Global Yeast Market

Market Size in USD Billion

CAGR :

%

USD

5.94 Billion

USD

2.80 Billion

2024

2032

USD

5.94 Billion

USD

2.80 Billion

2024

2032

| 2025 –2032 | |

| USD 5.94 Billion | |

| USD 2.80 Billion | |

|

|

|

|

Yeast Market Size

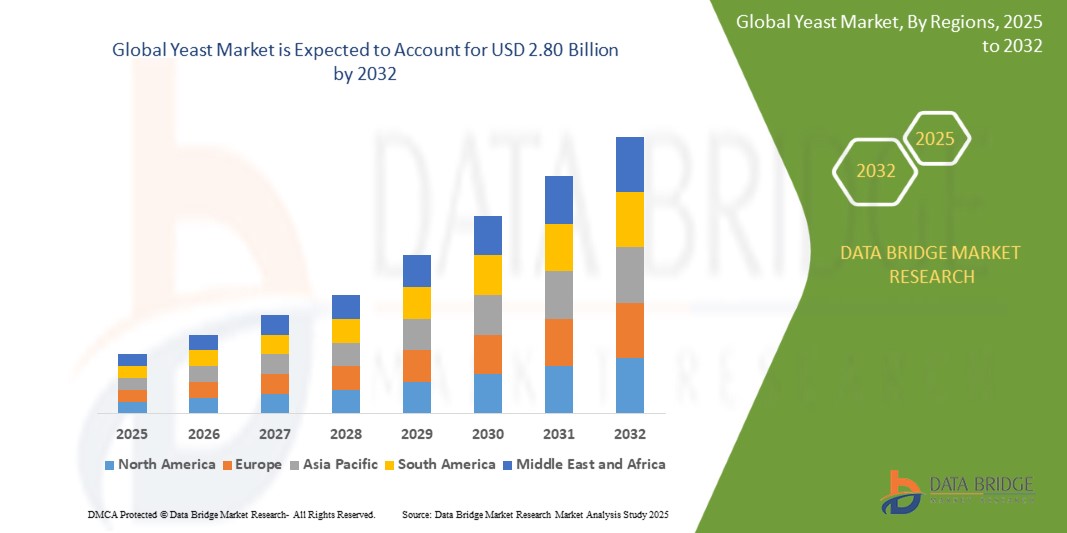

- The global yeast market was valued at USD 5.94 billion in 2024 and is expected to reach USD 2.80 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.70%, primarily driven by increasing demand in the food and beverage sector

- This growth is driven by factors such as the rising popularity of clean-label and organic food products, expanding bakery industry, and increased use of yeast in bioethanol production and animal feed applications

Yeast Market Analysis

- Yeast is a vital microorganism used extensively in various industries including food & beverage, animal feed, bioethanol production, and pharmaceuticals. It plays a crucial role in fermentation processes, especially in baking, brewing, and winemaking

- The demand for yeast is significantly driven by the growing popularity of functional foods, clean-label products, and the rising consumption of bakery and alcoholic beverages. Increased focus on nutritional yeast in vegan and vegetarian diets is also contributing to demand

- The Asia-Pacific region stands out as one of the dominant markets for yeast, driven by its large population base, rising disposable income, and expanding food processing industries

- For instance, countries such as China and India have seen a surge in bakery product consumption and beer production, which is directly fueling yeast demand. Moreover, regional players are actively expanding production capacities to meet both domestic and export demands

- Globally, yeast is regarded as one of the most essential fermentation ingredients in the food and beverage industry, with growing relevance in bioethanol and pharmaceutical sectors due to its role in sustainable and health-focused innovations

Report Scope and Yeast Market Segmentation

|

Attributes |

Yeast Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Yeast Market Trends

“Expansion of Yeast Applications in Nutraceuticals and Bioethanol”

- One prominent trend in the global yeast market is the expansion of yeast applications in nutraceuticals and bioethanol production

- Yeast-derived products, especially nutritional yeast and yeast beta-glucans, are gaining popularity due to their health benefits, including immune system support, gut health improvement, and protein enrichment

- For instance, several food manufacturers are incorporating nutritional yeast into plant-based and fortified food products to cater to the rising demand for vegan, high-protein, and clean-label nutrition solutions

- In the energy sector, yeast-based fermentation is becoming increasingly important for bioethanol production, with governments and energy firms investing in biofuel technologies as part of sustainability initiatives

- This trend is broadening the scope of yeast beyond traditional food and beverage applications, positioning it as a key player in both health-focused and green energy markets, and further stimulating market growth globally

Yeast Market Dynamics

Driver

“Growing Demand for Yeast in Functional Foods and Fermentation Industries”

- The rising demand for functional foods, alcoholic beverages, and clean-label bakery products is significantly contributing to the increased global consumption of yeast

- As health-conscious consumers seek products with enhanced nutritional value, yeast—especially nutritional yeast and yeast extracts—is gaining popularity due to its high protein content, essential amino acids, and natural flavor-enhancing properties

- The use of baker’s and brewer’s yeast continues to rise in bread, beer, and wine production, particularly in emerging economies where urbanization and westernized eating patterns are increasing processed food and beverage consumption

- Ongoing innovation in the food industry is highlighting the need for high-performance yeast strains that improve texture, fermentation efficiency, and shelf-life in a wide variety of products

- In addition, yeast is seeing expanded applications in bioethanol and animal feed production due to its efficiency and sustainability profile

For instance,

- In April 2024, Angel Yeast Co., Ltd. announced the expansion of its yeast extract production facility in Egypt to meet rising global demand in the food, fermentation, and biotech sectors

- In October 2023, Lesaffre launched new yeast-based ingredients for plant-based and fermented foods, aligning with the global surge in alternative proteins and clean-label demands

- As a result of these developments, the demand for yeast continues to rise across multiple sectors, driving market expansion and innovation in yeast-based solutions worldwide

Opportunity

“Expanding Potential of Yeast in Sustainable Agriculture and Biotechnology”

- Yeast-based biotechnologies are emerging as a promising solution in sustainable agriculture and environmental biotechnology, offering opportunities to replace synthetic additives and chemicals with natural, eco-friendly alternatives

- Yeast-derived biofertilizers, biopesticides, and growth-promoting agents are gaining traction due to their ability to enhance soil fertility, improve crop yields, and reduce environmental impact

- In addition, yeast is being increasingly explored for bioplastic production and wastewater treatment, where its metabolic versatility supports the development of green technologies and circular bioeconomy models

For instance,

- In December 2023, Alltech announced the expansion of its yeast-based feed additive lines to address sustainable animal nutrition, improving gut health and reducing reliance on antibiotics in livestock

- In August 2023, researchers at the University of Queensland developed engineered yeast strains capable of producing biodegradable plastics, showcasing their role in reducing reliance on petroleum-based plastics

- The versatility of yeast in both bioprocessing and agricultural applications is unlocking new market segments and revenue streams for manufacturers

- As global industries focus on reducing carbon footprints and embracing sustainable practices, the application of yeast in green technology and biotechnology represents a significant growth opportunity for the global yeast market

Restraint/Challenge

“Volatile Raw Material Prices and Supply Chain Disruptions”

- The yeast industry is highly dependent on raw materials such as molasses, corn, and sugarcane, which are susceptible to price volatility and seasonal fluctuations. This poses a significant challenge for yeast manufacturers in maintaining stable production costs and pricing

- Unpredictable weather conditions, geopolitical tensions, and global supply chain disruptions can lead to raw material shortages, increased procurement costs, and inconsistent supply

- Smaller and mid-sized manufacturers are particularly impacted, as they may lack the resources to hedge against price fluctuations or secure long-term supply contracts

For instance,

- In October 2023, Lesaffre India reported challenges in sourcing molasses due to erratic sugarcane harvests caused by extreme weather events in Maharashtra and Uttar Pradesh, which temporarily disrupted yeast production schedules

- In March 2023, a global rise in corn prices, triggered by drought conditions in the U.S. Midwest and export restrictions in Argentina, significantly increased input costs for yeast producers involved in both food-grade and bioethanol-grade yeast production

- These supply-side challenges not only increase production costs but also limit the ability of producers to scale efficiently, affecting pricing competitiveness and profit margins

- Consequently, ongoing raw material instability and logistical disruptions act as key restraints to the consistent growth and market penetration of yeast products, especially in emerging economies

Yeast Market Scope

The market is segmented on the basis of type, form, application, nature, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Application |

|

|

By Nature |

|

|

By Distribution Channel

|

|

Yeast Market Regional Analysis

“North America is the Dominant Region in the Yeast Market”

- North America holds a dominant position in the global yeast market, driven by a high demand for yeast in the food and beverage sector, particularly for baking, brewing, and fermentation

- The U.S. is a major contributor to the market share, owing to its strong food and beverage industry, increasing demand for functional foods, and growing popularity of plant-based and fermented products

- The well-established food processing industry, along with innovations in yeast-based ingredients for health-conscious consumers, contributes significantly to market growth in the region

- Furthermore, North America benefits from the presence of key yeast producers and suppliers, who focus on technological advancements and sustainable practices, thus boosting market expansion

- The increasing demand for nutritional yeast, probiotics, and the growing trend of vegan and gluten-free diets further strengthen the yeast market in North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global yeast market, driven by rapid industrialization, growing consumer demand for processed and fermented food products, and increased awareness about the health benefits of yeast

- Countries like China, India, and Japan are emerging as key markets due to their expanding food and beverage sectors, particularly in baking, brewing, and bioethanol production

- Japan, with its advanced food processing technologies and strong demand for functional and fermented foods, remains a crucial market for yeast. The country continues to lead in the adoption of innovative yeast-based products in the food and beverage industry

- China and India, with their large populations and increasing demand for food production, are witnessing substantial growth in the yeast market. The growing popularity of fermented food products, such as soy sauce, and the rising demand for nutraceuticals are driving the market expansion in these countries

- In addition, the presence of a large number of global yeast manufacturers and increasing investments in biotechnology for yeast-based innovations further contribute to market growth in the Asia-Pacific region

Yeast Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- dnb (U.S.)

- Conagra Brands, Inc. (U.S.)

- London Dairy (U.K.)

- Danone (France)

- ADM (U.S.)

- Daiya Foods (Canada)

- Grupo Bimbo (Mexico)

- Associated British Foods plc (U.K.)

- General Mills Inc. (U.S.)

- Lantmännen Unibake (Denmark)

- ARYZTA AG (Switzerland)

- Vandemoortele (Belgium)

- Europastry S.A. (Spain)

- Cole’s (U.S.)

Latest Developments in Global Yeast Market

- In October 2024, Lesaffre, a prominent yeast producer, introduced an innovative line of bio-based yeast products. This launch reflects the company's commitment to sustainability by reducing environmental impact while enhancing efficiency in food and beverage production. The new range leverages advanced fermentation technologies to meet the growing demand for eco-friendly solutions in the industry. Lesaffre's initiative aligns with its broader mission to promote healthier and more sustainable food practices globally. These products are designed to cater to diverse applications, ensuring quality and performance without compromising environmental responsibility

- In August 2023, AB Mauri significantly increased its yeast production capacity across North America. This strategic expansion was aimed at addressing the rising demand for yeast products, driven by both industrial-scale operations and the growing popularity of home baking. By enhancing its production capabilities, AB Mauri reinforced its commitment to supporting diverse baking needs while ensuring consistent supply and quality. This initiative reflects the company's dedication to innovation and meeting market demands effectively

- In October 2023, AB Vista, a leading yeast manufacturer, unveiled a groundbreaking yeast strain aimed at improving ethanol production efficiency from corn. This innovative development represents a major step forward in optimizing fermentation processes. The newly designed strain is anticipated to play a pivotal role in advancing sustainable and effective bioethanol production techniques. AB Vista's initiative highlights its commitment to driving innovation and sustainability within the biofuel industry

- In June 2023, Lallemand Biofuels, a division of Lallemand Inc., launched an advanced yeast strain capable of thriving under high-temperature conditions. This breakthrough significantly enhances its utility in bioethanol production, allowing efficient conversion of various feedstocks into bioethanol. The innovation is set to improve the adaptability and effectiveness of biofuel production processes, marking a notable step forward in sustainable energy solutions. Lallemand Biofuels continues to lead in fermentation technology, driving advancements in the biofuel industry

- In January 2022, Lesaffre, a leading name in yeast production, introduced a new line of organic yeast products specifically crafted for the bakery industry. This innovative range addresses the increasing demand for organic ingredients among health-conscious consumers. By launching these products, Lesaffre demonstrated its dedication to sustainability and maintaining high-quality standards in the baking sector. The initiative aligns with the company's mission to promote healthier and more eco-friendly baking practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Yeast Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Yeast Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Yeast Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.