Global Window Lift Motors Market

Market Size in USD Billion

CAGR :

%

USD

3.43 Billion

USD

3.99 Billion

2024

2032

USD

3.43 Billion

USD

3.99 Billion

2024

2032

| 2025 –2032 | |

| USD 3.43 Billion | |

| USD 3.99 Billion | |

|

|

|

|

Window Lift Motors Market Size

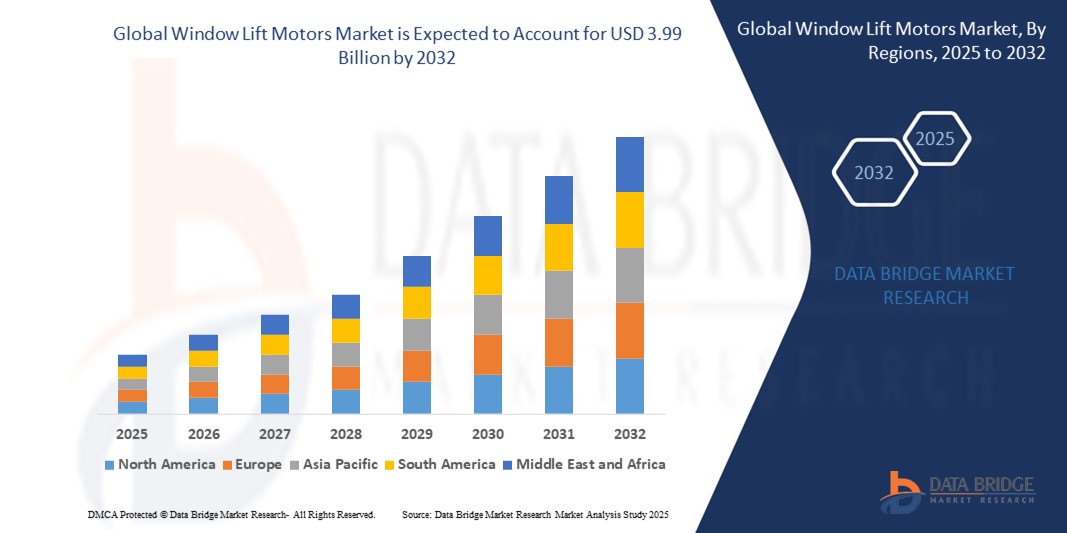

- The global window lift motors market size was valued at USD 3.43 billion in 2024 and is expected to reach USD 3.99 billion by 2032, at a CAGR of 1.91% during the forecast period

- The market growth is largely fueled by the increasing integration of power window systems in modern vehicles, driven by rising consumer expectations for comfort, convenience, and safety across all vehicle classes, including entry-level and mid-range segments

- Furthermore, advancements in motor technologies, including brushless and energy-efficient motors, along with the accelerating shift toward electric vehicles, are propelling demand for window lift motors. These converging trends are significantly boosting production volumes and technological upgrades in the automotive components sector

Window Lift Motors Market Analysis

- Window lift motors are electromechanical components used to control the raising and lowering of vehicle windows via switches or automated systems. These motors are integral to power window mechanisms and are designed to deliver smooth, reliable, and quiet operation, enhancing in-vehicle experience

- The growing adoption of electric and premium vehicles, coupled with increased consumer demand for automated comfort features, is driving market expansion. In addition, OEMs are emphasizing lightweight, compact, and energy-efficient motor designs, further stimulating innovation and growth in the window lift motors market

- Asia-Pacific dominated the window lift motors market with a share of 49.68% in 2024, due to rising vehicle production, rapid urbanization, and increasing adoption of power window systems in mid-range vehicles across the region

- North America is expected to be the fastest growing region in the window lift motors market during the forecast period due to rising demand for electric and high-performance vehicles, along with strong consumer interest in vehicle automation and comfort

- Passenger cars segment dominated the market with a market share of 58.8% in 2024, due to the high production volume of passenger vehicles and the rising demand for comfort features such as power windows. The integration of window lift motors in all four doors of most passenger vehicles has contributed significantly to this dominance. In addition, consumer expectations for convenience and safety features in mid-range and premium passenger cars continue to drive the demand for motorized window systems

Report Scope and Window Lift Motors Market Segmentation

|

Attributes |

Window Lift Motors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Window Lift Motors Market Trends

“Increasing Vehicle Production”

- The window lift motors market is witnessing steady growth propelled by rising global vehicle production and increasing integration of power windows as a standard feature, even in entry-level and mid-segment vehicles

- For instance, Han Yale Ind. Co. Ltd. has developed smart window lift motors with local interconnected network (LIN) protocols that surpass industry standards for noise reduction, current control, and speed, making them highly sought after by top automakers enhancing vehicle comfort and safety

- Advances in lightweight motor construction and improved electromagnetic compatibility (EMC) are enabling manufacturers to meet evolving demands for emission reduction and enhanced fuel efficiency in modern automobiles

- The adoption of anti-pinch, auto-closing, and rain-sensing window technologies is accelerating as automakers respond to consumer preferences for improved safety and convenience, especially in urban markets

- A growing trend toward noiseless operation and smart motor integration is influencing OEMs such as Denso and Bosch to invest in next-generation window lift motors for premium, electric, and autonomous vehicles

- In the Asia Pacific region, rapid urbanization, increased disposable income, and expanding automotive manufacturing hubs are boosting demand for technologically advanced window lift motors at competitive prices

Window Lift Motors Market Dynamics

Driver

“Growing Adoption of EVs and Autonomous Vehicles”

- The shift toward electric vehicles (EVs) and autonomous mobility is significantly increasing demand for efficient, lightweight, and digitally integrated window lift motors that help maximize battery range and enhance passenger experience

- For instance, Tesla incorporates advanced low-power, networked window lift motors supplied by global giants such as Robert Bosch GmbH to support seamless digital command control in its EV lineup, setting benchmarks for the industry

- Automakers are adopting brushless motors, smart sensors, and CAN/LIN communication technologies to provide noise-free, energy-efficient window operation aligned with the smart interior requirements of modern EVs and autonomous platforms

- The trend toward vehicle automation and smart cabin environments is fostering the need for window lift systems that can be controlled remotely, adaptively, or via integrated AI for improved safety and user personalization

- The move toward shared mobility and ride-hailing fleets is amplifying demand for durable, high-cycle window lift motors that offer consistent performance and minimal downtime under heavy usage

Restraint/Challenge

“High Maintenance Costs”

- The cost and complexity of maintaining advanced power window systems—particularly those integrated with anti-pinch, auto up/down, and networked features—pose challenges to both automakers and end users

- For instance, customer reports indicate that repair and replacement costs for power window lift motors by brands such as Johnson Electric and Brose can become significant when vehicles require specialized diagnostics, proprietary parts, or out-of-warranty service

- Frequent replacement of high-pressure and electronic components, as well as the need for skilled technicians for troubleshooting, increases long-term operational costs—especially in regions with less developed service infrastructure

- Supply chain issues such as semiconductor shortages, strikes, or raw material scarcities can disrupt part availability, delay repairs, and increase costs for manufacturers and vehicle owners alike

- Intense price competition in the market can encourage the use of lower-quality components, raising the risk of premature failure and impacting consumer trust in power window technologies

Window Lift Motors Market Scope

The market is segmented on the basis of type, vehicle type, and sales channel.

- By Type

On the basis of type, the window lift motors market is segmented into DC motors, stepper motors, and brushless motors. The DC motors segment accounted for the largest revenue share in 2024, primarily due to its widespread application in standard power window systems across passenger and commercial vehicles. DC motors are favored for their cost-effectiveness, ease of control, and mature integration into existing vehicle architectures. Their established performance in delivering consistent torque and responsive lifting action under various operating conditions makes them the dominant choice among automakers globally.

The brushless motors segment is anticipated to witness the fastest CAGR from 2025 to 2032, owing to its superior efficiency, extended lifespan, and minimal maintenance requirements. As automotive manufacturers increasingly adopt advanced electronic control systems and aim to reduce vehicle weight and power consumption, brushless motors are gaining traction, particularly in electric and premium vehicles. Their capability to provide precise control and higher durability positions them as a preferred choice in next-generation automotive window systems.

- By Vehicle Type

On the basis of vehicle type, the market is categorized into passenger cars, commercial vehicles, and electric vehicles. The passenger cars segment held the largest market share of 58.8% in 2024, driven by the high production volume of passenger vehicles and the rising demand for comfort features such as power windows. The integration of window lift motors in all four doors of most passenger vehicles has contributed significantly to this dominance. In addition, consumer expectations for convenience and safety features in mid-range and premium passenger cars continue to drive the demand for motorized window systems.

The electric vehicles (EVs) segment is projected to witness the fastest growth rate from 2025 to 2032, propelled by the accelerating global shift towards vehicle electrification and the demand for energy-efficient automotive components. Window lift motors designed for EVs often feature advanced brushless technology and are optimized for reduced power draw, aligning with the industry’s emphasis on extended battery life and overall system efficiency. As EV adoption increases worldwide, so does the demand for innovative and lightweight window lift motor solutions tailored to this segment.

- By Sales Channel

On the basis of sales channel, the market is bifurcated into original equipment manufacturer (OEM) and aftermarket. The OEM segment captured the largest revenue share in 2024, owing to direct installation of window lift motors during vehicle assembly. OEMs prioritize high-quality, tested, and durable components, which ensures a steady demand for window lift motors through long-term supply contracts with automotive manufacturers. The integration of smart and automated window lift systems in new car models further reinforces OEM dominance.

The aftermarket segment is expected to register the fastest CAGR from 2025 to 2032, driven by the growing need for replacements and upgrades in aging vehicle fleets, particularly in developing economies. Vehicle owners increasingly opt for enhanced or compatible motor solutions to restore or improve window operation. The availability of a wide range of motor types, competitive pricing, and rising DIY auto repair culture are also fueling aftermarket growth across both passenger and commercial vehicle categories.

Window Lift Motors Market Regional Analysis

- Asia-Pacific dominated the window lift motors market with the largest revenue share of 49.68% in 2024, driven by rising vehicle production, rapid urbanization, and increasing adoption of power window systems in mid-range vehicles across the region

- Growing consumer demand for enhanced vehicle comfort, expanding middle-class income levels, and the electrification of vehicles are contributing significantly to regional growth

- The region benefits from strong OEM presence, low manufacturing costs, and supportive government policies that promote automotive innovation and EV infrastructure development

Japan Window Lift Motors Market Insight

Japan’s market is supported by the presence of advanced automotive technology and high consumer expectations for vehicle comfort and safety. The demand for compact, high-precision motor systems in both traditional and electric vehicles is fueling the adoption of brushless window lift motors. Local manufacturers emphasize energy efficiency, product miniaturization, and long-term reliability, aligning with the country’s strong quality standards.

China Window Lift Motors Market Insight

China held the largest share in the Asia-Pacific window lift motors market in 2024, driven by its position as the world’s leading vehicle producer and its booming domestic automotive market. The country’s aggressive push for electric vehicle adoption, combined with large-scale OEM operations and increasing consumer demand for technologically advanced vehicle features, is propelling market expansion. Chinese suppliers are also heavily investing in brushless motor development to meet evolving performance and energy standards.

Europe Window Lift Motors Market Insight

Europe is projected to grow at a significant CAGR over the forecast period, supported by regulatory mandates for vehicle safety and increasing preference for luxury and electric vehicles. The region’s strong automotive engineering base and commitment to sustainability are prompting OEMs to incorporate efficient, noise-reducing window lift motors. Adoption is particularly high in Western Europe, where innovation and high consumer expectations shape vehicle design standards.

U.K. Window Lift Motors Market Insight

The U.K. market is expected to grow steadily, driven by rising EV adoption, government decarbonization initiatives, and increased demand for advanced in-vehicle comfort systems. Automakers are incorporating smart window lift technologies in new vehicle models to meet customer expectations for convenience and energy efficiency. The growing shift toward aftermarket upgrades in aging vehicles also supports market growth.

Germany Window Lift Motors Market Insight

Germany’s window lift motors market is expanding due to its leadership in automotive R&D, premium car manufacturing, and innovation in electric mobility. The demand for compact, quiet, and high-torque motor solutions in high-end and electric vehicles is significant. In addition, strong partnerships between Tier-1 suppliers and global OEMs foster continuous development of advanced motor technologies tailored for precision and performance.

North America Window Lift Motors Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand for electric and high-performance vehicles, along with strong consumer interest in vehicle automation and comfort. The region benefits from a robust automotive aftermarket, rapid EV expansion, and increased vehicle personalization trends. Technological innovations and higher penetration of advanced driver-assistance systems (ADAS) are reinforcing the adoption of smart window lift motors.

U.S. Window Lift Motors Market Insight

The U.S. held the largest revenue share in North America in 2024, supported by a high volume of vehicle sales, strong aftermarket activity, and increasing consumer expectations for comfort and convenience features. OEMs in the U.S. are prioritizing energy-efficient and electronically controlled window lift motors in both ICE and electric vehicles. The ongoing shift toward premium trims and the popularity of SUVs and trucks are also contributing to higher motor integration per vehicle.

Window Lift Motors Market Share

The window lift motors industry is primarily led by well-established companies, including:

- Denso Corporation (Japan)

- Brose Fahrzeugteile GmbH & Co. KG (Germany)

- Robert Bosch GmbH (Germany)

- Mitsuba Corp. (Japan)

- HI-LEX Corporation (Japan)

- Antolin (Spain)

- Valeo (France)

- Johnan Manufacturing Inc. (Japan)

- Inteva Products (U.S.)

- AISIN SHIROKI (Japan)

- Johnson Electric Holdings Limited (Hong Kong)

- Standard Motor Products, Inc. (U.S.)

- Hella GmbH & Co. KGaA (Germany)

- Kuster Holding GmbH (Germany)

- DY Auto Corporation (South Korea)

- SONTIAN AUTOMOTIVE CO., LTD. (China)

Latest Developments in Global Window Lift Motors Market

- In May 2024, Denso Corporation (Japan) established a new office in Minato-ku, Tokyo, aiming to integrate its sales, engineering, business, and corporate divisions under one roof. This strategic consolidation is expected to enhance operational efficiency, promote faster decision-making, and strengthen customer relationships. For the window lift motors market, this development signals Denso’s commitment to advancing automotive component innovation and responsiveness in the Greater Tokyo Area, a key hub for Japan's automotive sector

- In February 2024, STMicroelectronics (Switzerland) launched the AEK-MOT-WINH92 evaluation board, specifically designed for driving DC motors used in car window lifters. Featuring an anti-pinch mechanism and current sensing without the need for motor encoders, the board allows for flexible configurations and integrated fault detection. This innovation represents a significant advancement in smart window motor control, addressing safety and efficiency demands and potentially accelerating OEM adoption of intelligent window lift systems across various vehicle segments

- In January 2024, Han Yale Ind. Co., Ltd. (Taiwan) announced its plan to showcase a new smart window lift motor and window regulator at the AAPEX event in 2024. This move highlights the company’s focus on entering the growing market for smart and electronically controlled window systems. By introducing advanced products at a global platform, Han Yale is positioning itself to expand its international reach, attract new partnerships, and contribute to technological competition within the window lift motors industry

- In December 2023, Brose Fahrzeugteile SE & Co., KG (Germany) signed a 25-year contract renewal with HASCO Co., Ltd. (China), reinforcing their long-standing joint venture, Shanghai Brose Automotive Components. The partnership focuses on the development and production of door modules, window regulators, seat structures, and latches. This extended collaboration ensures sustained investment in localized manufacturing and R&D in China, supporting long-term growth in one of the world’s largest automotive markets and bolstering Brose’s footprint in the global window lift motors supply chain

- In April 2022, SONTIAN AUTOMOTIVE CO., LTD. (China) announced its relocation to a new, larger factory in Rui-An City to significantly boost its production capabilities. This expansion reflects the company’s response to rising global demand for window lift motors, particularly from OEMs and aftermarket clients. By increasing its manufacturing capacity and operational efficiency, SONTIAN is better positioned to serve both domestic and international markets, enhancing its competitiveness in a rapidly evolving automotive components landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.