Global Wooden Cutlery Market

Market Size in USD Million

CAGR :

%

USD

211.00 Million

USD

323.81 Million

2025

2033

USD

211.00 Million

USD

323.81 Million

2025

2033

| 2026 –2033 | |

| USD 211.00 Million | |

| USD 323.81 Million | |

|

|

|

|

What is the Global Wooden Cutlery Market Size and Growth Rate?

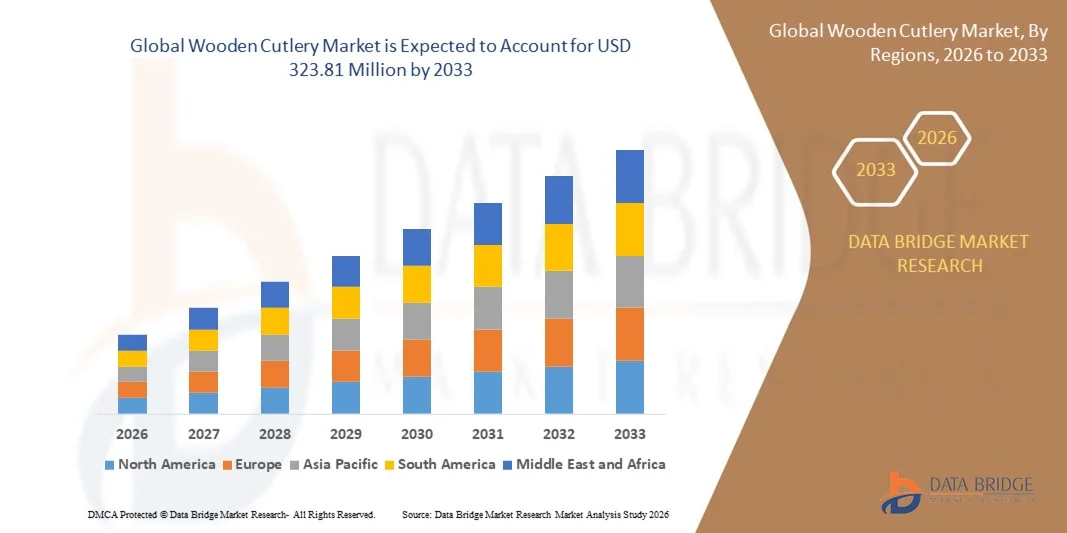

- The global wooden cutlery market size was valued at USD 211.00 million in 2025 and is expected to reach USD 323.81 million by 2033, at a CAGR of5.50% during the forecast period

- The rapid growth of food and beverage sector across the globe acts as one of the major factors driving the growth of wooden cutlery market

- The increase in inclination towards wooden cutlery owning to the rise in concerns related to environment degradation and surge in demand for these cutlery sets as they are lightweight, heat-resistant, and eco-friendly making them an ideal choice as a biodegradable cutlery accelerates the market growth

What are the Major Takeaways of Wooden Cutlery Market?

- The growing replacement of single use plastic cutlery by single use wooden cutlery from QSRs and cafes and the wide availability of the sets in wide range of design, shape and shades in accordance with their requirements and consumer preferences further influence the market

- In addition, urbanization, change in lifestyle, expansion of e-commerce sector and increase in disposable income of people positively affect the wooden cutlery market. Furthermore, product innovations and new launch extend profitable opportunities to the market players

- North America dominated the wooden cutlery market with an estimated 42.58% revenue share in 2025, driven by strict regulations on single-use plastics, high consumer awareness regarding sustainability, and strong adoption of eco-friendly foodservice products across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.14% from 2026 to 2033, driven by rapid urbanization, expanding food delivery services, rising environmental awareness, and government initiatives to curb plastic waste

- The Spoons segment dominated the market with an estimated 41.6% share in 2025, as wooden spoons are widely used across takeaway meals, desserts, beverages, and institutional catering due to their versatility, smooth finish, and ease of use

Report Scope and Wooden Cutlery Market Segmentation

|

Attributes |

Wooden Cutlery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wooden Cutlery Market?

Rising Shift Toward Sustainable, Eco-Friendly, and Single-Use Wooden Cutlery

- The wooden cutlery market is witnessing strong adoption of biodegradable, compostable, and plastic-free alternatives driven by increasing environmental awareness and global restrictions on single-use plastics

- Manufacturers are introducing lightweight, splinter-free, and ergonomically designed wooden cutlery made from sustainably sourced birch, bamboo, and beech wood to improve user experience and safety

- Growing demand for disposable, hygienic, and eco-friendly foodservice products is accelerating adoption across quick-service restaurants, catering services, airlines, events, and take-away food outlets

- For instance, companies such as Huhtamaki, Dart Container, Pactiv, and Eco-Products have expanded their sustainable cutlery portfolios to address rising demand from foodservice and hospitality sectors

- Increasing focus on sustainability certifications, recyclable packaging, and reduced carbon footprint is strengthening the shift toward wooden alternatives

- As sustainability becomes a priority across foodservice value chains, wooden cutlery is expected to play a vital role in replacing conventional plastic disposables

What are the Key Drivers of Wooden Cutlery Market?

- Rising global bans on single-use plastic cutlery across Europe, North America, and parts of Asia-Pacific are significantly boosting demand for wooden alternatives

- For instance, between 2024 and 2025, several foodservice chains and packaging suppliers increased procurement of wooden cutlery to comply with environmental regulations

- Growing consumer preference for eco-friendly, biodegradable, and compostable tableware is driving adoption in restaurants, cafes, and food delivery platforms

- Rapid growth of online food delivery, takeaway meals, and outdoor dining is increasing consumption of disposable wooden cutlery

- Advancements in manufacturing processes have improved strength, finish, and cost efficiency of wooden cutlery products

- Supported by sustainability initiatives, regulatory support, and expanding foodservice demand, the Wooden Cutlery market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Wooden Cutlery Market?

- Higher production and raw material costs compared to plastic cutlery limit adoption in price-sensitive markets

- For instance, fluctuations in wood supply, sourcing regulations, and transportation costs during 2024–2025 increased manufacturing expenses for several suppliers

- Limited durability and moisture resistance compared to plastic alternatives can affect user acceptance in certain applications

- Supply chain constraints related to sustainable forestry certifications and raw material availability pose operational challenges

- Competition from alternative eco-friendly materials such as bagasse, paper-based, and bioplastic cutlery creates pricing pressure

- To overcome these challenges, manufacturers are focusing on cost optimization, improved material treatments, scalable production, and sustainable sourcing to expand global adoption of wooden cutlery

How is the Wooden Cutlery Market Segmented?

The market is segmented on the basis of product type, sales channel, and end use.

- By Product Type

On the basis of product type, the wooden cutlery market is segmented into Knives, Forks, and Spoons. The Spoons segment dominated the market with an estimated 41.6% share in 2025, as wooden spoons are widely used across takeaway meals, desserts, beverages, and institutional catering due to their versatility, smooth finish, and ease of use. High consumption in food delivery services, airlines, and events further supports dominance. Wooden spoons are also preferred for soups, ice creams, and ready-to-eat meals, driving large-scale demand.

The Forks segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing consumption of fast food, salads, and western cuisine through QSRs and food trucks. Rising outdoor dining, sustainability mandates, and improved fork strength and design are accelerating adoption, supporting rapid segment growth.

- By Sales Channel

Based on sales channel, the market is segmented into Manufacturers (Direct Sales), Distributors, Retailers, and E-retail. The Distributors segment dominated the market with around 38.9% share in 2025, supported by strong distribution networks serving restaurants, hotels, catering companies, and institutional buyers. Distributors enable bulk procurement, consistent supply, and cost efficiency, making them the preferred channel for large-volume buyers.

The E-retail segment is projected to grow at the fastest CAGR during 2026–2033, driven by rapid expansion of online foodservice suppliers, B2B e-commerce platforms, and direct-to-consumer sustainability brands. Increasing digital procurement by small restaurants, cloud kitchens, and event organizers is boosting online sales, while wider product visibility and doorstep delivery further strengthen growth prospects.

- By End Use

On the basis of end use, the wooden cutlery market is segmented into Food Service Outlets, Institutional Use, and Online Catering. The Food Service Outlets segment held the largest share of approximately 45.3% in 2025, driven by extensive usage in restaurants, cafés, QSRs, food trucks, and takeaway services. Rising regulatory pressure to replace plastic cutlery and strong consumer preference for eco-friendly dining options continue to support dominance.

The Online Catering segment is expected to register the fastest CAGR from 2026 to 2033, fueled by rapid growth of food delivery platforms, meal subscription services, and event-based catering. Increasing demand for hygienic, disposable, and sustainable cutlery in packaged food deliveries is accelerating adoption, positioning online catering as a key future growth driver.

Which Region Holds the Largest Share of the Wooden Cutlery Market?

- North America dominated the wooden cutlery market with an estimated 42.58% revenue share in 2025, driven by strict regulations on single-use plastics, high consumer awareness regarding sustainability, and strong adoption of eco-friendly foodservice products across the U.S. and Canada. Widespread use of wooden cutlery in restaurants, quick-service chains, food delivery platforms, airlines, and institutional catering continues to support regional dominance

- Leading manufacturers in North America are investing in certified sustainable sourcing, FSC-compliant wood, and improved product durability, strengthening the region’s competitive position. Rising preference for biodegradable and compostable tableware further accelerates demand

- Strong retail penetration, well-developed foodservice infrastructure, and supportive environmental policies reinforce North America’s leadership in the global wooden cutlery market

U.S. Wooden Cutlery Market Insight

The U.S. is the largest contributor in North America, supported by nationwide bans on plastic cutlery in several states, high takeaway and food delivery consumption, and strong sustainability-driven purchasing behavior. Restaurants, QSRs, catering services, and online food platforms increasingly adopt wooden cutlery to meet regulatory compliance and brand image goals. The presence of large foodservice distributors and growing demand from corporate cafeterias and events further drive steady market growth.

Canada Wooden Cutlery Market Insight

Canada contributes significantly to regional growth due to federal restrictions on single-use plastics and rising consumer demand for eco-friendly alternatives. Foodservice outlets, educational institutions, and government facilities are increasingly switching to wooden cutlery. Growing emphasis on waste reduction, compostable food packaging, and sustainable dining solutions strengthens market adoption across the country.

Asia-Pacific Wooden Cutlery Market

Asia-Pacific is projected to register the fastest CAGR of 9.14% from 2026 to 2033, driven by rapid urbanization, expanding food delivery services, rising environmental awareness, and government initiatives to curb plastic waste. High growth in hospitality, catering, and takeaway food services across China, India, Japan, South Korea, and Southeast Asia is accelerating demand for wooden cutlery. Increasing exports and cost-competitive manufacturing further support regional expansion.

China Wooden Cutlery Market Insight

China is the largest contributor to Asia-Pacific, supported by strong manufacturing capabilities, large-scale exports, and growing domestic adoption of biodegradable tableware. Rising environmental regulations, expanding food delivery platforms, and increasing international demand for sustainable cutlery drive steady market growth.

Japan Wooden Cutlery Market Insight

Japan shows stable growth due to high standards for hygiene, quality, and sustainability in foodservice operations. Increasing use of wooden cutlery in convenience stores, ready-to-eat meals, and events supports market expansion. Strong preference for eco-friendly packaging reinforces long-term adoption.

India Wooden Cutlery Market Insight

India is emerging as a key growth market, driven by bans on single-use plastics, rapid growth of food delivery platforms, and expanding hospitality and catering sectors. Rising awareness of biodegradable alternatives and increasing local manufacturing are accelerating market penetration.

South Korea Wooden Cutlery Market Insight

South Korea contributes steadily due to strong sustainability initiatives, growing takeaway food culture, and regulatory measures targeting plastic waste reduction. Adoption across cafés, restaurants, and institutional foodservices supports consistent market growth.

Which are the Top Companies in Wooden Cutlery Market?

The wooden cutlery industry is primarily led by well-established companies, including:

- Biotrem (Poland)

- Georgia-Pacific (U.S.)

- DOpla SpA (Italy)

- Huhtamaki (Finland)

- Al Bayader International (U.A.E.)

- Pappco Greenware (India)

- Dart Container Corporation (U.S.)

- Reynolds Consumer Products (U.S.)

- Dinearth (U.S.)

- Yash Pakka Limited (India)

- Natural Tableware (India)

- Pactiv LLC (U.S.)

- PAPSTAR GmbH (Germany)

- SOLIA (France)

- Eco-Products, Inc. (U.S.)

- Cosmos Eco Friends (India)

- Visfortec (Spain)

- Xiamen Greenday Import & Export Co., Ltd (China)

What are the Recent Developments in Global Wooden Cutlery Market?

- In December 2022, Eatlery, a U.A.E.-based company, introduced innovative edible cutlery and spoons as a sustainable alternative to conventional disposable utensils. Made from cereal grains, the spoons are durable enough for wet foods such as curries, do not alter food taste, and naturally decompose within 30 days after disposal, highlighting a strong move toward zero-waste dining solutions

- In March 2022, Natur-Tec, a U.S.-based bioplastic resin manufacturer, announced the launch of a new biodegradable cutlery range made using plant-based ingredients. Designed to perform effectively with both hot and cold foods, the product line strengthens the company’s portfolio of sustainable foodservice solutions

- In November 2020, KFC began testing compostable fiber-based sporks across its restaurants in Canada. Manufactured using bamboo, corn, and sugarcane, the fork-spoon hybrid is compostable at room temperature, decomposes naturally within 18 months, and leaves no toxic residue, reinforcing KFC’s commitment to sustainable packaging

- In April 2020, Good Natured Products Inc., headquartered in Vancouver, Canada, expanded its plant-based packaging portfolio by adding 22 certified compostable and biodegradable foodservice products, including cutlery, cups, bowls, and containers. Made from sustainable materials such as sugarcane fiber waste, this expansion supported the company’s focus on environmentally responsible

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wooden Cutlery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wooden Cutlery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wooden Cutlery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.