Global X Ray Systems Market

Market Size in USD Billion

CAGR :

%

USD

8.90 Billion

USD

11.29 Billion

2024

2032

USD

8.90 Billion

USD

11.29 Billion

2024

2032

| 2025 –2032 | |

| USD 8.90 Billion | |

| USD 11.29 Billion | |

|

|

|

|

X-Ray System Market Size

- The global X-Ray System Treatment market was valued at USD 8.9 billion in 2024 and is expected to reach USD 11.29 billion by 2032, at a CAGR of 4.0%, during the forecast period

- The increasing global prevalence of coronary artery disease (CAD) and other chronic conditions is significantly boosting demand for advanced diagnostic tools, particularly X-ray systems. As cardiovascular and orthopedic disorders rise worldwide, early detection and minimally invasive intervention are becoming critical components of patient care. X-ray imaging plays a vital role in facilitating real-time visualization during procedures such as angioplasty, stent implantation, and orthopedic surgeries, making it indispensable in modern clinical practice.

X-Ray System Market Analysis

- X-ray systems are a critical component of diagnostic imaging in modern healthcare, playing a pivotal role in accurately identifying and monitoring a wide range of medical conditions. These systems enhance clinical decision-making by enabling precise visualization of internal structures, leading to timely and effective treatment interventions. X-ray technology is widely used across medical specialties including orthopedics, dentistry, cardiology, pulmonology, and emergency medicine, significantly contributing to improved diagnostic accuracy, reduced procedural risks, and better patient outcomes.

- The demand for X-ray systems is fueled by several key factors, including continuous technological advancements (such as digital and portable X-ray units), a rising number of diagnostic procedures, and an aging population with growing chronic disease prevalence. In addition, well-developed healthcare infrastructure and substantial healthcare spending promote the adoption of next-generation imaging technologies across hospitals, diagnostic centers, and ambulatory surgical facilities.

- North America emerges as a leading region in the global X-ray system market due to its advanced medical imaging facilities, strong regulatory standards, and growing preference for non-invasive diagnostic tools. Meanwhile, the United States holds the largest global market share, driven by its high diagnostic imaging volumes, early adoption of cutting-edge radiology solutions, and continued investments in healthcare innovation. The presence of leading manufacturers and a supportive reimbursement framework further accelerates the growth of the X-ray system market in the U.S.

- Globally, the X-ray system market is evolving rapidly with an emphasis on digital transformation, AI-integrated imaging, and portable radiography solutions. The shift toward minimally invasive diagnostics, along with innovations in flat-panel detectors and mobile X-ray units, is fueling market growth—particularly in developed economies like the U.S., where clinical demand for rapid, high-resolution imaging continues to rise. Emerging markets are also witnessing increased adoption due to expanding healthcare access and growing investments in diagnostic infrastructure.

Report Scope and X-Ray System Segmentation

|

Attributes |

X-Ray System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

X-Ray System Market Trends

“Growing Preference for Minimally Invasive and Digitally-Enhanced Diagnostic Imaging”

- A key trend in the global X-Ray System market is the increasing preference for minimally invasive, high-precision diagnostic imaging to support faster, safer, and more accurate clinical decision-making across various medical specialties.

- Digital radiography (DR) systems and flat-panel detectors are gaining momentum due to their ability to deliver high-resolution images with lower radiation doses, faster processing times, and improved workflow efficiency in both inpatient and outpatient settings.

- For instance, next-generation X-ray systems equipped with artificial intelligence (AI) and image enhancement algorithms are offering tailored imaging protocols, automated positioning, and real-time diagnostics—aligning with the healthcare industry's move toward precision medicine and patient-centric care

- The trend is further supported by advancements in mobile and portable X-ray units, which are enabling bedside diagnostics, reducing patient transport risks, and improving accessibility in emergency rooms, ICUs, and rural or home-based care environments.

- Additionally, the integration of digital health tools—such as cloud-based image storage, PACS (Picture Archiving and Communication Systems), and remote radiology platforms—is transforming how X-ray data is shared, interpreted, and utilized, fostering collaboration and accelerating time-to-treatment.

- This shift toward digitally-enhanced, patient-focused diagnostic solutions is reshaping the global X-ray system market, encouraging innovation and adoption across developed and emerging healthcare markets alike.

X-Ray System Market Dynamics

Driver

“Rising Diagnostic Procedures and Technological Advancements”

- The growing volume of diagnostic imaging procedures globally—driven by an aging population, rising prevalence of chronic diseases, and increased demand for early disease detection—is significantly boosting the demand for advanced X-ray systems. These systems play a vital role in various clinical areas such as orthopedics, pulmonology, cardiology, emergency care, and oncology, thereby supporting a wide range of medical interventions.

- Continuous technological advancements in X-ray imaging, such as the transition from analog to digital radiography, integration of artificial intelligence (AI), and innovations in flat-panel detector technology, are enhancing diagnostic precision, reducing radiation exposure, and improving workflow efficiency. These upgrades make X-ray systems more reliable, user-friendly, and accessible in both hospital and outpatient settings.

For instance,

- In September 2024, according to a report by the Radiological Imaging Technology Association (RITA), the integration of AI in digital X-ray systems has shown to reduce diagnostic errors by up to 30%, significantly improving image quality and aiding early disease detection. Additionally, mobile X-ray units equipped with wireless image transmission capabilities are being rapidly adopted in emergency departments and rural clinics.

- As a result, the growing need for faster, safer, and more efficient diagnostic imaging, combined with ongoing digital transformation in healthcare, is prompting providers to invest in next-generation X-ray systems—thereby accelerating the expansion of the global X-ray system market.

Opportunity

“Expansion of Ambulatory Imaging Centers and Tele-radiology Services”

- The rapid growth of ambulatory imaging centers is opening significant opportunities for X-ray system manufacturers. These centers prioritize efficiency, cost-effectiveness, and compact equipment—creating strong demand for portable, digital X-ray systems that support high patient throughput and rapid diagnostics, particularly in outpatient and preventive care settings.

- Additionally, the expansion of tele-radiology services is revolutionizing how X-ray imaging is accessed, shared, and interpreted remotely. Modern X-ray systems that integrate seamlessly with cloud-based platforms and PACS (Picture Archiving and Communication Systems) enable real-time image transfer, remote diagnostics, and second-opinion services—enhancing access to quality care in underserved and rural regions.

For instance,

- In October 2024, a report by the International Society of Radiology highlighted that the global tele-radiology market is expected to grow at over 15% CAGR through 2030, driven by rising demand for diagnostic imaging in remote settings. X-ray systems with wireless image transmission, AI-enabled triaging, and compact form factors are becoming essential tools for mobile clinics and virtual healthcare providers.

- This shift toward decentralized, technology-enabled diagnostic services presents a promising opportunity for X-ray system manufacturers to expand their presence across both developed and emerging markets—meeting the growing need for accessible, fast, and accurate imaging solutions outside traditional hospital environments.

Restraint/Challenge

“High Cost and Accessibility Barriers to Advanced X-Ray Imaging Technologies”

- The high cost of advanced X-ray systems, particularly digital radiography (DR) units and AI-integrated platforms, presents a significant challenge to broader adoption—especially in low- and middle-income countries (LMICs) and resource-constrained healthcare settings. These high upfront equipment costs, combined with ongoing maintenance, calibration, and software upgrade expenses, often limit access to modern imaging infrastructure.

- While digital systems offer superior image quality, faster workflow, and lower radiation exposure compared to analog units, their price differential remains a barrier for many hospitals, clinics, and outpatient centers in rural or economically underserved regions. Consequently, facilities may continue to rely on older, less efficient X-ray technologies, leading to diagnostic delays or reduced image accuracy.

- Operational costs such as staff training, service contracts, radiation safety compliance, and IT integration (e.g., PACS, EHRs) further burden healthcare providers, particularly in smaller institutions or developing nations. Limited radiologist availability and inconsistent electricity supply in some areas also reduce the feasibility of deploying high-end digital systems.

For instance,

- A 2024 WHO diagnostic report noted that the cost of installing a fully digital X-ray suite can exceed USD 250,000, excluding recurring software licensing and IT infrastructure costs—making it unaffordable for many public hospitals in sub-Saharan Africa and South Asia.

- According to a March 2024 market update by GE HealthCare, disparities in healthcare infrastructure funding and digital readiness across regions continue to limit the penetration of next-generation X-ray systems, despite growing global demand for imaging services.

- These financial and infrastructural constraints create a divide in diagnostic capabilities between high-income and lower-income settings. Addressing these issues through scalable pricing models, portable system innovations, public-private partnerships, and increased funding for healthcare infrastructure will be critical to achieving equitable access and sustainable market growth.

X-Ray System Market Scope

The market is segmented on the product type, modality, technology, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Modality |

|

|

By Technology |

|

|

By Application |

|

|

By End Users |

|

In 2025, the Digital Radiography (DR) Segment is Projected to Dominate the Market with the Largest Share in the technology Segment

The Digital Radiography (DR) segment is expected to dominate the Global X-Ray System Market in 2025, capturing the largest market share of approximately 38.7%. This dominance is primarily driven by DR’s superior imaging capabilities, faster processing times, and reduced radiation exposure compared to conventional analog and computed radiography systems. DR systems offer high-resolution imaging, immediate image preview, and seamless integration with PACS and hospital information systems, which significantly enhance clinical workflows and diagnostic accuracy.

Hospitals are Expected to Account for the Largest Share During the Forecast Period in end user segment

In 2025, hospitals are projected to lead the Global X-Ray System Market, accounting for the largest market share of approximately 34.9%. This segment’s dominance is attributed to the growing global incidence of chronic conditions—especially cardiovascular, orthopedic, and pulmonary diseases—which require advanced diagnostic imaging for early detection, intervention planning, and follow-up care.

Hospitals and specialized centres are equipped with high-end X-ray systems, including mobile and C-arm units, to support interventional procedures such as angiography, catheter-based treatments, and fluoroscopic imaging. Countries like the United States, Germany, Japan, and China are heavily investing in next-generation radiology infrastructure, integrating AI, 3D imaging, and image-guided intervention systems to improve diagnostic accuracy, procedural safety, and patient outcomes. These facilities continue to drive demand for high-performance, multi-functional X-ray systems in both acute and elective care settings.

X-Ray System Market Regional Analysis

“North America is the Dominant Region in the Global X-Ray System Market”

- North America leads the global X-Ray System market, primarily driven by its advanced healthcare infrastructure, high diagnostic imaging volumes, and early adoption of cutting-edge radiology technologies such as digital radiography (DR), computed radiography (CR), and mobile X-ray units.

- The United States holds the largest market share due to the increasing prevalence of chronic diseases like cancer, cardiovascular, and respiratory conditions, which require timely and accurate diagnostic imaging.

- Strong reimbursement frameworks, extensive healthcare coverage, and robust investments in hospital digitization and AI-enabled diagnostic platforms contribute significantly to market dominance in the region.

- Moreover, the presence of leading market players—such as GE HealthCare, Carestream Health, and Hologic Inc.—combined with continuous R&D efforts and frequent product launches, fosters innovation and widespread adoption of advanced imaging systems in North America

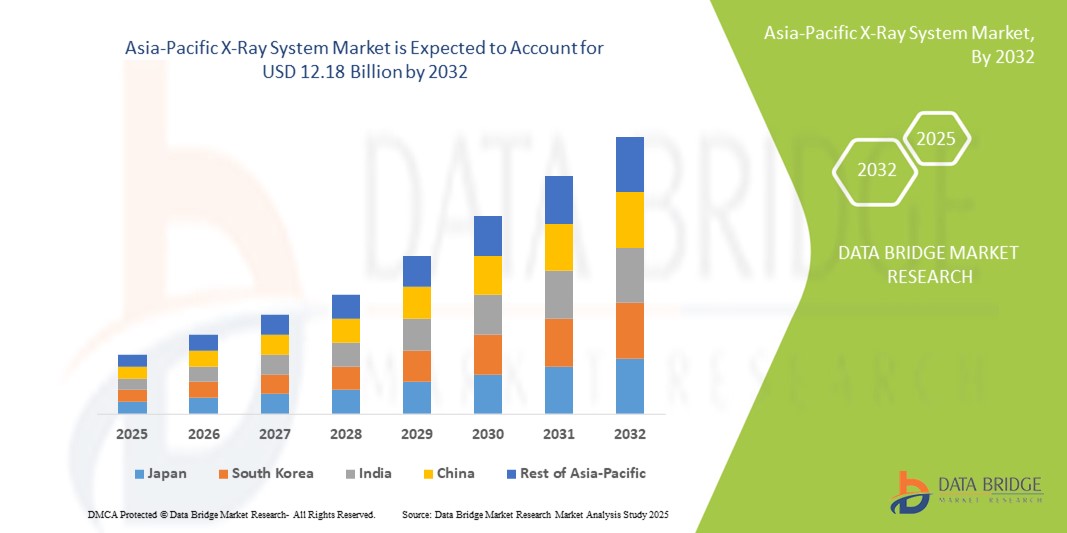

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the fastest growth in the X-Ray System market, fueled by a rising disease burden, increasing diagnostic awareness, and expanding access to imaging technologies in both urban and rural settings.

- Countries like China, India, and Japan are driving this growth due to their large patient populations, growing healthcare expenditures, and strategic focus on improving radiological services.

- Japan, with its sophisticated medical infrastructure and emphasis on early disease detection, remains a key adopter of digital imaging systems, including AI-integrated radiography for oncology and cardiovascular screening.

- In China and India, government healthcare initiatives, public-private partnerships, and the establishment of new diagnostic centers are accelerating the adoption of mobile and digital X-ray systems, particularly in underserved areas.

- Rapid urbanization, increased health insurance penetration, and the growing need for point-of-care diagnostic solutions are expected to further boost the region’s X-ray imaging market over the forecast period.

X-Ray System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Siemens Healthineers AG (Germany)

- GE HealthCare Technologies Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Shimadzu Corporation (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Carestream Health (U.S.)

- Agfa-Gevaert Group (Belgium)

- Hologic, Inc. (U.S.)

- Mindray Medical International Limited (China)

- Samsung Medison Co., Ltd. (South Korea)

- Ziehm Imaging GmbH (Germany)

- United Imaging Healthcare Co., Ltd. (China)

Latest Developments in Global X-Ray System

- In March 2025, Siemens Healthineers unveiled its next-generation MULTIX Impact C ceiling-mounted digital radiography (DR) system in global markets. This system incorporates AI-powered workflow enhancements, automatic image post-processing, and dose reduction technologies aimed at improving imaging precision and efficiency in high-volume clinical settings.

- In January 2025, GE HealthCare received FDA clearance for its Definium 656 HD X-ray system, designed to deliver enhanced image quality using intelligent image chain technology. The system supports advanced connectivity with hospital IT infrastructures and facilitates streamlined diagnostics across emergency and radiology departments.

- In November 2024, Canon Medical Systems Corporation launched its Radrex-i DR system with upgraded AI-enabled auto-positioning features and dose optimization algorithms. The innovation focuses on improving patient comfort and reducing retakes, especially in pediatric and trauma imaging.

- In August 2024, Philips Healthcare announced the commercial rollout of its DuraDiagnost F30, a cost-effective digital X-ray solution tailored for emerging markets. The system offers essential radiography features in a compact footprint, enabling expanded diagnostic access in community hospitals and rural health centers.

- In June 2024, Fujifilm Holdings Corporation introduced its advanced FDR Cross mobile X-ray system in Southeast Asia and Latin America. This dual-functionality platform supports both fluoroscopy and static radiography in a portable format, meeting the growing demand for versatile imaging solutions in point-of-care and critical care environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.