Indonesia Goat Milk Market

Market Size in USD Million

CAGR :

%

USD

120.31 Million

USD

155.44 Million

2025

2033

USD

120.31 Million

USD

155.44 Million

2025

2033

| 2026 –2033 | |

| USD 120.31 Million | |

| USD 155.44 Million | |

|

|

|

|

Indonesia Goat Milk Market Size

- The Indonesia goat milk market size was valued at USD 120.31 Million in 2025 and is expected to reach USD 155.44 Million by 2033, at a CAGR of 3.3% during the forecast period

- Increasing health awareness and preference for natural and organic products is accelerating the demand for Indonesia goat milks is a major factor driving demand across the country

- Rising product ranges of goat milk is further strengthening market reach

Indonesia Goat Milk Market Analysis

- Indonesia’s goat milk market is expanding steadily as consumers increasingly associate goat milk with superior digestibility, natural nutrition, and suitability for lactose-intolerant individuals. This shift is supported by rising health consciousness, greater awareness of functional dairy benefits, and gradual lifestyle changes in urban areas where premium and specialty dairy products are gaining traction.

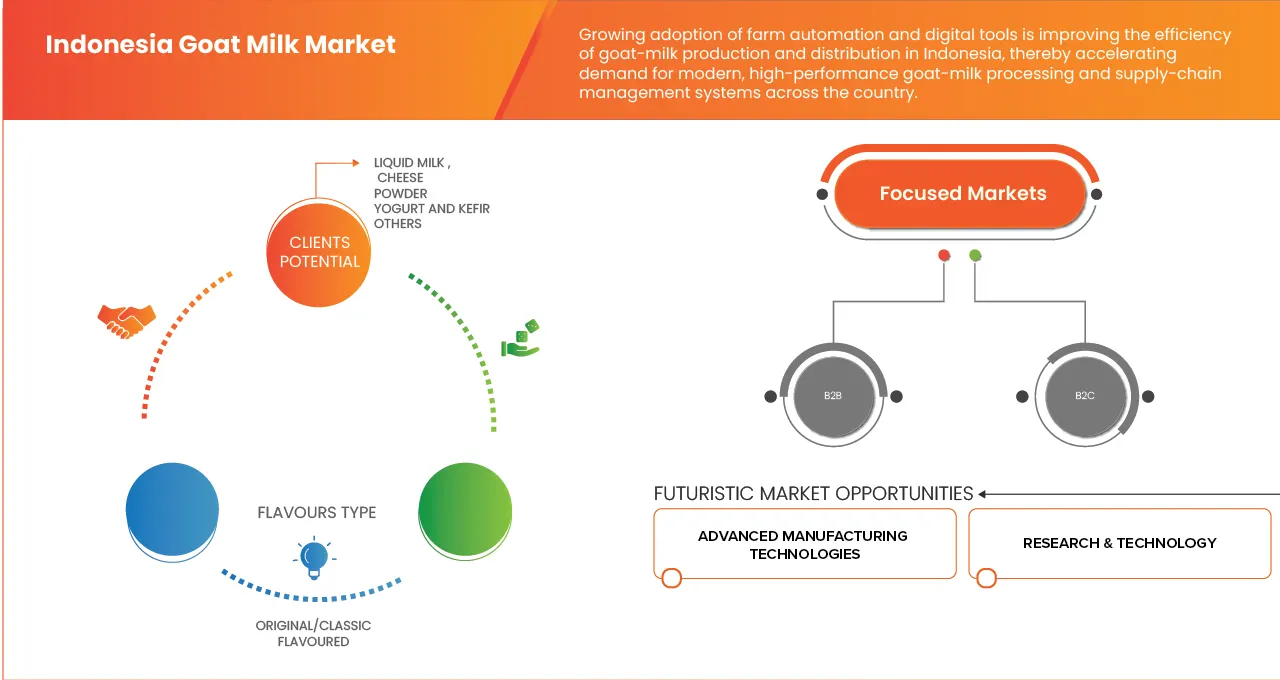

- Product diversification is strengthening market depth, with manufacturers extending offerings beyond traditional liquid milk into powder, yogurt, kefir, cheese, and toddler formulations. While liquid milk remains the dominant segment, fermented products and value-added formats are driving future growth as Indonesians seek convenient, immunity-supporting, and probiotic-rich options that align with evolving dietary preferences.

- The distribution landscape is transitioning as well, with offline channels still leading due to strong retail networks, yet online sales accelerating rapidly. Growing e-commerce adoption, improved cold-chain logistics, and targeted digital marketing are increasing accessibility, particularly among younger consumers seeking convenience and reliable home delivery.

- In 2025, liquid milk dominates the Indonesia goat milk market with a market share of 59.54% due to widely recognized, trusted, and easily incorporated into everyday consumption habits, benefiting from established distribution and strong household penetration.

Report Scope and Indonesia Goat Milk Market Segmentation

|

Attributes |

Indonesia Goat Milk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Indonesia Goat Milk Market Trends

“Rising Health-Driven Demand for Premium Goat Milk in Indonesia”

- Demand for goat milk is increasing as Indonesian consumers become more health-conscious and seek dairy products perceived as more nutritious, natural, and easier to digest than cow’s milk. This shift is especially visible among younger urban buyers who actively look for “clean label” and functional foods.

- Consumers with lactose intolerance or sensitivity to cow’s milk are turning to goat milk as a gentler alternative. Its naturally lower lactose content and different protein structure make it appealing for people who experience digestive discomfort with traditional dairy.

- Product diversification is accelerating the trend. Goat-milk producers are expanding beyond liquid milk into value-added items such as powdered milk, yogurt, cheese, beauty products, and even specialized infant and toddler formulas, broadening the market significantly.

- Urbanization and rising disposable incomes are supporting premium dairy consumption. As more Indonesians move to cities and adopt modern lifestyles, they show a greater willingness to pay more for healthy, convenient, and high-quality goat-milk products.

- Growth in the sector is further encouraged by initiatives supporting small-scale dairy goat farming, which help stabilize supply, improve quality standards, and make goat milk more accessible nationwide.

Indonesia Goat Milk Market Dynamics

Driver

Increasing Health Awareness and Preference for Natural and Organic Products

- The Indonesia goat milk market has been experiencing a surge in demand, primarily driven by increasing health awareness and a growing preference for natural and organic products among consumers. This trend reflects a broader global shift towards healthier dietary choices, and goat milk is emerging as a favored option due to its numerous health benefits.

- Health Consciousness: In recent years, there has been a significant shift in consumer attitudes towards health and nutrition. They are actively seeking out food and beverage options that offer health benefits as people become more health-conscious. Goat milk, known for its nutrient-rich composition, has gained popularity as a wholesome and natural choice.

- Nutrient Density: Goat milk is often regarded as a highly nutritious alternative to cow's milk. It is rich in essential nutrients, including vitamins (such as A and D), minerals (such as calcium, magnesium, and phosphorus), and protein. These nutrients play a crucial role in supporting overall health, and consumers are increasingly recognizing the value of incorporating such nutrient-dense options into their diets.

- Lactose Intolerance: One significant driver for the preference for goat milk is the prevalence of lactose intolerance in many individuals. Lactose intolerance is the inability to digest lactose, a sugar found in cow's milk. Goat milk contains less lactose than cow's milk, making it easier to digest for those with lactose intolerance. More people are turning to goat milk as a viable and nutritious alternative as awareness of lactose intolerance grows.

- Digestibility: Goat milk is known for its smaller fat globules and different protein structure compared to cow's milk. This unique composition makes it more easily digestible for some individuals, reducing the risk of digestive discomfort and allergic reactions. This quality has further driven its adoption among consumers seeking digestive health benefits.

- Immune-Boosting Properties: Goat milk is believed to possess immune-boosting properties due to its rich content of vitamins, minerals, and bioactive compounds. Goat milk's potential immune-enhancing benefits have contributed to its growing popularity as immunity and overall health have gained paramount importance in recent times.

- In conclusion, the rising health consciousness and the preference for natural and organic products are driving market growth. Consumers increasingly recognize the nutritional value, digestibility, and potential health benefits of goat milk. Meeting the growing demand for goat milk and its derivatives while maintaining quality and sustainable production practices will be essential for industry players looking to capitalize on this trend. Thus, rising health consciousness and the preference for natural and organic products are expected to drive market growth.

Restraint/Challenge

Lack of Awareness About the Benefits of Goat Milk

- The key constraint facing the industry is the lack of awareness about the benefits of goat milk among consumers. This limited awareness poses a considerable hurdle to the widespread adoption of goat milk products in the market.

- Cultural and Historical Factors: One of the primary reasons for the lack of awareness about goat milk in Indonesia is deeply rooted in cultural and historical factors. Cow's milk has traditionally been the dominant dairy product in many Indonesian households. The cultural preference for cow's milk, along with the long history of its consumption, has made it the default choice for most consumers.

- Limited Marketing and Promotion: Another significant factor contributing to the lack of awareness is the limited marketing and promotion of goat milk products in Indonesia. Compared to cow's milk, which enjoys extensive marketing campaigns and brand recognition, goat milk products have not received the same level of promotional efforts. This results in a lack of visibility and consumer education about goat milk advantages.

- Misconceptions and Myths: In addition to the absence of active promotion, there are misconceptions and myths surrounding goat milk that hinder its adoption. Some people believe that goat milk has a strong and unpleasant taste, or they associate it with a pungent odor. These misconceptions can deter potential consumers from trying goat milk products, preventing them from experiencing its true benefits.

- Limited Availability: Goat milk products may also face challenges related to their limited availability. Compared to cow's milk, which is widely accessible in various forms, goat milk products might be less accessible in some regions of Indonesia. This limited availability can restrict consumers' ability to purchase and incorporate goat milk into their daily routines.

- Addressing this challenge through targeted educational initiatives and marketing efforts can unlock the market's full potential and provide consumers with a healthier and more diverse range of dairy options. Thus, lack of awareness about the benefits of goat milk is expected to restrain market growth.

Indonesia Goat Milk Market Scope

The market is segmented on the basis of product, flavors, fat content, sales channel, and end use.

By Product

On the basis of product, the market is segmented into liquid milk, cheese, powder, yogurt and kefir, and, others. In 2025, liquid milk dominates the Indonesia goat milk market with a market share of 59.54% due to widely recognized, trusted, and easily incorporated into everyday consumption habits, benefiting from established distribution and strong household penetration.

However, the yogurt and kefir segment is projected to register the highest CAGR of 3.7% during the forecast period of 2026 to 2033, as Indonesians increasingly prefer probiotic, digestive-friendly, and functional fermented dairy options.

By Flavors

On the basis of flavors, the market is segmented into original/classic and flavoured. In 2025, the original/classic segment dominates the Indonesia goat milk market with a market share of 85.07% owing to its strong consumer familiarity, preference for natural tastes, and cultural inclination toward minimally processed dairy.

However, the flavoured segment is projected to register the highest CAGR of 3.5% during the forecast period of 2026 to 2033, owing to the younger consumers demand variety, enhanced palatability, and modern dairy experiences aligned with lifestyle-driven taste experimentation.

By Fat Content

On the basis of fat content, the market is segmented into regular, low fat, and fat free. In 2025, regular dominates the Indonesia goat milk market with a market share of 65.07% owing to consumers value its richer taste, creamier texture, and traditional nutritional perception.

However, the low fat segment is projected to register the highest CAGR of 3.5% during the forecast period of 2026 to 2033, as health-conscious individuals seek lighter dairy options that still provide essential nutrients, appealing to calorie-aware and fitness-oriented urban populations.

By Sales Channel

On the basis of sales channel, the market is segmented into offline, and online. In 2025, offline dominates the Indonesia goat milk market with a market share of 84.36% owing to the supermarkets, convenience stores, and specialty shops remain primary purchasing points, offering freshness assurance.

However, the online segment is projected to register the highest CAGR of 3.5% during the forecast period of 2026 to 2033, driven by e-commerce growth, wider digital access, and increasing consumer preference for fast, convenient, home-delivered goat milk products.

By End Use

On the basis of end use, the market is segmented into B2C and B2B. In 2025, B2C dominates the Indonesia goat milk market with a market share of 74.70% owing to its growing household adoption of goat milk for daily nutrition, infant needs, and health-focused consumption.

Moreover, this segment is projected to register the highest CAGR during the forecast period of 2026 to 2033, owing to the rising wellness awareness and improved direct-to-consumer distribution strengthen demand across Indonesia’s expanding middle-income population.

The Major Market Leaders Operating in the Market are:

-

milkup.co.id (Indonesia)

- Etawa Goat Milk Producer (Indonesia)

- Supergoat Official (Indonesia)

- Milktawa Premilux (Indonesia)

- CV. My Green Earth (Indonesia)

- Etawalin (Indonesia)

- PT. ABC Holding (Indonesia)

- PT. DeBALI Kosmetik Indonesia (Indonesia)

- PT. Megasurya Mas (Indonesia)

- PT. Pasti Enak (Indonesia)

Latest Developments in Indonesia Goat Milk Market

- In January 2023, Both AVH dairy trade B.V. and Goat Milk Powder B.V. begin a new chapter in the form of a new corporate name on April 1, 2023. AVH dairy trade B.V. is founded on their experience in goat and sheep dairy products for a variety of nutritious uses. Emmi Nutritional Solutions (ENS) is their new name to better represent their purpose (ENS). While their personnel and emphasis remain unaltered in offering the finest quality ingredients for nutritious goods such as infant formula, senior nutrition, bread, pet food, dairy, or confectionery, this shift also represents Emmi Group, the leading Swiss premium dairy company.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING HEALTH AWARENESS AND PREFERENCE FOR NATURAL AND ORGANIC PRODUCTS

5.1.2 GOAT MILK IS OFTEN PREFERRED BY INDIVIDUALS WITH LACTOSE INTOLERANCE

5.1.3 GOAT MILK IS RICH IN NUTRIENTS, VITAMINS, AND MINERALS

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT THE BENEFITS OF GOAT MILK

5.2.2 ISSUES RELATED TO PRODUCTION, DISTRIBUTION, AND SHELF LIFE

5.3 OPPORTUNITIES

5.3.1 EXPANDING THE RANGE OF GOAT MILK-BASED PRODUCTS

5.3.2 EXPLORING INTERNATIONAL MARKETS FOR GOAT MILK AND RELATED PRODUCTS

5.4 CHALLENGES

5.4.1 COMPETITION FROM COW'S MILK AND PLANT-BASED ALTERNATIVES

5.4.2 MAINTAINING CONSISTENT QUALITY AND SAFETY STANDARDS

6 INDONESIA GOAT MILK MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 LIQUID MILK

6.3 CHEESE

6.4 POWDER

6.5 YOGURT AND KEFIR

6.6 OTHERS

7 INDONESIA GOAT MILK MARKET, BY FLAVORS

7.1 OVERVIEW

7.2 ORIGINAL/CLASSIC

7.3 FLAVOURED

8 INDONESIA GOAT MILK MARKET, BY FAT CONTENT

8.1 OVERVIEW

8.2 REGULAR

8.3 LOW FAT

8.4 FAT FREE

9 INDONESIA GOAT MILK MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 OFFLINE

9.3 ONLINE

10 INDONESIA GOAT MILK MARKET, BY END USE

10.1 OVERVIEW

10.2 B2C

10.3 B2B

11 COMPANY SHARE ANALYSIS: INDONESIA

11.1 ANNOUNCEMENT

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 MILKUP.CO.ID

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 ETAWA GOAT MILK PRODUCER

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 SUPERGOAT OFFICIAL

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 MILKTAWA PREMILUX

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 CV. MY GREEN EARTH

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 ETAWALIN

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 PT. ABC HOLDING

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 PT. DEBALI KOSMETIK INDONESIA

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 PT. MEGASURYA MAS

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 PT. PASTI ENAK

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 INDONESIA GOAT MILK MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 2 INDONESIA LIQUID MILK IN GOAT MILK MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 3 INDONESIA WHOLE MILK IN GOAT MILK MARKET, BY PROCESSING METHOD, 2018-2033 (USD MILLION)

TABLE 4 INDONESIA LIQUID MILK IN GOAT MILK MARKET, BY PACKAGING TYPE, 2018-2033 (USD MILLION)

TABLE 5 INDONESIA BOTTLE IN GOAT MILK MARKET, BY MATERIAL, 2018-2033 (USD MILLION)

TABLE 6 INDONESIA GOAT MILK MARKET, BY FLAVORS, 2018-2033 (USD MILLION)

TABLE 7 INDONESIA FLAVOURED IN GOAT MILK MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 8 INDONESIA GOAT MILK MARKET, BY FAT CONTENT, 2018-2033 (USD MILLION)

TABLE 9 INDONESIA GOAT MILK MARKET, BY SALES CHANNEL, 2018-2033 (USD MILLION)

TABLE 10 INDONESIA OFFLINE IN GOAT MILK MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 11 INDONESIA ONLINE IN GOAT MILK MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 12 INDONESIA GOAT MILK MARKET, BY END USE, 2018-2033 (USD MILLION)

List of Figure

FIGURE 1 INDONESIA GOAT MILK MARKET

FIGURE 2 INDONESIA GOAT MILK MARKET: DATA TRIANGULATION

FIGURE 3 INDONESIA GOAT MILK MARKET: DROC ANALYSIS

FIGURE 4 INDONESIA GOAT MILK MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 INDONESIA GOAT MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDONESIA GOAT MILK MARKET: MULTIVARIATE MODELLING

FIGURE 7 INDONESIA GOAT MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 INDONESIA GOAT MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDONESIA GOAT MILK MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 INDONESIA GOAT MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 INDONESIA GOAT MILK MARKET: SEGMENTATION

FIGURE 12 INCREASING HEALTH AWARENESS AND PREFERENCE FOR NATURAL AND ORGANIC PRODUCTS BOOST DEMAND FOR GOAT MILK IS EXPECTED TO DRIVE THE INDONESIA GOAT MILK MARKET IN THE FORECAST PERIOD

FIGURE 13 THE LIQUID MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDONESIA GOAT MILK MARKET IN 2023 AND 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDONESIA GOAT MILK MARKET

FIGURE 15 INDONESIA GOAT MILK MARKET: BY PRODUCT, 2025

FIGURE 16 INDONESIA GOAT MILK MARKET: BY FLAVORS, 2025

FIGURE 17 INDONESIA GOAT MILK MARKET: BY FAT CONTENT, 2025

FIGURE 18 INDONESIA GOAT MILK MARKET: BY SALES CHANNEL, 2025

FIGURE 19 INDONESIA GOAT MILK MARKET: BY END USE, 2025

FIGURE 20 INDONESIA GOAT MILK MARKET: COMPANY SHARE 2025 (%)

Indonesia Goat Milk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Indonesia Goat Milk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Indonesia Goat Milk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.