Global Wood And Laminate Flooring Market

Market Size in USD Billion

CAGR :

%

USD

59.46 Billion

USD

90.56 Billion

2024

2032

USD

59.46 Billion

USD

90.56 Billion

2024

2032

| 2025 –2032 | |

| USD 59.46 Billion | |

| USD 90.56 Billion | |

|

|

|

|

Wood and Laminate Flooring Market Size

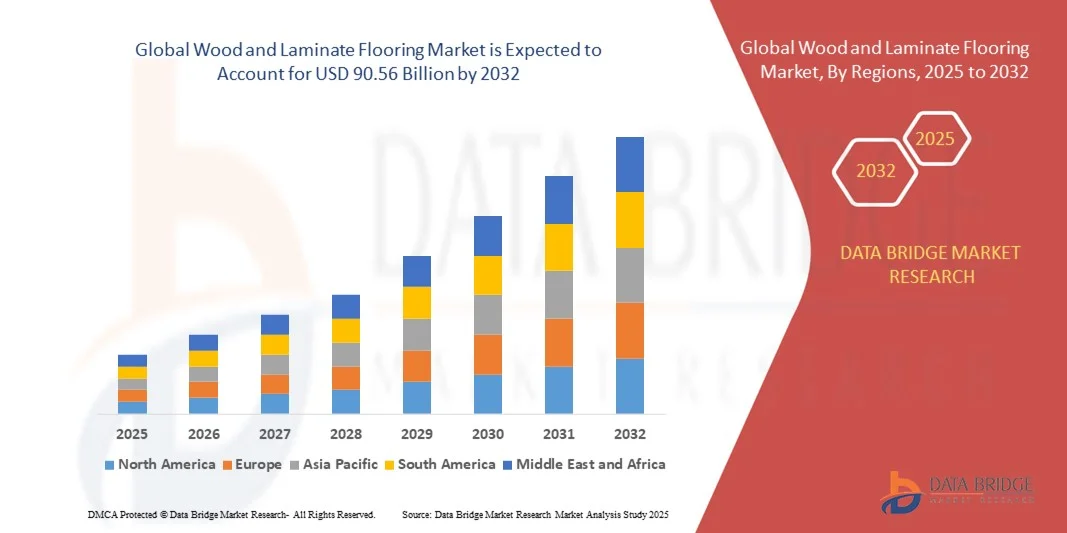

- The global wood and laminate flooring market size was valued at USD 59.46 billion in 2024 and is expected to reach USD 90.56 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fuelled by the rising demand for aesthetically appealing, durable, and eco-friendly flooring solutions across residential and commercial sectors

- The increasing preference for sustainable materials, coupled with advancements in installation technology and surface durability, is further boosting market expansion

Wood and Laminate Flooring Market Analysis

- The market is witnessing strong growth due to rapid urbanization, changing consumer lifestyles, and the growing trend of home renovation and interior enhancement. Manufacturers are focusing on developing innovative flooring options that replicate natural textures while offering superior performance at lower costs

- In addition, the expanding construction industry in emerging economies and the growing penetration of laminate flooring in commercial spaces such as offices, retail stores, and hotels are contributing to overall market growth

- North America dominated the wood and laminate flooring market with the largest revenue share of 38.24% in 2024, driven by rising residential renovation projects, the growing popularity of sustainable flooring options, and the increasing adoption of modern interior designs across commercial spaces

- Asia-Pacific region is expected to witness the highest growth rate in the global wood and laminate flooring market, driven by expanding construction activities, rising population, and increased demand for cost-effective, eco-friendly flooring solutions

- The wood flooring segment held the largest market revenue share in 2024, driven by its superior aesthetic appeal, durability, and premium finish, making it a preferred choice for high-end residential and commercial projects. Increasing consumer demand for natural materials and sustainable construction practices has further strengthened the adoption of wood flooring across global markets

Report Scope and Wood and Laminate Flooring Market Segmentation

|

Attributes |

Wood and Laminate Flooring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wood and Laminate Flooring Market Trends

Rising Popularity of Eco-Friendly and Sustainable Flooring Materials

- The growing consumer inclination toward eco-friendly building materials is driving demand for wood and laminate flooring made from sustainable sources. Manufacturers are increasingly adopting certified timber and low-emission adhesives to meet green building standards. This shift aligns with global sustainability initiatives, promoting reduced carbon footprints in residential and commercial construction and fostering the rise of green architecture across multiple regions

- The increasing adoption of recycled wood fibers and environmentally responsible laminates is also transforming the market. Consumers prefer these materials for their durability, aesthetic appeal, and minimal environmental impact, especially in urban housing projects emphasizing green interiors. Moreover, the long product lifecycle and recyclability of these materials support circular economy goals within the construction industry

- The rise of green certifications such as LEED and BREEAM has further boosted the demand for sustainable flooring. Builders and architects are increasingly incorporating eco-conscious materials to comply with environmental standards and attract environmentally aware buyers. These certifications not only enhance building value but also serve as key differentiators in the competitive real estate market

- For instance, in 2024, several European flooring manufacturers introduced collections made from reclaimed wood and biodegradable resins, significantly reducing waste and energy consumption during production. This advancement is helping companies enhance their environmental performance and brand value. Furthermore, these initiatives are supported by government incentives promoting the use of low-emission construction materials

- While sustainable flooring solutions are gaining traction, continued innovation in renewable raw materials, manufacturing efficiency, and recycling technologies will be essential to meet evolving consumer expectations and regulatory requirements. The collaboration between industry stakeholders and sustainability organizations will be vital to scale eco-friendly solutions globally and maintain profitability

Wood and Laminate Flooring Market Dynamics

Driver

Increasing Residential and Commercial Construction Activities Worldwide

- The expansion of residential and commercial construction projects across both developed and emerging economies is a major driver of market growth. Wood and laminate flooring are preferred for their aesthetic appeal, comfort, and long lifespan, making them an integral part of modern interior designs. The growing focus on high-quality, visually appealing interiors is increasing the adoption of these flooring materials in both new builds and refurbishments

- Rapid urbanization, rising disposable incomes, and evolving lifestyle preferences are leading to increased home renovations and remodeling projects, further propelling flooring demand. The affordability and design versatility of laminate flooring make it especially popular among middle-income households. In addition, the availability of a wide variety of finishes and textures provides consumers with cost-effective alternatives to natural hardwood flooring

- The commercial sector, including offices, retail spaces, and hospitality, is increasingly adopting engineered wood and laminate flooring due to its resilience, easy maintenance, and premium finish. This trend is supported by the growing preference for visually appealing and durable interior solutions. Commercial developers are also investing in acoustic insulation and moisture-resistant flooring technologies to enhance occupant comfort and building efficiency

- For instance, in 2023, the U.S. and China witnessed significant growth in new residential housing developments and renovation activities, boosting the demand for sustainable and cost-effective flooring materials such as laminate and engineered wood. This surge in demand was complemented by rising investments in smart cities and infrastructure modernization programs worldwide

- While construction activity continues to drive demand, market players must ensure the availability of durable, moisture-resistant, and easy-to-install flooring options to cater to diverse application needs across regions. Strengthening distribution networks and local production capabilities will be crucial to meeting growing global demand efficiently and sustainably

Restraint/Challenge

Fluctuating Raw Material Prices and Environmental Regulations

- The volatility in raw material costs, particularly wood, resins, and adhesives, poses a major challenge for manufacturers. Price fluctuations impact production costs and profit margins, especially in markets dependent on imported timber or synthetic resins. Frequent price changes force producers to revise pricing strategies and sourcing agreements, affecting long-term profitability and market stability

- Stringent environmental regulations concerning deforestation and formaldehyde emissions are also affecting the industry. Manufacturers are under increasing pressure to adopt sustainable sourcing practices and eco-friendly production processes, which can increase operational costs. Compliance with emission standards and sustainable forestry certifications requires ongoing investment in cleaner technologies and supply chain transparency

- The limited availability of high-quality wood due to global deforestation concerns and supply chain disruptions further challenges market stability. These constraints often push manufacturers to explore alternative or engineered wood solutions to maintain cost efficiency. However, the demand-supply imbalance has resulted in extended lead times and inconsistent raw material quality in certain regions

- For instance, in 2024, several European and North American flooring companies reported higher production expenses due to increased wood prices and compliance costs associated with environmental standards. This prompted a shift toward engineered and composite materials as viable alternatives. Such transitions have helped companies maintain sustainability commitments while mitigating the financial impact of volatile raw material markets

- While regulatory and cost pressures persist, innovation in sustainable manufacturing practices, enhanced material recycling, and strategic sourcing partnerships will be critical for ensuring long-term market growth and competitiveness. Companies focusing on local material procurement, digital supply chain optimization, and eco-certifications are likely to strengthen their position in the evolving global market

Wood and Laminate Flooring Market Scope

The market is segmented on the basis of product, application, and type.

- By Product

On the basis of product, the wood and laminate flooring market is segmented into wood flooring and laminate flooring. The wood flooring segment held the largest market revenue share in 2024, driven by its superior aesthetic appeal, durability, and premium finish, making it a preferred choice for high-end residential and commercial projects. Increasing consumer demand for natural materials and sustainable construction practices has further strengthened the adoption of wood flooring across global markets.

The laminate flooring segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness, easy installation, and wide range of design options that replicate natural wood textures. Laminate flooring also offers high resistance to wear and moisture, making it suitable for heavy-traffic areas such as retail stores and office spaces, especially in developing economies where affordability and performance are key considerations.

- By Application

On the basis of application, the market is segmented into residential, commercial, and industrial. The residential segment dominated the market in 2024, owing to the rising number of housing developments, home renovation projects, and growing consumer interest in aesthetic and durable flooring solutions. The trend toward personalized interior design and eco-friendly materials has further increased the adoption of wood and laminate flooring in households globally.

The commercial segment is expected to exhibit the highest growth rate from 2025 to 2032, fuelled by expanding construction in the hospitality, retail, and office sectors. Demand for long-lasting, low-maintenance, and visually appealing flooring solutions is driving adoption, with developers favoring materials that enhance space aesthetics and acoustic performance.

- By Type

On the basis of type, the market is segmented into deck flooring, solid wood flooring, and engineered flooring. The solid wood flooring segment accounted for the largest revenue share in 2024 due to its timeless appeal, high durability, and strong demand in luxury interior projects. Consumers continue to value solid wood for its natural grain and ability to increase property value, particularly in premium residential and commercial spaces.

The engineered flooring segment is expected to exhibit the highest growth rate from 2025 to 2032, driven by its enhanced stability, moisture resistance, and cost-efficiency compared to traditional solid wood. Its multilayered structure makes it suitable for diverse climatic conditions and installation over various subfloors, boosting its use in both new construction and renovation projects worldwide.

Wood and Laminate Flooring Market Regional Analysis

- North America dominated the wood and laminate flooring market with the largest revenue share of 38.24% in 2024, driven by rising residential renovation projects, the growing popularity of sustainable flooring options, and the increasing adoption of modern interior designs across commercial spaces

- Consumers in the region are highly inclined toward premium, eco-friendly flooring materials that offer a balance of durability, design versatility, and cost efficiency

- The strong presence of leading flooring manufacturers, advanced construction technologies, and a surge in home remodeling activities have further strengthened the regional market, positioning North America as a key hub for wood and laminate flooring adoption

U.S. Wood and Laminate Flooring Market Insight

The U.S. wood and laminate flooring market captured the largest revenue share in 2024 within North America, driven by expanding residential construction, urban redevelopment projects, and consumer demand for stylish yet affordable flooring solutions. Rising disposable incomes and the growing influence of sustainable building practices have accelerated the use of engineered wood and laminate products. Furthermore, the increasing integration of recyclable materials and advanced manufacturing techniques is supporting the market’s long-term growth and sustainability goals.

Europe Wood and Laminate Flooring Market Insight

The Europe wood and laminate flooring market is expected to witness substantial growth from 2025 to 2032, driven by the region’s emphasis on sustainable construction and energy-efficient housing. Stringent environmental regulations and the adoption of eco-certified wood materials are shaping market dynamics. European consumers increasingly prefer flooring products that combine modern aesthetics with low environmental impact, encouraging manufacturers to innovate with recyclable and low-emission materials. The market also benefits from a surge in renovation projects across residential and commercial sectors.

U.K. Wood and Laminate Flooring Market Insight

The U.K. wood and laminate flooring market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing home renovation activities, a growing preference for natural textures, and the adoption of green building standards. The shift toward sustainable interiors and minimalistic designs has driven demand for high-quality engineered wood and laminate flooring. Moreover, the post-pandemic rise in remote working and increased investment in home improvement have contributed to steady market expansion across residential properties.

Germany Wood and Laminate Flooring Market Insight

The Germany wood and laminate flooring market is expected to witness significant growth from 2025 to 2032, supported by advanced construction practices, eco-friendly design trends, and the strong presence of leading flooring manufacturers. Germany’s commitment to sustainability and innovation is driving the adoption of recyclable and certified timber materials. The growing use of wood and laminate flooring in energy-efficient buildings and modern office spaces further enhances market performance, with an emphasis on long-lasting, low-maintenance flooring systems.

Asia-Pacific Wood and Laminate Flooring Market Insight

The Asia-Pacific wood and laminate flooring market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, industrial development, and expanding residential construction activities in countries such as China, Japan, and India. Rising disposable incomes and the growing influence of Western-style interiors have boosted demand for aesthetic and durable flooring solutions. In addition, government initiatives promoting green infrastructure and sustainable housing are stimulating the adoption of eco-friendly flooring materials across the region.

Japan Wood and Laminate Flooring Market Insight

The Japan wood and laminate flooring market is expected to witness steady growth from 2025 to 2032, attributed to the country’s focus on modern housing design, energy efficiency, and premium home aesthetics. Consumers in Japan are increasingly opting for natural and sustainable materials that align with minimalist design principles. The market is also benefiting from technological innovations in laminated wood, providing high resistance to moisture and wear, making it suitable for both residential and commercial applications.

China Wood and Laminate Flooring Market Insight

The China wood and laminate flooring market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by large-scale residential construction, rapid urbanization, and the availability of cost-effective flooring products. The expansion of real estate projects and increasing middle-class affordability have accelerated the adoption of engineered and laminate flooring. Moreover, the growing focus on smart city development and sustainable building practices is encouraging local manufacturers to enhance product quality and production capacity to meet global standards.

Wood and Laminate Flooring Market Share

The Wood and Laminate Flooring industry is primarily led by well-established companies, including:

• Mohawk Industries (U.S.)

• Shaw Industries Group, Inc. (U.S.)

• CLASSEN (Germany)

• Tarkett USA & Canada (U.S.)

• Power Dekor (China)

• AFI Licensing LLC (U.S.)

• Kastamonu Entegre (Turkey)

• Krono Original (Germany)

• Formica Group (U.K.)

• Nature-Flooring (China)

• Samling Group of Companies (Malaysia)

• Mannington Mills, Inc. (U.S.)

• EGGER Group (Austria)

• SWISS KRONO AG (Switzerland)

• ALSAPAN Siège social (France)

• Der International Flooring Co., Ltd. (China)

• KAINDL FLOORING GMBH (Austria)

• MeisterWerke Schulte GmbH (Germany)

• Hamberger Industriewerke GmbH (Germany)

• ROBINA FLOORING SDN. BHD (Malaysia)

Latest Developments in Global Wood and Laminate Flooring Market

- In September 2024, Beaulieu International Group appointed Jean-Baptiste De Ruyck as its new CEO, succeeding Pol Deturck, to steer the company toward sustainable expansion and strategic innovation. This leadership transition aims to strengthen Beaulieu’s global presence and drive long-term growth through a stronger focus on operational excellence and eco-friendly flooring solutions, positively influencing the company’s market positioning

- In May 2024, Beaulieu International Group inaugurated its Experience Center during the Flanders Flooring Days, offering visitors an immersive opportunity to explore the company’s wide range of innovative and sustainable flooring products. The initiative reinforces Beaulieu’s customer engagement strategy and highlights its commitment to design innovation, product quality, and environmental responsibility, boosting its brand visibility in the global flooring market

- In April 2024, Kährs introduced the Duramen Collection, a sustainable, three-strip engineered wood flooring line emphasizing the natural beauty of heartwood. Certified by the Nordic Swan Ecolabel, this collection showcases Kährs’ dedication to combining design excellence with environmental stewardship. The launch enhances the company’s eco-conscious product portfolio and meets the rising demand for sustainable premium flooring options

- In April 2024, Tarkett unveiled its Collective Pursuit collection, a high-performance non-PVC flooring range that rivals luxury vinyl tile in durability and aesthetics. The development highlights Tarkett’s continuous focus on sustainability and innovation by offering a low-emission, recyclable alternative for commercial and residential spaces. This move strengthens the company’s competitive edge in the eco-friendly flooring segment

- In January 2024, Shaw Floors launched its 2024 Phase I product lineup, featuring advanced soft and hard surface flooring collections tailored to diverse consumer preferences. The new introductions emphasize affordability, design versatility, and performance, enhancing Shaw’s product appeal across multiple market segments. This strategic expansion supports the company’s growth by addressing evolving design trends and sustainability demands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wood And Laminate Flooring Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wood And Laminate Flooring Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wood And Laminate Flooring Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.