Global Wound Contact Layer Dressings Market

Market Size in USD Million

CAGR :

%

USD

483.16 Million

USD

1,311.98 Million

2024

2032

USD

483.16 Million

USD

1,311.98 Million

2024

2032

| 2025 –2032 | |

| USD 483.16 Million | |

| USD 1,311.98 Million | |

|

|

|

|

Wound Contact Layer Dressings Market Size

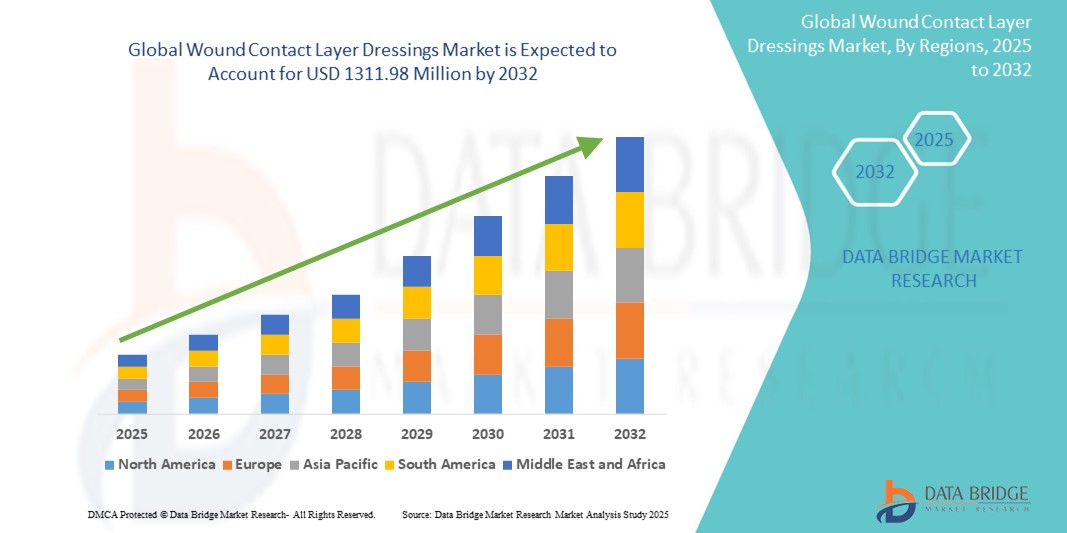

- The global wound contact layer dressings market size was valued at USD 483.16 million in 2024 and is expected to reach USD 1,311.98 million by 2032, at a CAGR of 13.3% during the forecast period

- The market growth is largely fueled increasing prevalence of chronic wounds, advancements in wound care technology, and the rising aging population

- The rising global burden of conditions such as diabetes, pressure ulcers, and venous leg ulcers is significantly increasing the demand for advanced wound care solutions, including contact layer dressings that promote faster healing with minimal trauma

- Innovations such as antimicrobial dressings, silicone-based contact layers, and bioactive materials are enhancing the effectiveness and comfort of wound contact layer dressings, driving their adoption in both clinical and homecare settings

Wound Contact Layer Dressings Market Analysis

- The introduction of composite dressings like "aquacel ag+" combines a hydrocolloid layer with a silver-infused antimicrobial layer, effectively regulating wound exudate while offering antibacterial protection

- This trend towards incorporating innovative materials into wound contact layer dressings underscores the market's evolution, focusing on improving patient outcomes through enhanced healing properties and infection prevention

- North America dominated the wound contact layer dressings market with the largest revenue share of 45.49% in 2024, driven by advanced healthcare infrastructure and high adoption of innovative wound care technologies

- Asia-Pacific is expected to be the fastest growing region in the wound contact layer dressings market poised to grow at the fastest CAGR of 24% during the forecast period from 2025 to 2032. This growth is driven by rapid urbanization, rising healthcare expenditure, and an increasing prevalence of lifestyle-related diseases such as diabetes and obesity

- The non-antimicrobial wound contact layer dressing segment held the largest market share, accounting for 75.78% in 2024, supported by their superior ability to maintain moisture balance, reduce healing time, and minimize infection risks

Report Scope and Wound Contact Layer Dressings Market Segmentation

|

Attributes |

Wound Contact Layer Dressings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Wound Contact Layer Dressings Market Trends

“Advancements in Composite Wound Dressing Solutions”

- The global wound contact layer dressings market is experiencing a growing trend toward the adoption of advanced composite dressings designed to improve healing efficiency and patient comfort

- These dressings combine multiple materials such as silicone, hydrocolloids, and antimicrobial layers to manage moisture, reduce trauma, and protect against infection

- They are especially valued for their ability to stay in place while allowing exudate to pass through to secondary dressings, ensuring a clean and moist environment for healing

- The trend reflects a shift in focus from basic wound coverage to multifunctional solutions that address both healing and comfort needs in sensitive or complex wounds

- Hospitals and home healthcare providers are increasingly selecting composite dressings for their convenience, versatility, and reduced frequency of dressing changes

- For instance, the launch of next-generation dressings with silver ion technology by major manufacturers showcases how innovation is reshaping wound care standards by combining infection control with gentle adhesion

- In conclusion, this growing reliance on composite wound contact layer dressings marks a significant evolution in wound care practices, emphasizing the importance of multi-layered, patient-friendly solutions that accelerate recovery while simplifying care routines

Wound Contact Layer Dressings Market Dynamics

Driver

“Increasing Prevalence of Chronic Wounds and Aging Population”

- The rising cases of chronic wounds like diabetic foot ulcers and pressure ulcers are increasing demand for wound contact layer dressings, especially as chronic wounds affect over 6.5 million patients in the United States alone (CDC data)

- Elderly populations with declining skin health and healing abilities form a growing patient base, driving the need for advanced dressings that minimize infection and promote faster recovery

- Wound contact layer dressings provide a protective barrier to manage exudate and prevent damage to new tissue during dressing changes, supporting a moist healing environment proven to speed wound closure

- Healthcare providers in hospitals and home care settings are increasingly adopting these dressings as part of wound management protocols; for instance, the global diabetic population reaching 537 million in 2021 boosts demand for related wound care products (International Diabetes Federation)

- Government initiatives like the U.S. Wound Care Education Institute’s programs raise awareness and encourage early wound treatment, further propelling market growth

- The expanding chronic wound patient population and supportive healthcare frameworks highlight the critical role of wound contact layer dressings in improving patient outcomes and reducing treatment costs

Restraint/Challenge

“High Cost of Advanced Wound Contact Layer Dressings Limiting Accessibility”

- The high cost of advanced wound contact layer dressings, driven by the use of specialized materials for moisture control and antimicrobial features, limits their adoption in many healthcare settings

- These dressings often include smart monitoring technologies, which improve outcomes but increase manufacturing expenses and final product prices compared to traditional dressings

- Healthcare providers in low- and middle-income countries or budget-constrained facilities struggle to afford these dressings, restricting patient access to effective wound care and potentially prolonging healing times

- In many regions, reimbursement policies do not fully cover the cost of advanced dressings, placing additional financial burdens on patients and caregivers, which impacts market growth

- Manufacturers are challenged to balance innovation with affordability, and efforts to educate healthcare professionals about the long-term cost benefits of advanced dressings are ongoing but inconsistent; for instance, some insurers in the US are beginning to revise reimbursement to encourage better wound care products

- Until production costs decrease or reimbursement systems improve, the high price of advanced wound contact layer dressings will remain a significant barrier to widespread use and accessibility

Wound Contact Layer Dressings Market Scope

The market is segmented on the basis of product and end user.

• By Product

On the basis of product, the global wound contact layer dressings market is segmented into antimicrobial and non-antimicrobial. In 2024, the non-antimicrobial wound contact layer dressing segment held the largest market share, accounting for 75.78%. These dressings are designed to protect the wound, support the healing process, and maintain proper moisture levels without using agents that directly target microbial activity. By minimizing pain during dressing changes and creating an optimal environment for healing, they enhance the overall patient experience.

The antimicrobial segment is anticipated to witness the fastest growth, with a projected CAGR of 14.23% during the forecast period. These dressings are used to control and reduce the microbial load within the wound bed. They are particularly effective in treating both partial- and full-thickness wounds, including surgical incisions and percutaneous line sites. Antimicrobial dressings are available in a wide range of formats, such as nylon fabrics, island dressings, film dressings, sponges, impregnated woven gauzes, and various material combinations.

• By End User

On the basis of end user, the market is segmented into hospitals, outpatients, home healthcare, and research & manufacturing. The hospitals segment dominated the market share at approximately 45.7% in 2024. This dominance can be attributed to the growing demand for advanced medical facilities, significant technological progress in emerging economies, and increasing healthcare expenditure in developing nations. Hospitals utilize wound dressings to manage various types of wounds, including surgical wounds, burns, pressure ulcers, and diabetic foot ulcers. The demand for wound dressings in hospital settings is fueled by the rising prevalence of chronic wounds, a surge in surgical procedures, and a growing elderly population.

The home healthcare segment is expected to register the highest CAGR of 14% during the forecast period of 2025 to 2032. The growing aging population is driving increased demand for home healthcare services, including wound care. Elderly individuals are more susceptible to chronic wounds such as pressure ulcers, diabetic foot ulcers, and venous leg ulcers which require consistent and long-term care. Additionally, with the rising cost of healthcare, there is a stronger focus on cost-efficient treatment options. Home healthcare is often more economical compared to inpatient care, making it a preferred choice for patients, healthcare providers, and insurers alike.

Wound Contact Layer Dressings Market Regional Analysis

- North America dominated the wound contact layer dressings market with the largest revenue share of 45.49% in 2024, driven by advanced healthcare infrastructure and high adoption of innovative wound care technologies

- Strong reimbursement policies and increasing healthcare expenditure are supporting market growth, enabling better access to cutting-edge wound care products across hospitals and homecare settings

- Ongoing product innovation, including antimicrobial and bioactive dressings, enhances treatment outcomes and patient comfort, encouraging faster adoption by healthcare providers

U.S. Wound Contact Layer Dressings Market Insight

The U.S. wound contact layer dressings market captured the largest revenue share of 81% in North America in 2024, driven by a high prevalence of chronic wounds, increased surgical procedures, and strong adoption of advanced wound care products. the growing geriatric population, coupled with rising incidences of diabetes and pressure ulcers, is significantly contributing to demand. furthermore, favorable reimbursement policies, robust healthcare infrastructure, and strong presence of leading manufacturers are fueling market growth. ongoing clinical advancements and the introduction of innovative, pain-reducing dressing materials are also enhancing adoption among healthcare professionals and patients.

Europe Wound Contact Layer Dressings Market Insight

The Europe wound contact layer dressings market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising healthcare awareness, an aging population, and a growing focus on wound management in both hospital and home care settings. countries in western Europe, especially Germany, France, and the U.K., are leading the adoption of advanced dressings due to well-established healthcare systems. additionally, stringent regulatory guidelines and emphasis on reducing hospital stays and associated healthcare costs are encouraging the use of efficient, skin-friendly wound contact layer dressings.

U.K. Wound Contact Layer Dressings Market Insight

The U.K. Wound contact layer dressings market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increased demand for outpatient care, rising surgical interventions, and the government’s emphasis on improving chronic wound management. The U.K.’S aging population and high incidence of diabetes contribute to the growing need for effective and easy-to-use wound dressings. The national health service (nhs) initiatives to promote evidence-based wound care practices, along with strong procurement of advanced dressing products, are expected to further bolster market growth.

Germany Wound Contact Layer Dressings Market Insight

The Germany wound contact layer dressings market is expected to expand at a considerable CAGR during the forecast period, driven by a rising number of elderly individuals, a high standard of healthcare services, and increasing demand for advanced wound care solutions. The country's focus on innovation and sustainability in medical products is promoting the development and use of bio-compatible and eco-conscious dressings. Additionally, widespread adoption in both acute and chronic wound cases, supported by strong reimbursement frameworks, is facilitating growth across clinical and homecare settings.

Asia-Pacific Wound Contact Layer Dressings Market Insight

The Asia-pacific wound contact layer dressings market is poised to grow at the fastest CAGR of 24% during the forecast period from 2025 to 2032. This growth is driven by rapid urbanization, rising healthcare expenditure, and an increasing prevalence of lifestyle-related diseases such as diabetes and obesity. Countries such as China, Japan, and India are witnessing robust growth due to expanding healthcare infrastructure, growing awareness of wound care, and supportive government policies. Additionally, local manufacturing and cost-effective product availability are making advanced wound contact dressings more accessible to a broader population base.

Japan Wound Contact Layer Dressings Market Insight

The Japan wound contact layer dressings market is gaining momentum owing to the country’s rapidly aging population, growing focus on patient comfort, and the increasing incidence of chronic wounds. Japan is known for adopting advanced medical technologies, and wound dressings that support faster healing with minimal patient discomfort are seeing high demand. The integration of wound care into telehealth services and home-based care models is further fueling market expansion, especially among the elderly who require ongoing wound management in non-hospital settings.

China Wound Contact Layer Dressings Market Insight

The China wound contact layer dressings market accounted for the largest market revenue share in Asia-pacific in 2024, supported by the country’s expanding healthcare system, increased surgical procedures, and rising cases of chronic wounds. The growing middle class and rising healthcare awareness are enhancing demand for quality wound care products. Furthermore, government initiatives aimed at improving healthcare access and the strong presence of domestic manufacturers offering affordable advanced dressings are significantly contributing to market growth. The development of local manufacturing hubs also aids in reducing costs and improving supply chain efficiency.

Wound Contact Layer Dressings Market Share

The wound contact layer dressings industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Hollister Incorporated (U.S.)

- Elkem ASA (Norway)

- Cardinal Health (U.S.)

- Advanced Medical Solutions Group plc (U.K.)

- AVERY DENNISON CORPORATION (U.S.)

- PAUL HARTMANN Limited (Germany)

- Essity Health & Medical (Sweden)

- Medline Industries, Inc. (U.S.)

- Smith + Nephew (U.K.)

- Molnlycke Health Care AB (Sweden)

- Convatec Inc. (U.K.)

- Brightwake Ltd (U.K.)

- Allegro Enterprises, Inc. (U.S.)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- INTEGRA LIFESCIENCES (U.S.)

- URGO (France)

- DermaRite Industries, LLC (U.S.)

- Winner Medical Co., Ltd. (China)

Latest Developments in Global Wound Contact Layer Dressings Market

- In January 2024, Medline Industries, LP introduced its inaugural transparent wound dressing designed specifically for pressure injury prevention. The innovative dressing aims to enhance patient care by offering a versatile, protective solution for preventing pressure-related wounds

- In July 2023, Coloplast A/S acquired Kerecis, a company specializing in biologics for wound care. This strategic acquisition is intended to enhance Coloplast's portfolio by integrating Kerecis's advanced wound care solutions. The move aims to bolster Coloplast’s capabilities and market presence in the wound care sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.