India Phthalates and Non Phthalates Market Analysis and Insights

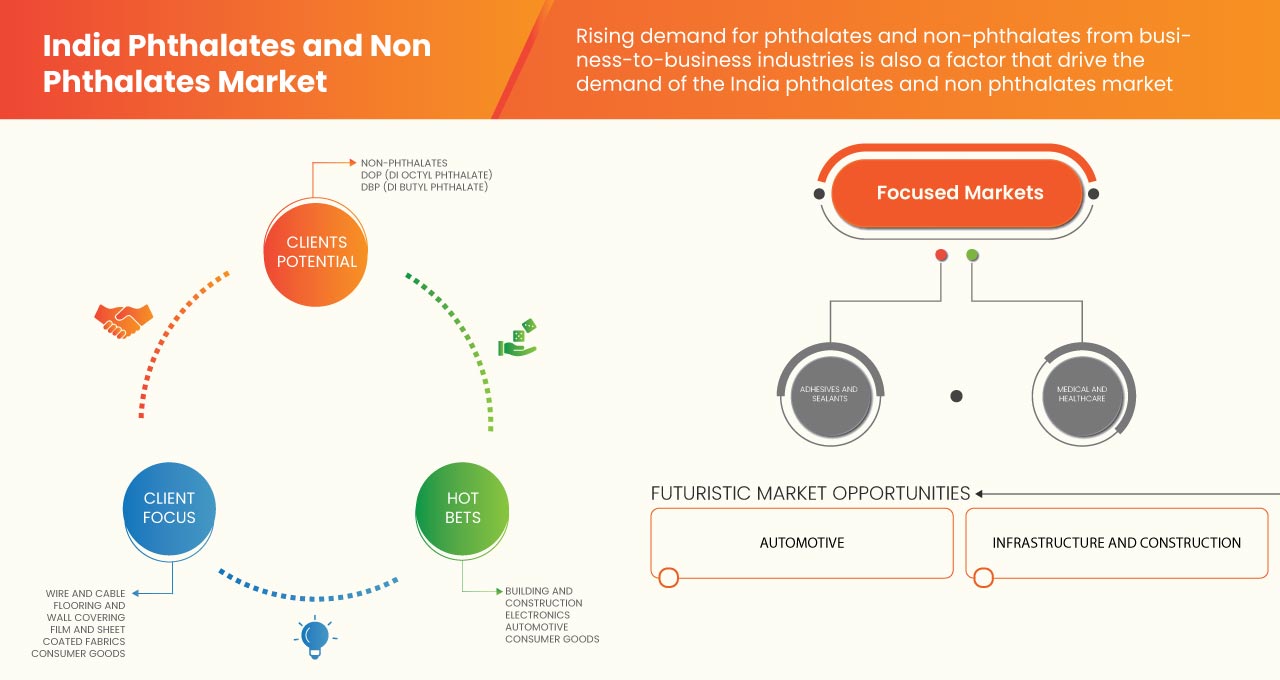

The India phthalates and non phthalates market is expected to gain significant growth from 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.2% from 2023 to 2030 and is expected to reach INR 132,586.98 million by 2030. The major factor driving the growth of the India phthalates and non phthalates market is the rising demand for phthalate and non-phthalate from business-to-business.

Non-phthalates are essentially plasticizers that are free of phthalates. The non-phthalate plasticizers are used for softening PVC products and for increasing the strength of products. Non-phthalate plasticizers are manufactured from petroleum or bio-based products. Phthalate plasticizers are an integral part of the plastic industry; between 90 and 95% of all phthalates are used as plasticizers for producing flexible PVC.

The India phthalates and non phthalates market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. Contact us for an analyst brief to understand the analysis and the market scenario. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in INR Million |

|

Segments Covered |

Product (Non-Phthalates, DOP (Di, Octyl Phthalate), DBP (Di Butyl Phthalate), DMP (Di Methyl Phthalate), DEP (Di Ethyl Phthalate), DOA (Di Octyl Adipate), Tec (Tri Ethyl Citrate), and Other Phthalates), Application (Wire and Cable, Flooring and Wall Covering, Film and Sheet, Coated Fabrics, Consumer Goods, Packaging, Adhesive And Sealants, and Others), End-Use (Building and Construction, Electronics, Automotive, Consumer Goods, Medical and Healthcare, Food & Beverages, Sports & Leisure, and Others) |

|

Countries Covered |

India |

|

Market Players Covered |

KLJ Group., BASF SE, Mitsubishi Chemical Corporation., Aarti Industries Ltd., DIC Corporation, LG Chem, Evonik Industries AG, Kao Corporation., Eastman Chemical Company or its subsidiaries., NAN YA PLASTICS CORPORATION, Avient Corporation, LANXESS, Exxon Mobil Corporation., DOW, Nayakem, Nishant Organics Pvt. Ltd., Supreme Plasticizers., Payal Group, ABC Chemicals, Henan GO Biotech Co.,Ltd, Perstorp, Velsicol Chemical LLC, Indo-Nippon Chemical Co. Ltd., MarvelVinyls amongst others. |

Market Definition

Non-phthalate plasticizers are those plasticizers that are free from phthalates. The non-phthalate plasticizers are used to soften PVC products and increase their strength. Non-phthalate plasticizers are manufactured from petroleum or bio-based products, which have less effect on the human body. A few non-phthalates include DOTP (diethyl hexyl terephthalate, aka DEHT), Hexamoll DINCH (diisononyl cyclohexane dicarboxylate), as well as bio-based plasticizers, which are based on soya oil, vegetable oil. Phthalate plasticizers are an integral part of the plastic industry, especially PVC plastics, as most plastic products require flexible low viscosity material at the manufacturing time. The plastic industry is expected to grow steadily in the next few years due to increased demand for plastics in automobiles, building & construction, and consumer products.

India Phthalates and Non Phthalates Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

- Growth in the medical and healthcare sector

The medical and healthcare sector has been one of the flourishing industries in India in terms of employment and revenue. The sector has flourished mainly through increasing disposable income, an aging population, increasing lifestyle diseases, using digital technologies like telemedicine, and increased foreign direct investment over the last two decades. The recent COVID-19 pandemic has paved a path to grow this sector through increased Indian start-ups organization, low-cost medical devices, and the manufacturing of generic medicines. The increasing numbers of medical insurance users and rising numbers of public health sectors in rural areas boost the healthcare and medical-based industries.

- Rising demand for phthalate and non-phthalate from business-to-business industries

In recent times there has been growth in business-to-business industries, especially markets related to plastics. The plastic industry is one of the fastest-growing industries across India. Plastics have become an important part of every aspect of modern life. Plastics find its application ranging from the automotive sector, such as automobile interiors, to the electronic sector, such as wires, cables, plastic enclosures, and many other applications. The automobile industry requires various part which is flexible or moldable in nature. Thus, to make such parts of plastics like PVC, phthalates, and non-phthalates act as plasticizers.

- Use of phthalate and non-phthalate in business-to-consumer industries

The B2C industry is rapidly changing how business is done in India. The B2C industry comprises various industries engaged in producing cosmetics, personal care products, food and beverages, home care products, and others. Such products are mostly bought from consumers through supermarkets, groceries, and e-commerce websites. Increasing disposable incomes, new technology to manufacture products, increasing foreign direct investment, favorable frameworks of government, unique marketing strategies, rapid urbanization, and the boom of e-commerce platforms are the factors that have caused the growth of the B2C industry.

Phthalate has been found in food packaging and plastics such as storage containers and lunch boxes. They are also used as a plasticizer in the manufacturing of water bottles and baby bottles.

Opportunities

- Increase in infrastructure and construction activities

A major driver of the Indian economy is the infrastructure industry. The sector receives great attention from the government to launch policies that would assure the country's construction of world-class infrastructure within a set period. This sector plays a significant role in driving India's overall growth. Power, bridges, dams, highways, and urban infrastructure development are all included in the infrastructure industry. In other words, the infrastructure sector propels the development of related industries, including townships, housing, built-up infrastructure, and construction development projects, acting as a catalyst for India's economic growth.

Phthalate is a chemical substance used to make vinyl (or PVC) flexible, malleable, and durable. Using phthalates makes floors more resilient, low maintenance, and stain resistant.

- Growth in the Indian plastic industry

The plastic industry is one of the fastest-growing industries across India. Plastics and plastic packaging have now permeated every aspect of modern life. Plastics find applications ranging from the healthcare sector, such as diagnostic equipment, plastic syringes, and Petri dishes, to food sector applications, such as packing food-related items. India produces many goods, including plastics, home furnishings, cordage, fishnets, floor coverings, medical supplies, packaging, pipes, plastic films, and raw materials. Such plastics are used up in various industries, such as electronics, construction, packaging, healthcare, and transportation.

Restraints

- Serious environmental and health effects

Phthalate is the most utilized material in plastics and cosmetics, among many other applications. They are well-known plasticizers that create a wide range of products, such as plastic packaging films, toys, floorings, personal care products, and automobile and electrical components. Due to such varied applications, phthalate is released in environments where it can be ingested, inhaled, or absorbed unintentionally. The environmental effects and detrimental health problems caused by phthalate exposure may restrain the growth of the Indian phthalate and non phthalates market.

Food, drinking water, and beverage are the main ways consumers consume phthalates. Phthalates are not chemically attached to plastic objects. They gradually leak out of them and evaporate into the air, water, food, household dust, soil, and living things, especially in hot weather.

- Credible threat of sustainable substitutes

Many compounds have been recognized as substitutes for phthalate plasticizers. The alternatives consist of citrates, sebacates, adipates, and phosphates. They are used in place of phthalates in products like toys, baby products, and medical equipment. These compounds are employed as solvents and fixatives in cosmetics, inks, adhesives, and other consumer goods, in addition to their use as substitutes for PVC plasticizers.

Epoxidized soybean oil (ESBO) is used as a plasticizer, compatibilizer, and phthalate. ESBO has also found its application as a plasticizer in seals for glass jars and as a stabilizer to decrease the UV degradation of polyvinyl chloride. Similarly, trimellitates have also been used as a substitute for diethyl phthalate, which is used in wall coverings, packaging, and flooring. In cosmetic products, acetyl tributyl citrate is used as a plasticizer in cosmetic products and PVC applications. Chemicals like DINCH are used instead of phthalate in commercial products such as toys, medical devices, and food packaging.

Challenge

- Stringent rules and regulations

Although there are various applications of phthalate and non-phthalates in our day-to-day life, however contrary to it, there are various other health problems, such as obesity, diabetes, asthma, and insulin resistance which have been linked to the use and synthesis of phthalates. India has imposed strict regulations over phthalate use and exposure to regulate such chemical use and protect public health.

Recent Developments

- In December 28, 2022, according to Fortune India, By 2026, it is anticipated that India will export INR 30 billion worth of automotive components, with the sector's total value predicted to be INR 200 billion and represent 5-7% of India's GDP.

- In December 24, 2022, according to The Hindu Business Line, India's medical tourism industry is estimated at INR 9 billion, which makes it the 10th largest India medical tourism hub, which is expected to reach INR 13 billion by 2026.

India Phthalates and Non Phthalates Market Scope

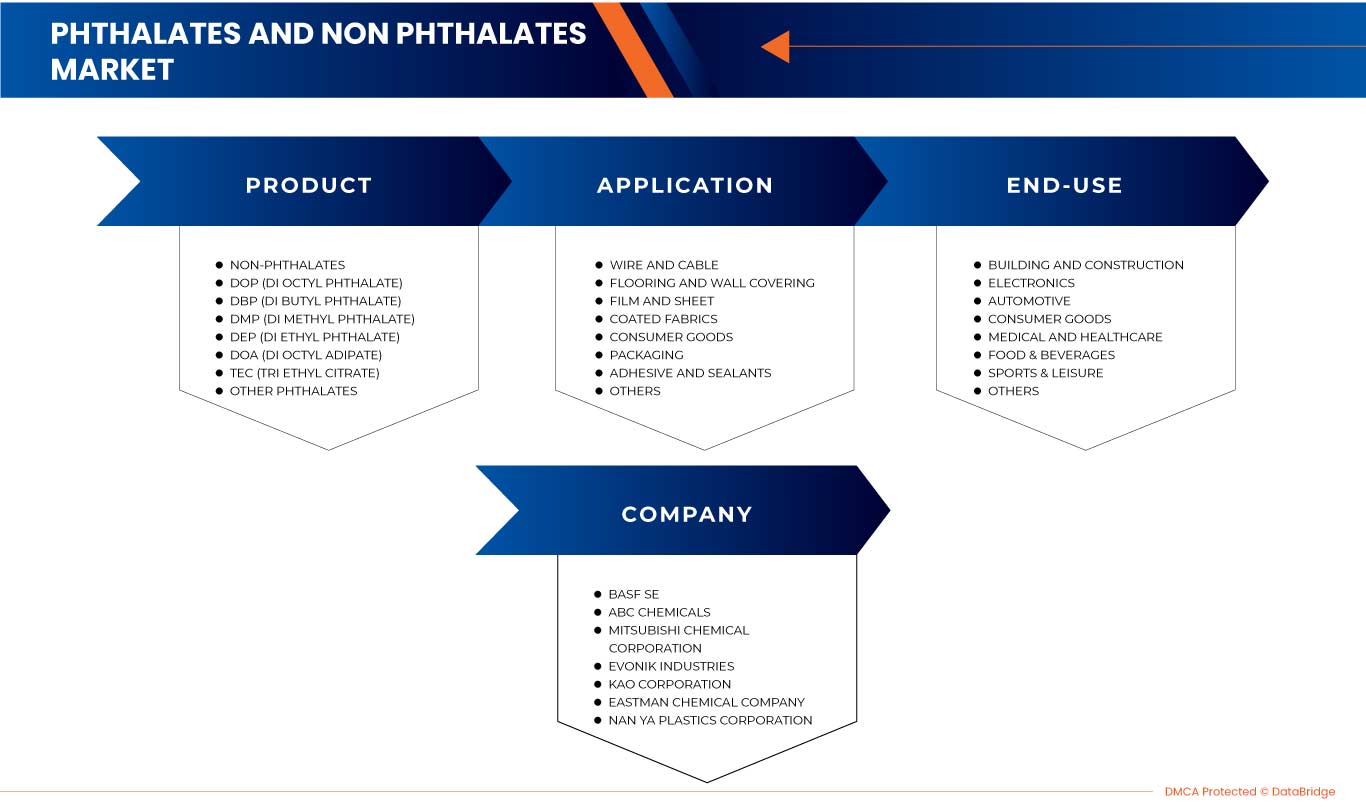

The India phthalates and non phthalates market is categorized based on product, application, and end-use. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and insights to make strategic decisions to identify core market applications.

Product

- Non-Phthalates

- DOP (di, octyl phthalate)

- DBP (di butyl phthalate)

- DMP (di methyl phthalate)

- DEP (di ethyl phthalate)

- DOA (di octyl adipate)

- TEC (tri ethyl citrate)

- Other phthalates

Based on product, the India phthalates and non phthalates market is classified into non-phthalates, DOP (di, octyl phthalate), DBP (di butyl phthalate), DMP (di methyl phthalate), DEP (di ethyl phthalate), DOA (di octyl adipate), TEC (tri ethyl citrate), and other phthalates.

Application

- Wire and cable

- Flooring and wall covering

- Film and sheet

- Coated fabrics

- Consumer goods

- Packaging

- Adhesive and sealants

- Others

Based on application, the India phthalates and non phthalates market is classified into wire and cable, flooring and wall covering, film and sheet, coated fabrics, consumer goods, packaging, adhesive and sealants, and others.

End-Use

- Building and construction

- Electronics

- Automotive

- Consumer Goods

- Medical and Healthcare

- Food & Beverages

- Sports & Leisure

- Others

Based on the end-use, the India phthalates and non phthalates market is classified into building and construction, electronics, automotive, consumer goods, medical and healthcare, food & beverages, sports & leisure, and others.

Competitive Landscape and India Phthalates and Non Phthalates Market Share Analysis

India phthalates and non phthalates market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, product lifeline curve. The above data points are only related to the company's focus on the India phthalates and non phthalates market.

Some of the prominent participants operating in the India phthalates and non phthalates market are KLJ Group., BASF SE, Mitsubishi Chemical Corporation., Aarti Industries Ltd., DIC Corporation, LG Chem, Evonik Industries AG, Kao Corporation., Eastman Chemical Company or its subsidiaries., NAN YA PLASTICS CORPORATION, Avient Corporation, LANXESS, Exxon Mobil Corporation., DOW, Nayakem, Nishant Organics Pvt. Ltd., Supreme Plasticizers., Payal Group, ABC Chemicals, Henan GO Biotech Co.,Ltd, Perstorp, Velsicol Chemical LLC, Indo-Nippon Chemical Co. Ltd., MarvelVinyls amongst others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA PHTHALATES AND NON PHTHALATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS- GEOPOLITICAL SCENARIO AND INDIAN MARKET SCENARIO

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SUPPLY CHAIN ANALYSIS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT'S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VALUE CHAIN OF INDIA PHTHALATES AND NON- PHTHALATES MARKET

4.9 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN THE MEDICAL AND HEALTHCARE SECTOR

6.1.2 RISING DEMAND FOR PHTHALATES AND NON-PHTHALATES FROM BUSINESS-TO-BUSINESS INDUSTRIES

6.1.3 USE OF PHTHALATES AND NON-PHTHALATES IN BUSINESS-TO-CONSUMER INDUSTRIES

6.2 RESTRAINTS

6.2.1 SERIOUS ENVIRONMENTAL AND HEALTH EFFECTS

6.2.2 CREDIBLE THREAT OF SUSTAINABLE SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 INCREASE IN INFRASTRUCTURE AND CONSTRUCTION ACTIVITIES

6.3.2 GROWTH IN THE INDIAN PLASTIC INDUSTRY

6.4 CHALLENGE

6.4.1 STRINGENT RULES AND REGULATIONS

7 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 NON-PHTHALATES

7.2.1 MONOMERIC PLASTICIZERS

7.2.1.1 ADIPATES

7.2.1.2 TEREPHTHALATES

7.2.1.3 EPOXIES

7.2.1.4 ALIPHATICS

7.2.1.5 MALEATES

7.2.1.6 BENZOATES

7.2.1.7 TRIMELLITATES

7.2.1.8 MONOALCOHOLS

7.2.1.9 OTHERS

7.2.2 POLYMERIC PLASTICIZERS

7.2.2.1 HAXENEDIOIC ACID

7.2.2.2 PHOSPHATE ESTERS

7.2.2.3 ALKYL SULFONIC ACID ESTERS

7.2.2.4 POLYOL-CARBOXYLIC ACID ESTERS

7.2.2.5 SEBACIC

7.2.2.6 CITRIC ACID ESTERS

7.2.2.7 PENTAERYTHRITOL ESTER OF VALERIC ACID

7.2.2.8 OTHERS

7.3 DOP (DI, OCTYL PHTHALATE)

7.4 DBP (DI BUTYL PHTHALATE)

7.5 DMP (DI METHYL PHTHALATE)

7.6 DEP (DI ETHYL PHTHALATE)

7.7 DOA (DI OCTYL ADIPATE)

7.8 TEC (TRI ETHYL CITRATE)

7.9 OTHER PHTHALATES

7.9.1 DI-ISONONYL PHTHALATE (DINP)

7.9.2 DI-ISODECYL PHTHALATE (DIDP)

7.9.3 DI-ISOBUTYL PHTHALATE (DIBP)

7.9.4 DI-PROPYLHEPTYL PHTHALATE (DPHP)

7.9.5 DI-ETHYLHEXYL PHTHALATE (DEHP)

7.9.6 OTHERS

8 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 WIRE AND CABLE

8.3 FLOORING AND WALL COVERING

8.4 FILM AND SHEET

8.5 COATED FABRICS

8.6 CONSUMER GOODS

8.7 PACKAGING

8.8 ADHESIVE AND SEALANTS

8.9 OTHERS

9 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY END-USE

9.1 OVERVIEW

9.2 BUILDING AND CONSTRUCTION

9.2.1 BY SEGMENT

9.2.1.1 RESIDENTIAL

9.2.1.2 COMMERCIAL

9.2.1.3 INFRASTRUCTURE

9.2.1.4 INDUSTRIAL

9.2.2 BY PRODUCT

9.2.2.1 PHTHALATES PLASTICIZERS

9.2.2.2 NON-PHTHALATES PLASTICIZERS

9.3 ELECTRONICS

9.3.1 BY SEGMENT

9.3.1.1 CONSUMER ELECTRONICS

9.3.1.2 INDUSTRIAL ELECTRONICS

9.3.2 BY PRODUCT

9.3.2.1 PHTHALATES PLASTICIZERS

9.3.2.2 NON-PHTHALATES PLASTICIZERS

9.4 AUTOMOTIVE

9.4.1 BY SEGMENT

9.4.1.1 PASSENGER VEHICLE

9.4.1.2 COMMERCIAL VEHICLE

9.4.1.3 HEAVY DUTY VEHICLE

9.4.1.4 OTHERS

9.4.2 BY PRODUCT

9.4.2.1 PHTHALATES PLASTICIZERS

9.4.2.2 NON-PHTHALATES PLASTICIZERS

9.5 CONSUMER GOODS

9.5.1 BY SEGMENT

9.5.1.1 TOYS

9.5.1.2 STATIONERY

9.5.1.3 CHILD CARE ARTICLES

9.5.1.4 OTHERS

9.5.2 BY PRODUCT

9.5.2.1 PHTHALATES PLASTICIZERS

9.5.2.2 NON-PHTHALATES PLASTICIZERS

9.6 MEDICAL AND HEALTHCARE

9.6.1 BY PRODUCT

9.6.1.1 PHTHALATES PLASTICIZERS

9.6.1.2 NON-PHTHALATES PLASTICIZERS

9.7 FOOD & BEVERAGES

9.7.1 BY PRODUCT

9.7.1.1 PHTHALATES PLASTICIZERS

9.7.1.2 NON-PHTHALATES PLASTICIZERS

9.8 SPORTS & LEISURE

9.8.1 BY PRODUCT

9.8.1.1 PHTHALATES PLASTICIZERS

9.8.1.2 NON-PHTHALATES PLASTICIZERS

9.9 OTHERS

9.9.1 BY PRODUCT

9.9.1.1 PHTHALATES PLASTICIZERS

9.9.1.2 NON-PHTHALATES PLASTICIZERS

10 COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: INDIA

10.2 EVENT

10.3 NEW PRODUCT LAUNCH

10.4 CERTIFICATION

10.5 COMPANY LAUNCH

10.6 AWARD

10.7 COLLABORATION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 KLJ GROUP

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 BASF SE

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 MITSUBISHI CHEMICAL CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 AARTI INDUSTRIES LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 DIC CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ABC CHEMICAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 AVIENT CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DOW

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 EASTMAN CHEMICAL COMPANY

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 EVONIK INDUSTRIES AG

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 EXXON MOBIL CORPORATION

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 HENAN GO BIOTECH CO.,LTD

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 INDO-NIPPON CHEMICAL CO. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 KAO CORPORATION

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 LANXESS

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 LG CHEM

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 MARVELVINYLS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 NAN YA PLASTICS CORPORATION

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 NAYAKEM

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 NISHANT ORGANICS PVT. LTD.

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

12.21 PAYAL GROUP

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS

12.22 PERSTORP HOLDING AB

12.22.1 COMPANY SNAPSHOT

12.22.2 PRODUCT PORTFOLIO

12.22.3 RECENT DEVELOPMENT

12.23 SUPREME PLASTICIZERS

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 VELSICOL CHEMICAL LLC.

12.24.1 COMPANY SNAPSHOT

12.24.2 PRODUCT PORTFOLIO

12.24.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF COMPOUND PLASTICISERS FOR RUBBER OR PLASTICS, N.E.S.; HS CODE – 381220 (USD THOUSAND)

TABLE 2 EXPORT DATA OF COMPOUND PLASTICISERS FOR RUBBER OR PLASTICS, N.E.S.; HS CODE – 381220 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 5 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 6 INDIA NON-PHTHALATES IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 7 INDIA MONOMERIC PLASTICIZERS IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 8 INDIA POLYMERIC PLASTICIZERS IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 9 INDIA OTHER PHTHALATES IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 10 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY APPLICATION, 2021-2030 (INR MILLION)

TABLE 11 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY END-USE, 2021-2030 (INR MILLION)

TABLE 12 INDIA BUILDING AND CONSTRUCTION IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 13 INDIA BUILDING AND CONSTRUCTION IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 14 INDIA ELECTRONICS IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 15 INDIA ELECTRONICS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 16 INDIA AUTOMOTIVE IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 17 INDIA AUTOMOTIVE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 18 INDIA CONSUMER GOODS IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 19 INDIA CONSUMER GOODS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 20 INDIA MEDICAL AND HEALTHCARE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 21 INDIA FOOD & BEVERAGES IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 22 INDIA SPORTS & LEISURE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 23 INDIA OTHERS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

List of Figure

FIGURE 1 INDIA PHTHALATES AND NON PHTHALATES MARKET

FIGURE 2 INDIA PHTHALATES AND NON PHTHALATES MARKET: DATA TRIANGULATION

FIGURE 3 INDIA PHTHALATES AND NON PHTHALATES MARKET: DROC ANALYSIS

FIGURE 4 INDIA PHTHALATES AND NON PHTHALATES MARKET: INDIA MARKET ANALYSIS

FIGURE 5 INDIA PHTHALATES AND NON PHTHALATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA PHTHALATES AND NON PHTHALATES MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 INDIA PHTHALATES AND NON PHTHALATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE GAS BARRIER MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 INDIA PHTHALATES AND NON PHTHALATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 INDIA PHTHALATES AND NON PHTHALATES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDIA PHTHALATES AND NON PHTHALATES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 INDIA PHTHALATES AND NON PHTHALATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 INDIA PHTHALATES AND NON PHTHALATES MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FOR PHTHALATE AND NON PHTHALATE FROM BUSINESS-TO-BUSINESS INDUSTRIES IS EXPECTED TO DRIVE INDIA PHTHALATES AND NON PHTHALATES MARKET IN THE FORECAST PERIOD

FIGURE 15 NON-PHTHALATES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA PHTHALATES AND NON PHTHALATES MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDIA PHTHALATES AND NON PHTHALATES MARKET

FIGURE 17 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY PRODUCT, 2022

FIGURE 18 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY APPLICATION, 2022

FIGURE 19 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY END-USE, 2022

FIGURE 20 INDIA PHTHALATE AND NON PHTHALATES MARKET: COMPANY SHARE 2022 (%)

India Phthalates And Non Phthalates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its India Phthalates And Non Phthalates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as India Phthalates And Non Phthalates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.