India Smart Water Meters Market

Market Size in USD Million

CAGR :

%

USD

191.04 Million

USD

279.91 Million

2024

2032

USD

191.04 Million

USD

279.91 Million

2024

2032

| 2025 –2032 | |

| USD 191.04 Million | |

| USD 279.91 Million | |

|

|

|

Smart Water Meter Market Analysis

The India smart water meter market is witnessing rising demand for efficient water management and increasing urbanization and population growth and technological advancements and integration of IOT, AI and data analytics. Some of the major restraints that may negatively impact the market growth are the high initial installation and maintenance costs and limited awareness of smart water technologies. Growth in rural water management systems and partnerships with private players for funding, manufacturing, and distribution and government initiatives promoting smart city projects. Concerns regarding data privacy and security and regulatory hurdles and inconsistent policies and delays in government approvals.

Smart Water Meter Market Size

The India smart water meter market is expected to reach USD 279.91 million by 2032 from USD 191.04 million in 2024, growing with a substantial CAGR of 5.2% in the forecast period of 2025 to 2032.

Smart Water Meter Market Trends

“Rising Demand for Efficient Water Management”

The rising trend for efficient water management in India is a significant driver behind the growing adoption of smart water meters. Water scarcity, population growth, and urbanization have placed immense pressure on India's water resources, prompting the need for better management and conservation practices. Traditional water meters are often inaccurate, inefficient, and prone to data loss, leading to issues like high Non-Revenue Water (NRW), faulty billing, and wastage. Smart water meters offer a solution by providing real-time data on water usage, helping municipalities and industries optimize water distribution and consumption.

With smart meters, utility companies can detect leaks and inefficiencies quickly, reducing water loss and ensuring that resources are used more sustainably. These meters can also track usage patterns, enabling water providers to make informed decisions on water allocation and pricing, thereby encouraging consumers to conserve water. Additionally, the data collected through smart water meters facilitates accurate billing, eliminating discrepancies and disputes that are common with traditional metering systems.

Report Scope and Smart Water Meter Market Segmentation

|

Attributes |

Smart Water Meter Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Kamstrup A/S (Denamrk), Honeywell International Inc. (U.S.), Xylem (U.S.), Itron Inc. (U.S), Genus (India), Flowtech Water Meters and Instruments Pvt. Ltd. (India), Peltek India (India), Konarak Meters (India), Everest Sanitation (India), ADM Meters LLP (India), Innovatec Systems (India), and Asma Industrial Corporation (India) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

Smart Water Meter Market Definition

Smart water meters are advanced devices that use digital technology to monitor and measure water consumption in real-time. These meters are equipped with sensors, communication modules, and software that enable automatic data collection, transmission, and analysis. Unlike traditional water meters, smart meters provide more accurate readings and offer features such as remote monitoring, leak detection, and usage alerts. They empower consumers to manage water consumption efficiently and help utilities optimize water distribution, reduce losses, and improve billing accuracy. The Indian market for smart water meters is driven by the increasing demand for sustainable water management and smart city development.

Smart Water Meter Market Dynamics

Drivers

- Increasing Urbanization and Population Growth

Increasing urbanization and population growth in India are key factors contributing to the rising demand for smart water meters. As more people migrate to urban areas for better opportunities, the urban population in India is expected to reach over 600 million by 2031. This rapid urbanization strains existing infrastructure, including water supply systems, leading to inefficiencies in water distribution and increased demand for water resources. With more people relying on limited water sources, the need for efficient water management solutions has become crucial.

Population growth exacerbates the problem by increasing water consumption and placing additional pressure on water utilities to manage and distribute resources effectively. Traditional water metering systems often fail to keep pace with the rising demand and urban expansion, resulting in water wastage, inaccurate billing, and system inefficiencies. Smart water meters, with their ability to provide real-time data and track usage patterns, help address these challenges by allowing utilities to monitor water consumption, detect leaks, and optimize distribution networks

For instance,

- In January 2024, according to a news published by the World Bank Group, as urbanization accelerates, cities like Bengaluru and Pune are expanding rapidly, facing challenges such as overcrowding, strained infrastructure, and pollution. These cities highlight the need for sustainable urban planning, investment in infrastructure, and innovative solutions like green spaces and efficient public transport to manage population growth and improve livability.

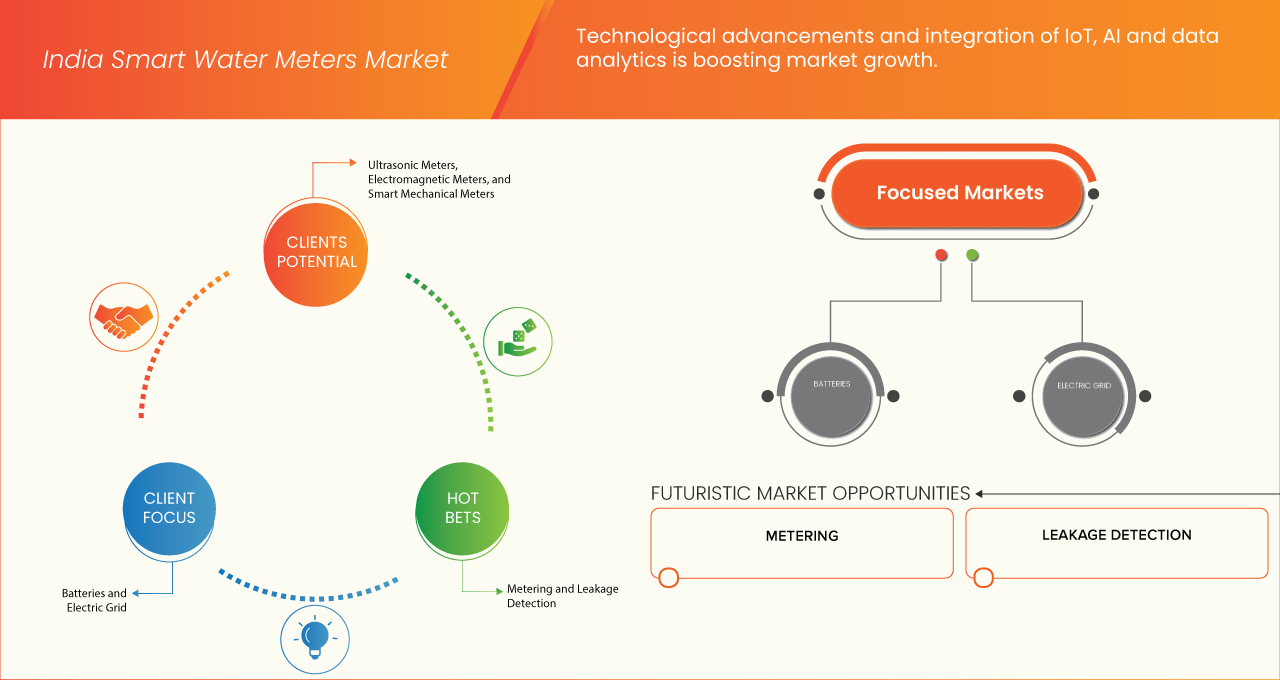

Technological Advancements and Integration of IOT, AI and Data Analytics

Technological advancements, particularly in the integration of Internet of Things (IoT), Artificial Intelligence (AI), and data analytics, are playing a crucial role in the evolution of the India Smart Water Meters Market. These technologies are revolutionizing the way water consumption is monitored, managed, and optimized, addressing critical challenges related to water scarcity and inefficient distribution systems.

IoT-enabled smart water meters are equipped with sensors that collect real-time data on water usage, pressure, and flow. This data is transmitted via wireless networks to a centralized system, allowing water utilities to monitor consumption patterns across vast urban areas. IoT technology ensures seamless communication between meters, utilities, and consumers, improving operational efficiency and enabling better decision-making.

For instance,

- In February 2023, according to a study published by ResearchGate GmbH, rapid urbanization strains resources and infrastructure, and AI and IoT offer transformative solutions. By integrating these technologies, cities can enhance infrastructure monitoring, optimize operations, and improve services in transportation, energy, and safety. However, challenges like data privacy, cost, and skills gaps need to be addressed for successful implementation

Opportunities

- Growth in Rural Water Management Systems

The growing demand for efficient water management in rural areas of India has created significant opportunities in the smart water meter market. Water scarcity and mismanagement have been persistent challenges in rural regions, often resulting in inefficient water distribution, leakage, and contamination. As a result, there is a pressing need for technology-driven solutions to ensure sustainable water usage, reduce wastage, and improve the monitoring of water resources.

Smart water meters offer a solution by providing real-time data on water consumption, which helps authorities manage water distribution systems more effectively. With the government focusing on rural development and the improvement of infrastructure, the adoption of smart water meters in rural India is expected to rise. These meters enable utilities to collect accurate data on water usage, identify areas of leakage, and facilitate better billing systems, which ultimately enhance revenue generation and water conservation efforts.

For instance,

- According to a blog by Genus, the implementation of smart water meters allowed real-time monitoring of water consumption, reducing water wastage and improving billing accuracy. The system helped identify areas of high usage, enabling timely interventions to optimize resource distribution and minimize losses

Partnerships with Private Players for Funding, Manufacturing, and Distribution

In India, the growth of the smart water meter market is being significantly influenced by partnerships between government entities and private players. These collaborations are driving innovation, improving manufacturing capabilities, and expanding the distribution network for smart water meters in both urban and rural areas. Private companies bring in essential funding, technology expertise, and advanced manufacturing techniques that are crucial for the large-scale deployment of smart meters.

One of the key opportunities lies in the development of a robust financing model, as private players can help fund the deployment of smart water meters in areas where government budgets may be insufficient. This will not only enhance the affordability of smart water metering solutions but also increase their accessibility. These partnerships also help facilitate the widespread adoption of advanced technologies, such as IoT and data analytics, which enhance the efficiency of smart meters.

For instance,

- In December 2023, according to PIB Delhi, The Indian government’s Revamped Distribution Sector Scheme (RDSS) focuses on implementing smart meters through Public-Private Partnerships (PPP) in the TOTEX mode, enabling utilities to avoid upfront capital costs. This approach ensures efficient operation and maintenance by advanced metering infrastructure service providers (AMISP), which are responsible for system management over 7-10 years, improving billing accuracy, energy accounting, and reducing losses. Additionally, prepaid smart metering for government departments aims to enhance financial and operational efficiency for DISCOMs.

Restraints/Challenges

- Concerns Regarding Data Privacy and Security

The adoption of smart water meters in India comes with significant challenges related to data privacy and security. These meters rely on advanced technologies, such as IoT and cloud computing, to collect, store, and transmit real-time water consumption data. While this enhances operational efficiency and user convenience, it also raises concerns about unauthorized access, data breaches, and misuse of sensitive information. One major issue is the potential vulnerability of IoT devices to cyberattacks. Smart water meters, if not properly secured, can be exploited to gain access to broader utility networks, compromising the integrity of critical infrastructure. Furthermore, the personal consumption data collected can reveal behavioral patterns, posing risks to individual privacy if accessed by malicious entities.

Data encryption and secure transmission protocols are essential, but their implementation can be complex and costly. Smaller utilities with limited technical expertise and budgets may find it challenging to adopt robust cybersecurity measures, increasing their susceptibility to risks. Additionally, there is a lack of standardized regulations and guidelines for ensuring data protection in the smart metering domain in India, creating inconsistencies in security practices across regions and providers.

For instance,

- In March 2023, according to CEEW, the cybersecurity challenges associated with India's Advanced Metering Infrastructure (AMI). While AMI promises improved efficiency and monitoring, its integration into legacy power systems introduces cyber risks. The document emphasizes the need for stronger security measures, technical capacity, and harmonized regulations across discoms to address vulnerabilities, and it recommends collaborative efforts between stakeholders to enhance resilience

Regulatory Challenges, Inconsistent Policies, and Delays in Government Approvals

The growth of the smart water meter market in India faces significant challenges due to regulatory hurdles, inconsistent policies, and delays in government approvals. The absence of uniform regulations across states creates a fragmented market, making it difficult for manufacturers and utility providers to streamline operations. This lack of policy uniformity often results in delays in project execution, affecting the timely deployment of smart water meters.

Moreover, prolonged approval processes and bureaucratic inefficiencies hinder the adoption of new technologies. Smart water meter projects often require multiple levels of approvals, involving various government departments. This creates bottlenecks that slow down implementation, discouraging private players from investing in the sector. Such delays not only escalate project costs but also impact public trust in these initiatives.

For instance,

- In January 2021, according to ORF, Interstate River Water Disputes (ISWDs) in India, such as the prolonged Cauvery River conflict between Karnataka and Tamil Nadu, stem from constitutional ambiguities and identity-based politics. The proposed River Basin Management Bill (2018) aims to establish River Basin Authorities to enhance cooperative federalism and address these challenges. Prolonged interstate water disputes and governance challenges can delay infrastructure projects, impacting the adoption of smart water meters, which rely on efficient water management and allocation to demonstrate their value effectively

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Smart Water Meter Market Scope

The market is segmented on the basis of meter type, component, technology, power source, deployment type, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Meter Type

- Ultrasonic Meters

- Ultrasonic Meters, By Type

- Transit Time Meter

- Doppler Meters

- Ultrasonic Meters, By Type

- Electromagnetic Meters

- Smart Mechanical Meters

Component

- Hardware

- Hardware, By Component

- Meter

- Modules

- Pressure Sensor

- Valve

- Others

- Hardware, By Component

- Software

- Software, By Solution

- Data and Analytics

- Source and Supply Management

- No-Flow and Abnormal Flow Alerts

- Others

- Software, By Solution

- Services

Technology

- AMR

- AMI

Power Source

- Batteries

- Electric Grid

Deployment Type

- Retrofit

- New Installation

Application

- Metering

- Leakage Detection

- Water Conservation

- Others

End User

- Residential

- Residential, By Meter Type

- Ultrasonic Meters

- Electromagnetic Meters

- Smart Mechanical Meters

- Residential, By Meter Type

- Commercial

- Commercial, By Meter Type

- Ultrasonic Meters

- Electromagnetic Meters

- Smart Mechanical Meters

- Commercial, By Type

- Hotels and Resorts

- Office Buildings

- Educational Institutions

- Retail and Shopping-Malls

- Others

- Commercial, By Meter Type

- Industrial

- Industrial, By Meter Type

- Ultrasonic Meters

- Electromagnetic Meters

- Smart Mechanical Meters

- Industrial, By Type

- Manufacturing and Processing Plants

- Hospitals

- Food and Beverage Industry

- Power Generation and Energy

- Others

- Hospitals, By Type

- Medical Research and Laboratories

- Dialysis Centres

- Industrial, By Meter Type

Smart Water Meter Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Smart Water Meter Market Leaders Operating in the Market Are:

- Kamstrup A/S (Denamrk)

- Honeywell International Inc. (U.S.)

- Xylem (U.S.), Itron Inc. (U.S)

- Genus (India)

- Flowtech Water Meters and Instruments Pvt. Ltd. (India)

- Peltek India (India)

- Konarak Meters (India)

- Everest Sanitation (India)

- ADM Meters LLP (India)

- Innovatec Systems (India)

- Asma Industrial Corporation (India)

Latest Developments in Smart Water Meter Market

- In March 2024, Kamstrup partners with Göteborg Energi on the FLEXUS project to enhance energy efficiency in Gothenburg. The intelligent demand-side management solution optimizes district heating, improves system flexibility, and supports the city’s goal of achieving CO2 neutrality by 2030

- In April 2022, Kamstrup acquires Thvilum A/S, a Danish GIS company, to enhance digitalization in the utility sector. The acquisition strengthens Kamstrup's capabilities in digital pipe registration and GIS systems, supporting improved data analysis and optimization for water and energy management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 COMPETITIVE RIVALRY

4.2.2 THREAT OF NEW ENTRANTS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 THREAT OF SUBSTITUTES

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.5.1 COMPLIANCE WITH REGULATORY STANDARDS

4.5.2 TECHNOLOGICAL CAPABILITY AND INNOVATION

4.5.3 PRODUCT DURABILITY AND PERFORMANCE

4.5.4 COST-EFFECTIVENESS

4.5.5 TRACK RECORD AND REPUTATION

4.5.6 CUSTOMIZATION AND SCALABILITY

4.5.7 INTEGRATION AND INTEROPERABILITY

4.5.8 AFTER-SALES SUPPORT AND MAINTENANCE

4.5.9 FINANCIAL STABILITY

4.5.10 CONCLUSION

4.6 LOCAL PLAYER LIST

4.7 RAW MATERIAL COVERAGE

4.7.1 METALS AND ALLOYS

4.7.2 POLYMERS AND PLASTICS

4.7.3 ELECTRONIC COMPONENTS

4.7.4 COMMUNICATION TECHNOLOGY AND IOT MODULES

4.7.5 SOFTWARE AND DATA ANALYTICS TOOLS

4.7.6 BATTERIES AND POWER SYSTEMS

4.7.7 ENVIRONMENTAL CONSIDERATIONS AND RECYCLING

4.7.8 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.8.1 INTEGRATION OF IOT (INTERNET OF THINGS) TECHNOLOGY

4.8.2 ADVANCED METERING INFRASTRUCTURE (AMI)

4.8.3 LEAK DETECTION AND REAL-TIME MONITORING

4.8.4 BATTERY LIFE AND ENERGY EFFICIENCY IMPROVEMENTS

4.8.5 CLOUD INTEGRATION AND DATA ANALYTICS

4.8.6 REMOTE READING AND BILLING SYSTEMS

4.8.7 INTEGRATION WITH SMART CITY INITIATIVES

4.8.8 CUSTOMIZATION AND SCALABILITY

4.8.9 MOBILE APP AND CONSUMER INTERFACE ENHANCEMENTS

4.8.10 CONCLUSION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR EFFICIENT WATER MANAGEMENT

5.1.2 INCREASING URBANIZATION AND POPULATION GROWTH

5.1.3 TECHNOLOGICAL ADVANCEMENTS AND INTEGRATION OF IOT, AI AND DATA ANALYTICS

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INSTALLATION AND MAINTENANCE COSTS

5.2.2 LIMITED AWARENESS OF SMART WATER TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN RURAL WATER MANAGEMENT SYSTEMS

5.3.2 PARTNERSHIPS WITH PRIVATE PLAYERS FOR FUNDING, MANUFACTURING, AND DISTRIBUTION

5.3.3 GOVERNMENT INITIATIVES PROMOTING SMART CITY PROJECTS

5.4 CHALLENGES

5.4.1 CONCERNS REGARDING DATA PRIVACY AND SECURITY

5.4.2 REGULATORY CHALLENGES, INCONSISTENT POLICIES, AND DELAYS IN GOVERNMENT APPROVALS

6 INDIA SMART WATER METER MARKET, BY METER TYPE

6.1 OVERVIEW

6.2 ULTRASONIC METERS

6.3 ELECTROMAGNETIC METERS

6.4 SMART MECHANICAL METERS

7 INDIA SMART WATER METER MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.3 SOFTWARE

7.4 SERVICES

8 INDIA SMART WATER METER MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 AMR

8.3 AMI

9 INDIA SMART WATER METER MARKET, BY POWER SOURCE

9.1 OVERVIEW

9.2 BATTERIES

9.3 ELECTRIC GRID

10 INDIA SMART WATER METER MARKET, BY DEPLOYMENT TYPE

10.1 OVERVIEW

10.2 RETROFIT

10.3 NEW INSTALLATION

11 INDIA SMART WATER METER MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 METERING

11.3 LEAKAGE DETECTION

11.4 WATER CONSERVATION

11.5 OTHERS

12 INDIA SMART WATER METER MARKET, BY END USER

12.1 OVERVIEW

12.2 RESIDENTIAL

12.3 COMMERCIAL

12.4 INDUSTRIAL

13 INDIA SMART WATER METER MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: INDIA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 KAMSTRUP A/S

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 HONEYWELL INTERNATIONAL INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 XYLEM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ITRON INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 GENUS

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ADM METERS LLP

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ASMA INDUSTRIAL CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 EVEREST SANITATION (INDIA)

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 FLOWTECH WATER METERS AND INSTRUMENTS PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 INNOVATEC SYSTEMS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 KONARAK METERS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 PELTEK INDIA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 LIST OF INDIA SMART WATER METERS LOCAL PLAYERS

TABLE 2 INDIA SMART WATER METER MARKET, BY METER TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 INDIA ULTRASONIC METERS IN SMART WATER METER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 INDIA SMART WATER METER MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 5 INDIA HARDWARE IN SMART WATER METER MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 6 INDIA SOFTWARE IN SMART WATER METER MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 7 INDIA SMART WATER METER MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 8 INDIA SMART WATER METER MARKET, BY POWER SOURCE, 2018-2032 (USD THOUSAND)

TABLE 9 INDIA SMART WATER METER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 INDIA SMART WATER METER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 INDIA SMART WATER METER MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 12 INDIA RESIDENTIAL IN SMART WATER METER MARKET, BY METER TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 INDIA COMMERCIAL IN SMART WATER METER MARKET, BY METER TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 INDIA COMMERCIAL IN SMART WATER METER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 INDIA INDUSTRIAL IN SMART WATER METER MARKET, BY METER TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 INDIA INDUSTRIAL IN SMART WATER METER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 INDIA HOSPITALS IN SMART WATER METER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 INDIA SMART WATER METERS MARKET

FIGURE 2 INDIA SMART WATER METERS MARKET: DATA TRIANGULATION

FIGURE 3 INDIA SMART WATER METERS MARKET: DROC ANALYSIS

FIGURE 4 INDIA SMART WATER METERS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 INDIA SMART WATER METERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA SMART WATER METERS MARKET: MULTIVARIATE MODELLING

FIGURE 7 INDIA SMART WATER METERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 INDIA SMART WATER METERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDIA SMART WATER METERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 INDIA SMART WATER METERS MARKET, APPLICATION COVERAGE GRID

FIGURE 11 INDIA SMART WATER METERS MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE INDIA SMART WATER METER MARKET, BY METER TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INDIA SMART WATER METER MARKET EXECUTIVE SUMMARY

FIGURE 15 RISING DEMAND FOR EFFICIENT WATER MANAGEMENT IS EXPECTED TO DRIVE THE INDIA SMART WATER METERS MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE ULTRASONIC METERS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA SMART WATER METERS MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR INDIA SMART WATER METERS MARKET

FIGURE 23 INDIA SMART WATER METER MARKET: BY METER TYPE, 2024

FIGURE 24 INDIA SMART WATER METER MARKET: BY COMPONENT, 2024

FIGURE 25 INDIA SMART WATER METER MARKET, BY TECHNOLOGY, 2024

FIGURE 26 INDIA SMART WATER METER MARKET: BY POWER SOURCE, 2024

FIGURE 27 INDIA SMART WATER METER MARKET: BY DEPLOYMENT TYPE, 2024

FIGURE 28 INDIA SMART WATER METER MARKET: BY APPLICATION, 2024

FIGURE 29 INDIA SMART WATER METER MARKET: BY END USER, 2024

FIGURE 30 INDIA SMART WATER METER MARKET: COMPANY SHARE 2024 (%)

India Smart Water Meters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its India Smart Water Meters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as India Smart Water Meters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.