Global Zero Waste Shampoo Market

Market Size in USD Million

CAGR :

%

USD

208.10 Million

USD

344.40 Million

2024

2032

USD

208.10 Million

USD

344.40 Million

2024

2032

| 2025 –2032 | |

| USD 208.10 Million | |

| USD 344.40 Million | |

|

|

|

|

Zero-Waste Shampoo Market Size

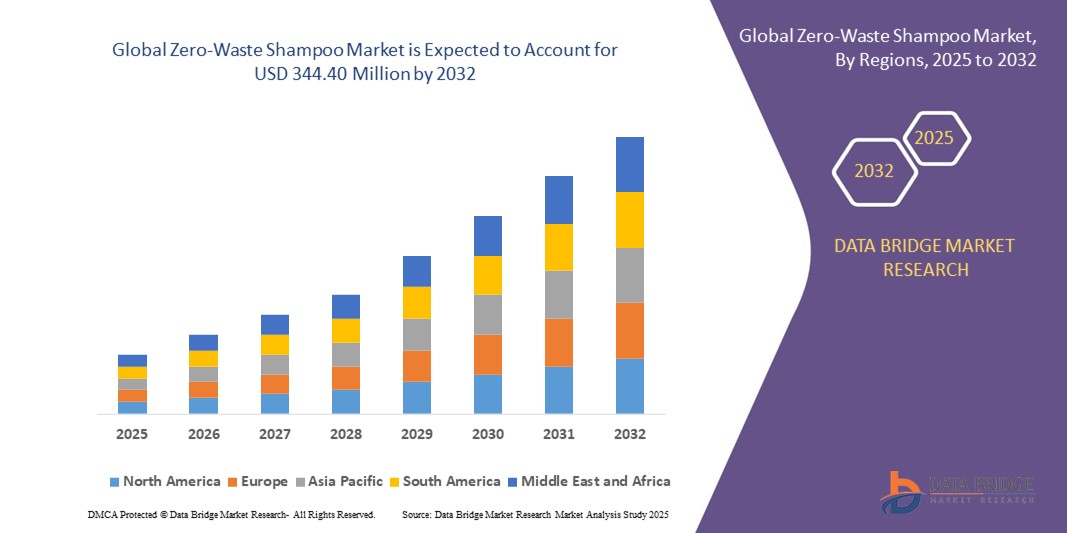

- The global zero-waste shampoo market size was valued at USD 208.10 million in 2024 and is expected to reach USD 344.40 million by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by increasing environmental awareness and consumer demand for sustainable personal care products that reduce plastic waste and promote eco-friendly lifestyles

- Furthermore, the rising preference for natural, chemical-free ingredients combined with innovative packaging solutions such as solid shampoo bars and refillable containers is driving widespread adoption across residential and commercial segments. These converging factors are accelerating the uptake of zero-waste shampoos, significantly boosting the market's expansion

Zero-Waste Shampoo Market Analysis

- Zero-waste shampoos are products designed to minimize environmental impact by eliminating single-use plastic packaging and using sustainable ingredients. They typically include solid shampoo bars and liquid shampoos offered in refillable or compostable packaging, appealing to eco-conscious consumers

- The escalating demand for zero-waste shampoos is primarily driven by increasing consumer focus on reducing plastic pollution, rising regulations on single-use plastics, and growing popularity of clean beauty trends. Convenience, performance, and ethical sourcing also play key roles in enhancing market acceptance across diverse demographics and regions

- North America dominated zero-waste shampoo market with a share of 42.3% in 2024, due to heightened consumer awareness around plastic pollution and growing adoption of sustainable personal care products

- Asia-Pacific is expected to be the fastest growing region in the zero-waste shampoo market during the forecast period due to rapid urbanization, rising environmental consciousness, and increasing disposable incomes in countries such as China, India, Japan, and Australia

- Solid shampoo bars segment dominated the market with a market share of 72.7% in 2024, due to increasing consumer preference for concentrated, water-free formulas that reduce plastic waste. Solid bars are favored for their portability, longer shelf life, and ease of use without the need for conventional plastic bottles. Their minimalist design and eco-friendly appeal strongly resonate with environmentally conscious consumers. Moreover, the growing awareness of harmful chemical ingredients in traditional liquid shampoos is prompting a shift toward natural, solid shampoo options. These bars often come infused with organic ingredients, attracting health- and sustainability-focused users. The rising trend of plastic bans and zero-waste lifestyle adoption further propels the demand for solid shampoo bars

Report Scope and Zero-Waste Shampoo Market Segmentation

|

Attributes |

Zero-Waste Shampoo Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Zero-Waste Shampoo Market Trends

Rising Popularity of Solid Shampoo Bars

- Surge in consumer adoption of solid shampoo bars driven by growing aversion to single-use plastics, heightened sustainability concerns, and the desire for minimalist hair care routines

- For instance, Ethique and Lush Retail Ltd. have pioneered the development and large-scale commercialization of solid shampoo bars, providing eco-conscious alternatives that eliminate the need for plastic packaging and leverage biodegradable materials, influencing mainstream beauty industry practices

- Expansion in travel-friendly, compact personal care products encourages trial and repeat purchases as consumers seek portability and convenience. Solid bars, powders, and concentrates dominate the trend with high concentration formulas that minimize material use, incentivizing innovation among leading brands

- Rising demand for natural and organic ingredients in shampoo bars appeals to health-conscious buyers, propelling product innovation in herbal, cruelty-free, and vegan formulations. Leading brands incorporate botanicals and non-toxic components that cater to diverse consumer needs and ethical standards

- E-commerce growth and strategic online promotions are facilitating access to varied zero-waste shampoo options globally, supporting direct-to-consumer marketing for emerging brands and niche products. Subscription services and online partnerships enhance market penetration and foster brand loyalty

- Government policies restricting plastic usage, especially in developed regions, continue to stimulate product launches, collaboration, and market uptake for plastic-free hair care. Regulatory pressure supports the adoption of biodegradable and compostable packaging, shaping industry direction towards sustainability

Zero-Waste Shampoo Market Dynamics

Driver

Increasing Environmental Awareness

- Heightened awareness of adverse environmental impacts from plastic waste and chemical-laden cosmetics motivates widespread consumer preference for eco-friendly zero-waste shampoo solutions. Consumer activism and “conscious consumerism” create powerful market drivers

- For instance, Plaine Products, HiBAR, and Rocky Mountain Soap are scaling production of refillable, recyclable, and solid-format shampoos that address environmental concerns, supported by regional regulatory mandates on sustainable packaging and prominent consumer campaigns

- Growing interest in cleaner lifestyles propels market demand for shampoos formulated with organic, non-toxic, and locally sourced ingredients. Eco-certifications and ethical sourcing increase the appeal of leading products

- Businesses are investing in R&D to elevate product efficacy and environmental stewardship, responding to millennial and Gen Z consumer priorities. Innovative product design focuses on concentrated bars, refillable bottles, and compostable pouches to minimize waste

- Industry collaboration with eco-certification bodies strengthens consumer trust and market positioning of sustainable brands. Mergers and acquisitions help established players acquire innovative start-ups, expanding product portfolios and accelerating market growth

Restraint/Challenge

Limitation in Product Variety

- The zero-waste shampoo market faces challenges in offering diversified products for all hair types, conditions, and fragrances, as solid and refillable options may lack the variety found in conventional shampoos. Formulation constraints can limit appeal across broader demographics

- For instance, small and medium-sized players such as Oregon Soap Company and Beauty and the Bees encounter formulation constraints when attempting to match the performance, lather, and specialty care of liquid shampoos, limiting consumer choice and affecting market penetration

- Variability in efficacy and hair compatibility can impact consumer satisfaction, leading to lower repurchase rates among users unfamiliar with solid shampoo formats. Consumer education and trial initiatives are critical to promote adoption among new users

- The need for educating the market about proper use, benefits, and expectations for zero-waste shampoos presents a barrier to widespread adoption. Misconceptions or resistance to change can hinder growth in mainstream segments

- Accessibility issues in certain geographies slow market expansion, as retail and supply chain adjustments lag behind demand for novel zero-waste products. Distribution channels and regulatory environments vary, influencing regional penetration rates and consumer adoption

Zero-Waste Shampoo Market Scope

The market is segmented on the basis of product type, packaging material, distribution channel, and end user.

- By Product Type

On the basis of product type, the zero-waste shampoo market is segmented into solid shampoo bars and liquid shampoos in refillable or sustainable packaging. The solid shampoo bars segment dominated the largest market revenue share of 72.7% in 2024, driven by increasing consumer preference for concentrated, water-free formulas that reduce plastic waste. Solid bars are favored for their portability, longer shelf life, and ease of use without the need for conventional plastic bottles. Their minimalist design and eco-friendly appeal strongly resonate with environmentally conscious consumers. Moreover, the growing awareness of harmful chemical ingredients in traditional liquid shampoos is prompting a shift toward natural, solid shampoo options. These bars often come infused with organic ingredients, attracting health- and sustainability-focused users. The rising trend of plastic bans and zero-waste lifestyle adoption further propels the demand for solid shampoo bars.

The liquid shampoos in refillable or sustainable packaging segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is fueled by increasing innovations in eco-friendly refill stations and reusable packaging systems offered by leading brands. Liquid shampoos provide a familiar user experience while significantly reducing single-use plastic waste through refill models. They appeal to consumers seeking convenience combined with sustainability, especially in urban areas with established refill infrastructure. The availability of biodegradable or compostable packaging materials for liquid shampoos also boosts their adoption. In addition, partnerships between brands and retailers to offer refillable options in supermarkets and specialty stores are expected to accelerate market expansion.

- By Packaging Material

On the basis of packaging material, the zero-waste shampoo market is segmented into compostable packaging, refillable containers, and reusable packaging. The refillable containers segment held the largest market revenue share in 2024, driven by consumer demand for sustainable alternatives that enable repeated use and reduce packaging waste. Refillable containers are gaining traction in both retail and direct-to-consumer models, supported by rising awareness of environmental impact and plastic pollution. These containers often feature durable materials and innovative designs to maintain product quality while encouraging reuse. The growing presence of refill stations in supermarkets and specialty stores enhances accessibility, making refillable packaging a preferred choice among eco-conscious shoppers. Regulatory pushes towards extended producer responsibility also incentivize brands to invest in refillable packaging solutions.

The compostable packaging segment is anticipated to experience the fastest growth from 2025 to 2032. This is fueled by advancements in biodegradable materials and increased consumer demand for packaging that breaks down naturally without harming the environment. Compostable packaging offers an effective solution to the growing plastic waste crisis, particularly among younger consumers and zero-waste advocates. The segment benefits from government initiatives promoting sustainable packaging and stricter regulations on plastic use. Moreover, collaborations between packaging innovators and shampoo manufacturers are driving the development of cost-effective, scalable compostable options. As consumer preference shifts toward fully sustainable product lifecycle solutions, compostable packaging adoption is expected to accelerate rapidly.

- By Distribution Channel

On the basis of distribution channel, the zero-waste shampoo market is segmented into online retail, specialty stores, supermarkets/hypermarkets, and others. The online retail segment dominated the largest market revenue share in 2024, owing to the convenience, wide product variety, and growing consumer inclination toward digital shopping. E-commerce platforms enable niche zero-waste shampoo brands to reach a global audience, often with educational content highlighting sustainability benefits. The pandemic accelerated the shift to online purchases, and customers now prefer home delivery options that reduce their carbon footprint. Subscription models and personalized product recommendations further boost online sales. In addition, the rising number of eco-conscious shoppers and social media-driven brand awareness contribute to the segment’s dominance.

The specialty stores segment is projected to witness the fastest growth during the forecast period. Specialty stores focusing on organic, natural, and zero-waste products offer curated selections, knowledgeable staff, and immersive shopping experiences that appeal to conscious consumers. These stores provide an important platform for emerging and artisanal zero-waste shampoo brands, enhancing consumer trust and product trial rates. The increasing number of wellness and green beauty stores globally supports this growth. Moreover, specialty stores often collaborate with local communities and sustainability initiatives, strengthening their appeal. Their ability to offer refill stations and packaging-free options also makes them a preferred channel for zero-waste shoppers.

- By End User

On the basis of end user, the zero-waste shampoo market is segmented into residential consumers, salons and spas, and hotels and hospitality. The residential consumers segment held the largest market share in 2024, driven by rising awareness of personal environmental impact and growing interest in sustainable lifestyle choices. Increasing penetration of eco-friendly beauty products in households and the influence of social media trends encouraging zero-waste routines fuel demand. Residential consumers seek affordable, effective, and convenient zero-waste shampoo options that align with their values. The expansion of refill stations and availability through multiple retail channels also supports widespread adoption. Furthermore, millennials and Gen Z, who prioritize ethical consumption, form a significant portion of this segment.

The salons and spas segment is expected to register the fastest growth rate from 2025 to 2032. This is driven by the professional adoption of zero-waste shampoos as part of sustainable business practices and rising consumer demand for green beauty services. Salons and spas are increasingly incorporating eco-friendly product lines to attract environmentally conscious clients and differentiate their services. The shift toward refillable bulk products and reduced single-use packaging also offers cost benefits for businesses. In addition, hotels and hospitality sectors are gradually adopting zero-waste shampoo options to meet sustainability goals and improve brand image, but salons and spas remain the fastest growing end user segment due to direct consumer engagement and service customization.

Zero-Waste Shampoo Market Regional Analysis

- North America dominated the zero-waste shampoo market with the largest revenue share of 42.3% in 2024, driven by heightened consumer awareness around plastic pollution and growing adoption of sustainable personal care products

- Consumers in the region prioritize environmentally friendly alternatives and are increasingly shifting toward products that reduce packaging waste. The strong presence of eco-conscious brands, combined with strict regulations on single-use plastics, supports market growth

- In addition, the rise of online retail channels and specialty stores offering zero-waste shampoos is facilitating widespread availability. High disposable incomes and an established culture of sustainable consumption further reinforce the region’s leadership in the market

U.S. Zero-Waste Shampoo Market Insight

The U.S. zero-waste shampoo market accounted for the largest revenue share in North America in 2024, fueled by increasing demand for natural and plastic-free hair care products. Consumers are embracing solid shampoo bars and refillable liquid shampoos to minimize environmental impact. The popularity of subscription services and refill stations enhances product accessibility and convenience. Moreover, collaborations between brands and retailers to promote sustainable packaging initiatives boost market penetration. Growing consumer education on ingredient transparency and waste reduction is also propelling the adoption of zero-waste shampoo products across residential and commercial segments.

Europe Zero-Waste Shampoo Market Insight

The Europe zero-waste shampoo market is projected to expand at a robust CAGR during the forecast period, driven by stringent environmental policies and increasing consumer preference for sustainable beauty products. European consumers value transparency in ingredient sourcing and eco-friendly packaging, which is fostering demand for solid bars and refillable liquids. The region benefits from well-established organic and natural product markets, as well as government incentives promoting zero-waste initiatives. The market growth is supported by rising urbanization, increasing disposable income, and a growing number of specialty stores and eco-friendly retailers.

U.K. Zero-Waste Shampoo Market Insight

The U.K. zero-waste shampoo market is expected to grow at a notable CAGR, driven by strong consumer demand for ethical and sustainable hair care solutions. Rising concerns about plastic pollution and the impact of conventional shampoo packaging are encouraging consumers and businesses to shift to zero-waste alternatives. The country’s expanding network of refill stations and green beauty retailers supports market accessibility. Furthermore, the U.K.’s robust e-commerce infrastructure enables a wide reach for innovative zero-waste shampoo brands. Increasing government campaigns focused on sustainability are also expected to stimulate market expansion.

Germany Zero-Waste Shampoo Market Insight

Germany’s zero-waste shampoo market is anticipated to grow steadily, propelled by heightened consumer environmental awareness and regulatory focus on plastic waste reduction. The demand for refillable containers and compostable packaging is increasing, aligning with Germany’s leadership in sustainability and circular economy initiatives. Consumers show a strong preference for high-quality, natural ingredient formulations combined with eco-friendly packaging. The country’s well-developed retail and specialty store networks further facilitate the adoption of zero-waste shampoos. In addition, corporate sustainability commitments among manufacturers and retailers promote innovation in product offerings.

Asia-Pacific Zero-Waste Shampoo Market Insight

The Asia-Pacific zero-waste shampoo market is expected to register the fastest CAGR between 2025 and 2032, driven by rapid urbanization, rising environmental consciousness, and increasing disposable incomes in countries such as China, India, Japan, and Australia. Government initiatives promoting sustainable consumption and waste management are accelerating market growth. The expanding middle class and growing digital penetration support increased online sales of zero-waste shampoos. In addition, rising demand for natural and organic personal care products is fostering the adoption of solid shampoo bars and refillable liquids across both residential consumers and hospitality sectors.

Japan Zero-Waste Shampoo Market Insight

Japan’s zero-waste shampoo market is growing steadily, influenced by the country’s strong culture of minimalism and eco-conscious living. Consumers increasingly prefer compact, plastic-free shampoo bars that align with sustainable lifestyles. The aging population also drives demand for convenient, easy-to-use products. Integration of zero-waste shampoos into wellness and spa services contributes to market expansion. In addition, Japan’s advanced retail infrastructure, including specialty stores and e-commerce platforms, supports product availability and consumer education on sustainability.

China Zero-Waste Shampoo Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, supported by increasing environmental awareness among urban consumers and government campaigns against plastic pollution. The rise of e-commerce giants offering sustainable personal care products has widened access to zero-waste shampoo options. The country’s growing middle class and rapid urbanization accelerate demand for eco-friendly beauty products, including solid shampoo bars and liquid shampoos in refillable packaging. Moreover, the presence of domestic manufacturers producing affordable zero-waste shampoos helps broaden market penetration across residential and commercial segments.

Zero-Waste Shampoo Market Share

The zero-waste shampoo industry is primarily led by well-established companies, including:

- Ethique (New Zealand)

- Lush Retail Ltd. (U.K.)

- Unilever (U.K.)

- Davines S.p.A (Italy)

- Plaine Products (U.S.)

- Biome (Australia)

- Beauty and the Bees (Australia)

- theearthlingco. (U.S.)

- HiBAR (U.S.)

- J.R. Liggett, Ltd (U.S.)

- Oregon Soap Company (U.S.)

- Rocky Mountain Soap (Canada)

- The Refill Shoppe (U.S.)

- By Humankind, Inc. (U.S.)

Latest Developments in Global Zero-Waste Shampoo Market

- In January 2025, Ethique expanded its presence at Ulta Beauty with a rebranded and enhanced range of high-performance, zero-waste hair care products, including solid shampoo and conditioner bars. This strategic expansion strengthened Ethique’s position in the competitive zero-waste shampoo market by increasing product accessibility through a major beauty retailer. Featuring popular items such as Repairing and Curl-Defining bars alongside new Hydrating Shampoo and Conditioner bars, Ethique reinforced its commitment to clean beauty with vegan, cruelty-free, and sustainably sourced ingredients. The inclusion of coconut oil sourced from a women’s cooperative in Samoa highlights the brand’s ethical sourcing efforts, resonating well with conscious consumers and driving growth in the eco-friendly hair care segment

- In October 2023, Superzero launched its high-performance, zero-waste hair care line at Sephora, introducing solid shampoo and conditioner bars infused with the proprietary 360 Triflex Complex. This launch marked a significant advancement in the zero-waste shampoo market by combining innovative bond-building technology with biome-enhancing botanicals tailored to various hair types. Superzero’s commitment to sustainability through vegan, cruelty-free, and carbon-neutral products positions it strongly among environmentally conscious consumers seeking effective and ethical hair care solutions. Its entry into Sephora’s premium retail network expanded brand visibility and accessibility, driving consumer adoption of plastic-free alternatives in mainstream beauty

- In April 2022, Lush acquired its U.S. partner, a move that significantly boosted its sales by over 80% and reinforced its commitment to revitalizing its UK operations post-pandemic. Valued at USD 145.54 million, this acquisition was strategically funded through property sales and leveraging surplus cash from North American operations. This deal substantially enhanced Lush’s market footprint in the zero-waste shampoo sector by consolidating its distribution channels and increasing brand presence across key regions. The acquisition enabled Lush to accelerate product availability and innovation, strengthening its leadership position in the sustainable personal care market during a period of renewed consumer interest in eco-friendly products

- In 2021, Beauty and the Bees launched a range of zero-waste shampoos, including Bee Shiny for Normal Hair pH-balanced shampoo bar, Frizzy Hair and Scalp pH-balanced shampoo bar, Happy Hemp Seed Oil, and Honey Shampoo Bar. These product offerings positioned the brand as a notable player in the zero-waste shampoo market by catering to diverse hair needs while emphasizing natural ingredients and sustainable packaging. Beauty and the Bees’ focus on pH-balanced and nourishing formulas aligns with consumer demand for effective, environmentally responsible hair care solutions, helping to grow their market share in the eco-conscious segment

- In 2021, Biome introduced zero-waste shampoos such as the Ditch Dandruff biome shampoo bar, Ethique Solid shampoo bar, and Biome Be Unity dry shampoo with Shaker Dark. This diverse range allows Biome to address various consumer concerns such as dandruff control and hair health within the zero-waste framework. By offering innovative, plastic-free shampoo bars and dry shampoo options, Biome taps into the growing trend of sustainable beauty products, expanding its influence in the zero-waste hair care market and appealing to consumers seeking both functionality and eco-friendliness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.