Ksa Aftermarket Used Spare Parts Market

Market Size in USD Million

CAGR :

%

USD

255.12 Million

USD

422.17 Million

2024

2032

USD

255.12 Million

USD

422.17 Million

2024

2032

| 2025 –2032 | |

| USD 255.12 Million | |

| USD 422.17 Million | |

|

|

|

|

KSA Aftermarket Used Spare Parts Market Size

- The KSA Aftermarket Used Spare Parts Market was valued at USD 255.12 million in 2024 and is expected to reach USD 422.17 million by 2032, at a CAGR of 6.6% during the forecast period

- Increasing consumer demand for cost-effective product alternatives is a primary driver of the growth and evolution of the KSA automotive aftermarket.

- This trend is fueled by a number of economic and demographic factors, including an aging national vehicle fleet and rising living costs, which make the purchase of new, genuine parts a significant financial burden for many car owners

KSA Aftermarket Used Spare Parts Market Analysis

- The KSA Aftermarket Used Spare Parts Market is experiencing steady growth, driven by increasing demand for cost-effective vehicle maintenance solutions and the expanding average vehicle age in Saudi Arabia. Consumers are increasingly opting for used spare parts due to their affordability, availability, and compatibility with a wide range of vehicle models. Government support for circular economy initiatives and environmental sustainability also strengthens demand by encouraging recycling and reuse across the automotive supply chain

- Used spare parts in KSA are widely applied across multiple vehicle segments, including passenger cars, commercial vehicles, and off-road equipment. In the passenger vehicle segment, high demand is noted for components such as engines, transmissions, body panels, and electronic modules. Commercial fleets rely heavily on aftermarket parts to reduce downtime and operational costs. The market is further supported by the growth of online B2B platforms and scrapyard digitization, improving access and logistics for buyers across the Kingdom

- The engine and transmission segment dominated the KSA Aftermarket Used Spare Parts Market share, accounting for 18.78% in 2025, and is projected to register the fastest growth over the forecast period. This is attributed to high replacement rates, rising costs of new OEM parts, and the growing reliability of tested used components. As the most traded and refurbished part category, engines and transmissions offer a consistent supply and strong demand across both retail and fleet maintenance networks, making them central to aftermarket growth in Saudi Arabia

Report Scope KSA Aftermarket Used Spare Parts Market Segmentation

|

Attributes |

KSA Aftermarket Used Spare Parts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

KSA Aftermarket Used Spare Parts Market Trends

“Strong Government Support for Domestic Automotive Recycling and Circular Economy”

- Saudi Arabia is witnessing increasing growth in its KSA Aftermarket Used Spare Parts Market, driven by strong government support for circular economy principles, local recycling initiatives, and localization of automotive supply chains under Vision 2030

- Strategic initiatives such as waste reduction programs, localization targets, and support for vehicle dismantling and recycling infrastructure are strengthening domestic supply chains for used parts and promoting sustainable automotive practices

- In April 2025, the Saudi Investment Recycling Company (SIRC) expanded its vehicle dismantling operations in Jeddah, improving availability of used spare parts and reducing reliance on imports, which is helping stabilize prices in the secondary market

- The National Industrial Development Center (NIDC) has also introduced incentives for private investors to set up certified dismantling and reconditioning facilities across major regions, enhancing quality standards and traceability in the used spare parts sector

KSA Aftermarket Used Spare Parts Market Dynamics

Driver

“Digitization and E-Commerce Growth Driving Used Auto Parts Accessibility”

- The KSA Aftermarket Used Spare Parts Market in KSA is undergoing a rapid transformation due to the rise of online auto parts platforms and digital B2B marketplaces. This trend is improving transparency, pricing comparison, and delivery logistics across the Kingdom

- Increasing consumer confidence in purchasing verified used parts online is reducing friction in the traditionally fragmented and informal spare parts market

- In March 2025, a leading Saudi e-commerce auto parts platform reported a 30% YoY increase in used part sales, driven by strong demand from independent garages, fleet operators, and DIY consumers

- Partnerships between logistics companies and certified dismantlers are enabling faster delivery and return policies, further supporting market growth through enhanced convenience and service quality

Restraint/Challenge

“Quality Variability and Lack of Standardization in Informal Supply Chains”

- A major challenge in the KSA Aftermarket Used Spare Parts Market is inconsistent product quality and the lack of formal regulations governing the resale, reconditioning, and traceability of used auto components

- Informal workshops and unlicensed dismantlers often operate outside quality control frameworks, leading to buyer concerns about part reliability, compatibility, and safety, especially in critical systems such as brakes, electronics, and airbags

- While certified operators exist, their market share remains limited due to higher costs and a lack of public awareness about the risks of uncertified parts

- To mitigate these issues, regulatory bodies such as SASO and the Zakat, Tax and Customs Authority are working on stricter import controls, standardization frameworks, and traceability requirements for both imported and domestically sourced used parts

KSA Aftermarket Used Spare Parts Market Scope

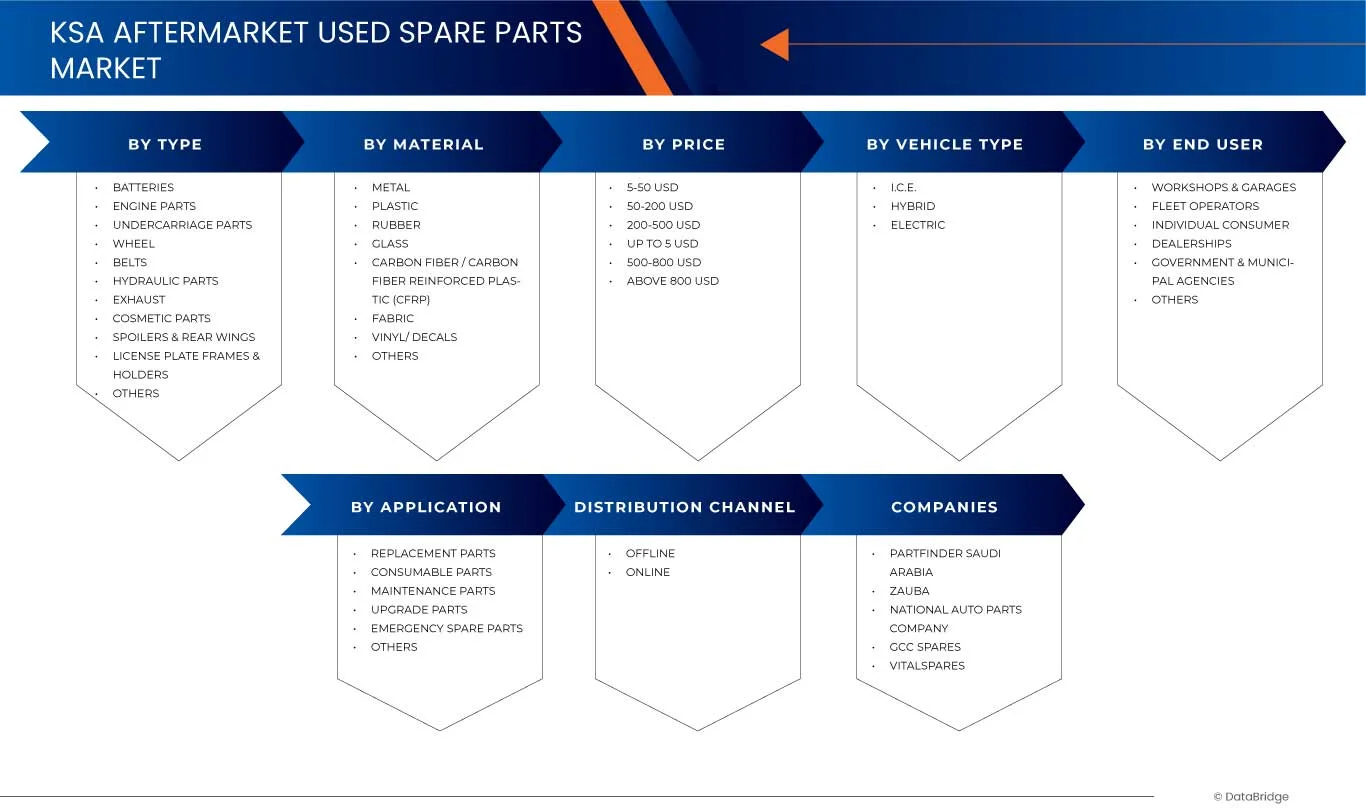

The market is segmented into on the basis of type, material, vehicle type, price, application, end user, distribution channel.

- By Type

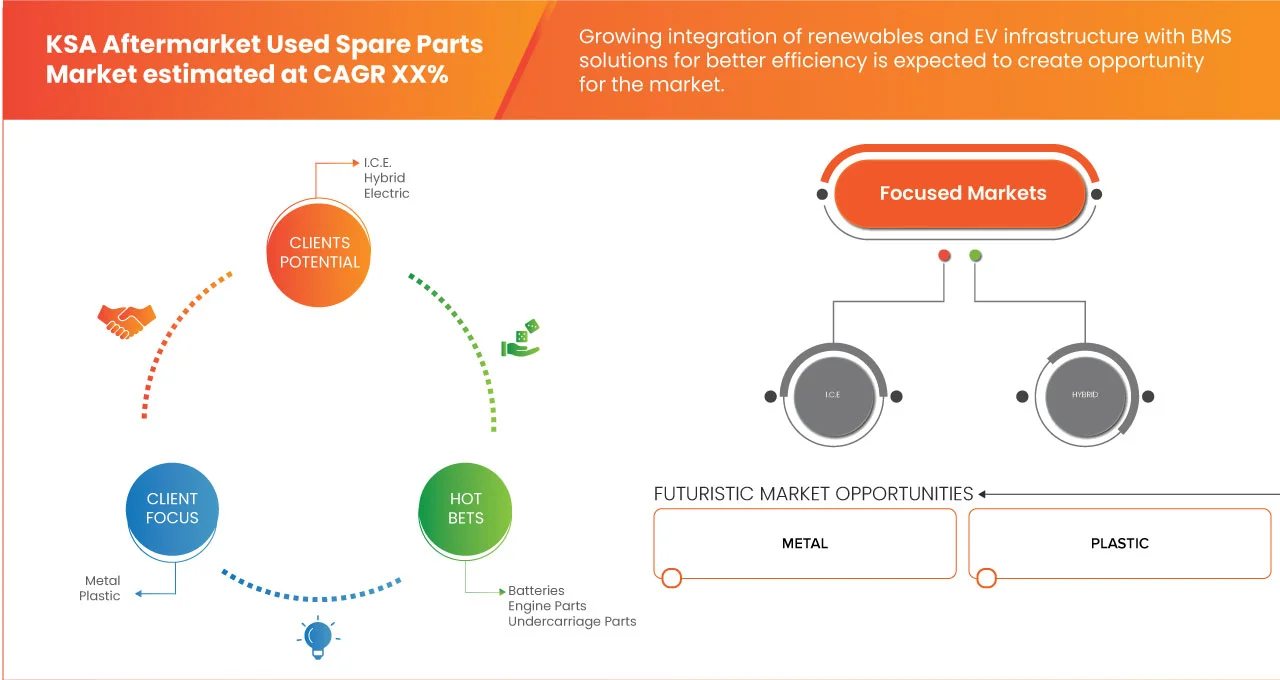

On the basis of type, the KSA Aftermarket Used Spare Parts Market is segmented into batteries, engine parts, undercarriage parts, wheel, belts, hydraulic parts, exhaust, cosmetic parts, spoilers & rear wings, license plate frames & holders, others. In 2025, batteries segment is expected to dominate the market with a market share of 18.78% and it is anticipated to show the fastest growth with a CAGR of 8.0% during the forecast period, due to high replacement frequency, cost of new batteries, and increased demand for affordable energy components. Older vehicles and extreme weather conditions in Saudi Arabia cause frequent battery failures, driving secondary market demand. Refurbished batteries offer a viable, low-cost alternative for both individuals and fleet operators. The rising number of hybrid and electric vehicles further boosts the demand for battery components. In addition, advancements in battery testing and reconditioning are enhancing product reliability and consumer trust. B2B demand from auto repair shops ensures continuous turnover. Government efforts to reduce e-waste support battery recycling initiatives. Local workshops prefer sourcing affordable used batteries over importing new ones.

- By Material

On the basis of material, the KSA Aftermarket Used Spare Parts Market is segmented into metal, plastic, rubber, glass, Carbon Fiber / Carbon Fiber Reinforced Plastic (CFRP), fabric, vinyl / decals, others. In 2025, metal segment is expected to dominate the market with a market share of 30.41%. and it is anticipated to show the fastest growth with a CAGR of 7.6% during the forecast period. Metal parts dominates due to their prevalence in core automotive components such as engines, transmissions, body panels, and suspension systems. These components are often reused or refurbished rather than replaced new, due to their high cost and durability. Metal is preferred in structural and mechanical parts, which retain functionality even after refurbishment. Local dismantlers prioritize salvaging and re-selling metal-based parts for maximum value recovery. The high resale potential of items such as steel wheels, axles, and engine blocks supports market growth. Saudi Arabia’s recycling policies and industrial sector investment also boost the reuse of metal parts. The high scrap value of metal adds secondary economic benefit. Reliability and strength further justify the dominance of metal-based spare parts.

- By Vehicle Type

On the basis of vehicle type, the KSA Aftermarket Used Spare Parts Market is segmented into I.C.E, hybrid, electric. In 2025, I.C.E. segment is expected to dominate the market with a market share of 61.30%. and it is anticipated to show the fastest growth with a CAGR of 6.8% during the forecast period. The Internal Combustion Engine (I.C.E.) segment leads due to the overwhelming presence of petrol and diesel vehicles in KSA’s current automotive fleet. Despite the push for electrification, ICE vehicles still dominate both passenger and commercial segments. These vehicles demand regular part replacements such as filters, engines, transmissions, and cooling systems. The high availability of used ICE components from dismantling operations keeps prices low and supply steady. Spare parts for ICE vehicles are widely standardized, making reuse easier and more efficient. Workshops are well-equipped for ICE maintenance, further driving preference. Affordability of repairs using used parts extends the lifespan of ICE vehicles. Government fleet renewal programs also contribute by pushing older vehicles into the used parts supply chain.

- By Price

On the basis of price, the KSA Aftermarket Used Spare Parts Market is segmented into 5-50 USD, 50-200 USD, 200-500 USD, Up TO 5 USD, 500-800 USD and above 800 USD. In 2025, 5-50 USD segment is expected to dominate the market with a market share of 33.42%. The 5–50 USD price segment leads due to the affordability and wide availability of frequently replaced components such as filters, hoses, belts, wipers, and lights. Consumers and repair shops heavily rely on low-cost parts to maintain older vehicles economically. The segment offers the best value for price-conscious buyers, especially among individual car owners and small workshops. Most common consumable and wear-and-tear items fall in this price range, ensuring continuous demand. High turnover and compatibility across models make these parts profitable for dismantlers and resellers. Fleet operators also bulk purchase within this range to reduce maintenance expenses. E-commerce platforms increasingly offer parts in this price band, supporting accessibility. These parts have short replacement cycles, sustaining recurring demand.

The 200–500 USD price range in the KSA Aftermarket Used Spare Parts Market is anticipated to witness the fastest growth with a CAGR of 7.4% during the forecast period, driven by rising demand for cost-effective yet reliable vehicle components. This segment particularly appeals to middle-income consumers and fleet operators seeking quality parts at affordable prices. Growing vehicle ownership, increasing wear-and-tear replacements, and consumer preference for value-based solutions over high-cost OEM parts further strengthen demand. Expanding online platforms and organized distributors also support market penetration.

- By Application

On the basis of application, the KSA Aftermarket Used Spare Parts Market is segmented into replacement parts, consumable parts, maintenance parts, upgrade parts, emergency spare parts, others. In 2025, replacement parts segment is expected to dominate the market with a market share of 32.47%. and it is anticipated to show the fastest growth with a CAGR of 7.2% during the forecast period Replacement parts dominate because they address essential, worn-out components critical to vehicle functionality and safety. These include engines, brakes, lights, and suspension parts, which are regularly sought after by workshops and individual users. The aging vehicle fleet in KSA drives frequent part replacements to extend lifespan. Used replacement parts offer a cost-effective alternative to new OEM parts, attracting budget-conscious customers. Easy availability through scrapyards and reconditioners supports strong market penetration. Insurance companies and garages often recommend used parts for minor repairs to control costs. Government regulations encouraging sustainable recycling further push the use of pre-owned parts. Workshops benefit from quick turnaround with available stock, reinforcing this segment’s demand. The market is supported by growing infrastructure for dismantling and resale.

- By End User

On the basis of end user, the KSA Aftermarket Used Spare Parts Market is segmented into workshops & garages, fleet operators, individual consumer, dealerships, government & municipal agencies, others. In 2025, workshops and garages segment is expected to dominate the market with a market share of 35.56%. and it is anticipated to show the fastest growth with a CAGR of 7.3% during the forecast period. Workshops and garages dominate the end-user segment as they are the primary channel for part installation, diagnostics, and repair services. These businesses routinely source used parts to reduce service costs and meet customer budgets. High part turnover and bulk procurement patterns give garages an operational advantage in sourcing used components. Trusted relationships with dismantlers and local suppliers streamline procurement. Workshops are better equipped to assess used part quality and ensure proper installation. They also act as influencers in customer decision-making, often recommending refurbished over new parts. The rise of independent garages in urban and semi-urban areas further strengthens this segment. Volume-based purchasing reduces per-unit costs, supporting profitability. Fleet operators also partner with garages for ongoing vehicle servicing using used parts.

- By Distribution Channel

On the basis of distribution channel, the KSA Aftermarket Used Spare Parts Market is segmented into offline and online. In 2025, Offline segment is expected to dominate the market with a market share of 84.52%. and it is anticipated to show the fastest growth with a CAGR of 6.8% during the forecast period. The offline channel dominates due to the nature of used part purchasing, which relies heavily on visual inspection, verification, and negotiation. Local auto markets, scrapyards, and garages form a well-established offline ecosystem for trading used parts in KSA. Buyers prefer in-person assessment to ensure fit and functionality, especially for critical parts. Informal networks and long-standing relationships between workshops and dismantlers reinforce the dominance of offline sales. Logistics and part compatibility concerns make offline sourcing more reliable for many users. Some regions lack e-commerce infrastructure, reinforcing reliance on physical outlets. In addition, offline channels often offer installation services alongside the parts. The cultural preference for face-to-face transactions also plays a significant role in offline market dominance.

KSA Aftermarket Used Spare Parts Market Regional Analysis

- The KSA Aftermarket Used Spare Parts Market is driven by rising demand for affordable vehicle maintenance, an aging car fleet, and strong government support for recycling and circular economy initiatives

- Growth in independent workshops, digital platforms, and certified dismantling centers enhances accessibility and trust. Increasing environmental awareness and cost pressures further push consumers and fleets toward reliable, low-cost used components

The Major Market Leaders Operating in the Market Are:

- Partfinder Saudi Arabia (UAE)

- Zauba (Saudi Arabia)

- Gcc Spares (Saudi Arabia)

- National Auto Parts Company (Saudi Arabia)

- Vitalspares (Saudi Arabia)

- Shobbak (Saudi Arabia)

- Dg Spare Parts Llc (Saudi Arabia)

- Az Parts (Saudi Arabia)

- Al Hattab Llc (UAE)

- Partzkart (UAE)

Latest Developments in KSA Aftermarket Used Spare Parts Market

- In December 2024, Al-Kadi Commerce & Industry partnered with FORVIA HELLA to launch the “Sharaka” initiative, aimed at localizing manufacturing and distributing automotive lighting and spare parts across KSA. This strategic alliance strengthens domestic supply chains and supports Vision 2030 industrialization goals

- In July 2025, Partfinder expanded its digital used auto parts platform into Saudi Arabia, simplifying the process of sourcing spare parts by connecting users with verified sellers. This expansion enhances e-commerce adoption in the aftermarket sector and improves access for workshops and individual buyers

- In August 2023, Petromin’s National Auto Parts Co. (NAP) became the official distributor of Pirelli tyres in Saudi Arabia, strengthening its product portfolio in the premium replacement segment. This move reinforces NAP’s position as a one-stop solution provider for aftermarket parts in the Kingdom

- In April 2025, Automechanika Riyadh hosted its flagship exhibition at the Riyadh International Convention & Exhibition Center, bringing together global aftermarket leaders, local suppliers, and buyers. The event showcased innovation in used parts, diagnostics, and repair technologies, driving B2B partnerships and market modernization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES ANALYSIS

4.2 REGULATORY STANDARDS — AFTERMARKET USED SPARE PARTS IN SAUDI ARABIA

4.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO — AFTERMARKET USED SPARE PARTS IN SAUDI ARABIA

4.4 KSA AFTERMARKET USED SPARE PARTS – NEW & EMERGING REVENUE OPPORTUNITIES

4.4.1 MARKET CONTEXT

4.4.2 REGULATORY LANDSCAPE UNLOCKING OPPORTUNITIES

4.4.3 EMERGING REVENUE OPPORTUNITIES

4.4.4 STRATEGIC GO-TO-MARKET APPROACHES

4.4.5 KEY RISKS AND CONTROLS

4.4.6 CLOSING INSIGHT

4.5 TECHNOLOGY ANALYSIS KSA AFTERMARKET USED SPARE PARTS MARKET

4.5.1 REGULATORY COMPLIANCE INFRASTRUCTURE

4.5.2 ANTI-COUNTERFEIT & TRACEABILITY TECHNOLOGIES

4.5.3 DIGITAL MARKETPLACES & PRODUCT DISCOVERY TOOLS

4.5.4 CIRCULAR ECONOMY & DISMANTLING PRACTICES

4.5.5 DATA STANDARDIZATION & HARMONIZATION

4.5.6 DAY-TO-DAY TECHNOLOGY APPLICATIONS

4.5.7 STAKEHOLDER IMPLICATIONS

4.5.8 RISKS ADDRESSED BY TECHNOLOGY

4.5.9 VISION OF “BETTER” FOR KSA AFTERMARKET USED PARTS

4.6 USE CASES & ITS ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.7.1 STRATEGIC DEVELOPMENT

4.7.2 TECHNOLOGY IMPLEMENTATION PROCESS

4.7.2.1 CHALLENGES

4.7.2.2 IN-HOUSE IMPLEMENTATION / OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.7.3 CUSTOMER BASE

4.7.4 SERVICE POSITIONING

4.7.5 CUSTOMER FEEDBACK / RATING (B2B OR B2C)

4.7.6 APPLICATION REACH

4.7.7 SERVICE PLATFORM MATRIX

4.8 LIST OF PROJECTS

4.8.1 REGIONAL MARKET OVERVIEW – KSA

4.9 PENETRATION AND GROWTH PROSPECT MAPPING FOR THE KSA AFTERMARKET USED SPARE PARTS MARKET

4.9.1 REGULATORY ENVIRONMENT

4.9.2 MARKET PENETRATION PATTERNS

4.9.3 GROWTH PROSPECTS

4.9.4 GEOGRAPHIC AND CHANNEL HOTSPOTS

4.9.5 CHALLENGES AND CONSTRAINTS

4.9.6 STRATEGIC CONSIDERATIONS

4.1 TECHNOLOGY MATRIX

5 TARIFF REVISIONS AND THEIR IMPACT ON THE AUTOMOTIVE INDUSTRY

5.1 OVERVIEW

5.2 TARIFF STRUCTURES

5.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

5.2.2 UNITED STATES: AUTOMOTIVE TARIFF POLICIES

5.2.3 NORTH AMERICA UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

5.2.4 NORTH AMERICA: GOVERNMENT-IMPOSED TARIFFS ON AUTOMOTIVE COMPONENTS

5.3 IMPACT ON AUTOMAKERS

5.3.1 INCREASED PRODUCTION COSTS

5.3.2 SUPPLY CHAIN DISRUPTIONS

5.3.3 SHIFT IN MANUFACTURING FOOTPRINT

5.3.4 COMPETITIVE DISADVANTAGE

5.3.5 INCREASED INVESTMENT IN DOMESTIC PRODUCTION

5.4 IMPACT ON SUPPLIERS

5.4.1 COST PRESSURES

5.4.2 REDUCED DEMAND

5.4.3 SUPPLY CHAIN VULNERABILITY

5.5 IMPACT ON CONSUMERS

5.5.1 HIGHER VEHICLE PRICES

5.5.2 REDUCED AVAILABILITY OF OPTIONS

5.5.3 INCREASED MAINTENANCE COSTS

5.6 THE FUTURE OF AUTOMOTIVE TRADE

5.6.1 ONGOING TRADE NEGOTIATIONS

5.6.2 TECHNOLOGICAL ADVANCEMENTS

5.6.3 GEOPOLITICAL FACTORS

5.6.4 FOCUS ON DOMESTIC PRODUCTION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION OF DOMESTIC VEHICLE MANUFACTURING AND INCREASED LOCALIZATION OF SPARE PARTS PRODUCTION

6.1.2 RISING SAFETY AWARENESS COUPLED WITH GROWING EMPHASIS ON PREVENTIVE VEHICLE MAINTENANCE

6.1.3 ACCELERATED DEVELOPMENT OF LOGISTICS NETWORKS AND SUPPORTING INFRASTRUCTURE

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN VOLATILITY ASSOCIATED WITH EMERGING LOCAL MANUFACTURING OPERATIONS

6.2.2 INTENSIFYING COMPETITION FROM LOW-COST IMPORTED COUNTERFEIT PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWTH POTENTIAL IN ONLINE MARKETPLACES AND E-COMMERCE DISTRIBUTION CHANNELS

6.3.2 INCREASING CONSUMER DEMAND FOR COST EFFECTIVE PRODUCT ALTERNATIVES

6.4 CHALLENGES

6.4.1 PREVALENCE OF COUNTERFEIT AND STOLEN PARTS IN THE SUPPLY CHAIN

6.4.2 RESISTANCE FROM OEMS AND AUTHORIZED DEALERS TOWARDS CERTAIN MARKET SHIFT

7 KSA AFTERMARKET USED SPARE PARTS MARKET, BY TYPE.

7.1 OVERVIEW

7.2 BATTERIES

7.2.1 LEAD-ACID

7.2.2 LITHIUM-ION BATTERIES

7.2.3 OTHERS

7.3 ENGINE PARTS

7.3.1 SPARK PLUGS

7.3.2 ENGINE STARTERS

7.3.3 BEARINGS

7.3.4 VALVES

7.3.5 PISTONS

7.3.6 OTHERS

7.4 UNDERCARRIAGE PARTS

7.4.1 TRACK CHAINS

7.4.2 TRACK SHOES

7.4.3 TRACK ROLLERS

7.4.4 IDLERS

7.4.5 SPROCKETS

7.4.6 BUSHINGS AND PINS

7.4.7 TENSIONERS

7.4.8 OTHERS

7.5 WHEEL

7.5.1 TYRE

7.5.2 ALLOY

7.5.3 BRAKE CALIPERS

7.5.4 DISCS / ROTORS

7.5.5 OTHERS

7.6 BELTS

7.6.1 RUBBER TIMING BELTS

7.6.2 ALTERNATOR BELTS

7.6.3 AIR CONDITIONING (A/C) BELTS

7.6.4 POWER STEERING BELTS

7.6.5 CHAIN-DRIVEN TIMING BELTS

7.6.6 OTHERS

7.7 HYDRAULIC PARTS

7.7.1 HOSES

7.7.2 PUMPS

7.7.3 VALVES

7.7.4 CYLINDERS

7.7.5 OTHERS

7.8 EXHAUST

7.8.1 MUFFLER

7.8.2 CATALYTIC CONVERTER

7.8.3 OXYGEN SENSOR

7.8.4 RESONATOR

7.8.5 OTHERS

7.9 COSMETIC PARTS

7.9.1 BUMPERS (FRONT/REAR)

7.9.2 HEADLIGHTS & TAILLIGHTS

7.9.3 SIDE MIRRORS & MIRROR COVERS

7.9.4 GRILLES

7.9.5 DOOR HANDLES

7.9.6 SPOILERS & REAR WINGS

7.9.7 BODY KITS

7.9.8 BONNET/HOOD SCOOPS

7.9.9 FOG LIGHT COVERS / BEZELS

7.9.10 BADGES & EMBLEMS

7.9.11 WIPER ARMS & COVERS

7.9.12 INTERIOR COSMETIC PARTS

7.9.12.1 FLOOR MATS

7.9.12.2 SEAT COVERS

7.9.12.3 DASHBOARD PANELS,

7.9.12.4 STEERING WHEEL COVERS

7.9.12.5 GEAR KNOB COVERS

7.9.12.6 OTHERS

7.9.13 LICENSE PLATE FRAMES & HOLDERS

7.9.14 TRIMS & MOLDINGS (DOOR, WINDOW, FENDER, ROOF RAILS)

7.1 SPOILERS & REAR WINGS

7.11 LICENSE PLATE FRAMES & HOLDERS

7.12 OTHERS

8 KSA AFTERMARKET USED SPARE PARTS MARKET, BY MATERIAL.

8.1 OVERVIEW

8.2 METAL

8.2.1 STEEL

8.2.2 ALUMINUM

8.2.3 CHROME

8.2.4 OTHERS

8.3 PLASTIC

8.3.1 POLYPROPYLENE

8.3.2 ABS

8.3.3 POLYETHYLENE

8.3.4 POLYCARBONATE

8.3.5 OTHERS

8.4 RUBBER

8.4.1 SYNTHETIC

8.4.2 NATURAL

8.5 GLASS

8.5.1 TEMPERED

8.5.2 LAMINATED

8.5.3 TINTED

8.5.4 BULLET PROOF GLASS

8.5.5 OTHERS

8.6 CARBON FIBER / CARBON FIBER REINFORCED PLASTIC (CFRP)

8.7 FABRIC

8.7.1 ALCANTARA

8.7.2 LEATHER

8.7.3 NYLON

8.7.4 NEOPRENE

8.7.5 VELVET

8.7.6 OTHERS

8.8 VINYL / DECALS

8.8.1 CAST VINYL

8.8.2 CALENDARED VINYL

8.8.3 MATTE VINYL

8.8.4 GLOSS

8.9 OTHERS

9 KSA AFTERMARKET USED SPARE PARTS MARKET, BY VEHICLE TYPE

9.1 OVERVIEW

9.2 I.C.E., BY TYPE

9.2.1 PASSENGER CARS

9.2.2 PASSENGER CARS, BY TYPE

9.2.2.1 SUV

9.2.2.2 SEDAN

9.2.2.3 MUV

9.2.2.4 HATCHBACK

9.2.2.5 COUPE

9.2.2.6 CONVERTIBLE

9.2.2.7 SPORTS CAR

9.2.2.8 OTHERS

9.2.3 COMMERCIAL VEHICLES

9.2.3.1 PICKUP TRUCKS

9.2.3.2 LIGHT COMMERCIAL VEHICLES (LCV)

9.2.3.3 CARGO VANS

9.2.3.4 MINI BUS

9.2.3.5 COACHES

9.2.3.6 HEAVY COMMERCIAL VEHICLES (HCV)

9.2.3.6.1 TRUCKS

9.2.3.6.1.1 DUMP TRUCKS

9.2.3.6.1.2 TOW TRUCKS

9.2.3.6.1.3 OTHERS

9.2.3.6.2 BUSES

9.2.3.7 VANS

9.2.3.8 OTHERS

9.3 HYBRID, BY TYPE

9.3.1 PASSENGER CARS

9.3.2 COMMERCIAL VEHICLES

9.3.3 PASSENGER CARS, BY TYPE

9.3.3.1 SUV

9.3.3.2 SEDAN

9.3.3.3 MUV

9.3.3.4 HATCHBACK

9.3.3.5 COUPE

9.3.3.6 CONVERTIBLE

9.3.3.7 SPORTS CAR

9.3.3.8 OTHERS

9.3.3.8.1 PICKUP TRUCKS

9.3.3.8.2 LIGHT COMMERCIAL VEHICLES (LCV)

9.3.3.8.3 CARGO VANS

9.3.3.8.4 MINI BUS

9.3.3.8.5 COACHES

9.3.3.8.6 HEAVY COMMERCIAL VEHICLES (HCV)

9.3.3.8.7 VANS

9.3.3.8.8 OTHERS

9.3.3.8.9 TRUCKS

9.3.3.8.10 BUSES

9.3.3.9 DUMP TRUCKS

9.3.3.10 TOW TRUCKS

9.3.3.11 OTHERS

9.4 ELECTRIC, BY TYPE

9.4.1 PASSENGER CARS

9.4.2 COMMERCIAL VEHICLES

9.4.2.1 PASSENGER CARS, BY TYPE

9.4.2.1.1 SUV

9.4.2.1.2 SEDAN

9.4.2.1.3 MUV

9.4.2.1.4 HATCHBACK

9.4.2.1.5 COUPE

9.4.2.1.6 CONVERTIBLE

9.4.2.1.7 SPORTS CAR

9.4.2.1.8 OTHERS

9.4.2.1.9 PICKUP TRUCKS

9.4.2.1.10 LIGHT COMMERCIAL VEHICLES (LCV)

9.4.2.1.11 CARGO VANS

9.4.2.1.12 MINI BUS

9.4.2.1.13 COACHES

9.4.2.1.14 HEAVY COMMERCIAL VEHICLES (HCV)

9.4.2.1.15 VANS

9.4.2.1.16 OTHERS

9.4.2.1.16.1 TRUCKS

9.4.2.1.16.2 BUSES

9.4.2.1.17 DUMP TRUCKS

9.4.2.1.18 TOW TRUCKS

9.4.2.1.19 OTHERS

10 KSA AFTERMARKET USED SPARE PARTS MARKET, BY PRICE

10.1 OVERVIEW

10.2 5-50 USD

10.3 50-200 USD

10.4 200-500 USD

10.5 UP TO 5 USD

10.6 500-800 USD

10.7 ABOVE 800 USD

11 KSA AFTERMARKET USED SPARE PARTS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 REPLACEMENT PARTS

11.3 CONSUMABLE PARTS

11.4 MAINTENANCE PARTS

11.5 UPGRADE PARTS

11.6 EMERGENCY SPARE PARTS

11.7 OTHERS

12 KSA AFTERMARKET USED SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.2.1 BY TYPE

12.2.1.1 AFTERMARKET DEALERSHIPS

12.2.1.2 SPARE PART STORES

12.2.1.3 OTHERS

12.3 ONLINE

13 KSA AFTERMARKET USED SPARE PARTS MARKET, BY END-USER

13.1 OVERVIEW

13.2 WORKSHOPS & GARAGES

13.2.1 BATTERIES

13.2.1.1 LEAD-ACID

13.2.1.2 LITHIUM-ION BATTERIES

13.2.1.3 OTHERS

13.2.2 ENGINE PARTS

13.2.2.1 SPARK PLUGS

13.2.2.2 ENGINE STARTERS

13.2.2.3 BEARINGS

13.2.2.4 VALVES

13.2.2.5 PISTONS

13.2.2.6 OTHERS

13.2.3 UNDERCARRIAGE PARTS

13.2.3.1 TRACK CHAINS

13.2.3.2 TRACK SHOES

13.2.3.3 TRACK ROLLERS

13.2.3.4 IDLERS

13.2.3.5 SPROCKETS

13.2.3.6 BUSHINGS AND PINS

13.2.3.7 TENSIONERS

13.2.3.8 OTHERS

13.2.4 WHEEL

13.2.4.1 TYRE

13.2.4.2 ALLOY

13.2.4.3 BRAKE CALIPERS

13.2.4.4 DISCS / ROTORS

13.2.4.5 OTHERS

13.2.5 BELTS

13.2.5.1 RUBBER TIMING BELTS

13.2.5.2 ALTERNATOR BELTS

13.2.5.3 AIR CONDITIONING (A/C) BELTS

13.2.5.4 POWER STEERING BELTS

13.2.5.5 CHAIN-DRIVEN TIMING BELTS

13.2.5.6 OTHERS

13.2.6 HYDRAULIC PARTS

13.2.6.1 HOSES

13.2.6.2 PUMPS

13.2.6.3 VALVES

13.2.6.4 CYLINDERS

13.2.6.5 OTHERS

13.2.7 EXHAUST

13.2.7.1 MUFFLER

13.2.7.2 CATALYTIC CONVERTER

13.2.7.3 OXYGEN SENSOR

13.2.7.4 RESONATOR

13.2.7.5 OTHERS

13.2.8 COSMETIC PARTS

13.2.8.1 BUMPERS (FRONT/REAR)

13.2.8.2 HEADLIGHTS & TAILLIGHTS

13.2.8.3 SIDE MIRRORS & MIRROR COVERS

13.2.8.4 GRILLES

13.2.8.5 DOOR HANDLES

13.2.8.6 SPOILERS & REAR WINGS

13.2.8.7 BODY KITS

13.2.8.8 BONNET/HOOD SCOOPS

13.2.8.9 FOG LIGHT COVERS / BEZELS

13.2.8.10 BADGES & EMBLEMS

13.2.8.11 INTERIOR COSMETIC PARTS

13.2.8.11.1 FLOOR MATS

13.2.8.11.2 SEAT COVERS

13.2.8.11.3 DASHBOARD PANELS

13.2.8.11.4 STEERING WHEEL COVERS

13.2.8.11.5 GEAR KNOB COVERS

13.2.8.11.6 OTHERS

13.2.8.12 LICENSE PLATE FRAMES & HOLDERS

13.2.8.13 TRIMS & MOLDINGS (DOOR, WINDOW, FENDER, ROOF RAILS)

13.2.9 SPOILERS & REAR WINGS

13.2.10 LICENSE PLATE FRAMES & HOLDERS

13.2.11 OTHERS

13.3 FLEET OPERATORS

13.3.1 BATTERIES

13.3.1.1 LEAD-ACID BATTERIES

13.3.1.2 LITHIUM-ION BATTERIES

13.3.1.3 OTHERS

13.3.2 ENGINE PARTS

13.3.2.1 SPARK PLUGS

13.3.2.2 ENGINE STARTERS

13.3.2.3 BEARINGS

13.3.2.4 VALVES

13.3.2.5 PISTONS

13.3.2.6 OTHERS

13.3.3 UNDERCARRIAGE PARTS

13.3.3.1 TRACK CHAINS

13.3.3.2 TRACK SHOES

13.3.3.3 TRACK ROLLERS

13.3.3.4 IDLERS

13.3.3.5 SPROCKETS

13.3.3.6 BUSHINGS AND PINS

13.3.3.7 TENSIONERS

13.3.3.8 OTHERS

13.3.4 WHEEL

13.3.4.1 TYRE

13.3.4.2 ALLOY

13.3.4.3 BRAKE CALIPERS

13.3.4.4 DISCS / ROTORS

13.3.4.5 OTHERS

13.3.5 BELTS

13.3.5.1 RUBBER TIMING BELTS

13.3.5.2 ALTERNATOR BELTS

13.3.5.3 AIR CONDITIONING (A/C) BELTS

13.3.5.4 POWER STEERING BELTS

13.3.5.5 CHAIN-DRIVEN TIMING BELTS

13.3.5.6 OTHERS

13.3.6 HYDRAULIC PARTS

13.3.6.1 HOSES

13.3.6.2 PUMPS

13.3.6.3 VALVES

13.3.6.4 CYLINDERS

13.3.6.5 OTHERS

13.3.7 EXHAUST

13.3.7.1 MUFFLER

13.3.7.2 CATALYTIC CONVERTER

13.3.7.3 OXYGEN SENSOR

13.3.7.4 RESONATOR

13.3.7.5 OTHERS

13.3.8 COSMETIC PARTS

13.3.8.1 BUMPERS (FRONT/REAR)

13.3.8.2 HEADLIGHTS & TAILLIGHTS

13.3.8.3 SIDE MIRRORS & MIRROR COVERS

13.3.8.4 GRILLES

13.3.8.5 DOOR HANDLES

13.3.8.6 SPOILERS & REAR WINGS

13.3.8.7 BODY KITS

13.3.8.8 BONNET/HOOD

13.3.8.9 FOG LIGHT COVERS / BEZELS

13.3.8.10 BADGES & EMBLEMS

13.3.8.11 WIPER ARMS & COVERS

13.3.8.12 INTERIOR COSMETIC PARTS

13.3.8.12.1 FLOOR MATS

13.3.8.12.2 SEAT COVERS

13.3.8.12.3 DASHBOARD PANELS

13.3.8.12.4 STEERING WHEEL COVERS

13.3.8.12.5 GEAR KNOB COVERS

13.3.8.12.6 OTHERS

13.3.8.13 LICENSE PLATE FRAMES & HOLDERS

13.3.8.14 TRIMS & MOLDINGS (DOOR, WINDOW, FENDER, ROOF RAILS)

13.3.9 SPOILERS & REAR WINGS

13.3.10 LICENSE PLATE FRAMES & HOLDERS

13.3.11 OTHERS

13.4 INDIVIDUAL CONSUMER

13.4.1 BATTERIES

13.4.1.1 LEAD-ACID BATTERIES

13.4.1.2 LITHIUM-ION BATTERIES

13.4.1.3 OTHERS

13.4.2 ENGINE PARTS

13.4.2.1 SPARK PLUGS

13.4.2.2 ENGINE STARTERS

13.4.2.3 BEARINGS

13.4.2.4 VALVES

13.4.2.5 PISTONS

13.4.2.6 OTHERS

13.4.3 UNDERCARRIAGE PARTS

13.4.3.1 TRACK CHAINS

13.4.3.2 TRACK SHOES

13.4.3.3 TRACK ROLLERS

13.4.3.4 IDLERS

13.4.3.4.1 SPROCKETS

13.4.3.5 BUSHINGS AND PINS

13.4.3.6 TENSIONERS

13.4.3.7 OTHERS

13.4.4 WHEEL

13.4.4.1 TYRE

13.4.4.2 ALLOY

13.4.4.3 BRAKE CALIPERS

13.4.4.4 DISCS / ROTORS

13.4.4.5 OTHERS

13.4.5 BELTS

13.4.5.1 RUBBER TIMING BELTS

13.4.5.2 ALTERNATOR BELTS

13.4.5.3 AIR CONDITIONING (A/C) BELTS

13.4.5.4 POWER STEERING BELTS

13.4.5.5 CHAIN-DRIVEN TIMING BELTS

13.4.5.6 OTHERS

13.4.6 HYDRAULIC PARTS

13.4.6.1 HOSES SEGMENT

13.4.6.2 PUMPS

13.4.6.3 VALVES

13.4.6.4 CYLINDERS

13.4.6.5 OTHERS

13.4.7 EXHAUST

13.4.7.1 MUFFLER

13.4.7.2 CATALYTIC CONVERTER

13.4.7.3 OXYGEN SENSOR

13.4.7.4 RESONATOR

13.4.7.5 OTHERS

13.4.8 COSMETIC PARTS

13.4.8.1 BUMPERS (FRONT/REAR)

13.4.8.2 HEADLIGHTS & TAILLIGHTS

13.4.8.3 SIDE MIRRORS & MIRROR COVERS

13.4.8.4 GRILLES

13.4.8.5 DOOR HANDLES

13.4.8.6 SPOILERS & REAR WINGS

13.4.8.7 BODY KITS

13.4.8.8 BONNET/HOOD SCOOPS

13.4.8.9 FOG LIGHT COVERS / BEZELS

13.4.8.10 BADGES & EMBLEMS

13.4.8.11 WIPER ARMS & COVERS

13.4.8.12 INTERIOR COSMETIC PARTS

13.4.8.12.1 FLOOR MATS

13.4.8.12.2 SEAT COVERS

13.4.8.12.3 DASHBOARD PANELS

13.4.8.12.4 STEERING WHEEL COVERS

13.4.8.12.5 GEAR KNOB COVERS

13.4.8.12.6 OTHERS

13.4.8.13 LICENSE PLATE FRAMES & HOLDERS

13.4.8.14 TRIMS & MOLDINGS (DOOR, WINDOW, FENDER, ROOF RAILS)

13.4.9 SPOILERS & REAR WINGS

13.4.10 LICENSE PLATE FRAMES & HOLDERS,

13.4.11 OTHERS

13.5 DEALERSHIPS

13.5.1 BATTERIES

13.5.1.1 LEAD-ACID

13.5.1.2 LITHIUM-ION BATTERIES

13.5.1.3 OTHERS

13.5.2 ENGINE PARTS

13.5.2.1 SPARK PLUGS

13.5.2.2 ENGINE STARTERS

13.5.2.3 BEARINGS

13.5.2.4 VALVES

13.5.2.5 PISTONS

13.5.2.6 OTHERS

13.5.3 UNDERCARRIAGE PARTS

13.5.3.1 TRACK CHAINS

13.5.3.2 TRACK SHOES

13.5.3.3 TRACK ROLLERS

13.5.3.4 IDLERS

13.5.3.5 SPROCKETS

13.5.3.6 BUSHINGS AND PINS

13.5.3.7 TENSIONERS

13.5.3.8 OTHERS

13.5.4 WHEEL

13.5.4.1 TYRE

13.5.4.2 ALLOY

13.5.4.3 BRAKE CALIPERS

13.5.4.4 DISCS / ROTORS

13.5.4.5 OTHERS

13.5.5 BELTS

13.5.5.1 RUBBER TIMING BELTS

13.5.5.2 ALTERNATOR BELTS

13.5.5.3 AIR CONDITIONING (A/C) BELTS

13.5.5.4 POWER STEERING BELTS

13.5.5.5 CHAIN-DRIVEN TIMING BELTS

13.5.5.6 OTHERS

13.5.6 HYDRAULIC PARTS

13.5.6.1 HOSES

13.5.6.2 PUMPS

13.5.6.3 VALVES

13.5.6.4 CYLINDERS

13.5.6.5 OTHERS

13.5.7 EXHAUST

13.5.7.1 MUFFLER

13.5.7.2 CATALYTIC CONVERTER

13.5.7.3 OXYGEN SENSOR

13.5.7.4 RESONATOR

13.5.7.5 OTHERS

13.5.8 COSMETIC PARTS

13.5.8.1 BUMPERS (FRONT/REAR)

13.5.8.2 HEADLIGHTS & TAILLIGHTS

13.5.8.3 SIDE MIRRORS & MIRROR COVERS

13.5.8.4 GRILLES

13.5.8.5 DOOR HANDLES

13.5.8.6 SPOILERS & REAR WINGS

13.5.8.7 BODY KITS

13.5.8.8 BONNET/HOOD SCOOPS

13.5.8.9 FOG LIGHT COVERS / BEZELS

13.5.8.10 BADGES & EMBLEMS

13.5.8.11 WIPER ARMS & COVERS

13.5.8.12 INTERIOR COSMETIC PARTS

13.5.8.12.1 FLOOR MATS

13.5.8.12.2 SEAT COVERS

13.5.8.12.3 DASHBOARD PANELS,

13.5.8.12.4 STEERING WHEEL COVERS

13.5.8.12.5 GEAR KNOB COVERS

13.5.8.12.6 OTHERS

13.5.8.13 LICENSE PLATE FRAMES & HOLDERS

13.5.8.14 TRIMS & MOLDINGS (DOOR, WINDOW, FENDER, ROOF RAILS)

13.5.9 SPOILERS & REAR WINGS

13.5.10 LICENSE PLATE FRAMES & HOLDERS

13.5.11 OTHERS

13.6 GOVERNMENT & MUNICIPAL AGENCIES

13.6.1 BATTERIES

13.6.1.1 LEAD-ACID

13.6.1.2 LITHIUM-ION BATTERIES

13.6.1.3 OTHERS

13.6.2 ENGINE PARTS

13.6.2.1 SPARK PLUGS

13.6.2.2 ENGINE STARTERS

13.6.2.3 BEARINGS

13.6.2.4 VALVES

13.6.2.5 PISTONS

13.6.2.6 OTHERS

13.6.3 UNDERCARRIAGE PARTS

13.6.3.1 TRACK CHAINS

13.6.3.2 TRACK SHOES

13.6.3.3 TRACK ROLLERS

13.6.3.4 IDLERS

13.6.3.5 SPROCKETS

13.6.3.6 BUSHINGS AND PINS

13.6.3.7 TENSIONERS

13.6.3.8 OTHERS

13.6.4 WHEEL

13.6.4.1 TYRE

13.6.4.2 ALLOY

13.6.4.3 BRAKE CALIPERS

13.6.4.4 DISCS / ROTORS

13.6.4.5 OTHERS

13.6.5 BELTS

13.6.5.1 RUBBER TIMING BELTS

13.6.5.2 ALTERNATOR BELTS

13.6.5.3 AIR CONDITIONING (A/C) BELTS

13.6.5.4 POWER STEERING BELTS

13.6.5.5 CHAIN-DRIVEN TIMING BELTS

13.6.5.6 OTHERS

13.6.6 HYDRAULIC PARTS

13.6.6.1 HOSES

13.6.6.2 PUMPS

13.6.6.3 VALVES

13.6.6.4 CYLINDERS

13.6.6.5 OTHERS

13.6.7 EXHAUST

13.6.7.1 MUFFLER

13.6.7.2 CATALYTIC CONVERTER

13.6.7.3 OXYGEN SENSOR

13.6.7.4 RESONATOR

13.6.7.5 OTHERS

13.6.8 COSMETIC PARTS

13.6.8.1 BUMPERS (FRONT/REAR)

13.6.8.2 HEADLIGHTS & TAILLIGHTS

13.6.8.3 SIDE MIRRORS & MIRROR COVERS

13.6.8.4 GRILLES

13.6.8.5 DOOR HANDLES

13.6.8.6 SPOILERS & REAR WINGS

13.6.8.7 BODY KITS

13.6.8.8 BONNET/HOOD SCOOPS

13.6.8.9 FOG LIGHT COVERS / BEZELS

13.6.8.10 BADGES & EMBLEMS

13.6.8.11 WIPER ARMS & COVERS

13.6.8.12 INTERIOR COSMETIC PARTS

13.6.8.12.1 FLOOR MATS

13.6.8.12.2 SEAT COVERS

13.6.8.12.3 DASHBOARD PANELS

13.6.8.12.4 STEERING WHEEL COVERS

13.6.8.12.5 GEAR KNOB COVERS

13.6.8.12.6 OTHERS

13.6.8.13 LICENSE PLATE FRAMES & HOLDERS

13.6.8.14 TRIMS & MOLDINGS (DOOR, WINDOW, FENDER, ROOF RAILS)

13.6.9 SPOILERS & REAR WINGS

13.6.10 LICENSE PLATE FRAMES & HOLDERS

13.6.11 OTHERS

13.7 OTHERS

13.7.1 BATTERIES

13.7.1.1 LEAD-ACID

13.7.1.2 LITHIUM-ION BATTERIES

13.7.1.3 OTHERS

13.7.2 ENGINE PARTS

13.7.2.1 SPARK PLUGS

13.7.2.2 ENGINE STARTERS

13.7.2.3 BEARINGS

13.7.2.4 VALVES

13.7.2.5 PISTONS

13.7.2.6 OTHERS

13.7.3 UNDERCARRIAGE PARTS

13.7.3.1 TRACK CHAINS

13.7.3.2 TRACK SHOES

13.7.3.3 TRACK ROLLERS

13.7.3.4 IDLERS

13.7.3.5 SPROCKETS

13.7.3.6 BUSHINGS AND PINS

13.7.3.7 TENSIONERS

13.7.3.8 OTHERS

13.7.4 WHEEL

13.7.4.1 TYRE

13.7.4.2 ALLOY

13.7.4.3 BRAKE CALIPERS

13.7.4.4 DISCS / ROTORS

13.7.4.5 OTHERS

13.7.5 BELTS

13.7.5.1 RUBBER TIMING BELTS

13.7.5.2 ALTERNATOR BELTS

13.7.5.3 AIR CONDITIONING (A/C) BELTS

13.7.5.4 POWER STEERING BELTS

13.7.5.5 CHAIN-DRIVEN TIMING BELTS

13.7.5.6 OTHERS

13.7.6 HYDRAULIC PARTS

13.7.6.1 HOSES

13.7.6.2 PUMPS

13.7.6.3 VALVES

13.7.6.4 CYLINDERS

13.7.6.5 OTHERS

13.7.7 EXHAUST

13.7.7.1 MUFFLER

13.7.7.2 CATALYTIC CONVERTER

13.7.7.3 OXYGEN SENSOR

13.7.7.4 RESONATOR

13.7.7.5 OTHERS

13.7.8 COSMETIC PARTS

13.7.8.1 BUMPERS (FRONT/REAR)

13.7.8.2 HEADLIGHTS & TAILLIGHTS

13.7.8.3 SIDE MIRRORS & MIRROR COVERS

13.7.8.4 GRILLES

13.7.8.5 DOOR HANDLES

13.7.8.6 SPOILERS & REAR WINGS

13.7.8.7 BODY KITS

13.7.8.8 BONNET/HOOD SCOOPS

13.7.8.9 FOG LIGHT COVERS / BEZELS

13.7.8.10 BADGES & EMBLEMS

13.7.8.11 WIPER ARMS & COVERS

13.7.8.12 INTERIOR COSMETIC PARTS

13.7.8.12.1 FLOOR MATS

13.7.8.12.2 SEAT COVERS

13.7.8.12.3 DASHBOARD PANELS,

13.7.8.12.4 STEERING WHEEL COVERS

13.7.8.12.5 GEAR KNOB

13.7.8.12.6 OTHERS

13.7.8.13 LICENSE PLATE FRAMES & HOLDERS

13.7.8.14 TRIMS & MOLDINGS (DOOR, WINDOW, FENDER, ROOF RAILS)

13.7.9 SPOILERS & REAR WINGS

13.7.10 LICENSE PLATE FRAMES & HOLDERS

13.7.11 OTHERS

14 KSA AFTERMARKET USED SPARE PARTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KSA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 PARTFINDER SAUDI ARABIA

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENT

16.2 ZAUBA

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 GCC SPARES

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 NATIONAL AUTO PARTS COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 VITAL SPARES

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 AL HATTAB HOLDING

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AZ PARTS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 DG SPARE PART LLC

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 PARTXKART

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 SHOBBAK.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 COMPANY SERVICE PLATFORM MATRIX

TABLE 3 KSA AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND )

TABLE 4 KSA BATTERIES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 KSA UNDERCARRIAGE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 KSA WHEEL IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 KSA BELTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 KSA HYDRAULIC ELEVATORS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 KSA EXHAUST IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 KSA AFTERMARKET USED SPARE PARTS MARKET, BY MATERIAL , 2018-2032 (USD THOUSAND)

TABLE 13 KSA METAL IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 KSA PLASTIC IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 KSA RUBBER IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 KSA GLASS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 KSA FABRIC IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 KSA VINYL / DECALS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 KSA AFTERMARKET USED SPARE PARTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 KSA I.C.E.IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 21 KSA PASSENGER CARS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 22 KSA COMMERCIAL VEHICLES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 23 KSA HEAVY COMMERCIAL VEHICLES (HCV) IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 24 KSA TRUCKS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 25 KSA HYBRID IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 26 KSA PASSENGER CARS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 27 KSA COMMERCIAL VEHICLES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 28 KSA HEAVY COMMERCIAL VEHICLES (HCV) IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 29 KSA TRUCKS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 30 KSA ELECTRIC IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 31 KSA PASSENGER CARS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 32 KSA COMMERCIAL VEHICLES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 33 KSA HEAVY COMMERCIAL VEHICLES (HCV) IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 34 KSA TRUCKS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032(USD THOUSAND)

TABLE 35 KSA AFTERMARKET USED SPARE PARTS MARKET, BY PRICE, 2018-2032 (USD THOUSAND)

TABLE 36 KSA AFTERMARKET USED SPARE PARTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 KSA AFTERMARKET USED SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 KSA OFFLINE IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 KSA AFTERMARKET USED SPARE PARTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 40 KSA WORKSHOPS & GARAGES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND

TABLE 41 KSA BATTERIES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 KSA UNDERCARRIAGE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 KSA WHEEL IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 KSA BELTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 KSA HYDRAULIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 KSA EXHAUST IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 KSA INTERIOR COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 KSA FLEET OPERATORS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 KSA UNDERCARRIAGE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 KSA WHEEL IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 KSA BELTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 KSA HYDRAULIC PARTS S IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 KSA EXHAUST IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 KSA INTERIOR COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 KSA INDIVIDUAL CONSUMER IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 KSA BATTERIES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 KSA UNDERCARRIAGE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 KSA WHEEL IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 KSA BELTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 KSA HYDRAULIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 KSA EXHAUST IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 KSA INTERIOR COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 KSA DEALERSHIPS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 KSA BATTERIES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 KSA UNDERCARRIAGE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 KSA BELTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 KSA HYDRAULIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 KSA EXHAUST IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 KSA INTERIOR COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 KSA GOVERNMENT & MUNICIPAL AGENCIES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 KSA BATTERIES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 KSA UNDERCARRIAGE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 KSA WHEEL IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 KSA BELTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 KSA HYDRAULIC ELEVATORS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 KSA EXHAUST IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 KSA INTERIOR COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 KSA OTHERS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 KSA BATTERIES IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 KSA ENGINE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 KSA UNDERCARRIAGE PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 KSA WHEEL IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 KSA BELTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 KSA HYDRAULIC ELEVATORS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 KSA EXHAUST IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 KSA COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 KSA INTERIOR COSMETIC PARTS IN AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 KSA AFTERMARKET USED SPARE PARTS MARKET

FIGURE 2 KSA AFTERMARKET USED SPARE PARTS MARKET: DATA TRIANGULATION

FIGURE 3 KSA AFTERMARKET USED SPARE PARTS MARKET: DROC ANALYSIS

FIGURE 4 KSA AFTERMARKET USED SPARE PARTS MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 KSA AFTERMARKET USED SPARE PARTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA AFTERMARKET USED SPARE PARTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 KSA AFTERMARKET USED SPARE PARTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 KSA AFTERMARKET USED SPARE PARTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 KSA AFTERMARKET USED SPARE PARTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 KSA AFTERMARKET USED SPARE PARTS MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 ELEVEN SEGMENTS COMPRISE THE KSA AFTERMARKET USED SPARE PARTS MARKET, BY TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 EXPANSION OF DOMESTIC VEHICLE MANUFACTURING AND INCREASED LOCALIZATION OF SPARE PARTS PRODUCTION IS EXPECTED TO DRIVE THE KSA AFTERMARKET USED SPARE PARTS MARKET IN THE FORECAST PERIOD

FIGURE 15 THE BATTERIES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA AFTERMARKET USED SPARE PARTS MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRINTS, OPPORTUNITIES AND CHALLENGES OF KSA AFTERMARKET USED SPARE PARTS MARKET

FIGURE 17 KSA AFTERMARKET USED SPARE PARTS MARKET, BY TYPE, 2025

FIGURE 18 KSA AFTERMARKET USED SPARE PARTS MARKET, BY MATERIAL, 2025

FIGURE 19 KSA AFTERMARKET USED SPARE PARTS MARKET: BY VEHICLE TYPE, 2024

FIGURE 20 KSA AFTERMARKET USED SPARE PARTS MARKET: BY PRICE, 2024

FIGURE 21 KSA AFTERMARKET USED SPARE PARTS MARKET: BY APPLICATION, 2024

FIGURE 22 KSA AFTERMARKET USED SPARE PARTS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 23 KSA AFTERMARKET USED SPARE PARTS MARKET, BY END-USER, 2024

FIGURE 24 KSA AFTERMARKET USED SPARE PARTS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.