Global Womens Digital Health Market

Market Size in USD Billion

CAGR :

%

USD

3.08 Billion

USD

12.58 Billion

2024

2032

USD

3.08 Billion

USD

12.58 Billion

2024

2032

| 2025 –2032 | |

| USD 3.08 Billion | |

| USD 12.58 Billion | |

|

|

|

|

Women’s Digital Health Market Size

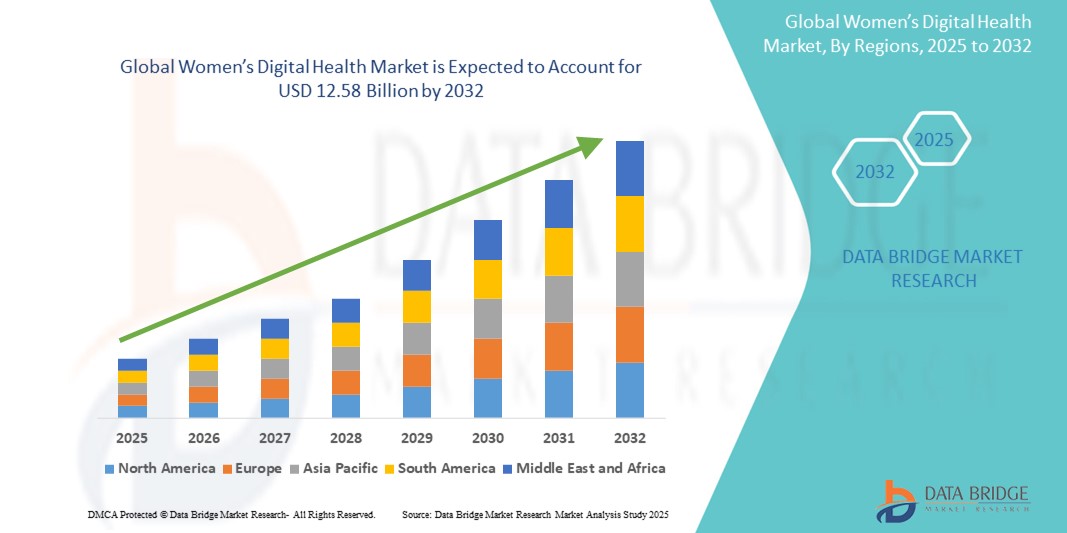

- The global women’s digital health market size was valued at USD 3.08 billion in 2024 and is expected to reach USD 12.58 billion by 2032, at a CAGR of 19.20% during the forecast period

- The market growth is largely fuelled by the growing adoption and technological advancements within digital health technologies and connected healthcare devices, leading to increased digitalization across women’s healthcare services globally

- Furthermore, rising consumer demand for personalized, accessible, and integrated healthcare solutions for women’s wellness, fertility, pregnancy, and chronic conditions is positioning digital health platforms as the preferred approach in modern women’s healthcare

Women’s Digital Health Market Analysis

- Women’s digital health solutions, encompassing technologies such as mobile health apps, wearable devices, telemedicine platforms, and reproductive health tracking tools, are becoming essential components of modern healthcare ecosystems due to their ability to offer personalized, remote, and data-driven care for women across all life stages

- The escalating demand for women’s digital health solutions is primarily fueled by the increasing prevalence of chronic and reproductive health conditions, growing awareness about women-specific health issues, and a rising preference for accessible and private digital healthcare services

- North America dominated the Women’s Digital Health market with the largest revenue share of 38.6% in 2024, attributed to early adoption of digital health technologies, high healthcare expenditure, and the presence of leading health-tech companies. The U.S. has seen substantial growth in the adoption of women’s digital health apps, telehealth consultations, and AI-driven wellness tools

- Asia-Pacific is expected to be the fastest growing region in the women’s digital health market during the forecast period, driven by increasing smartphone penetration, rising awareness of female health, urbanization, and expanding healthcare infrastructure

- The mobile app segment dominated the women’s digital health market with a revenue share of 43.2% in 2024, driven by the widespread availability of smartphones and increasing reliance on mobile health solutions for tracking menstrual cycles, fertility, mental well-being, and overall wellness. The ease of download, user engagement, and ability to provide real-time insights contribute to the growing preference for mobile apps as an entry point to women’s digital health

Report Scope and Women’s Digital Health Market Segmentation

|

Attributes |

Women’s Digital Health Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Women’s Digital Health Market Trends

“Rising Demand for Smarter, More Connected Women’s Digital Health Solutions”

- The global women’s digital health market is undergoing a transformation as smart technologies reshape how women engage with their health. A new wave of digital platforms—powered by AI, wearable integration, and seamless connectivity with voice-enabled ecosystems—is delivering unmatched convenience and personalization in care

- Digital health apps and wearables are increasingly supporting voice commands and real-time synchronization with smart devices like Amazon Alexa, Google Assistant, and Apple HealthKit. These integrations allow women to set reminders for prenatal appointments, receive medication alerts, track mental health trends, and monitor menstrual cycles—all with minimal user input, promoting effortless health engagement

- In parallel, AI is playing a critical role in personalizing experiences. Advanced algorithms now enable these platforms to analyze user patterns and predict key health events, such as ovulation windows or early signs of hormonal imbalances. This intelligent feedback loop supports timely, preventive interventions, improving outcomes and quality of life

- The integration of women’s digital health solutions with broader digital wellness ecosystems is fostering a more connected approach to care. Women can now manage reproductive health, fitness goals, nutrition, and emotional well-being through unified platforms that adapt to their individual needs over time

- As consumers demand smarter, more proactive tools for their unique health journeys, developers are focusing on intuitive, data-driven solutions. This shift is creating substantial opportunities across both mature and emerging markets, fueling competition and innovation in the Women’s Digital Health space

Women’s Digital Health Market Dynamics

Driver

“Growing Need Due to Rising Women’s Health Awareness and Digital Health Adoption”

- The increasing awareness surrounding women-specific health issues—such as fertility, menstruation, pregnancy, menopause, and chronic conditions—combined with the accelerating adoption of digital health ecosystems, is a major driver of demand for women’s digital health solutions

- For instance, in April 2024, The Cooper Companies Inc. announced the expansion of its digital reproductive health portfolio with advanced AI-powered menstrual and ovulation tracking features, marking a key strategic move to enhance women’s health access globally

- As women become more informed about preventive care and demand greater control over their health data, digital platforms offer features such as real-time symptom monitoring, personalized health insights, and remote consultations, positioning them as a powerful alternative to traditional in-clinic visits

- Furthermore, the growing popularity of smartphones, wearable tech, and telehealth services has made digital health tools an essential part of connected healthcare environments, offering seamless integration with electronic medical records, IoT-based diagnostics, and AI-driven risk prediction tools

- The convenience of on-demand healthcare access, virtual follow-ups, data privacy, and tailored health insights through apps and devices is propelling adoption across both urban and rural populations. The rise of direct-to-consumer models and increased government focus on maternal and reproductive health further contribute to market expansion

Restraint/Challenge

“Concerns Regarding Data Privacy, Clinical Validation, and High Costs”

- Concerns surrounding data privacy, regulatory compliance, and the clinical reliability of women’s digital health solutions pose key challenges to broader adoption. As these tools handle sensitive personal health data, breaches or misuse can result in major privacy violations, making some users wary

- For instance, several reports in recent years have highlighted privacy concerns over how menstrual tracking apps share user data with third-party advertisers, sparking debates around transparency and data control

- Addressing these issues through strong encryption, user consent protocols, and compliance with global regulations (such as HIPAA and GDPR) is essential for building consumer trust. Companies like Flo Health and Natural Cycles have recently revamped their privacy policies and introduced in-app data control dashboards to reassure users

- In addition, the relatively high initial costs of premium women’s digital health platforms—especially those offering AI-driven diagnostics, wearables, or fertility tech—can be a barrier in low- and middle-income markets

- Although more affordable options are entering the market, advanced solutions such as smart breast health wearables or remote fetal monitors still remain out of reach for many. This pricing disparity may hinder equitable access and limit adoption across economically diverse populations

- Overcoming these hurdles through enhanced data protection, clinical validation, insurance coverage, and development of cost-effective solutions will be critical to sustaining market momentum and ensuring inclusive access to women’s digital healthcare worldwide

Women’s Digital Health Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the women’s digital health market is segmented into mobile app, wearable device, telemedicine, medical device, and other product types. The mobile app segment dominated the largest market revenue share of 43.2% in 2024, driven by the widespread availability of smartphones and increasing reliance on mobile health solutions for tracking menstrual cycles, fertility, mental well-being, and overall wellness. The ease of download, user engagement, and ability to provide real-time insights contribute to the growing preference for mobile apps as an entry point to women’s digital health.

The wearable device segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by increasing integration of biosensors into fitness bands, smartwatches, and specialized devices for pregnancy monitoring or ovulation tracking. These wearables empower users with continuous data tracking, personalized feedback, and connectivity with healthcare providers, thereby promoting preventive care and early diagnosis.

- By Application

On the basis of application, the women’s digital health market is segmented into reproductive health, pregnancy and nursing care, menstrual tracking, breast cancer, mental health, and other applications. The reproductive health segment accounted for the largest market revenue share of 31.4% in 2024, driven by rising demand for fertility tracking apps, ovulation prediction tools, and digital contraceptive solutions. The global increase in fertility awareness and proactive family planning is further fueling growth in this segment.

The mental health segment is expected to witness the fastest CAGR of 15.8% from 2025 to 2032, driven by growing recognition of the impact of mental wellness on women’s overall health, increasing adoption of digital mental health platforms, and the integration of AI-driven tools for mood tracking, CBT-based therapy, and mindfulness coaching. Societal destigmatization of mental health and expanded teletherapy coverage are also contributing to this rapid expansion.

Women’s Digital Health Market Regional Analysis

- North America dominated the women’s digital health market with the largest revenue share of 38.6% in 2024, driven by a growing demand for personalized, accessible, and technology-driven women’s health solutions. High healthcare spending, increased smartphone penetration, and a strong presence of digital health startups and established players are fueling market growth in the region

- Consumers in North America place high value on the convenience and effectiveness offered by mobile apps, wearables, and telehealth services for managing reproductive health, pregnancy care, mental health, and chronic conditions

- This widespread adoption is further supported by high disposable incomes, a tech-savvy population, and growing awareness of the importance of preventive care, establishing women’s digital health platforms as a central part of modern healthcare delivery

U.S. Women’s Digital Health Market Insight

The U.S. women’s digital health market accounted for 82.05% of the North American market share in 2024, representing approximately 31.3% of the global market. This dominance is supported by widespread usage of mobile health apps, wearable tech, and telemedicine platforms tailored to women’s health needs. The U.S. also leads in adoption of AI-powered solutions, menstrual and fertility tracking apps, and remote maternal health services, bolstered by the growing role of digital health in everyday care routines.

Europe Women’s Digital Health Market Insight

The Europe women’s digital health market held a significant share of 27.4% of the global market in 2024, and is projected to grow at a CAGR of 17.8% during 2025–2032. The region’s growth is driven by increased investments in digital health infrastructure, regulatory support for digital therapeutics, and a strong consumer focus on women’s wellness, mental health, and reproductive care through digital platforms.

U.K. Women’s Digital Health Market Insight

The U.K. women’s digital health market contributed 23.6% to the European market in 2024, supported by its robust public health infrastructure, digital innovation initiatives like the NHS app, and a growing interest in self-managed health. Fertility apps, virtual pregnancy care, and menopause tracking tools are gaining traction among tech-savvy women across the country.

Germany Women’s Digital Health Market Insight

The Germany women’s digital health market captured 21.3% of the European market in 2024, fueled by high digital literacy, government-approved health apps (DiGA), and a strong focus on health data security. Digital solutions for chronic disease management, menstrual health, and maternal support are becoming increasingly integrated into mainstream healthcare.

Asia-Pacific Women’s Digital Health Market Insight

The Asia-Pacific women’s digital health market is projected to grow at the fastest CAGR during 2025–2032, accounting for 19.1% of the global market in 2024. The rapid growth is driven by urbanization, expanding smartphone use, and increasing government support for digital healthcare access in countries such as China, India, and Japan. The market is characterized by rising adoption of mobile-first reproductive health apps, telehealth consultations, and cost-effective wearables.

Japan Women’s Digital Health Market Insight

The Japan women’s digital health market constituted 21.8% of the Asia-Pacific market share in 2024, with growth supported by the country’s advanced technology infrastructure and aging population. Women in Japan are adopting AI-enabled menstrual and menopausal health tools, pregnancy monitoring apps, and wellness wearables that integrate with national health databases.

China Women’s Digital Health Market Insight

The China women’s digital health market accounted for the largest share in Asia-Pacific at 32.4% in 2024, and approximately 6.2% of the global market. China's rapid urban development, high mobile penetration, and government-led digital health initiatives are major drivers. In addition, local femtech startups are innovating in affordable fertility trackers, maternal health platforms, and mental wellness tools.

Women’s Digital Health Market Share

The women’s digital health industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Analogic Corporation (U.S.)

- FUJIFILM Sonosite, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Medtronic (Ireland)

- Getinge AB (Sweden)

- Neoventa Medical AB (Sweden)

- Natus Medical Incorporated (U.S.)

- OSI Systems, Inc. (U.S.)

- EDAN Instruments, Inc. (China)

- The Cooper Companies Inc. (U.S.)

- MEDGYN PRODUCTS, INC. (Canada)

- Lutech Resources Inc. (Italy)

- Advanced Instruments (U.S.)

- Shenzhen Bestman Instrument Co., Ltd. (China)

- TRISMED Co., LTD. (South Korea)

- Arjo (Sweden)

Latest Developments in Global Women’s Digital Health Market

- In March 2024, HeraMed teamed up with FemBridge to develop a scalable and comprehensive maternity care solution designed to meet the varied needs of expectant mothers and healthcare providers. This collaboration focuses on utilizing digital health technologies to improve the quality of care offered to pregnant women. By integrating innovative tools, the partnership aims to enhance communication and support throughout the maternity journey, ultimately leading to better health outcomes

- In February 2025, Medtronic announced a strategic partnership with Brainomix to enhance stroke care in Western Europe by integrating AI‑based imaging into neurovascular treatment workflows — showcasing the expansion of women's digital health into critical care areas like maternal stroke risk

- In June–July 2025, digital health and telemedicine experienced a surge of consolidation and platform growth, including an emphasis on women’s health, teletherapy, and digital mental wellness solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.