Global Wood Coatings Market

Market Size in USD Billion

CAGR :

%

USD

2.61 Billion

USD

5.06 Billion

2024

2032

USD

2.61 Billion

USD

5.06 Billion

2024

2032

| 2025 –2032 | |

| USD 2.61 Billion | |

| USD 5.06 Billion | |

|

|

|

|

What is the Global Wood Coatings Market Size and Growth Rate?

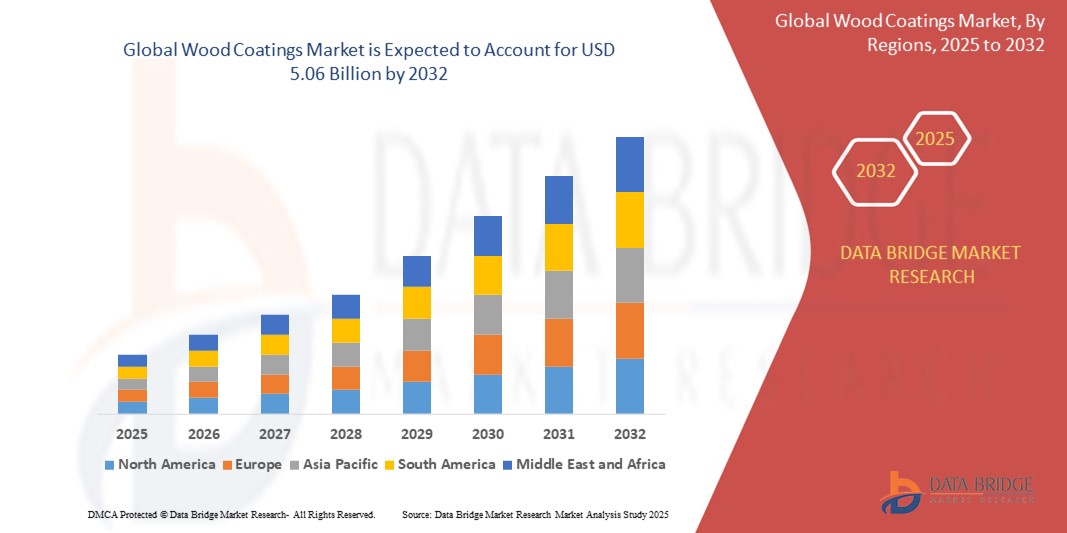

- The global wood coatings market size was valued at USD 2.61 billion in 2024 and is expected to reach USD 5.06 billion by 2032, at a CAGR of 8.60% during the forecast period

- The growing construction industry significantly boosts the demand for wood coatings across various applications such as furniture, flooring, and decking. As residential and commercial construction projects expand worldwide, there is a parallel increase in the need for high-quality wood finishes to enhance durability and aesthetics

- For instance, the surge in high-rise apartment complexes and commercial office spaces globally fuels the demand for wood coatings that offer both protection and visual appeal, driving market growth

What are the Major Takeaways of Wood Coatings Market?

- The wood coatings market is advancing through innovations such as nanotechnology and bio-based coatings. Latest methods focus on UV-curable and waterborne technologies for eco-friendly solutions. Increased demand in the construction and furniture sectors propels growth. Insights reveal a shift towards sustainable and durable coatings, driven by stringent regulations and consumer preference for high-performance, environmentally friendly products

- Asia-Pacific dominated the wood coatings market with the largest revenue share of 35.7% in 2024, driven by the expanding semiconductor industry and increasing demand for solar-grade polysilicon production in countries such as China, Japan, and South Korea

- Europe is projected to grow at the fastest CAGR of 6.3% from 2025 to 2032, driven by environmental regulations, clean energy mandates, and a rising need for domestic polysilicon production

- The Stains and Varnishes segment dominated the market with the largest market revenue share of 41.2% in 2024, driven by its wide applicability in both residential and commercial wood finishing

Report Scope and Wood Coatings Market Segmentation

|

Attributes |

Wood Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wood Coatings Market?

“Shift Towards Sustainable Formulations and UV-Curable Technologies”

- A key trend shaping the wood coatings market is the transition toward eco-friendly and UV-curable coatings driven by regulatory pressure and customer demand for low-VOC products. Waterborne and powder coatings are gaining ground as alternatives to traditional solvent-based products

- For instance, in March 2023, Akzo Nobel introduced a new waterborne wood coating line that significantly reduces emissions while maintaining durability and finish quality. Similarly, PPG Industries has invested in UV-cured coatings that cut energy consumption during application

- Manufacturers are emphasizing bio-based resins and natural additives to replace petrochemical derivatives, ensuring sustainability without sacrificing performance. Digital color-matching and smart coating systems are also being integrated into production

- The construction and furniture sectors are driving the demand for low-carbon and fast-drying coatings, especially in developed economies such as the U.S., Germany, and Japan

- Companies such as Sherwin-Williams and ICA Group are investing in innovative, water-based wood coatings to align with green building codes and interior air quality standards

- This trend is expected to lead to broader adoption of sustainable, fast-curing, and performance-optimized wood coatings across residential and commercial wood applications

What are the Key Drivers of Wood Coatings Market?

- The growing construction and furniture industries, especially in Asia-Pacific and North America, are primary drivers of the wood coatings market. Demand for decorative and protective finishes is surging due to increased urbanization and housing activities

- For instance, in August 2023, Nippon Paint Holdings reported a sharp rise in sales of wood coatings in India and Southeast Asia due to booming furniture exports and residential construction

- Rising consumer preference for aesthetic wooden finishes and customized furniture, particularly in emerging economies such as China and India, continues to drive market growth

- In addition, rising disposable income and renovation activities in developed regions such as the U.S. and Europe are supporting sustained demand for premium wood coatings

- Environmental awareness and government regulations are also pushing manufacturers toward low-VOC, non-toxic formulations, stimulating innovation in eco-friendly products

- Technological advancements such as UV-cured and waterborne coatings are enabling quicker application and drying, aligning with the need for productivity and performance in high-volume settings

Which Factor is challenging the Growth of the Wood Coatings Market?

- A key challenge for the wood coatings market is the hazardous nature of the chemical, which poses significant safety and handling risks during production, storage, and transportation. wood coatings is highly reactive with water and can release corrosive and toxic gases, requiring strict operational controls

- For instance, in July 2022, a fire incident at a chemical plant in China involving wood coatings triggered scrutiny over safety protocols and temporarily halted regional production

- These safety concerns necessitate high capital investments in safety infrastructure, personnel training, and regulatory compliance, increasing operational costs and slowing down new market entries

- Another limiting factor is the dependency on polysilicon demand, which can be cyclical and heavily influenced by government subsidy policies and global economic shifts. Any slowdown in the photovoltaic or electronics industry directly impacts wood coatings consumption

- In addition, environmental regulations regarding emissions and waste handling during Wood Coatings production are tightening globally. Producers must invest in pollution control systems, increasing capital and operational expenditures

- To overcome these hurdles, companies are adopting advanced containment systems, automation, and low-emission process designs, but the cost-intensive nature of these improvements remains a barrier, especially for smaller or regional players

How is the Wood Coatings Market Segmented?

The market is segmented on the basis of coating type, resin type, technology, end-user, and application method.

- By Coating Type

On the basis of coating type, the wood coatings market is segmented into Stains and Varnishes, Shellac, Wood Preservatives, Water Repellents, and Others. The Stains and Varnishes segment dominated the market with the largest market revenue share of 41.2% in 2024, driven by its wide applicability in both residential and commercial wood finishing. These coatings enhance the natural look of wood, provide protection against moisture, and are widely adopted in furniture and flooring applications. Growth in home improvement activities and the increasing demand for aesthetic wooden surfaces contribute to the segment’s leadership.

The Wood Preservatives segment is projected to witness the fastest CAGR of 8.7% from 2025 to 2032, attributed to the rising emphasis on long-term wood durability and protection against biological threats such as fungi and insects. Innovations in eco-friendly preservative formulations are also spurring demand.

- By Resin Type

On the basis of resin type, the wood coatings market is segmented into Acrylic, Nitrocellulose, Polyester, Polyurethane, and Other Resin Types. The Acrylic segment accounted for the largest market revenue share of 36.8% in 2024, supported by its superior color retention, UV resistance, and fast-drying properties. Acrylic-based coatings are widely used across furniture and exterior wood applications due to their low VOC emissions and environmental compliance.

The Polyurethane segment is anticipated to register the fastest CAGR of 9.1% during 2025–2032, owing to its exceptional abrasion resistance and smooth finish. Increasing demand for premium-grade finishes in interior décor and high-traffic wood surfaces is boosting the segment’s adoption.

- By Technology

On the basis of technology, the wood coatings market is classified into Waterborne, Conventional Solid Solvent Borne, High Solid Solvent Borne, Powder Coating, Radiation Cured, Solvent-borne, UV-cured, and Powder Coatings. The Waterborne technology segment led the market with the highest revenue share of 43.5% in 2024, favored for its low environmental impact and reduced VOC emissions. It is increasingly adopted across regions with stringent environmental regulations such as Europe and North America.

The UV-cured segment is expected to grow at the highest CAGR of 9.6% from 2025 to 2032, due to its rapid curing time, high-performance finish, and minimal energy usage. Its use in industrial production lines and high-speed coating applications is propelling demand.

- By Application Method

On the basis of application method, the wood coatings market is segmented into Roll Coating and Brush Coating, Vacuum Coating, Spray Coating, and Others. The Spray Coating segment dominated with a market share of 39.7% in 2024, owing to its ease of use, uniform application, and adaptability to complex surfaces. It is widely employed in furniture manufacturing and large-scale architectural woodwork.

The Vacuum Coating segment is anticipated to grow at the fastest CAGR of 9.3% between 2025 and 2032, fueled by advancements in automation and energy-efficient systems. This method provides a highly uniform coat and is gaining traction in engineered wood products.

- By End-User

On the basis of end-user, the wood coatings market is segmented into Furniture, Cabinets, Siding, Flooring and Decking, and Others. The Furniture segment held the highest market share of 44.6% in 2024, driven by increasing urbanization, evolving consumer lifestyles, and rising demand for aesthetically appealing and durable furniture.

The Flooring and Decking segment is projected to grow at the fastest CAGR of 8.8% from 2025 to 2032, due to increasing renovation activities and demand for long-lasting, decorative wooden flooring solutions in residential and commercial spaces.

Which Region Holds the Largest Share of the Wood Coatings Market?

- Asia-Pacific dominated the wood coatings market with the largest revenue share of 35.7% in 2024, driven by the expanding semiconductor industry and increasing demand for solar-grade polysilicon production in countries such as China, Japan, and South Korea

- The region benefits from robust electronics manufacturing ecosystems and government initiatives supporting renewable energy deployment, particularly in photovoltaic (PV) applications where wood coatings play a vital role

- In addition, cost-effective production capabilities, a growing industrial base, and strategic investments in polysilicon plants further reinforce Asia-Pacific’s leadership in the wood coatings market

China Wood Coatings Market Insight

Held the largest revenue share within Asia-Pacific in 2024, supported by its dominant position in global solar panel and semiconductor manufacturing. Government backing for domestic polysilicon production and ongoing solar infrastructure expansion drive market growth. Key players such as GCL-Poly and TBEA ensure supply chain stability and cost efficiency, strengthening China’s global influence.

Japan Wood Coatings Market Insight

Gaining momentum due to advancements in microelectronics and a focus on clean energy. Japanese companies are investing in ultra-high purity wood coatings for electronic-grade silicon and photovoltaic manufacturing. The market aligns with Japan’s sustainability goals and innovations in energy storage technologies.

South Korea Wood Coatings Market Insight

Poised for strong growth, backed by a robust semiconductor sector and investments in solar technology. Domestic companies are expanding production capacities to cater to both local and international markets. Government support for export-oriented industries enhances South Korea’s global supply chain position.

Which Region is the Fastest Growing in the Wood Coatings Market?

Europe is projected to grow at the fastest CAGR of 6.3% from 2025 to 2032, driven by environmental regulations, clean energy mandates, and a rising need for domestic polysilicon production. Countries such as Germany and France are boosting solar manufacturing efforts to reduce dependence on imports from Asia. The region’s push toward carbon neutrality and energy sovereignty is spurring the demand for Wood Coatings in high-purity silicon applications.

Germany Wood Coatings Market Insight

Experiencing rapid expansion due to leadership in renewable energy and demand for high-quality polysilicon in solar modules. German chemical firms are intensifying R&D efforts for eco-friendly Wood Coatings. EU-supported green programs are promoting the setup of local manufacturing hubs.

France Wood Coatings Market Insight

Witnessing significant growth through national solar energy goals and onshore manufacturing development. Public-private partnerships are driving innovation and expansion. Supported by incentives for low-carbon manufacturing, particularly in the semiconductor segment.

U.K. Wood Coatings Market Insight

Gaining traction with investments in clean energy infrastructure and efforts to strengthen advanced electronics capabilities. The U.K.’s net-zero commitment by 2050 and the rise of silicon-based technologies in R&D are pivotal growth drivers. A conducive ecosystem for innovation in next-gen materials is fueling demand for Wood Coatings.

Which are the Top Companies in Wood Coatings Market?

The wood coatings industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- Dow (U.S.)

- The Sherwin-Williams Company (U.S.)

- PPG Industries, Inc. (U.S.)

- Jotun (Norway)

- Arkema (France)

- Nippon Paint Holdings Co., Ltd. (Japan)

- RPM International Inc. (U.S.)

- Hempel A/S (Denmark)

- Berger Paints India Limited (India)

- Covestro AG (Germany)

- Huntsman International LLC (U.S.)

- Wacker Chemie AG (Germany)

- Wanhua (China)

- DIC CORPORATION (Japan)

- Allnex GMBH (Germany)

- Akzo Nobel Hilden GmbH (Germany)

What are the Recent Developments in Global Wood Coatings Market?

- In April 2023, Benjamin Moore & Co. introduced Element Guard, a new exterior paint designed for diverse substrates, including wood. This paint offers superior resistance to cracking and peeling while protecting against mildew, excessive humidity, and harsh weather conditions. It ensures long-lasting durability and aesthetic appeal, making it an ideal choice for exterior surfaces exposed to various environmental stresses

- In January 2023, Asian Paints revealed plans to establish a new manufacturing facility for waterborne paints, with an annual capacity of 4 lakh KL. This facility, which will also produce waterborne wood coatings, is set to become operational by 2026. The investment aims to bolster Asian Paints' production capabilities and meet the growing demand for environmentally friendly paint solutions

- In December 2022, The Sherwin-Williams Company announced the completion of its acquisition of ICA Group, significantly enhancing its wood division within the performance coatings group. ICA Group, with its strong presence in India and exports to the Middle East and Africa, will enable Sherwin-Williams to expand its market reach and improve its industrial wood coating product offerings in these regions, strengthening the company's global position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wood Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wood Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wood Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.