Global Wireless Condition Monitoring Systems Market

Market Size in USD Million

CAGR :

%

USD

957.52 Million

USD

2,483.13 Million

2025

2033

USD

957.52 Million

USD

2,483.13 Million

2025

2033

| 2026 –2033 | |

| USD 957.52 Million | |

| USD 2,483.13 Million | |

|

|

|

|

What is the Global Wireless Condition Monitoring Systems Market Size and Growth Rate?

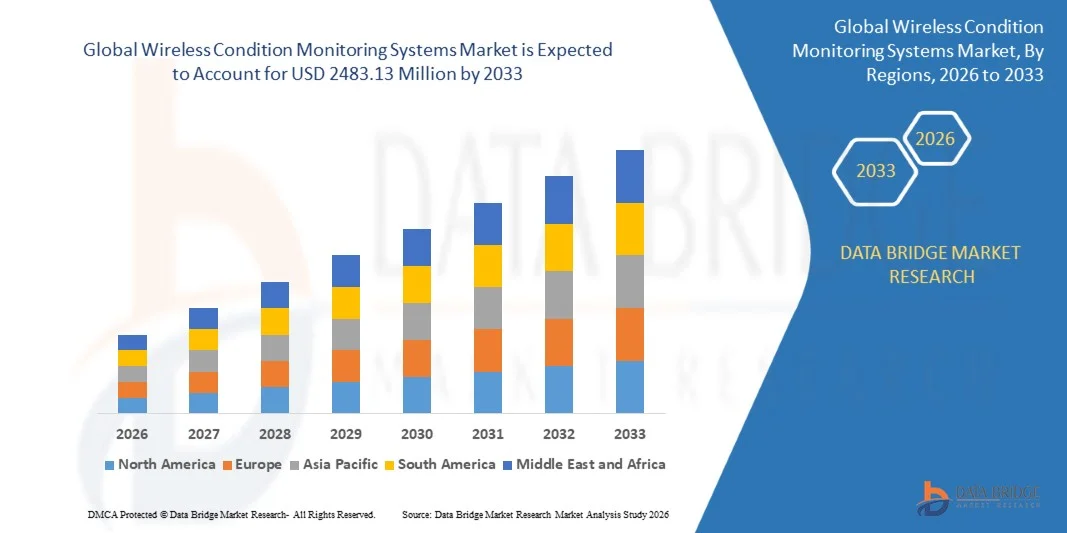

- The global wireless condition monitoring systems market size was valued at USD 957.52 million in 2025 and is expected to reach USD 2483.13 million by 2033, at a CAGR of12.65% during the forecast period

- Increasing adoption of Industrial IoT (IIoT), rising focus on predictive maintenance, growing demand for real-time asset health monitoring, expansion of smart manufacturing, and cost benefits associated with reduced downtime and maintenance efficiency are key factors driving market growth

What are the Major Takeaways of Wireless Condition Monitoring Systems Market?

- Rising deployment of wireless sensors across manufacturing, oil & gas, power generation, and automotive industries, along with increasing digital transformation initiatives, is creating significant growth opportunities for the market

- High initial deployment costs, cybersecurity concerns, and lack of skilled professionals for system integration and data interpretation are expected to act as major restraints impacting market growth

- North America dominated the wireless condition monitoring systems market with an estimated 34.26% revenue share in 2025, driven by widespread adoption of predictive maintenance solutions, strong penetration of Industrial IoT, and advanced industrial automation across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of around 9.32% from 2026 to 2033, driven by rapid industrialization, expanding manufacturing bases, and increasing investments in smart factories across China, Japan, India, South Korea, and Southeast Asia

- The Hardware segment dominated the market with an estimated 46.7% share in 2025, driven by high demand for wireless sensors, gateways, and edge devices used for vibration, temperature, and acoustic monitoring

Report Scope and Wireless Condition Monitoring Systems Market Segmentation

|

Attributes |

Wireless Condition Monitoring Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wireless Condition Monitoring systems Market?

“Rapid Shift Toward IIoT-Enabled, Cloud-Integrated, and Battery-Powered Wireless Condition Monitoring Systems”

- The wireless condition monitoring systems market is witnessing strong adoption of compact, battery-powered, and IIoT-enabled wireless sensors for continuous asset health monitoring across industrial environments

- Manufacturers are introducing multi-parameter monitoring solutions combining vibration, temperature, acoustic, and electrical measurements with advanced analytics and edge computing capabilities

- Growing demand for real-time condition data, remote accessibility, and predictive maintenance is accelerating deployment across geographically dispersed and hard-to-reach assets

- For instance, companies such as Emerson, Siemens, ABB, Honeywell, and SKF are enhancing their wireless monitoring portfolios with cloud dashboards, AI-based diagnostics, and mobile-enabled visualization platforms

- Increasing focus on reducing unplanned downtime, maintenance costs, and manual inspections is driving the transition from wired to wireless condition monitoring architectures

- As industries move toward smart factories and connected infrastructure, wireless condition monitoring systems will play a critical role in asset reliability, operational efficiency, and data-driven maintenance strategies

What are the Key Drivers of Wireless Condition Monitoring systems Market?

- Rising demand for predictive and preventive maintenance solutions to minimize equipment failure, production losses, and safety risks across industrial operations

- For instance, during 2024–2025, leading vendors expanded wireless sensor deployments across manufacturing plants, oil & gas facilities, and power generation sites to support real-time asset monitoring

- Growing adoption of Industrial IoT, Industry 4.0, and smart manufacturing initiatives is boosting demand for wireless condition monitoring solutions across the U.S., Europe, and Asia-Pacific

- Advancements in low-power wireless communication, sensor miniaturization, edge analytics, and cloud integration are improving system reliability and scalability

- Increasing use of rotating machinery, automated production lines, and critical infrastructure assets is creating demand for continuous monitoring solutions

- Supported by sustained investments in industrial automation, digital transformation, and asset management, the Wireless Condition Monitoring Systems market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Wireless Condition Monitoring systems Market?

- High initial deployment and integration costs associated with wireless sensors, gateways, and analytics platforms can limit adoption among small and mid-sized enterprises

- For instance, during 2024–2025, rising costs of industrial-grade sensors, batteries, and connectivity modules increased overall system expenses for end users

- Data security and cybersecurity concerns related to wireless communication and cloud-based monitoring platforms pose challenges for critical industries

- Complexity in data interpretation, analytics configuration, and system integration increases dependence on skilled professionals

- Limited awareness in emerging markets regarding predictive maintenance benefits and wireless monitoring capabilities slows adoption

- To overcome these challenges, companies are focusing on cost-optimized solutions, enhanced cybersecurity, simplified analytics platforms, and training initiatives to accelerate global adoption of wireless condition monitoring systems

How is the Wireless Condition Monitoring systems Market Segmented?

The market is segmented on the basis of component, monitoring technique, connectivity type, deployment, and end use.

• By Component

On the basis of component, the wireless condition monitoring systems market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with an estimated 46.7% share in 2025, driven by high demand for wireless sensors, gateways, and edge devices used for vibration, temperature, and acoustic monitoring. Industrial users prioritize robust, battery-powered hardware for continuous monitoring of rotating and critical assets in harsh environments. Widespread deployment across manufacturing plants, oil & gas facilities, and power stations further supports hardware dominance.

The Software segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of cloud-based analytics, AI-driven diagnostics, digital twins, and predictive maintenance platforms. As industries shift toward data-driven asset management, advanced visualization, real-time alerts, and condition-based insights are increasing software value within overall system deployments.

• By Monitoring Technique

Based on monitoring technique, the market is segmented into Vibration Monitoring, Thermography, Ultrasound Monitoring, Lubrication & Oil Analysis, Corrosion Monitoring, and Electrical & Motor Monitoring. Vibration Monitoring dominated the market with a 38.9% share in 2025, as it remains the most effective and widely used technique for early fault detection in rotating machinery such as motors, pumps, compressors, and turbines. Its ability to identify imbalance, misalignment, and bearing faults makes it indispensable in industrial maintenance programs.

The Ultrasound Monitoring segment is projected to grow at the fastest CAGR during 2026–2033, driven by increasing use in leak detection, electrical discharge monitoring, and early-stage bearing fault identification. Growing awareness of complementary multi-technique monitoring strategies is further accelerating adoption across industries.

• By Connectivity Type

On the basis of connectivity type, the wireless condition monitoring systems market is segmented into Bluetooth Low Energy, Wi-Fi, LoRaWAN & NB-IoT (LPWAN), Zigbee & WirelessHART, and Cellular. Zigbee & WirelessHART dominated the market with a 34.5% share in 2025, supported by strong adoption in industrial environments due to their reliability, mesh networking capability, and compatibility with process automation systems. These protocols are widely deployed in hazardous and large-scale industrial sites.

The LoRaWAN & NB-IoT (LPWAN) segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by demand for long-range, low-power connectivity for remote assets, pipelines, wind farms, and distributed infrastructure. Cost efficiency and extended battery life are key growth enablers.

• By Deployment

Based on deployment, the market is segmented into On-premises, Cloud, and Hybrid. The On-premises segment accounted for the largest share at 42.8% in 2025, as industries with strict data security, latency, and compliance requirements—such as oil & gas, power generation, and defense—continue to prefer localized data processing and control. On-premises systems offer higher reliability in remote or low-connectivity environments.

The Cloud deployment segment is anticipated to grow at the fastest CAGR from 2026 to 2033, fueled by increasing adoption of scalable analytics platforms, remote monitoring capabilities, and centralized asset management. Cloud solutions enable real-time insights across multiple facilities, supporting predictive maintenance and enterprise-wide decision-making.

• By End Use

On the basis of end use, the wireless condition monitoring systems market is segmented into Manufacturing, Oil & Gas, Power Generation, Automotive, Pharmaceutical, Mining & Metals, and Others. The Manufacturing segment dominated the market with a 35.6% share in 2025, driven by widespread deployment across production lines, CNC machines, robotics, and rotating equipment to minimize downtime and optimize operational efficiency. Industry 4.0 adoption further strengthens demand.

The Oil & Gas segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising investments in remote asset monitoring, pipeline integrity management, offshore platforms, and hazardous-area operations. The need to reduce manual inspections and improve safety is accelerating wireless condition monitoring adoption in this sector.

Which Region Holds the Largest Share of the Wireless Condition Monitoring systems Market?

- North America dominated the wireless condition monitoring systems market with an estimated 34.26% revenue share in 2025, driven by widespread adoption of predictive maintenance solutions, strong penetration of Industrial IoT, and advanced industrial automation across the U.S. and Canada. High deployment of wireless sensors for vibration, temperature, and electrical monitoring across manufacturing plants, oil & gas facilities, and power generation sites continues to fuel regional demand

- Leading companies in North America are introducing AI-enabled analytics platforms, cloud-integrated dashboards, and battery-powered wireless sensors, strengthening the region’s technological leadership. Continuous investment in smart factories, asset reliability programs, and digital transformation supports long-term market growth

- High concentration of industrial automation vendors, skilled workforce availability, and early adoption of condition-based maintenance further reinforce North America’s market dominance

U.S. Wireless Condition Monitoring Systems Market Insight

The U.S. is the largest contributor in North America, supported by strong adoption of Industry 4.0, predictive maintenance, and smart asset management across manufacturing, oil & gas, power, and automotive industries. Increasing focus on reducing unplanned downtime, improving operational efficiency, and enhancing worker safety is driving deployment of wireless condition monitoring solutions. Presence of major solution providers, strong industrial R&D, and large-scale infrastructure further accelerate market growth.

Canada Wireless Condition Monitoring Systems Market Insight

Canada contributes steadily to regional growth, driven by adoption across energy, mining, manufacturing, and utilities. Rising use of wireless sensors in remote and harsh environments, coupled with government-backed digital innovation initiatives, supports market expansion. Increasing focus on asset integrity and sustainability further strengthens adoption.

Asia-Pacific Wireless Condition Monitoring Systems Market

Asia-Pacific is projected to register the fastest CAGR of around 9.32% from 2026 to 2033, driven by rapid industrialization, expanding manufacturing bases, and increasing investments in smart factories across China, Japan, India, South Korea, and Southeast Asia. Growing adoption of IIoT, automation, and predictive maintenance is significantly boosting demand for wireless condition monitoring solutions.

China Wireless Condition Monitoring Systems Market Insight

China leads Asia-Pacific due to large-scale manufacturing operations, expanding energy infrastructure, and strong government support for industrial digitalization. Rising deployment of wireless monitoring systems across factories, power plants, and process industries drives robust demand.

Japan Wireless Condition Monitoring Systems Market Insight

Japan shows stable growth supported by advanced manufacturing practices, robotics adoption, and focus on equipment reliability. High emphasis on quality control and preventive maintenance accelerates adoption of advanced wireless monitoring technologies.

India Wireless Condition Monitoring Systems Market Insight

India is emerging as a high-growth market, driven by expanding industrial automation, infrastructure development, and government initiatives such as smart manufacturing and Make in India. Increasing awareness of predictive maintenance benefits is accelerating market penetration.

South Korea Wireless Condition Monitoring Systems Market Insight

South Korea contributes significantly due to strong electronics, automotive, and heavy industry sectors. Rising investments in smart factories, AI-driven maintenance, and industrial connectivity support sustained growth in wireless condition monitoring system adoption.

Which are the Top Companies in Wireless Condition Monitoring systems Market?

The wireless condition monitoring systems industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- Siemens (Germany)

- ABB Ltd. (Switzerland)

- Honeywell International Inc. (U.S.)

- General Electric Company (U.S.)

- Schneider Electric (France)

- Rockwell Automation (U.S.)

- SKF (Sweden)

- Baker Hughes Company (U.S.)

- Parker Hannifin Corp (U.S.)

What are the Recent Developments in Global Wireless Condition Monitoring systems Market?

- In November 2025, Emerson Electric Co. unveiled AMS Machine Works v2.1, integrating enhanced Wi-Fi and edge-connectivity capabilities to accelerate wireless condition monitoring, enabling faster diagnostics through Store on Alert, improved automated fault detection, and scalable data transfer for predictive maintenance programs, strengthening connected maintenance adoption across industrial facilities

- In October 2025, GE Vernova partnered with Verizon Business to introduce the MDS Orbit industrial wireless platform, delivering secure and resilient communications for utilities while enhancing remote monitoring, SCADA connectivity, and grid automation for dispersed assets, supporting modernization of utility operations and data reliability

- In October 2025, MISTRAS Group collaborated with Villari to integrate wireless crack-detection technology into its structural health monitoring portfolio, expanding real-time fatigue and crack growth monitoring for steel assets and reducing reliance on manual inspections, improving asset visibility and minimizing unplanned downtime

- In April 2025, Emerson Electric launched advanced vibration monitoring devices equipped with enhanced AI-driven analytics, enabling earlier fault detection and more accurate predictive insights for rotating machinery, boosting reliability-centered maintenance outcomes

- In June 2024, Siemens AG expanded its Asia-Pacific presence by partnering with local industrial automation firms to promote IoT-enabled condition monitoring solutions, accelerating regional adoption of smart maintenance technologies, reinforcing digital transformation across emerging industrial markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.