Global Wireless Infrastructure Market

Market Size in USD Billion

CAGR :

%

USD

125.60 Billion

USD

248.30 Billion

2024

2032

USD

125.60 Billion

USD

248.30 Billion

2024

2032

| 2025 –2032 | |

| USD 125.60 Billion | |

| USD 248.30 Billion | |

|

|

|

|

Global Wireless Infrastructure Market Size

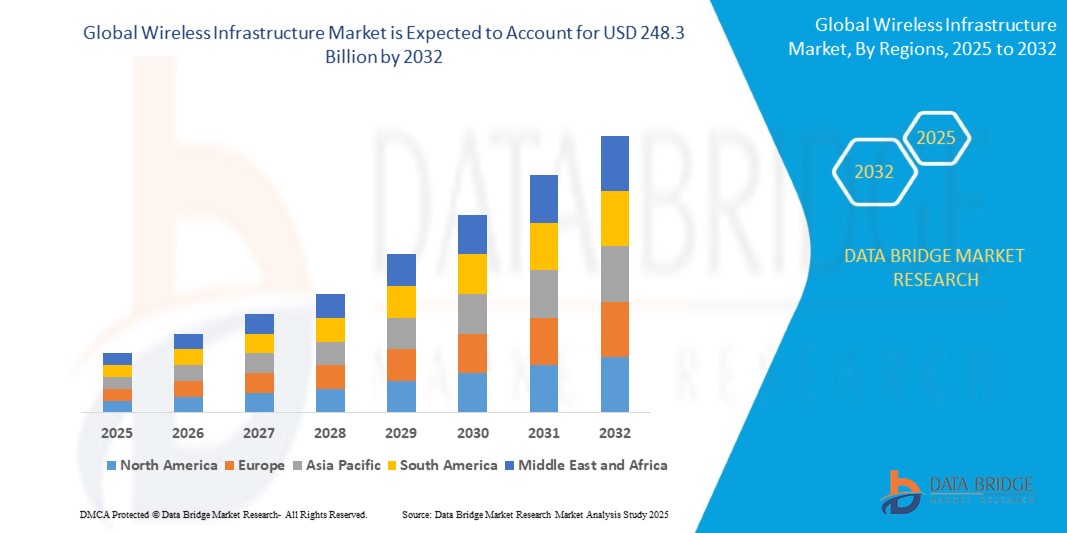

- The global wireless infrastructure market is projected to reach USD 125.6 billion by 2024 and is expected to hit USD 248.3 billion by 2032, growing at a CAGR of 10.12% during the forecast period..

- This strong growth reflects rising demand for high-speed connectivity, the rollout of 5G networks, and the growing importance of seamless communication across industries. As the digital economy expands, wireless infrastructure is becoming the backbone of everything from smart cities and connected homes to industrial automation and remote healthcare.

Global Wireless Infrastructure Market Analysis

- Wireless infrastructure is transforming how we connect with the world—both in our personal lives and across industries. With mobile data traffic surging, businesses and governments are racing to upgrade their infrastructure to deliver faster, more reliable wireless services. Whether it’s small cells enhancing urban connectivity or fiber backhaul networks supporting 5G rollout, every piece of infrastructure plays a crucial role in keeping us connected.

- What’s driving this evolution is the global push for 5G. The technology isn’t just about faster phones—it powers innovations like autonomous vehicles, smart manufacturing, and augmented reality. To support this, networks need to be denser, faster, and more resilient. This is where infrastructure like macro towers, distributed antenna systems (DAS), and edge data centers come into play.

- As a result, telecom operators, governments, and private enterprises are investing heavily in modernizing legacy infrastructure. In developed regions, the focus is on expanding capacity and preparing for 6G. In emerging markets, it's about closing connectivity gaps and supporting digital inclusion. The wireless infrastructure market is rising to meet both needs, offering a mix of scalability, reliability, and efficiency.

Report Scope and Global Wireless Infrastructure Market Segmentation

|

Attributes |

Global Wireless Infrastructure Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Industries like manufacturing, mining, and energy are adopting private 5G networks to enhance security and control.

The surge in IoT devices is increasing demand for edge data centers and low-latency wireless infrastructure.

Municipalities are deploying small cells, smart poles, and public Wi-Fi as part of smart city initiatives |

|

Value Added Data Infosets |

|

Global Wireless Infrastructure Market Trends

“The 5G Revolution Reshaping Global Connectivity”

- 5G is no longer a concept—it’s real, and it’s rapidly changing the way we live and work. One of the biggest trends in wireless infrastructure is the shift from large, centralized networks to distributed, intelligent systems that bring connectivity closer to the end user. This means more small cells, more fiber, and more software-defined tools that allow networks to self-optimize and scale on demand.

- Another big trend is the convergence of wireless and edge computing. With applications like real-time analytics, autonomous systems, and VR/AR becoming mainstream, there's a need for computing power near the user. Wireless infrastructure is evolving to support edge processing alongside connectivity, offering low latency and high bandwidth where it's needed most.

- Operators are also increasingly turning to green infrastructure. Energy-efficient base stations, renewable-powered towers, and sustainable network design are not just good for the environment—they also lower operational costs. With ESG goals front and center, many telecoms are now aligning infrastructure strategy with sustainability benchmarks.

Global Wireless Infrastructure Market Dynamics

Driver

“Skyrocketing Mobile Data Demand and 5G Expansion”

- With billions of devices coming online and more people working, learning, and streaming from everywhere, mobile data demand is exploding. Wireless infrastructure is under pressure to handle higher loads, faster speeds, and lower latency. 5G addresses these demands—but only if the right infrastructure is in place.

- The global race to roll out 5G is prompting telecoms and governments to invest in everything from tower upgrades to new fiber backhaul systems. Infrastructure sharing among operators is also gaining traction, helping reduce costs and accelerate deployments. As connected devices multiply and digital services expand, robust and resilient wireless infrastructure has become non-negotiable.

- At the same time, infrastructure sharing models—where multiple telecom operators co-use towers, rooftops, and backhaul—are gaining popularity. These shared networks help lower capital expenditure and accelerate deployment in underserved and rural regions, where building redundant infrastructure is economically unsustainable.

- Governments are also stepping in with policy incentives, 5G auctions, and public-private partnerships to support nationwide coverage. In countries like the U.S., South Korea, China, and Germany, 5G deployment is being fast-tracked as part of broader digital economy strategies.

Restraint/Challenge

“High Deployment Costs and Regulatory Hurdles”

Building wireless infrastructure is expensive—especially when it comes to 5G and rural deployments. Acquiring spectrum, installing base stations, and upgrading backhaul networks require significant upfront investments. On top of that, telecom companies often face regulatory delays, zoning restrictions, and lengthy permit processes that can stall progress.

Rural and underserved areas pose an added challenge due to lower returns on investment. While subsidies and partnerships are helping to bridge the gap, infrastructure providers still face technical, financial, and political obstacles in rolling out widespread coverage.

Global Wireless Infrastructure market Scope

|

Segmentation |

Sub-Segmentation |

|

By Component Type |

|

|

By Infrastructure Type |

|

|

By Network Tech. Type |

|

|

By Ownership |

|

- By Infrastructure Type

Macrocell: These are the traditional large cell towers covering wide areas. Still relevant in rural and suburban regions where long-range coverage is required.

Small Cell: Compact base stations used to increase network capacity and coverage in densely populated urban areas.

- By Component

Hardware dominates due to the large-scale deployment of base stations, antennas, and other physical infrastructure needed for network expansion.

Software is gaining momentum as networks become virtualized and AI-driven, enabling smarter network management and automation.

Services are critical in supporting planning, installation, and maintenance, especially as operators transition to 5G and private network deployments.

- By Network Technology

4G LTE continues to hold a significant share globally, serving as the backbone in many developing markets.

5G is the fastest-growing segment, fueled by increasing demand for low-latency, high-capacity networks across industries.

Wi-Fi 6/6E is rising in enterprise and campus environments due to faster speeds and better device handling.

2G/3G is gradually being phased out, although still operational in some developing regions.

Future Technologies (6G, LEO Satellites) are in early development stages, with strong long-term potential for ultra-high-speed connectivity.

- By Ownership Type

Mobile Network Operators (MNOs) lead in infrastructure ownership, especially for core networks and nationwide 5G rollouts.

Tower Companies are expanding their footprint by leasing passive infrastructure to multiple operators, reducing CapEx burdens.

Private Network Providers are emerging in verticals like manufacturing, energy, and logistics, offering tailored wireless solutions.

Government Agencies play a key role in spectrum allocation and rural broadband initiatives, particularly in developing regions

- By End User

Telecom remains the largest end user, as operators expand coverage and enhance network capacity to support 5G.

Enterprises such as manufacturing, healthcare, and retail are adopting private 5G and Wi-Fi 6 for secure, low-latency operations.

Government & Public Safety rely on robust wireless infrastructure for surveillance, emergency response, and smart city initiatives.

Transportation & Logistics utilize wireless systems for real-time tracking, fleet management, and connected infrastructure.

Residential usage is growing with smart homes, IoT devices, and broadband services driving demand for high-speed connectivity.

Global Wireless Infrastructure Market – Regional Development Analysis

- North America

North America leads in 5G infrastructure investments, thanks to aggressive spectrum auctions, deep-pocketed telecom players, and strong policy backing. The U.S. is particularly focused on densifying its 5G networks in urban and suburban areas, supported by small cell rollouts, fiber upgrades, and increasing adoption of Open RAN technologies. Canada and Mexico are also ramping up investments to close rural coverage gaps and prepare for advanced wireless use cases.

- Europe

Europe is taking a more measured approach, balancing innovation with regulatory harmonization across countries. Nations like Germany, France, and the U.K. are leading the way with public-private partnerships for smart city deployments and 5G corridors for autonomous mobility. Green infrastructure and spectrum efficiency are top priorities as European operators commit to climate goals while modernizing their networks.

- Asia-Pacific

Asia-Pacific is the fastest-growing market, led by China, South Korea, and Japan—each aggressively investing in 5G and beyond. China’s large-scale network deployments are unmatched, while Japan and South Korea focus on high-density coverage and advanced industrial use cases. India is also emerging as a strong player, rolling out nationwide 5G networks and exploring shared infrastructure models to speed up deployments.

- Middle East and Africa

The Middle East, especially countries like UAE and Saudi Arabia, is investing heavily in next-gen wireless infrastructure as part of national digital transformation goals. Africa is seeing progress too, with infrastructure providers partnering with governments to improve broadband access in underserved regions using fixed wireless and satellite technologies

- South America

In Latin America, Brazil and Argentina are leading the charge. Governments are auctioning 5G spectrum and investing in urban fiber networks to support modern digital services. However, economic challenges and uneven regulatory environments still pose hurdles to broader infrastructure development across the region

Global Wireless Infrastructure Market Insight

The global wireless infrastructure market is competitive, with a mix of long-established telecom players and specialized infrastructure providers.

Companies like Huawei Technologies, Ericsson, and Nokia dominate the global market with end-to-end wireless network solutions. These vendors offer everything from radio units and antennas to software and cloud-native infrastructure.

American Tower, Crown Castle, and SBA Communications lead the tower ownership and leasing space, especially in the Americas.

Samsung Networks is gaining share through its innovative 5G solutions in Asia and North America. Other notable players include ZTE Corporation, Cisco Systems, CommScope, NEC Corporation, and Parallel Wireless, who are innovating in areas like Open RAN, backhaul, and network virtualization..

The following companies are recognized as major players in the Global Wireless Infrastructure market:

- Huawei Technologies Co., Ltd. (China)

- Ericsson AB (Sweden)

- Nokia Corporation (Finland)

- ZTE Corporation (China)

- Samsung Electronics Co., Ltd. (South Korea)

- American Tower Corporation (U.S.)

- Crown Castle International Corp. (U.S.)

- SBA Communications Corporation (U.S.)

- CommScope Holding Company, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- NEC Corporation (Japan)

- Parallel Wireless, Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Intel Corporation (U.S.)

Latest Developments in Global Wireless Infrastructure Market

- May 2025: Ericsson announced a new AI-powered RAN optimization suite designed to reduce energy usage across 5G networks while boosting capacity during peak hours.

- April 2025: Nokia launched its next-gen AirScale portfolio with Open RAN compatibility, targeting cost-effective and flexible 5G rollouts across Europe and Asia..

- February 2025: American Tower partnered with Microsoft Azure to deploy edge data centers on existing towers, bringing low-latency cloud services to rural areas...

- January 2025: Huawei unveiled its green 5G macro base station with integrated solar backup, aimed at supporting sustainable telecom deployments in emerging markets..

- November 2024: ZTE Corporation rolled out its 5G FWA (Fixed Wireless Access) solutions in Latin America, expanding broadband access in suburban and rural areas.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wireless Infrastructure Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wireless Infrastructure Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wireless Infrastructure Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.