Global Wrap Around Labelling Machine Market

Market Size in USD Billion

CAGR :

%

USD

2.68 Billion

USD

2.92 Billion

2024

2032

USD

2.68 Billion

USD

2.92 Billion

2024

2032

| 2025 –2032 | |

| USD 2.68 Billion | |

| USD 2.92 Billion | |

|

|

|

|

Wrap Around Labelling Machine Market Size

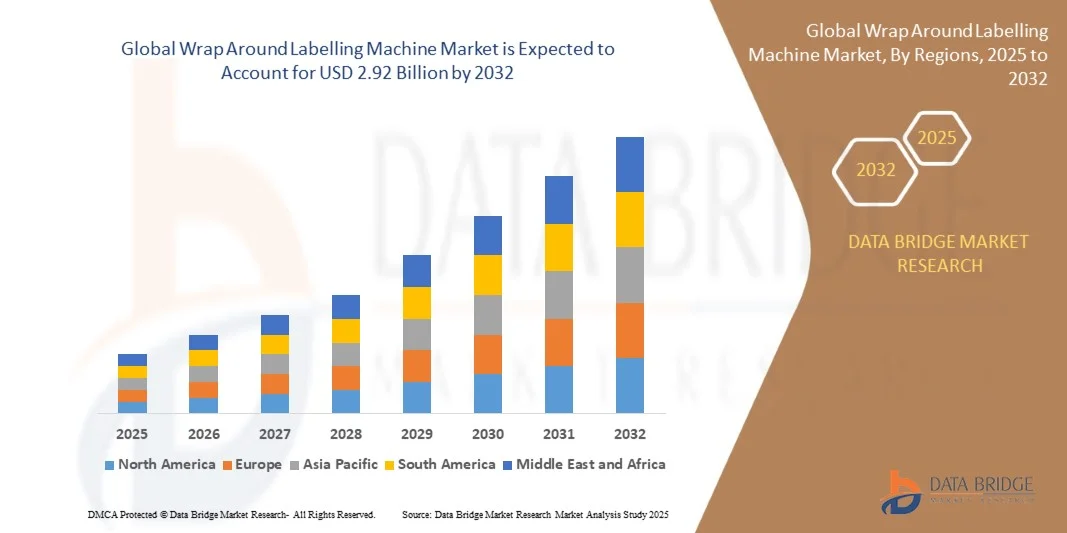

- The global wrap around labelling machine market size was valued at USD 2.68 billion in 2024 and is expected to reach USD 2.92 billion by 2032, at a CAGR of 1.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation and packaging efficiency across manufacturing industries, leading to a higher demand for labeling solutions that ensure accuracy, speed, and consistency in product presentation and traceability

- Furthermore, growing emphasis on product branding, regulatory compliance, and advanced packaging standards across food, beverage, pharmaceutical, and cosmetic sectors is driving the adoption of wrap around labelling machines. These machines provide precision, flexibility, and adaptability, significantly boosting operational performance and market expansion

Wrap Around Labelling Machine Market Analysis

- Wrap around labelling machines are increasingly utilized for applying labels to cylindrical containers, bottles, and jars across diverse industries such as food and beverage, pharmaceuticals, and personal care due to their ability to deliver high-speed labeling, versatility in handling various container sizes, and reduced downtime during production

- The escalating demand for automated labeling systems is driven by the need for consistent labeling quality, enhanced production efficiency, and compliance with labeling standards. In addition, growing integration of smart sensors and servo-driven technology in these machines is improving precision and adaptability, strengthening their role in modern packaging lines across global markets

- North America dominated the wrap around labelling machine market with a share of 34.4% in 2024, due to strong demand for automated packaging solutions across industries such as food and beverages, pharmaceuticals, and personal care

- Asia-Pacific is expected to be the fastest growing region in the wrap around labelling machine market during the forecast period due to rapid industrialization, expanding manufacturing capacity, and the rising demand for packaged products. Increasing automation in packaging facilities across China, Japan, and India is significantly boosting adoption

- Automatic segment dominated the market with a market share of 64.8% in 2024, due to its efficiency in high-speed production environments. Automatic wrap around labelling machines offer superior precision, reduced human error, and seamless integration with conveyors and inspection units. Their widespread use in large-scale food and pharmaceutical manufacturing facilities enhances output consistency and operational efficiency. The continuous push for fully automated packaging lines to meet global quality and regulatory standards further fuels segment demand

Report Scope and Wrap Around Labelling Machine Market Segmentation

|

Attributes |

Wrap Around Labelling Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wrap Around Labelling Machine Market Trends

“Increasing Adoption of Sustainable and Eco-Friendly Labelling Solutions”

- The global wrap around labelling machine market is witnessing robust growth as manufacturers increasingly adopt eco-friendly labelling solutions to align with sustainability and waste reduction objectives. Wrap around labelling systems, known for their precision and efficiency, are being upgraded to accommodate recyclable labels, biodegradable adhesives, and energy-efficient components to support greener packaging operations

- For instance, Krones AG and Herma GmbH have launched sustainable labelling systems designed for reduced material waste and compatibility with bio-based label films and water-based adhesives. These innovations demonstrate how automation and sustainability are converging to create environmentally responsible packaging systems for food, beverage, and pharmaceutical industries

- Growing regulatory emphasis on sustainable packaging and extended producer responsibility (EPR) policies is encouraging manufacturers to implement label materials that enhance recyclability of bottles, cans, and containers. Machines designed to handle thinner, PET-compatible, and recyclable substrates are becoming increasingly popular across global production lines

- The integration of servomotor technology and smart sensors in wrap around labelling machines is improving application accuracy while reducing adhesive use and waste. Modern systems also feature automatic adjustment mechanisms that minimize material consumption during setup and changeovers, contributing to resource efficiency and lowered carbon emissions

- The shift toward digital connectivity and cloud-based production control enables real-time performance monitoring, optimizing overall energy consumption and label usage. These advancements make eco-friendly labelling processes both cost-effective and scalable for large-volume production

- As environmental sustainability continues to shape packaging strategies worldwide, wrap around labelling machines that support recyclable materials and smart operation models are emerging as essential technologies for clean, compliant, and efficient packaging production

Wrap Around Labelling Machine Market Dynamics

Driver

“Rising Demand for Automated and High-Speed Packaging Solutions”

- The growing preference for automated, high-precision, and high-speed labelling solutions across industries is a major factor driving the wrap around labelling machine market. As companies seek greater production throughput and consistency, automated wrap around systems provide significant advantages in operational efficiency and accuracy over manual labelling methods

- For instance, manufacturers such as Sidel Group and KHS GmbH have introduced high-speed wrap around labelling systems capable of applying labels at rates exceeding 50,000 containers per hour. These systems cater to beverage, pharmaceutical, and personal care segments where rapid, continuous production is essential for profitability and brand consistency

- The increasing globalization of supply chains and rising demand for uniform packaging standards are prompting manufacturers to adopt automation-driven labelling systems that ensure consistent label placement, even on complex or curved surfaces. Integration with conveyor lines and robotic handling systems further enhances automation efficiency across multi-format packaging units

- In addition, the proliferation of digital control systems and vision-based inspection technologies ensures error-free labelling and quality assurance, reducing waste and rework. This capability is particularly critical for sectors such as food and healthcare where traceability and compliance standards are stringent

- As industrial automation expands globally, wrap around labelling machines represent a key enabling technology for smart production lines. The ability to combine speed, reliability, and minimal manual intervention makes them vital for enhancing productivity in large-scale packaging operations

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- The high initial capital investment and ongoing maintenance costs associated with advanced wrap around labelling machines pose significant barriers to adoption, particularly for small and medium-sized enterprises (SMEs). The integration of servo drives, digital controllers, and precision sensors increases manufacturing complexity and upfront costs compared with conventional labelling equipment

- For instance, high-performance machines from Krones and Sacmi Imola require substantial investment due to automated changeover systems, vision verification modules, and adaptive alignment technologies. These features, while enhancing efficiency, elevate total setup expenditures and prolong return-on-investment cycles

- Regular maintenance, calibration, and operator training further contribute to higher operational costs. Complex label handling systems and digital interfaces demand skilled technicians to ensure optimal performance, which adds to overall production expenses

- Small manufacturers operating in cost-sensitive regions often find it challenging to balance equipment costs with profit margins, restraining large-scale implementation of cutting-edge labelling systems. The high cost of spare parts and downtime during servicing also impacts productivity levels

- Manufacturers are increasingly addressing cost challenges by developing modular systems, offering leasing models, and integrating predictive maintenance technologies to minimize breakdowns. As technological adoption scales and equipment costs decline, wrap around labelling machines are expected to become more accessible to a broader range of packaging producers

Wrap Around Labelling Machine Market Scope

The market is segmented on the basis of orientation, technology, dispensing speed, and end-user industry.

• By Orientation

On the basis of orientation, the wrap around labelling machine market is segmented into horizontal and vertical. The vertical segment dominated the market with the largest revenue share in 2024, primarily due to its widespread use across beverage, pharmaceutical, and personal care packaging lines. Vertical wrap around labelling machines are preferred for cylindrical containers such as bottles and jars, ensuring precise label application and high-speed performance. Their ability to handle a wide range of product sizes and shapes with minimal manual intervention further enhances productivity. The growing adoption in high-volume packaging operations, coupled with the integration of vision inspection systems, continues to strengthen the dominance of vertical machines in the market.

The horizontal segment is projected to witness the fastest growth rate from 2025 to 2032, driven by its rising utilization in the food and electronics sectors. These machines are ideal for labelling unstable or irregular-shaped products that cannot stand upright, offering flexibility in packaging design. Manufacturers increasingly prefer horizontal labelling systems for compact packaging lines requiring efficient and consistent labelling. The growing demand for automation in small and medium enterprises and advancements in servo-driven horizontal systems are expected to propel segment growth during the forecast period.

• By Technology

Based on technology, the wrap around labelling machine market is segmented into automatic and semi-automatic. The automatic segment accounted for the largest market revenue share of 64.8% in 2024 due to its efficiency in high-speed production environments. Automatic wrap around labelling machines offer superior precision, reduced human error, and seamless integration with conveyors and inspection units. Their widespread use in large-scale food and pharmaceutical manufacturing facilities enhances output consistency and operational efficiency. The continuous push for fully automated packaging lines to meet global quality and regulatory standards further fuels segment demand.

The semi-automatic segment is expected to register the fastest growth from 2025 to 2032, owing to its cost-effectiveness and adaptability for small and medium production batches. These machines require limited operator assistance, making them ideal for companies transitioning toward automation without heavy capital investment. Growing adoption among cosmetic and nutraceutical manufacturers, coupled with improvements in ergonomic design and user interfaces, is accelerating the uptake of semi-automatic labelling systems. The segment’s balance of affordability and efficiency positions it as an attractive choice for emerging market players.

• By Dispensing Speed

On the basis of dispensing speed, the market is categorized into up to 20m/min, 20–40m/min, and above 40m/min. The 20–40m/min segment dominated the market in 2024, supported by its suitability for medium to high-speed production lines across food and personal care industries. Machines in this range provide an optimal balance between performance, energy efficiency, and cost, making them a preferred choice for most packaging facilities. Their ability to handle various label materials and container types ensures versatility in application. Growing demand for balanced productivity solutions and precision labelling further reinforces the dominance of this segment.

The above 40m/min segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing automation in large-scale manufacturing environments. These high-speed machines cater to mass production units, particularly in the beverage and pharmaceutical industries, where throughput and accuracy are critical. The integration of advanced motion control technology and servo motors enhances speed without compromising label alignment. As manufacturers pursue production efficiency and reduced downtime, the demand for above 40m/min systems is expected to rise substantially.

• By End-User Industry

On the basis of end-user industry, the market is segmented into food and beverages, healthcare and pharmaceuticals, cosmetics and personal care, electricals and electronics, e-commerce, automotive, homecare, and others. The food and beverages segment dominated the market in 2024, driven by the growing need for attractive product presentation and compliance with stringent labelling regulations. Wrap around labelling machines ensure precise application on bottles, cans, and jars, supporting high-volume production. The segment benefits from the rising consumption of packaged foods and beverages, coupled with brand owners’ emphasis on shelf appeal and product differentiation.

The cosmetics and personal care segment is anticipated to grow at the fastest rate from 2025 to 2032, fueled by increasing demand for premium and customized packaging. These machines offer high flexibility in label design and material, catering to diverse product shapes and aesthetics. Manufacturers in this sector are investing in compact, automated systems to improve line efficiency and maintain consistent branding. The rising popularity of beauty and skincare products, along with rapid expansion of private label brands, continues to propel the demand for advanced wrap around labelling machines in this segment.

Wrap Around Labelling Machine Market Regional Analysis

- North America dominated the wrap around labelling machine market with the largest revenue share of 34.4% in 2024, driven by strong demand for automated packaging solutions across industries such as food and beverages, pharmaceuticals, and personal care

- Manufacturers in the region prioritize efficiency, precision, and compliance with stringent labelling regulations, fueling adoption of advanced labelling systems

- The integration of robotics, vision inspection, and digital control systems further enhances operational performance. High labor costs and the push toward automation have accelerated investments in high-speed wrap around labelling machines across major production facilities

U.S. Wrap Around Labelling Machine Market Insight

The U.S. wrap around labelling machine market captured the largest revenue share in 2024 within North America, supported by the country’s highly automated manufacturing sector and strong presence of packaging equipment manufacturers. Increasing production volumes in beverages, healthcare, and cosmetics sectors have driven demand for precision labelling systems. The shift toward smart packaging and eco-friendly labelling materials also promotes technological upgrades. Furthermore, manufacturers’ emphasis on flexible, high-speed labelling lines for diversified product portfolios contributes to sustained market dominance.

Europe Wrap Around Labelling Machine Market Insight

The Europe wrap around labelling machine market is projected to expand at a significant CAGR during the forecast period, supported by the region’s focus on sustainability, automation, and packaging innovation. The demand for energy-efficient, low-maintenance labelling machines is rising across food, pharmaceutical, and cosmetic industries. Strict EU labelling standards and traceability regulations are encouraging the deployment of advanced automation solutions. The region’s strong manufacturing base and continuous investment in Industry 4.0 technologies further support the adoption of modern labelling systems across production lines.

U.K. Wrap Around Labelling Machine Market Insight

The U.K. wrap around labelling machine market is expected to grow at a notable CAGR from 2025 to 2032, driven by the need for efficient packaging operations in food processing, healthcare, and personal care sectors. The growing demand for sustainable labelling materials and compact, automated machinery supports market growth. The country’s expanding e-commerce and private-label industries further fuel the adoption of high-speed, accurate labelling equipment that ensures product traceability and shelf appeal.

Germany Wrap Around Labelling Machine Market Insight

The Germany wrap around labelling machine market is anticipated to expand steadily during the forecast period, driven by the country’s strong manufacturing infrastructure and preference for precision engineering. High standards for quality control in food, pharmaceuticals, and industrial goods promote the integration of automated labelling machines. Manufacturers in Germany are increasingly adopting modular, IoT-enabled labelling systems that offer flexibility and real-time monitoring. Sustainability goals and demand for efficient, low-waste labelling technologies continue to influence market development.

Asia-Pacific Wrap Around Labelling Machine Market Insight

The Asia-Pacific wrap around labelling machine market is poised to grow at the fastest CAGR from 2025 to 2032, propelled by rapid industrialization, expanding manufacturing capacity, and the rising demand for packaged products. Increasing automation in packaging facilities across China, Japan, and India is significantly boosting adoption. The growth of the FMCG, healthcare, and electronics industries further accelerates market expansion. Government support for smart manufacturing and the presence of low-cost production capabilities position APAC as a key growth hub for labelling machine manufacturers.

China Wrap Around Labelling Machine Market Insight

The China wrap around labelling machine market accounted for the largest share within Asia-Pacific in 2024, driven by large-scale manufacturing operations and rising demand for efficient labelling in food, beverage, and pharmaceutical industries. Strong government initiatives promoting automation and the presence of numerous domestic machinery producers support local production. The expanding export of packaged goods and the growing emphasis on high-speed, accurate labelling systems continue to reinforce China’s market leadership.

Japan Wrap Around Labelling Machine Market Insight

The Japan wrap around labelling machine market is witnessing steady growth, supported by advanced technological adoption and a strong focus on precision and quality. The country’s packaging industry emphasizes compact, high-speed systems that cater to both large and small production batches. Growing demand for premium product presentation and automated inspection systems enhances market expansion. In addition, Japan’s commitment to sustainable manufacturing and innovation in machine design continues to drive investments in modern labelling technologies.

Wrap Around Labelling Machine Market Share

The wrap around labelling machine industry is primarily led by well-established companies, including:

- Sidel Group (Italy)

- MULTIVAC (Germany)

- Labeling Machines HERMA (Germany)

- EXCEL PACKAGING SYSTEMS, INC. (U.S.)

- Neostarpack Co., Ltd (Taiwan)

- APACKS (U.S.)

- Pack Leader Machinery Inc. (Taiwan)

- Quadrel (U.S.)

- Arca Etichette S.p.A (Italy)

- ALTECH srl (Italy)

- P.E. LABELLERS S.p.A. (Italy)

- Etipack s.p.a. (Italy)

- Shemesh Automation Ltd. (U.K.)

- Krones AG (Germany)

- Sacmi (Italy)

- KHS Group (Germany)

- ProMach (U.S.)

- Marchesini Group S.p.A. (Italy)

- Novexx Solutions GmbH (Germany)

- Fuji Seal International, Inc. (Japan)

Latest Developments in Global Wrap Around Labelling Machine Market

- In September 2025, HERMA expanded its partnership with a leading U.S. grocery chain to deploy over two dozen of its 752C and 652C wrap-around labelling systems across salad packaging lines. This collaboration strengthens HERMA’s footprint in the North American market by showcasing its ability to provide precision, automation, and high-speed labelling for fresh food applications. The move reflects rising adoption of advanced wrap-around labelling solutions in the food packaging industry, supporting HERMA’s market leadership and driving demand for customizable and efficient labelling systems

- In May 2024, ATS Corporation announced the acquisition of Paxiom Group, a prominent provider of automated packaging and labelling machines. This acquisition expands ATS’s portfolio in the integrated packaging solutions space, including wrap-around labelling technologies. The move enhances ATS’s global market reach and positions the company as a comprehensive provider of automation systems. By combining Paxiom’s packaging expertise with ATS’s automation technology, the deal is expected to accelerate innovation and competitiveness in the wrap-around labelling machine segment

- In March 2024, HERMA US introduced its 152C wrap-around labeller at Pack Expo East, designed for cylindrical containers with tool-free changeovers and high precision. This product launch marks HERMA’s continued innovation in compact, efficient, and flexible labelling equipment. The 152C model’s integration capabilities make it ideal for food, cosmetics, and pharmaceutical industries seeking adaptable automation solutions. Its introduction reinforces HERMA’s presence in the North American market and supports the ongoing shift toward high-speed, low-maintenance labelling technologies

- In February 2023, Sidel Group completed the acquisition of Makro Labelling Srl, an Italian manufacturer specializing in modular labelling systems, including wrap-around machines. This strategic acquisition significantly strengthened Sidel’s labelling machine portfolio and broadened its customer base across the food, beverage, and personal care sectors. The integration of Makro’s expertise in high-precision and modular systems has enhanced Sidel’s competitive edge, positioning it as a major player in the global labelling automation market

- In January 2023, HERMA GmbH launched its high-performance 132M HC wrap-around labeller tailored for pharmaceutical and healthcare products. The machine offers exceptional speed of up to 600 products per minute and supports tool-free format changes, improving efficiency and compliance in regulated packaging environments. This product launch underscores HERMA’s commitment to innovation in precision labelling, reinforcing its dominance in healthcare automation and boosting its market presence amid growing demand for traceable, high-speed labelling systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wrap Around Labelling Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wrap Around Labelling Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wrap Around Labelling Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.