Global Xenon Headlight Market

Market Size in USD Billion

CAGR :

%

USD

33.89 Billion

USD

44.28 Billion

2024

2032

USD

33.89 Billion

USD

44.28 Billion

2024

2032

| 2025 –2032 | |

| USD 33.89 Billion | |

| USD 44.28 Billion | |

|

|

|

|

Xenon Headlight Market Size

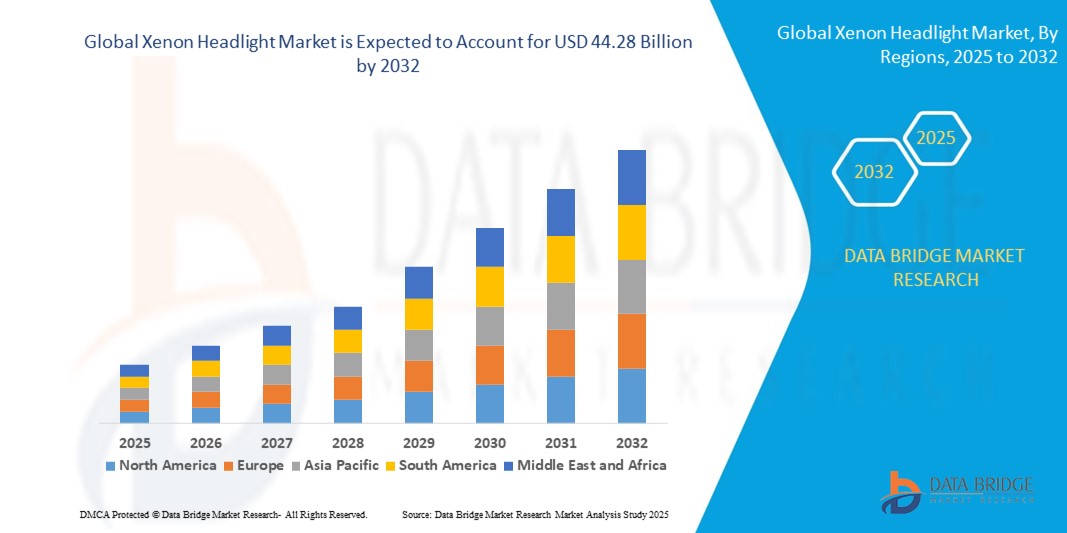

- The global xenon headlight market size was valued at USD 33.89 billion in 2024 and is expected to reach USD 44.28 billion by 2032, at a CAGR of 3.40% during the forecast period

- The market growth is largely fueled by increasing demand for enhanced vehicle safety and visibility, along with ongoing advancements in automotive lighting technology. Xenon headlights provide superior brightness, longer lifespan, and better energy efficiency compared to traditional halogen lights, making them a preferred choice among manufacturers and consumers

- Furthermore, stringent government regulations on vehicle safety and emissions are encouraging automakers to adopt advanced lighting solutions such as Xenon headlights. Growing consumer preference for premium and luxury vehicles equipped with advanced lighting systems is also accelerating market expansion. These factors collectively drive higher adoption rates of Xenon headlights across passenger and commercial vehicles, thereby significantly boosting the industry's growth

Xenon Headlight Market Analysis

- Xenon headlights use high-intensity discharge (HID) technology that produces bright, white light by igniting xenon gas inside the bulb. This results in better road illumination, improved night driving safety, and increased visibility under adverse weather conditions. Xenon headlights are favored for their superior performance, durability, and aesthetic appeal compared to conventional lighting

- The escalating demand for Xenon headlights is primarily driven by the automotive industry’s shift towards energy-efficient and technologically advanced lighting solutions. Consumer awareness about road safety and government mandates for improved vehicle lighting standards are fueling the adoption of Xenon technology. In addition, the rise in vehicle production and aftermarket upgrades further supports the market’s robust growth trajectory

- North America dominated the xenon headlight market with a share of 35.9% in 2024, due to the rapid adoption of advanced automotive lighting technologies and stringent safety regulations

- Asia-Pacific is expected to be the fastest growing region in the xenon headlight market during the forecast period due to rapid urbanization, rising vehicle production, and increasing consumer preference for premium lighting technologies

- Passenger cars segment dominated the market with a market share of 65.5% in 2024, due to the rapid adoption of Xenon headlights in this category due to rising consumer demand for better aesthetics and superior lighting performance. Xenon headlights enhance the overall look of passenger cars while providing brighter, more natural light that improves night driving safety. Automakers increasingly equip mid-range to luxury passenger vehicles with Xenon technology as a standard or optional feature, propelling market growth. The growing replacement market in passenger vehicles also supports the sustained demand for Xenon headlights

Report Scope and Xenon Headlight Market Segmentation

|

Attributes |

Xenon Headlight Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Xenon Headlight Market Trends

Adaptive and Smart Lighting Integration

- Xenon headlight systems are increasingly incorporating adaptive and smart lighting technologies, allowing dynamic control of beam patterns and intensity based on road conditions, vehicle speed, and ambient light, which improves safety and driving comfort

- For instance, manufacturers such as Osram, Philips, and Hella are developing xenon headlights with integrated sensors and electronic control units that support features such as automatic high beam switching, cornering lights, and glare reduction systems, contributing to greater market demand for intelligent lighting solutions

- The adoption of digital lighting platforms enables seamless connectivity with vehicle electronics, facilitating integration with ADAS (advanced driver-assistance systems), traffic sign recognition, and navigation for enhanced visibility in varying environments

- Competition from LED and laser technologies stimulates innovation in xenon systems, leading to hybrid configurations that offer superior illumination, energy efficiency, and longevity for premium and mid-tier automotive segments

- Consumer preference for stylish and high-performance vehicle aesthetics drives demand for xenon headlights, supporting luxury car sales and aftermarket upgrades across major regions, especially in Asia-Pacific, North America, and Europe

- Regulatory initiatives promoting road safety and energy efficiency encourage automakers to deploy advanced xenon headlight technologies, particularly in new vehicle launches and electric vehicles where adaptive lighting integration is increasingly prioritized

Xenon Headlight Market Dynamics

Driver

Growing Automotive Sales

- Rising global automotive sales, particularly in passenger and luxury vehicle segments, accelerate demand for xenon headlights as automakers and consumers seek enhanced safety, reliability, and aesthetic appeal through advanced lighting solutions

- For instance, industry reports show Asia-Pacific holding over 37% market share in xenon lights due to strong automotive production and rising adoption of smart headlight technologies in China, Japan, and South Korea, alongside consistent demand from North America and Europe

- Expanding electric vehicle (EV) production contributes to xenon headlight market growth, as EV manufacturers incorporate premium lighting features to differentiate models and meet consumer expectations for advanced technology

- Growth in vehicle exports, aftermarket upgrades, and regulatory mandates for improved night-driving safety boost market penetration across commercial, passenger, and specialty vehicle categories

- Increasing demand for value-added features in mid-range cars further expands xenon headlight adoption beyond the traditional luxury segment

Restraint/Challenge

High Initial Cost

- The high initial cost of xenon headlight systems—driven by complex manufacturing requirements, integration of adaptive technologies, and the need for specialized components—presents a significant barrier for widespread adoption, especially in price-sensitive markets

- For instance, elevated costs associated with xenon bulbs, ballast modules, and electronic control units push OEMs and consumers to consider alternatives such as LED headlights in budget or entry-level vehicles, limiting xenon penetration in developing regions and cost-conscious segments

- Market competition from rapidly advancing LED designs and emerging laser technologies challenges xenon headlight systems to deliver cost-effective solutions while retaining performance advantages

- Price volatility for raw materials and electronic components can affect margin structures and pricing strategies for xenon lighting manufacturers, particularly when scaling production for global distribution

- Adoption barriers remain in fleet and commercial vehicle segments, where operational costs and maintenance budgets influence headlight technology choices

Xenon Headlight Market Scope

The market is segmented on the basis of component, light type, vehicle type, and sales channel.

- By Component

On the basis of component, the Xenon Headlight market is segmented into bulb, ballast, and igniter. The bulb segment holds the largest market revenue share, driven by its critical role as the primary light-emitting source in Xenon headlights. Bulbs are favored due to their high brightness, energy efficiency, and long lifespan compared to traditional halogen bulbs, making them essential for enhanced visibility and safety in vehicles. The continuous advancements in bulb technology, including improvements in color temperature and light intensity, further boost demand. Moreover, the widespread replacement and maintenance needs for bulbs in both passenger and commercial vehicles sustain steady market growth. The ballast and igniter components, responsible for regulating voltage and ignition respectively, also contribute to system reliability but have smaller shares compared to bulbs.

The ballast segment is expected to witness the fastest growth during the forecast period, owing to technological innovations that improve the ignition process and overall performance of Xenon headlights. Advanced ballasts enhance energy efficiency, reduce flickering, and enable quick start-up times, attracting OEMs aiming to improve vehicle lighting systems. The growing demand for smart and adaptive lighting technologies in vehicles also accelerates ballast adoption, as they play a key role in controlling dynamic light adjustments.

- By Light Type

On the basis of light type, the Xenon Headlight market is segmented into high beam, low beam, and fog light. The low beam segment commands the largest market share, largely due to its essential function in providing clear and safe illumination for regular driving conditions without blinding oncoming traffic. Low beam Xenon lights are preferred for their superior brightness and longer illumination range compared to conventional lighting, enhancing driver safety during night and poor weather conditions. Their compatibility with various vehicle models and integration with advanced driver assistance systems (ADAS) add to their widespread adoption. The demand for low beam headlights is reinforced by stringent vehicle safety regulations globally, which mandate effective low beam performance.

The high beam segment is projected to register the fastest growth rate, driven by increasing consumer preferences for enhanced road visibility in rural and off-road environments. High beam Xenon headlights provide intense, far-reaching light that supports safer driving at high speeds and in poorly lit areas. Continuous improvements in beam focus and automatic switching features contribute to the rising popularity of high beams in newer vehicle models.

- By Vehicle Type

On the basis of vehicle type, the Xenon Headlight market is divided into passenger cars and commercial vehicles. The passenger cars segment holds the dominant market share of 65.5%, largely because of the rapid adoption of Xenon headlights in this category due to rising consumer demand for better aesthetics and superior lighting performance. Xenon headlights enhance the overall look of passenger cars while providing brighter, more natural light that improves night driving safety. Automakers increasingly equip mid-range to luxury passenger vehicles with Xenon technology as a standard or optional feature, propelling market growth. The growing replacement market in passenger vehicles also supports the sustained demand for Xenon headlights.

Commercial vehicles are expected to witness the fastest growth, fueled by the need for enhanced illumination for long-haul and heavy-duty applications. Xenon headlights improve visibility for trucks, buses, and other commercial vehicles operating in diverse conditions, reducing accident risks and improving operational safety. Regulatory pressure to upgrade vehicle lighting in commercial fleets and the rising adoption of advanced lighting solutions contribute to the accelerated growth in this segment.

- By Sales Channel

On the basis of sales channel, the Xenon Headlight market is segmented into OEMs and aftermarket. The OEM segment accounts for the largest market share, supported by the increasing integration of Xenon headlights as original equipment in new vehicle models. OEMs prioritize Xenon lighting technology for its superior performance, energy efficiency, and regulatory compliance, which boosts its inclusion in premium and mid-tier vehicle production lines. The ongoing shift towards advanced vehicle lighting systems as part of smart and electric vehicle trends further strengthens OEM demand. Collaborations between headlight manufacturers and automakers also enhance product innovation and deployment.

The aftermarket segment is anticipated to exhibit the fastest growth, driven by the rising number of vehicles on the road requiring retrofitting or replacement of traditional halogen lights with Xenon headlights. Consumers and fleet operators increasingly seek aftermarket upgrades to improve vehicle safety, aesthetics, and performance at competitive prices. The availability of diverse aftermarket products and growing awareness about the benefits of Xenon headlights accelerate market expansion in this channel.

Xenon Headlight Market Regional Analysis

- North America dominated the xenon headlight market with the largest revenue share of 35.9% in 2024, driven by the rapid adoption of advanced automotive lighting technologies and stringent safety regulations

- The region’s well-established automotive industry, combined with increasing consumer demand for improved vehicle aesthetics and enhanced nighttime visibility, fuels market growth

- High disposable incomes and strong preferences for premium and luxury vehicles equipped with Xenon headlights further support market expansion. In addition, growing awareness about road safety and energy-efficient lighting systems is promoting the replacement of traditional halogen lights with Xenon headlights in both passenger and commercial vehicles

U.S. Xenon Headlight Market Insight

The U.S. Xenon Headlight market captured the largest revenue share in North America in 2024, supported by the widespread presence of major automobile manufacturers and continuous innovations in automotive lighting technology. Consumers increasingly favor vehicles with superior lighting performance for enhanced safety and comfort. The integration of Xenon headlights as standard or optional features in mid-range to luxury vehicles and the growing aftermarket demand for retrofitting older vehicles are key growth drivers. Furthermore, stringent regulatory mandates regarding vehicle lighting standards propel the adoption of Xenon headlights across the country.

Europe Xenon Headlight Market Insight

The Europe Xenon Headlight market is projected to grow steadily, propelled by strict safety regulations and increasing emphasis on vehicle performance and environmental sustainability. The region benefits from a strong automotive manufacturing base, especially in countries such as Germany, France, and Italy, where innovation in vehicle lighting technologies is a priority. Consumers prefer Xenon headlights for their improved brightness and energy efficiency compared to halogen alternatives. The rising demand for electric and hybrid vehicles, which often come equipped with advanced lighting systems, also accelerates market growth. Europe’s focus on reducing vehicle emissions encourages the adoption of energy-efficient lighting such as Xenon.

Germany Xenon Headlight Market Insight

Germany holds a significant share in the European Xenon Headlight market, driven by its leadership in automotive manufacturing and technological innovation. The demand for Xenon headlights is boosted by growing awareness about road safety and advancements in automotive lighting control systems. German automakers continue to incorporate Xenon technology into new vehicle models, focusing on enhancing driver visibility and safety. Government policies encouraging innovation and eco-friendly solutions also stimulate the adoption of Xenon headlights in passenger and commercial vehicles.

Asia-Pacific Xenon Headlight Market Insight

The Asia-Pacific Xenon Headlight market is expected to register the fastest CAGR during the forecast period from 2025 to 2032, driven by rapid urbanization, rising vehicle production, and increasing consumer preference for premium lighting technologies. Countries such as China, Japan, and India are witnessing surging demand due to expanding middle-class populations and growing automotive industries. The rising trend of vehicle modernization and aftermarket upgrades, coupled with government initiatives to improve road safety, supports market growth. Furthermore, Asia-Pacific’s emergence as a manufacturing hub for automotive lighting components makes Xenon headlights more affordable and accessible to a broader consumer base.

China Xenon Headlight Market Insight

China accounted for the largest revenue share in the Asia-Pacific Xenon Headlight market in 2024, fueled by its robust automotive production and growing adoption of smart vehicle technologies. The expanding middle class, increasing disposable incomes, and strong government support for smart and energy-efficient automotive solutions drive demand. China’s focus on electric and hybrid vehicles, which frequently incorporate Xenon lighting systems, further propels market expansion. The presence of numerous domestic manufacturers providing competitively priced xenon headlights enhances market penetration in both new vehicle production and aftermarket segments.

Xenon Headlight Market Share

The xenon headlight industry is primarily led by well-established companies, including:

- HELLA GmbH & Co. KGaA (Germany)

- OSRAM GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Panasonic Holding Corporation (Japan)

- General Electric (U.S.)

- KDGTECH (U.S.)

- Mosobee (Singapore)

- Ushio Inc. (Japan)

- Valeo S.A. (France)

- Stanley Electric Co., Ltd. (Japan)

- Koito Manufacturing Co., Ltd. (Japan)

- Magneti Marelli S.p.A. (Italy)

- Hyundai Mobis Co., Ltd. (South Korea)

- ZKW Group GmbH (Austria)

- Lumileds Holding B.V. (Netherlands)

- HELLA KGaA Hueck & Co. (Germany)

Latest Developments in Global Xenon Headlight Market

- In September 2024, OSRAM showcased its automotive aftermarket portfolio at Automechanika Frankfurt, highlighting advanced xenon lights, LED extra headlights, and innovative workshop tools. The highlight of the exhibition was the OSRAM NIGHT BREAKER LED SPEED H7, which promises to set new standards in automotive lighting performance. This launch reinforces OSRAM’s strong position in the automotive aftermarket by offering products that enhance vehicle visibility and safety, responding to growing consumer demand for superior lighting solutions and increased road safety

- In October 2024, Underground Lighting launched a new line of Xenon/HID headlights designed to significantly enhance vehicle lighting performance, visibility, and driver safety. This upcoming release is poised to strengthen the brand’s presence in the automotive lighting market by providing advanced, durable, and reliable headlight solutions. The introduction of this new product line reflects the ongoing innovation in headlight technology aimed at meeting evolving consumer expectations and regulatory requirements for improved vehicle safety

- In November 2023, XENON Corporation unveiled the X-1100/2x Pulsed Light Research System, an advanced version of its earlier model released in 2016. The system utilizes pulsed xenon light technology to deliver high radiant energy per pulse, enabling breakthrough applications such as single-flash sintering of multilayer copper printed circuits. This innovation expands the application scope of pulsed xenon lighting beyond traditional uses, positioning XENON Corporation at the forefront of technological advancement in industries including sterilization, disinfection, and material processing, thereby driving growth in niche high-tech markets

- In January 2022, XENON Corporation introduced the Compact Integrated Xenon Lamp (CIXL), offering an affordable yet high-energy xenon illumination solution for Pulsed Light technology applications. Targeted at decontaminating food contact surfaces, enhancing food safety, and disinfecting various environments, the CIXL integrates an 11-inch xenon arc lamp with a diffuse reflector and advanced electronics. This product launch expanded the accessibility of pulsed xenon technology to food safety and sanitation sectors, supporting market growth by addressing rising demand for effective, non-chemical decontamination methods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Xenon Headlight Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Xenon Headlight Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Xenon Headlight Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.