Global Wind Turbine Operations And Maintenance Market

Market Size in USD Billion

CAGR :

%

USD

15.94 Billion

USD

37.55 Billion

2025

2033

USD

15.94 Billion

USD

37.55 Billion

2025

2033

| 2026 –2033 | |

| USD 15.94 Billion | |

| USD 37.55 Billion | |

|

|

|

|

Wind Turbine Operations and Maintenance Market Size

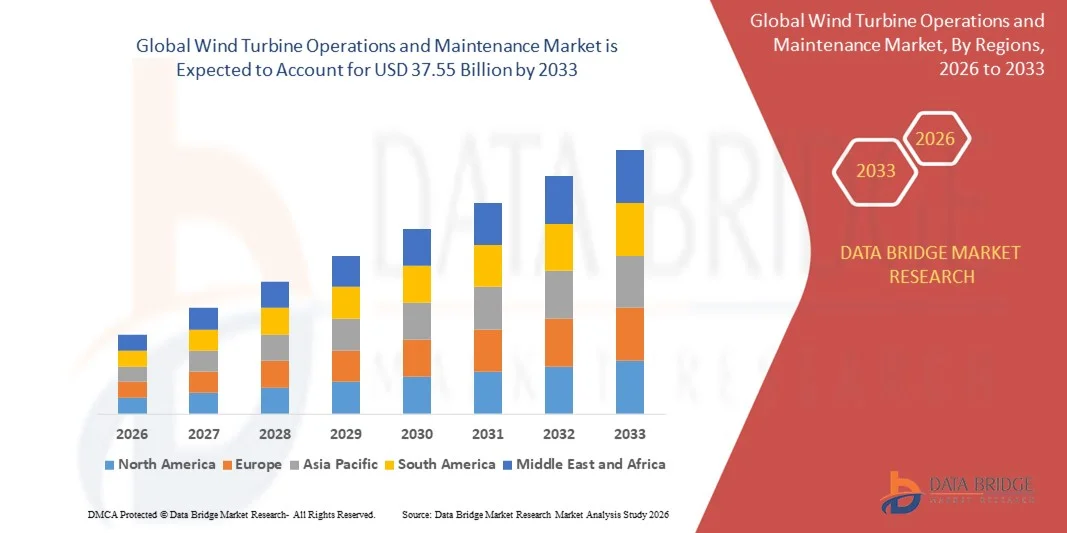

- The global wind turbine operations and maintenance market size was valued at USD 15.94 billion in 2025 and is expected to reach USD 37.55 billion by 2033, at a CAGR of 11.30% during the forecast period

- The market growth is largely fuelled by the rising number of onshore and offshore wind installations, ageing turbine fleets requiring frequent servicing, and technological advancements in predictive maintenance

Wind Turbine Operations and Maintenance Market Analysis

- The market is driven by increasing emphasis on reducing turbine downtime, improving energy efficiency, and extending asset life through advanced monitoring and diagnostic systems

- Growing adoption of digital solutions such as AI-based forecasting, condition monitoring systems, and remote inspection technologies such as drones is enhancing operational reliability and lowering maintenance costs

- North America dominated the wind turbine operations and maintenance market with the largest revenue share in 2025, driven by the presence of large-scale wind farms, rising investments in renewable energy, and a strong focus on maximizing turbine efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global wind turbine operations and maintenance market, driven by rapid wind power expansion, increasing offshore developments, and growing investments in modern maintenance technologies

- The Maintenance segment held the largest market revenue share in 2025 driven by the growing need for component repairs, inspections, and life-extension services as global turbine installations continue to expand. Maintenance activities such as blade repair, gearbox servicing, and structural assessments remain essential for ensuring turbine reliability and preventing performance degradation

Report Scope and Wind Turbine Operations and Maintenance Market Segmentation

|

Attributes |

Wind Turbine Operations and Maintenance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wind Turbine Operations and Maintenance Market Trends

Rise Of Predictive And Condition-Based Monitoring

- The growing shift toward predictive and condition-based monitoring is transforming the wind turbine O&M landscape by enabling real-time equipment assessment and early detection of mechanical issues. Sensors, digital twins, and advanced analytics allow operators to schedule maintenance precisely, reducing downtime and extending turbine life. This proactive approach significantly enhances reliability and minimizes unexpected failures across both onshore and offshore turbines

- The increasing adoption of IoT-powered monitoring platforms is accelerating the use of remote diagnostics and automated fault detection. These tools are particularly effective in offshore and hard-to-access sites, helping reduce operational costs and improving safety for maintenance crews. Continuous data collection enables operators to respond to anomalies quickly and improve overall operational transparency

- The affordability and scalability of modern predictive systems are making them attractive for both large wind farms and smaller operators, enabling more efficient asset management. This leads to optimized performance, reduced repair frequency, and higher energy output across long-term turbine operations. As digital solutions mature, adoption rates are rising across emerging and established wind markets

- For instance, in 2023, several European offshore wind farms reported significant reductions in maintenance-related downtime after implementing AI-driven monitoring systems developed by leading energy technology firms. These systems enabled early detection of gearbox and blade anomalies, improving turbine reliability and operational efficiency. The integration of AI-based tools has strengthened inspection accuracy and reduced human intervention

- While predictive monitoring is improving turbine performance, its success depends on continued innovation, data accuracy, and operator training. O&M service providers must focus on integrated digital solutions to fully capitalize on this growing demand. Ongoing investments in software platforms, analytics, and workforce training will be crucial for maximizing long-term value

Wind Turbine Operations and Maintenance Market Dynamics

Driver

Increasing Installed Wind Capacity And Aging Turbine Fleet

- The rapid expansion of global wind power installations is significantly increasing the need for reliable O&M services. As countries deploy larger and more complex turbines, the demand for advanced maintenance solutions is rising sharply to ensure long-term operational efficiency. Operators are prioritizing regular inspections and digital monitoring to sustain performance

- A growing number of wind turbines are reaching the end of their initial design life, creating strong demand for repair, retrofitting, and component replacement services. Operators are prioritizing O&M to maintain performance and avoid costly downtime, especially in high-wind regions. This shift is driving investments into refurbishment programs and upgraded turbine components

- Government support for renewable energy development and decarbonization policies is further boosting the use of structured O&M programs. Many regions are implementing standards for turbine maintenance, ensuring compliance and improving asset performance. Incentives for repowering old turbines are also increasing O&M demand across mature wind markets

- For instance, in 2022, the U.S. Department of Energy expanded funding for wind life-extension programs, enabling advanced inspections and retrofitting activities across aging onshore turbines. These initiatives helped operators identify critical defects earlier and reduce operational risks. The program also encouraged adoption of digital tools to enhance turbine longevity

- While rising installations and aging assets drive market growth, there is a continued need for standardized service models, skilled labor, and advanced diagnostic technologies to enhance efficiency and reduce long-term operational costs. Industry collaboration and technology integration will be essential for scaling O&M strategies globally

Restraint/Challenge

High Cost Of Maintenance Services And Skill Shortages

- The high cost of turbine maintenance, especially for offshore projects, continues to be a major barrier. Specialized equipment, vessel logistics, and advanced repair procedures make O&M one of the most expensive components of wind farm operations. These high costs often delay critical maintenance schedules and impact energy output

- Many regions face a shortage of trained technicians capable of handling complex turbine systems. The lack of skilled labor leads to slower maintenance cycles and increased reliance on expensive third-party service providers. This talent gap is more severe in offshore wind, where technical expertise is essential for ensuring worker safety

- Market expansion is further hindered by supply chain challenges in remote and offshore locations, where the availability of spare parts and maintenance infrastructure is limited. These delays can significantly impact energy production and turbine lifespan. Developing localized supply chains has become a priority for operators in high-growth regions

- For instance, in 2023, several offshore wind operators in the Asia-Pacific region reported extended downtime due to delayed component shipments and insufficient local technical expertise. This resulted in reduced capacity factors and increased operational costs. The shortage of specialized service vessels further complicated timely repairs

- While O&M technologies continue to advance, addressing cost pressures and skill shortages remains critical. Market stakeholders must focus on automation, remote operations, and workforce training to improve reliability and reduce long-term maintenance expenses. Strategic partnerships with technology companies and training institutions are becoming increasingly important

Wind Turbine Operations and Maintenance Market Scope

The wind turbine operations and maintenance market is segmented on the basis of type, farm type, application, and connectivity.

- By Type

On the basis of type, the wind turbine O&M market is segmented into Maintenance and Operations. The Maintenance segment held the largest market revenue share in 2025 driven by the growing need for component repairs, inspections, and life-extension services as global turbine installations continue to expand. Maintenance activities such as blade repair, gearbox servicing, and structural assessments remain essential for ensuring turbine reliability and preventing performance degradation.

The Operations segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by the increasing adoption of digital monitoring systems and remote supervisory control platforms. Enhanced automation, real-time performance analytics, and preventive monitoring technologies are enabling operators to optimize turbine output with minimal manual intervention. Operators across both onshore and offshore sites are prioritizing streamlined operational workflows to improve energy generation efficiency.

- By Farm Type

On the basis of farm type, the market is segmented into Offshore and Onshore. The Onshore segment accounted for the largest market revenue share in 2025 due to the extensive deployment of land-based wind farms and lower installation complexities compared to offshore projects. Onshore O&M activities are widely adopted owing to easier accessibility, reduced service costs, and well-established maintenance infrastructures across leading wind markets.

The Offshore segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rapid expansion of offshore wind capacity globally and the increasing need for specialized maintenance solutions. Offshore O&M relies on advanced vessel logistics, remote monitoring systems, and predictive technologies to manage turbines exposed to harsh marine conditions. Growing investments in deepwater wind projects continue to boost demand for high-value O&M services.

- By Application

On the basis of application, the market is segmented into Industrial, Commercial, and Residential. The Industrial segment held the largest market revenue share in 2025 owing to large-scale wind farm installations primarily used for utility power generation. Industrial operators require extensive ongoing maintenance, performance optimization, and monitoring services to ensure consistent output from large turbine fleets.

The Commercial segment is expected to witness significant growth from 2026 to 2033 as businesses increasingly adopt wind energy systems to meet sustainability goals and reduce operational energy costs. Commercial facilities benefit from structured O&M programs that ensure system reliability and long-term cost savings. Meanwhile, the Residential segment is growing steadily with small-scale wind systems gaining traction in rural and off-grid locations.

- By Connectivity

On the basis of connectivity, the market is segmented into Grid Connected and Stand Alone. The Grid Connected segment held the largest revenue share in 2025 as most utility-scale wind farms are integrated into national grids to meet rising electricity demand. Grid-connected systems require comprehensive O&M services to maintain consistent power flow, adhere to grid regulations, and optimize turbine performance.

The Stand Alone segment is expected to witness the fastest growth rate from 2026 to 2033 due to increasing adoption of off-grid wind systems in remote regions and islands. Stand-alone turbines rely heavily on specialized maintenance strategies and continuous monitoring to ensure stable energy supply in isolated locations. Growing interest in decentralized renewable energy solutions is further supporting segment growth.

Wind Turbine Operations and Maintenance Market Regional Analysis

- North America dominated the wind turbine operations and maintenance market with the largest revenue share in 2025, driven by the presence of large-scale wind farms, rising investments in renewable energy, and a strong focus on maximizing turbine efficiency

- Operators in the region emphasize predictive maintenance, advanced monitoring systems, and digital solutions such as remote diagnostics for enhancing operational performance

- This widespread adoption is further supported by favorable government policies, technological advancements, and the growing demand for clean energy, positioning wind turbine O&M as a critical component of the region’s renewable energy infrastructure

U.S. Wind Turbine Operations And Maintenance Market Insight

The U.S. wind turbine operations and maintenance market captured the largest revenue share in 2025 within North America, fuelled by the rapid expansion of onshore wind farms and increasing adoption of digital O&M solutions. Operators are prioritizing enhanced turbine reliability, reduced downtime, and lifecycle optimization through automation and data-driven maintenance. The rising demand for sustainable energy, combined with strong federal and state incentives, continues to support O&M activities across both new and aging wind installations.

Europe Wind Turbine Operations And Maintenance Market Insight

The Europe wind turbine operations and maintenance market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by ambitious renewable energy targets and the increasing deployment of both onshore and offshore wind farms. The region’s focus on sustainability, coupled with advanced grid infrastructure, is promoting the expansion of O&M services. European operators are also adopting innovative techniques such as drone inspections and AI-based monitoring to optimize performance and reduce operational costs.

U.K. Wind Turbine Operations And Maintenance Market Insight

The U.K. wind turbine operations and maintenance market is expected to witness the fastest growth rate from 2026 to 2033, driven by significant offshore wind development and growing emphasis on operational efficiency. The rising number of large-scale offshore projects demands advanced maintenance solutions, supported by strong government initiatives and investments. Increasing digitalization and the shift toward predictive maintenance are further enhancing market growth.

Germany Wind Turbine Operations And Maintenance Market Insight

The Germany wind turbine operations and maintenance market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s robust wind energy sector and commitment to technological innovation. Germany’s extensive onshore wind capacity and adoption of advanced monitoring tools are contributing to market expansion. A strong emphasis on efficiency, sustainability, and integration of smart maintenance systems continues to promote O&M service demand across the sector.

Asia-Pacific Wind Turbine Operations And Maintenance Market Insight

The Asia-Pacific wind turbine operations and maintenance market is expected to witness the fastest growth rate from 2026 to 2033, driven by accelerating renewable energy adoption, increasing wind farm installations, and supportive government initiatives in countries such as China, India, and Japan. Growing investments in grid modernization and the availability of cost-effective O&M solutions are further enhancing the region’s market potential.

Japan Wind Turbine Operations And Maintenance Market Insight

The Japan wind turbine operations and maintenance market is expected to witness the fastest growth rate from 2026 to 2033 due to the rising focus on clean energy, increasing offshore wind development, and strong demand for reliable power systems. Japan’s technological advancement and integration of IoT-based maintenance tools are driving O&M adoption. The need for efficient, automated inspection and maintenance processes is further propelling growth across the sector.

China Wind Turbine Operations And Maintenance Market Insight

The China wind turbine operations and maintenance market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the nation’s vast onshore and offshore wind capacity, rapid industrialization, and strong manufacturing ecosystem. China’s large-scale wind installations require extensive O&M services, and the increasing use of smart monitoring technologies and domestic service providers continues to support market expansion across the region.

Wind Turbine Operations and Maintenance Market Share

The Wind Turbine Operations and Maintenance industry is primarily led by well-established companies, including:

• ACCIONA, S.A. (Spain)

• NORDEX SE (Germany)

• General Electric (U.S.)

• Envision (China)

• Goldwind (China)

• Siemens Gamesa Renewable Energy, S.A. (Spain)

• Suzlon Energy Limited (India)

• Vestas Wind Systems A/S (Denmark)

• Sinovel Wind Group Co., Ltd. (China)

• Dongfang Electric Corporation (China)

• ENERCON GmbH (Germany)

• Mingyang Smart Energy Group Co., Ltd. (China)

• juwi AG (Germany)

• Inox Wind Ltd. (India)

• AEROVIDE GmbH (Germany)

Latest Developments in Global Wind Turbine Operations and Maintenance Market

- In June 2023, Enercon (Germany) entered a strategic partnership with Kalyon Enerji to support a 260 MW wind project in Turkey. The company will supply and install 64 E-138 EP3 turbines, enhancing Turkey’s renewable capacity and strengthening Enercon’s project portfolio. This development is expected to boost regional wind deployment and reinforce Enercon’s position in emerging markets by showcasing its advanced turbine technology

- In April 2023, ENERCON GmbH (Germany) signed a memorandum of understanding with Enerjisa Üretim Santralleri A.Ş. to deliver two ENERCON E-175 EP5 wind energy converters in Turkey. The agreement includes prototype installation of the flagship 6 MW model by the end of 2024, featuring a 175-meter rotor diameter. This initiative highlights ENERCON’s technological progress and is anticipated to accelerate next-generation turbine adoption in the region

- In April 2023, Siemens Gamesa Renewable Energy, S.A. (Spain) secured a contract with an Indian subsidiary of ArcelorMittal to supply 46 SG 3.6-145 turbines for a 166 MW project in Andhra Pradesh. The development expands Siemens Gamesa’s presence in India and supports the nation’s growing renewable energy targets. The deployment of high-capacity turbines is expected to improve project efficiency and contribute to India’s wind power expansion

- In May 2023, General Electric (U.S.) launched an upgraded online marketplace for onshore wind components, offering more than 100,000 spare parts and supplies. The platform aims to streamline procurement for wind farm operators, improving maintenance efficiency and reducing operational downtime. This digital advancement strengthens GE’s service offerings and supports broader industry digitalization

- In March 2023, Siemens Gamesa Renewable Energy, S.A. (Spain) announced its selection by RWE to supply 132 units of its RecyclableBlades technology for the Sofia offshore wind project. The initiative promotes circularity in wind components, positioning Siemens Gamesa as a leader in sustainable turbine innovation. It is expected to influence future offshore projects by encouraging adoption of recyclable turbine solutions

- In February 2023, General Electric (U.S.) was chosen by Germany’s Wpd to deliver 16 GE 5.5 MW turbines for three onshore wind farms in Niedersachsen. The projects, totaling 88 MW of capacity, also include a 15-year full-service agreement with an optional 5-year extension. This collaboration strengthens GE’s footprint in Europe and reinforces market confidence in its high-efficiency turbine technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wind Turbine Operations And Maintenance Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wind Turbine Operations And Maintenance Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wind Turbine Operations And Maintenance Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.