Global Wiper Motor Aftermarket Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

3.98 Billion

2024

2032

USD

2.50 Billion

USD

3.98 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 3.98 Billion | |

|

|

|

|

Wiper Motor Aftermarket Market Size

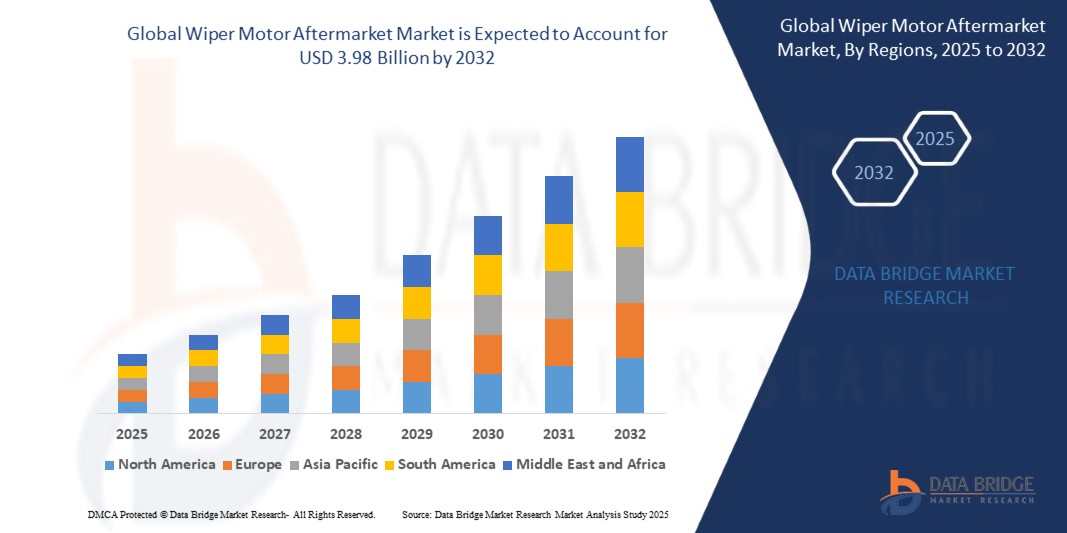

- The global Wiper Motor Aftermarket market size was valued at USD 2.50 billion in 2024 and is expected to reach USD 3.98 billion by 2032, at a CAGR of 6.00% during the forecast period

- This growth is driven by increasing vehicle ownership, aging vehicle fleets, and rising consumer awareness of vehicle maintenance and safety, particularly in regions with adverse weather conditions.

- Advancements in wiper motor technologies, such as the integration of smart sensors and energy-efficient designs, along with the growing demand for replacement parts in the aftermarket, are further fueling market expansion, especially in emerging economies with expanding automotive sectors.

Wiper Motor Aftermarket Market Analysis

- Wiper motors are critical components that power wiper systems in vehicles, enabling the movement of wiper blades to clear windshields of rain, snow, dust, and debris, ensuring driver visibility and safety in adverse weather conditions. These motors are essential in both passenger and commercial vehicles, with aftermarket demand driven by the need for replacements due to wear and tear.

- The market is propelled by the global increase in vehicle production, which reached 85.4 million units in 2022, and the rising average age of vehicles, necessitating frequent replacements of wiper motors.

- The aftermarket segment dominates due to the high replacement rate of wiper motors, driven by continuous usage, exposure to harsh weather, and consumer preference for cost-effective aftermarket solutions over OEM parts.

- North America held the largest market share of 32.8% in 2024, driven by a robust automotive industry, high vehicle ownership, and stringent safety regulations in the U.S. and Canada. The United States alone accounted for 80.4% of the regional market, supported by a strong aftermarket ecosystem and consumer awareness of vehicle maintenance.

- The Asia-Pacific region is expected to register the fastest CAGR of 7.2% from 2025 to 2032, fueled by rapid urbanization, increasing vehicle sales, and growing aftermarket demand in countries like China, India, and Japan, where automotive production and weather variability drive the need for reliable wiper systems.

- Among product types, brushless DC motors led the market with a 38.5% share in 2024, valued at USD 0.96 billion, due to their durability, energy efficiency, and compatibility with advanced wiper systems, such as rain-sensing and adaptive-speed technologies.

Report Scope and Wiper Motor Aftermarket Market Segmentation

|

Attributes |

Wiper Motor Aftermarket Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wiper Motor Aftermarket Market Trends

“Advancements in Smart Wiper Technologies and Sustainability”

- A key trend in the global wiper motor aftermarket is the adoption of smart wiper motors equipped with rain-sensing and adaptive-speed technologies, which account for over 35% of new product launches. These systems enhance driver safety by automatically adjusting wiper speed based on precipitation levels.

- The integration of brushless DC motors, which offer improved durability and energy efficiency, is gaining traction, with over 30% of new wiper motor launches in 2023 and 2024 focusing on this technology.

- Sustainability is reshaping the market, with over 20% of manufacturers incorporating eco-friendly materials, such as recycled components, into wiper motor production to meet environmental regulations and consumer demand for green products.

- The rise of e-commerce platforms has transformed the aftermarket, with online sales of wiper motors increasing by 15% annually, driven by consumer preference for convenience and competitive pricing.

- Miniaturization and noise reduction technologies are gaining prominence, particularly in luxury and electric vehicles, where over 20% of new wiper motors feature enhanced noise reduction for quieter operation.

Wiper Motor Aftermarket Market Dynamics

Driver

““Increasing Vehicle Ownership, Aging Fleets, and Demand for Safety Features”

- The global rise in vehicle ownership, with 85.4 million vehicles produced in 2022, is a major driver for the wiper motor aftermarket, as wiper motors require periodic replacement due to wear from continuous use.

- Aging vehicle fleets, particularly in North America and Europe, where the average vehicle age exceeds 12 years, are boosting demand for aftermarket wiper motors as older vehicles require frequent maintenance.

- Stringent safety regulations, such as those mandated by the U.S. National Highway Traffic Safety Administration (NHTSA) and the European Union, require functional wiper systems for road safety, driving aftermarket demand.

- The growing popularity of electric and hybrid vehicles, which demand energy-efficient and low-noise wiper motors, is creating new opportunities for aftermarket suppliers, with electric vehicle integration accounting for over 30% of advanced wiper motor systems.

- The expansion of e-commerce and DIY automotive repair trends, particularly in urban areas, is increasing aftermarket sales, as consumers and repair shops seek cost-effective and accessible replacement parts.

Restraint/Challenge

“High Costs, Supply Chain Disruptions, and Availability of Substitutes”

- The high cost of advanced wiper motors, particularly those with smart features like rain-sensing technology, limits adoption in cost-sensitive markets, especially among small repair shops and individual consumers.

- Supply chain disruptions, including semiconductor shortages and raw material constraints, have impacted production and delivery timelines, with the COVID-19 pandemic causing a temporary decline in aftermarket demand due to reduced vehicle usage.

- The availability of low-cost substitutes and refurbished wiper motors in emerging markets poses a challenge to branded aftermarket suppliers, as price-sensitive consumers opt for cheaper alternatives.

- Technical complexities in integrating smart wiper motors with legacy vehicle systems require skilled labor and specialized tools, increasing installation costs and limiting adoption in regions with limited technical expertise.

- Stringent quality standards and certification requirements for aftermarket wiper motors, particularly in regulated markets like Europe and North America, increase production costs and compliance burdens for manufacturers.

Wiper Motor Aftermarket Market Scope

The global wiper motor aftermarket market is segmented on the basis of product type, component, application, sales channel, technology, and end-user.

- By Product Type

On the basis of product type, the market is segmented into stepper motors, brush DC motors, brushless DC motors, and others. Brushless DC motors dominated with a 38.5% revenue share in 2024, valued at USD 0.96 billion, due to their energy efficiency, durability, and compatibility with smart wiper systems.

The stepper motor segment is expected to grow at the fastest CAGR of 7.5% from 2025 to 2032, driven by its precision in controlling wiper blade movement in advanced systems.

- By Component

On the basis of component, the market is segmented into hardware, software, and services. The hardware segment held the largest share of 65.2% in 2024, driven by the high demand for physical wiper motors in replacement applications.

The software segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by the adoption of IoT-enabled software for smart wiper systems.

- By Application

On the basis of application, the market is segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, and others. Passenger cars accounted for the largest share of 60.8% in 2024, driven by high vehicle ownership and frequent wiper motor replacements.

The heavy commercial vehicles segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by rising logistics and transportation activities.

- By Sales Channel

On the basis of Sales Channel, the market is segmented into OEM and aftermarket. The aftermarket segment dominated with a 65.8% share in 2024, driven by the high replacement rate of wiper motors and consumer preference for cost-effective solutions.

The OEM segment is expected to grow steadily due to partnerships with automakers, fueled by rising logistics and transportation activities

- By Technology

On the basis of technology, the market is segmented into conventional wiper motors, smart wiper motors (rain-sensing, adaptive speed), and others. Smart wiper motors held a significant share in 2024, driven by their adoption in premium and electric vehicles.

This segment is expected to grow at the fastest CAGR from 2025 to 2032 due to increasing demand for advanced safety features.

- By End-User

On the basis of end-user, the market is segmented into individual consumers, fleet operators, automotive repair shops, and others. Automotive repair shops held the largest share of 45.6% in 2024, driven by their role in vehicle maintenance and repair.

The fleet operators segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the expansion of commercial vehicle fleets.

Wiper Motor Aftermarket Market Regional Analysis

North America

North America dominated the global wiper motor aftermarket with a revenue share of 32.8% in 2024, driven by high vehicle ownership, a robust aftermarket ecosystem, and stringent safety regulations. The U.S. accounted for 80.4% of the regional market, supported by a strong automotive industry and consumer awareness of maintenance needs. The passenger car segment led with a 62.3% share in 2024, while the heavy commercial vehicles segment is expected to grow at the fastest CAGR from 2025 to 2032 due to rising logistics demand.

U.S. Wiper Motor Aftermarket Market Insight

The U.S. captured the largest share of the North American market in 2024, driven by its leadership in automotive production, high vehicle ownership (92% of households own at least one vehicle), and a strong aftermarket network. The adoption of smart wiper motors in electric vehicles and the presence of key players like WAI Global and Federal Mogul Motorparts LLC further propel market growth.

Europe Wiper Motor Aftermarket Market Insight

Europe’s market is driven by stringent safety regulations, increasing vehicle sales, and a focus on sustainability. Germany, the U.K., and France are key contributors, with growth fueled by the adoption of advanced wiper motors in premium vehicles and the aftermarket’s role in maintenance. The smart wiper motor segment is gaining traction due to its integration with advanced driver assistance systems (ADAS).

U.K. Wiper Motor Aftermarket Market Insight

The U.K. market is expected to grow at a notable CAGR during the forecast period, driven by its strong automotive sector and increasing demand for smart wiper systems. The U.K.’s Net Zero Strategy is boosting the adoption of energy-efficient wiper motors in electric vehicles, while e-commerce platforms enhance aftermarket accessibility.

Germany Wiper Motor Aftermarket Market Insight

Germany’s market is expanding due to its leadership in automotive manufacturing and precision engineering. The adoption of brushless DC motors and smart wiper technologies in luxury and electric vehicles is driving growth, supported by Germany’s focus on sustainability and Industry 4.0.

Asia-Pacific Wiper Motor Aftermarket Market Insight

The Asia-Pacific region is poised to grow at the fastest CAGR of 7.2% from 2025 to 2032, driven by rapid urbanization, increasing vehicle sales, and growing aftermarket demand in China, India, and Japan. The market was valued at USD 0.9 billion in 2024 and is expected to reach USD 1.6 billion by 2032. Government initiatives like India’s Automotive Mission Plan and China’s focus on electric vehicles are boosting demand.

Japan Wiper Motor Aftermarket Market Insight

Japan’s market is driven by its advanced automotive industry and focus on smart technologies. The adoption of rain-sensing wiper motors in premium vehicles and the presence of manufacturers like Mitsuba Corporation and Nippon Wiper Blade Co., Ltd. support market growth.

China Wiper Motor Aftermarket Market Insight

China held the largest share in Asia-Pacific in 2024, driven by its massive automotive production, rapid urbanization, and government policies promoting electric vehicles. The aftermarket is expanding due to increasing vehicle ownership and e-commerce growth, with smart wiper motors gaining traction in urban areas.

Wiper Motor Aftermarket Market Share

- The Wiper Motor Aftermarket industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Valeo S.A. (France)

- DENSO Corporation (Japan)

- Mitsuba Corporation (Japan)

- WAI Global (U.S.)

- Magneti Marelli S.p.A. (Italy)

- DOGA Automotive (Spain)

- Federal Mogul Motorparts LLC (U.S.)

- HELLA GmbH & Co. KGaA (Germany)

- Nippon Wiper Blade Co., Ltd. (Japan)

- Trico Products Corporation (U.S.)

- B. Hepworth and Company Limited (U.K.)

- ASMO Co., Ltd. (Japan)

- WEXCO Industries, Inc. (U.S.)

- Syndicate Wiper Systems (India)

- Johnson Electric (Hong Kong)

Latest Developments in Global Wiper Motor Aftermarket Market

- In November 2020, Valeo S.A. introduced a new range of 18 front and rear wiper motor references specifically designed for the aftermarket, covering approximately 3.3 million vehicles across Europe, North America, and Asia-Pacific. These motors feature enhanced durability and compatibility with both conventional and smart wiper systems, addressing the growing demand for reliable replacement parts.

- In February 2023, Robert Bosch GmbH launched a sensory campaign to promote its ICON beam windshield wiper blades, emphasizing their compatibility with advanced wiper motors, particularly brushless DC motors, for improved performance in extreme weather conditions. This campaign indirectly boosted aftermarket demand for high-performance wiper motors, with sales increasing by 10% in key markets.

- In March 2024, DENSO Corporation unveiled a new line of brushless DC wiper motors designed for electric and hybrid vehicles, offering up to 20% improved energy efficiency and reduced noise levels compared to traditional motors. These motors are tailored for the growing electric vehicle market, with a focus on sustainability and performance.

- In January 2024, Mitsuba Corporation introduced a smart wiper motor system with integrated IoT diagnostics, enabling real-time performance monitoring and predictive maintenance for commercial vehicle fleets. This system has been adopted by logistics companies in Japan and Southeast Asia, reducing maintenance costs by 15%.

- In April 2024, HELLA GmbH & Co. KGaA launched a series of compact wiper motors for electric vehicles, featuring eco-friendly materials and noise reduction technologies, aligning with the EU’s sustainability regulations and catering to the growing demand for quiet operation in premium vehicles.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.