Global X Ray Crystallography Market

Market Size in USD Billion

CAGR :

%

USD

1.04 Billion

USD

2.68 Billion

2025

2033

USD

1.04 Billion

USD

2.68 Billion

2025

2033

| 2026 –2033 | |

| USD 1.04 Billion | |

| USD 2.68 Billion | |

|

|

|

|

X-ray Crystallography Market Size

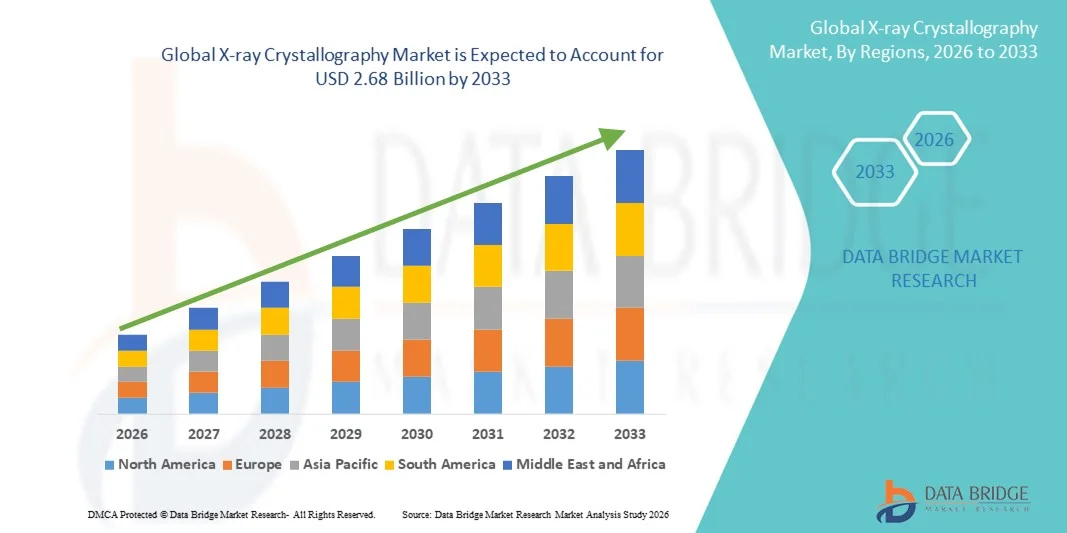

- The global X-ray crystallography market size was valued at USD 1.04 billion in 2025 and is expected to reach USD 2.68 billion by 2033, at a CAGR of 12.5% during the forecast period

- The market growth is largely driven by increasing adoption of advanced analytical techniques in structural biology, pharmaceuticals, and materials science, enabling precise molecular and atomic-level characterization

- Furthermore, rising demand for drug discovery, biomolecular research, and high-throughput crystallography solutions is positioning X-ray crystallography as a critical tool in research and industrial applications. These factors collectively are accelerating the adoption of X-ray crystallography instruments, thereby significantly fueling market expansion

X-ray Crystallography Market Analysis

- X-ray crystallography, a technique for determining the atomic and molecular structure of crystals, is increasingly essential in pharmaceutical development, structural biology, and materials science due to its precision, reliability, and capability to analyze complex molecules

- The growing demand for high-resolution structural analysis, coupled with advancements in automated crystallography systems and software, is driving market adoption across research institutions and industrial applications

- North America dominated the X-ray crystallography market with the largest revenue share of 38.7% in 2025, supported by strong pharmaceutical and biotechnology industries, extensive R&D investments, and the presence of leading instrument manufacturers, with the U.S. leading in the adoption of high-throughput and automated crystallography solutions for drug discovery and protein structure analysis

- Asia-Pacific is expected to be the fastest growing region in the X-ray crystallography market during the forecast period due to increasing investment in life sciences research, expanding pharmaceutical manufacturing, and rising adoption of advanced analytical technologies in countries such as China, Japan, and India

- Instruments segment dominated the X-ray crystallography market with a market share of 45.3% in 2025, driven by their critical role in conducting precise structural analysis, widespread adoption in pharmaceutical and academic research, and continuous technological advancements enhancing throughput and accuracy

Report Scope and X-ray Crystallography Market Segmentation

|

Attributes |

X-ray Crystallography Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

X-ray Crystallography Market Trends

Advancements in Automated and High-Throughput Systems

- A significant and accelerating trend in the global X-ray crystallography market is the growing adoption of automated and high-throughput crystallography systems, which streamline data collection and analysis for complex molecules

- For instance, the Rigaku XtaLAB Synergy-S integrates automated sample handling and advanced data processing software, enabling researchers to analyze multiple crystal samples efficiently

- High-throughput systems reduce manual intervention, minimize errors, and accelerate structural determination, particularly in pharmaceutical and protein research applications

- Integration with AI-powered analysis software allows predictive modeling of crystal quality and optimizes experimental conditions, improving accuracy and throughput

- This trend towards automation and efficiency is driving the development of more sophisticated crystallography instruments, with companies such as Bruker offering robotic sample changers and AI-assisted software for rapid structure determination

- The growing demand for faster, more reliable structural analysis across academic, industrial, and pharmaceutical sectors is rapidly increasing adoption of automated X-ray crystallography systems worldwide

- Increasing collaborations between instrument manufacturers and research institutions are fostering innovation in integrated crystallography solutions, enhancing throughput and usability

- The expansion of cloud-based data analysis and remote operation capabilities is enabling broader access to X-ray crystallography services, particularly for geographically dispersed research teams

X-ray Crystallography Market Dynamics

Driver

Increasing Demand for Structural Analysis in Drug Discovery and Materials Research

- The rising need for precise molecular and atomic-level structural information in pharmaceutical development, protein engineering, and advanced materials research is a key driver of market growth

- For instance, in March 2025, Thermo Fisher Scientific launched an advanced X-ray crystallography platform optimized for high-throughput drug screening, enhancing early-stage drug discovery

- Accurate crystallographic data supports the design of novel therapeutics, validation of protein structures, and discovery of new materials, increasing reliance on X-ray crystallography

- Expanding research activities in biotechnology, pharmaceuticals, and materials science are fueling investment in crystallography instruments, reagents, and related services

- The demand for integrated, efficient, and reliable X-ray crystallography solutions is further amplified by the growth of CROs and academic institutions seeking high-quality structural insights

- These factors collectively contribute to the sustained expansion of the X-ray crystallography market across North America, Europe, and Asia-Pacific

- Rising government funding for life sciences and materials research is creating additional opportunities for adoption of X-ray crystallography instruments and services

- Increasing partnerships between pharmaceutical companies and academic institutions are driving large-scale structural studies, further boosting market demand

Restraint/Challenge

High Instrument Costs and Technical Complexity

- The substantial cost of advanced X-ray crystallography instruments, coupled with the technical expertise required for operation and data interpretation, poses a significant barrier to adoption

- For instance, the high acquisition price of single-crystal X-ray diffraction systems from companies such as Bruker and Rigaku can limit adoption in smaller research labs or budget-constrained institutions

- In addition, complex sample preparation procedures and the need for skilled personnel can hinder efficient utilization of crystallography instruments

- While software and automation are improving usability, training requirements and maintenance costs remain challenging for many potential users

- High costs for reagents, consumables, and maintenance services further increase the total cost of ownership, particularly for institutions in developing regions

- Overcoming these challenges through cost-effective solutions, user-friendly interfaces, and remote operation capabilities will be essential for wider market penetration and sustained growth

- Limited availability of highly purified and well-diffracting crystals can impede experimental success and delay research outcomes

- Regulatory and safety requirements in pharmaceutical and materials research can restrict instrument usage or slow adoption, particularly in highly controlled laboratory environments

X-ray Crystallography Market Scope

The market is segmented on the basis of product type, application, and end-user industries.

- By Product Type

On the basis of product type, the X-ray crystallography market is segmented into instruments, reagents, and services. The instruments segment dominated the market with the largest market revenue share of 45.3% in 2025, driven by the critical role of instruments in conducting precise structural analysis. Instruments such as single-crystal and powder X-ray diffractometers are essential for both academic and industrial research, and their adoption is bolstered by ongoing technological advancements that improve throughput, resolution, and automation. Researchers and pharmaceutical companies prioritize instruments for high-accuracy molecular characterization, which supports drug discovery and materials research. The segment’s dominance is further supported by established manufacturers offering advanced features such as robotic sample handling, AI-assisted analysis, and integration with high-throughput platforms. Overall, instruments remain the backbone of X-ray crystallography workflows across all applications.

The services segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the increasing demand for outsourced structural analysis and contract research. Many academic institutions, startups, and small biotech companies prefer using third-party crystallography services due to high instrument costs, technical complexity, and limited in-house expertise. Services providers often offer end-to-end solutions, including crystal preparation, data collection, analysis, and reporting, which makes them attractive to organizations aiming to accelerate research timelines. In addition, the rise of cloud-based data sharing and remote access to crystallography services is expanding their adoption across global markets.

- By Application

On the basis of application, the X-ray crystallography market is segmented into academic research, industrial, mineralogy & metallurgy, chemicals, pharmaceuticals, and others. The pharmaceutical segment dominated the market with the largest market revenue share in 2025, driven by the critical role of X-ray crystallography in drug discovery, protein structure determination, and quality control. Pharmaceutical companies rely on high-resolution structural insights to design targeted therapeutics, validate molecular interactions, and optimize formulations. The segment also benefits from increasing R&D investments, the rising number of clinical trials, and collaboration between pharma and CROs to accelerate drug development. X-ray crystallography is indispensable for understanding complex biomolecular structures, which directly impacts drug efficacy and safety.

The industrial segment is expected to witness the fastest growth from 2026 to 2033, driven by expanding applications in materials science, nanotechnology, and chemical manufacturing. Industrial users require precise structural characterization to develop advanced materials, catalysts, and polymers with specific properties. Increasing adoption of automated and high-throughput crystallography systems in industrial labs is improving efficiency, enabling rapid material screening, and accelerating product innovation. In addition, government-supported initiatives to promote industrial research and advanced materials development are fueling the segment’s growth globally.

- By End-User Industry

On the basis of end-user industries, the market is segmented into pharmaceutical, life science & biotechnology, hospitals & research laboratories, CROs, and others. The pharmaceutical industry dominated the market in 2025, accounting for the largest revenue share due to the reliance on X-ray crystallography for drug discovery, structural biology, and quality assurance. Pharmaceutical companies invest heavily in advanced instruments and reagents to achieve high-resolution molecular insights, while collaborations with academic institutions and CROs further strengthen market demand. X-ray crystallography supports regulatory compliance, accelerates drug development timelines, and enables the creation of novel therapies, making it indispensable for pharmaceutical R&D.

The CROs segment is expected to witness the fastest growth from 2026 to 2033, as outsourcing structural analysis becomes increasingly cost-effective and practical for pharmaceutical and biotech companies. CROs offer specialized expertise, automated systems, and scalable services that allow clients to reduce infrastructure costs and accelerate research projects. Growing pharmaceutical outsourcing trends, coupled with increasing global demand for high-throughput and reliable crystallography services, are contributing to the rapid adoption of CROs. This segment is further bolstered by emerging markets where local CROs provide access to advanced crystallography capabilities without the need for large capital investments.

X-ray Crystallography Market Regional Analysis

- North America dominated the X-ray crystallography market with the largest revenue share of 38.7% in 2025, supported by strong pharmaceutical and biotechnology industries, extensive R&D investments, and the presence of leading instrument manufacturers, with the U.S. leading in the adoption of high-throughput and automated crystallography solutions for drug discovery and protein structure analysis

- Researchers and institutions in the region prioritize high-resolution structural analysis for drug discovery, protein engineering, and materials research, supporting strong demand for advanced X-ray crystallography instruments and services

- The widespread adoption is further supported by the availability of cutting-edge laboratories, skilled scientific workforce, and early adoption of automated and high-throughput crystallography systems, establishing North America as a key hub for both academic and industrial applications

U.S. X-ray Crystallography Market Insight

The U.S. X-ray crystallography market captured the largest revenue share of 82% in 2025 within North America, fueled by strong pharmaceutical and biotechnology R&D activities and the presence of leading instrument manufacturers. Academic and industrial research institutions are increasingly adopting automated and high-throughput X-ray crystallography systems for drug discovery, protein structure analysis, and materials research. The growing trend of outsourcing crystallography services to CROs is also supporting market expansion. Furthermore, integration with AI-assisted analysis software and cloud-based data management is enhancing operational efficiency and accelerating adoption. Robust government funding for life sciences research further strengthens the U.S. market’s dominance.

Europe X-ray Crystallography Market Insight

The Europe X-ray crystallography market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing investments in pharmaceutical R&D, life sciences research, and materials characterization. Stringent regulatory standards for drug development and quality control are fostering the adoption of high-precision crystallography instruments and services. Growing urbanization, coupled with the demand for advanced analytical solutions, is supporting uptake across both academic and industrial applications. European researchers are also increasingly leveraging automation and remote data analysis capabilities. The region is witnessing significant growth across pharmaceutical, chemicals, and materials research applications.

U.K. X-ray Crystallography Market Insight

The U.K. X-ray crystallography market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of structural biology research and pharmaceutical innovation. The increasing need for high-resolution molecular characterization in drug discovery and academic studies is propelling instrument and service adoption. In addition, collaborations between universities, CROs, and pharmaceutical companies are expanding market reach. The U.K.’s advanced infrastructure, coupled with strong government support for life sciences, encourages investments in automated and high-throughput crystallography platforms. Remote access and cloud-based data analysis solutions are further enhancing operational efficiency and accessibility.

Germany X-ray Crystallography Market Insight

The Germany X-ray crystallography market is expected to expand at a considerable CAGR during the forecast period, fueled by strong focus on pharmaceutical and materials research and a highly developed industrial base. German research institutions and industries are increasingly adopting automated and high-precision instruments to enhance productivity and ensure regulatory compliance. The integration of crystallography with advanced data analysis software is facilitating more accurate structural determination. Germany’s emphasis on innovation and sustainability promotes the use of environmentally efficient and technologically advanced solutions. Residential, industrial, and academic research facilities are driving demand for reliable and high-throughput X-ray crystallography platforms.

Asia-Pacific X-ray Crystallography Market Insight

The Asia-Pacific X-ray crystallography market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing pharmaceutical and biotechnology research investments in countries such as China, Japan, and India. Rapid urbanization, growing life sciences R&D infrastructure, and government initiatives promoting digitalization are supporting market adoption. The region is also emerging as a manufacturing hub for crystallography instruments and reagents, improving affordability and accessibility. Expanding CRO services and collaboration between academic institutions and industry players are accelerating the use of X-ray crystallography in drug discovery, materials science, and chemical research.

Japan X-ray Crystallography Market Insight

The Japan X-ray crystallography market is gaining momentum due to the country’s advanced research culture, strong pharmaceutical industry, and focus on high-precision analytical instruments. Researchers increasingly adopt automated and AI-assisted crystallography systems for structural biology and materials research. Integration with other laboratory technologies and IoT-enabled instruments is enhancing efficiency and workflow. Government initiatives supporting scientific research and funding for life sciences further drive growth. The aging population and demand for precision medicine are also encouraging adoption across pharmaceutical and clinical research applications.

India X-ray Crystallography Market Insight

The India X-ray crystallography market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid expansion of pharmaceutical and biotechnology research facilities and increasing investments in advanced laboratory infrastructure. India’s growing middle-class research workforce and rising urbanization support adoption of automated and high-throughput crystallography instruments. Collaborations with global CROs and academic institutions further enhance market growth. The emergence of local instrument manufacturers and service providers is improving affordability and accessibility. Government initiatives promoting scientific research and pharmaceutical innovation are also key factors driving market expansion in India.

X-ray Crystallography Market Share

The X-ray Crystallography industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- ARINAX SAS (France)

- Bruker Corporation (U.S.)

- Calibre Scientific, Inc. (U.S.)

- Charles River Laboratories (U.S.)

- Hitachi High‑Tech Corporation (Japan)

- HUBER Diffraktionstechnik GmbH & Co. KG (Germany)

- Intertek Group plc (U.K.)

- MiTeGen LLC (U.S.)

- Nippon Kayaku Co., Ltd. (Japan)

- Olympus Corporation (Japan)

- PerkinElmer (U.S.)

- Rigaku Corporation (Japan)

- Shimadzu Corporation (Japan)

- Spectris plc (U.K.)

- Tecan Trading AG (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- WuXi AppTec Co. Ltd. (China)

- Oxford Instruments plc (U.K.)

What are the Recent Developments in Global X-ray Crystallography Market?

- In January 2024, Bruker Corporation announced the launch of the new D8 Quest X‑ray diffractometer designed for both academic and industrial research applications, featuring a compact footprint and improved data collection performance, making advanced X‑ray crystallography more accessible to laboratories with space constraints

- In August 2023, JEOL Ltd. launched the official XtaLAB Synergy‑ED website to support global researchers, providing applications, analysis data galleries, and resources on electron diffraction structure analysis. The dedicated site helps scientists apply XtaLAB Synergy‑ED technologies to pharmaceuticals, new materials, and broader crystallographic research

- In January 2023, the UK’s National Electron Diffraction Facility was announced at the University of Southampton and University of Warwick, featuring Rigaku XtaLAB Synergy‑ED electron diffractometers to enable structural analysis of nanocrystals previously unattainable by traditional X‑ray techniques. This new facility aims to accelerate materials, pharmaceutical, and chemical research by expanding analytical capability into nanoscale structures

- In April 2023, Rigaku and JEOL jointly launched the XtaLAB Synergy‑ED, a fully integrated electron diffractometer platform that streamlines data collection to structure determination for nanocrystals, enhancing crystallography workflows by combining Rigaku’s HyPix‑ED detector and JEOL’s TEM expertise. This innovative product supports molecular structure analysis of samples too small for conventional X‑ray crystallography, expanding capabilities in pharmaceuticals and materials science

- In May 2021, Rigaku Corporation and JEOL Ltd. jointly launched the XtaLAB Synergy‑ED, an integrated electron diffraction platform that enables crystal structure determination of nanocrystals with a seamless workflow from data collection to structure solution, making advanced crystallographic analysis more accessible to researchers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.