Global Wine Additives Market

Market Size in USD Billion

CAGR :

%

USD

2.98 Billion

USD

4.62 Billion

2025

2033

USD

2.98 Billion

USD

4.62 Billion

2025

2033

| 2026 –2033 | |

| USD 2.98 Billion | |

| USD 4.62 Billion | |

|

|

|

|

Global Wine Additives Market Size

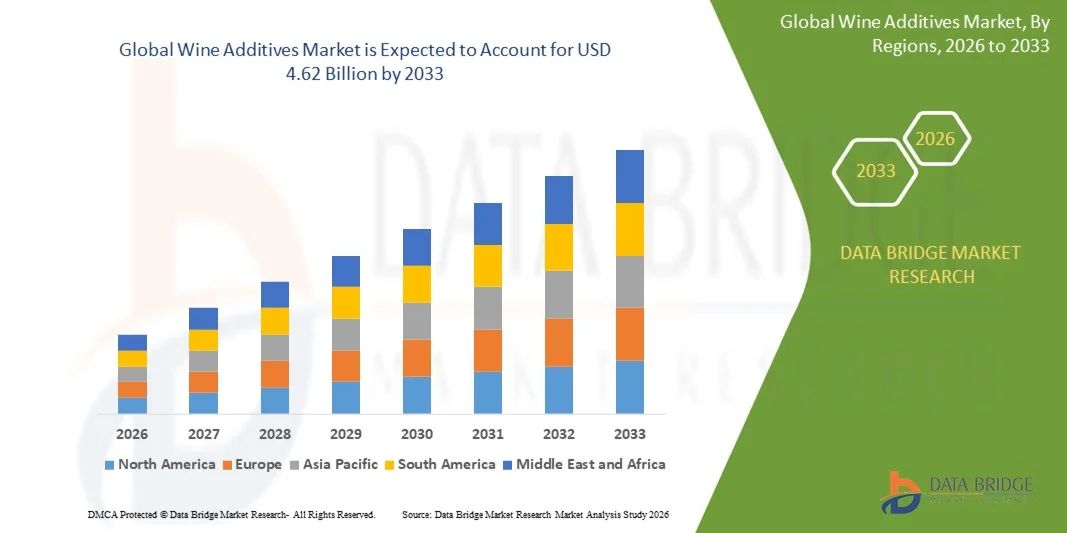

- The global Wine Additives Market size was valued at USD 2.98 billion in 2025 and is expected to reach USD 4.62 billion by 2033, at a CAGR of 5.60% during the forecast period.

- The market growth is largely driven by the increasing demand for high-quality wines and the growing awareness of wine preservation and flavor enhancement techniques among producers and consumers.

- Furthermore, advancements in additive formulations, rising adoption of natural and organic additives, and the expanding wine industry in emerging regions are fueling the market. These factors are accelerating the integration of innovative wine additives, thereby significantly boosting the industry's growth.

Global Wine Additives Market Analysis

- Wine additives, including preservatives, flavor enhancers, and fining agents, are increasingly vital components in modern winemaking due to their ability to improve shelf life, maintain quality, and enhance sensory attributes in both commercial and artisanal wine production.

- The escalating demand for wine additives is primarily fueled by the growing global wine consumption, increasing preference for premium and diverse wine varieties, and the need for consistent product quality across domestic and international markets.

- North America dominated the Global Wine Additives Market with the largest revenue share of 33.5% in 2025, characterized by a mature wine industry, high consumer awareness, and a strong presence of key market players, with the U.S. experiencing substantial growth in demand for advanced additive solutions, driven by innovations in natural and organic formulations.

- Asia-Pacific is expected to be the fastest-growing region in the Global Wine Additives Market during the forecast period due to rising wine consumption, increasing disposable incomes, and expansion of domestic wineries adopting modern production techniques.

- The still wine segment dominated the market with the largest revenue share of 47.5% in 2025, driven by its widespread global consumption and consistent demand for high-quality additives that enhance flavor, aroma, and stability.

Report Scope and Global Wine Additives Market Segmentation

|

Attributes |

Wine Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Chr. Hansen Holding A/S (Denmark) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Wine Additives Market Trends

Enhanced Wine Quality Through Advanced Additive Technologies

- A significant and accelerating trend in the global Wine Additives Market is the deepening development of advanced formulations, including natural, organic, and precision-targeted additives, which are increasingly enhancing wine quality, stability, and flavor profiles. This technological evolution is significantly improving consistency and efficiency in winemaking processes.

- For instance, fining agents such as plant-based proteins and enzymatic clarifiers are being adopted to improve clarity and reduce unwanted compounds, while modern preservatives such as potassium metabisulfite allow for longer shelf life without compromising taste. Similarly, flavor enhancers and tannin formulations enable winemakers to fine-tune aroma and mouthfeel, catering to evolving consumer preferences.

- Advanced additive technologies also enable predictive and optimized usage, where data-driven analysis of wine composition guides precise additive application. For instance, some wineries use analytical software combined with additives to enhance fermentation control and achieve consistent sensory profiles across batches. Furthermore, natural and organic additives are increasingly valued by consumers, meeting the demand for clean-label, sustainable wine products.

- The integration of modern additives with broader winemaking processes allows for greater control over multiple aspects of wine production, including color stability, acidity balance, and aroma retention. Through this approach, producers can create premium wines with uniform quality, reduced spoilage, and optimized aging potential.

- This trend towards more intelligent, precise, and sustainable additive solutions is fundamentally reshaping winemaker and consumer expectations. Consequently, companies such as Chr. Hansen, Lallemand, and Enartis are developing innovative additives that enhance flavor, preserve quality naturally, and support organic and biodynamic winemaking practices.

- The demand for advanced wine additives that offer consistent quality enhancement and sustainable solutions is growing rapidly across both commercial wineries and artisanal producers, as the global wine industry increasingly prioritizes premiumization, innovation, and consumer-driven differentiation.

Global Wine Additives Market Dynamics

Driver

Growing Need Due to Rising Demand for Premium and Consistent Wine Quality

- The increasing consumer preference for high-quality, premium wines, coupled with the expanding global wine market, is a significant driver for the heightened demand for wine additives.

- For instance, in 2025, several leading wineries in California and France announced the adoption of advanced natural and organic additives to enhance flavor stability and extend shelf life. Such initiatives by key companies are expected to drive the growth of the wine additives market during the forecast period.

- As consumers become more discerning about taste, aroma, and consistency, wine additives offer advanced solutions such as color stabilization, aroma preservation, and controlled fermentation, providing a compelling upgrade over traditional winemaking methods.

- Furthermore, the growing popularity of specialty and craft wines, along with the desire for consistent quality across batches, is making additives an integral component of modern winemaking, allowing producers to meet both domestic and international quality standards.

- The ability to enhance wine flavor, extend shelf life, prevent spoilage, and maintain clarity are key factors propelling the adoption of wine additives in both commercial wineries and artisanal production. The trend towards natural and clean-label ingredients, along with innovations in enzymatic and fining agents, further contributes to market growth.

Restraint/Challenge

Concerns Regarding Health Implications and Regulatory Compliance

- Concerns surrounding potential health effects of synthetic additives and strict regulatory requirements pose a significant challenge to broader market adoption. Some consumers remain cautious about sulfites, preservatives, and artificial flavoring agents in wines.

- For instance, rising awareness of sulfite sensitivity and the increasing demand for organic wines have made certain consumers hesitant to accept chemically enhanced wines.

- Addressing these concerns through natural and organic alternatives, transparent labeling, and compliance with international safety standards is crucial for building consumer trust. Companies such as Chr. Hansen, Lallemand, and Enartis emphasize the use of natural, non-GMO, and sustainably sourced additives in their marketing to reassure potential buyers.

- Additionally, variations in regional regulations regarding permissible additive levels can limit market penetration in certain countries, while high-quality natural additives may come at a premium price compared to conventional options.

- Overcoming these challenges through education on safe additive use, the development of cost-effective natural solutions, and adherence to regulatory standards will be vital for sustained market growth.

Global Wine Additives Market Scope

The market is segmented on the basis of type, flavor, Distribution Channel.

- By Type

On the basis of type, the Global Wine Additives Market is segmented into sparkling, still, and others. The still wine segment dominated the market with the largest revenue share of 47.5% in 2025, driven by its widespread global consumption and consistent demand for high-quality additives that enhance flavor, aroma, and stability. Additives such as preservatives, fining agents, and flavor enhancers are widely used in still wines to maintain clarity, prevent spoilage, and optimize fermentation outcomes.

The sparkling wine segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by the growing popularity of sparkling wines in emerging markets, increasing celebratory consumption, and rising premiumization trends. Innovations in natural carbonation stabilizers and flavor-enhancing additives for sparkling wines are enabling producers to meet evolving consumer preferences and maintain product quality during storage and transportation.

- By Flavor

On the basis of flavor, the Global Wine Additives Market is segmented into red, white, and rosé wines. The red wine segment accounted for the largest market revenue share of 44.3% in 2025, supported by its high consumption in established markets such as Europe and North America. Red wine production heavily relies on additives for color stabilization, tannin management, and aromatic enhancement, ensuring consistency and premium sensory experience.

The rosé wine segment is projected to witness the fastest CAGR of 20.5% from 2026 to 2033, driven by increasing demand among younger consumers and social media-driven trends emphasizing rosé as a fashionable beverage choice. Advances in natural and organic additives specifically designed for rosé wines, such as aroma enhancers and color stabilizers, are facilitating growth in both domestic and international markets.

- By Distribution Channel

On the basis of distribution channel, the Global Wine Additives Market is segmented into on-trade and off-trade. The off-trade segment dominated the market with a revenue share of 52.1% in 2025, owing to the rising popularity of retail wine purchases from supermarkets, liquor stores, and online platforms, where consistent product quality is critical. Wine additives in the off-trade segment ensure stability during storage and transportation, maintaining flavor and appearance until the point of consumption.

The on-trade segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, fueled by the growing number of restaurants, bars, and hotels seeking high-quality wines with enhanced sensory attributes. Additives tailored for on-trade applications enable operators to provide premium experiences, optimize shelf life, and maintain consistent wine performance under varying storage conditions.

Global Wine Additives Market Regional Analysis

- North America dominated the Global Wine Additives Market with the largest revenue share of 33.5% in 2025, driven by the presence of a mature wine industry, high consumer awareness, and strong adoption of advanced winemaking technologies.

- Producers in the region prioritize the use of wine additives to maintain consistent quality, enhance flavor and aroma, and extend shelf life, meeting the growing demand for premium and specialty wines.

- This widespread adoption is further supported by high disposable incomes, a preference for premium and diverse wine varieties, and the strong presence of leading market players such as Chr. Hansen, Lallemand, and Enartis, establishing North America as a key hub for innovation and advanced additive applications in both commercial wineries and artisanal production.

U.S. Wine Additives Market Insight

The U.S. wine additives market captured the largest revenue share of 81% in North America in 2025, driven by the country’s mature wine industry, high consumer awareness, and demand for premium and consistent-quality wines. Wineries are increasingly adopting advanced additives such as preservatives, fining agents, and flavor enhancers to maintain product stability, aroma, and color. The growing preference for organic and natural additives, combined with technological innovations in winemaking processes, further propels market growth. Moreover, the expanding e-commerce and retail channels allow producers to reach diverse consumer segments, boosting the adoption of high-quality additive solutions.

Europe Wine Additives Market Insight

The Europe wine additives market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s established wine culture, stringent quality regulations, and growing demand for premium and innovative wine products. Producers are leveraging advanced additives to ensure consistency across vintages and enhance sensory attributes. The rise of wine tourism, craft wineries, and export-oriented production is further fostering adoption. Countries such as France, Italy, and Spain are experiencing strong growth in both commercial and boutique wineries.

U.K. Wine Additives Market Insight

The U.K. wine additives market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing consumer demand for high-quality imported and domestic wines. Wineries are investing in additives to maintain flavor, clarity, and stability, catering to a market that values premium sensory experiences. Additionally, the growth of on-trade and off-trade retail channels, alongside rising interest in organic and low-sulfite wines, is expected to stimulate market expansion.

Germany Wine Additives Market Insight

The Germany wine additives market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong domestic wine industry, increasing demand for high-quality wines, and awareness of innovative additive technologies. German producers are adopting advanced fining, preservation, and flavor-enhancing solutions to meet consumer expectations for consistency and premium taste. Sustainability-focused additives and natural formulations are increasingly popular, aligning with local preferences for environmentally conscious production practices.

Asia-Pacific Wine Additives Market Insight

The Asia-Pacific wine additives market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and expanding wine consumption in countries such as China, Japan, and India. Growing awareness of wine quality, the proliferation of domestic wineries, and demand for premium imported wines are fueling adoption. Moreover, technological advancements in additive formulations and the trend toward natural and organic additives are further boosting market growth in the region.

Japan Wine Additives Market Insight

The Japan wine additives market is gaining momentum due to the country’s high wine quality standards, growing premium wine consumption, and interest in diverse wine varieties. Wineries are increasingly using additives to enhance flavor, preserve aroma, and maintain product consistency. The integration of additives in boutique and imported wine production is growing, catering to consumers’ preference for refined taste and natural formulations. Moreover, the aging population is driving demand for wines that are consistent, smooth, and easy to consume.

China Wine Additives Market Insight

The China wine additives market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, an expanding middle class, and growing wine consumption. Wineries are increasingly adopting additives to ensure product stability, flavor consistency, and premium quality, meeting both domestic and export demands. The country’s rise as a wine production and consumption hub, along with increasing awareness of natural and organic additives, is a key factor propelling market growth. Additionally, government support for food and beverage innovation and the expansion of retail and e-commerce channels enhance accessibility and adoption of advanced wine additives.

Global Wine Additives Market Share

The Wine Additives industry is primarily led by well-established companies, including:

• Chr. Hansen Holding A/S (Denmark)

• Lallemand Inc. (Canada)

• Enartis (Italy)

• BASF SE (Germany)

• Novozymes A/S (Denmark)

• Kerry Group (Ireland)

• Archer Daniels Midland Company (U.S.)

• DSM Food Specialties (Netherlands)

• FMC Corporation (U.S.)

• Perdomini-IOC S.p.A. (Italy)

• Tate & Lyle PLC (U.K.)

• Vitivita (Italy)

• Proenol (Spain)

• Aromata Group (France)

• Cantina di Soave (Italy)

• Da Vinci Wines Additives (U.S.)

• Enzyme Development Corporation (U.S.)

• Ingredion Incorporated (U.S.)

• Redox Group (Australia)

• Novacane Ingredients (France)

What are the Recent Developments in Global Wine Additives Market?

- In April 2024, Chr. Hansen Holding A/S, a global leader in natural ingredient solutions, launched a strategic initiative in South Africa aimed at enhancing wine quality and stability through its advanced natural and organic wine additives. This initiative underscores the company's dedication to delivering innovative, safe, and effective solutions tailored to the needs of local winemakers. By leveraging its global expertise and cutting-edge formulations, Chr. Hansen is not only addressing regional production challenges but also reinforcing its position in the rapidly growing Global Wine Additives Market.

- In March 2024, Lallemand Inc., a veteran-led Canadian company, introduced a new range of fermentation and fining agents specifically engineered for boutique wineries and commercial production. The innovative additive solutions are designed to improve flavor consistency, aroma retention, and fermentation control, highlighting Lallemand’s commitment to advancing winemaking technologies and supporting quality-focused producers.

- In March 2024, Enartis, a leading provider of winemaking ingredients and solutions, successfully collaborated on a premium wine project in India to enhance flavor, aroma, and shelf life using advanced additive technologies. This initiative leverages state-of-the-art solutions to improve wine quality and consistency, underscoring Enartis’ dedication to innovation and supporting the global expansion of high-quality wine production.

- In February 2024, BASF SE, a major player in food and beverage additives, announced a strategic partnership with emerging wineries in California to create a tailored portfolio of fining and preservation agents for sustainable wine production. This collaboration is designed to enhance wine stability, streamline production processes, and improve sensory attributes, underscoring BASF’s commitment to innovation and operational excellence in the wine industry.

- In January 2024, Novozymes A/S, a global biotechnology company, unveiled a new enzymatic additive solution at Vinexpo 2024 designed to optimize fermentation efficiency and enhance flavor profiles in both red and white wines. The solution highlights the company’s commitment to integrating advanced biotechnology into winemaking, offering producers enhanced control, consistency, and product quality while supporting sustainable production practices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wine Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wine Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wine Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.