Global Wine Glass Market

Market Size in USD Billion

CAGR :

%

USD

2.53 Billion

USD

3.20 Billion

2025

2033

USD

2.53 Billion

USD

3.20 Billion

2025

2033

| 2026 –2033 | |

| USD 2.53 Billion | |

| USD 3.20 Billion | |

|

|

|

|

Wine Glass Market Size

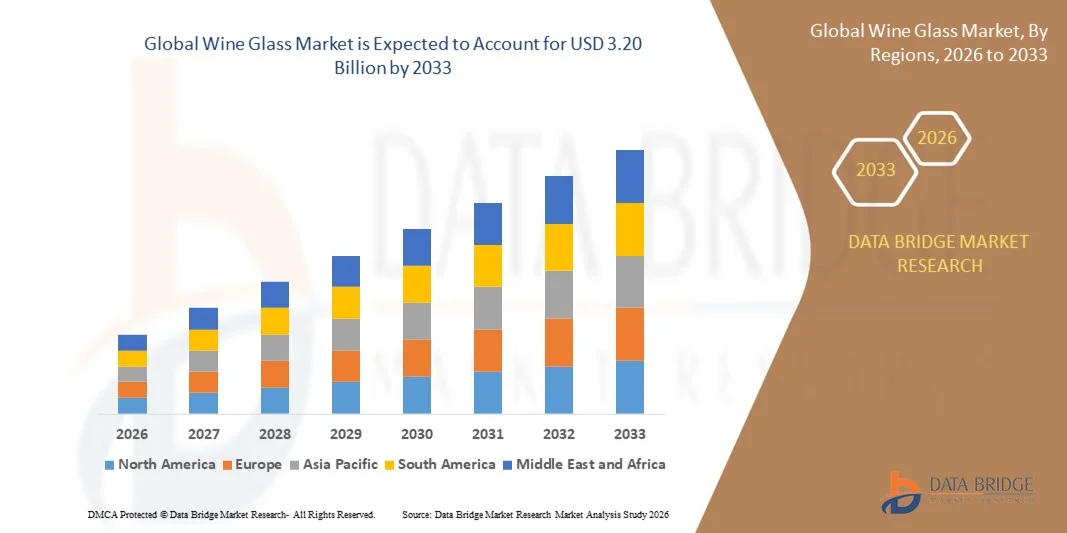

- The global wine glass market size was valued at USD 2.53 billion in 2025 and is expected to reach USD 3.20 billion by 2033, at a CAGR of 3.0% during the forecast period

- The market growth is largely fueled by rising global wine consumption and the increasing emphasis on premium dining and beverage presentation across both residential and commercial settings

- Furthermore, growing consumer awareness of wine appreciation, coupled with the expansion of hospitality, fine dining, and at-home entertaining trends, is reinforcing demand for specialized and high-quality wine glassware, thereby significantly supporting overall market growth

Wine Glass Market Analysis

- Wine glasses are specially designed drinkware products intended to enhance the aroma, flavor, and overall tasting experience of different wine varieties, widely used across households, restaurants, hotels, wineries, and bars

- The escalating demand for wine glasses is primarily driven by the premiumization of wine consumption, growth in the hospitality and tourism industries, and increasing consumer preference for aesthetically appealing and functional glassware that elevates the overall wine-drinking experience

- North America dominated the wine glass market in 2025, due to high wine consumption rates, a well-established hospitality industry, and strong consumer preference for premium dining experiences

- Asia-Pacific is expected to be the fastest growing region in the wine glass market during the forecast period due to rising wine consumption, urbanization, and increasing disposable incomes

- Glass segment dominated the market with a market share of 58.9% in 2025, due to its affordability, wide availability, and suitability for everyday use across households and foodservice outlets. Standard glass wineware is preferred due to its durability, ease of maintenance, and compatibility with mass production, which enables manufacturers to meet large-volume demand. Consumers often choose glass wine glasses for casual dining and regular consumption, as they offer functional design without significantly increasing cost

Report Scope and Wine Glass Market Segmentation

|

Attributes |

Wine Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wine Glass Market Trends

Premiumization of Wine Consumption

- A significant trend in the wine glass market is the growing premiumization of wine consumption, driven by increasing consumer interest in enhanced tasting experiences and refined dining aesthetics. Consumers are becoming more conscious of how glass shape, rim thickness, and material quality influence aroma and flavor perception, which is elevating demand for specialized and premium wine glasses

- For instance, Bormioli Rocco S.p.A. and Zwiesel Crystal Glass are widely supplying premium stemware ranges designed specifically for different wine varietals, supporting both fine-dining establishments and wine enthusiasts seeking professional-grade glassware

- The rising popularity of wine education, tasting events, and wine tourism is further reinforcing this trend, as consumers increasingly associate premium glassware with authenticity and sophistication. This shift is strengthening the preference for crystal and high-clarity glass products across mature wine-consuming regions

- Hospitality operators are investing in premium wine glasses to differentiate customer experience and reinforce brand positioning, particularly in upscale restaurants, wineries, and luxury hotels. This trend is encouraging consistent replacement and upgrading of glassware inventories

- Design innovation and craftsmanship are also gaining importance, with manufacturers focusing on elegance, balance, and durability without compromising sensory performance. These advancements are reshaping purchasing decisions across both residential and commercial segments

- The continued alignment between premium wine consumption and experiential dining is reinforcing long-term demand for high-quality wine glasses, positioning premiumization as a defining trend shaping product development and market expansion

Wine Glass Market Dynamics

Driver

Growth of Global Wine Consumption and Hospitality Industry

- The expansion of global wine consumption, supported by the steady growth of the hospitality and foodservice industries, is a key driver for the wine glass market. Increasing wine intake across households, restaurants, hotels, and tasting venues is directly boosting demand for dedicated wine glassware that enhances presentation and consumption experience

- For instance, Libbey, Inc. supplies a wide range of wine glasses to restaurants and hospitality chains worldwide, benefiting from the consistent demand generated by dining-out culture and large-scale foodservice operations

- The rapid growth of premium and casual dining establishments is increasing the need for durable yet aesthetically appealing wine glasses capable of withstanding high usage volumes. This is supporting strong procurement activity from commercial buyers

- The rise of wine-focused venues, including wine bars and tasting rooms, is further strengthening demand for specialized glassware tailored to specific wine styles. These venues rely on appropriate glass design to improve customer perception and tasting accuracy

- The combined momentum of hospitality expansion and evolving consumer drinking habits continues to reinforce this driver, sustaining consistent growth across global wine glass markets

Restraint/Challenge

Rising Raw Material and Energy Costs

- The wine glass market faces notable challenges due to rising raw material and energy costs associated with glass production. Manufacturing wine glasses requires high-temperature furnaces and energy-intensive processes, making producers vulnerable to fluctuations in fuel and electricity prices

- For instance, O-I Glass Inc. has highlighted the need to invest in lightweighting and energy-efficient production methods to manage rising operational costs while maintaining product quality and sustainability targets

- Increasing costs of silica, soda ash, and packaging materials are adding pressure to overall manufacturing expenses, limiting pricing flexibility for producers serving cost-sensitive markets. This is particularly challenging for suppliers catering to large-volume commercial buyers

- Transportation costs also contribute to this restraint, as wine glasses are fragile and require protective packaging, increasing logistics and handling expenses. These factors collectively impact profit margins across the value chain

- Manufacturers are required to balance cost optimization with quality expectations, especially as demand for premium and sustainable glassware rises. This ongoing cost pressure remains a key challenge influencing pricing strategies and production planning within the wine glass market

Wine Glass Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the wine glass market is segmented into glass, crystal, and others. The glass segment dominated the largest market revenue share of 58.9% in 2025, supported by its affordability, wide availability, and suitability for everyday use across households and foodservice outlets. Standard glass wineware is preferred due to its durability, ease of maintenance, and compatibility with mass production, which enables manufacturers to meet large-volume demand. Consumers often choose glass wine glasses for casual dining and regular consumption, as they offer functional design without significantly increasing cost. The segment also benefits from consistent demand from bars, restaurants, and event venues that prioritize replacement ease and standardized inventory. Continuous design improvements and improved clarity have further strengthened the position of glass wine glasses in the global market.

The crystal segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising premiumization trends and growing consumer interest in elevated wine-drinking experiences. Crystal wine glasses are valued for superior brilliance, thin rims, and enhanced sensory perception, which appeals to wine enthusiasts and luxury hospitality establishments. Increasing gifting culture, rising disposable income, and the expansion of fine-dining restaurants are accelerating demand for crystal wineware. Manufacturers are also introducing lead-free crystal variants, addressing health and sustainability concerns while maintaining premium quality. This shift is supporting faster adoption across both developed and emerging markets.

- By Application

On the basis of application, the wine glass market is segmented into personal consumption and commercial consumption. The personal consumption segment held the largest market revenue share in 2025, driven by increasing at-home wine consumption and growing interest in curated dining experiences. Consumers are investing in dedicated wine glasses to enhance flavor, aroma, and presentation during home gatherings and casual occasions. The rise of e-commerce and lifestyle branding has made a wide variety of wine glass designs easily accessible to individual buyers. Social media influence and wine education trends are also encouraging consumers to purchase specialized glassware for different wine varieties. These factors continue to support steady demand from the household segment.

The commercial consumption segment is anticipated to register the fastest growth from 2026 to 2033, supported by the expansion of hospitality, tourism, and foodservice industries. Hotels, restaurants, bars, and wineries are increasingly investing in high-quality wine glassware to elevate customer experience and brand positioning. Frequent replacement cycles due to breakage and high usage volumes further contribute to strong demand from commercial buyers. Growth in wine tourism, tasting rooms, and premium dining concepts is also increasing the need for specialized and aesthetically refined wine glasses. This sustained commercial investment is expected to drive faster segmental growth over the forecast period.

Wine Glass Market Regional Analysis

- North America dominated the wine glass market with the largest revenue share in 2025, driven by high wine consumption rates, a well-established hospitality industry, and strong consumer preference for premium dining experiences

- Consumers in the region place high value on quality glassware that enhances wine aroma, taste, and presentation, supporting steady demand across both households and commercial establishments

- The presence of a mature restaurant culture, widespread wine tourism, and high disposable incomes continues to reinforce North America’s leading position in the global wine glass market

U.S. Wine Glass Market Insight

The U.S. wine glass market accounted for the largest revenue share within North America in 2025, supported by strong domestic wine consumption and the popularity of at-home entertaining. Consumers increasingly invest in specialized wine glasses for red, white, and sparkling wines to elevate drinking experiences. The expansion of premium restaurants, wineries, and tasting rooms, along with the growth of online retail channels, further contributes to sustained market growth.

Europe Wine Glass Market Insight

The Europe wine glass market is projected to expand at a notable CAGR over the forecast period, driven by deep-rooted wine culture and the strong presence of wine-producing countries. High demand from restaurants, hotels, and wine tourism destinations supports consistent consumption of both standard and premium wine glassware. European consumers show a strong inclination toward craftsmanship, design, and crystal wine glasses, reinforcing regional market expansion.

U.K. Wine Glass Market Insight

The U.K. wine glass market is expected to grow at a steady CAGR during the forecast period, supported by rising wine consumption and an evolving dining-out culture. Increasing interest in premium home dining and gifting is encouraging consumers to purchase aesthetically refined wine glasses. The country’s robust retail and e-commerce ecosystem also facilitates easy access to a wide range of wine glass products.

Germany Wine Glass Market Insight

The Germany wine glass market is anticipated to witness considerable growth, driven by strong demand from both households and the hospitality sector. Germany’s appreciation for quality glassware, coupled with its reputation for precision manufacturing, supports steady adoption of durable and premium wine glasses. Growth in wine festivals, restaurants, and fine-dining establishments further strengthens market prospects.

Asia-Pacific Wine Glass Market Insight

The Asia-Pacific wine glass market is expected to grow at the fastest CAGR during the forecast period, fueled by rising wine consumption, urbanization, and increasing disposable incomes. Growing exposure to Western dining habits and the expansion of premium hotels and restaurants are driving demand for wine glassware. The region is also benefiting from expanding local manufacturing capabilities, improving product affordability and availability.

Japan Wine Glass Market Insight

The Japan wine glass market is gaining traction due to growing interest in wine culture and refined dining experiences. Japanese consumers emphasize aesthetics, minimalistic design, and quality, supporting demand for premium and crystal wine glasses. The steady growth of upscale restaurants and wine bars is further contributing to market expansion.

China Wine Glass Market Insight

China accounted for the largest revenue share in the Asia-Pacific wine glass market in 2025, driven by rapid urbanization, a growing middle class, and increasing wine adoption. The expansion of wine imports, domestic wineries, and luxury dining establishments is boosting demand for wine glassware. Rising consumer awareness of wine appreciation and presentation continues to support strong market growth in China.

Wine Glass Market Share

The wine glass industry is primarily led by well-established companies, including:

- Anhui Deli Daily Glass Co., Ltd. (China)

- Arc Holdings (France)

- Bormioli Rocco S.p.A. (Italy)

- Libbey, Inc. (U.S.)

- Ocean Glass Public Company Limited (Thailand)

- RONA USA (U.S.)

- Steelite International (U.K.)

- Oneida Ltd. (U.S.)

- Fiskars Group (Finland)

- Lifetime Brands, Inc. (U.S.)

- True Brands (U.S.)

- Zwiesel Crystal Glass (Germany)

- Nambé, LLC (U.S.)

- KegWorks (U.S.)

- Rabbit (U.S.)

- Carlisle FoodService Products (U.S.)

- Cocktail Kingdom LLC (U.S.)

- Cresimo (U.S.)

- Vacu Vin B.V. (Netherlands)

- American Metalcraft, Inc. (U.S.)

- Chenimage (China)

Latest Developments in Global Wine Glass Market

- In January 2026, Heinz introduced a first-of-its-kind French fries box featuring an integrated side compartment for dipping sauce, reflecting the company’s focus on packaging innovation that enhances on-the-go consumer convenience. This intuitive and mess-free design addresses common issues associated with traditional condiment packets, such as spills and handling difficulties, strengthening Heinz’s positioning in functional food packaging. The development highlights the growing importance of user-centric packaging solutions in the broader food packaging market, where differentiation increasingly depends on convenience and experience rather than product alone

- In July 2025, Ardagh Glass Packaging-Europe, part of Ardagh Group, launched a new 300g lightweight glass wine bottle that combines reduced weight with high strength and premium shelf appeal. This innovation supports the wine packaging market’s shift toward lightweighting, enabling producers to lower transportation emissions and costs without compromising bottle performance or aesthetics. The development reinforces AGP-Europe’s role in advancing sustainable glass packaging while meeting brand owners’ demand for environmentally responsible yet visually premium solutions

- In May 2024, ALPLA introduced a recyclable PET wine bottle positioned as a safe, affordable, and sustainable alternative to traditional glass bottles. Weighing roughly one-eighth of a glass bottle, the solution can reduce carbon footprint by up to 50 percent and deliver cost savings of up to 30 percent, significantly impacting the sustainable packaging market. Its availability in fully recycled PET and adoption by pilot customer Wegenstein in Austria demonstrate rising acceptance of alternative wine packaging formats, particularly for cost-sensitive and environmentally conscious producers

- In May 2024, O-I Glass Inc. launched its lightweight glass wine bottle, Estampe, in the French market, featuring a reduced carbon impact and validation from the Carbon Trust. This launch directly supports O-I’s Science Based Targets Initiative commitment to cut greenhouse gas emissions by 25 percent by 2030, reinforcing sustainability as a core competitive factor in the glass packaging market. The development strengthens demand for low-carbon glass solutions among wine producers seeking to align packaging choices with environmental goals and regulatory expectations

- In October 2023, the online wine club industry experienced a notable market transition as e-commerce wine companies adjusted to a slowdown following the surge in at-home drinking during the early pandemic period. This shift highlighted the maturation of the online alcohol sales market, where growth is increasingly driven by customer retention, curated experiences, and value-added services rather than rapid volume expansion. The evolution is reshaping competitive strategies across digital wine retail and subscription-based distribution models

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wine Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wine Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wine Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.