India Menstrual Cups Market

Market Size in USD Million

CAGR :

%

USD

15.43 Million

USD

27.38 Million

2025

2033

USD

15.43 Million

USD

27.38 Million

2025

2033

| 2026 –2033 | |

| USD 15.43 Million | |

| USD 27.38 Million | |

|

|

|

|

India Menstrual Cup Market Size

- The India menstrual cup market is expected to reach USD 27.38 million by 2033 from USD 15.43 million in 2025, growing with a substantial CAGR of 7.6% in the forecast period of 2025 to 2033

- The India menstrual cup market is experiencing strong growth, driven by rising consumer awareness of sustainable menstrual hygiene solutions and increasing preference for affordable, long-term alternatives to disposable sanitary products. Growing emphasis on women’s health, environmental consciousness, and the desire for safer, chemical-free menstrual products are further accelerating the market’s expansion.

- Market adoption is being strengthened by advancements in product design, such as medical-grade silicone cups, multiple size variations, and improved comfort features tailored to diverse physiologies. Innovations in digital education platforms, hygiene-focused applications, and online community support are helping brands overcome awareness barriers and guide first-time users, thereby boosting acceptance across urban and semi-urban populations.

- Additionally, higher disposable incomes, supportive government and NGO initiatives promoting menstrual hygiene, and the rapid rise of e-commerce channels are improving market accessibility. Strong participation from domestic manufacturers and local D2C brands is enhancing product affordability and visibility. As a result, menstrual cups are becoming an integral component of next-generation menstrual hygiene strategies in India, contributing to both women’s wellness and sustainable living.

India Menstrual Cup Market Analysis

- Increasing awareness of eco-friendly menstrual products, combined with concerns over the long-term costs and environmental impact of disposable sanitary pads, is driving Indian consumers, especially urban and educated segments, toward menstrual cups. Growing discussions on women’s health, social media advocacy, and support from NGOs and government hygiene programs further strengthen market acceptance.

The rapid growth of e-commerce platforms and D2C brands is improving accessibility and affordability of menstrual cups across India. Domestic manufacturers are offering competitively priced, medical-grade silicone products tailored to Indian consumers, while digital education, product tutorials, and customer reviews help reduce apprehension among first-time users. This digital ecosystem is significantly boosting market penetration and accelerating overall industry growth.

- In 2026, the reusable menstrual cups segment is expected to dominate the market with a market share of 83.09%, due to increasing consumer preference for long-lasting and cost-effective menstrual hygiene solutions. Their reusability for up to 5–10 years significantly reduces long-term expenditure compared to disposable products. Growing awareness about environmental sustainability, supported by NGO initiatives and digital education campaigns, is further driving adoption.

Report Scope and India Menstrual Cup Market Segmentation

|

Attributes |

India Menstrual Cup Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

India Menstrual Cups Market Trends

“Rising Demand for Sustainable & Reusable Menstrual Products”

- In India, there is a clear shift toward sustainable menstrual hygiene solutions as more women become aware of the environmental impact of disposable pads and tampons.

- Menstrual cups, being reusable for several years, are increasingly preferred for their eco-friendliness, long-term cost savings, and convenience.

- For instance, Many Indian consumers are increasingly conscious about plastic waste and environmental impact of disposable sanitary products; reusable menstrual cups reduce waste significantly versus pads/tampons.

- Urban and semi-urban consumers, in particular, are driving this adoption, supported by growing educational campaigns and social-media advocacy around safe and hygienic cup usage.

- This trend is further strengthened by government and community-level initiatives that promote menstrual cups as a greener, more economical alternative for long-term menstrual health.

India Menstrual Cups Market Dynamics

Driver

“Environmental sustainability through reduced non-biodegradable waste”

- The reduction of non-biodegradable menstrual waste emerges as a key driver for the India menstrual cups market. Menstrual cups significantly lower the volume of disposable sanitary products that end up in landfills and water bodies, offering a sustainable alternative aligned with India’s growing environmental consciousness.

- With increasing policy emphasis on waste management and heightened public awareness about eco-friendly menstrual solutions, the shift toward reusable products strengthens. This strong alignment with environmental sustainability directly propels demand for menstrual cups, acting as a major driver for market growth.

- For instances- in June 2023, according to the article published by Population foundation of India, A 2023 ARTH report released by Dr. Soumya Swaminathan highlights that menstrual cup generate 99% less non-biodegradable waste than disposable sanitary pads, which produce about 14.1 kg of lifetime waste per woman. With growing evidence of their environmental and health benefits, menstrual cups are increasingly promoted in public programs. This strong sustainability advantage significantly strengthens market demand, acting as a key driver for growth

- Menstrual cups offer a highly sustainable alternative to disposable sanitary products, drastically reducing non-biodegradable waste and environmental impact.

- Their long-term reusability, combined with growing public awareness and institutional support, reinforces their appeal among consumers and policymakers. This strong alignment with environmental sustainability serves as a key driver, fueling the growth of the India menstrual cups market

Restraint/Challenge

“Low adoption and limited consumer acceptance ”

- Despite increasing awareness about menstrual cups, the actual adoption rate among women in India remains relatively low. lack of familiarity with insertion-based products, and hesitation to switch from traditional sanitary pads and tampons contribute to limited usage.

- Additionally, misconceptions regarding comfort, hygiene, and suitability for unmarried women restrict wider acceptance. This low adoption rate acts as a significant restraint on the growth of the India menstrual cup market.

- For instance- in April 2025, as per the article published by Cureus, Studies in India show that while awareness of menstrual cups ranges from 43% to 65% among students and medical professionals, actual usage remains low, often below 50%. Limited in-depth knowledge, cultural beliefs, and mixed attitudes toward cost, convenience, and hygiene restrict adoption. This low consumer acceptance continues to act as a significant restraint on the growth of the India menstrual cup market.

- Despite growing awareness of menstrual cups in India, actual usage remains limited due to cultural preferences, lack of familiarity, and insufficient education or counselling. Misconceptions regarding comfort, hygiene, and convenience further restrict adoption.

- This persistent low adoption and limited consumer acceptance continue to act as a major restraint on the growth of the India menstrual cup market

India Menstrual Cups Market Scope

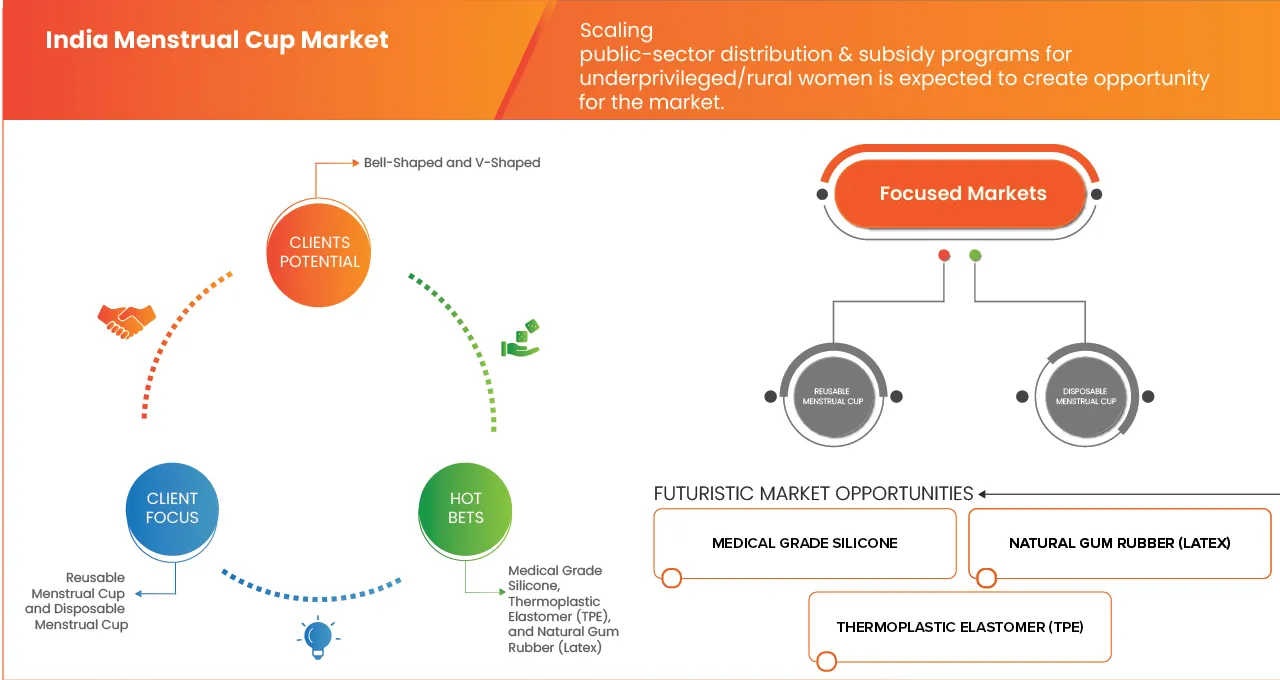

The India menstrual cup market is segmented into eleven notable segments based on usability, material, shape, type, size, packaging/kit variants, age group, lifestyle, geography, end user, and distribution channel.

- By Usability

On the basis of usability, the India menstrual cup market is segmented into reusable menstrual cups and disposable menstrual cups. In 2026, the reusable menstrual cups segment is expected to dominate the India menstrual cups market with a market share of 83.09% due to their long lifespan, cost-effectiveness, and increasing preference for sustainable menstrual hygiene products.

Reusable menstrual cups segment is expected to grow with the CAGR of 7.7% in the forecast period of 2026 to 2033 due to increasing consumer shift toward eco-friendly menstrual solutions, rising cost savings over long-term usage, and growing awareness initiatives promoting reusable hygiene products.

- By Material

On the basis of material, the India menstrual cups market is segmented into medical grade silicone, Natural Gum Rubber (latex), Thermoplastic Elastomer (TPE), and others. In 2026, the medical grade silicone segment is expected to dominate the India menstrual cups market with a market share of 69.74% due to its high biocompatibility, durability, and safety profile, which make it suitable for long hours of internal use without causing irritation or allergic reactions.

Thermoplastic Elastomer (TPE) segment is expected to grow with the CAGR of 8.2% in the forecast period of 2026 to 2033 due to its flexible, softer feel, hypoallergenic nature, and increasing adoption among beginners who prefer more pliable menstrual cup options.

- By Shape

On the basis of shape, the India menstrual cup market is segmented into bell-shaped, V-shaped, cylindrical, disc-style, asymmetrical. In 2026, the bell-shaped segment is expected to dominate the India menstrual cups market with a market share of 56.48 % due to its superior fit, leak-prevention design, and comfort, which make it suitable for a wide range of users, including beginners.

The asymmetrical segment is expected to grow with the CAGR of 8.5% in the forecast period of 2026 to 2033 due to rising demand for anatomically adaptive designs that offer improved comfort, tailored fit, and better usability for individuals with unique cervix positions or sensitivities.

- By Type

On the basis of type, the India menstrual cups market is segmented into round solid stem, round hollow stem, flat tab stem, and pointed/conical stem, stemless / no-stem design. In 2026, the round solid stem segment is expected to dominate the India menstrual cups market with a market share of 39.82% due to its sturdiness, ease of grip, and user-friendly design, which make insertion and removal simpler—especially for first-time cup users.

The round hollow stem segment is expected to grow with the CAGR of 8.3% in the forecast period of 2026 to 2033 due to its lightweight, flexible structure, enhanced comfort during movement, and reduced irritation compared to solid stems.

- By Size

On the basis of size, the India menstrual cups market is segmented into small (low flow, nulliparous), medium, and large. In 2026, the medium segment is expected to dominate the India menstrual cup market with a market share of 48.37% due to its suitability for a broad range of users, including women with moderate flow, those who have given birth, and individuals seeking a balanced capacity-to-comfort ratio.

Medium segment is expected to grow with the CAGR of 8.0% in the forecast period of 2026 to 2033 due to its versatility, suitability for the majority of menstruators, and rising preference for mid-capacity cups that balance comfort and fluid-holding capacity.

- By Packaging/Kit Variants

On the basis of packaging/kit variants, the India menstrual cups market is segmented into cup only, cup + carry case, cup + sterilizer/cleaning accessory, multi-pack/family pack, and educational kit. In 2026, the cup-only segment is expected to dominate the India menstrual cups market with a market share of 53.28% due to its affordability and strong appeal among first-time users, who often prefer starting with a basic, low-cost option before investing in accessories.

Educational kit segment is expected to grow with the CAGR of 8.7% in the forecast period of 2026 to 2033 due to increasing awareness campaigns, government and NGO-led menstrual education initiatives, and rising first-time user demand for guided, instructional kits.

- By Age Group

On the basis of age group, the India menstrual cups market is segmented into adolescents (12–17), young adults (18–24), adults (25–39), and mature adults (40–50). In 2026, the adults (25–39) segment is expected to dominate the India menstrual cups market with a market share of 46.94% due to this group’s higher purchasing power, greater health awareness, and stronger inclination toward sustainable menstrual products.

Adolescents (12–17) segment is expected to grow with the CAGR of 8.3% in the forecast period of 2026 to 2033 due to increasing exposure to menstrual health education, social media awareness, and growing acceptance of sustainable hygiene products among younger users.

- By Lifestyle

On the basis of lifestyle, the India menstrual cups market is segmented into students, working professionals, sports & fitness users (athletes), and frequent travelers/outdoor users. In 2026, the working professionals segment is expected to dominate the India menstrual cups market with a market share of 48.11% due to the rising preference among employed women for convenient, long-lasting, and low-maintenance menstrual solutions that suit busy daily schedules.

Sports & fitness users (athletes) segment is expected to grow with the CAGR of 8.4% in the forecast period of 2026 to 2033 due to the rising need for secure, leak-free, movement-friendly menstrual solutions that support high physical activity levels.

- By Geography

On the basis of geography, the India menstrual cups market is segmented into urban, semi-urban, and rural. In 2026, the urban segment is expected to dominate the India menstrual cup market with a market share of 70.39% due to higher levels of menstrual health awareness, better access to information, and stronger exposure to digital marketing and educational campaigns.

Semi-urban segment is expected to grow with the CAGR of 8.1% in the forecast period of 2026 to 2033 due to improving access to menstrual health education, growing digital penetration, and increasing affordability and availability of menstrual cup brands.

- By End User

On the basis of end user, the India menstrual cups market is segmented into hospitals, specialty clinics/gynecology centers, homecare/individual users, NGO & institutional programs, and others. In 2026, the homecare/individual users segment is expected to dominate the India menstrual cup market with a market share of 76.28% due to the increasing preference for self-managed menstrual hygiene solutions that offer convenience, comfort, and long-term cost savings.

NGO & institutional programs segment is expected to grow with the CAGR of 8.2% in the forecast period of 2026 to 2033 due to expanding government and non-profit initiatives aimed at promoting sustainable menstrual hygiene, especially in low-income and underserved communities.

- By Distribution Channel

On the basis of distribution channel, the India menstrual cups market is segmented into hospital pharmacies, retail pharmacies/chemists, online pharmacies, and others. In 2026, the online pharmacies segment is expected to dominate the India menstrual cups market with a market share of 55.62% due to the growing preference for convenient, discreet, and doorstep delivery of menstrual hygiene products.

Online pharmacies segment is expected to grow with the CAGR of 7.9% in the forecast period of 2026 to 2033 due to expanding e-commerce penetration, increasing digital literacy among women, wider product availability, and attractive discounts that encourage online purchasing of menstrual cups.

India Menstrual Cups Market Share

The menstrual cup industry is primarily led by well-established companies, including:

- Leevacare (India)

- SAFECUP (India)

- Avni Wellness (India)

- Redcliffe Hygine Private Limited (Pee Safe) (India)

- RG Biocosmetic Private Limited (India)

- Ami Polymer (India)

- Asan India (U.K.)

- HLL LIFECARE LIMITED (India)

- Reva Eco-nauts (India)

- Shecup (India)

- Silky Cup (India)

- Sirona (India)

- Chemco Group (India)

- PT Overseas Exports (India)

- Smilepad huygine India Pvt. Ltd. (India)

- Aditya Polymers (India)

- Suresh Enterprise (India)

- Khyati Expo India (India)

- RCSP Trading Company (India)

- Wet and Dry Personal Care Private Limited (India)

Latest Developments in India Menstrual Cup Market

- In July 2025, according to public procurement/tender records, Leevacare Pvt Ltd was listed in mid‑2025 for “Supply of reusable menstrual cup (qty: 30,000)” to a Kerala-based public contract.

- In January 2021, Namyaa now offers combined “Period Care Kits” that bundle their reusable menstrual cup with complementary products such as a cleansing wash and post-period care items — offering a more holistic period-care solution than just a standalone cup.

- In August 2025, Nari Yari’s website lists a full range of 12 variants of menstrual cups — covering different firmness levels, stem vs. stemless designs, and sizes (small/medium/large) to suit different users’ needs.

- In August 2025, Nari Yari’s through its outreach arm, Nari Yari is collaborating with NGOs, CSR initiatives, and retailers to distribute menstrual cups, reusable hygiene kits, and run awareness campaigns — aiming to spread sustainable menstrual care beyond individual consumers and into communities and institutions.

- In February 2020, Logicserve Digital bags digital mandate for Wet and Dry Personal Care Private Limited — The agency has been appointed the official Digital Agency on Record (AOR) for Wet & Dry. They will handle paid-media services, social-media management and creative duties for the brand. Wet & Dry — part of PAN Health with brands such as Everteen, NEUD, Nature Sure and ManSure — partnered with Logicserve Digital after a multi-agency pitch. The partnership aims to strengthen their digital presence and expand outreach to their target consumers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE INDIA MENSTRUAL CUP MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END USER COVERAGE GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 BRAND OUTLOOK

4.3.1 BRAND COMPARATIVE ANALYSIS

4.3.2 COMPANY VS BRAND OVERVIEW

4.4 CONSUMER BUYING BEHAVIOUR

4.4.1 GROUP 1 URBAN YOUNG PROFESSIONALS

4.4.2 GROUP 2 STUDENTS & FIRST-TIME USERS

4.4.3 GROUP 3 HEALTH-CONSCIOUS & ECO-AWARE CONSUMERS

4.4.4 GROUP 4 PRICE-SENSITIVE RURAL USERS

4.4.5 GROUP 5 REPEAT BUYERS / EXPERIENCED USERS

4.4.6 GROUP 6 PREMIUM & QUALITY-FOCUSED BUYERS

4.5 COST ANALYSIS BREAKDOWN

4.5.1 RAW MATERIAL COSTS

4.5.2 MANUFACTURING & PROCESSING COSTS

4.5.3 LOGISTICS & DISTRIBUTION COSTS

4.5.4 REGULATORY COMPLIANCE COSTS

4.5.5 MARGIN & PROFITABILITY CONSIDERATIONS

4.6 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.6.1.1 JOINT VENTURES

4.6.1.2 MERGERS AND ACQUISITIONS

4.6.1.3 LICENSING AND PARTNERSHIP

4.6.1.4 TECHNOLOGY COLLABORATIONS

4.6.1.5 STRATEGIC DIVESTMENTS

4.6.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.6.3 STAGE OF DEVELOPMENT

4.6.4 TIMELINES AND MILESTONES

4.6.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.6.6 FUTURE OUTLOOK

4.7 PATENT ANALYSIS

4.7.1 PATENT QUALITY AND STRENGTH

4.7.2 REGION PATENT LANDSCAPE

4.7.3 PUBLICATION TREND ANALYSIS (2016–2025)

4.7.4 IP STRATEGY AND MANAGEMENT

4.7.5 PATENT FAMILIES

4.7.6 LICENSING & COLLABORATION

4.8 PRICING ANALYSIS

4.8.1 OVERVIEW

4.8.2 LONG-TERM VALUE VS UPFRONT COST — ECONOMIC TRADEOFF

4.8.3 PRICE SENSITIVITY & MARKET SEGMENTATION

4.8.4 BARRIERS RELATED TO PRICING — UPFRONT COST & PERCEIVED VALUE

4.9 PROFIT MARGINS SCENARIO

4.9.1 MANUFACTURING STAGE MARGINS

4.9.2 BRANDING, MARKETING & DISTRIBUTION MARGINS

4.9.3 RETAIL & E-COMMERCE MARGINS

4.9.4 OVERALL INDUSTRY NET MARGINS

4.9.5 PROFIT MARGIN SCENARIOS

4.1 RAW MATERIAL COVERAGE

4.10.1 MEDICAL GRADE SILICONE

4.10.2 NATURAL GUM RUBBER (LATEX)

4.10.3 THERMOPLASTIC ELASTOMER (TPE)

4.10.4 BIODEGRADABLE/BIO-POLYMER ALTERNATIVES

4.10.5 FOOD-GRADE PIGMENTS

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 VALUE CHAIN ANALYSIS –

4.12.1 RAW MATERIAL PROCUREMENT

4.12.2 PRODUCT DESIGN & R&D

4.12.3 MANUFACTURING & PROCESSING

4.12.4 REGULATORY COMPLIANCE & CERTIFICATIONS

4.12.5 BRANDING, MARKETING & EDUCATION

4.12.6 DISTRIBUTION LOGISTICS

4.12.7 RETAIL & CUSTOMER INTERFACE

4.12.8 CONSUMER USAGE, MAINTENANCE & AFTER-SALES SUPPORT

4.12.9 END-OF-LIFE MANAGEMENT

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMISATION

5.6 JOINT VENTURE ESTABLISHMENTS

5.7 CONCLUSION

6 REGULATION COVERAGE

6.1 PRODUCT CODES / REGULATORY CLASSIFICATION

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.4 MATERIAL HANDLING & STORAGE

6.5 TRANSPORT & PRECAUTIONS

6.6 HAZARD IDENTIFICATION & RISK MANAGEMENT

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 ENVIRONMENTAL SUSTAINABILITY THROUGH REDUCED NON-BIODEGRADABLE WASTE

7.1.2 LONG-TERM COST-EFFECTIVENESS OF MENSTRUAL CUPS

7.1.3 INSTITUTIONAL SUPPORT AND NATIONWIDE AWARENESS INITIATIVES

7.2 RESTRAINTS

7.2.1 LOW ADOPTION AND LIMITED CONSUMER ACCEPTANCE

7.2.2 PRACTICAL BARRIERS TO MENSTRUAL CUP USAGE

7.3 OPPORTUNITIES

7.3.1 PROMOTING ADOPTION AMONG COLLEGE AND WORKPLACE POPULATIONS

7.3.2 SCALING PUBLIC-SECTOR DISTRIBUTION & SUBSIDY PROGRAMMES FOR UNDERPRIVILEGED/RURAL WOMEN

7.3.3 EXPANDING EVIDENCE THROUGH RESEARCH AND HEALTH-OUTCOME STUDIES

7.4 CHALLENGES

7.4.1 LACK OF KNOWLEDGE AND AWARENESS GAP

7.4.2 CULTURAL AND SOCIAL STIGMA AND TABOOS.

8 INDIA MENSTRUAL CUP MARKET, BY USABILITY

8.1 OVERVIEW

8.2 REUSABLE MENSTRUAL CUPS

8.3 DISPOSABLE MENSTRUAL CUPS

9 INDIA MENSTRUAL CUP MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 MEDICAL GRADE SILICONE

9.3 THERMOPLASTIC ELASTOMER (TPE)

9.4 NATURAL GUM RUBBER (LATEX)

9.5 OTHERS

10 INDIA MENSTRUAL CUP MARKET, BY SHAPE

10.1 OVERVIEW

10.2 BELL-SHAPED

10.3 V-SHAPED

10.4 CYLINDRICAL

10.5 DISC-STYLE

10.6 ASYMMETRICAL

11 INDIA MENSTRUAL CUP MARKET, BY TYPE

11.1 OVERVIEW

11.2 ROUND SOLID STEM

11.3 ROUND HOLLOW STEM

11.4 FLAT TAB STEM

11.5 POINTED / CONICAL STEM

11.6 STEMLESS / NO-STEM DESIGN

12 INDIA MENSTRUAL CUP MARKET, BY SIZE

12.1 OVERVIEW

12.2 MEDIUM

12.3 SMALL

12.3.1 NULLIPAROUS

12.3.2 LOW FLOW

12.4 LARGE

13 INDIA MENSTRUAL CUP MARKET, BY PACKAGING / KIT VARIANTS

13.1 OVERVIEW

13.2 CUP ONLY

13.3 CUP + CARRY CASE

13.4 CUP + STERILIZER/CLEANING ACCESSORY

13.5 MULTI-PACK / FAMILY PACK

13.6 EDUCATIONAL KIT

14 INDIA MENSTRUAL CUP MARKET, BY AGE GROUP

14.1 OVERVIEW

14.2 ADULTS (25–39)

14.3 YOUNG ADULTS (18–24)

14.4 MATURE ADULTS / PERIMENOPAUSAL (40–50)

14.5 ADOLESCENTS (12–17)

15 INDIA MENSTRUAL CUP MARKET, BY LIFESTYLE

15.1 OVERVIEW

15.2 WORKING PROFESSIONALS

15.3 STUDENTS

15.4 SPORTS & FITNESS USERS (ATHLETES)

15.5 FREQUENT TRAVELLERS / OUTDOORS USERS

16 INDIA MENSTRUAL CUP MARKET, BY GEOGRAPHY

16.1 OVERVIEW

16.2 URBAN

16.3 SEMI-URBAN

16.4 RURAL

17 INDIA MENSTRUAL CUP MARKET, BY END-USER

17.1 OVERVIEW

17.2 HOMECARE / INDIVIDUAL USERS

17.3 SPECIALTY CLINICS / GYNECOLOGY CENTERS

17.4 HOSPITALS

17.5 NGO & INSTITUTIONAL PROGRAMS

17.6 OTHERS

18 INDIA MENSTRUAL CUP MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 ONLINE PHARMACIES

18.3 RETAIL PHARMACIES / CHEMISTS

18.4 HOSPITAL PHARMACIES

18.5 OTHERS

19 INDIA MENSTRUAL CUP MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: INDIA (MANUFACTURER)

19.2 COMPANY SHARE ANALYSIS: INDIA (DISTRIBUTOR)

20 SWOT ANALYSIS

21 MANUFACTURERS COMPANY PROFILE

21.1 LEEVACARE

21.1.1 COMPANY SNAPSHOT

21.1.2 PRODUCT PORTFOLIO

21.1.3 RECENT DEVELOPMENTS

21.2 SAFECUP

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 RECENT DEVELOPMENT

21.3 AVNI WELLNESS

21.3.1 COMPANY SNAPSHOT

21.3.2 PRODUCT PORTFOLIO

21.3.3 RECENT DEVELOPMENT

21.4 REDCLIFFE HYGIENE PRIVATE LIMITED (PEE SAFE)

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENT

21.5 RG BIOCOSMETIC PRIVATE LIMITED

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 RECENT DEVELOPMENTS

21.6 AMI POLYMER

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 ASAN INDIA

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 HLL LIFECARE LIMITED

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENT

21.9 REVA ECO-NAUTS

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENTS

21.1 SHECUP

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENT

21.11 SILKY CUP

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 SIRONA

21.12.1 COMPANY SNAPSHOT

21.12.2 PRODUCT PORTFOLIO

21.12.3 RECENT DEVELOPMENT

22 DISTRIBUTORS COMPANY PROFILE

22.1 CHEMCO GROUP

22.1.1 COMPANY SNAPSHOT

22.1.2 PRODUCT PORTFOLIO

22.1.3 RECENT DEVELOPMENT

22.2 PT OVERSEAS EXPORTS

22.2.1 COMPANY SNAPSHOT

22.2.2 PRODUCT PORTFOLIO

22.2.3 2.3. RECENT DEVELOPMENT

22.3 SMILEPAD HYGIENE INDIA PVT. LTD.

22.3.1 COMPANY SNAPSHOT

22.3.2 PRODUCT PORTFOLIO

22.3.3 RECENT DEVELOPMENT

22.4 ADITYA POLYMERS

22.4.1 COMPANY SNAPSHOT

22.4.2 PRODUCT PORTFOLIO

22.4.3 RECENT DEVELOPMENT

22.5 SURESH ENTERPRISE

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENT

22.6 KHYATI EXPO INDIA

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENT

22.7 RCSP TRADING COMPANY

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 WET AND DRY PERSONAL CARE PRIVATE LIMITED

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

List of Table

TABLE 1 INDIA MENSTRUAL CUPS MARKET, BY USABILITY, 2018-2033 (USD THOUSAND)

TABLE 2 INDIA MENSTRUAL CUPS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 3 INDIA MENSTRUAL CUPS MARKET, BY SHAPE, 2018-2033 (USD THOUSAND)

TABLE 4 INDIA MENSTRUAL CUPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 INDIA MENSTRUAL CUPS MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 6 INDIA SMALL IN MENSTRUAL CUPS MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 7 INDIA MENSTRUAL CUPS MARKET, BY PACKAGING / KIT VARIANTS, 2018-2033 (USD THOUSAND)

TABLE 8 INDIA MENSTRUAL CUPS MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 9 INDIA MENSTRUAL CUPS MARKET, BY LIFESTYLE, 2018-2033 (USD THOUSAND)

TABLE 10 INDIA MENSTRUAL CUPS MARKET, BY GEOGRAPHY, 2018-2033 (USD THOUSAND)

TABLE 11 INDIA MENSTRUAL CUPS MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 12 INDIA MENSTRUAL CUPS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 INDIA MENSTRUAL CUP MARKET: SEGMENTATION

FIGURE 2 INDIA MENSTRUAL CUP MARKET: DATA TRIANGULATION

FIGURE 3 INDIA MENSTRUAL CUP MARKET: DROC ANALYSIS

FIGURE 4 INDIA MENSTRUAL CUP MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA MENSTRUAL CUP MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA MENSTRUAL CUP MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA MENSTRUAL CUP MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA MENSTRUAL CUP MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 INDIA MENSTRUAL CUP MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 INDIA MENSTRUAL CUP MARKET: SEGMENTATION

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 ADOPTION OF SUSTAINABLE MENSTRUAL HYGIENE PRODUCTS IS EXPECTED TO DRIVE THE GROWTH OF THE INDIA MENSTRUAL CUP MARKET FROM 2026 TO 2033

FIGURE 13 THE REUSABLE MENSTRUAL CUPS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA MENSTRUAL CUP MARKET IN 2026 - 2032

FIGURE 14 PATENT ANALYSIS BY IPC CODE

FIGURE 15 PATENT ANALYSIS BY COUNTRIES

FIGURE 16 PATENT ANALYSIS BY YEAR

FIGURE 17 PATENT ANALYSIS BY APPLICANT

FIGURE 18 DROC ANALYSIS

FIGURE 19 INDIA MENSTRUAL CUP MARKET: BY USABILITY, 2025

FIGURE 20 INDIA MENSTRUAL CUP MARKET: BY USABILITY, 2026 TO 2033 (USD THOUSAND)

FIGURE 21 INDIA MENSTRUAL CUP MARKET: BY USABILITY, CAGR (2026- 2033)

FIGURE 22 INDIA MENSTRUAL CUP MARKET: BY USABILITY, LIFELINE CURVE

FIGURE 23 INDIA MENSTRUAL CUP MARKET: BY MATERIAL, 2025

FIGURE 24 INDIA MENSTRUAL CUP MARKET: BY MATERIAL, 2026 TO 2033 (USD THOUSAND)

FIGURE 25 INDIA MENSTRUAL CUP MARKET: BY MATERIAL, CAGR (2026- 2033)

FIGURE 26 INDIA MENSTRUAL CUP MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 27 INDIA MENSTRUAL CUP MARKET: BY SHAPE, 2025

FIGURE 28 INDIA MENSTRUAL CUP MARKET: BY SHAPE, 2026 TO 2033 (USD THOUSAND)

FIGURE 29 INDIA MENSTRUAL CUP MARKET: BY SHAPE, CAGR (2026- 2033)

FIGURE 30 INDIA MENSTRUAL CUP MARKET: BY SHAPE, LIFELINE CURVE

FIGURE 31 INDIA MENSTRUAL CUP MARKET: BY TYPE, 2025

FIGURE 32 INDIA MENSTRUAL CUP MARKET: BY TYPE, 2026 TO 2033 (USD THOUSAND)

FIGURE 33 INDIA MENSTRUAL CUP MARKET: BY TYPE, CAGR (2026- 2033)

FIGURE 34 INDIA MENSTRUAL CUP MARKET: BY TYPE, LIFELINE CURVE

FIGURE 35 INDIA MENSTRUAL CUP MARKET: BY SIZE, 2025

FIGURE 36 INDIA MENSTRUAL CUP MARKET: BY SIZE, 2026 TO 2033 (USD THOUSAND)

FIGURE 37 INDIA MENSTRUAL CUP MARKET: BY SIZE, CAGR (2026- 2033)

FIGURE 38 INDIA MENSTRUAL CUP MARKET: BY SIZE, LIFELINE CURVE

FIGURE 39 INDIA MENSTRUAL CUP MARKET: BY PACKAGING / KIT VARIANTS, 2025

FIGURE 40 INDIA MENSTRUAL CUP MARKET: BY PACKAGING / KIT VARIANTS, 2026 TO 2033 (USD THOUSAND)

FIGURE 41 INDIA MENSTRUAL CUP MARKET: BY PACKAGING / KIT VARIANTS, CAGR (2026- 2033)

FIGURE 42 INDIA MENSTRUAL CUP MARKET: BY PACKAGING / KIT VARIANTS, LIFELINE CURVE

FIGURE 43 INDIA MENSTRUAL CUP MARKET: BY AGE GROUP, 2025

FIGURE 44 INDIA MENSTRUAL CUP MARKET: BY AGE GROUP, 2026 TO 2033 (USD THOUSAND)

FIGURE 45 INDIA MENSTRUAL CUP MARKET: BY AGE GROUP, CAGR (2026- 2033)

FIGURE 46 INDIA MENSTRUAL CUP MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 47 INDIA MENSTRUAL CUP MARKET: BY LIFESTYLE, 2025

FIGURE 48 INDIA MENSTRUAL CUP MARKET: BY LIFESTYLE, 2026 TO 2033 (USD THOUSAND)

FIGURE 49 INDIA MENSTRUAL CUP MARKET: BY LIFESTYLE, CAGR (2026- 2033)

FIGURE 50 INDIA MENSTRUAL CUP MARKET: BY LIFESTYLE, LIFELINE CURVE

FIGURE 51 INDIA MENSTRUAL CUP MARKET: BY GEOGRAPHY, 2025

FIGURE 52 INDIA MENSTRUAL CUP MARKET: BY GEOGRAPHY, 2026 TO 2033 (USD THOUSAND)

FIGURE 53 INDIA MENSTRUAL CUP MARKET: BY GEOGRAPHY, CAGR (2026- 2033)

FIGURE 54 INDIA MENSTRUAL CUP MARKET: BY GEOGRAPHY, LIFELINE CURVE

FIGURE 55 INDIA MENSTRUAL CUP MARKET: BY END-USER, 2025

FIGURE 56 INDIA MENSTRUAL CUP MARKET: BY END-USER, 2026 TO 2033 (USD THOUSAND)

FIGURE 57 INDIA MENSTRUAL CUP MARKET: BY END-USER, CAGR (2026- 2033)

FIGURE 58 INDIA MENSTRUAL CUP MARKET: BY END-USER, LIFELINE CURVE

FIGURE 59 INDIA MENSTRUAL CUP MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 60 INDIA MENSTRUAL CUP MARKET: BY DISTRIBUTION CHANNEL, 2026 TO 2033 (USD THOUSAND)

FIGURE 61 INDIA MENSTRUAL CUP MARKET: BY DISTRIBUTION CHANNEL, CAGR (2026- 2033)

FIGURE 62 INDIA MENSTRUAL CUP MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 63 INDIA MENSTRUAL CUP MARKET: COMPANY SHARE 2025 (%)

FIGURE 64 INDIA MENSTRUAL CUP MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.