India Building Management System Market

Market Size in USD Million

CAGR :

%

USD

442.98 Million

USD

938.95 Million

2024

2030

USD

442.98 Million

USD

938.95 Million

2024

2030

| 2025 –2030 | |

| USD 442.98 Million | |

| USD 938.95 Million | |

|

|

|

|

India Building Management System Market Size

- The India Building Management System Market is expected to reach USD 938.95 million by 2030 from USD 442.98 million in 2024, growing with a substantial CAGR of 13.4% in the forecast period of 2025 to 2030

- The India Building Management System Market's expansion is propelled by the accelerating demand for cost optimization, operational efficiency, and access to specialized expertise, driven by businesses navigating competitive landscapes and focusing on core competencies

- This growth is further fueled by the integration of innovative technologies like Robotic Process Automation (RPA) for automating routine tasks, Artificial Intelligence (AI) for enhanced analytics and customer service, and cloud-based solutions for scalable and flexible operations. These advancements, coupled with the increasing need for data security and compliance, are particularly expanding segments in intelligent automation, customer experience management, and knowledge process outsourcing

India Building Management System Market Analysis

- India building management system is a commercially available service solution designed to manage and optimize non-core business functions, from customer service and human resources to finance and accounting. These services offer essential cost reduction, enhanced efficiency, and access to specialized expertise, and are a staple across diverse sectors such as finance, healthcare, retail, and technology, satisfying enterprise demand for agility, scalability, and strategic focus in a competitive India landscape

- The growing demand for India building management system is driven by the accelerating pace of digital transformation and the increasing complexity of India business operations and competitive pressures, providing a critical operational backbone for modern enterprises. This demand is further supported by innovations integrated within building management system services, such as Robotic Process Automation (RPA) for automating routine tasks, Artificial Intelligence (AI) for advanced analytics and customer experience management, and cloud-based platforms for flexible service delivery, which enhance efficiency, decision-making, and service quality. The India push for business resilience and operational agility, driven by increasing economic volatility and the need for scalable solutions, coupled with rising investments in digital transformation initiatives in emerging economies, is significantly boosting the adoption of advanced Building Management System services worldwide

- India Building Management System Market is driven by its early adoption of advanced business services, the high concentration of key end-user industries, and significant investments in digital transformation and customer experience. The India, in particular, has emerged as a leader due to its robust technology infrastructure, the presence of major Building Management System vendors, and the pressing need for enterprises to manage complex, globally distributed operations and enhance efficiency

- The products segment is expected to dominate the India Building Management System Market with a market share of 57.53% in 2025, due to increasing demand for digital transformation, enhanced automation tools, and integration capabilities across diverse enterprise platforms

Report Scope and India Building Management System Market Segmentation

|

Attributes |

India Building Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

India |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

India Building Management System Market Trends

“Smart Building Technologies & IoT Integration Drive Next-Gen BMS Adoption”

- The increasing integration of smart building technologies and the Internet of Things (IoT) is a major new market trend for India's Building Management System (BMS) market. This trend is driven by the demand for more intelligent, interconnected, and data-driven building operations that go beyond traditional energy management to encompass predictive maintenance, enhanced security, and superior occupant experiences.

- Consequently, developers and building owners are looking beyond basic control systems to embrace comprehensive platforms that leverage AI, machine learning, and sensor networks to optimize building performance holistically, creating new avenues for advanced BMS solutions and service providers.

- For instance, In November 2024, a leading Indian real estate developer announced a partnership with a global tech firm to implement AI-powered smart BMS across its upcoming commercial projects, focusing on predictive fault detection and personalized climate control.

- In January 2025, the Indian Green Building Council (IGBC) released new guidelines for "Smart Net-Zero Energy Buildings," emphasizing the role of integrated IoT platforms and advanced BMS in achieving high sustainability benchmarks and offering new certification pathways.

- The accelerating adoption of smart building technologies and the deep integration of IoT solutions signify a paradigm shift in India's BMS market.

- This trend is moving beyond basic automation towards intelligent, data-driven ecosystems that offer unprecedented levels of control, efficiency, and occupant comfort. Government initiatives, industry partnerships, and evolving certification standards are actively fostering an environment where advanced, interconnected BMS solutions are becoming central to India's urban development and energy efficiency goals.

India Building Management System Market Dynamics

Driver

“Rising Focus on Energy Efficiency and Building Electrification”

- India has been actively positioning energy efficiency and building electrification as core levers in its efforts to reduce emissions, manage rising energy demand, and meet its climate pledges.

- Buildings, both residential and commercial, are increasingly seen not merely as static consumers of electricity and fuel but as dynamic systems whose design, envelope, services (HVAC, lighting, hot water, etc.), and controls can deliver substantial efficiency gains. With rapid urbanization, rising cooling loads, and increasing appliance ownership, the operational energy use of buildings has become a major driver of electricity demand growth. Policy, regulatory, and institutional reforms are now aligning in India to drive electrification of end‐uses (especially cooling, water heating, etc.), stricter building codes, mandatory energy performance standards, deployment of renewables in buildings, and smart controls building management systems.

- These trends are creating fertile conditions for growth in the India Building Management System Market, as efficiency gains depend heavily on instrumentation, monitoring, control, and optimization, which are often enabled only through digital or automated systems.

For instance,

- In November 2022, GBPN reported that the Energy Conservation (Amendment) Bill, 2022, mandates that the Eco-Niwas Samhita (ENS) (i.e., the residential building energy code) be adopted nationwide, and requires states and municipalities in India to adopt and implement the code

- In April 2025, the Ministry of Power announced, as part of its target of doubling energy efficiency, that it plans to reduce energy consumption by 89 million tonnes of oil equivalent (Mtoe) by 2030. The plan includes the publication of two new building codes: the Energy Conservation and Sustainable Building Code (ECSBC) for commercial buildings, and the Eco Niwas Samhita (ENS) for residential buildings, encouraging states to adopt these frameworks

- In December 2024, the Bureau of Energy Efficiency formally published the Energy Conservation & Sustainable Building Code (ECSBC) 2024 for commercial and office buildings. This code lays down norms and standards not only for energy efficiency of lighting, HVAC, etc., but also for sustainable building requirements

Recent policies show India’s shift from voluntary guidelines to firm-building efficiency regulations. The ENS extension, ECSBC 2024, and net-zero targets embed efficiency into law, while states and local bodies are mandated to enforce higher standards. With ambitious goals like cutting 89 Mtoe by 2030, efficient buildings now require smart HVAC, lighting, and renewables integration, making energy efficiency and electrification key drivers of India’s BMS market.

Restraint/Challenge

“High Upfront Capex for Integrated Bms in Price-Sensitive Mid & Small Commercial Projects”

- While India’s building sector is moving toward digitization and efficiency, the high upfront Capital Expenditure (CAPEX) of integrated Building Management Systems (BMS) remains a major barrier for mid-sized and small commercial projects.

- Unlike large-scale corporate campuses, malls, or hyperscale data centers that can absorb such costs, smaller offices, retail complexes, and community infrastructure often operate in a price-sensitive environment.

- The cost of advanced automation hardware, software integration, and skilled installation can be prohibitive, especially where margins are tight and return on investment is longer term. This leads many projects either to adopt partial systems (like standalone HVAC or lighting controls) or to avoid BMS altogether. Despite long-run operational savings, affordability challenges persist, slowing the widespread adoption of BMS across India’s diverse commercial building stock.

- For instance, In February 2023, NITI Aayog published an annual report, noting that energy-efficient and smart building systems are under-adopted by smaller players because of higher capital costs and inadequate credit access

- In May 2025, Small Industries Development Bank of India reported that although MSMEs are increasingly interested in adopting green technologies, high initial investment costs and limited awareness continue to slow uptake in commercial sectors

- In May 2025, The Times of India reported that Chandigarh’s Energy Management Cell observed that while large government buildings achieved higher star ratings, smaller offices and private commercial complexes lagged behind due to budget constraints and high installation costs

- The evidence from NITI Aayog, SIDBI, and Chandigarh’s Energy Management Cell shows that high upfront costs and financing gaps remain the key restraints for adopting energy-efficient systems and integrated BMS in India’s mid and small commercial sector. Smaller players struggle with limited credit access and cost awareness, while larger government projects progress faster. Unless targeted subsidies, financial instruments, or incentive programs reduce the initial burden, mid-sized and smaller commercial projects will continue to lag in adopting BMS despite proven long-term efficiency benefits.

Oppurtunity

“Retrofitting Legacy Buildings Unlocks Large-Scale Energy Savings Potential”

- Retrofitting India’s existing building stock represents a principal opportunities for the Building Management System (BMS) market because upgrading building services and controls in legacy structures enables measurable reductions in operational energy demand while enhancing occupant comfort and asset value;

- consequently, owners and public authorities are increasingly prioritizing comprehensive retrofit programmes that create clear procurement pathways for integrated BMS solutions, performance contracting, and lifecycle services.

- For instance, In September 2023, as per Energy Efficiency Services Limited, it reported widespread implementation of energy-efficiency retrofit measures across government and commercial facilities and documented cumulative achievements in retrofitting public buildings as part of its large-scale building-sector interventions

- The policy momentum, regulatory updates, and large-scale implementation programs initiated by national and state agencies demonstrate that retrofitting India’s vast stock of legacy buildings is no longer a marginal activity but a structured priority within the country’s energy-transition agenda

- This alignment of public policy with market demand positions retrofitting as a central driver for sustained growth in the Indian BMS sector, offering long-term opportunities for technology providers, integrators, and service companies

India Building Management System Market Scope

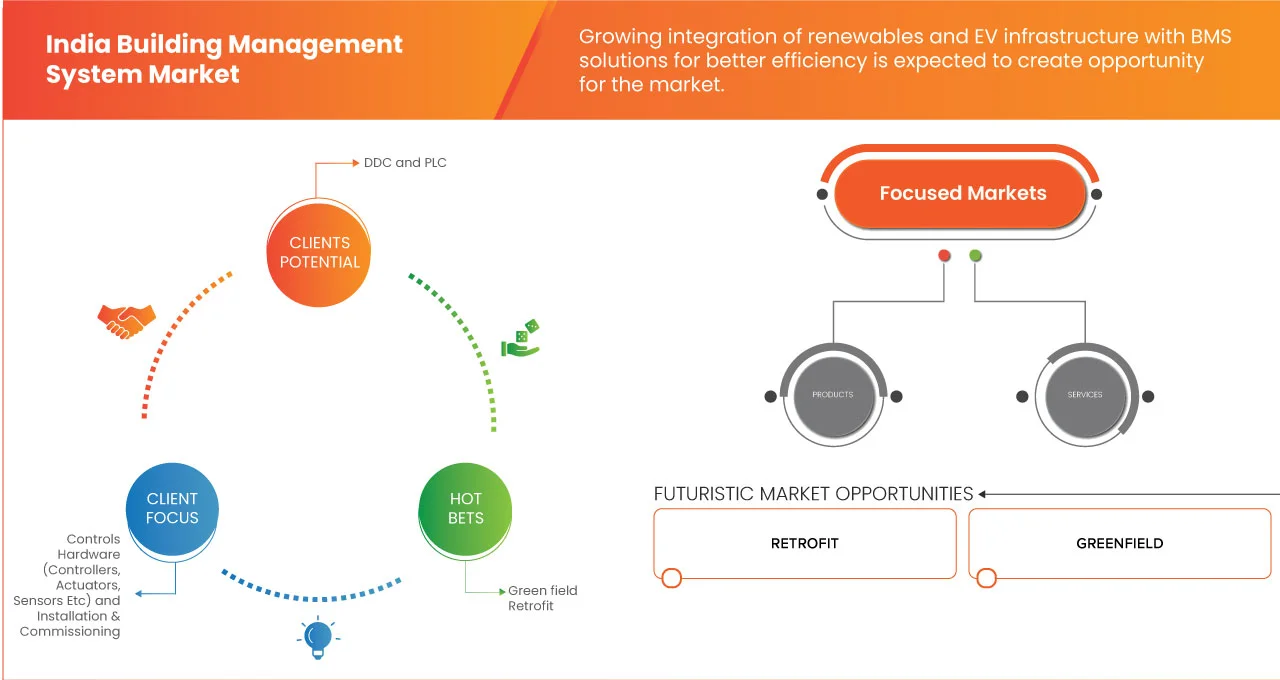

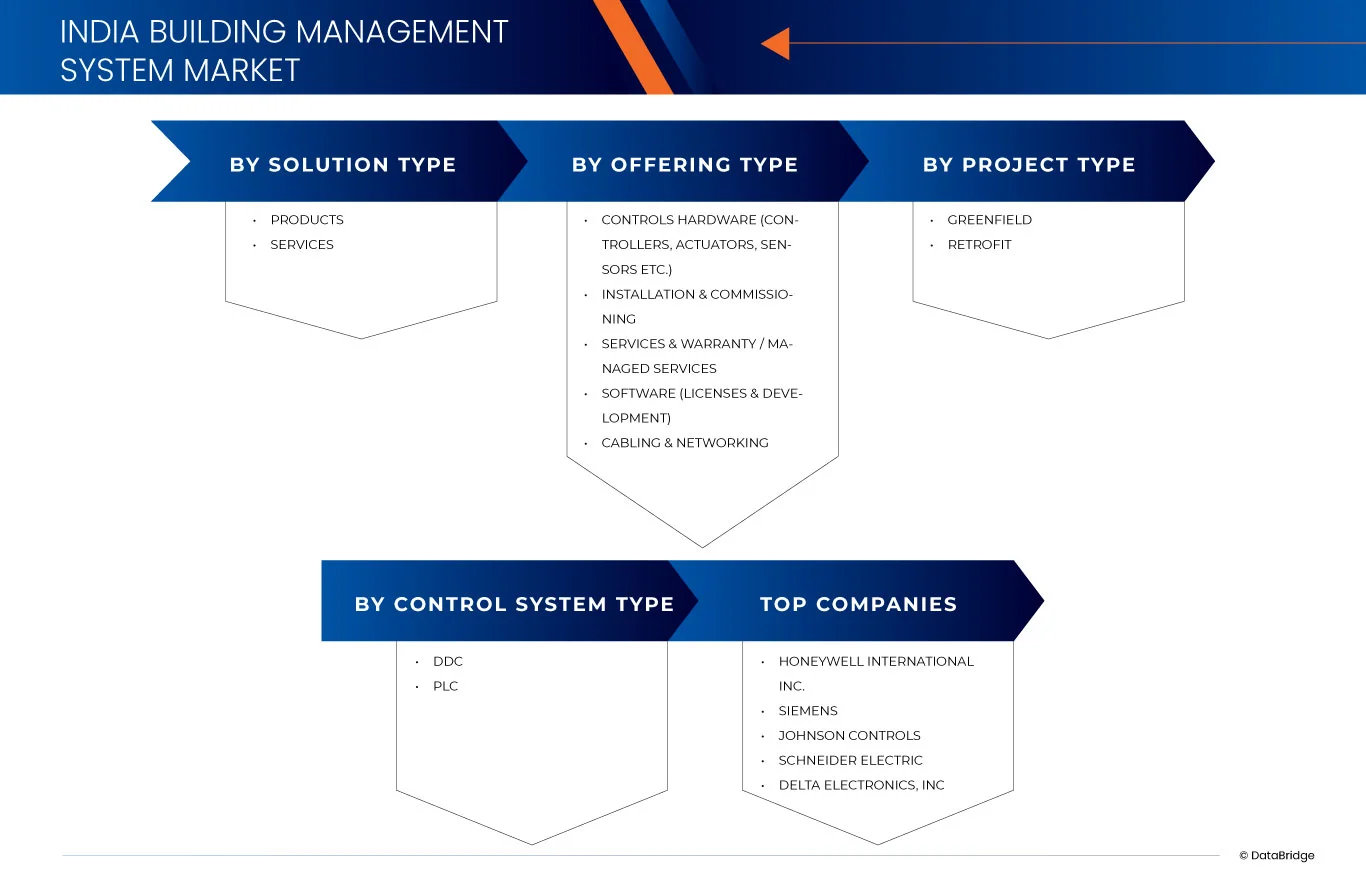

The India Building Management System Market is segmented into solution type, offering type, project type, control system type.

• By Solution Type

On the basis of solution type, the market is segmented into products and services. In 2025, the products segment is expected to dominate the market with the market share of 57.53%, due to the increasing demand for specialized expertise, ongoing maintenance, and comprehensive solutions that go beyond basic hardware and software offerings.

The services segment is projected to be the fastest-growing with a CAGR of 13.8%, due to the continuous need for installation, commissioning, managed services, and warranty support, which ensure the optimal performance and longevity of building management systems.

• By Offering Type

On the basis of offering type, the India market is segmented into controls hardware (controllers, actuators, sensors etc), installation & commissioning, services & warranty / managed services, software (licenses & development), and cabling & networking. In 2025, the controls hardware (controllers, actuators, sensors etc) segment is expected to dominate the market with the market share of 41.77%, reflecting the crucial role of ongoing support, preventive maintenance, and expert management in maximizing the efficiency and lifespan of BMS installations.

The controls hardware (controllers, actuators, sensors etc), segment is projected to be the fastest-growing with a CAGR of 13.8%, due to the increasing sophistication of BMS software, the demand for custom solutions, and the integration of advanced analytics, AI, and IoT capabilities that enhance system intelligence and operational efficiency.

• By Project Type

On the basis of project type, the India market is segmented into green field and retrofit. In 2025, the green field segment is expected to dominate the market with a market share of 66.77%, due to the vast number of existing buildings requiring upgrades to improve energy efficiency, comply with new regulations, and integrate modern smart building technologies.

The retrofit segment is projected to be the fastest-growing with a CAGR of 13.8%, driven by the increasing construction of new smart buildings and sustainable developments that incorporate advanced building management systems from the initial design phase to optimize performance and reduce environmental impact.

• By Control System Type

On the basis of control system type, the India market is segmented into DDC and PLC. In 2025, the DDC segment is expected to dominate the market with a market share of 57.31%, driven by the large installed base of existing buildings that typically use DDC for HVAC and building-level energy management—making retrofits and upgrades to improve energy efficiency, comply with new regulations, and add smart-building capabilities both common and cost-effective.

The PLC segment is projected to be the fastest-growing with a CAGR of 13.8%, supported by the construction of new smart and sustainable developments that increasingly specify PLCs for their industrial-grade reliability, scalability, and tighter integration with complex automation, IoT platforms, and design-phase building management strategies to optimize performance and reduce environmental impact.

India Building Management System Market Share

The India building management system industry is primarily led by well-established companies, including:

- Honeywell (U.S.)

- Siemens (Germany)

- ohnson Controls (Ireland)

- Schneider Electric (France)

- Delta Electronics, Inc (Taiwan)

- ABB (Switzerland)

- Carrier (U.S.)

- Trane (U.S.)

- Azbil Corporation (Japan)

- Acuity Brands, Inc (U.S.)

- 75F (U.S.)

- Automated Logic Corporation (U.S.)

Latest Developments in India Building Management System Market

- In July 2025, Honeywell announced evaluation of strategic alternatives supporting a focus on growth areas including building technologies and digital automation as part of its ongoing realignment aligned with megatrends including energy transition and automation.

- In January, 2024 Honeywell launched a ground breaking platform called Advance Control for Buildings that uses a building’s existing wiring for automation, cybersecurity, and faster network speeds, significantly enhancing operational efficiency and occupant experience. This marked a substantial leap in building controls innovation

- In May 2025, Siemens has released a comprehensive modernization roadmap for the Desigo building automation family, including Desigo Building Management, Pro Automation, and Room Automation systems. The guide outlines lifecycle phases, product updates, and migration strategies towards newer generations of controllers such as PXC 3rd Gen and emphasizes cloud connectivity and cybersecurity enhancements

- In September 2025, Johnson Controls released Metasys 14.0, a significant update to its industry-leading Building Automation System (BAS). This new version enhances user experience, network efficiency, flexibility, security, and energy management. It introduces a continual release model for deploying new features and supports IPv6 and seamless BACnet communications. This update is aimed at elevating building performance, sustainability, occupant comfort, health, and safety

- In August 2025, Trane Technologies launched the BrainBox AI Lab to drive energy optimization and sustainability in buildings and transport. The lab focuses on AI-driven HVAC innovation, predictive controls, ethical AI practices, and advancing global carbon reduction goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INDIA BUILDING MANAGEMENT SYSTEM MARKET, BY SOLUTION TYPE

5.1 OVERVIEW

5.2 PRODUCTS

5.3 SERVICES

6 INDIA BUILDING MANAGEMENT SYSTEM MARKET, BY OFFERING TYPE

6.1 OVERVIEW

6.2 CONTROLS HARDWARE (CONTROLLERS, ACTUATORS, SENSORS, ETC.)

6.3 INSTALLATION & COMMISSIONING

6.4 SERVICES & WARRANTY / MANAGED SERVICES

6.5 SOFTWARE (LICENSES & DEVELOPMENT)

6.6 CABLING & NETWORKING

7 INDIA BUILDING MANAGEMENT SYSTEM MARKET, BY PROJECT TYPE

7.1 OVERVIEW

7.2 GREENFIELD

7.3 RETROFIT

8 INDIA BUILDING MANAGEMENT SYSTEM MARKET, BY CONTROL SYSTEM TYPE

8.1 OVERVIEW

8.2 DDC

8.3 PLC

9 INDIA BUILDING MANAGEMENT SYSTEM MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: INDIA

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 HONEYWELL INTERNATIONAL INC.

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 SIEMENS

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 JOHNSON CONTROLS.

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 SCHNEIDER ELECTRIC

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENT

11.5 DELTA ELECTRONICS INC.

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 ABB

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 AZBIL CORPORATION

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENTS

11.8 CARRIER

11.8.1 COMPANY SNAPSHOT

11.8.2 REVENUE ANALYSIS

11.8.3 PRODUCT PORTFOLIO

11.8.4 RECENT DEVELOPMENT

11.9 TRANE TECHNOLOGIES PLC

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 INDIA BMS MARKET, IN USD THOUSAND, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 2 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 3 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 4 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 5 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 6 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 7 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 8 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 9 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 10 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 11 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 12 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 13 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 14 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 15 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 16 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY GRADE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 17 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 18 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 19 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 20 INDIA BMS SERVICE MARKET, IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 21 INDIA BMS MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 22 INDIA BMS MARKET, IN USD THOUSAND, BY OFFERING TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 23 INDIA BMS MARKET, IN USD THOUSAND, BY PROJECT TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 24 INDIA BMS GREENFIELD MARKET, IN USD THOUSAND, BY OFFERING TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 25 INDIA BMS GREENFIELD MARKET, IN USD THOUSAND, BY SOLUTION TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 26 INDIA BMS MARKET GREENFIELD (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 27 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 28 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 29 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 30 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 31 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 32 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 33 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 34 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 35 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 36 INDIA BMS RETROFIT MARKET, IN USD THOUSAND, BY OFFERING TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 37 INDIA BMS RETROFIT MARKET, IN USD THOUSAND, BY SOLUTION TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 38 INDIA BMS MARKET RETROFIT (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 39 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 40 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 41 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 42 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 43 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 44 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 45 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 46 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 47 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 48 INDIA BMS MARKET, IN USD THOUSAND, BY CONTROL SYSTEM TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 49 INDIA BMS MARKET GREENFIELD (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 50 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 51 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 52 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 53 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 54 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 55 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 56 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 57 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 58 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 59 INDIA BMS MARKET RETROFIT (EXCLUDING SERVICES), IN USD THOUSAND, BY END-USER INDUSTRY, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 60 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 61 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 62 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 63 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 64 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 65 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 66 INDIA BMS GREENFIELD MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 67 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

TABLE 68 INDIA BMS RETROFIT MARKET (EXCLUDING SERVICES), IN USD THOUSAND, BY TYPE, BASE YEAR: 2024, FORECAST PERIOD: 2025 TO 2030

List of Figure

FIGURE 1 INDIA BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 2 INDIA BUILDING MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 INDIA BUILDING MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 INDIA BUILDING MANAGEMENT SYSTEM MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 INDIA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA BUILDING MANAGEMENT SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 INDIA BUILDING MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 INDIA BUILDING MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDIA BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 TWO SEGMENTS COMPRISE THE INDIA BUILDING MANAGEMENT SYSTEM MARKET, BY SOLUTION TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING FOCUS ON ENERGY EFFICIENCY AND BUILDING ELECTRIFICATION IS EXPECTED TO DRIVE THE INDIA BUILDING MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD (2025-2030)

FIGURE 14 THE PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA BUILDING MANAGEMENT SYSTEM MARKET IN 2025 AND 2030

FIGURE 15 INDIA BUILDING MANAGEMENT SYSTEM MARKET: BY SOLUTION TYPE, 2024

FIGURE 16 INDIA BUILDING MANAGEMENT SYSTEM MARKET: BY OFFERING TYPE, 2024

FIGURE 17 INDIA BUILDING MANAGEMENT SYSTEM MARKET: BY PROJECT TYPE, 2024

FIGURE 18 INDIA BUILDING MANAGEMENT SYSTEM MARKET: BY CONTROL SYSTEM TYPE, 2024

FIGURE 19 INDIA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.