Global Zinc Chloride Market

Market Size in USD Million

CAGR :

%

USD

320.13 Million

USD

418.30 Million

2024

2032

USD

320.13 Million

USD

418.30 Million

2024

2032

| 2025 –2032 | |

| USD 320.13 Million | |

| USD 418.30 Million | |

|

|

|

|

Zinc Chloride Market Size

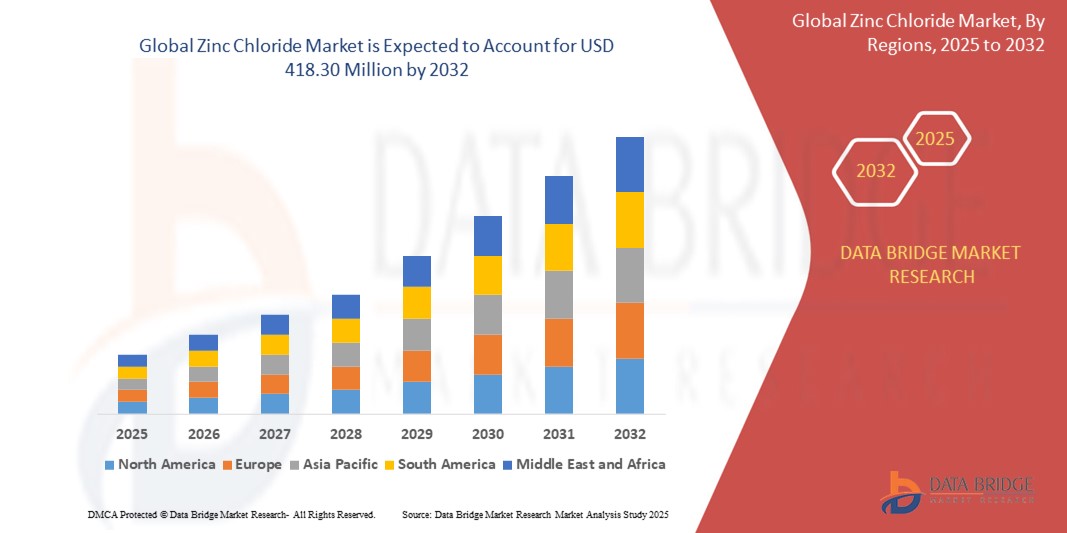

- The global zinc chloride market size was valued at USD 320.13 million in 2024 and is expected to reach USD 418.30 million by 2032, at a CAGR of 3.40% during the forecast period

- The market growth is primarily driven by increasing demand for zinc chloride in battery production, water treatment processes, and as a catalyst in chemical synthesis, fueled by advancements in industrial applications and growing environmental concerns

- In addition, rising adoption in agriculture for fertilizers and in pharmaceuticals for antiseptic and medicinal applications is positioning zinc chloride as a versatile chemical compound, accelerating market expansion

Zinc Chloride Market Analysis

- Zinc chloride, a white crystalline solid or colorless liquid, is a critical chemical used across various industries due to its properties as a catalyst, corrosion inhibitor, and dehydrating agent. Its applications range from dry cell battery production to water treatment and pharmaceutical formulations

- The growing demand for zinc chloride is driven by the rising need for efficient energy storage solutions, particularly in dry cell batteries, increasing environmental regulations promoting water treatment, and expanding agricultural activities requiring zinc-based fertilizers

- Asia-Pacific dominated the zinc chloride market with the largest revenue share of 42.5% in 2023, driven by rapid industrialization, high demand for electronics, and significant agricultural activities, particularly in countries such as China and India

- Europe is expected to be the fastest-growing region during the forecast period, propelled by stringent environmental regulations, advancements in chemical manufacturing, and increasing adoption of zinc chloride in water treatment and pharmaceutical applications

- The battery grade segment dominated the largest market revenue share of 33% in 2024, driven by the rising demand for zinc chloride in battery production, particularly for zinc-carbon and zinc-chloride batteries used in electric vehicles and consumer electronics

Report Scope and Zinc Chloride Market Segmentation

|

Attributes |

Zinc Chloride Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Zinc Chloride Market Trends

“Increasing Integration of Advanced Manufacturing and Eco-Friendly Formulations”

- The global zinc chloride market is experiencing a significant trend toward the adoption of advanced manufacturing techniques and eco-friendly formulations.

- Technologies such as continuous flow reactors are being utilized to enhance production efficiency, reduce costs, and improve the purity of zinc chloride, particularly for high-purity and battery-grade applications.

- These advancements enable more sustainable production processes, aligning with global regulatory pushes for environmentally safe chemical formulations, especially in Europe and North America.

- For instances, companies are developing high-purity zinc chloride for use in advanced battery technologies and pharmaceutical applications, ensuring minimal impurities for high-precision industries.

- This trend enhances the appeal of zinc chloride across diverse applications, making it more attractive to industries such as electronics, pharmaceuticals, and water treatment.

- Advanced analytics are also being employed to optimize production processes, ensuring consistent quality and cost-effectiveness for applications such as catalysts and water treatment chemicals.

Zinc Chloride Market Dynamics

Driver

“Rising Demand for Battery-Grade Zinc Chloride and Sustainable Applications”

- Increasing consumer and industrial demand for energy storage solutions, particularly in dry cell batteries and electric vehicle (EV) applications, is a major driver for the global zinc chloride market.

- Zinc chloride enhances battery performance by offering high conductivity, leak resistance, and up to 50% greater capacity compared to traditional zinc-carbon batteries, making it ideal for consumer electronics and automotive applications.

- Government regulations, especially in Europe with mandates for eco-friendly and sustainable chemical practices, are accelerating the adoption of zinc chloride in battery production and other applications.

- The proliferation of renewable energy technologies and the expansion of the chemical industry, particularly in Asia-Pacific, are further driving demand for zinc chloride in catalysts, water treatment, and agricultural applications.

- Manufacturers are increasingly integrating zinc chloride into production processes for fertilizers, textiles, and pharmaceuticals to meet industry needs for high-performance, sustainable materials.

Restraint/Challenge

“High Production Costs and Toxicity Concerns”

- The significant initial investment required for advanced manufacturing equipment and high-purity zinc chloride production can be a barrier, particularly for small-scale manufacturers in emerging markets.

- Developing eco-friendly and high-purity formulations involves complex processes, increasing production costs and limiting adoption in cost-sensitive regions.

- Toxicity concerns surrounding zinc chloride, including risks of skin irritation, respiratory issues, and environmental impact, pose significant challenges. Strict regulations on handling and disposal, particularly in Europe, further complicate market operations.

- The fragmented regulatory landscape across countries regarding chemical safety and environmental standards creates compliance challenges for international manufacturers and service providers.

- These factors may deter adoption in regions with high environmental awareness or limited budgets, potentially slowing market growth in certain applications

Zinc Chloride market Scope

The market is segmented on the basis of grade, application, form, and end-use industries.

- By Grade

On the basis of grade, the global zinc chloride market is segmented into high purity grade, battery grade, technical grade, and commercial grade. The battery grade segment dominated the largest market revenue share of 33% in 2024, driven by the rising demand for zinc chloride in battery production, particularly for zinc-carbon and zinc-chloride batteries used in electric vehicles and consumer electronics. The increasing adoption of electric vehicles (EVs) and advancements in battery technology further bolster this segment's dominance.

The high purity grade segment is expected to witness the fastest growth rate from 2025 to 2031, with a CAGR of 4.9%. This growth is attributed to its increasing use in pharmaceutical applications, such as anti-inflammatory and analgesic drug formulations, and in high-precision industries such as electronics for producing zinc-carbon batteries, where purity is critical for optimal performance.

- By Application

On the basis of application, the global zinc chloride market is segmented into dry cell batteries, water treatment, catalyst, and others. The dry cell Batteries segment accounted for the largest market revenue share of 35% in 2024, driven by its critical role as an electrolyte in zinc-carbon and zinc-chloride batteries, which are widely used in automotive and consumer electronics applications. The shift toward sustainable battery technologies, eliminating toxic substances such as cadmium and mercury, further supports this segment's growth.

The water treatment segment is anticipated to experience the fastest growth from 2025 to 2031, driven by increasing investments in water purification systems where zinc chloride is used for its flocculant and disinfectant properties. Enhanced environmental regulations and the need for efficient wastewater treatment solutions in industrial and municipal applications are key growth drivers.

- By Form

On the basis of form, the global zinc chloride market is segmented into powder and liquid. The powder segment dominated the market with a revenue share of over 50% in 2024, attributed to its versatility and ease of use in applications such as battery manufacturing, pharmaceuticals, and chemical synthesis. Powdered zinc chloride's high purity and crystallized form make it ideal for large-scale industrial processes.

The liquid segment is expected to witness significant growth from 2025 to 2031, driven by its increasing use in industrial wastewater treatment and corrosion prevention. Liquid zinc chloride's ability to integrate seamlessly into processes such as textile processing and chemical reactions enhances its adoption in specialized applications.

- By End-Use Industries

On the basis of end-use industries, the global zinc chloride market is segmented into electronics, chemical, agriculture, and pharmaceutical. The Electronics segment held the largest market revenue share of 40% in 2024, driven by the widespread use of zinc chloride in battery production and soldering processes for consumer electronics and electric vehicles. The surge in demand for energy storage solutions and high-performance batteries supports this segment's dominance.

The pharmaceutical segment is anticipated to witness the fastest growth from 2025 to 2031, fueled by zinc chloride's role in medicinal formulations, antiseptics, and disinfectants. The expanding healthcare sector, coupled with increasing demand for wound care products and oral hygiene solutions, drives the adoption of zinc chloride in pharmaceutical applications.

Zinc Chloride Market Regional Analysis

- Asia-Pacific dominated the zinc chloride market with the largest revenue share of 42.5% in 2023, driven by rapid industrialization, high demand for electronics, and significant agricultural activities, particularly in countries such as China and India

- Consumers prioritize zinc chloride for its versatility in applications such as battery electrolytes, catalysts in chemical synthesis, and water treatment solutions, particularly in regions with growing industrial and agricultural activities

- Growth is supported by advancements in production technologies, including continuous flow reactors and high-purity manufacturing processes, alongside rising adoption in electronics, pharmaceuticals, and agriculture sectors

U.S. Zinc Chloride Market Insight

The U.S. zinc chloride market is expected to witness significant growth, fueled by robust demand in the electronics and pharmaceutical industries. High-purity zinc chloride is widely used in battery production and chemical synthesis, driven by consumer awareness of energy-efficient solutions and technological advancements. The trend towards sustainable chemical manufacturing and strict environmental regulations further supports market expansion, with both industrial and aftermarket applications contributing to growth.

Europe Zinc Chloride Market Insight

The Europe zinc chloride market is expected to witness the fastest growth rate, supported by stringent environmental regulations and a focus on sustainable industrial practices. Consumers and industries seek zinc chloride for its applications in catalysts, water treatment, and battery production, particularly in countries such as Germany and the U.K. The growth is prominent in both chemical manufacturing and renewable energy sectors, driven by innovations in zinc-based battery technologies and eco-friendly solutions.

U.K. Zinc Chloride Market Insight

The U.K. market for zinc chloride is expected to experience rapid growth, driven by increasing demand in the petrochemical and textile industries. The adoption of zinc chloride in catalysts and water treatment applications is rising due to growing environmental concerns and regulatory emphasis on sustainable practices. In addition, consumer interest in advanced battery technologies for electric vehicles and industrial applications supports market expansion, balancing performance with compliance.

Germany Zinc Chloride Market Insight

Germany is expected to witness the fastest growth rate in the European zinc chloride market, attributed to its advanced chemical and automotive manufacturing sectors. German industries prioritize high-purity and battery-grade zinc chloride for applications in electronics, catalysts, and energy storage solutions. The focus on energy efficiency and reduced carbon emissions drives the integration of zinc chloride in premium battery technologies and sustainable chemical processes, supporting robust market growth.

Asia-Pacific Zinc Chloride Market Insight

The Asia-Pacific region dominates the global zinc chloride market and is expected to maintain its lead, driven by expanding industrial activities and rising demand in countries such as China, India, and Japan. Increasing awareness of zinc chloride’s benefits in dry cell batteries, water treatment, and agricultural applications boosts market growth. Government initiatives promoting sustainable industrial practices and energy-efficient solutions further encourage the adoption of advanced zinc chloride products.

Japan Zinc Chloride Market Insight

Japan’s zinc chloride market is expected to witness significant growth, driven by strong consumer and industrial demand for high-quality, technologically advanced zinc chloride in battery production and chemical synthesis. The presence of major electronics and automotive manufacturers accelerates market penetration, with zinc chloride integrated into OEM and aftermarket applications. Rising interest in sustainable energy storage solutions and high-purity chemical applications further contributes to growth.

China Zinc Chloride Market Insight

China holds the largest share of the Asia-Pacific zinc chloride market, propelled by rapid industrialization, increasing vehicle production, and growing demand for dry cell batteries and water treatment solutions. The country’s expanding chemical and pharmaceutical industries, coupled with a focus on cost-effective and sustainable manufacturing, support the adoption of zinc chloride. Strong domestic production capabilities and competitive pricing enhance market accessibility and growth.

Zinc Chloride Market Share

The zinc chloride industry is primarily led by well-established companies, including:

- Zaclon LLC (U.S.)

- American Elements (U.S.)

- TIB Chemicals AG (Germany)

- Global Chemical Co., Ltd. (South Korea)

- INDO LYSAGHT. Tbk (Indonesia)

- S.A. Lipmes (India)

- Eurocontal (Germany)

- Vinipul Inorganics Private Limited (India)

- Advance Chemical sales corporation (U.S.)

- Suvidhi Group (India)

- Prime Specialities (India)

- Vishnu Priya Chemicals Pvt Ltd (India)

- Indian Platinum Pvt.Ltd. (India)

- Kalyani Chemicals (India)

- Benzer Multitech India Private Limited (India)

- Akme Sons Enterprise (India)

What are the Recent Developments in Global Zinc Chloride Market?

- In June 2024, Hindustan Zinc, India’s largest integrated zinc producer, launched EcoZen, Asia’s first low-carbon ‘green’ zinc product for the global market. Produced using renewable energy, EcoZen has a carbon footprint of less than one tonne of CO₂ equivalent per tonne of zinc, approximately 75% lower than the global average. This launch reflects Hindustan Zinc’s commitment to sustainable production and its goal of achieving net-zero emissions by 2050.In addition, Hindustan Zinc signed a Memorandum of Understanding (MoU) with AEsir Technologies, a U.S.-based battery innovator, to become the primary supplier of zinc for AEsir’s zinc chloride-based battery technologies. This partnership aims to promote high-performance, cost-effective, and long-lasting energy storage solutions, reinforcing zinc’s growing role in the global clean energy transition

- In April 2024, TIB Chemicals AG, a key player in the global chemical industry, successfully completed the renovation and restart of its zinc chloride plant in Ludwigshafen, Germany. This milestone followed several years of modernization efforts aimed at enhancing the plant’s production efficiency, safety standards, and environmental performance. The upgraded facility is now better equipped to meet the growing global demand for zinc chloride, a critical compound used in applications ranging from batteries and catalysts to textiles and water treatment. This investment underscores TIB Chemicals’ commitment to sustainable growth and technological advancement in specialty chemicals

- In February 2024, Sigma-Aldrich introduced a new line of zinc chloride solutions engineered for enhanced stability and high purity, targeting both laboratory and industrial applications. These formulations are designed to meet the stringent requirements of analytical chemistry, catalysis, and materials science, offering consistent performance across a range of conditions. The launch also featured improved packaging solutions to ensure product integrity during storage and transport, reducing contamination risks and extending shelf life. This innovation reflects Sigma-Aldrich’s ongoing commitment to quality, safety, and precision in chemical manufacturing

- In March 2024, Fisher Scientific introduced a new high-purity zinc chloride powder under its Fisher Chemical™ brand. Designed specifically for research and chemical synthesis applications, this product offers ≥97% purity, excellent solubility, and consistent performance across a range of laboratory and industrial processes. The zinc chloride is available in Certified ACS grade, ensuring it meets stringent analytical standards. Enhanced poly bottle packaging helps maintain product integrity by protecting against moisture and contamination, making it ideal for sensitive environments. This launch reflects Fisher Scientific’s commitment to delivering reliable, high-quality reagents for advanced scientific work

- In March 2021, CoastalZinc successfully completed EU REACH registration for its zinc chloride product (CAS No.: 7646-85-7), marking a significant milestone in the company’s commitment to chemical safety and regulatory compliance. This registration under the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) framework ensures that CoastalZinc’s zinc chloride meets the stringent environmental and health standards set by the European Union. It also enables the company to expand its presence in the EU market, supplying high-quality zinc chloride for use in pharmaceuticals, water treatment, personal care, textiles, and metal surface treatment industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Zinc Chloride Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Zinc Chloride Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Zinc Chloride Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.