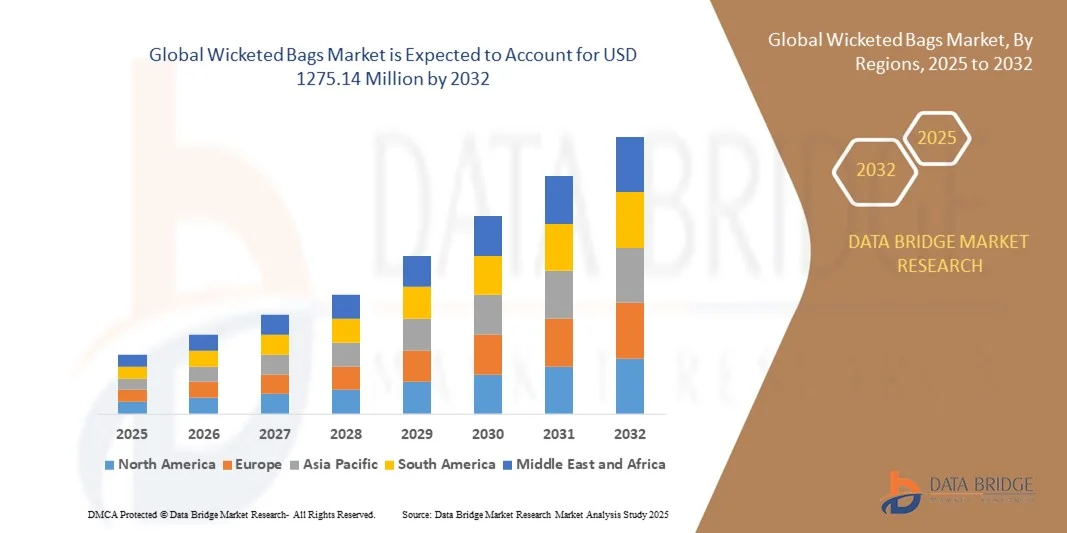

- The global Wicketed Bags Market size was valued at USD 896.66 million in 2024 and is expected to reach USD 1275.14 million by 2032, at a CAGR of 4.50% during the forecast period

- Market growth is primarily driven by increasing demand across food packaging, healthcare, and retail sectors, where wicketed bags offer convenience, hygiene, and efficiency in high-speed packing lines

- Additionally, the surge in e-commerce and sustainable packaging solutions is propelling adoption, as manufacturers seek cost-effective, recyclable, and customizable options—positioning wicketed bags as a key solution in modern packaging systems

Global Wicketed Bags Market Analysis

- Wicketed bags, designed for high-speed dispensing and packaging, are increasingly essential in industries such as food & beverage, healthcare, and retail due to their ease of use, cost-efficiency, and compatibility with automated filling lines

- The rising demand for wicketed bags is primarily driven by the need for efficient and hygienic packaging solutions, growing consumer preference for convenience packaging, and the expansion of online retail and food delivery services

- Asia-Pacific dominated the Global Wicketed Bags Market with the largest revenue share of 34.4% in 2024, supported by a mature packaging industry, high consumption of packaged goods, and the presence of leading manufacturers focused on sustainable and innovative packaging formats

- Europe is expected to be the fastest growing region in the Global Wicketed Bags Market during the forecast period due to rapid industrialization, growth in organized retail, and increasing demand for flexible packaging across emerging economies like China and India

- The polyethylene (PE) segment dominated the market with the largest revenue share of approximately 45% in 2024, due to its cost-effectiveness, flexibility, moisture resistance, and recyclability.

Report Scope and Global Wicketed Bags Market Segmentation

|

Attributes |

Wicketed Bags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Wicketed Bags Market Trends

Sustainability and Automation Driving Packaging Innovation

- A significant and accelerating trend in the global Wicketed Bags Market is the growing emphasis on sustainability and automation, with manufacturers integrating eco-friendly materials and advanced production technologies to meet evolving regulatory and consumer demands for responsible packaging. This shift is enhancing operational efficiency while reducing environmental impact across industries.

- For instance, leading players such as Coveris and Mondi Plc are producing wicketed bags made from recyclable polyethylene films, biodegradable resins, and post-consumer recycled (PCR) content, helping brands reduce their carbon footprint without compromising performance or shelf appeal.

- Material innovation is enabling multi-layer barrier films that offer both product protection and recyclability, making them suitable for food packaging where freshness and safety are critical. These high-performance bags are now widely used in frozen foods, bakery items, and produce due to their superior durability and sustainability.

- The integration of automated high-speed wicketing machines is further revolutionizing production lines, allowing manufacturers to increase throughput while minimizing manual handling. These advancements reduce labor costs, improve hygiene standards, and ensure consistent packaging quality—especially vital in food and medical applications.

- Additionally, brands are adopting custom-printed wicketed bags with features like smart labels, QR codes, and anti-counterfeiting elements, enabling greater supply chain transparency and consumer engagement. These digital enhancements reflect the broader movement toward smart packaging solutions.

- As industries place higher value on eco-conscious practices, automation, and traceability, demand for advanced wicketed bag solutions is expanding rapidly across food processing, healthcare, and e-commerce packaging, positioning the segment as a key contributor to the future of sustainable and efficient packaging.

Global Wicketed Bags Market Dynamics

Driver

Growing Need Due to Rise in Food Safety, Retail Demand, and E-commerce Packaging

- The increasing demand for safe, efficient, and hygienic packaging solutions—especially in the food, healthcare, and retail sectors—is a significant driver fueling the growth of the global Wicketed Bags Market. As industries focus on speed, compliance, and product protection, wicketed bags are emerging as a preferred choice for automated and high-volume packaging applications.

- For instance, in early 2024, Coveris introduced a new range of sustainable wicketed bags for fresh produce and bakery items, offering high-speed filling compatibility and recyclable materials, tailored for modern retail and grocery chains. Such innovations are positioning wicketed bags as essential packaging components for both fresh and processed goods.

- Growing awareness of food safety regulations and hygiene standards is prompting food manufacturers to adopt packaging solutions that minimize human contact, reduce contamination risks, and extend shelf life. Wicketed bags—especially those made from FDA-compliant films—help meet these requirements efficiently.

- Additionally, the explosive growth of e-commerce and online grocery platforms is driving the need for durable, lightweight, and customizable packaging that supports fast order fulfillment, brand visibility, and minimal damage during transit. Wicketed bags meet these needs with their ability to be tailored in size, material, and printing, while ensuring easy integration with automated packing systems.

- Their convenience in high-speed production lines, ability to handle various product types, and compatibility with both manual and automated processes are making wicketed bags increasingly essential in modern packaging strategies across global supply chains.

Restraint/Challenge

Environmental Concerns and Fluctuating Raw Material Costs

- Despite the rising adoption, the Wicketed Bags Market faces notable challenges, particularly environmental concerns related to plastic waste and the volatile cost of raw materials, which can affect profit margins and discourage adoption among eco-conscious brands.

- The use of conventional plastics in many wicketed bags contributes to long-term waste and landfill accumulation, prompting criticism from both consumers and environmental groups. In regions with strict plastic use regulations, such as parts of Europe and North America, demand is shifting toward compostable or recyclable alternatives—pressuring manufacturers to invest in new materials and machinery.

- For Instance, bans on single-use plastics in countries such as India and Canada have accelerated the push toward biodegradable and paper-based wicketed bags, which, while more sustainable, often come at higher production costs and may lack the same strength or transparency as traditional plastic versions.

- Another key challenge is the fluctuation in prices of polyethylene and polypropylene, which are primary materials for wicketed bag production. These price swings—often tied to global oil markets—can disrupt production planning and make it difficult for manufacturers to maintain competitive pricing, especially in cost-sensitive markets.

- Overcoming these challenges will require sustained innovation in bio-based materials, cost-efficient manufacturing, and broader recycling infrastructure, alongside educational initiatives to promote the environmental benefits of sustainable wicketed bag alternatives. This will be crucial for long-term adoption and regulatory compliance across diverse global markets.

Global Wicketed Bags Market Scope

Global wicketed bags market is segmented on the basis of material type, packaging type, closure type and application.

- By Material Type

On the basis of material type, the Global Wicketed Bags Market is segmented into Polyethylene (PE), Polyvinylidene Chloride (PVDC), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Polyester (PET), and Polyamide (PA). The polyethylene (PE) segment dominated the market with the largest revenue share of approximately 45% in 2024, due to its cost-effectiveness, flexibility, moisture resistance, and recyclability. PE wicketed bags are widely used in food and retail packaging, favored for their durability and compatibility with automated packing lines. The cast polypropylene (CPP) segment is expected to witness the fastest CAGR of around 19.5% from 2025 to 2032. CPP’s growing adoption is attributed to its superior clarity, heat resistance, and strength, making it ideal for premium food and pharmaceutical packaging. Additionally, increasing demand for sustainable and high-performance materials in emerging markets supports CPP’s rapid growth.

- By Packaging Type

Based on packaging type, the Global Wicketed Bags Market is segmented into flexible packaging and semi-rigid packaging. The flexible packaging segment led the market with a dominant revenue share of 62% in 2024, due to its lightweight, cost-efficiency, and excellent barrier properties. Flexible wicketed bags are extensively used in food, pharmaceuticals, and personal care sectors, owing to their adaptability to different product shapes and sizes. The semi-rigid packaging segment is anticipated to register the fastest growth rate of 20.3% from 2025 to 2032. This growth is driven by increasing demand in industries requiring more robust and reusable packaging, such as cosmetics and specialty pharmaceuticals. The semi-rigid type provides added product protection and enhances shelf appeal, further propelling its adoption in premium packaging applications.

- By Closure Type

On the basis of closure type, the Global Wicketed Bags Market is segmented into re-closable bags and non-re-closable bags. The re-closable bags segment held the largest revenue share of 55% in 2024, driven by the increasing consumer preference for convenience, product freshness, and multiple-use capability. Features like zip locks, slider zippers, and press-to-close strips have become standard in food, personal care, and pharmaceutical packaging. The non-re-closable bags segment is expected to witness the fastest CAGR of 18.9% during the forecast period, due to their simplicity and cost-effectiveness in bulk packaging, industrial goods, and disposable applications. Despite lower convenience, non-re-closable wicketed bags maintain significant demand in sectors where resealing is not essential.

- By Application

On the basis of application, the Global Wicketed Bags Market is segmented into food, pharmaceuticals, personal care & cosmetic products, industrial goods, commercial goods, and others. The food segment dominated the market with the largest revenue share of 48.5% in 2024, driven by the growing need for hygienic, durable packaging solutions that extend product shelf life. Wicketed bags are widely used for bakery, frozen foods, snacks, and fresh produce due to their compatibility with high-speed filling machines and customizable features. The pharmaceuticals segment is projected to register the fastest CAGR of 21.2% from 2025 to 2032, fueled by stringent regulatory requirements, increasing demand for tamper-evident packaging, and rising production of pharmaceutical products globally. Growth in personal care and cosmetic products also contributes significantly to the expanding market.

Global Wicketed Bags Market Regional Analysis

- Asia-Pacific dominated the Global Wicketed Bags Market with the largest revenue share of 34.4% in 2024, driven by high demand across food, pharmaceutical, and personal care packaging industries.

- The region benefits from advanced manufacturing infrastructure, well-established distribution networks, and increasing consumer preference for high-quality, sustainable packaging solutions.

- Rising awareness about environmental sustainability, coupled with stringent regulations on packaging materials, encourages the adoption of recyclable and innovative wicketed bag materials. High disposable incomes and the presence of key market players further bolster growth, making North America a leading market for wicketed bags in both commercial and industrial applications.

U.S. Wicketed Bags Market Insight

The U.S. wicketed bags market captured the largest revenue share of 81% in 2024 within North America, driven by strong demand across the food packaging, pharmaceutical, and personal care sectors. The rising preference for sustainable and innovative packaging solutions, coupled with stringent regulatory standards on packaging materials, is fueling market growth. The country’s well-established manufacturing base and advanced supply chain infrastructure support widespread adoption of wicketed bags in both commercial and industrial applications. Additionally, consumer demand for convenient, resealable, and customizable packaging solutions further propels the market.

Europe Wicketed Bags Market Insight

The Europe wicketed bags market is projected to grow at a substantial CAGR during the forecast period, driven by increasing environmental regulations and rising awareness regarding sustainable packaging. The demand for eco-friendly materials such as recyclable polyethylene and biodegradable polymers is accelerating adoption across food, pharmaceutical, and cosmetic sectors. Urbanization and a surge in e-commerce activities are encouraging innovative packaging solutions like wicketed bags for ease of handling and distribution. The market benefits from advanced production technologies and a strong focus on reducing plastic waste.

U.K. Wicketed Bags Market Insight

The U.K. wicketed bags market is expected to register notable growth during the forecast period, supported by rising consumer demand for sustainable and convenient packaging. The country's stringent environmental policies and increasing emphasis on plastic reduction are encouraging manufacturers to adopt recyclable and reusable wicketed bags. Growth is further propelled by the booming food and beverage industry, retail packaging needs, and the rise of online grocery shopping. The U.K.’s robust logistics and retail infrastructure facilitate efficient distribution and use of wicketed bags across various sectors.

Germany Wicketed Bags Market Insight

The Germany wicketed bags market is anticipated to grow steadily, driven by stringent packaging waste regulations and a strong industrial base. German consumers and manufacturers prioritize eco-friendly and high-performance packaging materials, resulting in increased use of biodegradable and recyclable wicketed bags. The growing food processing and pharmaceutical industries contribute significantly to demand. Additionally, Germany’s commitment to innovation and sustainability fosters the development of advanced packaging solutions, including multi-layer films and specialized closure systems within wicketed bag formats.

Asia-Pacific Wicketed Bags Market Insight

The Asia-Pacific wicketed bags market is expected to witness the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing industrialization in countries such as China, India, Japan, and South Korea. The region’s expanding food processing, pharmaceutical, and personal care sectors demand cost-effective, durable, and sustainable packaging solutions. Government initiatives promoting digitalization and environmental sustainability further support market growth. Additionally, the presence of major manufacturing hubs and improving supply chain infrastructure increases the availability and affordability of wicketed bags across diverse applications.

Japan Wicketed Bags Market Insight

The Japan wicketed bags market is growing steadily due to high demand for innovative packaging in the food, pharmaceutical, and cosmetics industries. Japanese consumers prioritize quality, convenience, and eco-friendly packaging solutions, encouraging the adoption of advanced wicketed bag materials such as multilayer films and biodegradable plastics. The country’s aging population also drives demand for easy-to-use, resealable packaging formats. Integration of packaging with smart technology for enhanced product tracking and freshness is becoming more prevalent, supporting market expansion.

China Wicketed Bags Market Insight

China accounted for the largest revenue share in the Asia-Pacific wicketed bags market in 2024, fueled by rapid urbanization, a growing middle class, and strong industrial growth. The country’s large-scale food processing and pharmaceutical sectors demand innovative and cost-effective packaging solutions, boosting wicketed bag usage. Government policies encouraging sustainable packaging and waste reduction contribute to the shift towards recyclable and biodegradable materials. Furthermore, China’s position as a major manufacturing hub ensures competitive pricing and widespread availability of wicketed bags, making it a key driver of the regional market.

Global Wicketed Bags Market Share

The Wicketed Bags industry is primarily led by well-established companies, including:

• Chun Yip Plastics (Hong Kong)

• Sheel Pack (India)

• WrapEx (U.K.)

• Midwest Poly Pak (U.S.)

• A-Pac Manufacturing (U.S.)

• Rutan Poly Industries (U.S.)

• Richmond Plastics (Canada)

• KG Marketing and Bags (U.S.)

• Maco PKG (U.S.)

• International Plastics (U.S.)

• OM FLEX (India)

• Coveris Holdings S.A. (Austria)

• Uflex Ltd. (India)

• LPS Industries, Inc. (U.S.)

• St. John Packaging (Canada)

• PAC Worldwide Corporation (U.S.)

• Sonoco Products Company (U.S.)

• Mondi Plc (U.K.)

• Supreme Plastics Group (India)

• Berry Global Group Inc. (U.S.)

• Bischof + Klein (Germany)

What are the Recent Developments in Global Wicketed Bags Market?

- In April 2023, Berry Global Group, a global leader in engineered materials and packaging solutions, announced a strategic expansion of its wicketed bags manufacturing capabilities in South Africa. This initiative aims to meet the growing demand for high-quality, sustainable packaging solutions across food and pharmaceutical sectors. By leveraging its advanced production technologies and local market insights, Berry Global reinforces its commitment to providing innovative and reliable packaging options tailored to regional needs, further strengthening its position in the rapidly expanding global Wicketed Bags Market.

- In March 2023, Innovia Films, a specialist in sustainable packaging films, launched a new range of biodegradable wicketed bags designed specifically for the food and personal care industries. These eco-friendly bags combine durability with compostable materials, addressing increasing consumer and regulatory demands for sustainable packaging. This product launch underscores Innovia Films’ dedication to advancing environmentally responsible packaging solutions, enhancing safety and shelf life while minimizing environmental impact.

- In March 2023, Amcor plc successfully implemented a large-scale packaging upgrade for a major pharmaceutical company in India, replacing conventional bags with high-barrier wicketed bags to improve product protection and extend shelf life. This project highlights Amcor’s expertise in developing innovative packaging solutions that meet stringent industry standards, contributing to enhanced product safety and compliance in emerging markets.

- In February 2023, Mondi Group, a global packaging and paper company, formed a strategic partnership with a leading European food retailer to introduce custom-branded flexible wicketed bags for fresh produce. This collaboration aims to improve product visibility and convenience for consumers while emphasizing sustainability through recyclable materials. Mondi’s initiative demonstrates its commitment to driving innovation and operational efficiency within the retail packaging sector.

- In January 2023, Sealed Air Corporation unveiled its next-generation wicketed bags featuring antimicrobial properties and enhanced barrier protection at the PACK EXPO trade show. These bags are designed to offer superior hygiene and longer product freshness, especially for food and pharmaceutical applications. Sealed Air’s new offering reflects the company’s focus on integrating advanced technology into packaging solutions, providing end-users with improved safety, convenience, and environmental benefits.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL WICKETED BAGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL WICKETED BAGS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL WICKETED BAGS MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL WICKETED BAGS MARKET, BY MATERIAL, (2020-2029), (USD MILLION) (MILLION UNITS)

(Value , volume and ASP for each segment will be provided)

8.1 OVERVIEW

8.2 POLYETHYLENE (PE)

8.2.1 VALUE

8.2.2 VOLUME

8.2.3 ASP

8.3 POLYVINYLIDENCHLORIDE (PVDC)

8.3.1 VALUE

8.3.2 VOLUME

8.3.3 ASP

8.4 CAST POLYPROPYLENE (CPP)

8.4.1 VALUE

8.4.2 VOLUME

8.4.3 ASP

8.5 POLYVINYLCHLORIDE (PVC)

8.5.1 VALUE

8.5.2 VOLUME

8.5.3 ASP

8.6 POLYESTER (PET)

8.6.1 VALUE

8.6.2 VOLUME

8.6.3 ASP

8.7 POLYAMIDE (PA)

8.7.1 VALUE

8.7.2 VOLUME

8.7.3 ASP

9 GLOBAL WICKETED BAGS MARKET, BY TYPE, (2020-2029), (USD MILLION)

9.1 OVERVIEW

9.2 LOOSE FLAP

9.3 BOTTOM GUSSET

9.4 SIDE GUSSET

9.5 OTHERS

10 GLOBAL WICKETED BAGS MARKET, BY PACKAGING TYPE, (2020-2029), (USD MILLION)

10.1 OVERVIEW

10.2 FLEXIBLE PACKAGING

10.3 SEMI- RIGID PACKAGING

11 GLOBAL WICKETED BAGS MARKET, BY CLOSURE TYPE, (2020-2029), (USD MILLION)

11.1 OVERVIEW

11.2 RE-CLOSABLE BAGS

11.3 NON-RE-CLOSABLE BAGS

12 GLOBAL WICKETED BAGS MARKET, BY APPLICATION, (2020-2029), (USD MILLION)

12.1 OVERVIEW

12.2 FOOD

12.2.1 FOOD, BY TYPE

12.2.1.1. LOOSE FLAP

12.2.1.2. BOTTOM GUSSET

12.2.1.3. SIDE GUSSET

12.2.1.4. OTHERS

12.3 PHARMACEUTICALS

12.3.1 PHARMACEUTICALS, BY TYPE

12.3.1.1. LOOSE FLAP

12.3.1.2. BOTTOM GUSSET

12.3.1.3. SIDE GUSSET

12.3.1.4. OTHERS

12.4 PERSONAL CARE & COSMETIC PRODUCTS

12.4.1 PERSONAL CARE & COSMETIC PRODUCTS, BY TYPE

12.4.1.1. LOOSE FLAP

12.4.1.2. BOTTOM GUSSET

12.4.1.3. SIDE GUSSET

12.4.1.4. OTHERS

12.5 INDUSTRIAL GOODS

12.5.1 INDUSTRIAL GOODS, BY TYPE

12.5.1.1. LOOSE FLAP

12.5.1.2. BOTTOM GUSSET

12.5.1.3. SIDE GUSSET

12.5.1.4. OTHERS

12.6 COMMERCIAL GOODS

12.6.1 COMMERCIAL GOODS, BY TYPE

12.6.1.1. LOOSE FLAP

12.6.1.2. BOTTOM GUSSET

12.6.1.3. SIDE GUSSET

12.6.1.4. OTHERS

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1. LOOSE FLAP

12.7.1.2. BOTTOM GUSSET

12.7.1.3. SIDE GUSSET

12.7.1.4. OTHERS

13 GLOBAL WICKETED BAGS MARKET, BY GEOGRAPHY, (2020-2029), (USD MILLION)

13.1 GLOBAL WICKETED BAGS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 ITALY

13.3.4 FRANCE

13.3.5 SPAIN

13.3.6 SWITZERLAND

13.3.7 RUSSIA

13.3.8 TURKEY

13.3.9 BELGIUM

13.3.10 NETHERLANDS

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 SINGAPORE

13.4.5 THAILAND

13.4.6 INDONESIA

13.4.7 MALAYSIA

13.4.8 PHILIPPINES

13.4.9 AUSTRALIA AND NEW ZEALAND

13.4.10 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 UNITED ARAB EMIRATES

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL WICKETED BAGS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT ANALYSIS AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 GLOBAL WICKETED BAGS MARKET – COMPANY PROFILE

16.1 OM FLEX

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 PRODUCTION CAPACITY OVERVIEW

16.1.4 SWOT ANALYSIS

16.1.5 REVENUE ANALYSIS

16.1.6 RECENT UPDATES

16.2 INTERNATIONAL PLASTICS INC

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 PRODUCTION CAPACITY OVERVIEW

16.2.4 SWOT ANALYSIS

16.2.5 REVENUE ANALYSIS

16.2.6 RECENT UPDATES

16.3 BERRY GLOBAL INC

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 PRODUCTION CAPACITY OVERVIEW

16.3.4 SWOT ANALYSIS

16.3.5 REVENUE ANALYSIS

16.3.6 RECENT UPDATES

16.4 MACO PKG

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 PRODUCTION CAPACITY OVERVIEW

16.4.4 SWOT ANALYSIS

16.4.5 REVENUE ANALYSIS

16.4.6 RECENT UPDATES

16.5 NORTH COAST PLASTICS, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 PRODUCTION CAPACITY OVERVIEW

16.5.4 SWOT ANALYSIS

16.5.5 REVENUE ANALYSIS

16.5.6 RECENT UPDATES

16.6 UFLEX LIMITED

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 PRODUCTION CAPACITY OVERVIEW

16.6.4 SWOT ANALYSIS

16.6.5 REVENUE ANALYSIS

16.6.6 RECENT UPDATES

16.7 RUTAN POLY INDUSTRIES, INC

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 PRODUCTION CAPACITY OVERVIEW

16.7.4 SWOT ANALYSIS

16.7.5 REVENUE ANALYSIS

16.7.6 RECENT UPDATES

16.8 A-PAC MANUFACTURING CO., INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 PRODUCTION CAPACITY OVERVIEW

16.8.4 SWOT ANALYSIS

16.8.5 REVENUE ANALYSIS

16.8.6 RECENT UPDATES

16.9 RAYNA ENTERPRISES

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 PRODUCTION CAPACITY OVERVIEW

16.9.4 SWOT ANALYSIS

16.9.5 REVENUE ANALYSIS

16.9.6 RECENT UPDATES

16.1 MID-WEST POLY PAK, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 PRODUCTION CAPACITY OVERVIEW

16.10.4 SWOT ANALYSIS

16.10.5 REVENUE ANALYSIS

16.10.6 RECENT UPDATES

16.11 WRAPEX

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 PRODUCTION CAPACITY OVERVIEW

16.11.4 SWOT ANALYSIS

16.11.5 REVENUE ANALYSIS

16.11.6 RECENT UPDATES

16.12 EUPHORIA PACKAGING LLP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 PRODUCTION CAPACITY OVERVIEW

16.12.4 SWOT ANALYSIS

16.12.5 REVENUE ANALYSIS

16.12.6 RECENT UPDATES

16.13 WELTON BIBBY & BARON

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 PRODUCTION CAPACITY OVERVIEW

16.13.4 SWOT ANALYSIS

16.13.5 REVENUE ANALYSIS

16.13.6 RECENT UPDATES

16.14 BISCHOF + KLEIN FRANCE SAS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 PRODUCTION CAPACITY OVERVIEW

16.14.4 SWOT ANALYSIS

16.14.5 REVENUE ANALYSIS

16.14.6 RECENT UPDATES

16.15 PAC WORLDWIDE CORPORATION.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 PRODUCTION CAPACITY OVERVIEW

16.15.4 SWOT ANALYSIS

16.15.5 REVENUE ANALYSIS

16.15.6 RECENT UPDATES

16.16 COVERIS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 PRODUCTION CAPACITY OVERVIEW

16.16.4 SWOT ANALYSIS

16.16.5 REVENUE ANALYSIS

16.16.6 RECENT UPDATES

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Wicketed Bags Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wicketed Bags Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wicketed Bags Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.