Global Wooden Packaging Market

Market Size in USD Billion

CAGR :

%

USD

3.96 Billion

USD

6.25 Billion

2024

2032

USD

3.96 Billion

USD

6.25 Billion

2024

2032

| 2025 –2032 | |

| USD 3.96 Billion | |

| USD 6.25 Billion | |

|

|

|

|

Wooden Packaging Market Size

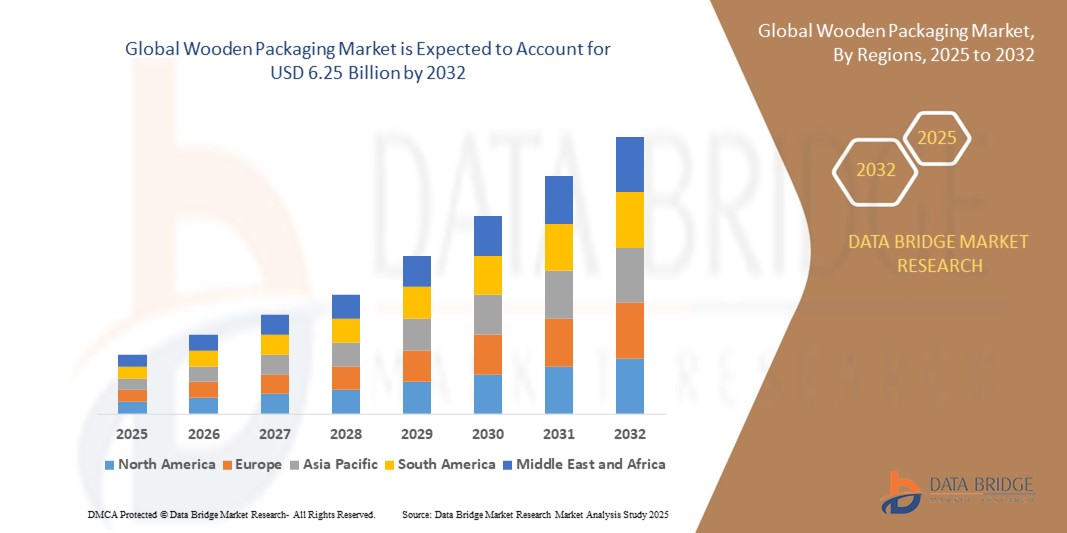

- The global wooden packaging market size was valued at USD 3.96 billion in 2024 and is expected to reach USD 6.25 billion by 2032, at a CAGR of 5.89% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and reusable packaging solutions across industries such as food and beverage, agriculture, logistics, and construction

- Rising global trade and export activities are boosting the need for durable and cost-effective packaging, driving the adoption of wooden crates, pallets, and boxes across various shipping and transportation applications

Wooden Packaging Market Analysis

- The wooden packaging market is experiencing steady growth as businesses prioritize sustainable and recyclable packaging materials that align with eco-conscious supply chain practices

- Rising demand from industries such as food and beverage, chemicals, and manufacturing is supporting consistent use of wooden pallets and crates for safe and efficient product handling

- North America dominates the wooden packaging market with the largest revenue share of 39.4% in 2024, driven by strong demand across food and beverage, logistics, and construction industries

- Asia-Pacific is expected to be the fastest growing region in the wooden packaging market during the forecast period due to rapid industrialization, growth in manufacturing and construction sectors, and rising export activities in emerging economies such as China, India, and Southeast Asia. Increased demand for sustainable and cost-effective packaging solutions further accelerates market expansion in this region

- The pallets segment dominated the largest market revenue share in 2024, primarily due to its widespread use in material handling, shipping, and storage across diverse industries. Wooden pallets are valued for their durability, cost-efficiency, and recyclability, making them a preferred choice for manufacturers and logistics providers. Their compatibility with automation systems and ease of customization also drive adoption, especially in large-scale warehousing and distribution networks

Report Scope and Wooden Packaging Market Segmentation

|

Attributes |

Wooden Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wooden Packaging Market Trends

“Rising Adoption of Eco-Friendly and Recyclable Wooden Packaging Solutions”

- The wooden packaging market is shifting toward eco-friendly and recyclable solutions as businesses respond to rising sustainability priorities

- Companies are using wooden packaging that supports circular economy principles and reduces reliance on non-biodegradable materials

- Wooden materials offer lower environmental impact and are being chosen over plastic alternatives for their reusability and biodegradability

- Regulatory pressures and consumer demand are pushing manufacturers to introduce low-chemical and certified wooden packaging

- For instance, many logistics firms are adopting heat-treated wooden pallets that comply with international phytosanitary standards to ensure safe global transport

Wooden Packaging Market Dynamics

Driver

“Increasing Demand for Sustainable and Durable Packaging Materials”

- The wooden packaging market growth is driven by rising demand for sustainable and durable packaging materials across various industries

- Increasing global trade requires protective packaging that can endure long-distance transport and different climatic conditions

- Wooden packaging is preferred in logistics, agriculture, food & beverage, and manufacturing due to its strength, recyclability, and biodegradability

- Businesses use wood-based pallets, crates, and boxes to safely handle and ship heavy or fragile goods

- For instance, the food industry uses wooden boxes for fresh produce thanks to their breathability and structural integrity

- Growing environmental concerns and regulations encourage companies to adopt wooden packaging for compliance and sustainability, supported by consumer demand for greener alternatives which fosters innovation and market expansion

Restraint/Challenge

“Raw Material Availability and Compliance Cost”

- A major challenge in the wooden packaging market is the fluctuation in raw material availability and cost due to seasonal limits, regional supply variations, and environmental regulations on deforestation

- Sourcing high-quality timber can lead to increased operational costs, supply delays, and production capacity constraints for manufacturers

- Wooden packaging requires treatments such as heat treatment or fumigation to prevent pests and meet international phytosanitary standards, adding time and expense to processing

- Small to mid-sized businesses often struggle to comply with these treatment regulations for global shipping, which can hurt their competitiveness

- For instance, exporters may face delays or higher costs when meeting phytosanitary rules

- Environmental concerns about unsustainable logging practices impact consumer perception and demand, pushing the need for responsible sourcing and sustainable forest management to ensure market growth

Wooden Packaging Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the wooden packaging market is segmented into pallets and cases and boxes. The pallets segment dominated the largest market revenue share in 2024, primarily due to its widespread use in material handling, shipping, and storage across diverse industries. Wooden pallets are valued for their durability, cost-efficiency, and recyclability, making them a preferred choice for manufacturers and logistics providers. Their compatibility with automation systems and ease of customization also drive adoption, especially in large-scale warehousing and distribution networks.

The cases and boxes segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for protective and secure packaging for high-value or fragile goods. These wooden enclosures offer enhanced safety and support during transportation and are increasingly used in export-oriented sectors. Their strong structural integrity and ability to withstand harsh handling conditions make them ideal for industrial machinery, electronics, and construction material shipping.

- By Application

On the basis of application, the wooden packaging market is segmented into food and beverages, shipping, transportation, construction industry, and others. The shipping segment accounted for the largest market revenue share in 2024, attributed to the growing global trade volumes and the need for reliable and cost-effective packaging solutions. Wooden packaging is widely used in shipping due to its ability to protect goods in long-haul logistics while maintaining sustainability.

The construction industry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased urbanization and infrastructure development projects. Wooden packaging, such as crates and pallets, is essential for transporting construction tools, equipment, and raw materials. The rise in prefabricated construction and modular buildings further contributes to demand, as wooden packaging supports efficient material handling on-site.

Wooden Packaging Market Regional Analysis

- North America dominates the wooden packaging market with the largest revenue share of 39.4% in 2024, driven by strong demand across food and beverage, logistics, and construction industries

- The region’s well-established transportation infrastructure and emphasis on durable, reusable packaging solutions further support market dominance

- Widespread use of pallets and crates in supply chains, combined with sustainability initiatives and rising export activities, reinforces the strong presence of wooden packaging across both the U.S. and Canada.

U.S. Wooden Packaging Market Insight

The U.S. wooden packaging market held the largest share within North America in 2024, fuelled by advanced logistics operations, high product turnover in retail and e-commerce, and the growing emphasis on eco-friendly packaging. The presence of leading pallet and crate manufacturers and strong regulatory frameworks promoting sustainable forestry practices further boost market growth.

Asia-Pacific Wooden Packaging Market Insight

The Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, during the forecast period, supported by rapid industrialization, urbanization, and expanding cross-border trade in countries such as China, India, and Southeast Asia. The region is increasingly leveraging wooden packaging for efficient and cost-effective storage and transport across sectors such as food, electronics, and manufacturing.

China Wooden Packaging Market Insight

The China accounted for the largest revenue share in Asia-Pacific in 2024, driven by its position as a global export leader and strong domestic demand across manufacturing, electronics, and agriculture. Government focusses on packaging standards and the abundance of timber resources continue to support widespread use of wooden pallets and crates.

Europe Wooden Packaging Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent environmental regulations, a mature logistics ecosystem, and increasing use of sustainable materials. The demand for durable, recyclable, and biodegradable packaging solutions is fueling adoption across manufacturing and export industries.

Germany Wooden Packaging Market Insight

The Germany’s wooden packaging market is bolstered by strong industrial output and demand for export-grade pallets and crates, particularly in automotive and machinery sectors. The country’s advanced logistics infrastructure and focus on environmental sustainability are key contributors to market growth.

U.K. Wooden Packaging Market Insight

The U.K. wooden packaging market is expected to witness the fastest growth rate from 2025 to 2032, supported by high-volume retail and food exports. Increased adoption of eco-conscious packaging alternatives and the expansion of trade relationships post-Brexit are expected to sustain demand for wooden crates, boxes, and pallets.

Wooden Packaging Market Share

The Wooden Packaging industry is primarily led by well-established companies, including:

- Boise Cascade (U.S.)

- Celulosa Arauco Y Constitucion (Chile)

- Huber Wooden packagings LLC (U.S.)

- Kahrs (Sweden)

- Louisiana-Pacific Corporation (U.S.)

- West Fraser(Canada)

- Patrick (U.S.)

- Futamura (Japan)

- Celanese Corporation (U.S.)

- Hubei Golden Ring New Materials (China)

- Rotofil Srl (Italy)

- weifang henglian international trading co. ltd (China)

- nfocom Network Private Limited (China)

- Eastman Chemical Company (U.S.)

- Sappi (South Africa)

- Tembec Inc. (Canada)

- UFP Industries, Inc., (U.S.)

- Mondi (U.K.)

- Shur-way Group Inc. (Canada)

- ACKXPERT INDIA PVT LTD. (India)

- Brambles Ltd, (Australia)

- C&K Box Company (U.S.)

- RRINGTON LUMBER & PALLET CO. (U.S.)

Latest Developments in Global Wooden Packaging Market

- In 2023, Nefab AB expanded its market presence by acquiring Green Pack Industries, a leading producer of wooden packaging solutions. This strategic acquisition strengthens Nefab’s product portfolio and enhances its capacity to offer sustainable and innovative packaging options. By integrating Green Pack’s expertise, Nefab aims to meet growing customer demand for eco-friendly packaging, improving supply chain efficiency and reinforcing its position in the global wooden packaging market. The move is expected to drive innovation and provide customers with more diverse, high-quality wooden packaging solutions

- In 2023, Edwards Wood Products, Inc. launched a new line of eco-friendly wooden pallets designed to support sustainable logistics and transportation needs. These pallets offer durability and recyclability while reducing environmental impact, appealing to companies focused on green supply chain practices. The introduction of this product range helps Edwards Wood Products address the rising demand for sustainable packaging materials, enhancing its competitive edge and promoting wider adoption of eco-conscious packaging in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL WOODEN PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL WOODEN PACKAGING MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TOP TO BOTTOM ANALYSIS

2.1 STANDARDS OF MEASUREMENT

2.11 VENDOR SHARE ANALYSIS

2.12 IMPORT DATA

2.13 EXPORT DATA

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL WOODEN PACKAGING MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 PRODUCTION CAPACITY OF KEY MANUFACTURERES-

11 GLOBAL WOODEN PACKAGING MARKET , BY MATERIAL, 2018-2032, (USD MILLION), (KILO TONS)

11.1 OVERVIEW

11.2 HARDWOOD

11.2.1 MAHOGANY

11.2.2 MAPLE

11.2.3 POPLAR

11.2.4 OAK

11.2.5 TEAK

11.2.6 CHERRY

11.2.7 LARCH

11.2.8 1BIRCH

11.2.9 OTHERS

11.3 SOFTWOOD

11.3.1 PINE

11.3.2 DOUGLAS FIR

11.3.3 SPRUCE

11.3.4 YEW

11.3.5 PINES

11.3.6 OTHERS

12 GLOBAL WOODEN PACKAGING MARKET , BY PRODUCT TYPE, 2018-2032, (USD MILLION)

12.1 OVERVIEW

12.2 WOODEN PALLETS

12.2.1 HARDWOOD

12.2.2 SOFTWOOD

12.3 WOODEN CONTAINERS

12.3.1 HARDWOOD

12.3.2 SOFTWOOD

12.4 WOODEN CASES & BOXES

12.4.1 HARDWOOD

12.4.2 SOFTWOOD

12.5 WOODEN CRATES & CASES

12.5.1 HARDWOOD

12.5.2 SOFTWOOD

12.6 WOODEN SPOOLS

12.6.1 HARDWOOD

12.6.2 SOFTWOOD

12.7 WOODEN DUNNAGE

12.7.1 HARDWOOD

12.7.2 SOFTWOOD

12.8 OTHERS

13 GLOBAL WOODEN PACKAGING MARKET , BY GRADE, 2018-2032, (USD MILLION)

13.1 OVERVIEW

13.2 BOILING WATERPROOF OR BWP GRADE

13.3 BOILING WATER-RESISTANT OR BWR GRADE

13.4 MOISTURE RESISTANT OR MR GRADE

14 GLOBAL WOODEN PACKAGING MARKET , BY MACHINE TYPE, 2018-2032, (USD MILLION)

14.1 OVERVIEW

14.2 AUTOMATIC

14.3 MANUAL

15 GLOBAL WOODEN PACKAGING MARKET , BY APPLICATION, 2018-2032, (USD MILLION)

15.1 OVERVIEW

15.2 FOOD & BEVERAGES

15.2.1 HARDWOOD

15.2.2 SOFTWOOD

15.3 SHIPPING

15.3.1 HARDWOOD

15.3.2 SOFTWOOD

15.4 TRANSPORTATION

15.4.1 HARDWOOD

15.4.2 SOFTWOOD

15.5 TELECOMMUNICATIONS

15.5.1 HARDWOOD

15.5.2 SOFTWOOD

15.6 AUTOMOTIVE

15.6.1 HARDWOOD

15.6.2 SOFTWOOD

15.7 CHEMICAL & PHARMACEUTICAL

15.7.1 HARDWOOD

15.7.2 SOFTWOOD

15.8 BUILDING & CONSTRUCTION

15.8.1 HARDWOOD

15.8.2 SOFTWOOD

15.9 OTHERS

16 GLOBAL WOODEN PACKAGING MARKET , BY DISTRIBUTION CHANNEL, 2018-2032, (USD MILLION)

16.1 OVERVIEW

16.2 INDIRECT SALES

16.3 DIRECT SALES

17 GLOBAL WOODEN PACKAGING MARKET, BY GEOGRAPHY , 2018-2032, (USD MILLION)

17.1 GLOBAL WOODEN PACKAGING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.2 OVERVIEW

17.3 NORTH AMERICA

17.3.1 U.S.

17.3.2 CANADA

17.3.3 MEXICO

17.4 EUROPE

17.4.1 GERMANY

17.4.2 U.K.

17.4.3 ITALY

17.4.4 FRANCE

17.4.5 SPAIN

17.4.6 SWITZERLAND

17.4.7 RUSSIA

17.4.8 TURKEY

17.4.9 BELGIUM

17.4.10 NETHERLANDS

17.4.11 REST OF EUROPE

17.5 ASIA-PACIFIC

17.5.1 JAPAN

17.5.2 CHINA

17.5.3 SOUTH KOREA

17.5.4 INDIA

17.5.5 SINGAPORE

17.5.6 THAILAND

17.5.7 INDONESIA

17.5.8 MALAYSIA

17.5.9 PHILIPPINES

17.5.10 AUSTRALIA AND NEW ZEALAND

17.5.11 HONG KONG

17.5.12 TAIWAN

17.5.13 REST OF ASIA-PACIFIC

17.6 SOUTH AMERICA

17.6.1 BRAZIL

17.6.2 ARGENTINA

17.6.3 REST OF SOUTH AMERICA

17.7 MIDDLE EAST AND AFRICA

17.7.1 SOUTH AFRICA

17.7.2 EGYPT

17.7.3 SAUDI ARABIA

17.7.4 UNITED ARAB EMIRATES

17.7.5 ISRAEL

17.7.6 REST OF MIDDLE EAST AND AMERICA

18 GLOBAL WOODEN PACKAGING MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 SWOT ANALYSIS

20 GLOBAL WOODEN PACKAGING MARKET , COMPANY PROFILES

(NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST)

20.1 UFP INDUSTRIES, INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT UPDATES

20.2 SHUR-WAY GROUP INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT UPDATES

20.3 PALCON LLC

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT UPDATES

20.4 COX CO.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT UPDATES

20.5 SURESH TIMBER CO.

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT UPDATES20.6

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT UPDATES

20.7 ROWLINSON PACKAGING LTD

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT UPDATES

20.8 C&K BOX COMPANY, INC

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT UPDATES

20.9 INTERAGRA S.C.

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT UPDATES20.10

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT UPDATES20.11

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT UPDATES

20.12 NEFAB GROUP

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT UPDATES

20.13 HEMANT WOODEN PACKAGING

20.13.1 COMPANY SNAPSHOT

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT UPDATES

20.14 SPRUCE PAX PRIVATE LIMITED

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT UPDATES

20.15 PACKXPERT INDIA PVT LTD

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT UPDATES

20.16 DNA PACKAGING SYSTEMS.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT UPDATES20.17

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT UPDATES

20.18 TIMBERLINE, LLC.

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT UPDATES

20.19 HATZEL WOOD PRODUCTS.

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT UPDATES

20.2 SIL GROUP - INDUSTRIAL PACKAGING

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT UPDATES

20.21 CAISSERIE CHANUSSOT COMPANY

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT UPDATES

20.22 DREW-BOX

20.22.1 COMPANY SNAPSHOT

20.22.2 REVENUE ANALYSIS

20.22.3 PRODUCT PORTFOLIO

20.22.4 RECENT UPDATES

20.23 GLOBAL WOOOD PACKERS

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT UPDATES

20.24 ELITE INDUSTRIES.

20.24.1 COMPANY SNAPSHOT

20.24.2 REVENUE ANALYSIS

20.24.3 PRODUCT PORTFOLIO

20.24.4 RECENT UPDATES

20.25 BENTLEY WORLD PACKAGING

20.25.1 COMPANY SNAPSHOT

20.25.2 REVENUE ANALYSIS

20.25.3 PRODUCT PORTFOLIO

20.25.4 RECENT UPDATES

20.26 E.W. HANNAS INC.,

20.26.1 COMPANY SNAPSHOT

20.26.2 REVENUE ANALYSIS

20.26.3 PRODUCT PORTFOLIO

20.26.4 RECENT UPDATES

20.27 BASIC CRATING & PACKAGING.

20.27.1 COMPANY SNAPSHOT

20.27.2 REVENUE ANALYSIS

20.27.3 PRODUCT PORTFOLIO

20.27.4 RECENT UPDATES

20.28 FOREST CITY COMPANIES,

20.28.1 COMPANY SNAPSHOT

20.28.2 REVENUE ANALYSIS

20.28.3 PRODUCT PORTFOLIO

20.28.4 RECENT UPDATES

20.29 ACTIONPAK

20.29.1 COMPANY SNAPSHOT

20.29.2 REVENUE ANALYSIS

20.29.3 PRODUCT PORTFOLIO

20.29.4 RECENT UPDATES

20.3 EXPORT CORPORATION

20.30.1 COMPANY SNAPSHOT

20.30.2 REVENUE ANALYSIS

20.30.3 PRODUCT PORTFOLIO

20.30.4 RECENT UPDATES

Global Wooden Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wooden Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wooden Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.