Global Wilsons Disease Market

Market Size in USD Million

CAGR :

%

USD

670.50 Million

USD

1,084.91 Million

2024

2032

USD

670.50 Million

USD

1,084.91 Million

2024

2032

| 2025 –2032 | |

| USD 670.50 Million | |

| USD 1,084.91 Million | |

|

|

|

|

Wilson’s Disease Market Size

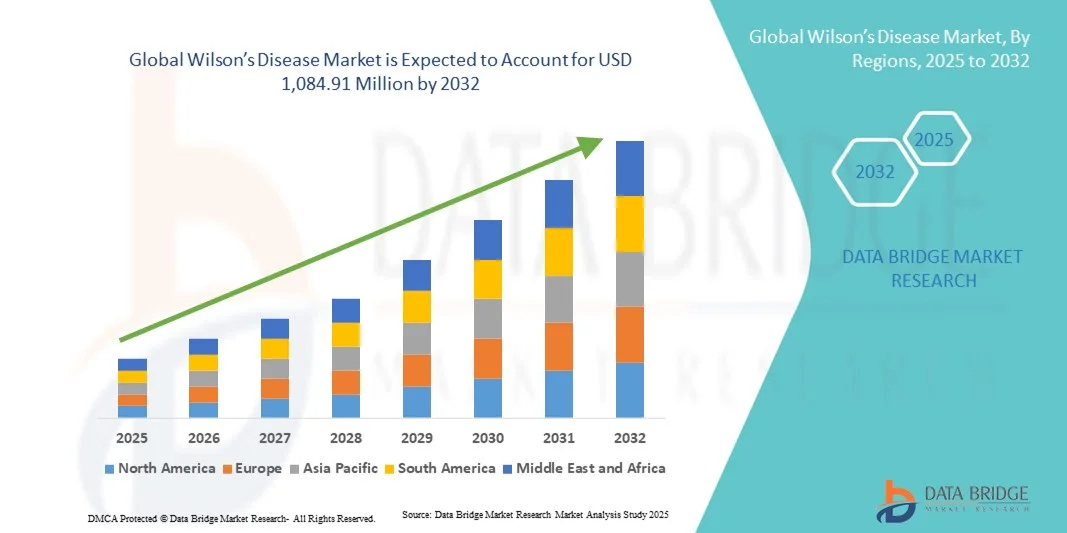

- The global Wilson’s Disease market size was valued at USD 670.50 million in 2024 and is expected to reach USD 1,084.91 million by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is largely fueled by increasing awareness and advancements in the diagnosis and treatment of Wilson’s disease, leading to earlier detection and improved management in both clinical and homecare settings

- Furthermore, the rising prevalence of Wilson’s disease globally and the expansion of treatment options, including chelating agents and zinc-based therapies, are enhancing patient outcomes and adherence, establishing modern pharmacological interventions as the preferred approach. These converging factors are accelerating the uptake of Wilson’s disease treatments, thereby significantly boosting the industry’s growth

Wilson’s Disease Market Analysis

- Wilson’s Disease market, encompassing diagnostic testing and pharmacological or surgical interventions, is increasingly vital in both clinical and homecare settings due to its ability to improve patient outcomes, manage copper accumulation, and prevent severe liver or neurological complications

- The escalating demand for Wilson’s Disease solutions is primarily fueled by growing awareness of the disease, advancements in diagnostic technologies such as blood, urine, and genetic tests, and improved access to effective treatment options

- North America dominated the Wilson’s Disease market with the largest revenue share of 41% in 2024, characterized by well-established healthcare infrastructure, high patient awareness, and a strong presence of leading pharmaceutical companies, with the U.S. experiencing substantial growth in treatment adoption and diagnostic testing, driven by innovations in pharmacological therapies and expanded access to specialty care

- Asia-Pacific is expected to be the fastest-growing region in the Wilson’s Disease market during the forecast period due to increasing healthcare access, rising disease awareness, and growing investment in rare disease diagnostics and therapeutics

- Symptomatic Wilson’s Disease segment dominated the Wilson’s Disease market with a market share of 55.5% in 2024, due to the higher clinical intervention requirements, increased detection rates among patients showing clear disease symptoms, and the greater demand for timely treatment to prevent severe liver and neurological complications

Report Scope and Wilson’s Disease Market Segmentation

|

Attributes |

Wilson’s Disease Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wilson’s Disease Market Trends

Advancements in Genetic and Early Diagnostic Testing

- A significant and accelerating trend in the global Wilson’s Disease market is the increasing adoption of genetic testing and advanced diagnostic technologies, enabling early detection and family-based screening

- For instance, institutions are implementing whole-exome sequencing to identify ATP7B gene mutations, allowing timely intervention before severe symptoms manifest

- Early diagnostics allow healthcare providers to initiate treatment sooner, improving patient prognosis and reducing long-term liver and neurological complications

- Integration of non-invasive tests, such as blood and urine copper assessments, with genetic testing facilitates a comprehensive and patient-friendly diagnostic workflow

- This trend is fundamentally reshaping clinical practice and patient expectations for Wilson’s Disease management, with companies developing integrated testing panels for routine and preventive care

- The growing preference for early and precise diagnosis is driving the adoption of genetic and biochemical tests across hospitals and specialty clinics globally

- Advances in digital health platforms are enabling remote monitoring of patient copper levels and adherence to therapy, improving long-term disease management

- Collaboration between research institutions and pharmaceutical companies is fostering the development of innovative biomarkers, further enhancing early detection and personalized care strategies

Wilson’s Disease Market Dynamics

Driver

Rising Awareness and Expanding Treatment Access

- The increasing awareness of Wilson’s Disease among healthcare providers, patients, and caregivers, coupled with expanding access to effective pharmacological therapies, is a key driver for market growth

- For instance, patient advocacy programs and rare disease awareness campaigns are helping identify previously undiagnosed cases, boosting treatment uptake

- Improved access to chelating agents and zinc therapy enables more patients to manage copper accumulation effectively, reducing morbidity and enhancing quality of life

- Growth in specialized clinics and enhanced insurance coverage for rare diseases is facilitating broader adoption of treatment protocols across regions

- Rising global prevalence of symptomatic cases and increased healthcare spending are further propelling the demand for timely diagnosis and pharmacological interventions

- Increased research funding for rare diseases is accelerating the development of novel therapies, expanding treatment options for patients

- Collaborations between pharmaceutical companies and healthcare providers are improving drug availability and distribution in underserved regions, supporting market growth

Restraint/Challenge

High Treatment Costs and Limited Disease Awareness

- The relatively high cost of long-term pharmacological therapy and limited disease awareness in certain regions remain significant challenges to market expansion

- For instance, in developing countries, delayed diagnosis and restricted access to chelating agents result in under-treatment and lower market penetration

- Lack of trained specialists and limited diagnostic infrastructure in rural or low-resource areas impede early detection and proper management of Wilson’s Disease

- Although awareness programs exist, patient and physician education gaps still hinder timely intervention, affecting overall treatment outcomes

- Overcoming these challenges through cost-effective therapies, increased awareness campaigns, and expanded healthcare infrastructure will be crucial for sustained market growth

- Limited patient adherence to lifelong medication regimens can reduce treatment effectiveness, posing a challenge to disease management and market expansion

- Regulatory hurdles and slow approval processes for new therapies in certain regions can delay patient access to advanced treatments, impacting market growth

Wilson’s Disease Market Scope

The market is segmented on the basis of patient population, test type, treatment, route of administration, end-users, and distribution channel.

- By Patient Population

On the basis of patient population, the Wilson’s Disease market is segmented into symptomatic Wilson Disease, asymptomatic Wilson Disease, and during pregnancy. The symptomatic Wilson’s Disease segment dominated the market with a share of 55.5% in 2024, driven by the higher clinical intervention requirements and prevalence of observable disease symptoms. Symptomatic patients require immediate and ongoing management to prevent severe liver damage or neurological complications, which drives demand for both diagnostics and pharmacological treatments. Hospitals and specialty clinics prioritize symptomatic patients for intensive monitoring and therapy initiation, boosting treatment adoption. The segment also benefits from increased awareness campaigns and early detection programs that focus on symptomatic presentations. In addition, healthcare providers emphasize patient adherence and long-term follow-up for this population, ensuring continued market growth. Symptomatic cases represent the majority of treated patients, making this segment critical for pharmaceutical and diagnostic companies.

The asymptomatic Wilson’s Disease segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing adoption of genetic testing and early screening programs. Early detection in asymptomatic individuals allows intervention before serious organ damage occurs, improving patient prognosis. Growing awareness among families with a history of Wilson’s Disease is contributing to proactive testing and monitoring. The expansion of newborn and family screening programs in several regions is identifying more asymptomatic cases. Pharmaceutical companies are developing preventive treatment protocols for these patients, creating new market opportunities. Healthcare providers are emphasizing preventive care, increasing demand for diagnostic tests and early-stage medication.

- By Test Type

On the basis of test type, the Wilson’s Disease market is segmented into blood and urine tests, eye exam, liver biopsy, imaging tests, and genetic testing. Blood and urine tests dominated the market with a share of 48% in 2024, as they are non-invasive, cost-effective, and widely used for routine monitoring of copper levels. These tests enable frequent follow-ups, making them essential for symptomatic and asymptomatic patients such as. Hospitals and specialty clinics rely on these tests for both initial diagnosis and ongoing disease management. Blood and urine tests also integrate easily with other diagnostic procedures, supporting comprehensive patient care. Patient preference for minimally invasive procedures further drives the adoption of these tests. The accessibility and affordability of these tests in both developed and emerging markets reinforce their dominant position.

Genetic testing is expected to witness the fastest growth from 2025 to 2032, driven by the increasing recognition of the importance of early detection and family-based screening. Genetic testing allows identification of ATP7B gene mutations even before symptoms appear, enabling preventive interventions. Rising investments in rare disease diagnostics and the availability of high-throughput sequencing technologies are boosting market adoption. Physicians are increasingly recommending genetic tests for at-risk individuals and families with a history of Wilson’s Disease. The growing integration of genetic testing with routine diagnostic panels is expanding its application in clinical settings. This trend is further supported by patient awareness campaigns highlighting the benefits of early genetic diagnosis.

- By Treatment

On the basis of treatment, the Wilson’s Disease market is segmented into medication and surgery. Medication dominated the market with a share of 72% in 2024, driven by the widespread use of chelating agents and zinc therapies for managing copper accumulation. Medications provide a non-invasive and effective long-term solution for most patients, reducing the need for surgical interventions. Hospitals and specialty clinics prioritize pharmacological management for symptomatic and asymptomatic patients. The continuous development of safer, more tolerable medications has further reinforced this segment’s dominance. Treatment adherence programs and patient monitoring enhance effectiveness and market stability. Medication remains the preferred choice for first-line therapy across global markets.

Surgery is expected to witness the fastest growth from 2025 to 2032, primarily due to liver transplantation procedures in severe, end-stage liver disease cases. Advancements in surgical techniques and post-operative care have improved patient survival rates. Increasing awareness of surgery as a viable treatment option is expanding its adoption in hospitals. Governments and healthcare organizations are investing in transplant infrastructure to support rare disease patients. The rising number of transplant centers in emerging markets is creating growth opportunities. Surgical interventions are often considered when medication fails, making this a critical niche with strong growth potential.

- By Route of Administration

On the basis of route of administration, the Wilson’s Disease market is segmented into oral, parenteral, and others. Oral administration dominated the market in 2024, due to convenience, patient adherence, and widespread availability of oral chelating agents and zinc formulations. Oral medications are suitable for long-term therapy, which is essential in Wilson’s Disease management. They are easier to distribute through hospital and retail pharmacies. Patients and caregivers prefer oral routes due to ease of use and minimal invasiveness. Oral formulations reduce hospital visits and associated costs, reinforcing adoption. Pharmaceutical companies continue to develop oral therapies with improved safety profiles to maintain dominance.

Parenteral administration is expected to witness the fastest growth from 2025 to 2032, driven by cases where oral therapy is not feasible or effective. Parenteral treatments provide direct delivery of medications, ensuring faster therapeutic effects in severe cases. Increasing hospital-based interventions and growing awareness of intensive treatment protocols are contributing to adoption. Specialty clinics are adopting parenteral therapy for patients with poor oral compliance. Pharmaceutical innovations in injectable formulations are improving safety and efficacy. This route is critical for acute management and bridging therapy for advanced Wilson’s Disease patients.

- By End-Users

On the basis of end-users, the Wilson’s Disease market is segmented into hospitals, specialty clinics, and others. Hospitals dominated the market in 2024, as they are primary centers for diagnosis, treatment initiation, and long-term disease management. Hospitals provide access to diagnostic tests, medication, and surgical interventions under professional supervision. The dominance is supported by higher patient volumes and advanced infrastructure. Hospitals also lead in rare disease awareness and patient education programs. Integration of multidisciplinary teams in hospitals ensures comprehensive care for Wilson’s Disease patients. Hospitals remain the preferred setting for initiating and monitoring complex treatment regimens.

Specialty clinics are expected to witness the fastest growth from 2025 to 2032, due to their focus on rare diseases and personalized care. Clinics offer specialized monitoring and follow-up, improving adherence and outcomes. Growing patient preference for specialized centers for genetic counseling and therapy management is driving demand. Expansion of specialty clinics in urban and semi-urban areas is increasing accessibility. Collaborations between clinics and pharmaceutical companies are enhancing treatment delivery. The personalized approach and dedicated care pathways make specialty clinics a rapidly expanding end-user segment.

- By Distribution Channel

On the basis of distribution channel, the Wilson’s Disease market is segmented into hospital pharmacy, retail pharmacy, and others. Hospital pharmacies dominated the market in 2024, providing easy access to medications for inpatients and outpatients under clinical supervision. Hospital pharmacies ensure proper dosing, adherence monitoring, and availability of specialized medications. The dominance is supported by bulk procurement and partnerships with pharmaceutical companies. Patients often rely on hospital pharmacies for continuity of care, particularly for long-term therapies. Integration with hospital systems facilitates efficient inventory and treatment management. Hospital pharmacies remain the primary channel for critical medications and rare disease therapies.

Retail pharmacies are expected to witness the fastest growth from 2025 to 2032, fueled by rising patient preference for convenient access to maintenance medications. Increasing availability of Wilson’s Disease drugs in retail outlets and online pharmacies is expanding reach. Retail channels improve adherence by reducing travel and wait times for patients. Pharmacy chains are offering patient counseling and support services for chronic disease management. Expansion in emerging markets is driving adoption of retail pharmacies as a distribution channel. Growing partnerships between pharmaceutical companies and retail networks enhance product accessibility and market growth.

Wilson’s Disease Market Regional Analysis

- North America dominated the Wilson’s Disease market with the largest revenue share of 41% in 2024, characterized by well-established healthcare infrastructure, high patient awareness, and a strong presence of leading pharmaceutical companies

- Patients and healthcare providers in the region highly value access to advanced diagnostic tests, effective pharmacological therapies, and comprehensive treatment protocols for both symptomatic and asymptomatic cases

- This widespread adoption is further supported by early disease detection programs, higher healthcare spending, and strong insurance coverage for rare diseases, establishing North America as the leading market for Wilson’s Disease diagnosis and treatment

U.S. Wilson’s Disease Market Insight

The U.S. Wilson’s Disease market captured the largest revenue share of 81% in 2024 within North America, fueled by advanced healthcare infrastructure, early disease detection programs, and high patient awareness. Patients and caregivers are increasingly prioritizing timely diagnosis and effective treatment to prevent severe liver and neurological complications. The growing availability of pharmacological therapies and specialized clinics, combined with insurance coverage for rare diseases, further propels the market. Moreover, the integration of genetic testing, routine biochemical monitoring, and personalized care plans is significantly contributing to the market’s expansion.

Europe Wilson’s Disease Market Insight

The Europe Wilson’s Disease market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of rare diseases and the need for early diagnosis and effective management. The rise in healthcare spending, along with stringent regulations for rare disease care, is fostering the adoption of advanced diagnostics and treatments. European patients are also drawn to the comprehensive care offered by specialty clinics and hospitals. The region is experiencing significant growth across symptomatic and asymptomatic patient segments, with genetic testing and medication increasingly incorporated into treatment protocols.

U.K. Wilson’s Disease Market Insight

The U.K. Wilson’s Disease market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness campaigns and the desire for timely, effective treatment. In addition, early screening programs and increasing healthcare access are encouraging both patients and providers to adopt genetic testing and pharmacological therapies. The U.K.’s robust healthcare infrastructure and insurance coverage for rare diseases are expected to continue stimulating market growth. Patients increasingly prefer specialized care centers that offer integrated diagnostic and treatment services for Wilson’s Disease.

Germany Wilson’s Disease Market Insight

The Germany Wilson’s Disease market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of rare diseases and the demand for advanced diagnostic and treatment solutions. Germany’s well-developed healthcare system, combined with strong emphasis on innovation and research in rare diseases, promotes the adoption of genetic testing and pharmacological therapies. Hospitals and specialty clinics are increasingly integrating monitoring and treatment programs for Wilson’s Disease patients. The focus on personalized care and preventive interventions aligns with patient expectations and supports market growth.

Asia-Pacific Wilson’s Disease Market Insight

The Asia-Pacific Wilson’s Disease market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing healthcare access, rising patient awareness, and technological advancements in countries such as China, Japan, and India. The region’s growing emphasis on early diagnosis and the expansion of specialty clinics are driving the adoption of genetic testing and pharmacological treatments. Furthermore, government initiatives supporting rare disease care and the development of medical infrastructure are expanding access to Wilson’s Disease management solutions. Increased awareness campaigns and local manufacturing of therapies are improving affordability and accessibility.

Japan Wilson’s Disease Market Insight

The Japan Wilson’s Disease market is gaining momentum due to the country’s advanced healthcare system, growing awareness of rare diseases, and increasing demand for timely diagnosis and treatment. The Japanese market emphasizes early detection, with genetic testing and biochemical monitoring becoming standard practice. Hospitals and specialty clinics are expanding patient care programs, integrating pharmacological therapies and personalized monitoring. Moreover, the aging population is such asly to spur demand for efficient, manageable treatment options in both residential and clinical settings.

India Wilson’s Disease Market Insight

The India Wilson’s Disease market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, rising awareness of rare diseases, and growing patient population. India stands as one of the largest emerging markets for Wilson’s Disease therapies, and diagnostic testing is becoming increasingly accessible across hospitals and specialty clinics. Government initiatives supporting rare disease management and the availability of affordable treatment options are key factors propelling the market in India. Increased awareness campaigns and local production of pharmacological therapies are further enhancing market growth.

Wilson’s Disease Market Share

The Wilson’s Disease industry is primarily led by well-established companies, including:

- Ultragenyx Pharmaceutical Inc. (U.S.)

- Vivet Therapeutics (France)

- Monopar Therapeutics Inc. (U.S.)

- Orphalan SA (France)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Eton Pharmaceuticals (U.S.)

- Pfizer Inc. (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Amneal Pharmaceuticals LLC (U.S.)

- Nobelpharma Co., Ltd. (Japan)

- Wilson Therapeutics AB (Sweden)

- Kadmon Holdings, Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Meda Pharmaceuticals (U.S.)

- Ipsen Pharma (France)

- TSUMURA & CO. (Japan)

- ANI Pharmaceuticals, Inc. (U.S.)

- APOTEX (Canada)

- Lupin (India)

- VHB Life Sciences Ltd. (India)

What are the Recent Developments in Global Wilson’s Disease Market?

- In April 2025, Yale Medicine highlighted the growing role of genetic testing in diagnosing Wilson’s Disease. Genetic testing is increasingly used to identify ATP7B gene mutations, aiding in the diagnosis of Wilson’s Disease, particularly in patients with unexplained liver disease, neurological or psychiatric symptoms, or those with a family history of the condition

- In October 2024, Ultragenyx provided an update on the Stage 1 cohorts of its pivotal Phase 1/2/3 trial of UX701 for Wilson’s Disease. The company reported that dosing of all 15 patients in Stage 1 was expected to be completed by the end of 2023. The trial aims to evaluate the safety and efficacy of a single intravenous dose of UX701 in patients with Wilson’s Disease

- In October 2024, Monopar Therapeutics announced the acquisition of ALXN1840 (bis-choline tetrathiomolybdate), a late-stage drug candidate for Wilson’s Disease, from Alexion, AstraZeneca Rare Disease. This acquisition aims to advance the global development and commercialization of ALXN1840, a once-daily oral medication designed to selectively and tightly bind and remove copper from the body’s tissues and blood

- In April 2024, Ultragenyx provided an update on its CYPRUS2+ study, a pivotal Phase 1/2/3 trial evaluating UX701, an investigational gene therapy for Wilson’s Disease. The study aims to assess the safety and efficacy of a single intravenous dose of UX701 in patients with Wilson’s Disease. This trial represents a significant advancement in gene therapy research for this rare genetic disorder

- In November 2023, Ultragenyx provided an update on its gene therapy trial for Wilson’s Disease. The study was expected to complete dosing of all 15 patients in Stage 1 by the end of 2023. Additional information on safety and efficacy was anticipated to be released following the completion of dosing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.