Global Wound Cleanser Products Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

3.94 Billion

2024

2032

USD

2.81 Billion

USD

3.94 Billion

2024

2032

| 2025 –2032 | |

| USD 2.81 Billion | |

| USD 3.94 Billion | |

|

|

|

|

Wound Cleanser Products Market Size

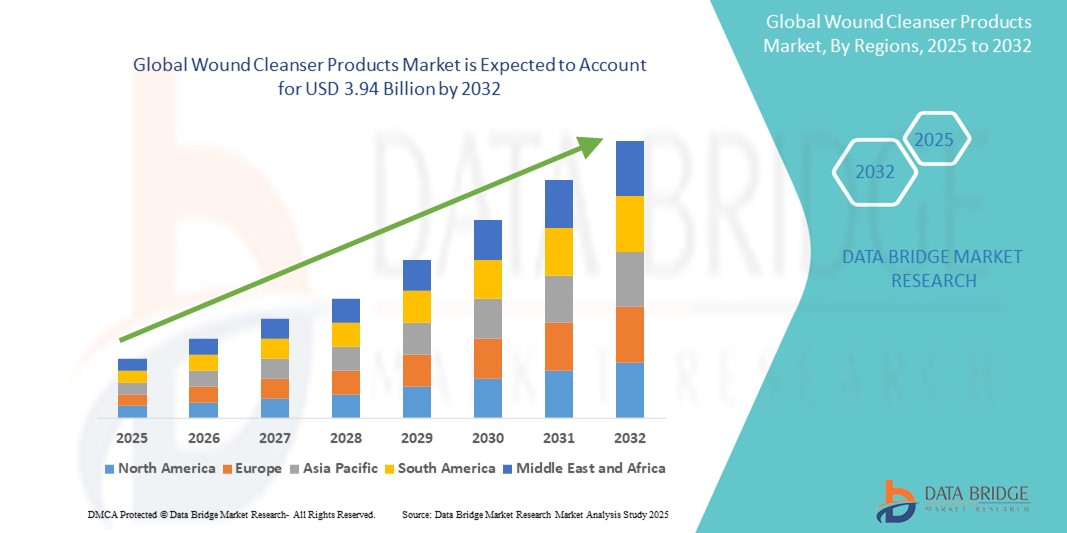

- The global wound cleanser products market size was valued at USD 2.81 billion in 2024 and is expected to reach USD 3.94 billion by 2032, at a CAGR of 4.3% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within advanced wound care solutions and infection control practices, leading to increased utilization of specialized wound cleanser products in both clinical and homecare settings

- Furthermore, rising consumer demand for effective, easy-to-use, and non-cytotoxic wound cleaning solutions is establishing wound cleanser products as an essential component of modern wound management protocols. These converging factors are accelerating the uptake of Wound Cleanser Products solutions, thereby significantly boosting the industry's growth

Wound Cleanser Products Market Analysis

- Wound cleanser products, designed to clean, hydrate, and prepare wounds for optimal healing, are increasingly vital components of modern wound management protocols in both clinical and home care settings due to their non-cytotoxic nature, ease of use, and effectiveness in reducing infection risk

- The escalating demand for wound cleanser products is primarily fueled by the growing prevalence of chronic wounds, rising geriatric population, increased surgical procedures, and heightened awareness regarding advanced wound care

- North America dominated the wound cleanser products market with the largest revenue share of 38.5% in 2024, characterized by well-established healthcare infrastructure, increasing incidence of diabetes-related wounds, and widespread adoption of evidence-based wound care practices, particularly in the U.S., where home healthcare and outpatient treatment settings are driving high product demand

- Asia-Pacific is expected to be the fastest growing region in the wound cleanser products market with a CAGR of 19% during the forecast period, due to increasing healthcare investments, growing burden of chronic conditions, and expanding awareness about modern wound care across emerging economies such as China and India

- The wound care segment dominated the wound cleanser products market with a market revenue share of 68.4% in 2024, attributed to its extensive use in chronic and acute wound management, infection prevention, and effective cleaning

Report Scope and Wound Cleanser Products Market Segmentation

|

Attributes |

Wound Cleanser Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wound Cleanser Products Market Trends

“Growing Demand Due to Rising Surgical Procedures and Wound Management Awareness”

- A significant and accelerating trend in the global wound cleanser products market is the shift towards smart, technology-enabled healthcare tools that enhance the convenience and effectiveness of wound management in both clinical and home care settings

- Although voice-controlled ecosystems such as Amazon Alexa and Google Assistant are more applicable to home automation, in the medical field, the integration of intelligent technologies (such as digital monitoring and automated wound assessment systems) is helping clinicians optimize wound cleansing protocols, improving patient outcomes and workflow efficiency

- For instance, digital wound care platforms integrated with imaging and assessment software allow for consistent evaluation of wound healing, enabling healthcare providers to adjust cleansing products and regimens based on real-time data, thus personalizing treatment

- Furthermore, smart dispensers and sensor-based wound care systems are increasingly being developed to automate and track product usage, reduce contamination risk, and support documentation. These innovations help in reducing infection rates and improving compliance with hygiene protocols in hospital environments

- This trend toward smarter wound care delivery is reshaping expectations in wound management, driving demand for advanced cleanser products that complement digital and connected health ecosystems

- As the demand for effective, user-friendly, and technologically enhanced solutions rises, manufacturers are focusing on innovations such as single-use delivery systems, no-rinse formulations, and compatibility with electronic medical records (EMR) to meet evolving clinical needs

Wound Cleanser Products Market Dynamics

Driver

“Rising Chronic Conditions and Surgical Procedures Drive Demand for Advanced Wound Cleanser Products”

- The increasing prevalence of chronic wounds, surgical site infections, diabetic ulcers, and traumatic injuries has significantly raised the demand for advanced wound care solutions, including wound cleanser products

- For instance, the American Diabetes Association reports that over 11% of the U.S. population suffers from diabetes, and nearly 15% of these individuals develop diabetic foot ulcers during their lifetime—highlighting a growing need for effective wound cleaning and infection control products

- In addition, the surge in surgical interventions globally—particularly in aging populations and among patients with chronic illnesses—has further fueled the use of wound cleansers to support proper post-operative care and prevent complications

- The increasing awareness among patients and healthcare providers regarding the importance of wound hygiene, infection prevention, and faster healing outcomes is promoting the adoption of both over-the-counter and prescription-based wound cleansers

- Product innovations such as pH-balanced, non-cytotoxic, and antimicrobial wound cleansers are gaining popularity due to their effectiveness and ease of use across home care, hospitals, and ambulatory surgical centers

Restraint/Challenge

“Stringent Regulatory Approvals and High Cost of Advanced Products”

- Stringent regulatory requirements by agencies such as the FDA and EMA for new wound cleanser formulations can lead to longer product approval timelines and increased costs for manufacturers

- In addition, the cost of advanced wound cleansers—especially those incorporating antimicrobial agents, bioactive compounds, or novel delivery systems—can be significantly higher than traditional saline solutions, limiting their accessibility in cost-sensitive regions

- For instance, high-performance cleansers using polyhexanide (PHMB) or hypochlorous acid (HOCl) require advanced production and preservation methods, making them more expensive for patients and healthcare facilities in low- and middle-income countries

- Furthermore, inconsistent reimbursement policies for wound care products across different healthcare systems present a barrier to adoption, particularly in outpatient and home care settings

- Addressing these challenges through streamlined regulatory pathways, healthcare provider education, and affordable product offerings will be key to expanding market access and sustaining growth in the global wound cleanser products market

Wound Cleanser Products Market Scope

The market is segmented on the basis of product type, wound type, application, and end-user.

- By Product Type

On the basis of product type, the wound cleanser products market is segmented into wound care and wound closure. The wound care segment dominated the largest market revenue share of 68.4% in 2024, attributed to its extensive use in chronic and acute wound management, infection prevention, and effective cleaning.

The wound closure segment is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032, driven by increasing surgical procedures and advancements in closure materials such as tissue adhesives and hydrocolloids.

- By Wound Type

On the basis of wound type, the market is segmented into chronic wound and acute wound. The chronic wound segment held the largest market share of 61.2% in 2024, due to the rising burden of diabetes, venous ulcers, and pressure ulcers requiring long-term care.

The acute wound segment is expected to register a CAGR of 7.6% from 2025 to 2032, supported by a rise in traumatic injuries, surgical wounds, and emergency care demand.

- By Application

On the basis of application, the wound cleanser products market is segmented into surgical wounds, ulcers, burn wounds, and trauma wounds. The surgical wounds segment accounted for the highest share of 37.5% in 2024, fueled by the growing number of surgeries globally and the need for effective post-operative wound care.

The ulcers segment is anticipated to grow at the fastest CAGR of 9.1% from 2025 to 2032, owing to the increasing geriatric population and prevalence of diabetic foot and pressure ulcers.

- By End-User

On the basis of end-user, the market is segmented into hospitals, clinics, home healthcare settings, and trauma centers. The hospitals segment captured the largest revenue share of 52.8% in 2024, owing to higher patient volumes, advanced wound care infrastructure, and skilled healthcare staff.

The home healthcare settings segment is projected to witness the fastest CAGR of 10.3% from 2025 to 2032, due to increasing preference for home treatment and chronic wound management in aging populations.

Wound Cleanser Products Market Regional Analysis

- North America dominated the wound cleanser products market with the largest revenue share of 38.5% in 2024, driven by the high prevalence of chronic wounds, rising rates of diabetes and obesity, and an increasing number of surgical procedures

- A well-established healthcare infrastructure, along with favorable reimbursement policies and strong presence of key market players, also supports this dominance

- The region’s growing elderly population and heightened awareness regarding advanced wound care options further contribute to the increasing adoption of wound cleanser products in both hospital and home care settings

U.S. Wound Cleanser Products Market Insight

The U.S. wound cleanser products market captured the largest revenue share of 78.9% in 2024 within North America, propelled by rising hospital admissions, a growing focus on infection prevention, and the increasing demand for personalized wound care solutions. The country is witnessing strong uptake of advanced wound cleansers—especially antimicrobial and non-cytotoxic solutions—used in treating pressure ulcers, diabetic foot ulcers, surgical wounds, and burns. Continued investment in research and development, coupled with favorable reimbursement frameworks, are further strengthening the market position.

Europe Wound Cleanser Products Market Insight

The Europe wound cleanser products market is expected to register substantial growth throughout the forecast period, owing to the increasing incidence of chronic wounds and surgical site infections. Factors such as aging populations, growing healthcare expenditure, and the strong presence of advanced wound care companies in countries such as Germany, France, and the U.K. support regional market growth. In addition, strict regulatory frameworks promoting the use of safe, evidence-based wound care products are driving adoption.

U.K. Wound Cleanser Products Market Insight

The U.K. wound cleanser products market is anticipated to grow at a noteworthy CAGR, driven by rising rates of obesity- and diabetes-related complications, increasing surgical volumes, and greater demand for community-based wound care services. The National Health Service (NHS) initiatives promoting early wound intervention and improved infection control are expected to further boost the adoption of both traditional and advanced wound cleanser products.

Germany Wound Cleanser Products Market Insight

The Germany wound cleanser products market is forecasted to expand at a steady CAGR during the forecast period, supported by a large elderly population, increasing hospitalizations, and well-established wound care protocols. Strong emphasis on clinical hygiene and growing acceptance of innovative cleanser formulations (e.g., those containing PHMB or hypochlorous acid) are driving the demand for both inpatient and outpatient wound care.

Asia-Pacific Wound Cleanser Products Market Insight

The Asia-Pacific wound cleanser products market is projected to grow at the fastest CAGR of 19% during 2025 to 2032, driven by rapid urbanization, improving healthcare infrastructure, and increasing awareness of wound management in countries such as China, India, and Japan. Rising incidences of chronic diseases, coupled with government-led healthcare reforms and expanding access to advanced medical care, are fueling demand for wound cleansers across both hospital and home care settings.

Japan Wound Cleanser Products Market Insight

The Japan wound cleanser products market is gaining momentum, bolstered by an aging population, a high prevalence of chronic conditions, and strong adoption of hospital-grade antiseptic and wound care solutions. Growing demand for effective outpatient wound management, alongside innovations in non-cytotoxic and antimicrobial wound cleanser technologies, are expected to accelerate market expansion.

China Wound Cleanser Products Market Insight

The China wound cleanser products market held the largest revenue share in the Asia-Pacific region in 2024, driven by a large diabetic population, increased surgical activity, and a rising middle class with greater access to healthcare services. Domestic production capabilities and competitive pricing by local manufacturers are enhancing product availability. Government initiatives to modernize hospitals and rural healthcare facilities are further bolstering the adoption of wound care solutions, including cleansers.

Wound Cleanser Products Market Share

The wound cleanser products industry is primarily led by well-established companies, including:

- Smith + Nephew (U.K.)

- Mölnlycke Health Care AB (Sweden)

- ConvaTec Group PLC (U.K.)

- Baxter International (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- URGO Medical (U.S.)

- Coloplast Corp. (Denmark)

- Medtronic (Ireland)

- 3M Company (U.S.)

- Derma Sciences Inc. (Integra LifeSciences) (U.S.)

- Medline Industries (U.S.)

- Advancis Medical (U.K.)

- B. Braun SE (Germany)

Latest Developments in Global Wound Cleanser Products Market

- In April 2023, Sanara MedTech Inc. received FDA 510(k) clearance for Biasurge, an advanced mechanical wound cleanser designed to remove debris and microbes effectively—marking a significant innovation in surgical wound-care protocols

- In June 2025, Mölnlycke Health Care announced a EUR 115 million investment to expand its wound-care production capacity in Brunswick, Maine (USA). This expansion includes a state-of-the-art manufacturing facility aimed at increasing supply responsiveness and sustainability for North American markets

- In July 2024, Mölnlycke Health Care announced the acquisition of a leading wound cleansing manufacturer to strengthen its position as a global leader in advanced wound care. This strategic acquisition aims to consolidate Mölnlycke’s wound cleanser portfolio, expand its customer base, and accelerate innovation in infection prevention and wound healing solutions

- In June 2023, Evonik’s subsidiary JeNaCell launched Epicite Balance, a next-generation wound dressing made from biosynthetic cellulose, designed to support moist wound healing and improve patient outcomes. The product offers excellent conformability, fluid management, and compatibility with antimicrobial agents, enhancing treatment for chronic and acute wounds

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.