Global Wiring Device Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

8.42 Billion

USD

18.85 Billion

2024

2032

USD

8.42 Billion

USD

18.85 Billion

2024

2032

| 2025 –2032 | |

| USD 8.42 Billion | |

| USD 18.85 Billion | |

|

|

|

|

Wiring Device Manufacturing Market Size

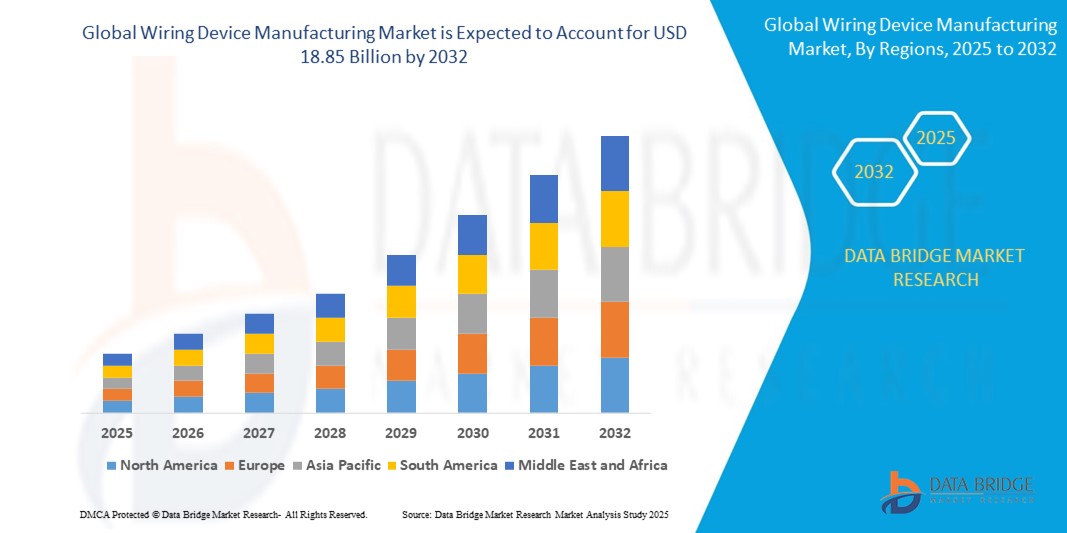

- The global wiring device manufacturing market size was valued at USD 8.42 billion in 2024 and is expected to reach USD 18.85 billion by 2032, at a CAGR of 10.6% during the forecast period

- Growth is driven by rising urbanization, infrastructure development, and demand for smart, energy-efficient wiring solutions across residential, commercial, and industrial sectors

- In addition, the rising consumer demand for secure, user-friendly, and integrated wiring solutions is propelling innovations in smart locks and access control systems, which are rapidly becoming preferred choices for modern homes and businesses. These factors are significantly boosting market expansion

Wiring Device Manufacturing Market Analysis

- Smart wiring devices, including switches, outlets, and smart locks, are becoming essential components in modern residential and commercial buildings, enhancing convenience, energy efficiency, and integration with smart home and building automation systems

- The growing demand for connected and automated wiring devices is fueled by the increasing adoption of IoT-enabled smart home technologies, rising consumer preference for energy management, and growing awareness of safety and security features

- Asia-Pacific dominates the wiring device manufacturing market with a substantial market share of approximately 42.7% in 2025, driven by rapid urbanization, large-scale smart city projects, rising disposable incomes, and increasing investments in residential and commercial infrastructure development across countries such as China, India, Japan, and South Korea

- Europe is expected to witness significant growth, capturing around 25.3% market share by 2025, supported by stringent energy efficiency regulations, growing adoption of smart home technologies, and increasing investments in modernizing residential and commercial electrical infrastructure

- The wire connectors segment is anticipated to lead the product category with a market share of approximately 43.2% in 2025, driven by its essential role in electrical wiring systems, ease of installation, and increasing demand across residential, commercial, and industrial sectors

Report Scope and Wiring Device Manufacturing Market Segmentation

|

Attributes |

Wiring Device Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wiring Device Manufacturing Market Trends

“Rising Adoption of Energy-Efficient and IoT-Enabled Wiring Devices”

- The global wiring device manufacturing market is witnessing a strong trend toward the adoption of energy-efficient and IoT-enabled wiring devices such as smart switches, sockets, and circuit breakers. These devices allow real-time energy monitoring and remote control, helping users reduce electricity consumption and costs

- For instance, products like the Legrand Smart Energy Socket provide users with detailed energy usage data via mobile apps, enabling more informed decisions to optimize energy use at home and in commercial buildings

- Integration with IoT platforms is enabling wiring devices to communicate with other smart home and building automation systems. This interoperability supports automated workflows such as turning off all connected devices when a building is unoccupied, improving energy savings and reducing carbon footprints

- Growing regulatory pressure worldwide to improve energy efficiency in buildings is accelerating the demand for smart wiring devices equipped with energy-saving features, such as load sensing and automated shutoff

- The demand for modular and easy-to-install wiring devices is increasing, driven by the rise in retrofitting older buildings with modern electrical systems that support smart technology without extensive reconstruction

- Industry leaders like ABB and Honeywell are investing in R&D to develop next-generation wiring devices with embedded sensors, IoT connectivity, and compatibility with major smart home ecosystems

- This trend of energy efficiency combined with IoT connectivity is expanding rapidly in commercial real estate, residential construction, and industrial facilities, driven by cost savings, sustainability goals, and consumer preferences for smart, connected environments.

Wiring Device Manufacturing Market Dynamics

Driver

“Growing Demand Driven by Smart Infrastructure Development and Energy Efficiency Initiatives”

- The rising investments in smart infrastructure development across residential, commercial, and industrial sectors, combined with increasing emphasis on energy efficiency and digitalization, are key drivers boosting the demand for advanced wiring devices globally

- For instance, in March 2024, Schneider Electric launched its new range of smart wiring devices featuring integrated energy monitoring and IoT connectivity, aimed at enhancing energy management and automation in modern buildings. Such innovations by leading companies are expected to propel market growth during the forecast period

- Increasing adoption of smart homes and commercial buildings equipped with connected switches, outlets, and circuit breakers is driving the demand for wiring devices that offer remote control, real-time monitoring, and seamless integration with building management systems

- Furthermore, stringent government regulations promoting energy conservation and sustainability, especially in regions like Europe and North America, are encouraging the replacement of traditional wiring devices with smart, energy-efficient alternatives

- The convenience offered by smart wiring devices, including automation capabilities, remote access via smartphone apps, and compatibility with voice assistants like Alexa and Google Assistant, is further accelerating their adoption in both new constructions and retrofit projects

- In addition, the growing trend toward IoT-enabled smart buildings, where electrical infrastructure is interconnected with HVAC, lighting, and security systems, is increasing the complexity and demand for advanced wiring devices that support centralized and automated control

Restraint/Challenge

“Concerns Over Cybersecurity Risks and High Initial Investment Costs”

- The increasing integration of wiring devices with IoT and smart home ecosystems raises significant cybersecurity concerns. Connected wiring devices, such as smart switches and circuit breakers, can be vulnerable to hacking, unauthorized access, and data breaches, which may deter some consumers and businesses from adopting these technologies

- For example, recent reports highlighting vulnerabilities in smart electrical devices have caused hesitancy among potential buyers regarding the security and privacy of their electrical infrastructure

- Addressing these concerns requires manufacturers to implement robust cybersecurity protocols, including encrypted communication, secure firmware updates, and multi-factor authentication. Companies like Legrand and Schneider Electric actively promote their secure wiring device solutions to build consumer confidence

- In addition, the relatively high upfront cost of smart wiring devices compared to traditional electrical components remains a barrier to adoption, particularly in price-sensitive and developing markets. While basic wiring devices remain affordable, advanced smart solutions featuring connectivity, energy monitoring, and automation typically come at a premium

- Although prices for smart wiring devices are gradually decreasing due to technological advancements and economies of scale, the perceived high initial investment and uncertain return on investment can limit rapid market penetration

- Overcoming these challenges through enhanced cybersecurity measures, educating end-users about the benefits and safety of smart wiring infrastructure, and developing cost-effective product lines will be critical to sustaining market growth

Wiring Device Manufacturing Market Scope

The market is segmented on the basis of type, voltage, installation, and end use.

By Type

On the basis of type, the wiring device manufacturing market is segmented into receptacles, wire connectors, metal contacts, light dimmers, lamp holders, and electric switches. The wire connectors segment is anticipated to lead the product category with the largest market revenue share in 2025, driven by their critical role in ensuring secure and reliable electrical connections in residential, commercial, and industrial applications. Receptacles and electric switches also hold significant shares, supported by expanding construction activities and rising demand for modernization of electrical systems globally.

The metal contacts segment is expected to witness the fastest growth rate during the forecast period, fueled by innovations in conductive materials and the increasing demand for enhanced electrical performance in advanced electronic and automotive applications. Light dimmers and lamp holders are also gaining traction as smart lighting solutions become more prevalent in building and infrastructure projects.

• By Voltage

On the basis of voltage, the market is segmented into low voltage, medium voltage, and high voltage. The low voltage segment dominates with the largest revenue share in 2025, attributed to its widespread use in residential and commercial wiring devices, which account for a substantial portion of the overall market. The segment benefits from increasing adoption of energy-efficient solutions and the growing number of smart building projects worldwide.

The medium voltage segment is projected to grow steadily, driven by infrastructural upgrades and increased industrial automation, while the high voltage segment sees growth from investments in power transmission and large-scale infrastructure projects. These trends collectively support the expansion of voltage-specific wiring device demand across sectors.

• By Installation

On the basis of installation, the wiring device manufacturing market is segmented into overhead and underground. The overhead installation segment holds the largest market share in 2025, due to its cost-effectiveness, easier maintenance, and broad usage in urban and rural electrification projects. Overhead systems continue to be preferred in developing regions where quick deployment is critical.

The underground installation segment is anticipated to witness the fastest growth, propelled by increasing urbanization, safety regulations, and aesthetic considerations. Underground wiring is preferred in densely populated areas and modern smart city initiatives, as it reduces risks associated with weather and accidents, and supports reliable power distribution.

• By End Use

On the basis of end use, the market is segmented into aerospace and defense, automotive, building and construction, and others. The building and construction segment accounted for the largest market revenue share in 2025, driven by rapid urbanization, growth in commercial and residential infrastructure, and increasing investments in smart building technologies worldwide.

The automotive segment is expected to record strong growth during the forecast period, fueled by the rising demand for electric vehicles, which require specialized wiring devices to support complex electrical systems. Aerospace and defense applications contribute consistent demand due to stringent safety and performance standards, while other sectors such as industrial equipment and consumer electronics provide additional growth opportunities.

Wiring Device Manufacturing Market Regional Analysis

- Asia-Pacific dominates the wiring device manufacturing market with the largest revenue share of 42.7% in 2024, driven by rapid urbanization, large-scale infrastructure projects, and rising investments in residential and commercial construction across countries such as China, India, Japan, and South Korea

- The region’s growth is supported by increasing disposable incomes, government initiatives promoting smart city developments, and the expanding adoption of energy-efficient wiring devices in both new constructions and retrofit projects, making Asia-Pacific the leading market globally

Japan Wiring Device Manufacturing Market Insight

The Japan wiring device manufacturing market is witnessing steady growth driven by the country’s advanced industrial base, rapid urban infrastructure modernization, and emphasis on energy-efficient building solutions. Japan’s aging population also creates demand for user-friendly and safe wiring devices tailored to smart homes and commercial buildings. Integration of wiring devices with smart building management systems further accelerates market adoption, supported by strong government focus on sustainable construction and digital innovation

China Wiring Device Manufacturing Market Insight

The China wiring device manufacturing market holds the largest share in Asia-Pacific due to massive infrastructure development, urbanization, and booming construction activities. Rising investments in smart city projects and industrial automation fuel demand for advanced wiring devices. Additionally, China’s role as a global manufacturing hub ensures widespread availability and competitive pricing, promoting the adoption of innovative wiring solutions across residential, commercial, and industrial sectors

Europe Wiring Device Manufacturing Market Insight

The European wiring device manufacturing market is expanding steadily, propelled by stringent energy efficiency regulations and a growing emphasis on smart buildings. Countries like Germany, France, and Italy lead in adopting eco-friendly wiring devices integrated with intelligent building systems. The market benefits from increasing retrofit projects in older infrastructures and rising awareness about safety and digital connectivity, especially in commercial and institutional applications

U.K. Wiring Device Manufacturing Market Insight

The U.K. wiring device manufacturing market is set for moderate growth supported by government initiatives on smart home technologies and building automation. Demand is rising for wiring devices that enable enhanced safety, energy management, and seamless integration with IoT ecosystems. The retail and construction sectors are driving adoption, alongside growing consumer preference for modern electrical fittings in residential renovations and new developments

Germany Wiring Device Manufacturing Market Insight

Germany’s wiring device manufacturing market is growing, bolstered by a strong industrial sector and the country’s focus on sustainability and innovation. The shift towards energy-efficient and digitally connected buildings increases demand for smart wiring components. High standards for product quality and safety, along with incentives for green building certifications, promote adoption in residential, commercial, and industrial construction

North America Wiring Device Manufacturing Market Insight

The North America wiring device manufacturing market is driven by technological advancements, increasing construction activities, and strong demand for smart and energy-efficient wiring solutions. The U.S. leads the region, supported by growing awareness of building automation and retrofit demand. High investments in commercial infrastructure, coupled with government policies emphasizing energy conservation and safety standards, enhance market prospects

U.S. Wiring Device Manufacturing Market Insight

The U.S. wiring device manufacturing market commands a significant share in North America, propelled by extensive residential and commercial construction, adoption of smart building technologies, and rising demand for advanced wiring systems. The trend toward green buildings and smart homes, along with consumer preference for reliable and easy-to-install wiring devices, drives market growth. Integration with IoT platforms and voice-controlled systems further expands opportunities

Wiring Device Manufacturing Market Share

The wiring device manufacturing industry is primarily led by well-established companies, including:

- Panasonic Life Solutions India Pvt. Ltd. (India)

- Eaton (Ireland)

- Honeywell International Inc. (U.S.)

- ABB (Sweden)

- Hubbell (U.S.)

- Legrand North America, LLC (U.S.)

- Leviton Manufacturing Co., Inc. (U.S.)

- Orel Corporation (Sri Lanka)

- OSRAM GmbH (Germany)

- Schneider Electric (France)

- Simon Electric Pvt. Ltd. (India)

- Marinco Power Products (U.S)

- Molex (U.S.)

- KEI Industries Limited (India)

- TE Connectivity (Switzerland)

- FURUKAWA ELECTRIC CO., LTD. (Japan)

- VIMAL SWITCHES (India)

- SMK Corporation (Japan)

- Incotex Electronics Group (Russia)

- EMKA Beschlagteile GmbH & Co., KG (Germany)

Latest Developments in Global Wiring Device Manufacturing Market

- In March 2025, Legrand launched an innovative series of smart switches designed to enhance voice assistant compatibility, catering to both residential and commercial users. These advanced switches integrate seamlessly with popular smart home platforms, allowing effortless control of lighting and appliances through voice commands. With improved connectivity and automation features, they offer greater convenience, energy efficiency, and security. Whether for homes or businesses, Legrand's latest smart switches simplify daily operations while promoting intelligent living spaces

- In March 2025, Eaton Corporation introduced new sustainability initiatives aimed at implementing eco-friendly production methods and developing energy-efficient wiring devices. These efforts align with growing environmental regulations and evolving consumer preferences for sustainable solutions. Eaton has been actively working on reducing its carbon footprint and enhancing energy efficiency across its product lines

- In January 2025, ABB launched a new portfolio of energy-efficient wiring devices aimed at enhancing safety standards while significantly reducing installation time. Designed for both residential and commercial applications, these advanced devices streamline electrical installations, improving efficiency and reliability. With a strong focus on sustainability, ABB’s latest range incorporates smart technologies to optimize energy usage and compliance with modern safety regulations

- In January 2025, Schneider Electric introduced a new series of smart Wi-Fi-enabled switches, enhancing connectivity for both residential and commercial spaces. These advanced switches integrate seamlessly with smart home ecosystems, allowing users to control lighting and appliances remotely via smartphone apps or voice assistants. Designed to support the expanding smart home market, they offer improved energy efficiency, convenience, and automation

- In May 2024, ABB completed the acquisition of Siemens’ wiring accessories business in China, significantly expanding its presence in smart building systems and home automation. This strategic move allows ABB to enhance its product portfolio, including wiring accessories, smart home systems, and smart door locks, while leveraging Siemens’ established distribution network across 230 cities in China. The acquisition aligns with ABB’s commitment to delivering advanced automation and energy-efficient solutions for modern infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wiring Device Manufacturing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wiring Device Manufacturing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wiring Device Manufacturing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.