Market Analysis and Size

Micro solar inverters offer numerous advantages over the conventional string and central inverters such as high energy yield, module level monitoring abilities, longer life cycles, enhanced safety, betters flexibility, simplicity, and no single point of failure. These prime factors have increased the adoption of micro inverters in the photovoltaic industry in the recent past. Therefore, these benefits are expected to boost the India micro inverters market growth over the forecast period. They are located beneath each solar panel and convert direct current (DC) power produced by a single solar panel, unlike conventional inverters, which are placed at a distance from the solar array and can monitor a number of solar panels at the same time. This feature allows micro inverters to work independently and improve efficiency of the solar panels.

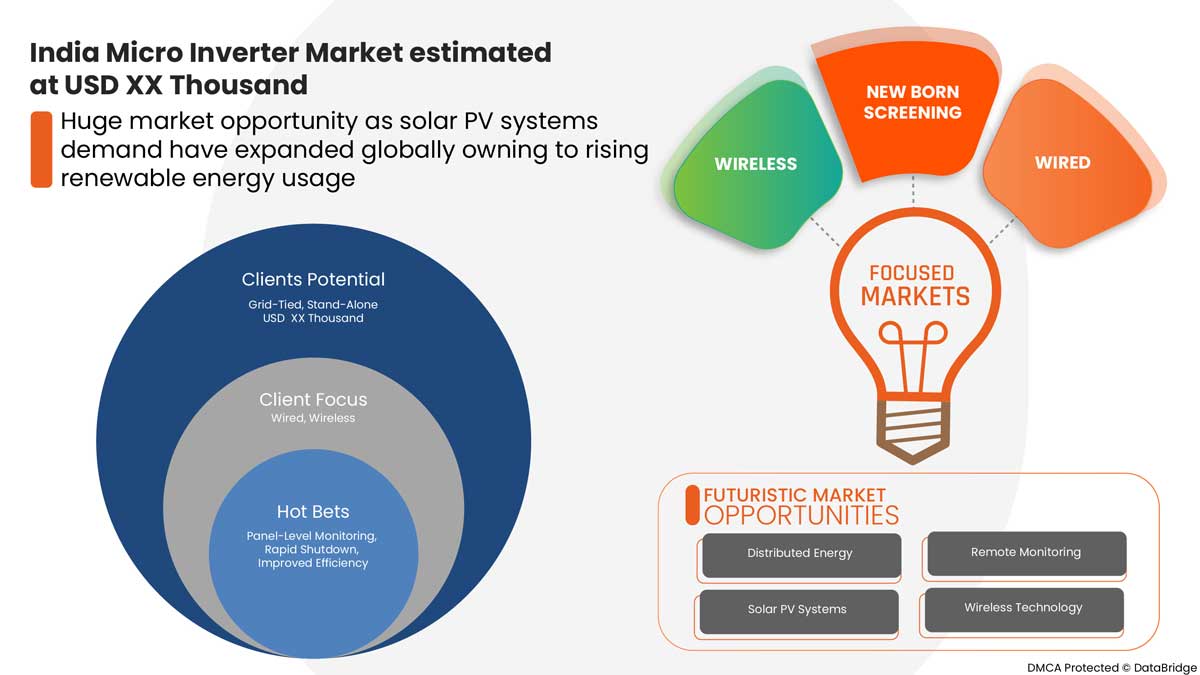

Data Bridge Market Research analyses that the India micro inverter market is expected to reach the value of USD 530,969.11 thousand by 2029, at a CAGR of 16.1% during the forecast period. The micro inverter market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Connection Type (Stand-Alone, Grid-Tied), Utility (Rapid Shutdown, Panel-Level Monitoring, System Expansion Ease, Multiple Angel Installation, Higher Durability, Others (IP67 Rated Protection, Electricity)), Type (Single Phase, Three Phase), Offering (Hardware, Software, Services), Communication Technology (Wired, Wireless), Power Rating (Below 250 W, Between 251 W & 500 W, Above 500 W) Sales Channel (Direct Channel, Indirect Channel), Industry (Residential, Commercial, PV Power Plants) |

|

Countries Covered |

India |

|

Market Players Covered |

Infineon Technologies AG, Fchoice Solar Tech India Pvt Ltd, Nordic (India) Solutions Pvt. Ltd, SunSights Solar, U R Energy, Enphase Energy, 360 Power Products, gracerenew.com, Sun Sine Solution Private Limited, Texas Instruments Incorporated, SuratExim, Waaree Energies Ltd., SMA Solar Technology AG, and P2 Power Solutions Pvt. Ltd among others. |

Market Definition

A solar micro inverter is plug-and-play equipment that transforms direct current generated by a single module to alternating current in photovoltaic installations. Micro inverters, unlike conventional central inverters, operate on module level power electronics (MLPE), which involves power conversion at the module level. As a result, the negative impacts of module mismatch are reduced, and the system's overall efficiency is improved. Micro inverters also provide module level monitoring, increased design flexibility, quicker installation, and improved safety over traditional inverters. Module-level power electronics, which use maximum power point tracking and micro inverters and power optimizers, give significant efficiency above conventional systems (MPPT). As a result, each module's production is maximized, and the whole system is more efficient.

India Micro Inverter Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rise in demand of renewable energy across the sector

Renewable energy is produced from natural sources or from renewable resources that are constantly replenished. India is third-largest consumer of electricity in the world after U.S. and China. The increasing demand for electricity is forcing India to search for new ways, especially renewable, to produce energy due to which India is constantly investing and developing its renewable energy sector. The lack of an electricity grid in a rural area of India and all the government initiatives to attract more consumers for renewable energy offers a chance to local manufacturers to provide solar panels for many applications. Thus, the growth in the renewable energy sector in India will boost the micro inverter market significantly.

- Increase in installations of solar products such as solar panels across the country

Over the years, the number of solar photovoltaic installations has increased exponentially across the globe. According to the International Energy Agency (IEA) roadmap, solar PV capacity is expected to reach 4,600 GW by 2050, amounting to 16% of the global electricity production. As per IRENA (International Renewable Energy Agency), India’s total gross power capacity will more than double from 284 gigawatts (GW) in 2015 to an estimated 670 GW by 2030, while electricity generation more than triples from 1100 terawatt-hours (TWh) per year to over 3450 TWh per year. Renewable power will maintain its strong growth in the Indian market reaching 35% share of generation and 60% share of power generation capacity. This shows that the there is a rising demand for solar energy and as micro inverters are connected to each solar panel, the demand for it is likely to increase in the nearby future.

Opportunities

- The integrated structure of micro inverter is proving opportunities for many market players

Embedded micro inverters can fully be integrated into the junction box of a module to create a more reliable and cheaper AC module. This, in turn, offers major cost advantage to customers, which replaces conventional junction box arrangement. Moreover, this technology is being incorporated by DC optimizer manufacturers to develop embedded mobiles that are called smart modules.

Moreover, since micro-inverters are not exposed to as high power and heat loads as central inverter, therefore they last significantly longer compare to other types. In addition, micro-inverters typically come with a warranty of 20-25 years to 10-15 years longer than central inverters. As micro inverters are very small in size, so they fit easily in the back of a solar panel. Because of its compact and small size, one doesn’t need to have separate cooling as central inverters.

Restraints/Challenges

- Higher dependence on conventional sources of energy for electricity generation

Conventional energy sources are natural energy resources such as natural gas, oil, coal, and nuclear. These are sources of energy used for since the industrial revolution and the dependency on these sources is too high as the infrastructure needed to generate electricity using these resources has already been built and in use. These infrastructures were made with high capital investments by the government and businesses and has taken decades to build. The time and capital needed to build infrastructure for non-conventional sources is high and technology is not reliable to generate the same capacity of energy as conventional sources. This high dependency on conventional source for electricity generation is being acting as blockage for the transition from conventional source to clean source of energy.

- Complicated design structure of micro inverter

Micro inverter technologies are becoming increasingly popular as a choice of grid connection for small-scale photovoltaic systems are required to harvest direct current (DC) electrical energy from PV modules and convert it to alternating Current (AC). Micro inverter consists of many hardware components such as fly back converter, switches, filter and other electronics components. In any PV (Photovoltaics) system, multiple solar modules are connected in series and parallel to provide voltage output. Combinations of these panels are then connected to a single centralized inverter to yield certain power modules. As each inverter is independently located below a solar panel, a communication bus and a common monitoring system is required as there is on board display system like in string inverters. Hence, the complicated design structure of micro inverter is imposing a challenge for the market to grow.

Post-COVID-19 Impact on India Micro Inverter Market

COVID-19 created a major impact on the micro inverter market as almost every country opted for the shutdown of every production facility except the ones dealing in producing the essential goods. The production of micro inverter system got hampered during lockdown. In post lockdown scenario, the growth of India micro inverter market is attributed to the increasing adoption of solar PV systems and technologies across all regions and countries. India's increasing renewable energy demand is major factor that contribute to the growth of the India micro inverter market.

Manufacturers & solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the micro inverter. With this, the companies will bring advanced technologies to the market. In addition, government initiatives related to smart energy system has led to the market's growth

Recent Developments

- In February 2022, Waaree Energies Ltd.’s subsidiary Waaree Renewable Technologies Limited awarded with the 180 MW DC solar power plant project in Tamil Nadu, India. The scope of this project includes engineering, procurement and construction (EPC) services of the solar plant

- In April 2021, Enphase Energy and IBC SOLAR had partnered together to offer their customers even more options for quick and easy solar system planning and installation

India Micro Inverter Market Scope

The India micro inverter market is segmented on the basis of connection type, utility, type, offering, communication technology, power rating, sales channel, and industry. The growth amongst these segments will help you analyse major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Connection Type

- Stand-Alone

- Grid-Tied

On the basis of connection type, the India micro inverter market is segmented into stand-alone, grid-tied.

Utility

- Rapid Shutdown

- Panel-Level Monitoring

- System Expansion Ease

- Multiple Angel Installation

- Higher Durability

- Others (IP67 Rated Protection, Electricity)

On the basis of utility, the India micro inverter market has been segmented into rapid shutdown, panel-level monitoring, system expansion ease, multiple angel installation, higher durability, others IP67 rated protection, electricity).

Type

- Single Phase

- Three Phase

On the basis of type, the India micro inverter market has been segmented into single phase, three phase.

Offering

- Hardware

- Software

- Services

On the basis of offering, the India micro inverter market has been segmented into hardware, software, services.

Communication Technology

- Wired

- Wireless

On the basis of communication technology, the India micro inverter market has been segmented into wired, wireless.

Power Rating

- Below 250 W

- Between 251 W & 500 W

- Above 500 W

On the basis of power rating, the India micro inverter market has been segmented into below 250 W, between 251 W & 500 W, above 500 W.

. Sales Channel

- Direct Channel

- Indirect Channel

On the basis of sales channel, the India micro inverter market is segmented into direct channel, indirect channel.

Industry

- Residential

- Commercial

- PV Power Plants

On the basis of industry, the India micro inverter market has been segmented into residential, commercial, PV power plants.

Competitive Landscape and India Micro Inverter Market Share Analysis

The India micro inverter market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, India presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to India micro inverter market.

Some of the major players operating in the India micro inverter market are Infineon Technologies AG, Fchoice Solar Tech India Pvt Ltd, Nordic (India) Solutions Pvt. Ltd, SunSights Solar, U R Energy, Enphase Energy, 360 Power Products, gracerenew.com, Sun Sine Solution Private Limited, Texas Instruments Incorporated, SuratExim, Waaree Energies Ltd., SMA Solar Technology AG, and P2 Power Solutions Pvt. Ltd among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA MICRO INVERTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 CONNECTION TYPE TIMELINE CURVE

2.9 MARKET CHALLENGE MATRIX

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS

4.2 ECOSYSTEM

4.3 TECHNOLOGY ANALYSIS

4.4 PRICING ANALYSIS

4.5 REGULATIONS

4.6 CASE STUDY

4.6.1 ENPHASE INSTALLED 7X M250 MICRO INVERTERS AND 1X ENVOY-R FOR RESIDENTIAL END USERS AS ENVIRONMENTALLY FRIENDLY SOLAR INVESTMENT

4.6.2 ENPHASE INSTALLED M215 MICRO INVERTERS FOR FAT WEST MEATS (US) COMMERCIAL PROJECT, PROVING THEM BETTER THAN DC OPTIMIZERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR RENEWABLE ENERGY ACROSS THE SECTOR

5.1.2 INCREASE IN INSTALLATIONS OF SOLAR PRODUCTS SUCH AS SOLAR PANELS ACROSS THE COUNTRY

5.1.3 TECHNICAL ADVANTAGES OF MICRO INVERTERS OVER CONVENTIONAL SOLAR INVERTERS

5.2 RESTRAINTS

5.2.1 HIGHER INSTALLATION AND MAINTENANCE COSTS OF MICRO-INVERTERS

5.2.2 HIGHER DEPENDENCE ON CONVENTIONAL SOURCES OF ENERGY FOR ELECTRICITY GENERATION

5.3 OPPORTUNITIES

5.3.1 INCREASE IN ACQUISITION AND PARTNERSHIP AMONG VARIOUS ORGANIZATIONS

5.3.2 THE INTEGRATED STRUCTURE OF MICRO INVERTER IS PROVING OPPORTUNITIES FOR MANY MARKET PLAYERS

5.3.3 GROWING GOVERNMENT INITIATIVES FOR USING ALTERNATIVES SOURCE OF ENERGY

5.4 CHALLENGES

5.4.1 RISING ADOPTION OF DC OPTIMIZERS ACROSS THE MARKET

5.4.2 COMPLICATED DESIGN STRUCTURE OF MICRO INVERTER

6 ANALYSIS OF IMPACT OF COVID 19 ON THE MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND, SUPPLY, AND PRICE

6.4 CONCLUSION

7 INDIA MICRO INVERTER MARKET, BY CONNECTION TYPE

7.1 OVERVIEW

7.2 GRID-TIED

7.2.1 SINGLE INPUT SINGLE OUTPUT (SISO)PLATFORM

7.2.2 MULTI INPUT SINGLE OUTPUT (MISO) PLATFORM

7.3 STAND-ALONE

7.3.1 PURE SINE WAVE

7.3.2 SQUARE WAVE

7.3.3 MODIFIED SINE WAVE

8 INDIA MICRO INVERTER MARKET, BY UTILITY

8.1 OVERVIEW

8.2 RAPID SHUTDOWN

8.3 PANEL-LEVEL MONITORING

8.4 SYSTEM EXPANSION EASE

8.5 MULTIPLE ANGEL INSTALLATION

8.6 HIGHER DURABILITY

8.7 OTHERS

9 INDIA MICRO INVERTER MARKET, BY TYPE

9.1 OVERVIEW

9.2 SINGLE PHASE

9.3 THREE PHASE

10 INDIA MICRO INVERTER MARKET, BY OFFERING

10.1 OVERVIEW

10.2 HARDWARE

10.3 SERVICES

10.4 SOFTWARE

11 INDIA MICRO INVERTER MARKET, BY COMMUNICATION TECHNOLOGY

11.1 OVERVIEW

11.2 WIRED

11.3 WIRELESS

12 INDIA MICRO INVERTER MARKET, BY POWER RATING

12.1 OVERVIEW

12.2 BETWEEN 251 & 500 W

12.3 BELOW 250 W

12.4 ABOVE 500 W

13 INDIA MICRO INVERTER MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 INDIRECT CHANNEL

13.3 DIRECT CHANNEL

14 INDIA MICRO INVERTER MARKET, BY INDUSTRY

14.1 OVERVIEW

14.2 RESIDENTIAL

14.2.1 INDIVIDUAL HOMES

14.2.1.1 RAPID SHUTDOWN

14.2.1.2 PANEL-LEVEL MONITORING

14.2.1.3 SYSTEM EXPANSION EASE

14.2.1.4 MULTIPLE ANGEL INSTALLATION

14.2.1.5 HIGHER DURABILITY

14.2.1.6 OTHERS

14.2.2 APARTMENTS

14.2.2.1 RAPID SHUTDOWN

14.2.2.2 PANEL-LEVEL MONITORING

14.2.2.3 SYSTEM EXPANSION EASE

14.2.2.4 MULTIPLE ANGEL INSTALLATION

14.2.2.5 HIGHER DURABILITY

14.2.2.6 OTHERS

14.2.3 SOCIETIES

14.2.3.1 RAPID SHUTDOWN

14.2.3.2 PANEL-LEVEL MONITORING

14.2.3.3 SYSTEM EXPANSION EASE

14.2.3.4 MULTIPLE ANGEL INSTALLATION

14.2.3.5 HIGHER DURABILITY

14.2.3.6 OTHERS

14.3 COMMERCIAL

14.3.1 RETAIL

14.3.1.1 RAPID SHUTDOWN

14.3.1.2 PANEL-LEVEL MONITORING

14.3.1.3 SYSTEM EXPANSION EASE

14.3.1.4 MULTIPLE ANGEL INSTALLATION

14.3.1.5 HIGHER DURABILITY

14.3.1.6 OTHERS

14.3.2 HOTELS & RESTAURANTS

14.3.2.1 RAPID SHUTDOWN

14.3.2.2 PANEL-LEVEL MONITORING

14.3.2.3 SYSTEM EXPANSION EASE

14.3.2.4 MULTIPLE ANGEL INSTALLATION

14.3.2.5 HIGHER DURABILITY

14.3.2.6 OTHERS

14.3.3 EDUCATIONAL INSTITUTIONS

14.3.3.1 RAPID SHUTDOWN

14.3.3.2 PANEL-LEVEL MONITORING

14.3.3.3 SYSTEM EXPANSION EASE

14.3.3.4 MULTIPLE ANGEL INSTALLATION

14.3.3.5 HIGHER DURABILITY

14.3.3.6 OTHERS

14.3.4 GOVERNMENT INSTITUTIONS

14.3.4.1 RAPID SHUTDOWN

14.3.4.2 PANEL-LEVEL MONITORING

14.3.4.3 SYSTEM EXPANSION EASE

14.3.4.4 MULTIPLE ANGEL INSTALLATION

14.3.4.5 HIGHER DURABILITY

14.3.4.6 OTHERS

14.3.5 HOSPITALS

14.3.5.1 RAPID SHUTDOWN

14.3.5.2 PANEL-LEVEL MONITORING

14.3.5.3 SYSTEM EXPANSION EASE

14.3.5.4 MULTIPLE ANGEL INSTALLATION

14.3.5.5 HIGHER DURABILITY

14.3.5.6 OTHERS

14.3.6 AGRICULTURE

14.3.6.1 RAPID SHUTDOWN

14.3.6.2 PANEL-LEVEL MONITORING

14.3.6.3 SYSTEM EXPANSION EASE

14.3.6.4 MULTIPLE ANGEL INSTALLATION

14.3.6.5 HIGHER DURABILITY

14.3.6.6 OTHERS

14.4 PV POWER PLANTS

14.4.1 ON-GRID

14.4.1.1 RAPID SHUTDOWN

14.4.1.2 PANEL-LEVEL MONITORING

14.4.1.3 SYSTEM EXPANSION EASE

14.4.1.4 MULTIPLE ANGEL INSTALLATION

14.4.1.5 HIGHER DURABILITY

14.4.1.6 OTHERS

14.4.2 OFF-GRID

14.4.2.1 RAPID SHUTDOWN

14.4.2.2 PANEL-LEVEL MONITORING

14.4.2.3 SYSTEM EXPANSION EASE

14.4.2.4 MULTIPLE ANGEL INSTALLATION

14.4.2.5 HIGHER DURABILITY

14.4.2.6 OTHERS

14.4.3 HYBRID

14.4.3.1 RAPID SHUTDOWN

14.4.3.2 PANEL-LEVEL MONITORING

14.4.3.3 SYSTEM EXPANSION EASE

14.4.3.4 MULTIPLE ANGEL INSTALLATION

14.4.3.5 HIGHER DURABILITY

14.4.3.6 OTHERS

15 INDIA MICRO INVERTER MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: INDIA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ENPHASE ENERGY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 WAAREE ENERGIES LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 FCHOICE SOLAR TECH INDIA PVT LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 P2 POWER SOLUTIONS PVT. LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 SERVICE PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SUN SINE SOLUTION PRIVATE LIMITED

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 GRACERENEW.COM

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 INFINEON TECHNOLOGIES AG

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 SOLUTION PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 NORDIC (INDIA) SOLUTIONS PVT. LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 360 POWER PRODUCTS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 SURATEXIM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 SMA SOLAR TECHNOLOGY AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 SUNSIGHTS SOLAR

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 TEXAS INSTRUMENTS INCORPORATED

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 SOLUTION PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 U R ENERGY

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 PRICE RANGE OF SOME MICRO INVERTERS BY COMPANIES IN INDIA:

TABLE 2 INDIA MICRO INVERTER MARKET, BY CONNECTION TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 INDIA MICRO INVERTER MARKET, BY CONNECTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 4 INDIA GRID-TIED IN MICRO INVERTER MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 5 INDIA STAND-ALONE IN MICRO INVERTER MARKET, BY POWER OUTPUT TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 INDIA MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 7 INDIA MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 INDIA MICRO INVERTER MARKET, BY OFFERING, 2020-2029 (USD THOUSAND)

TABLE 9 INDIA MICRO INVERTER MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 10 INDIA MICRO INVERTER MARKET, BY POWER RATING, 2020-2029 (USD THOUSAND)

TABLE 11 INDIA MICRO INVERTER MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 12 INDIA MICRO INVERTER MARKET, BY INDUSTRY, 2020-2029 (USD THOUSAND)

TABLE 13 INDIA RESIDENTIAL IN MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 INDIA INDIVIDUAL HOMES IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 15 INDIA APARTMENTS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 16 INDIA SOCIETIES IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 17 INDIA COMMERCIAL IN MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 INDIA RETAIL IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 19 INDIA HOTELS & RESTAURANTS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 20 INDIA EDUCATIONAL INSTITUTIONS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 21 INDIA GOVERNMENT INSTITUTIONS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 22 INDIA HOSPITALS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 23 INDIA AGRICULTURE IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 24 INDIA PV POWER PLANTS IN MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 INDIA ON-GRID IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 26 INDIA OFF-GRID IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 27 INDIA HYBRID IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 INDIA MICRO INVERTER MARKET: SEGMENTATION

FIGURE 2 INDIA MICRO INVERTER MARKET: DATA TRIANGULATION

FIGURE 3 INDIA MICRO INVERTER MARKET: DROC ANALYSIS

FIGURE 4 INDIA MICRO INVERTER MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA MICRO INVERTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA MICRO INVERTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA MICRO INVERTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA MICRO INVERTER MARKET: SEGMENTATION

FIGURE 9 RISE IN DEMAND OF RENEWABLE ENERGY ACROSS THE SECTOR IS EXPECTED TO DRIVE THE INDIA MICRO INVERTER MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 10 GRID-TIED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA MICRO INVERTER MARKETIN 2022 & 2029

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF INDIA MICRO INVERTER MARKET

FIGURE 12 GLOBAL CUMULATIVE PV INSTALLATION, BY REGION (2020)

FIGURE 13 INDIA MICRO INVERTER MARKET: BY CONNECTION TYPE, 2021

FIGURE 14 INDIA MICRO INVERTER MARKET: BY UTILITY, 2021

FIGURE 15 INDIA MICRO INVERTER MARKET: BY TYPE, 2021

FIGURE 16 INDIA MICRO INVERTER MARKET: BY OFFERING, 2021

FIGURE 17 INDIA MICRO INVERTER MARKET: BY COMMUNICATION TECHNOLOGY, 2021

FIGURE 18 INDIA MICRO INVERTER MARKET: BY POWER RATING, 2021

FIGURE 19 INDIA MICRO INVERTER MARKET: BY SALES CHANNEL, 2021

FIGURE 20 INDIA MICRO INVERTER MARKET: BY INDUSTRY, 2021

FIGURE 21 INDIA MICRO INVERTER MARKET: COMPANY SHARE 2021 (%)

India Micro Inverter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its India Micro Inverter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as India Micro Inverter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.