India Ultrasound Sensor Market

Market Size in USD Million

CAGR :

%

USD

158.24 Million

USD

270.45 Million

2024

2032

USD

158.24 Million

USD

270.45 Million

2024

2032

| 2025 –2032 | |

| USD 158.24 Million | |

| USD 270.45 Million | |

|

|

|

|

India Ultrasound Sensor Market Size

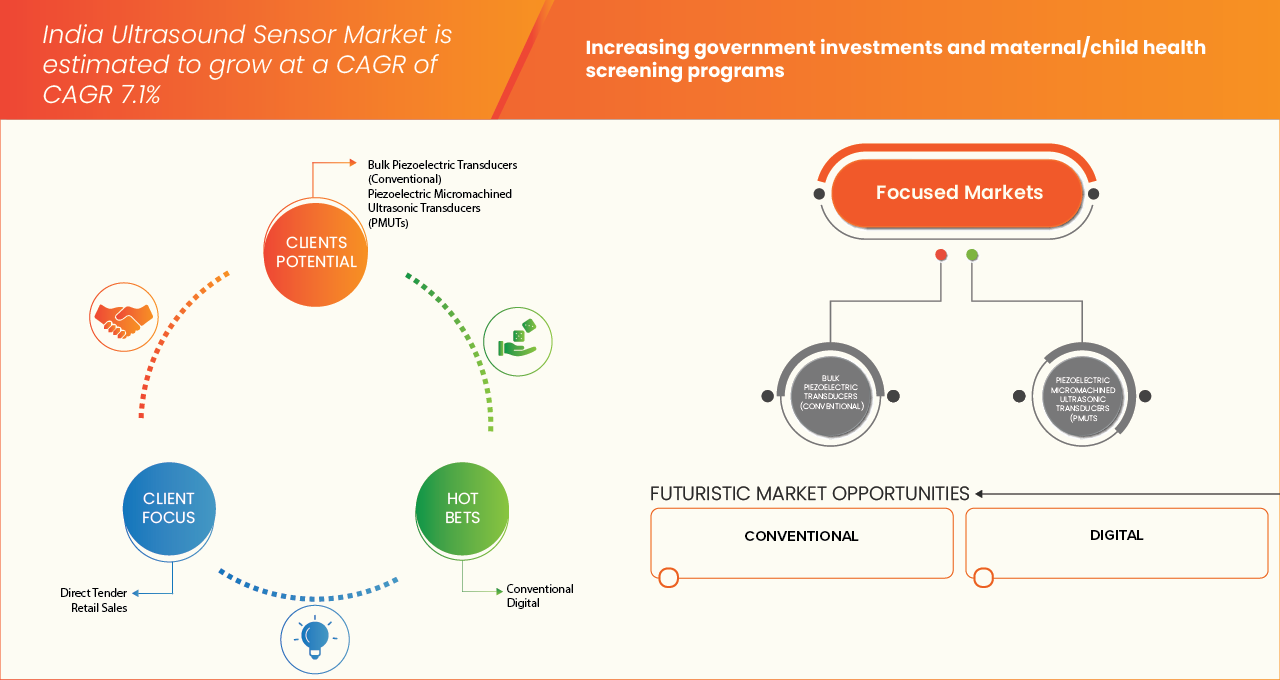

- The India ultrasound sensor market size was valued at USD 158.24 million in 2024 and is expected to reach USD 270.45 million by 2032, at a CAGR of 7.1% during the forecast period

- The ultrasound sensor market is expanding rapidly, driven by rising demand in healthcare imaging, industrial automation, and automotive safety applications. Advancements in sensor technology ensure improved accuracy, compact design, and energy efficiency for diverse applications

- Additional growth stems from broader industrial adoption (non-destructive testing, automotive/robotics sensors), local manufacturing initiatives, and government programs that expand rural diagnostic reach — all boosting sensor volume and innovations

India Ultrasound Sensor Market Analysis

- An ultrasound sensor is a non-contact device that employs high-frequency sound waves beyond human hearing to detect, measure, and analyze objects, distances, or fluid levels. It works by emitting ultrasonic pulses and interpreting their echoes. Commonly used in medical imaging, industrial automation, robotics, automotive, and environmental monitoring, ultrasound sensors provide accurate, real-time, and reliable measurements across diverse applications, ensuring efficiency, safety, and precision in operations

- Increasing use of advanced driver assistance systems (ADAS) in automotive accelerates ultrasound sensor deployment. They play a crucial role in parking assistance, collision avoidance, and autonomous driving, enhancing vehicle safety, efficiency, and user experience globally. Rising healthcare investments strengthen ultrasound sensor applications in diagnostic imaging, patient monitoring, and therapeutic devices. Their non-invasive, reliable, and radiation-free attributes make them preferred tools, supporting preventive healthcare, early disease detection, and technological innovations in medical devices

- Bulk Piezoelectric Transducers (Conventional) segment dominated the India ultrasound sensor market with 53.10% revenue share in 2024, driven by their widespread use in medical imaging, industrial non-destructive testing, and automotive applications. Their reliability, cost-effectiveness, and high sensitivity make them ideal for diagnostic equipment and industrial sensors, supporting growing demand in healthcare and manufacturing sectors

Report Scope and India Ultrasound Sensor Market Segmentation

|

Attributes |

India Ultrasound Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

India Ultrasound Sensor Market Trends

“Integration of Digital Imaging Technologies and Expanding Use in Point-of-Care Diagnostics”

- The India ultrasound sensor market is advancing with the adoption of digital beamforming, portable systems, and AI-enabled imaging solutions to improve diagnostic accuracy

- Growing demand for point-of-care and bedside diagnostics is fueling the integration of compact ultrasound devices in primary healthcare and emergency care

- Hospitals and diagnostic centers are increasingly adopting handheld ultrasound units, which provide mobility, lower costs, and faster imaging capabilities

- For instance, Indian medical device manufacturers are collaborating with global technology providers to localize production and make portable ultrasound solutions more affordable

- This trend highlights the role of ultrasound sensors as enablers of cost-effective, non-invasive diagnostics, aligned with the government’s healthcare expansion initiatives

India Ultrasound Sensor Market Dynamics

Driver

“Rising Burden of Chronic Diseases and Increasing Focus on Early Diagnostics”

- The rising prevalence of cardiovascular disorders, cancer, and pregnancy-related complications is increasing demand for ultrasound-based diagnostic imaging

- A growing focus on early and preventive healthcare is accelerating the use of ultrasound sensors in advanced imaging systems

- Government initiatives such as Ayushman Bharat and expansion of diagnostic infrastructure are creating new opportunities for adoption of cost-efficient ultrasound devices

- In 2024, several public and private hospitals introduced portable and mobile ultrasound units in semi-urban and rural clinics, reflecting efforts to expand healthcare access

- These developments are expected to improve patient outcomes, support faster diagnostics, and drive ultrasound sensor market penetration across India

Restraint/Challenge

“High Cost of Advanced Technologies and Dependence on Imports”

- The integration of advanced ultrasound technologies such as adaptive beamforming and AI-enabled imaging is limited by high system and sensor costs

- Heavy reliance on imported ultrasound components and equipment increases the financial burden on healthcare providers, particularly in tier-2 and tier-3 cities

- Smaller diagnostic centers face challenges in adopting high-end ultrasound machines due to affordability constraints and limited reimbursement support

- In 2023, industry reports highlighted that several hospitals postponed procurement of advanced ultrasound systems due to cost concerns and delayed funding approvals

- These barriers slow the adoption of cutting-edge technologies, creating disparities between advanced urban hospitals and resource-limited rural healthcare facilities in India

India Ultrasound Sensor Market Scope

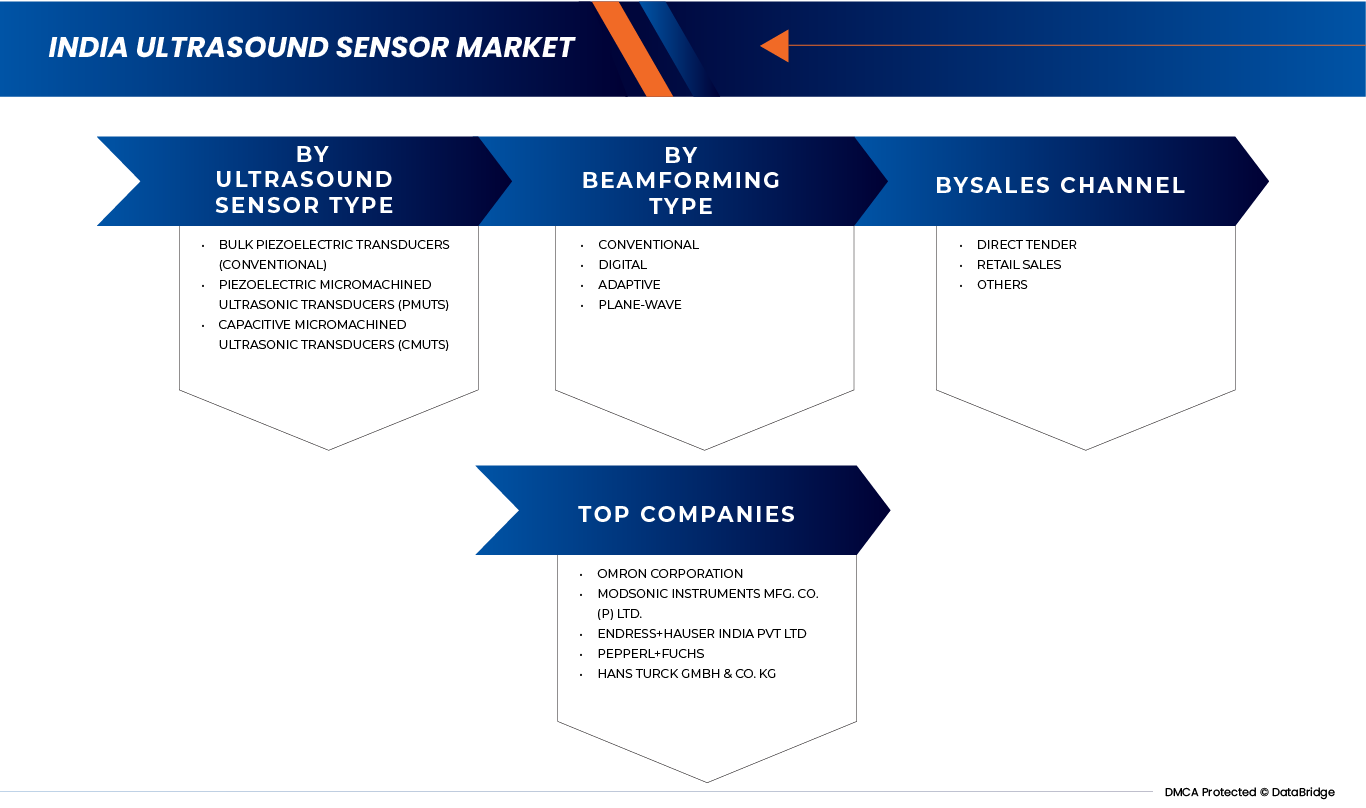

The market is segmented on the basis of ultrasound sensor type, beamforming type, sales channel.

- By Ultrasound Sensor Type

On the basis of ultrasound sensor type, the India ultrasound sensor market is segmented into Bulk Piezoelectric Transducers (Conventional), Piezoelectric Micromachined Ultrasonic Transducers (PMUTs) and and Capacitive Micromachined Ultrasonic Transducers (CMUTs). In 2025, Bulk Piezoelectric Transducers (Conventional) segment is expected to dominate the market with a share of 53.04%, driven by their proven reliability, high sensitivity, and cost-effectiveness in medical imaging applications such as obstetrics, cardiology, and abdominal diagnostics. These conventional sensors remain widely used in hospitals and diagnostic centers due to established manufacturing capabilities and familiarity among healthcare professionals. Their compatibility with a wide range of ultrasound machines, coupled with affordability compared to advanced alternatives, ensures continued adoption, especially in mid-sized clinics and public healthcare facilities.

Piezoelectric Micromachined Ultrasonic Transducers (PMUTs) is anticipated show the highest CAGR of 7.9% during the forecast period, due to their compact design, lower power consumption, and integration potential with portable and wearable ultrasound systems. Growing demand for point-of-care diagnostics, telemedicine, and home healthcare supports their adoption. The miniaturization of sensors enables wider application in mobile and handheld ultrasound devices, improving accessibility in rural areas. In addition, rising R&D investments and partnerships between Indian startups and global players are accelerating the localization of PMUT-based technologies, positioning them as next-generation solutions in ultrasound diagnostics.

- By Beamforming Type

On the basis of beamforming type, the India ultrasound sensor market is segmented into conventional, digital, adaptive and plane-wave. In 2025, Conventional segment is expected to dominate the market with a share of 40.39% and it is anticipated to show the fastest growth during the forecast period with a CAGR of 7.8% as conventional ultrasound sensor designs provide stable performance, durability, and compatibility with existing imaging platforms. Hospitals and diagnostic centers prefer these solutions because they are easier to operate, cost-efficient, and well-suited for routine diagnostic procedures. With India’s healthcare sector expanding rapidly in both public and private segments, conventional sensors remain a practical choice for widespread deployment. Their established supply chains and proven clinical outcomes further strengthen demand across high-volume diagnostic centers and maternity hospitals.

- By Sales Channel

On the basis of sales channel, the India ultrasound sensor market is segmented into direct tender, retail sales and others. In 2025, the Direct Tender segment is expected to dominate the market with a share of 57.25% and it is anticipated to show the fastest growth during the forecast period with a CAGR of 7.3%, since it is a driver of ultrasound sensor demand in India, particularly across government hospitals, public health programs, and large tertiary care centers. Central and state governments are investing heavily in medical device procurement under schemes such as Ayushman Bharat to expand diagnostic access. Direct tenders enable bulk purchasing, cost negotiation, and faster distribution of ultrasound systems equipped with advanced sensors. This channel ensures affordability for resource-constrained facilities while supporting wider adoption in semi-urban and rural regions.

India Ultrasound Sensor Market Regional Analysis

India

- India ultrasound sensor market is driven by rising demand for non-invasive diagnostic imaging, growing prevalence of chronic diseases, and increasing use in maternal and fetal healthcare.

- Government initiatives to strengthen healthcare infrastructure, coupled with technological advancements such as portable and AI-enabled ultrasound devices, support adoption. Expanding applications in industrial testing and automotive safety further fuel market growth

- Technological advancements, including portable, wearable, and AI-integrated ultrasound systems, are improving diagnostic accuracy and accessibility, particularly in rural and remote regions

- Expanding applications in industrial non-destructive testing, robotics, and automotive safety systems—such as parking assistance and proximity sensing—are broadening the market’s reach beyond healthcare

- Increasing investments by public and private players, coupled with the rising number of diagnostic centers and imaging facilities, are further propelling market growth across India

India Ultrasound Sensor Market Share

The India Ultrasound Sensor industry is primarily led by well-established companies, including

- MakTechnosys (India)

- Modsonic Instruments Mfg. Co. (P) Ltd. (India)

- Electronic & Engineering Company India Private Limited (India)

- Butterfly Network, Inc. (U.S.)

- OMRON Corporation (Japan)

- Hans Turck GmbH & Co. KG (Germany)

- Pepperl+Fuchs (Germany)

- Endress+Hauser India Pvt Ltd (India)

- Sick India Pvt Ltd (Germany)

- Banner Engineering India Pvt Ltd (U.S.)

- Pulsar Measurement (U.K.)

- Microsonic (Germany)

- Esaote SPA (Italy)

- Dipel Electronics (India)

Latest Developments in India Ultrasound Sensor Market

- In September 2024, SICK AG and Endress+Hauser have entered into a strategic partnership to enhance process automation solutions. Under this collaboration, Endress+Hauser will assume global sales and service responsibilities for SICK’s process analyzers and gas flowmeters

- In August 2025, The MyLab A50 and MyLab A70 ultrasound systems received FDA approval. These portable, battery-operated systems feature advanced imaging technology and AI-based diagnostic capabilities, reinforcing Esaote's innovative presence in global and Indian markets

- In June 2024, Esaote Group expands production in India with a new manufacturing site in Noida, Uttar Pradesh, launched in 2024. The site produces a full range of advanced ultrasound series — MyLab A, MyLab E series, and compact portable ultrasounds — all made in India to serve the local market with AI-enhanced imaging and touchscreen control for improved clinical workflow

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 INNOVATION PIPELINE

4.3 PROCUREMENT & TENDER INTELLIGENCE

4.3.1 PUBLIC AND PRIVATE SECTOR PROCUREMENT TRENDS FOR SENSORS/MODULES

4.3.2 TENDER PRICING BENCHMARKS FOR ULTRASOUND PROBES AND TRANSDUCERS

4.3.3 KEY MEDICAL PROCUREMENT AGENCIES

4.3.3.1 HLL LIFECARE LIMITED (HLL)

4.3.3.2 HLL INFRATECH SERVICES LTD (HITES)

4.3.3.3 GOVERNMENT E-MARKETPLACE (GEM)

4.3.3.4 CENTRAL PROCUREMENT AGENCY (CPA), DELHI

4.3.3.5 HSCC LIMITED (HEALTHCARE SECTOR CONSULTANCY COMPANY)

4.3.3.6 KARNATAKA STATE MEDICAL SUPPLIES CORPORATION LIMITED (KSMSCL)

4.3.3.7 UTTAR PRADESH MEDICAL SUPPLIES CORPORATION LIMITED (UPMSCL)

4.3.3.8 MAHARASHTRA MEDICAL GOODS PROCUREMENT AUTHORITY (MMGPA)

4.3.3.9 GUJARAT MEDICAL SERVICES CORPORATION (GMSC)

4.3.3.10 CHHATTISGARH MEDICAL SERVICES CORPORATION LIMITED

4.3.3.11 INDIAN COUNCIL OF MEDICAL RESEARCH (ICMR)

4.3.3.12 ALL INDIA INSTITUTE OF MEDICAL SCIENCES (AIIMS)

4.4 PRICING ANALYSIS

4.4.1 TARGET PRICING STRATEGY

4.5 SUPPLY CHAIN DYNAMICS

4.6 TECHNICAL BENCHMARKING

4.7 IP OWNERSHIP DISTRIBUTION FOR KEY TECHNOLOGIES AMONG LEADING GLOBAL AND REGIONAL VENDORS

4.8 PATENT LANDSCAPE AND MAJOR HOLDERS OF ULTRASOUND SENSOR RELATED IP

4.9 OWNERSHIP/PARTNERSHIP STRUCTURES OF RELEVANT MANUFACTURERS AND TECHNOLOGY PROVIDERS THAT SUPPLY INTO INDIA

4.1 CURRENT AND POTENTIAL DEMAND DRIVERS IN INDIA ACROSS KEY END-USER SECTORS

4.10.1 CURRENT DEMAND DRIVERS

4.10.1.1 MEDICAL DEVICE OEMS

4.10.1.2 INDUSTRIAL AUTOMATION & ROBOTICS

4.10.2 AUTOMOTIVE MANUFACTURERS

4.10.3 RESEARCH & ACADEMIC INSTITUTIONS

4.10.4 POTENTIAL DRIVERS

4.10.4.1 MEDICAL DEVICE OEMS

4.10.5 INDUSTRIAL AUTOMATION & ROBOTICS

4.10.6 RESEARCH & ACADEMIC INSTITUTIONS

4.11 CURRENT AND POTENTIAL DEMAND DRIVERS IN INDIA ACROSS KEY END-USER SECTORS

4.11.1 ULTRASOUND SENSORS – VALUE PROPOSITION STRATEGY

4.11.2 CORE BENEFITS & DIFFERENTIATORS

4.11.3 TECHNOLOGY-DRIVEN ADVANTAGES

4.11.4 MARKET GROWTH VALUE

4.11.5 SOCIETAL & ECONOMIC VALUE

4.11.6 COST–BENEFIT POSITIONING VS. EXISTING ALTERNATIVES

4.12 SUGGESTED MESSAGING FOR MEDICAL OEMS, ROBOTIC SENSOR INTEGRATORS

4.12.1 MEDICAL DEVICE OEMS

4.12.1.1 STRATEGIC MESSAGING:

4.12.1.2 KEY MESSAGES:

4.12.2 ROBOTIC SENSOR INTEGRATORS & INDUSTRIAL AUTOMATION COMPANIES

4.12.2.1 STRATEGIC MESSAGING:

4.12.2.2 KEY VALUE MESSAGES:

5 REGULATORY ENVIRONMENT – CURRENT LANDSCAPE

5.1 MEDICAL DEVICE REGULATION (MDR, 2017)

5.2 PC-PNDT ACT (1994, AMENDED)

5.3 IMPORT CONTROLS & CDSCO LICENSING

5.4 STANDARDS & CERTIFICATIONS

5.5 GOVERNMENT PUSH FOR LOCALIZATION (MAKE IN INDIA)

5.6 TRIGGERS FOR FUTURE LOCAL MARKET DEVELOPMENT

5.6.1 EXPANSION OF MDR TO INCLUDE ALL DEVICES

5.6.2 PLI & LOCALIZATION MANDATES

5.6.3 TAX & IMPORT DUTY ADJUSTMENTS

5.6.4 DIGITAL HEALTH & AI REGULATION

5.6.5 PUBLIC PROCUREMENT & TIER-II/TIER-III MARKET PENETRATION

5.6.6 EXPORT-ORIENTED GROWTH PUSH

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING CHRONIC DISEASE BURDEN & AGING POPULATION DRIVING NEED FOR DIAGNOSTIC IMAGING

6.1.2 GROWING ADOPTION OF POINT-OF-CARE AND PORTABLE ULTRASOUND SYSTEMS IN RURAL/REMOTE AREAS..

6.1.3 INCREASING GOVERNMENT INVESTMENTS AND MATERNAL/CHILD HEALTH SCREENING PROGRAMS..

6.1.4 CONTINUOUS PROBE TECHNOLOGY ADVANCEMENTS (MINIATURIZATION, DURABILITY, AI-ASSISTED IMAGING).

6.2 RESTRAINTS

6.2.1 HIGH PRICE SENSITIVITY AND LIMITED REIMBURSEMENT POLICIES IN THE INDIAN HEALTHCARE SYSTEM

6.2.2 REGULATORY DELAYS AND IMPORT DEPENDENCY FOR ADVANCED PROBES, SLOWING MARKET PENETRATION.

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF DOMESTIC MANUFACTURING UNDER “MAKE IN INDIA” AND MEDICAL DEVICE PARKS, REDUCING RELIANCE ON IMPORTS

6.3.2 RISING MEDICAL TOURISM IN INDIA, INCREASING DEMAND FOR ADVANCED IMAGING TOOLS AND PROBES IN PRIVATE HOSPITALS

6.3.3 EMERGENCE OF TELEMEDICINE & REMOTE DIAGNOSTICS, WHERE ULTRASOUND PROBES INTEGRATED WITH CLOUD/AI PLATFORMS CAN SERVE RURAL POPULATIONS.

6.4 CHALLENGES

6.4.1 HIGHLY FRAGMENTED MARKET FUELING INTENSE COMPETITION AND PRICING PRESSURE...

6.4.2 SHORT SHELF LIFE AND HANDLING CHALLENGES

7 INDIA ULTRASOUND SENSOR MARKET, TYPE.

7.1 OVERVIEW

7.2 BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL)

7.3 PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS)

7.4 CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS)

8 INDIA ULTRASOUND SENSOR MARKET, BEAMFORMING TYPE.

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 DIGITAL

8.4 ADAPTIVE

8.5 PLANE-WAVE

9 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL.

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL SALES

9.4 OTHERS

10 INDIA ULTRASOUND SENSOR MARKET MARKET

10.1 COMPANY SHARE ANALYSIS: INDIA

10.2 COMPANY SHARE ANALYSIS: INDIA (BY SENSOR TYPE)

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 OMRON CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 MODSONIC INSTRUMENTS MFG. CO. (P) LTD.

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT DEVELOPMENT

12.3 ENDRESS+HAUSER GROUP SERVICES AG,

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 PEPPERL+FUCHS

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 HANS TURCK GMBH & CO. KG

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENT

12.6 BANNER ENGINEERING CORP.

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 BUTTERFLY NETWORK, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DIPEL ELECTRONICS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 ELECTRONIC & ENGINEERING COMPANY INDIA PRIVATE LIMITED

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 ESAOTE SPA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 MAK TECHNOSYS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 MICROSONIC INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 PULSAR MEASUREMENT

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 SICK AG

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 3 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 4 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 5 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 7 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 8 INDIA RETAIL SALES IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS), BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 10 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 11 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 12 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 14 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 15 INDIA RETAIL SALES IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 18 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 19 ) INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND

TABLE 20 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 21 INDIACAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 22 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 23 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 INDIA ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 25 INDIA RETAIL SALES IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 INDIA ULTRASOUND SENSOR MARKET

FIGURE 2 INDIA ULTRASOUND SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 INDIA ULTRASOUND SENSOR MARKET: DROC ANALYSIS

FIGURE 4 INDIA ULTRASOUND SENSOR MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 INDIA ULTRASOUND SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA ULTRASOUND SENSOR MARKET: MULTIVARIATE MODELLING

FIGURE 7 INDIA ULTRASOUND SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 INDIA ULTRASOUND SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDIA ULTRASOUND SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY: INDIA ULTRASOUND SENSORS MARKET

FIGURE 11 INDIA ULTRASOUND SENSOR MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 THREE SEGMENTS COMPRISE THE INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE (2024)

FIGURE 14 RISING CHRONIC DISEASE BURDEN & AGING POPULATION DRIVING NEED FOR DIAGNOSTIC IMAGING IS EXPECTED TO DRIVE THE INDIA ULTRASOUND SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 15 THE BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA ULTRASOUND SENSOR MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 OEM PRICING ULTRASOUND SENSORS PRICING TRENDS, 2024-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 18 OEM PRICING UULTRASOUND SENSORS PRICING TRENDS, 2024-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 19 RETAIL AND TENDER BY PRODUCT TYPE, 2024-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 20 SUPPLY CHAIN DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDIA ULTRASOUND SENSOR MARKET

FIGURE 22 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, 2024

FIGURE 23 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, CAGR (2025 TO 2032)

FIGURE 24 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, CAGR (2025 TO 2032)

FIGURE 25 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, LIFELINE CURVE

FIGURE 26 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, 2024

FIGURE 27 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, CAGR (2025-2032)

FIGURE 28 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, CAGR (2025-2032)

FIGURE 29 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, LIFELINE CURVE

FIGURE 30 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL 2024

FIGURE 31 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL, CAGR (2025-2032)

FIGURE 32 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL, CAGR (2025-2032)

FIGURE 33 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL, LIFELINE CURVE

FIGURE 34 INDIA ULTRASOUND SENSOR MARKET MARKET: COMPANY SHARE 2024 (%)

FIGURE 35 INDIA ULTRASOUND SENSOR MARKET: COMPANY SHARE, BY SENSOR TYPE, 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.