Global Zinc Sulfate Market

Market Size in USD Billion

CAGR :

%

USD

2.12 Billion

USD

3.79 Billion

2024

2032

USD

2.12 Billion

USD

3.79 Billion

2024

2032

| 2025 –2032 | |

| USD 2.12 Billion | |

| USD 3.79 Billion | |

|

|

|

|

What is the Global Zinc Sulfate Market Size and Growth Rate?

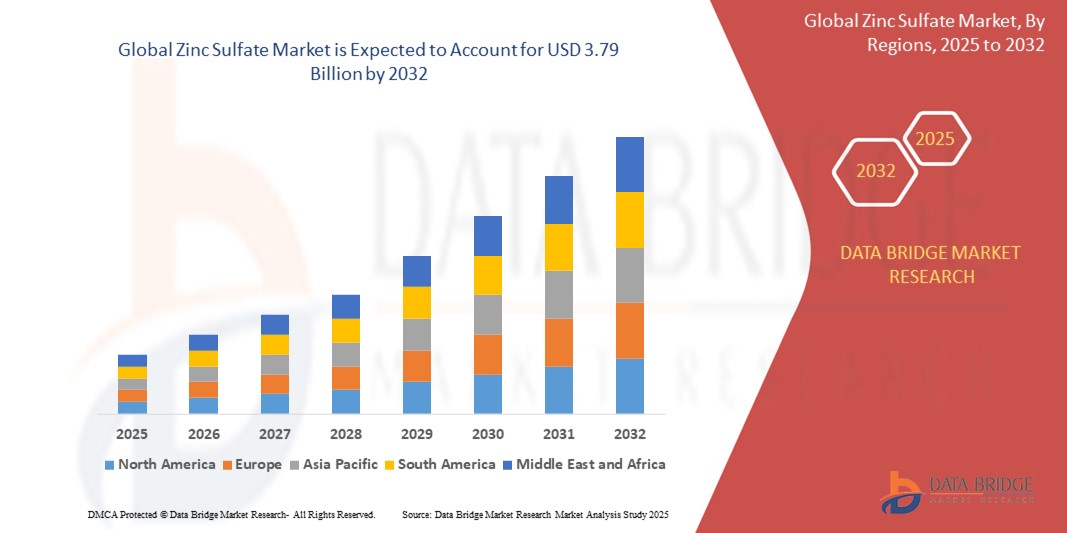

- The global zinc sulfate market size was valued at USD 2.12 billion in 2024 and is expected to reach USD 3.79 billion by 2032, at a CAGR of 7.50% during the forecast period

- The global zinc sulfate market is experiencing notable growth due to its diverse applications across various industries. In agriculture, zinc sulfate is a vital nutrient supplement that addresses zinc deficiencies in crops, enhancing soil fertility and improving crop yields. This drives substantial demand from the agricultural sector as farmers seek to optimize their crop production and soil health

- The industrial sector also contributes significantly to the market. Zinc sulfate uses in manufacturing processes, including the production of rayon, rubber, and other materials, where it serves as a critical raw material are further driving market growth

What are the Major Takeaways of Zinc Sulfate Market?

- Zinc sulfate's role in various manufacturing processes significantly drives market growth. In particular, its use in the production of rayon and rubber is noteworthy. Rayon, a semi-synthetic fiber, relies on zinc sulfate as a critical component in its manufacturing process, contributing to its global demand. Similarly, zinc sulfate is employed in rubber production to enhance the quality and durability of rubber products

- These industrial applications support the market's expansion and underscore the versatility of zinc sulfate across different sectors. As industries continue to grow and evolve, the need for zinc sulfate in these applications is expected to increase, further boosting market demand

- Asia-Pacific dominated the zinc sulfate market with the largest revenue share of 45.7% in 2024, driven by the booming semiconductor and solar-grade polysilicon industries in countries such as China, Japan, and South Korea

- Europe is projected to grow at the fastest CAGR of 9.78% from 2025 to 2032, driven by stringent environmental regulations, green energy initiatives, and increasing demand for localized polysilicon production

- The Zinc Sulfate Monohydrate segment dominated the market with the largest market revenue share of 42.7% in 2024, owing to its high bioavailability and cost-effective production, making it ideal for use in agriculture and animal feed

Report Scope and Zinc Sulfate Market Segmentation

|

Attributes |

Zinc Sulfate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Zinc Sulfate Market?

“Technological Advancements in Polysilicon Production and Green Manufacturing”

- A key trend in the global zinc sulfate market is the advancement in polysilicon production technologies, primarily driven by demand from the solar photovoltaics and semiconductor sectors. Innovations are boosting purity, efficiency, and environmental performance of zinc sulfate used in these processes

- For instance, REC Silicon employs fluidized bed reactor (FBR) technology to produce solar-grade polysilicon using zinc sulfate with lower energy input and minimal waste, while Wacker Chemie AG is optimizing closed-loop systems to recycle by-products and reduce carbon emissions

- The market is witnessing a shift toward green manufacturing, as producers prioritize low-carbon processes and circular resource use. Optimized zinc sulfate production methods are aligning with global decarbonization goals

- Digital tools and smart monitoring systems are also being integrated for real-time control of reaction conditions, further enhancing process sustainability

- Notably, companies such as China National Bluestar and Tokuyama Corporation are investing in eco-friendly zinc sulfate facilities to support expanding solar panel manufacturing

- This trend is expected to reshape the cost-efficiency and environmental compliance of zinc sulfate production, enhancing competitiveness in a low-emission future

What are the Key Drivers of Zinc Sulfate Market?

- The surging demand for solar-grade polysilicon is a key driver, as zinc sulfate serves as a crucial feedstock in silicon refinement for solar panel and semiconductor production

- In October 2023, OCI Company Ltd. announced the expansion of its solar polysilicon plant in Malaysia, driving up the requirement for industrial-grade zinc sulfate

- Rising demand for consumer electronics and the growth of semiconductor fabrication in Asia-Pacific and North America are further boosting zinc sulfate consumption

- National targets and clean energy policies in countries such as China, India, and the U.S. are accelerating investment in photovoltaic capacity, indirectly expanding zinc sulfate usage

- In addition, the trend of regional supply chain localization and the development of new silicon purification plants in the U.S. and Europe is creating sustained demand

- Increased R&D efforts in advanced materials and next-gen semiconductor technologies also support long-term market growth for zinc sulfate in industrial applications

Which Factor is challenging the Growth of the Zinc Sulfate Market?

- A major challenge in the zinc sulfate market is its hazardous chemical nature, posing safety risks during handling, transportation, and production. Zinc Sulfate reacts with water, releasing toxic and corrosive fumes that demand high safety standards

- For instance, in July 2022, a chemical plant fire in China involving zinc sulfate led to regulatory audits and a temporary production halt, highlighting safety vulnerabilities

- Managing these risks requires significant investments in protective infrastructure, advanced equipment, and workforce training, raising entry barriers and operating costs

- Moreover, market dependency on polysilicon demand, which is subject to policy changes and economic cycles, creates revenue uncertainty for zinc sulfate producers

- Environmental regulations are also tightening globally. Producers must implement wastewater treatment, emission controls, and sustainable practices, increasing capital expenditure

- While automation and closed-loop designs are being adopted to address these concerns, such improvements are cost-intensive, particularly impacting small-scale or regional manufacturers

How is the Zinc Sulfate Market Segmented?

The market is segmented on the basis of type, application, and end-user industry.

- By Type

On the basis of type, the zinc sulfate market is segmented into Zinc Sulfate Anhydrous, Zinc Sulfate Monohydrate, Zinc Sulfate Hexahydrate, and Zinc Sulfate Heptahydrate. The Zinc Sulfate Monohydrate segment dominated the market with the largest market revenue share of 42.7% in 2024, owing to its high bioavailability and cost-effective production, making it ideal for use in agriculture and animal feed. Its stability and solubility have made it a preferred choice in both fertilizer formulations and pharmaceutical applications.

The Zinc Sulfate Heptahydrate segment is projected to witness the fastest CAGR of 9.1% from 2025 to 2032, driven by increasing demand from the water treatment and textile industries. This type’s enhanced solubility and crystal structure make it suitable for industrial-scale applications and provide ease of handling during processing.

- By Application

On the basis of application, the zinc sulfate market is segmented into Medicine, Agrochemicals, Chemical, Transportation, Water Treatment, and Synthetic Fibers. The Agrochemicals segment held the largest market revenue share of 38.4% in 2024, attributed to rising global demand for micronutrient-enriched fertilizers and increasing awareness of zinc deficiency in crops. Zinc Sulfate is widely used to improve soil fertility and crop yield, particularly in Asia-Pacific and Latin America.

The Medicine segment is expected to witness the fastest CAGR of 9.6% from 2025 to 2032, owing to growing pharmaceutical applications such as oral rehydration therapy and zinc supplementation. Rising health awareness, an aging population, and increasing demand for over-the-counter zinc-based products are major factors fueling this segment’s growth.

- By End-User Industry

On the basis of end-user industry, the zinc sulfate market is segmented into Healthcare, Agriculture, Chemical, and Synthetic Textile. The Agriculture segment dominated the market with the largest revenue share of 46.9% in 2024, driven by large-scale adoption of zinc-based fertilizers to combat micronutrient deficiencies and enhance crop productivity. The support from government initiatives and subsidies for sustainable farming practices has further fueled this dominance.

The Healthcare segment is projected to register the fastest CAGR of 10.2% from 2025 to 2032, primarily due to increasing use of zinc sulfate in nutraceuticals, immune health products, and therapeutic applications. Growing demand for preventive healthcare and fortified food products globally is expected to propel the segment's rapid expansion.

Which Region Holds the Largest Share of the Zinc Sulfate Market?

- Asia-Pacific dominated the zinc sulfate market with the largest revenue share of 45.7% in 2024, driven by the booming semiconductor and solar-grade polysilicon industries in countries such as China, Japan, and South Korea

- The region benefits from low-cost production, skilled labor, and robust electronics ecosystems. National initiatives for renewable energy and green technology deployment—particularly solar PV further enhance demand

- In addition, investments in high-purity zinc sulfate and favorable regulatory frameworks bolster Asia-Pacific’s dominance, positioning it as a global hub for electronic materials and solar infrastructure

China Zinc Sulfate Market Insight

China led the Asia-Pacific zinc sulfate market in 2024, owing to its stronghold in global solar panel and semiconductor production. Government subsidies, aggressive expansion in domestic polysilicon capacity, and strategic initiatives such as “Made in China 2025” are key growth drivers. Companies such as GCL-Poly and TBEA ensure stable Zinc Sulfate supply through large-scale integration and cost-efficient operations. In addition, China's dominance in rare metals and chemicals allows it to maintain pricing competitiveness, further strengthening its influence in the global zinc sulfate supply chain.

Japan Zinc Sulfate Market Insight

Japan’s zinc sulfate market is advancing steadily, fueled by its innovation-driven electronics and renewable energy sectors. The demand is particularly high for ultra-pure zinc sulfate used in semiconductors and solar-grade polysilicon. Strategic investments by Japanese firms into silicon refinement, coupled with sustainability-focused national energy policies, are enhancing market prospects. Moreover, Japan’s push for energy efficiency, battery storage, and green hydrogen creates secondary growth channels, reinforcing zinc sulfate’s critical role in clean tech applications.

South Korea Zinc Sulfate Market Insight

South Korea is witnessing strong growth in the Zinc Sulfate market, primarily due to its globally competitive semiconductor industry and government-backed solar initiatives. Major manufacturers are scaling up production to meet international quality standards and rising export demand. The government's commitment to energy transition, smart grids, and localized silicon production also drives demand for high-purity zinc sulfate. Technological innovation and research collaboration between academia and industry are enabling South Korea to emerge as a key supplier in the zinc sulfate value chain.

Which Region is the Fastest Growing in the Zinc Sulfate Market?

Europe is projected to grow at the fastest CAGR of 9.78% from 2025 to 2032, driven by stringent environmental regulations, green energy initiatives, and increasing demand for localized polysilicon production. Countries such as Germany and France are investing in solar PV manufacturing to reduce import dependence on Asia. Europe’s shift toward energy sovereignty, circular economy goals, and innovation in semiconductor fabrication are pushing up the demand for high-grade zinc sulfate. EU funding and climate policy frameworks are expected to fuel consistent market expansion.

Germany Zinc Sulfate Market Insight

Germany's zinc sulfate market is thriving due to its leadership in clean energy adoption and domestic polysilicon manufacturing. The demand for eco-friendly, high-purity zinc sulfate is rising as solar PV installations expand. German companies are investing in R&D to develop sustainable and efficient production technologies, aligned with EU decarbonization goals. The growth is further accelerated by policy-driven programs such as the Renewable Energy Sources Act (EEG) and partnerships aimed at reshoring semiconductor and solar supply chains.

France Zinc Sulfate Market Insight

France is emerging as a promising market for zinc sulfate, driven by solar PV growth and national efforts to build local manufacturing capabilities. Public-private collaborations are enabling the development of high-purity materials for renewable and electronic applications. France’s "France Relance" recovery plan supports green industrial projects, including zinc sulfate facilities. In addition, the government’s emphasis on carbon neutrality and energy security is encouraging industrial innovation in the solar-grade silicon segment, making France a vital player in Europe’s Zinc Sulfate landscape.

U.K. Zinc Sulfate Market Insight

The U.K. zinc sulfate market is gaining momentum, supported by investments in advanced electronics, solar energy, and chemical manufacturing. The country’s long-term net-zero strategy has driven demand for high-quality zinc sulfate in green energy and semiconductor applications. R&D initiatives focused on silicon materials and battery technology in collaboration with universities and tech hubs are boosting domestic production. Policy incentives targeting low-carbon manufacturing and strategic materials sourcing further position the U.K. as a growing market for zinc sulfate in Europe.

Which are the Top Companies in Zinc Sulfate Market?

The zinc sulfate industry is primarily led by well-established companies, including:

- Changsha Latian Chemicals Co., Ltd. (China)

- Rech Chemical Co. Ltd (China)

- Tianjin Xinxin Chemical Factory (China)

- Alpha Chemicals Private Limited (India)

- Zinc Nacional (Mexico)

- Ravi Chem Industries (India)

- Balaji Industries (India)

- Tianjin Topfert Agrochemical Co. Limited (China)

- Old Bridge Chemical, Inc. (U.S.)

- China Bohigh (China)

- Changsha Haolin Chemicals Co., Ltd. (China)

- Sulfozyme Agro India Private Limited (India)

- Merck KGaA, (Germany)

- Akrochem Corporation (U.S.)

- Zochem, Inc. (Canada)

- Hindustan Zinc (India)

- Purity Zinc Metals (Canada)

What are the Recent Developments in Global Zinc Sulfate Market?

- In March 2023, Nevada Zinc Corporation announced the successful production of high-quality zinc sulfate monohydrate at its pilot plant facility, which marked a significant progression from its initial small-scale trial started in March 2021. This milestone strengthens the company's position in the specialty zinc chemical market and showcases its ability to scale operations for commercial viability

- In September 2022, Redox obtained the FAMI-QS certification from DNV Business Assurance Australia Pty Limited, highlighting its compliance with global quality and safety standards for feed additives and pre-mixtures. This achievement enhances Redox’s reputation as a reliable supplier of high-quality zinc sulfate in the animal feed industry

- In August 2022, Piramal Pharma’s Critical Care division introduced the first-ever generic Zinc Sulfate Injection in the U.S. market, expanding access to this essential supplement for zinc-deficient patients in hospital settings. The launch supports affordability and availability of zinc-based therapeutics in critical care

- In January 2020, American Regent launched Zinc Sulfate Injection, intended as a trace element for adult and pediatric patients requiring parenteral nutrition due to the lack or inadequacy of oral or enteral intake. This release broadened clinical options for zinc supplementation in medical nutrition therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Zinc Sulfate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Zinc Sulfate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Zinc Sulfate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.