India Solar Inverter and Battery Market Analysis and Size

Data Bridge Market Research analyses that the India solar inverter and battery market is expected to reach the value of USD 2,586.23 million by 2029, at a CAGR of 14.7% during the forecast period. The solar inverter and battery market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

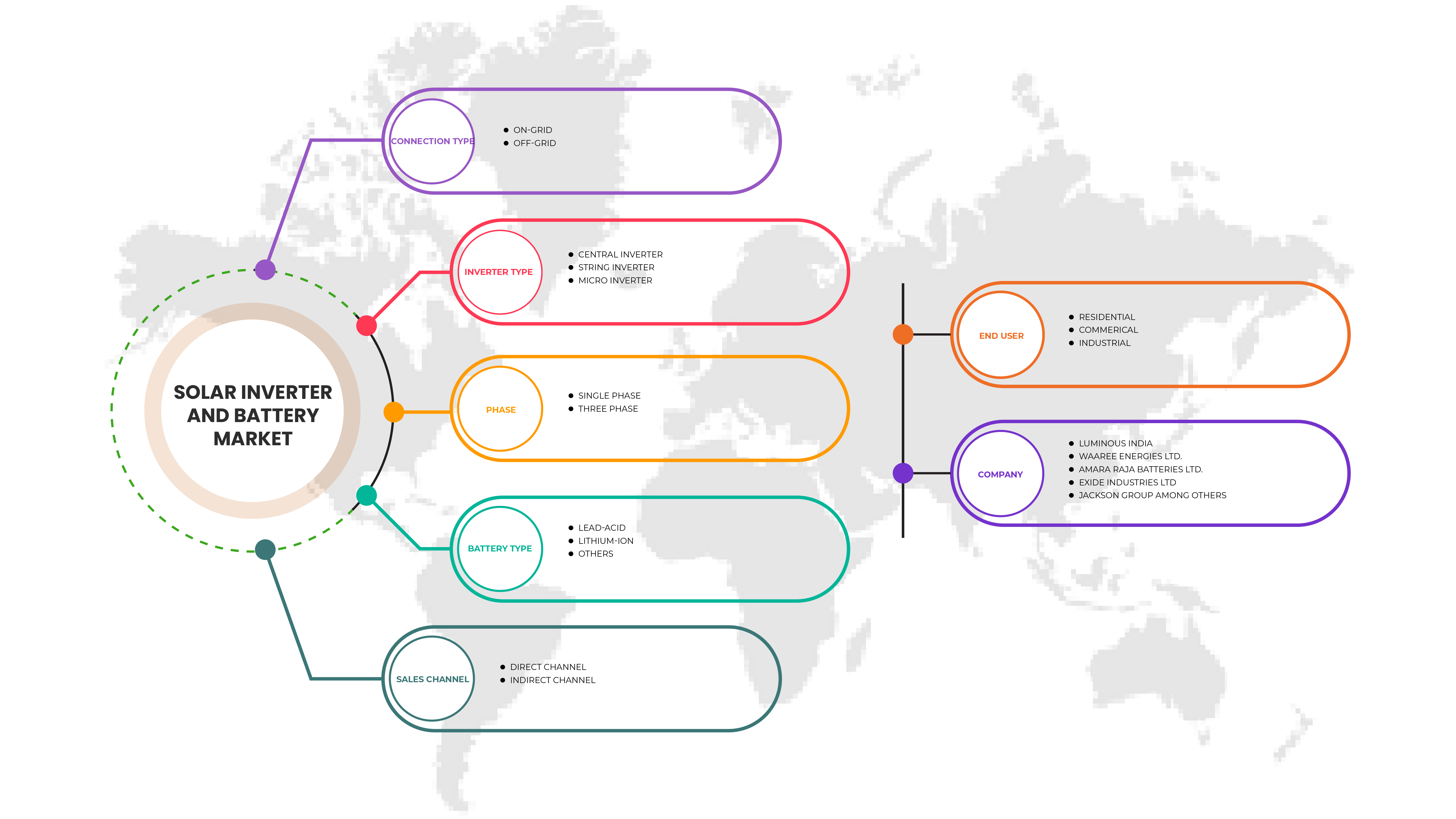

By Connection Type (On-Grid, Off-Grid), Phase (Single Phase, Three Phase), Inverter Type (Central Inverter, String Inverter, Micro Inverter), Battery Type (Lead-Acid, Lithium-Ion, Others), End User (Residential, Commercial, Industrial), Sales Channel (Direct Channel, Indirect Channel). |

|

Countries Covered |

India |

|

Market Players Covered |

Luminous India, Amara Raja Group, Lento Industries Pvt. Ltd., Waaree Energies Ltd., Fchoice Solar Tech India Pvt Ltd., MICROTEK, EXIDE INDUSTRIES LTD., UTL SOLAR, V-GUARD INDUSTRIES LTD., Flin Technologies Private Limited, Genus Innovations Ltd. and Jakson Group, among others. |

Market Definition

A solar inverter is plug-and-play equipment that transforms direct current generated by a single module into alternating current in photovoltaic installations. Solar inverter, unlike conventional central inverters, operate on module level power electronics (MLPE), which involves power conversion at the module level. As a result, the negative impacts of module mismatch are reduced, and the system's overall efficiency is improved.

Solar battery is a storage system which stores energy from a solar PV system for later use. There are several types of solar batteries such as lithium-ion, lead acid, Nickel cadmium and many others. These battery technologies are used in various applications, especially for commercial purpose and is integrated with solar panels and photovoltaic cells.

India Solar Inverter and Battery Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

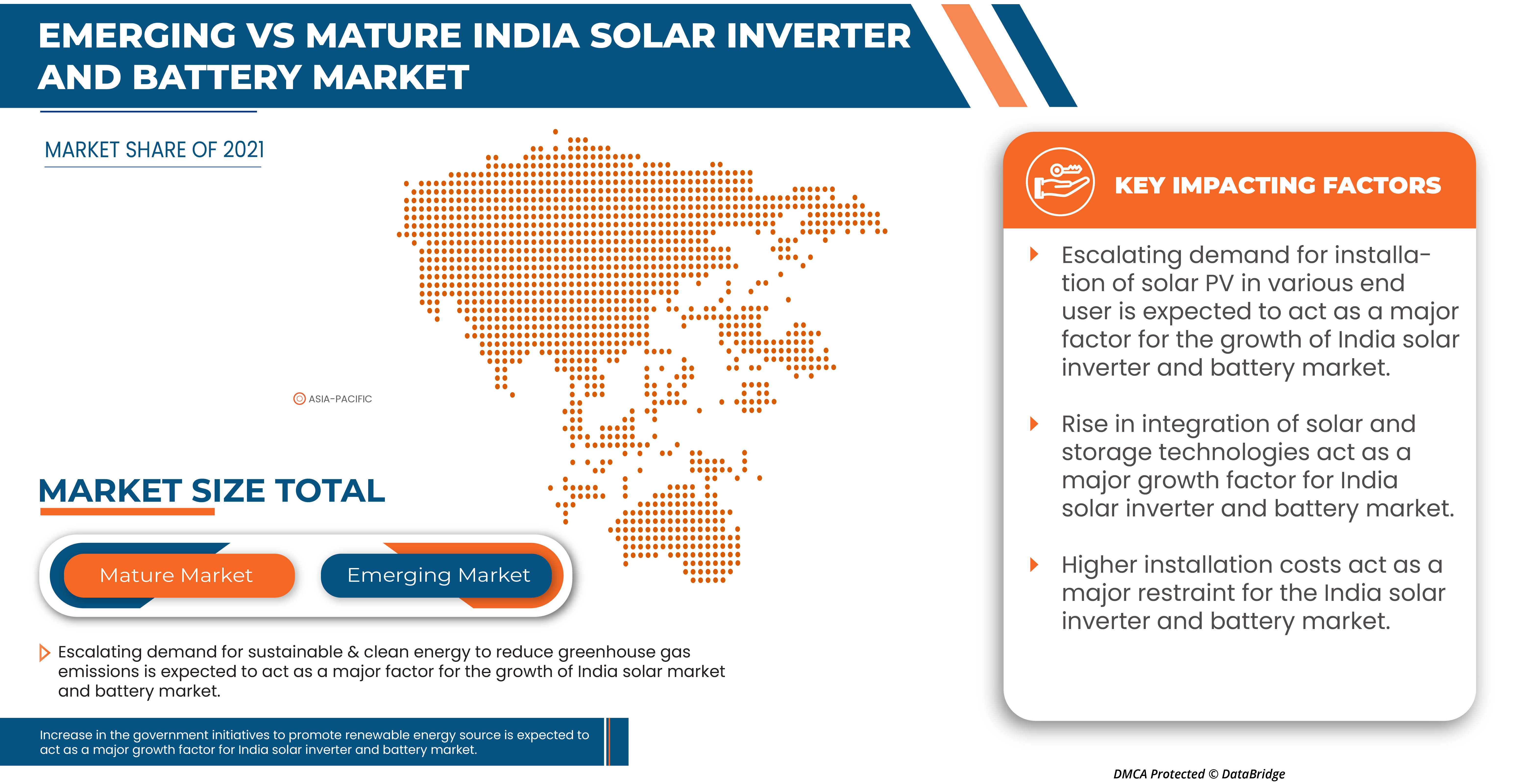

Drivers

-

Increase in installation of solar PV in various end-user

The solar photovoltaic (PV) technology converts solar energy into electricity, and over the years, the need for electricity has been increasing across the globe. The solar PV electricity generation is important in electricity generation and is demonstrated as the second-largest absolute generation growth of all renewable technologies in 2021 by the International Energy Agency (IEA).

Similarly, solar PV installations are increasing through the new trend of residential rooftop installations and solar parks or farms. Household rooftop solar in India is seeing gradual improvement as it supports zero emissions and better and innovative financial models. This will help individuals to cut down the expenses for the energy consumed daily. Such benefits are boosting residential rooftop installations, and even the Indian government is willing to support solar installations in India through some incentives and subsidies. This will help solar system manufacturers to boost the market.

-

Rise in integration of solar and storage technologies

Solar energy is one of the most important renewable energy sources used to generate electricity in India. Solar energy is not always produced at the time when energy is required most. Solar energy has significant day and seasonal peaks, especially during summer afternoons and evenings. Solar energy production can be affected by seasons, time of day, clouds, dust, haze, or obstructions like shadows, rain, snow, and dirt. Sometimes energy storage is co-located with or placed next to a solar energy system. Sometimes the storage system stands alone to help more effectively integrate solar into the energy landscape. Thus, there is a huge requirement to develop an energy-efficient ecosystem through better and more advanced storage systems.

Opportunities

- Rise in need for sustainable & clean energy to reduce greenhouse gas emissions

Energy consumption has increased across the country, so the nation has to meet the demand without disturbance. Thus, electricity production capacities have to be boosted and accordingly there is a requirement for sustainable energy production solution because energy production through fossil fuels is responsible for more than a third of the world's greenhouse gas emissions, which cause pollution and climate change.

Moreover, India's energy generation is majorly dependent on coal through which 70% of electricity is produced and is responsible for 60% of particulate matter emissions, over 80% of mercury emissions, over 50% of SO2 emissions, and 30% of NOx emissions. This is why the government of India has announced ambitious targets to reduce emissions intensity through adopting sustainable and renewable energy source of production.

Currently, India has 26.53% share of renewable energy for generating electricity and is planning to increase the renewable energy facilities to cut overall emissions through some initiatives and project installations.

Restraints/Challenges

- Higher installation costs of solar-inverters

Although solar inverters have significant advantages over traditional central and string inverter systems, installation and maintenance costs are one of the major problems limiting the market. Solar inverters are high-end goods with a high-end price tag. One solar inverter per module, a communication gateway, pricey AC trunk cables, and bespoke tools make up a solar inverter system. The number of inverters that can be connected to the same cable trunk is limited due to the limited current of an AC trunk line.

However, the solar inverters are used when there is electricity generation through solar panels, thus installation of solar panels cost very high furthermore, there will be the requirement for solar inverter and other electronic devices, which will increase the cost structure.

- Complicated design structure of solar inverter

Solar inverter and battery technologies are becoming increasingly popular as a choice of grid connection for small-scale photovoltaic systems are required to harvest direct current (DC) electrical energy from PV modules and convert it to alternating current (AC). These systems consist of many hardware components such as a fly back converter, switches, filters, and other electronic components.

Moreover, typical design constraints apply to any system and are modified, expanded and personalised for a specific application. In any PV (Photovoltaic) system, multiple solar modules are connected in series and parallel to provide voltage output. Combinations of these panels are then connected to a single centralized inverter to yield certain power modules. As each inverter is independently located below a solar panel, a communication bus and a common monitoring system are required as there is an on-board display system like in string inverters. Hence, the complicated design structure of the solar inverter imposes a challenge for the market to grow.

Recent Development

- In June 2021, Amara Raja Batteries Ltd. announced the launch of several strategic initiatives take advantage of fast emerging new opportunities to accelerate growth and enhance stakeholder value for batteries in market. This will help the company to enhance the customer base and accelerate the revenue growth.

- In February 2022, Waaree Energies Ltd. announced the winning of new 180 MW DC solar project in Tamil Nadu, India. This project will help the company to enhance the business growth and get recognition in the market.

India Solar Inverter and Battery Market Scope

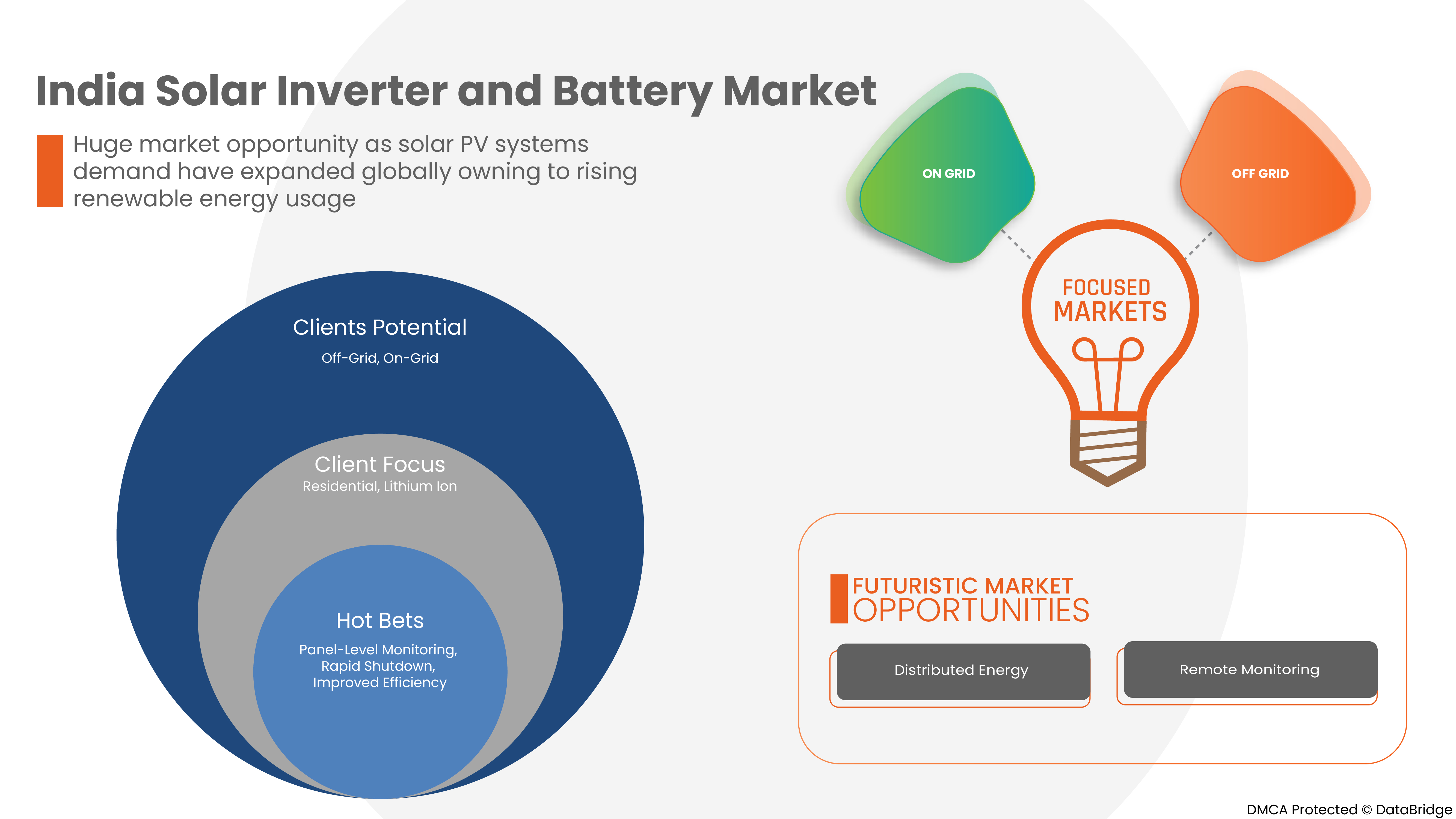

The India solar inverter and battery market is segmented on the basis of connection type, phase, inverter type, battery type, end user, and sales channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Connection Type

- On-Grid

- Off-Grid

On the basis of connection type, the India solar inverter and battery market is segmented into on-grid, off-grid.

Phase

- Single Phase

- Three Phase

On the basis of phase, the India solar inverter and battery market has been segmented into single phase, three phase.

Inverter Type

- Central Inverter

- String Inverter

- Micro Inverter

On the basis of inverter type, the India solar inverter and battery market has been segmented into central inverter, string inverter, and micro inverter.

Battery Type

- Lead-Acid

- Lithium-Ion

- Others

On the basis of offering, the India solar inverter and battery market has been segmented into lead-acid, lithium-ion, others.

End User

- Residential

- Commercial

- Industrial

On the basis of end user, the India solar inverter and battery market has been segmented into residential, commercial, industrial.

Sales Channel

- Direct Channel

- Indirect Channel

On the basis of sales channel, the India solar inverter and battery market is segmented into direct channel, and indirect channel.

Competitive Landscape and India Solar Inverter and Battery Market Share Analysis

The India solar inverter and battery market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, India presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to India solar inverter and battery market.

Some of the major players operating in this market are Luminous India, Amara Raja Group, Lento Industries Pvt. Ltd., Waaree Energies Ltd., Fchoice Solar Tech India Pvt Ltd., MICROTEK, EXIDE INDUSTRIES LTD., UTL SOLAR, V-GUARD INDUSTRIES LTD., Flin Technologies Private Limited, Genus Innovations Ltd. and Jakson Group among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA SOLAR INVERTER AND BATTERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 CONNECTION TYPE TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS

4.2 TECHNOLOGY ANALYSIS

4.3 STANDARDS

4.4 CASE STUDY

4.5 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN INSTALLATION OF SOLAR PV IN VARIOUS END-USER

5.1.2 RISE IN INTEGRATION OF SOLAR AND STORAGE TECHNOLOGIES

5.1.3 RISE IN THE ADVANCEMENT OF POWER ELECTRONICS

5.2 RESTRAINTS

5.2.1 HIGHER INSTALLATION COSTS OF SOLAR-INVERTERS

5.2.2 HIGHER DEPENDENCE ON CONVENTIONAL SOURCES OF ENERGY FOR ELECTRICITY GENERATION

5.3 OPPORTUNITIES

5.3.1 RISE IN NEED FOR SUSTAINABLE & CLEAN ENERGY TO REDUCE GREENHOUSE GAS EMISSIONS

5.3.2 INCREASE IN THE GOVERNMENT INITIATIVES TO PROMOTE A RENEWABLE ENERGY SOURCE

5.3.3 RISE IN POWER CRISIS WORLDWIDE

5.4 CHALLENGES

5.4.1 RISING ADOPTION OF ALTERNATIVES ACROSS THE MARKET

5.4.2 COMPLICATED DESIGN STRUCTURE OF SOLAR INVERTER

6 INDIA SOLAR INVERTER AND BATTERY MARKET, BY CONNECTION TYPE

6.1 OVERVIEW

6.2 ON-GRID

6.3 OFF-GRID

7 INDIA SOLAR INVERTER AND BATTERY MARKET, BY PHASE

7.1 OVERVIEW

7.2 THREE PHASE

7.3 SINGLE PHASE

8 INDIA SOLAR INVERTER MARKET, BY INVERTER TYPE

8.1 OVERVIEW

8.2 CENTRAL INVERTER

8.3 STRING INVERTER

8.4 MICRO INVERTER

9 INDIA SOLAR BATTERY MARKET, BY BATTERY TYPE

9.1 OVERVIEW

9.2 LEAD-ACID

9.3 LITHIUM-ION

9.4 OTHERS

10 INDIA SOLAR INVERTER AND BATTERY MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

10.4 INDUSTRIAL

11 INDIA SOLAR INVERTER AND BATTERY MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 INDIRECT CHANNEL

11.3 DIRECT CHANNEL

12 INDIA SOLAR INVERTER AND BATTERY MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: INDIA

13 SWOT

14 COMPANY PROFILES

14.1 WAAREE ENERGIES LTD.

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 LUMINOUS INDIA

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENTS

14.3 AMARA RAJA GROUP

14.3.1 COMPANY SNAPSHOT

14.3.1 REVENUE ANALYSIS

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 EXIDE INDUSTRIES LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 JAKSON GROUP

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 FCHOICE SOLAR TECH INDIA PVT LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 FLIN TECHNOLOGIES PRIVATE LIMITED

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GENUS INNOVATIONS LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 LENTO INDUSTRIES PVT. LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 MICROTEK

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 UTL SOLAR

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 V-GUARD INDUSTRIES LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 OFF GRID SOLAR INVERTER PRICE LIST

TABLE 2 LUMINOUS SOLAR ON-GRID INVERTER PRICE LIST

TABLE 3 INDIA SOLAR INVERTER AND BATTERY MARKET, BY CONNECTION TYPE, 2020-2029 (USD MILLION)

TABLE 4 INDIA SOLAR INVERTER AND BATTERY MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 5 INDIA SOLAR INVERTER MARKET, BY INVERTER TYPE, 2020-2029 (USD MILLION)

TABLE 6 INDIA SOLAR BATTERY MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 7 INDIA SOLAR INVERTER AND BATTERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 INDIA SOLAR INVERTER AND BATTERY MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 INDIA SOLAR INVERTER AND BATTERY MARKET: SEGMENTATION

FIGURE 2 INDIA SOLAR INVERTER AND BATTERY MARKET: DATA TRIANGULATION

FIGURE 3 INDIA SOLAR INVERTER AND BATTERY MARKET: DROC ANALYSIS

FIGURE 4 INDIA SOLAR INVERTER AND BATTERY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA SOLAR INVERTER AND BATTERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA SOLAR INVERTER AND BATTERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA SOLAR INVERTER AND BATTERY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA SOLAR INVERTER AND BATTERY MARKET: MULTIVARIATE MODELING

FIGURE 9 INDIA SOLAR INVERTER AND BATTERY MARKET: TIMELINE CURVE

FIGURE 10 INDIA SOLAR INVERTER AND BATTERY MARKET: SEGMENTATION

FIGURE 11 AN INCREASE IN INSTALLATION OF SOLAR PV IN VARIOUS END USER IS EXPECTED TO DRIVE THE INDIA SOLAR INVERTER AND BATTERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ON-GRID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA SOLAR INVERTER AND BATTERY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS

FIGURE 14 INDIA SOLAR INVERTER AND BATTERY MARKET: BY CONNECTION TYPE, 2021

FIGURE 15 INDIA SOLAR INVERTER AND BATTERY MARKET: BY PHASE, 2021

FIGURE 16 INDIA SOLAR INVERTER MARKET: BY INVERTER TYPE, 2021

FIGURE 17 INDIA SOLAR BATTERY MARKET: BY BATTERY TYPE, 2021

FIGURE 18 INDIA SOLAR INVERTER AND BATTERY MARKET: BY END USER, 2021

FIGURE 19 INDIA SOLAR INVERTER AND BATTERY MARKET: BY SALES CHANNEL, 2021

FIGURE 20 INDIA SOLAR INVERTER AND BATTERY MARKET: COMPANY SHARE 2021 (%)

India Solar Inverter And Battery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its India Solar Inverter And Battery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as India Solar Inverter And Battery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.