Global Workover Rigs Market

Market Size in USD Billion

CAGR :

%

USD

597.65 Billion

USD

917.21 Billion

2024

2032

USD

597.65 Billion

USD

917.21 Billion

2024

2032

| 2025 –2032 | |

| USD 597.65 Billion | |

| USD 917.21 Billion | |

|

|

|

|

Workover Rigs Market Size

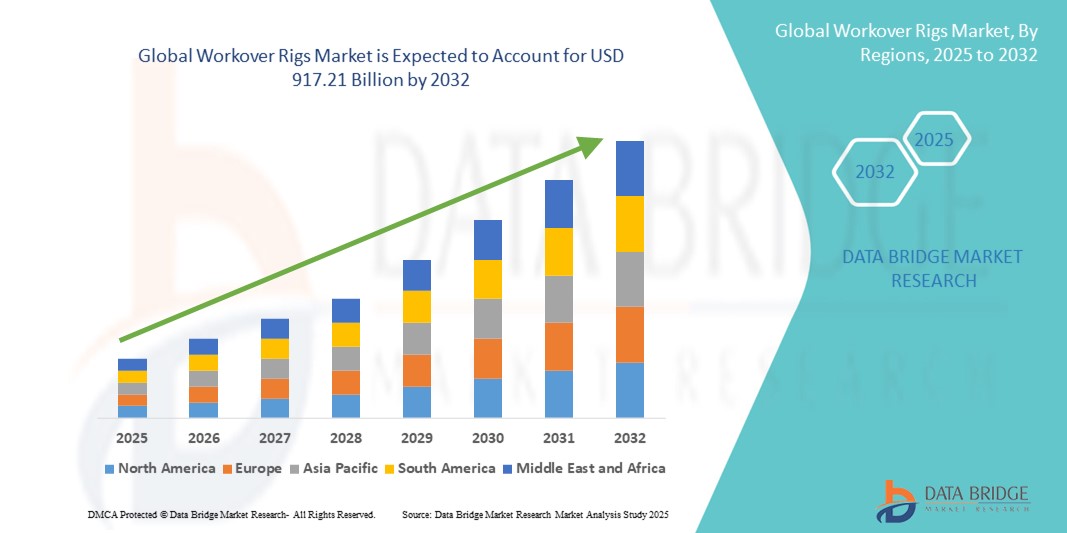

- The global workover rigs market size was valued at USD 597.65 billion in 2024 and is expected to reach USD 917.21 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the rising demand for efficient well intervention services and the need to maintain production levels in aging oil and gas wells.

- Increasing investments in upstream oilfield activities, coupled with advancements in rig technology and automation, are further propelling market expansion

Workover Rigs Market Analysis

- The workover rigs market is witnessing significant growth driven by continuous developments in the oil and gas industry, particularly in mature fields requiring well maintenance and intervention

- Technological innovations such as digital monitoring systems, automated handling equipment, and enhanced mobility features are improving operational efficiency and safety standards in workover operation

- North America dominated the workover rigs market with the largest revenue share of 38.5% in 2024, driven by a surge in oilfield redevelopment projects and increasing investments in mature field well interventions

- Asia-Pacific region is expected to witness the highest growth rate in the global workover rigs market, driven by rapid industrialization, expanding offshore and onshore oilfield activities, and growing investments in oilfield modernization across countries such as China, Japan, and Australia

- The Hydraulic Workover Rigs segment held the largest market revenue share in 2024, driven by its versatility, enhanced safety features, and suitability for both onshore and offshore well intervention activities. These rigs are widely adopted due to their ability to operate in high-pressure environments and deliver precision during workover operations

Report Scope and Workover Rigs Market Segmentation

|

Attributes |

Workover Rigs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand For Well Intervention Services |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Workover Rigs Market Trends

Rising Adoption Of Advanced Rig Automation And Digital Monitoring

• The growing integration of automation and digital monitoring technologies is revolutionizing the workover rigs industry by improving operational safety and efficiency. Automated rigs equipped with real-time sensors enable precise well intervention activities, reducing downtime and operational risks. This shift is significantly boosting productivity across oilfields worldwide

• The increasing demand for data-driven decision-making in remote and offshore wells is accelerating the adoption of rigs with IoT-enabled devices and AI-powered predictive maintenance tools. These advancements help operators minimize failures and optimize resource utilization, especially in high-cost drilling environments

• Digital twin technology and remote monitoring solutions are enabling companies to supervise well intervention operations from centralized control rooms. This not only enhances crew safety but also reduces the need for on-site personnel, thereby lowering operational expenses

• For instance, in 2023, several leading oilfield service providers in the Middle East deployed AI-integrated workover rigs to monitor drilling parameters in real-time, achieving a 20% reduction in non-productive time and significant cost savings

• While automation and digitalization are transforming workover operations, widespread implementation depends on continuous investment, workforce training, and the development of standardized platforms to ensure interoperability across different oilfield assets

Workover Rigs Market Dynamics

Driver

Increasing Oilfield Redevelopment And Well Intervention Activities

• The surge in oilfield redevelopment projects and aging well infrastructure is driving demand for efficient workover rigs. As production in mature fields declines, operators are increasingly turning to well intervention solutions to boost recovery rates, extend field life, and enhance profitability, fueling steady market expansion across both conventional and unconventional reserves

• The growing emphasis on maximizing hydrocarbon extraction from existing wells, especially in regions with strict environmental norms and limited new drilling opportunities, is creating consistent demand for onshore and offshore workover rigs. Rising global energy consumption and pressure to meet production targets further support this long-term trend

• Government incentives, tax reliefs, and favorable regulatory frameworks in key oil-producing regions are encouraging large-scale investments in well servicing activities. These policies are accelerating technological upgrades, adoption of automated rigs, and implementation of advanced well stimulation techniques across the sector

• For instance, in 2022, North American oilfield operators launched extensive redevelopment campaigns across mature shale plays. These initiatives led to a significant surge in the deployment of advanced workover rigs, enabling re-completions, enhanced oil recovery (EOR) methods, and improved field productivity

• Although the market is witnessing strong growth, operators must prioritize cost optimization, adopt digitally enabled rigs, and integrate real-time data analytics. Such strategies will ensure operational efficiency, reduce downtime, and achieve long-term sustainability amid volatile energy market conditions

Restraint/Challenge

High Capital Investment And Volatile Oil Prices

• The procurement, operation, and maintenance of advanced workover rigs involve substantial capital investment, making it difficult for small and mid-sized oilfield service companies to compete. This cost barrier limits market penetration in emerging economies, where budgetary constraints slow the adoption of technologically advanced equipment

• Fluctuations in global crude oil prices directly influence investment decisions for well intervention and redevelopment projects. During price downturns, operators often postpone or reduce capital spending on maintenance programs, affecting the overall demand for workover rigs and related services

• Limited availability of skilled manpower for operating technologically advanced rigs and executing complex well intervention activities creates additional challenges. Remote and offshore locations face heightened operational risks due to harsh environments, long mobilization times, and workforce shortages

• For instance, in 2023, several independent oil operators in Latin America deferred major well servicing projects as falling crude oil prices coincided with rising equipment rental and labor costs. These factors collectively constrained regional market growth and delayed redevelopment timelines

• Addressing cost barriers through modular rig designs, flexible leasing options, and capacity-building initiatives for local workforces will be critical. Moreover, introducing digital training platforms and remote operation capabilities could help reduce skill gaps and operational expenses over the long term

Workover Rigs Market Scope

The market is segmented on the basis of type, application, depth, power source, rig mobility, service type, well type, end user, and component.

- By Type

On the basis of type, the global workover rigs market is segmented into Hydraulic Workover Rigs, Electric Workover Rigs, and Mechanical Workover Rigs. The Hydraulic Workover Rigs segment held the largest market revenue share in 2024, driven by its versatility, enhanced safety features, and suitability for both onshore and offshore well intervention activities. These rigs are widely adopted due to their ability to operate in high-pressure environments and deliver precision during workover operations.

The Electric Workover Rigs segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing demand for low-emission, energy-efficient equipment and the growing push toward electrification across oilfield operations. Their reduced operating costs and compliance with environmental standards make them a preferred choice for future projects.

- By Application

On the basis of application, the market is segmented into Onshore Workover Rigs and Offshore Workover Rigs. The Onshore Workover Rigs segment held the largest share in 2024, supported by the extensive number of aging wells and mature oilfields requiring frequent interventions to sustain production levels. Their relatively lower operational costs and ease of deployment in diverse terrains have accelerated adoption across major oil-producing regions globally.

The Offshore Workover Rigs segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising investments in deepwater and ultra-deepwater exploration and production projects. Increasing demand for high-specification rigs capable of operating under challenging marine conditions is anticipated to further strengthen this segment’s position in the global market.

- By Depth

On the basis of depth, the market is divided into Light Workover Rigs (for shallow depths), Medium Workover Rigs, and Heavy Workover Rigs (for deep drilling). The Light Workover Rigs segment dominated in 2024 due to their suitability for shallow well interventions, reduced mobilization costs, and strong demand from onshore operators managing a large volume of low-depth wells across mature basins.

The Heavy Workover Rigs segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising deepwater and high-pressure, high-temperature (HPHT) operations requiring technically advanced rigs for complex interventions. Their role in expanding global oil production capacity from challenging environments will be crucial over the coming years.

- By Power Source

Based on power source, the market is segmented into Diesel, Electric, and Hybrid rigs. The Diesel Workover Rigs segment held the largest share in 2024, supported by their long-standing adoption, robust power delivery, and ability to operate in remote oilfields lacking grid connectivity. These rigs remain highly preferred for conventional onshore applications due to their proven reliability in harsh environments.

The Electric Workover Rigs segment is expected to witness the fastest growth rate from 2025 to 2032, as operators increasingly prioritize sustainability and emissions reduction. Lower fuel costs, quieter operations, and integration with renewable energy sources make electric rigs an attractive choice for modern oilfield operations.

- By Rig Mobility

On the basis of rig mobility, the market is classified into Skid-mounted Workover Rigs, Trailer-mounted Workover Rigs, and Truck-mounted Workover Rigs. The Truck-mounted Workover Rigs segment accounted for the largest share in 2024, driven by its high mobility, quick setup times, and suitability for frequent inter-well movements across vast onshore oilfields.

The Trailer-mounted Workover Rigs segment is expected to witness the fastest growth rate from 2025 to 2032 due to its cost-effectiveness and ease of transportation over longer distances. These rigs are increasingly preferred for operations involving multiple well locations with minimal site preparation requirements.

- By Service Type

On the basis of service type, the market is segmented into Workover and Completion services. The Workover services segment dominated in 2024, supported by the increasing need for well intervention to restore production levels, especially in aging onshore oilfields worldwide. Rising investments in redevelopment programs have further strengthened this segment’s position in the global market.

The Completion services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by higher well construction activity and the demand for advanced completion technologies enabling optimized hydrocarbon recovery. As unconventional resources gain momentum, completion services are expected to witness steady growth globally.

- By Well Type

On the basis of well type, the market is categorized into Horizontal, Vertical, and Directional wells. The Vertical wells segment held the largest share in 2024 due to the significant number of mature conventional wells worldwide requiring routine interventions and maintenance services to sustain production efficiency.

The Horizontal wells segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of horizontal drilling techniques in shale and tight oil formations. Increased lateral well lengths and complex well architectures are boosting demand for specialized workover rigs capable of handling advanced interventions.

- By End User

On the basis of end user, the market is segmented into Oil and Gas Companies and Contract Drilling Service Providers. The Oil and Gas Companies segment dominated in 2024, driven by the strong need for in-house well intervention capabilities to minimize downtime, reduce operational risks, and optimize hydrocarbon production efficiency.

The Contract Drilling Service Providers segment is expected to witness the fastest growth rate from 2025 to 2032, as outsourcing well servicing activities gains traction among operators seeking cost savings and operational expertise without maintaining large in-house rig fleets.

- By Component

On the basis of component, the market is segmented into Mast, Substructure, Drawworks, Power System, Control System, and Others. The Mast segment accounted for the largest share in 2024, supported by its central role in providing structural stability and load-handling capacity during well intervention operations.

The Control System segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing automation, digitalization, and remote monitoring capabilities across modern workover rigs. Integration of advanced control technologies ensures enhanced safety, efficiency, and real-time operational visibility.

Workover Rigs Market Regional Analysis

- North America dominated the workover rigs market with the largest revenue share of 38.5% in 2024, driven by a surge in oilfield redevelopment projects and increasing investments in mature field well interventions

- The region benefits from a high concentration of oilfield service companies, advanced drilling technologies, and favorable government policies encouraging energy security and production efficiency

- Rising demand for unconventional oil and gas, coupled with consistent exploration and production (E&P) spending, is further strengthening North America’s leadership position in the global workover rigs market

U.S. Workover Rigs Market Insight

The U.S. workover rigs market captured the largest revenue share in 2024 within North America, fueled by shale oil redevelopment projects and well re-completion activities. The growing focus on extending the life of existing wells, combined with advancements in hydraulic workover units and automated rigs, is driving adoption. Moreover, increasing offshore drilling operations in the Gulf of Mexico and rising energy consumption trends are contributing to the strong market demand in the U.S.

Europe Workover Rigs Market Insight

The Europe workover rigs market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by mature oilfields in the North Sea and rising energy demands across the region. Government incentives for optimizing hydrocarbon recovery and increasing interest in offshore exploration activities are fueling market growth. Moreover, the integration of digital oilfield technologies and a push toward low-emission, energy-efficient rigs are shaping Europe’s market expansion.

U.K. Workover Rigs Market Insight

The U.K. workover rigs market is expected to witness the fastest growth rate from 2025 to 2032, supported by redevelopment projects in the North Sea and increasing investments in offshore oil and gas production. The growing demand for modular, cost-efficient rigs and government-backed energy security initiatives are accelerating market penetration. In addition, the adoption of hybrid and electric-powered rigs aligns with the U.K.’s decarbonization goals, ensuring long-term industry sustainability.

Germany Workover Rigs Market Insight

The Germany workover rigs market is expected to witness the fastest growth rate from 2025 to 2032, driven by technological advancements in oilfield services and the country’s emphasis on operational efficiency. As European oil operators focus on optimizing production from existing wells, Germany is emerging as a hub for precision-engineered workover rigs. Moreover, the nation’s strong manufacturing base supports innovation in rig design, enhancing both safety and performance standards.

Asia-Pacific Workover Rigs Market Insight

The Asia-Pacific workover rigs market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising energy demand, rapid industrialization, and increased E&P spending in countries such as China, India, and Indonesia. Government initiatives supporting domestic oil and gas production, coupled with the discovery of new reserves, are fueling market growth. The region’s emergence as a manufacturing hub for oilfield equipment further boosts the availability and affordability of workover rigs.

China Workover Rigs Market Insight

The China workover rigs market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to large-scale redevelopment activities in mature oilfields and government-backed energy expansion policies. Domestic manufacturers play a key role in providing cost-competitive, technologically advanced rigs, while increasing offshore exploration projects in the South China Sea continue to drive demand for high-capacity workover units.

Japan Workover Rigs Market Insight

The Japan workover rigs market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s increasing offshore exploration activities and the redevelopment of aging oilfields. Japan’s strong focus on energy security and technological innovation is encouraging the adoption of advanced, automated, and environmentally friendly workover rigs. In addition, government-backed initiatives supporting sustainable energy production and the integration of digital oilfield technologies are driving demand for efficient well intervention and maintenance solutions across both offshore and onshore operations.

Workover Rigs Market Share

The Workover Rigs industry is primarily led by well-established companies, including:

- Nabors Industries Ltd. (Bermuda)

- Helmerich & Payne, Inc. (U.S.)

- Patterson-UTI (U.S.)

- PRECISION DRILLING CORPORATION (Canada)

- Ensign Energy Services (Canada)

- Archer drilling (Bermuda)

- Key Energy Services, LLC (U.S.)

- Independence Contract Drilling (U.S.)

- Pioneer Energy Services Corp. (U.S.)

- Unit Corporation (U.S.)

- Cyclone Drilling, Inc. (U.S.)

- VIKING SERVICES (U.S.)

Latest Developments in Global Workover Rigs Market

- In December 2021, Schlumberger launched an automated well intervention platform designed to enhance efficiency and safety in well servicing operations. The platform integrates robotics, advanced automation, and data analytics to enable remote-controlled interventions, reducing the reliance on manual labor while improving operational performance. This development is expected to streamline well maintenance, minimize risks, and increase productivity, driving adoption across the global workover rigs market

- In November 2021, Weatherford International entered into a collaboration with NOV (National Oilwell Varco) to develop advanced well servicing solutions. The partnership combines Weatherford's expertise in well intervention with NOV's drilling and completion technologies to optimize well performance and maximize hydrocarbon recovery. This initiative is poised to offer comprehensive, technologically enhanced services, supporting market growth and innovation in the oilfield services sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.