Global Wood Repair Epoxy Market

Market Size in USD Million

CAGR :

%

USD

746.19 Million

USD

1,360.82 Million

2024

2032

USD

746.19 Million

USD

1,360.82 Million

2024

2032

| 2025 –2032 | |

| USD 746.19 Million | |

| USD 1,360.82 Million | |

|

|

|

|

Wood Repair Epoxy Market Size

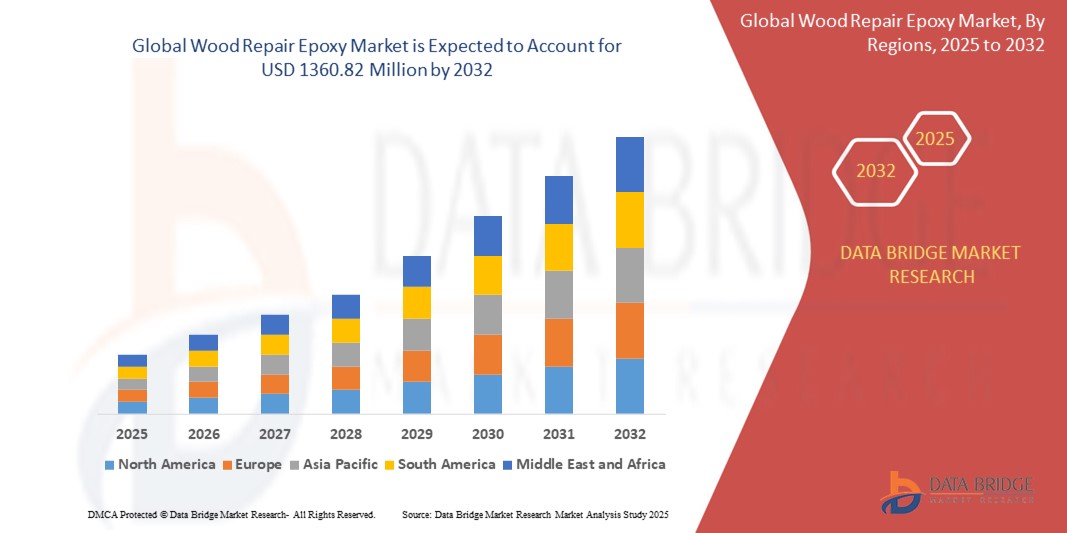

- The global wood repair epoxy market size was valued at USD 746.19 million in 2024 and is expected to reach USD 1360.82 million by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is primarily driven by the increasing demand for sustainable and durable repair solutions in residential and commercial applications, alongside advancements in epoxy formulations that enhance bonding strength and ease of application

- The rising trend of DIY home improvement projects and the growing construction industry, particularly in emerging economies, are further propelling the adoption of wood repair epoxy solutions

Wood Repair Epoxy Market Analysis

- Wood repair epoxies, known for their strong adhesive properties and versatility, are essential for restoring damaged wooden furniture and structures, offering durable and aesthetically pleasing repairs in both residential and commercial settings

- The surge in demand is fueled by increasing consumer awareness of sustainable repair solutions, the need for cost-effective alternatives to replacement, and the growing popularity of bio-based epoxy products that align with environmental concerns

- North America dominated the wood repair epoxy market with the largest revenue share of 38.5% in 2024, driven by a robust construction sector, high consumer spending on home improvement, and the presence of leading manufacturers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, increasing construction activities, and rising disposable incomes in countries such as China and India

- The two-part epoxy segment dominated the largest market revenue share of 65.0% in 2024, driven by its widespread use in both residential and commercial applications due to its superior bonding strength and versatility

Report Scope and Wood Repair Epoxy Market Segmentation

|

Attributes |

Wood Repair Epoxy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Wood Repair Epoxy Market Trends

“Increasing Adoption of Bio-Based Epoxy and Fast-Curing Solutions”

- The global wood repair epoxy market is experiencing a notable shift toward the adoption of bio-based epoxy and fast-curing formulations

- Bio-based epoxies, derived from renewable sources such as soybean oil or cardanol, are gaining traction due to their reduced environmental impact and alignment with sustainability goals

- Fast-curing epoxies are becoming increasingly popular as they significantly reduce project timelines, allowing for quicker repairs in both residential and commercial applications

- For instance, manufacturers are developing bio-based, fast-curing epoxy systems that offer enhanced adhesion and durability while meeting stringent environmental regulations

- These advancements enhance the appeal of wood repair epoxy for eco-conscious consumers, DIY enthusiasts, and professional contractors, driving market growth

- Advanced formulations also enable precise color-matching and stainable finishes, improving aesthetic outcomes for furniture and wooden structure repairs

Wood Repair Epoxy Market Dynamics

Driver

“Rising Demand for Sustainable and Cost-Effective Wood Repair Solutions”

- Increasing consumer and industry focus on sustainability is a major driver, with wood repair epoxies offering an eco-friendly alternative to replacing damaged wood, reducing waste and preserving natural resources

- The cost-effectiveness of epoxy-based repairs compared to full structural replacements is boosting demand, particularly in residential and commercial sectors for furniture and wooden structure restoration

- Regulatory support, such as incentives for green building practices in regions such as North America and Europe, is encouraging the adoption of bio-based epoxy solutions

- The proliferation of e-commerce platforms and DIY tutorials is making wood repair epoxy more accessible, further fueling demand among homeowners and small businesses

- The growing construction and renovation sectors, particularly in North America, which dominates the market, are increasing the need for durable, high-performance repair materials

Restraint/Challenge

“High Initial Costs and Environmental Compliance Issues”

- The high upfront costs of developing and integrating advanced epoxy formulations, particularly bio-based and fast-curing systems, can be a barrier, especially in cost-sensitive markets such as parts of Asia-Pacific and Latin America

- The complexity of applying two-part epoxy systems, which require precise mixing and curing, may deter less experienced users, limiting adoption in DIY applications

- Environmental compliance poses a significant challenge, as synthetic epoxies often contain volatile organic compounds (VOCs), raising concerns about emissions and regulatory restrictions in regions with strict environmental standards

- The fragmented regulatory landscape across countries, particularly regarding VOC emissions and waste disposal, complicates operations for manufacturers and service providers

- These challenges can slow market expansion in regions with high cost sensitivity or stringent environmental regulations, despite the rapid growth in Asia-Pacific, the fastest-growing region

Wood Repair Epoxy market Scope

The market is segmented on the basis of product type, application, end-user industry, curing time, and formulation type.

- By Product Type

On the basis of product type, the wood repair epoxy market is segmented into two-part epoxy and single-part epoxy. The two-part epoxy segment dominated the largest market revenue share of 65.0% in 2024, driven by its widespread use in both residential and commercial applications due to its superior bonding strength and versatility. Two-part epoxies, consisting of a resin and hardener, are favored for their ability to fill cracks, voids, and gaps, particularly in demanding applications such as furniture restoration and marine repairs.

The single-part epoxy segment is expected to witness the fastest growth rate of 8.2% from 2025 to 2032, fueled by its ease of use and convenience for DIY enthusiasts and small-scale repairs. Pre-mixed formulations eliminate the need for manual mixing, making them popular for minor residential repairs such as fixing furniture, doors, and windows. The rising trend of DIY home improvement projects is a key driver for this segment.

- By Application

On the basis of application, the wood repair epoxy market is segmented into furniture repair and wooden structure repair. The wooden structure repair segment dominated with a market revenue share of 58.0% in 2024, driven by the critical need for durable solutions in construction, infrastructure, and heritage preservation. Wood repair epoxies are extensively used to restore structural integrity in damaged wooden beams, floors, and frameworks, particularly in high-moisture or pest-prone environments.

The furniture repair segment is anticipated to experience the fastest growth from 2025 to 2032, with a CAGR of 7.5%. This growth is propelled by increasing consumer demand for restoring antique and modern furniture, driven by sustainability trends and the rising popularity of DIY restoration projects. Advancements in color-matching and stainable epoxy formulations further enhance adoption for aesthetic repairs.

- By End-User Industry

On the basis of end-user industry, the wood repair epoxy market is segmented into residential and commercial end-user industries. The residential segment held the largest market revenue share of 62.5% in 2024, attributed to the high volume of home renovation and repair activities worldwide. Homeowners and DIYers increasingly opt for wood repair epoxies to extend the lifespan of furniture, flooring, and structural elements, driven by cost-effectiveness and sustainability.

The commercial segment is expected to witness rapid growth of 8.5% from 2025 to 2032, fueled by the increasing adoption of wood repair epoxies in large-scale construction, furniture manufacturing, and restoration projects. Commercial applications benefit from epoxies’ durability and resistance to environmental factors, making them ideal for maintaining office furniture, retail environments, and heritage buildings.

- By Curing Time

On the basis of curing time, the wood repair epoxy market is segmented into fast-curing epoxy and medium-curing epoxy. The fast-curing epoxy segment accounted for the largest market revenue share of 60.0% in 2024, driven by its ability to reduce project timelines and enhance efficiency in both residential and commercial applications. Fast-curing epoxies are particularly valued in time-sensitive repairs, such as in commercial construction and marine maintenance.

The medium-curing epoxy segment is projected to grow significantly from 2025 to 2032, with a CAGR of 7.0%. This segment is favored for applications requiring a balance between curing speed and workability, such as intricate furniture repairs and structural reinforcements, where extended working time ensures precise application.

- By Formulation Type

On the basis of formulation type, the wood repair epoxy market is segmented into bio-based epoxy and synthetic epoxy. The synthetic epoxy segment dominated with a market revenue share of 70.0% in 2024, owing to its widespread availability, cost-effectiveness, and proven performance in diverse applications. Synthetic epoxies are widely used for their strong adhesion, durability, and resistance to moisture and wear.

The bio-based epoxy segment is expected to witness the fastest growth rate of 9.1% from 2025 to 2032, driven by increasing demand for eco-friendly and low-VOC formulations. Bio-based epoxies, made from plant oils or recycled waste, align with LEED and BREEAM construction standards and cater to environmentally conscious consumers and industries.

Wood Repair Epoxy Market Regional Analysis

- North America dominated the wood repair epoxy market with the largest revenue share of 38.5% in 2024, driven by a robust construction sector, high consumer spending on home improvement, and the presence of leading manufacturers

- Consumers prioritize wood repair epoxies for restoring damaged wooden structures, enhancing aesthetics, and extending the lifespan of furniture and architectural elements, particularly in regions with significant wooden infrastructure

- Growth is supported by advancements in epoxy formulations, including bio-based and fast-curing options, alongside increasing adoption in both new construction and restoration projects

U.S. Wood Repair Epoxy Market Insight

The U.S. wood repair epoxy market captured the largest revenue share of 75.8% in 2024 within North America, fueled by strong demand in the aftermarket and growing consumer awareness of the benefits of wood repair epoxies, such as moisture resistance and structural reinforcement. The trend towards DIY home improvement projects and the prevalence of wooden residential structures (approximately 94% of homes built in 2022 included wooden frames) further drive market expansion. The integration of epoxy in both OEM and aftermarket applications creates a diverse product ecosystem.

Europe Wood Repair Epoxy Market Insight

The European wood repair epoxy market is expected to witness significant growth, supported by a strong focus on sustainable construction and heritage preservation. Consumers seek epoxies that provide durable repairs while maintaining aesthetic appeal for wooden structures. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and the U.K. showing notable uptake due to rising environmental concerns and demand for eco-friendly formulations.

U.K. Wood Repair Epoxy Market Insight

The U.K. market for wood repair epoxies is expected to experience rapid growth, driven by increasing demand for furniture restoration and structural repairs in urban and heritage settings. Growing consumer awareness of the benefits of bio-based and low-VOC epoxies, coupled with the popularity of DIY projects, encourages adoption. Evolving regulations promoting sustainable repair solutions further influence consumer choices, balancing performance with environmental compliance.

Germany Wood Repair Epoxy Market Insight

Germany is expected to witness significant growth in the wood repair epoxy market, attributed to its advanced construction sector and high consumer emphasis on sustainability and durability. German consumers prefer technologically advanced epoxies, such as fast-curing and bio-based formulations, that enhance structural integrity and reduce maintenance costs. The integration of these epoxies in premium construction projects and aftermarket restoration supports sustained market growth.

Asia-Pacific Wood Repair Epoxy Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global wood repair epoxy market, driven by rapid urbanization, expanding construction activities, and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of wood repair epoxies for furniture repair and wooden structure restoration, along with government initiatives promoting sustainable construction, boosts demand. The region’s strong manufacturing base further enhances market accessibility.

Japan Wood Repair Epoxy Market Insight

Japan’s wood repair epoxy market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced epoxies that enhance structural durability and aesthetic appeal. The presence of major construction and furniture manufacturing industries, coupled with the integration of epoxies in OEM applications, accelerates market penetration. Rising interest in aftermarket restoration and preservation of traditional wooden architecture also contributes to growth.

China Wood Repair Epoxy Market Insight

China holds the largest share of the Asia-Pacific wood repair epoxy market, propelled by rapid urbanization, increasing construction activities, and growing demand for sustainable repair solutions. The country’s expanding middle class and focus on infrastructure development support the adoption of advanced epoxies for furniture and structural repairs. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, driving significant growth.

Wood Repair Epoxy Market Share

The wood repair epoxy industry is primarily led by well-established companies, including:

- 3M (U.S.)

- J-B Weld (U.S.)

- Gorilla Glue (U.S.)

- DAP Products Inc. (U.S.)

- West System (U.S.)

- Permatex (U.S.)

- Loctite (Germany)

- Sika AG (Switzerland)

- AkzoNobel (Netherlands)

- Henkel AG & Co. KGaA (Germany)

- Bostik (France)

- Devcon (U.S.)

- Abatron, Inc. (U.S.)

- Morrells Woodfinishes (U.K.)

- Polycell (U.K.)

What are the Recent Developments in Global Wood Repair Epoxy Market?

- In April 2025, Next Generation Systems launched Dura-Fix Flexible Wood Epoxy Filler, a high-performance solution engineered for long-lasting wood repair. Designed to move with the natural expansion and contraction of wood, Dura-Fix offers exceptional flexibility, a long open time, and quick, efficient application. It is ideal for both interior and exterior use, providing a durable, paintable finish that resists cracking, sagging, or shrinking. Available in a resealable dual-cartridge format, it’s especially suited for professional woodworkers tackling complex or high-traffic repairs

- In October 2023, PURE RESIN Brand Epoxy Resin Kits were recalled in Canada due to improper labeling that failed to meet the requirements of the Consumer Chemicals and Containers Regulations, 2001 under the Canada Consumer Product Safety Act. The affected products, available in multiple sizes, lacked essential safety information, posing a risk of unintentional exposure that could lead to serious illness or injury. Although no incidents were reported as of October 18, the recall highlights the critical importance of accurate labeling for consumer chemical products

- In April 2023, several New Classic Resin products—including Epoxy Resin for Art, Crafts & Table Tops, Thick Pour Epoxy Resin, and Quick Cure Epoxy Resin—were recalled in Canada due to improper labeling. The products failed to meet the requirements of the Consumer Chemicals and Containers Regulations, 2001 under the Canada Consumer Product Safety Act. The absence of appropriate safety information posed a risk of unintentional exposure, potentially leading to serious illness or injury. This recall underscores the importance of regulatory compliance in product packaging, especially for chemical-based consumer goods

- In March 2022, Aditya Birla Chemicals announced plans to double its epoxy manufacturing capacity and expand internationally, reinforcing its position as a global leader in specialty chemicals. The expansion, centered around its Vilayat plant in Gujarat, aimed to increase epoxy resin and formulation capacity to 246,000 tonnes per annum, making it one of the largest producers in India. This strategic move was driven by rising demand in sectors such as automotive, electronics, and construction, and reflects the company’s commitment to innovation, sustainability, and global competitiveness

- In February 2022, Westlake Chemical Corporation entered into a definitive agreement to acquire Hexion Inc.’s global epoxy business for approximately $1.2 billion in an all-cash transaction. The acquisition was aimed at expanding Westlake’s downstream portfolio of coatings, composites, and specialty resins, supporting the long-term development of its epoxy product line. With this move, Westlake significantly strengthened its position in high-growth, sustainability-driven markets such as wind energy and lightweight automotive components. The acquired business, now branded as Westlake Epoxy, includes global manufacturing and R&D operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wood Repair Epoxy Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wood Repair Epoxy Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wood Repair Epoxy Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.