Global Wire And Cable Compounds Market

Market Size in USD Billion

CAGR :

%

USD

25.30 Billion

USD

46.48 Billion

2024

2032

USD

25.30 Billion

USD

46.48 Billion

2024

2032

| 2025 –2032 | |

| USD 25.30 Billion | |

| USD 46.48 Billion | |

|

|

|

|

Wire and Cable Compounds Market Size

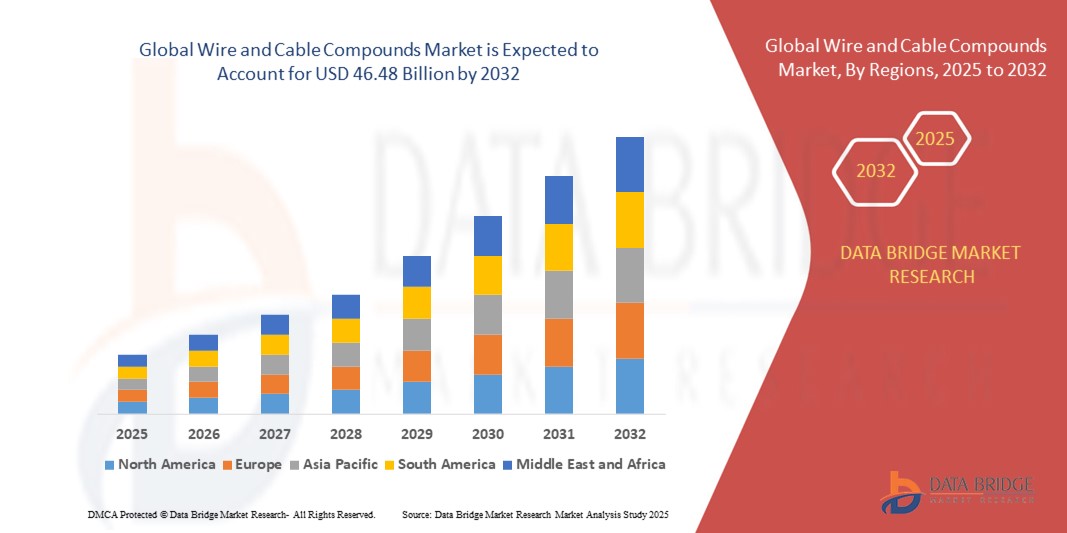

- The global wire and cable compounds market size was valued at USD 25.30 billion in 2024 and is expected to reach USD 46.48 billion by 2032, at a CAGR of 7.9% during the forecast period

- The market growth is largely fuelled by the rising demand for energy infrastructure upgrades, increasing urbanization, and the growing adoption of electric vehicles requiring efficient wiring systems

- The expanding construction sector, especially in developing regions, is significantly contributing to the demand for fire-retardant and durable wire and cable insulation materials, enhancing overall market expansion

Wire and Cable Compounds Market Analysis

- Rapid advancements in telecommunication networks, including the deployment of 5G infrastructure, are accelerating the need for high-performance insulation and jacketing materials in fiber optic and coaxial cables

- In addition, the shift toward renewable energy installations is boosting the use of low-smoke halogen-free compounds to ensure fire safety and environmental compliance in solar and wind power applications

- North America dominated the global wire and cable compounds market with the largest revenue share of 34.2% in 2024, driven by increased investments in renewable energy, electric vehicle infrastructure, and smart grid development

- Asia-Pacific region is expected to witness the highest growth rate in the global wire and cable compounds market, driven by fast-paced industrialization, expansion of smart city projects, and increasing automotive and construction activities in emerging economies such as China, India, and Southeast Asia

- The halogenated segment dominated the market with the largest market revenue share in 2024, driven by its excellent flame retardant properties, superior insulation capabilities, and cost-effectiveness. These compounds are widely used across a broad range of traditional applications due to their proven performance in ensuring cable safety and durability

Report Scope and Wire and Cable Compounds Market Segmentation

|

Attributes |

Wire and Cable Compounds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wire and Cable Compounds Market Trends

Growing Integration of Wire and Cable Compounds in Electric Vehicles and Renewable Energy

- The accelerating shift toward electric vehicles (EVs) is driving significant demand for wire and cable compounds due to the need for high-performance insulation and sheathing materials that can withstand elevated temperatures, vibrations, and electromagnetic interference. These compounds support vehicle safety, power distribution, and efficient signal transmission, contributing to overall performance and reliability

- As global initiatives around decarbonization grow, the expansion of solar and wind energy projects has increased the deployment of specialized cables with enhanced UV, moisture, and flame resistance. Wire and cable compounds such as halogen-free flame retardants are increasingly used to ensure safety and environmental compliance in harsh outdoor conditions

- Wire and cable manufacturers are focusing on sustainability by developing recyclable and low-smoke, zero-halogen (LSZH) compounds that meet modern regulatory and environmental standards. This transition helps end-users reduce carbon footprints and meet compliance across industrial applications

- For instance, in 2023, a leading North American utility company adopted high-performance thermoplastic compounds in its large-scale solar installation projects across California and Arizona, enabling enhanced durability and system longevity while minimizing maintenance requirements

- While demand continues to grow, the success of compound adoption will depend on further innovation in cost-effective materials, meeting evolving international safety standards, and expanding production capabilities to support next-gen energy and mobility infrastructure

Wire and Cable Compounds Market Dynamics

Driver

Rising Infrastructure Development and Power Sector Investments Globally

- Governments worldwide are accelerating investments in power distribution, smart grids, and broadband connectivity as part of modernization and electrification efforts. These infrastructure projects heavily rely on durable, weather-resistant, and thermally stable wire and cable compounds to support long-term performance and operational safety

- The global expansion of residential and commercial construction, particularly in emerging economies such as India, Brazil, and Southeast Asia, is creating robust demand for building wires, communication cables, and energy distribution lines. Compounds with enhanced flame-retardant and low-smoke properties are essential for ensuring compliance with local and international safety codes

- Advanced compounds enable better insulation, lightweighting, and enhanced mechanical strength, contributing to increased cable efficiency and longevity in both underground and overhead systems. These benefits are critical to meet the growing energy demands of expanding urban populations

- For instance, in 2022, a large-scale smart grid project in Germany integrated low-halogen, UV-resistant compounds into all its low-voltage distribution cables, significantly reducing risk and ensuring system durability under variable climatic conditions

- While infrastructure projects are boosting compound consumption, manufacturers must continue to optimize material costs and invest in R&D for high-performance, regulatory-compliant products to remain competitive in the global market

Restraint/Challenge

Volatile Raw Material Prices and Regulatory Compliance Burdens

- The prices of key raw materials used in wire and cable compounds, such as PVC, polyethylene, and flame-retardant additives, are subject to sharp fluctuations due to supply chain disruptions, energy costs, and geopolitical factors. These variations directly impact production costs and pricing flexibility for manufacturers

- Regulatory agencies across North America, Europe, and Asia-Pacific are enforcing strict environmental and safety standards, particularly regarding halogenated compounds and toxic emissions. Adhering to these evolving standards requires ongoing investment in testing, reformulation, and compliance audits, which can slow time-to-market for new products

- For small- and mid-sized manufacturers, maintaining consistent quality while transitioning to eco-friendly and recyclable compound alternatives poses both technical and financial challenges. This can hinder their ability to scale or enter highly regulated markets

- For instance, in 2023, multiple compound suppliers in Asia faced temporary shutdowns due to non-compliance with regional environmental guidelines, leading to production delays and supply shortages in the automotive cable segment

- As the industry advances, a major focus must remain on sustainable innovation, process optimization, and strategic raw material sourcing to balance environmental responsibility with profitability and global competitiveness

Wire and Cable Compounds Market Scope

The market is segmented on the basis of type, application, and end-use industry.

- By Type

On the basis of type, the wire and cable compounds market is segmented into halogenated and non-halogenated. The halogenated segment dominated the market with the largest market revenue share in 2024, driven by its excellent flame retardant properties, superior insulation capabilities, and cost-effectiveness. These compounds are widely used across a broad range of traditional applications due to their proven performance in ensuring cable safety and durability.

The non-halogenated segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing regulatory pressure and environmental concerns. These compounds are favored in green building projects and public infrastructure developments where low smoke, low toxicity, and recyclability are key priorities. Their adoption is rising in high-density urban zones and sectors where compliance with stringent fire and safety norms is critical.

- By Application

On the basis of application, the market is segmented into building wires, power cables, submarine cables, communication cables, and automotive wiring. The power cables segment held the largest market share in 2024, supported by the ongoing modernization of power grids, rising electricity demand, and investments in renewable energy infrastructure. These cables require compounds with high thermal resistance, dielectric strength, and mechanical robustness.

The automotive wiring segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid adoption of electric vehicles (EVs) and increasing vehicle electrification. Compounds used in this segment must endure extreme conditions, including heat, vibration, and exposure to chemicals, leading to greater demand for high-performance, lightweight, and eco-friendly formulations.

- By End-use Industry

On the basis of end-use industry, the market is segmented into construction, power, communication, and automotive. The construction segment accounted for the largest market revenue share in 2024, as a result of increased urbanization, residential and commercial development, and retrofitting of electrical infrastructure. Compounds used in this sector must offer high fire resistance, insulation stability, and longevity.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising global automotive production, advancements in autonomous and electric vehicle technologies, and stringent safety standards. Manufacturers are prioritizing materials that enhance energy efficiency, reduce emissions, and align with sustainable mobility goals.

Wire and Cable Compounds Market Regional Analysis

- North America dominated the global wire and cable compounds market with the largest revenue share of 34.2% in 2024, driven by increased investments in renewable energy, electric vehicle infrastructure, and smart grid development

- The region's focus on sustainability and safety standards has boosted the demand for non-halogenated compounds across various end-use industries such as construction, power, and automotive

- The rising trend of electrification and advancements in communication technologies are further supporting compound usage in high-performance cables designed for energy efficiency and fire resistance

U.S. Wire and Cable Compounds Market Insight

The U.S. wire and cable compounds market captured the largest revenue share in 2024 within North America, supported by large-scale modernization of electrical networks, expansion of data centers, and rapid growth in the electric vehicle sector. Regulatory emphasis on energy-efficient, low-emission materials is driving the preference for environmentally friendly compounds. The country’s strong presence of global compound manufacturers and investments in infrastructure upgrades are also key growth drivers.

Europe Wire and Cable Compounds Market Insight

The Europe wire and cable compounds market is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand for energy-efficient and halogen-free compounds in building and industrial applications. Stringent environmental regulations, coupled with the European Union’s push toward carbon neutrality, are encouraging the adoption of recyclable and low-toxicity compounds. Key infrastructure projects and digital connectivity initiatives are further enhancing the market outlook.

Germany Wire and Cable Compounds Market Insight

The Germany wire and cable compounds market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s leadership in green energy, electric mobility, and high-speed connectivity. Demand is surging for non-halogenated compounds in response to fire safety standards in construction and automotive industries. With major automakers and energy providers based in Germany, the focus on high-performance, sustainable cable insulation and jacketing materials is significantly advancing market development.

U.K. Wire and Cable Compounds Market Insight

The U.K. wire and cable compounds market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing investments in smart cities, renewable energy projects, and the electrification of transportation. The demand for halogen-free and fire-retardant compounds is growing due to strict building and electrical safety codes. Furthermore, the U.K.'s push toward carbon neutrality and green construction practices is encouraging the adoption of sustainable and recyclable cable materials across both residential and commercial infrastructure projects

Asia-Pacific Wire and Cable Compounds Market Insight

The Asia-Pacific wire and cable compounds market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid urbanization, growing electricity consumption, and large-scale industrial expansion in countries such as China, India, and South Korea. Government-led infrastructure projects and rural electrification initiatives are significantly increasing compound usage in power and communication cables. The region’s low production costs and growing domestic demand position it as a key global supplier of wire and cable compounds.

China Wire and Cable Compounds Market Insight

The China wire and cable compounds market accounted for the largest market revenue share in Asia-Pacific in 2024, backed by aggressive development in power transmission, smart grid technology, and renewable energy integration. China’s dominance in cable manufacturing, coupled with strong domestic demand from construction and electric vehicle industries, is fueling consistent growth. The country’s commitment to environmental sustainability is also driving the transition toward halogen-free and eco-friendly compound alternatives.

Japan Wire and Cable Compounds Market Insight

The Japan wire and cable compounds market is expected to witness the fastest growth rate from 2025 to 2032, supported by advancements in automotive electronics, high-speed rail networks, and smart factory technologies. The country’s strong focus on quality, safety, and miniaturization in electrical systems is driving the use of precision-engineered compounds with superior insulation and thermal resistance. In addition, Japan’s investment in earthquake-resilient infrastructure and smart energy grids is bolstering the demand for durable, high-performance cable compounds across multiple sectors.

Wire and Cable Compounds Market Share

The Wire and Cable Compounds industry is primarily led by well-established companies, including:

- Borealis GmbH (Austria)

- Eastman Chemical Company (U.S.)

- Electric Cable Compounds, Inc. (U.S.)

- Syensqo (Belgium)

- Exxon Mobil Corporation (U.S.)

- Orbia (Alphagary) (U.K.)

- Evonik Industries (Germany)

- Hanwha Solutions Corporation (South Korea)

- RIKEN TECHNOS CORP (Japan)

- DuPont (U.S.)

- SCG (Thailand)

- Avient Corporation (U.S.)

- Trelleborg AB (Sweden)

Latest Developments in Global Wire and Cable Compounds Market

- In April 2025, Syensqo entered into a strategic partnership agreement with Sinopec to advance collaboration in specialty chemicals and advanced materials. The alliance aims to drive innovation across sectors such as aerospace, transportation, electronics, energy, and industrial applications. This collaboration is expected to accelerate sustainable product development and strengthen both companies’ positions in the evolving global materials market

- In June 2023, Borealis GmbH completed the acquisition of Rialti S.p.A., a prominent European recycled polypropylene compound producer. This acquisition added 50,000 tonnes of recycled capacity to Borealis’ portfolio, reinforcing its circular economy strategy and meeting rising demand for sustainable polymer solutions across Europe

- In February 2025, Avient Corporation expanded its ECCOH XL flame-retardant portfolio with the launch of ECCOH XL 8054, a cross-linkable, low-smoke solution for wire and cable insulation. Designed to meet stringent European fire safety standards, the new grade supports improved electrical safety and enhances Avient’s offering for critical infrastructure applications

- In November 2021, Avient Corporation introduced new ECCOH grades aimed at telecom and industrial cable producers. These LSFOH materials are engineered to reduce emissions and extend cable service life, offering enhanced environmental benefits and operational efficiency for cable manufacturers seeking long-term, low-maintenance solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wire And Cable Compounds Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wire And Cable Compounds Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wire And Cable Compounds Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.