Global Windows And Doors Market

Market Size in USD Billion

CAGR :

%

USD

209.99 Billion

USD

315.01 Billion

2024

2032

USD

209.99 Billion

USD

315.01 Billion

2024

2032

| 2025 –2032 | |

| USD 209.99 Billion | |

| USD 315.01 Billion | |

|

|

|

|

Windows and Doors Market Size

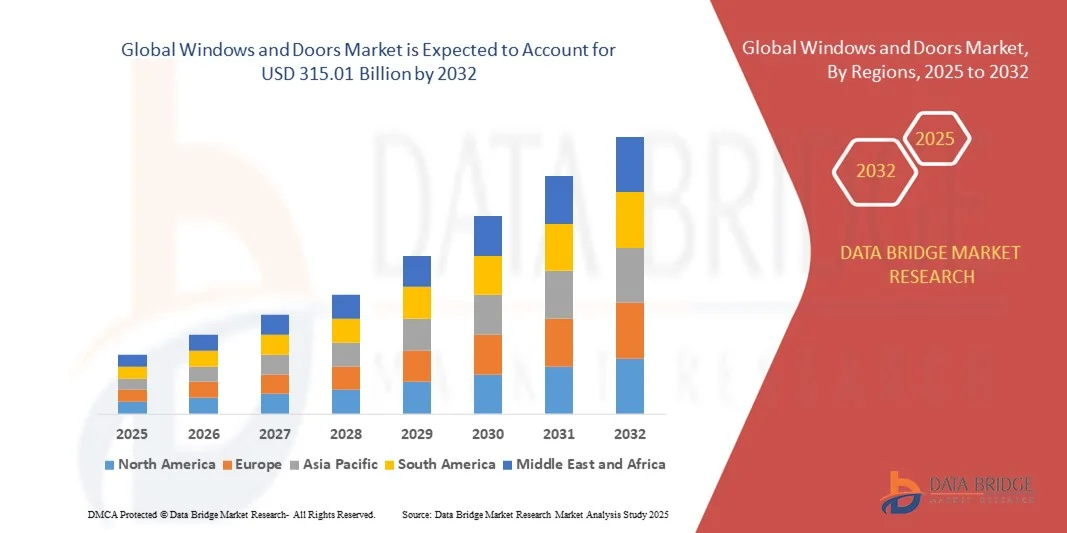

- The global windows and doors market size was valued at USD 209.99 billion in 2024 and is expected to reach USD 315.01 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the rapid expansion of residential and commercial construction activities across both developed and emerging economies

- Rising demand for energy-efficient and sustainable building materials, coupled with government initiatives promoting green buildings, is further supporting market growth

Windows and Doors Market Analysis

- The windows and doors market is witnessing steady growth driven by urbanization, infrastructural investments, and modernization of existing structures. Increasing renovation activities and the adoption of aesthetic, durable, and thermally insulated materials are key contributors to the expanding market

- In addition, the integration of digital technologies such as IoT-enabled doors and self-tinting windows is creating new opportunities for premium and smart building solutions worldwide

- North America dominated the windows and doors market with the largest revenue share of 38.60% in 2024, driven by strong residential construction activities, growing adoption of energy-efficient building materials, and rising renovation projects across the U.S. and Canada.

- Asia-Pacific region is expected to witness the highest growth rate in the global windows and doors market, driven by expanding construction activities, rising disposable incomes, and the increasing adoption of modern architectural designs

- The uPVC segment held the largest market revenue share in 2024, driven by its durability, low maintenance requirements, and excellent thermal insulation properties. uPVC windows and doors are widely used in residential and commercial buildings owing to their energy efficiency, soundproofing capabilities, and affordability compared to traditional materials. In addition, their resistance to corrosion and environmental degradation makes them highly suitable for long-term installations

Report Scope and Windows and Doors Market Segmentation

|

Attributes |

Windows and Doors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• ANDERSEN CORPORATION (U.S.) |

|

Market Opportunities |

• Growing Adoption Of Smart And Automated Windows And Doors |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Windows and Doors Market Trends

Rising Adoption of Smart and Energy-Efficient Windows and Doors

- The growing focus on energy conservation and smart building technologies is driving the adoption of intelligent window and door systems integrated with sensors and automation features. These products enhance indoor comfort, optimize natural light, and reduce energy consumption, making them highly preferred in modern residential and commercial constructions. In addition, they help lower operational costs by regulating temperature and improving overall energy performance, aligning with the increasing global push toward net-zero buildings. The integration of such systems is expected to become a standard feature in high-end and sustainable construction projects worldwide

- Increasing demand for sustainable building solutions has accelerated the use of energy-efficient glass, insulated frames, and automated shading systems. Builders and homeowners are prioritizing eco-friendly materials to comply with green building regulations and reduce carbon emissions, strengthening the market outlook. Furthermore, the introduction of recyclable and low-emission raw materials is making sustainable designs more accessible and affordable. The growing emphasis on LEED and BREEAM certifications continues to fuel adoption across both residential and commercial sectors

- The expansion of smart home ecosystems, supported by IoT and AI technologies, is further fuelling demand for connected doors and windows that can be remotely operated through smartphones and voice assistants. This integration enhances safety, convenience, and overall building intelligence. In addition, smart security systems with sensors for motion, glass breakage, and access control are becoming essential in modern homes. Manufacturers are also incorporating energy data analytics to help homeowners track and optimize their energy usage

- For instance, in 2024, several European manufacturers introduced solar-powered smart windows capable of adjusting opacity based on sunlight intensity, reducing dependence on artificial lighting and lowering utility costs for consumers. These advanced products use electrochromic glass technology, which automatically adapts to environmental conditions. Such innovations are helping consumers balance energy efficiency with aesthetic design preferences, further driving demand in the premium segment

- While the shift toward smart and sustainable products presents major growth opportunities, consistent innovation, affordability, and compatibility with existing infrastructure will remain essential for broader market penetration. Companies must invest in scalable manufacturing and R&D to produce cost-effective yet high-performing products. The growing collaboration between construction firms and technology providers is expected to further accelerate this transformation in the global windows and doors industry

Windows and Doors Market Dynamics

Driver

Growing Construction and Infrastructure Development Worldwide

- The rapid growth of residential and commercial construction activities, especially in emerging economies, is a key factor driving the windows and doors market. Government-backed infrastructure projects and smart city initiatives are fuelling demand for durable, efficient, and aesthetically advanced products. As urban populations continue to expand, the need for affordable housing and sustainable building solutions is increasing. These trends collectively strengthen product demand across diverse sectors including industrial, institutional, and retail spaces

- Rising urbanization and increasing disposable incomes are encouraging consumers to invest in modern housing equipped with high-performance doors and windows that provide better insulation, security, and visual appeal. The desire for energy-efficient and low-maintenance materials has boosted the popularity of uPVC, aluminium, and composite systems. Moreover, the aesthetic diversity offered by modern fenestration products is influencing interior and exterior design trends globally

- The expansion of the hospitality, retail, and office sectors is also contributing to steady market growth, as developers prioritize materials that ensure durability and meet evolving architectural trends. The increasing number of renovation and retrofitting projects in developed economies further supports this demand. Manufacturers are offering customized solutions tailored to commercial needs, such as soundproof and fire-resistant systems, enhancing product versatility

- For instance, in 2023, large-scale urban housing projects in India and China increased demand for aluminium and uPVC windows, reflecting the growing emphasis on energy efficiency and cost-effective design solutions. The surge in government housing schemes and foreign direct investment in construction has further driven industry expansion. This regional momentum highlights the rising influence of Asia-Pacific as a key manufacturing and consumption hub for the windows and doors market

- While infrastructure expansion continues to boost product demand, maintaining quality standards and ensuring supply chain stability remain vital to meeting large-scale project requirements. Manufacturers are increasingly adopting digital supply chain management systems to ensure efficiency and transparency. Partnerships with local distributors and builders are also essential to maintaining timely deliveries and cost optimization in high-volume projects

Restraint/Challenge

Fluctuating Raw Material Prices and High Installation Costs

- Price volatility of raw materials such as aluminium, steel, and glass poses a major challenge for manufacturers, directly impacting production costs and profit margins. Global supply chain disruptions and fluctuating commodity prices add to cost uncertainties. The dependence on imported materials further amplifies vulnerability to trade restrictions and currency fluctuations. As a result, companies are exploring long-term supply agreements and local sourcing strategies to stabilize operations

- The high installation and maintenance costs associated with advanced window and door systems, particularly automated or energy-efficient variants, limit adoption in cost-sensitive markets. Consumers in developing regions often prefer conventional materials due to affordability concerns. In addition, the requirement for skilled labor and specialized tools increases total installation expenses, further constraining market penetration among middle-income households

- Manufacturers also face challenges in maintaining consistent quality while balancing price competitiveness, especially in markets where low-cost alternatives dominate. This hinders the widespread adoption of premium and sustainable options. Moreover, counterfeit and substandard products in the market undermine brand credibility and customer trust. The growing competition among regional players intensifies pressure on established manufacturers to reduce prices without compromising performance

- For instance, in 2023, the European construction sector faced a sharp increase in glass and metal prices due to energy shortages, leading to project delays and reduced demand for high-end fenestration products. The inflationary impact of rising energy costs further strained production budgets, prompting companies to reconsider material selection and supply sourcing. Such fluctuations are expected to continue influencing market dynamics over the forecast period

- While manufacturers are investing in material innovation and local sourcing strategies to reduce dependency on imports, ensuring affordability and cost control will be critical to achieving sustained market growth. The development of lightweight, composite, and recycled materials presents new opportunities to address cost challenges. Industry collaboration and government incentives for sustainable materials could further mitigate raw material risks and support long-term industry stability

Windows and Doors Market Scope

The windows and doors market is segmented on the basis of material, product type, mechanism, and application.

- By Material

On the basis of material, the windows and doors market is segmented into uPVC, wood, metal, glass, steel, and aluminium. The uPVC segment held the largest market revenue share in 2024, driven by its durability, low maintenance requirements, and excellent thermal insulation properties. uPVC windows and doors are widely used in residential and commercial buildings owing to their energy efficiency, soundproofing capabilities, and affordability compared to traditional materials. In addition, their resistance to corrosion and environmental degradation makes them highly suitable for long-term installations.

The aluminium segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its lightweight strength, aesthetic flexibility, and adaptability to modern architectural designs. Aluminium frames are increasingly used in large-scale commercial and industrial projects due to their sleek appearance and compatibility with glass facades. Moreover, ongoing innovations in thermally broken aluminium systems are improving energy performance, enhancing their adoption across both new construction and renovation projects.

- By Product Type

On the basis of product type, the windows and doors market is segmented into windows and doors. The doors segment accounted for the largest market share in 2024, supported by the high demand for security-enhanced and aesthetically designed entry systems across residential and commercial sectors. Technological advancements, such as automated sliding and smart locking mechanisms, are further elevating the appeal of modern door systems. In addition, the trend toward personalized home design and premium interiors has driven the adoption of customized doors with advanced finishes and materials.

The windows segment is projected to grow at a significant rate from 2025 to 2032, driven by the increasing demand for energy-efficient and noise-reducing window solutions. Modern windows featuring double and triple glazing technology, along with low-emissivity coatings, are becoming essential components of sustainable construction. The growing emphasis on natural lighting and ventilation is also fuelling the replacement of traditional windows with advanced, high-performance alternatives.

- By Mechanism

On the basis of mechanism, the windows and doors market is segmented into swinging, sliding, folding, revolving, and others. The swinging segment dominated the market in 2024 owing to its widespread use in both residential and commercial buildings due to simplicity, ease of installation, and low maintenance. Swing doors and windows provide robust sealing and energy efficiency, making them suitable for varied climate conditions. Their versatility in design and compatibility with multiple materials further contribute to their dominance.

The sliding segment is anticipated to grow at a robust pace from 2025 to 2032, driven by increasing space optimization needs and modern architectural preferences. Sliding doors and windows are particularly popular in urban apartments, offices, and retail spaces where space efficiency is essential. Their sleek design, smooth operation, and ability to integrate large glass panels enhance natural lighting and create visually appealing interiors.

- By Application

On the basis of application, the windows and doors market is segmented into residential and commercial. The residential segment held the largest share in 2024, driven by rising urbanization, growing housing development, and increased spending on home improvement projects. Consumers are increasingly opting for energy-efficient, stylish, and secure window and door systems that enhance both functionality and aesthetics. In addition, government initiatives promoting sustainable housing are further propelling product adoption in this segment.

The commercial segment is anticipated to grow at a robust pace from 2025 to 2032, supported by expanding infrastructure investments in offices, retail complexes, hotels, and institutional buildings. The demand for large glass façades, automatic doors, and energy-efficient fenestration systems is rising as architects and developers focus on sustainability and modern design. The integration of smart door and window technologies in commercial spaces will continue to strengthen this segment’s growth trajectory.

Windows and Doors Market Regional Analysis

- North America dominated the windows and doors market with the largest revenue share of 38.60% in 2024, driven by strong residential construction activities, growing adoption of energy-efficient building materials, and rising renovation projects across the U.S. and Canada.

- The region’s demand is further supported by government initiatives promoting sustainable infrastructure and green buildings. Increasing consumer preference for aesthetically appealing and thermally insulated doors and windows continues to shape market dynamics.

- Moreover, advancements in material technologies and the widespread use of uPVC and aluminium products for enhanced durability and energy efficiency are reinforcing North America’s market leadership position.

U.S. Windows and Doors Market Insight

The U.S. windows and doors market captured the largest revenue share in 2024 within North America, fuelled by ongoing residential and commercial construction projects and the modernization of existing infrastructure. A growing inclination toward energy-efficient products, along with regulatory standards such as ENERGY STAR, is influencing consumer choices. Moreover, the rise in smart homes featuring automated windows and doors is enhancing comfort, safety, and energy management. Increasing spending on home remodeling and the shift toward high-performance glass materials are also supporting steady market growth.

Europe Windows and Doors Market Insight

The Europe windows and doors market is expected to witness significant growth from 2025 to 2032, driven by stringent energy efficiency regulations, sustainability goals, and growing demand for advanced fenestration systems. European countries are emphasizing eco-friendly materials and high-performance insulation products in both new constructions and renovations. The increasing adoption of triple-glazed windows, aluminum frames, and smart window solutions is further enhancing market expansion. In addition, retrofitting activities across Germany, France, and the U.K. are contributing to the growing replacement demand across the region.

U.K. Windows and Doors Market Insight

The U.K. windows and doors market is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing trend of smart and sustainable homes and increasing awareness of energy conservation. Builders are focusing on eco-friendly materials such as recycled aluminium and uPVC, which align with the U.K.’s net-zero carbon goals. The growing adoption of double and triple glazing systems to minimize energy loss and noise pollution is further stimulating market demand. Moreover, rising investments in infrastructure development and modernization projects are bolstering the market outlook.

Germany Windows and Doors Market Insight

The Germany windows and doors market is expected to witness substantial growth from 2025 to 2032, fuelled by advancements in smart building technologies and the rising adoption of high-performance insulation materials. The country’s strong focus on energy-efficient architecture and sustainable construction practices continues to drive demand for innovative window and door systems. Furthermore, the presence of leading manufacturers and a high level of technological expertise in precision engineering promote the adoption of durable, thermally efficient, and intelligent fenestration solutions.

Asia-Pacific Windows and Doors Market Insight

The Asia-Pacific windows and doors market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing infrastructure development, and rising consumer income levels. Countries such as China, Japan, and India are experiencing a surge in housing construction and commercial developments, boosting demand for modern and energy-efficient door and window solutions. Government programs promoting smart city projects and sustainable building designs are further accelerating market growth across the region.

Japan Windows and Doors Market Insight

The Japan windows and doors market is expected to witness steady growth during the forecast period, supported by technological innovations, energy conservation initiatives, and a growing emphasis on compact, efficient building designs. Japan’s focus on earthquake-resistant and durable structures drives demand for lightweight yet strong materials such as aluminium and uPVC. Moreover, the integration of smart glass and automated sliding doors in both residential and commercial spaces is shaping market advancement. The country’s commitment to reducing energy consumption is expected to further promote adoption of thermally efficient products.

China Windows and Doors Market Insight

The China windows and doors market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by extensive urban development, industrial expansion, and increasing demand for affordable housing. Rapid modernization of construction techniques, coupled with government incentives for sustainable materials, is accelerating the market. The availability of low-cost raw materials and large-scale manufacturing capabilities has also positioned China as a leading producer of aluminium and uPVC windows and doors. Moreover, rising adoption of energy-efficient glass and prefabricated construction solutions is expected to fuel continued growth in the coming years.

Windows and Doors Market Share

The Windows and Doors industry is primarily led by well-established companies, including:

• ANDERSEN CORPORATION (U.S.)

• JELD-WEN, Inc. (U.S.)

• PELLA CORPORATION (U.S.)

• SGM Window Manufacturing Limited (U.K.)

• Performance Doorset Solutions Ltd (U.K.)

• ATIS (Canada)

• Vinylguard Window & Door Systems Ltd. (Canada)

• NEUFFER WINDOWS + DOORS (Germany)

• Weru Windows Blackpool Ltd. (U.K.)

• BG Legno S.r.l. (Italy)

• Ponzio - P.IVA (Italy)

• Deceuninck nv (Belgium)

• RENSON (Belgium)

• TOSATTI (Italy)

• CANTERA DOORS (U.S.)

• Glass Rite (U.S.)

• Nawa International (U.A.E.)

• TAMCO GULF LTD. (U.A.E.)

• Fenesta Building Systems (India)

• CenturyPly (India)

• Swartland Windows and Doors (South Africa)

Latest Developments in Global Windows and Doors Market

- In January 2025, ASSA ABLOY completed the acquisition of 3millID in the U.S. and Third Millennium in the U.K., both specializing in physical access control readers and credentials. This strategic move strengthens ASSA ABLOY’s position in the physical access control market, expands its technological portfolio, and enhances its presence in key regions

- In December 2024, ASSA ABLOY acquired Premier Steel Doors and Frames, a U.S.-based company engaged in metal doors, frames, and aluminum windows manufacturing. The acquisition broadens ASSA ABLOY’s product range and boosts its brand visibility, particularly across the southern United States, contributing to its expansion in the commercial building sector

- In May 2024, YKK AP Inc. partnered with Kandenko Co., Ltd. to advance Building Integrated Photovoltaics (BIPV) for commercial structures. The collaboration aims to develop energy-efficient window and wall systems using perovskite solar cell technology, supporting carbon neutrality and driving innovation in sustainable building solutions

- In September 2023, Pella Corporation introduced its Hidden Screen feature for the Lifestyle Series Wood Windows, now available exclusively through Lowe’s stores and online. This product launch enhances consumer convenience, improves aesthetics, and strengthens Pella’s retail presence across more than 1,700 Lowe’s locations in the U.S

- In March 2023, Marvin launched its Elevate Bi-Fold doors designed for outdoor spaces, emphasizing versatility and modern design. The introduction of these folding doors is expected to boost demand in the premium outdoor living segment by offering enhanced aesthetics and functionality

- In March 2023, Fenesta inaugurated its G Interiors franchise showroom in Kadapa, Andhra Pradesh, featuring a range of uPVC and aluminum windows, designer, and interior doors. This expansion strengthens Fenesta’s retail footprint beyond 350 outlets in India, supporting its leadership in the domestic windows and doors market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Windows And Doors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Windows And Doors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Windows And Doors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.