Ksa Medical Device Market

Market Size in USD Billion

CAGR :

%

USD

3.32 Billion

USD

5.73 Billion

2025

2033

USD

3.32 Billion

USD

5.73 Billion

2025

2033

| 2026 –2033 | |

| USD 3.32 Billion | |

| USD 5.73 Billion | |

|

|

|

|

KSA Medical Device Market Size

- The KSA Medical Device Market size was valued at USD 3.32 Billion in 2025 and is expected to reach USD 5.73 Billion by 2033, at a CAGR of 7.1% during the forecast period

- Rising government investments in healthcare are a major factor driving demand nationwide.

- Expansion in telemedicine and remote patient monitoring is enhancing the market’s reach.

KSA Medical Device Market Analysis

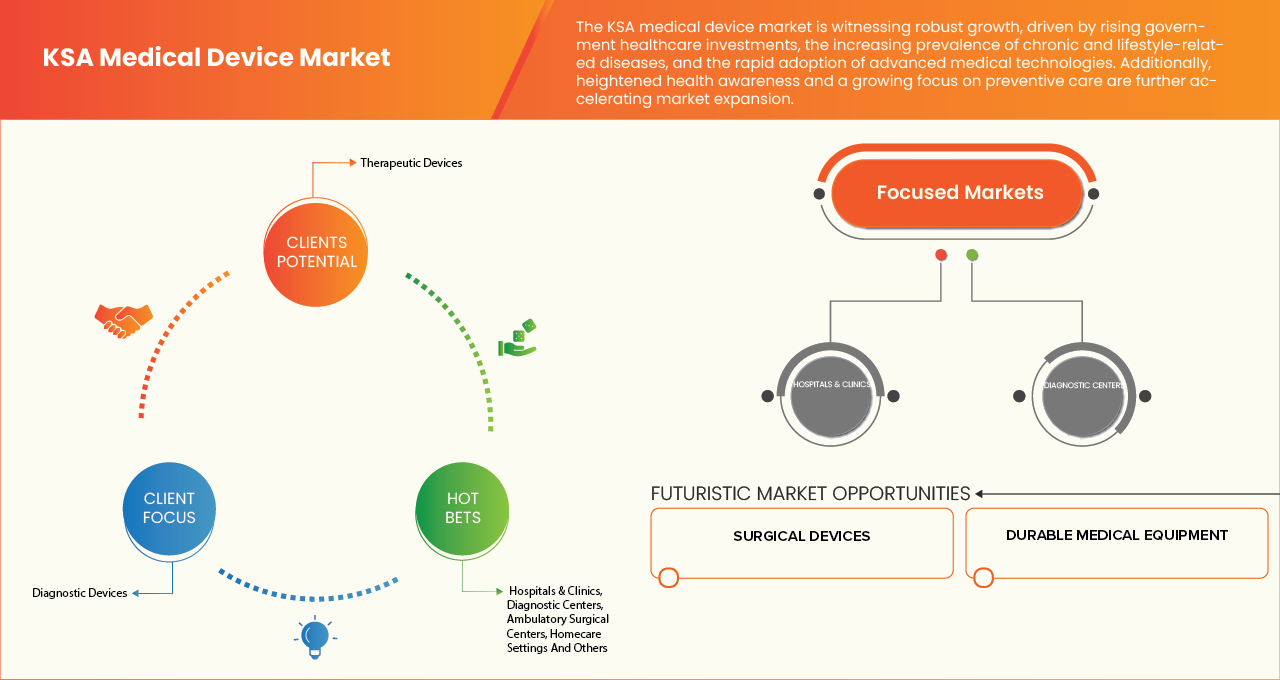

- The Saudi Arabia KSA Medical Device Market is witnessing strong growth, driven by rapid expansion of healthcare infrastructure and increasing government investment under Vision 2030. The Kingdom is actively modernizing its healthcare system by developing new hospitals, specialty clinics, and diagnostic centers, which is significantly boosting demand for advanced medical equipment. Rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions is further accelerating the adoption of diagnostic imaging systems, patient monitoring devices, and minimally invasive surgical equipment.

- An aging population and growing health awareness among citizens are increasing demand for preventive care and home healthcare devices. The market is currently dominated by imported products, as international manufacturers supply most high-end and technologically advanced equipment. However, local manufacturing is gradually expanding through localization initiatives and public-private partnerships aimed at strengthening domestic production capabilities.

- Regulatory supervision by the Saudi Food and Drug Authority (SFDA) ensures product quality, safety, and compliance with international standards, creating a transparent and structured business environment. The private healthcare sector is also growing rapidly, attracting foreign investments and encouraging technology upgrades. Additionally, digital health adoption and integration of artificial intelligence in diagnostics are emerging trends shaping the market. Overall, the Saudi KSA Medical Device Market is evolving into a technologically advanced and competitive landscape, supporting improved healthcare outcomes across the country.

- In 2025, the Diagnostic Devices segment is projected to dominate the KSA Medical Device Market, capturing a 29.85% share. This growth is driven by increasing demand for advanced diagnostic technologies, rising healthcare investments, and the adoption of innovative medical solutions across the region.

Report Scope and KSA Medical Device Market Segmentation

|

Attributes |

KSA Medical Device Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

KSA Medical Device Market Trends

“Rising Government Healthcare Investments”

- The Saudi government’s sustained investment in healthcare infrastructure under Vision 2030 is driving growth in the KSA Medical Device Market. Funding for hospital modernization, service expansion, and integrated health clusters has increased demand for advanced diagnostic, monitoring, and therapeutic devices, while encouraging private sector participation.

- Strategic reforms promoting digital health, telemedicine, and local manufacturing have strengthened investor confidence and encouraged global med-tech companies to enter the market. Regulatory improvements and strategic partnerships create dynamic conditions for both supply and demand in the medical device sector.

- Government allocations have supported local production capacity, with around 150 licensed medical device facilities and SR 10 billion (USD 2.6 billion) in funding. This expansion reduces reliance on imports, fosters domestic manufacturing of advanced devices, and strengthens the healthcare supply chain.

- Planned investments of over USD 65 billion in healthcare infrastructure and approximately USD 1.5 billion in digital health initiatives are driving demand for advanced medical devices. These funds support smart hospitals, connected devices, remote monitoring systems, and digital diagnostics across public healthcare facilities.

- The e-Health and telemedicine strategy by the Ministry of Health accelerates adoption of virtual care technologies. Telehealth-enabled devices, interoperable platforms, and digital diagnostic tools are in growing demand, improving healthcare access in remote and underserved regions while boosting market growth.

KSA Medical Device Market Dynamics

Driver

Increasing Prevalence of Chronic and Lifestyle-Related Diseases

- The rising prevalence of chronic and lifestyle-related diseases in Saudi Arabia, including diabetes, cardiovascular disorders, obesity, and respiratory conditions, is a major driver of medical device demand. Changing diets, sedentary lifestyles, and urbanization are contributing to this growing health burden.

- Patients increasingly require diagnostic, monitoring, and therapeutic devices for early detection, continuous management, and treatment of chronic conditions. Hospitals, clinics, and home-care providers rely on blood glucose monitors, cardiac implants, imaging devices, respiratory support systems, and wearable technologies.

- Government initiatives and public health programs targeting chronic diseases, such as awareness campaigns and preventive care programs, further boost demand for related medical devices, supporting sector growth and infrastructure expansion.

- High prevalence rates reinforce the need for medical technologies: in 2024, 18.95% of adults suffer from at least one chronic disease, while obesity affects 21.4% of adults, diabetes 18.3%, and cardiovascular diseases account for 37% of deaths. These statistics drive demand for specialized devices like insulin delivery systems, cardiac stents, pacemakers, and advanced imaging equipment.

- The increasing burden of chronic and lifestyle-related diseases ensures sustained market growth, as healthcare providers continue to invest in advanced technologies and hospital infrastructure to efficiently manage patient care across urban and home-care settings.

Restraint/Challenge

High Cost of Advanced Medical Devices

- Despite rapid modernization under Vision 2030, the high cost of advanced medical devices remains a key restraint on market growth in Saudi Arabia. Cutting-edge technologies, including robotic surgery systems, AI-powered platforms, and advanced imaging equipment, require substantial upfront capital and specialized infrastructure.

- Smaller hospitals and regional healthcare facilities often struggle to adopt these technologies due to budget constraints, leading to uneven diffusion of advanced devices and limiting patient access outside major urban centers.

- Many devices are import-dependent, with tariffs, logistics, and reliance on foreign manufacturers increasing acquisition costs. This further restricts market penetration and raises financial barriers for healthcare providers.

- High-cost examples include robotic surgical systems costing millions of riyals, high-field MRI and PET-CT scanners priced in the millions of dollars, and sophisticated home monitoring devices. These costs concentrate advanced care in large hospitals and limit adoption in smaller facilities.

- Addressing affordability through local manufacturing, value-based procurement, and pricing reforms will be critical for broader and equitable access to advanced medical devices, ensuring the benefits of modernization reach both urban and rural populations.

KSA Medical Device Market Scope

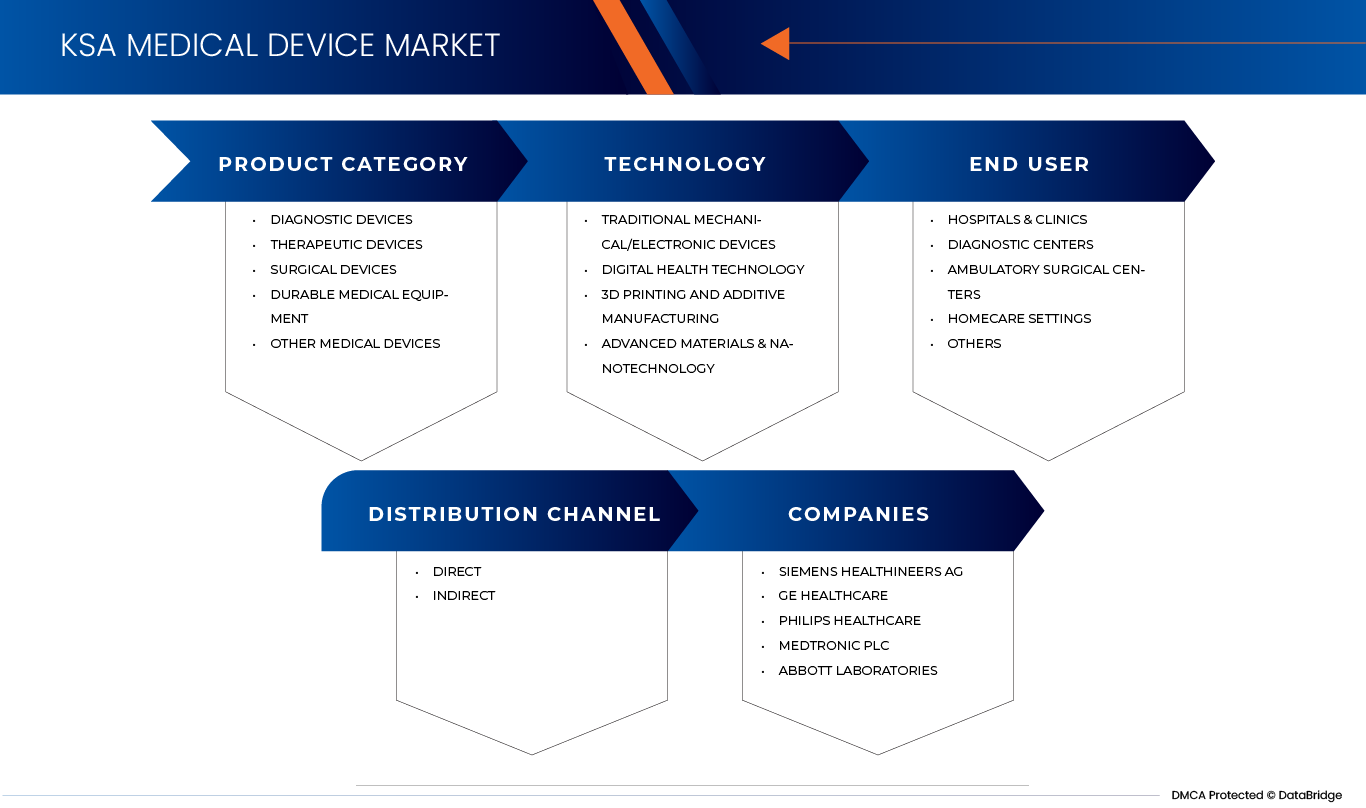

KSA Medical Device Market is segmented into four notable segments based on product category, technology, end user, and distribution channel.

By Product Category

On the basis of product category, the KSA Medical Device Market is segmented into diagnostic devices, therapeutic devices, surgical devices, durable medical equipment and, other medical devices.

In 2026, the diagnostic devices segment is expected to dominate the KSA Medical Device Market with a 29.90% share. This growth is driven by increasing demand for advanced diagnostic technologies, rising prevalence of chronic diseases, and expanding healthcare infrastructure. Hospitals and clinics are investing heavily in imaging systems, laboratory equipment, and monitoring devices to improve early detection and patient care outcomes.

The therapeutic devices segment in the KSA Medical Device Market is expected to register the fastest growth, with a CAGR of 7.5% from 2026 to 2033. This growth is driven by rising demand for advanced treatment solutions, the increasing prevalence of chronic and lifestyle-related diseases, and the continued expansion of hospital and home-care infrastructure. Additionally, advancements in minimally invasive therapies, targeted drug delivery systems, and patient-specific treatment technologies are accelerating adoption across the Kingdom.

By Technology

On the basis of technology, the KSA Medical Device Market is segmented into traditional mechanical/electronic devices, digital health technology, 3D printing and additive manufacturing and advanced materials & nanotechnology.

In 2026, the traditional mechanical/electronic devices segment is expected to dominate the KSA Medical Device Market with a 56.19% share. This leadership is driven by the continued reliance on conventional medical equipment, widespread adoption in hospitals and clinics, and steady demand for proven, cost-effective devices that support routine diagnostics and therapeutic procedures. These devices remain essential for both urban and regional healthcare facilities across the Kingdom.

The digital health technology segment in the KSA Medical Device Market is expected to witness the fastest growth, registering a CAGR of 7.7% from 2026 to 2033. This expansion is driven by the increasing adoption of telemedicine, remote patient monitoring, and connected healthcare solutions. In addition, strong government support for digital health initiatives, rising demand for real-time patient data, and the integration of AI and IoT into clinical workflows are further accelerating market growth across hospitals, clinics, and home-care settings.

By End User

On the basis of end user, the KSA Medical Device Market is segmented into hospitals & clinics, diagnostic centers, ambulatory surgical centers, homecare settings and others.

In 2026, the Hospitals & Clinics segment is expected to dominate the KSA Medical Device Market with a 55.55% share. This leadership is driven by the growing demand for advanced medical equipment in healthcare facilities, ongoing expansion and modernization of hospitals, and increased patient volumes. Investments in diagnostic, therapeutic, and monitoring devices are further strengthening adoption across both urban and regional healthcare centers.

The hospitals and clinics segment in the KSA Medical Device Market is expected to witness the fastest growth, registering a CAGR of 7.3% from 2026 to 2033. This growth is driven by the ongoing expansion and modernization of healthcare facilities, rising patient volumes, and increasing demand for advanced diagnostic, therapeutic, and monitoring devices. Furthermore, sustained investments in hospital infrastructure and the adoption of cutting-edge medical technologies are accelerating growth across both urban and regional healthcare centers.

By Distribution Channel

On the basis of distribution channel, the KSA Medical Device Market is segmented into direct and indirect.

In 2026, the direct segment is expected to dominate the KSA Medical Device Market with a 71.50% share. This dominance is driven by manufacturers supplying devices directly to hospitals, clinics, and healthcare facilities, ensuring faster delivery, customized solutions, and stronger post-sale support. Direct distribution channels continue to be preferred for high-value and technologically advanced medical devices across the Kingdom.

The indirect segment in the KSA Medical Device Market is expected to witness the fastest growth, registering a CAGR of 7.4% from 2026 to 2033. This growth is driven by the expanding role of distributors, wholesalers, and third-party resellers in reaching smaller hospitals, clinics, and remote healthcare facilities. By enabling wider geographic coverage, flexible supply solutions, and cost-effective access to medical devices, the indirect channel is supporting market expansion across both urban and underserved regions of the Kingdom.

The Major Market Leaders Operating in the Market Are:

- Siemens Healthineers AG (Germany)

- GE Healthcare (U.S.)

- Philips Healthcare (Netherlands)

- Medtronic Plc (Ireland/U.S.)

- Abbott Laboratories (U.S.)

- Stryker Corporation (U.S.)

- Boston Scientific Corporation (U.S.)

- Becton, Dickinson and Company (BD) (U.S.)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Smith & Nephew Plc (U.K.)

- Terumo Corporation (Japan)

- Baxter International Inc. (U.S.)

- Cardinal Health, Inc. (U.S.)

Latest Developments in KSA Medical Device Market

- In September 2024, Medtronic plc, the global leader in medical technology, has announced the launch of its groundbreaking VitalFlow ECMO System. This innovative platform is a fully configurable one-system ECMO solution, engineered to deliver superior performance while prioritizing operational simplicity.

- In July 2025, GE HealthCare introduced the Definium Pace Select ET, a new floor-mounted digital X-ray system designed to deliver high-quality imaging while improving workflow efficiency in high-volume environments. The system uses advanced automation and AI-enabled features to streamline repetitive tasks, reduce technologist strain, and help ensure consistent image quality, increasing throughput for busy radiology departments. This launch strengthens GE HealthCare’s imaging portfolio with accessible, efficient technology that can drive broader adoption in diagnostic imaging.

- In September 2025, Royal Philips announced a multi-year strategic partnership extension with Masimo to integrate advanced patient monitoring technologies—such as SET® pulse oximetry and Radius PPG—into Philips’ monitoring platforms. The collaboration aims to provide more reliable and integrated data across bedside and wearable monitors, helping clinicians make timely decisions. This expanded agreement focuses on simplifying workflows, enhancing interoperability, and responding to clinical needs like patient mobility.

- In November 2025, Abbott Laboratories has announced a definitive agreement to acquire Exact Sciences, a leader in cancer screening and precision oncology diagnostics, for about USD 21 billion in cash. The deal gives Abbott entry into the fast-growing U.S. cancer diagnostics market and adds advanced tests like Cologuard and Oncotype DX to its portfolio. Exact Sciences’ technologies help detect cancer earlier and guide personalized treatment decisions. The acquisition is expected to strengthen Abbott’s position in healthcare and expand access to life-changing diagnostics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE KSA MEDICAL DEVICE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END USER COVERAGE GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VALUE CHAIN ANALYSIS

4.2.1 OVERVIEW

4.2.2 RESEARCH & DEVELOPMENT (R&D)

4.2.3 RAW MATERIALS & COMPONENTS SOURCING

4.2.4 MANUFACTURING & ASSEMBLY

4.2.5 TECHNOLOGY PROVIDERS

4.2.6 QUALITY CONTROL, TESTING & CERTIFICATION

4.2.7 IMPORTATION, DISTRIBUTION & LOGISTICS

4.2.8 MARKETING, SALES & PROCUREMENT

4.2.9 INSTALLATION, TRAINING & AFTER-SALES SERVICES

4.2.10 END USERS & KEY CONSUMERS

4.2.11 CONCLUSION

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 INTRODUCTION

4.3.2 HEALTH-CONSCIOUSNESS DRIVES PURCHASES

4.3.3 PREFERENCE FOR QUALITY, TECHNOLOGY & FUNCTIONALITY

4.3.4 PRICE SENSITIVITY & VALUE-DRIVEN DECISIONS

4.3.5 DIGITAL & E-COMMERCE CHANNELS RESHAPE BUYING PATTERNS

4.3.6 TRUST IN REGULATION & SAFETY CRITERIA

4.3.7 YOUNGER, TECH-SAVVY POPULATION ACCELERATES ADOPTION

4.3.8 CONCLUSION

4.4 TECHNOLOGICAL ADVANCEMENTS

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.2 PRODUCTS IN DEVELOPMENT

4.5.3 STAGE OF DEVELOPMENT

4.5.4 TIMELINES AND MILESTONES

4.5.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.5.1 INNOVATION STRATEGIES IN THE SAUDI ARABIA MEDICAL DEVICE MARKET

4.5.5.1.1 OPEN INNOVATION & COLLABORATIONS:

4.5.5.1.2 TECHNOLOGY ADOPTION & DIGITAL TRANSFORMATION

4.5.5.1.3 LOCALIZATION & DOMESTIC MANUFACTURIN

4.5.5.1.4 USER-CENTERED DESIGN (UCD)

4.5.5.1.5 INCREMENTAL & DISRUPTIVE INNOVATION

4.5.5.1.6 REGULATORY-DRIVEN INNOVATION

4.5.5.1.7 DATA-DRIVEN & ANALYTICS-BASED INNOVATION

4.5.5.2 INNOVATION METHODOLOGIES IN THE SAUDI ARABIA MEDICAL DEVICE MARKET

4.5.5.2.1 DESIGN THINKING

4.5.5.2.2 AGILE & ITERATIVE DEVELOPMENT

4.5.5.2.3 LEAN STARTUP METHODOLOGY

4.5.5.2.4 STAGE-GATE / PHASE-GATE PROCESS

4.5.5.2.5 CO-CREATION & OPEN INNOVATION METHODOLOGY

4.5.5.2.6 REGULATORY-INTEGRATED R&D

4.5.6 RISK ASSESSMENT AND MITIGATION

4.5.7 FUTURE OUTLOOK

4.5.8 YEARLY NO. OF DEALS, KEY PLAYERS

4.6 PRICING ANALYSIS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE

5.1.1 CUSTOMS DUTY BASICS:

5.1.2 MEDICAL DEVICES – TYPICAL DUTY TREATMENT

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING GOVERNMENT HEALTHCARE INVESTMENTS

7.1.2 INCREASING PREVALENCE OF CHRONIC AND LIFESTYLE-RELATED DISEASES

7.1.3 ADOPTION OF TECHNOLOGICAL ADVANCEMENTS

7.1.4 HEIGHTENED HEALTH AWARENESS AND PREVENTIVE CARE ADOPTION

7.2 RESTRAINTS

7.2.1 HIGH COST OF ADVANCED MEDICAL DEVICES

7.2.2 LIMITED AVAILABILITY OF SKILLED HEALTHCARE WORKFORCE

7.3 OPPORTUNITIES

7.3.1 GROWTH IN LOCAL MANUFACTURING AND LOCALIZATION INITIATIVES

7.3.2 EXPANSION OF TELEMEDICINE AND REMOTE PATIENT MONITORING

7.3.3 GROWING DEMAND FOR HOME HEALTHCARE SOLUTIONS

7.4 CHALLENGES

7.4.1 INTENSIFYING COMPETITIVE PRESSURE

7.4.2 HIGH DEPENDENCY ON IMPORTED MEDICAL DEVICES

8 KSA MEDICAL DEVICE, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIAGNOSTIC DEVICES

8.3 THERAPEUTIC DEVICES

8.4 SURGICAL DEVICES

8.5 DURABLE MEDICAL EQUIPMENT

8.6 OTHER MEDICAL DEVICES

8.7 KSA DIAGNOSTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 IN-VITRO DIAGNOSTICS (IVD) DEVICES

8.7.2 IMAGING DEVICES

8.7.3 MONITORING DEVICES

8.8 KSA DIAGNOSTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.8.1 IN-VITRO DIAGNOSTICS (IVD) DEVICES

8.8.2 IMAGING DEVICES

8.8.3 MONITORING DEVICES

8.9 KSA DIAGNOSTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

8.9.1 IN-VITRO DIAGNOSTICS (IVD) DEVICES

8.9.2 IMAGING DEVICES

8.9.3 MONITORING DEVICES

8.1 KSA IMAGING DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 X-RAY SYSTEMS

8.10.2 ULTRASOUND DEVICES

8.10.3 MRI SYSTEMS

8.11 KSA IMAGING DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.11.1 X-RAY SYSTEMS

8.11.2 ULTRASOUND DEVICES

8.11.3 MRI SYSTEMS

8.12 KSA IMAGING DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

8.12.1 X-RAY SYSTEMS

8.12.2 ULTRASOUND DEVICES

8.12.3 MRI SYSTEMS

8.13 KSA X-RAY SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 STATIONARY X-RAY DEVICES

8.13.2 PORTABLE X-RAY DEVICES

8.14 KSA X-RAY SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.14.1 PORTABLE X-RAY DEVICES

8.14.2 STATIONARY X-RAY DEVICES

8.15 KSA X-RAY SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

8.15.1 PORTABLE X-RAY DEVICES

8.15.2 STATIONARY X-RAY DEVICES

8.16 KSA MRI SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 CLOSED MRI

8.16.2 OPEN MRI

8.17 KSA MRISYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.17.1 CLOSED MRI

8.17.2 OPEN MRI

8.18 KSA MRI SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

8.18.1 CLOSED MRI

8.18.2 OPEN MRI

8.19 KSA THERAPEUTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.19.1 CARDIOVASCULAR DEVICES

8.19.2 ORTHOPEDIC DEVICES

8.19.3 RESPIRATORY DEVICES

8.19.4 NEUROLOGICAL DEVICES (DEEP BRAIN STIMULATORS)

8.2 KSA CARDIOVASCULAR DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.20.1 STENTS

8.20.2 PACEMAKERS

8.21 KSA ORTHOPEDIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 IMPLANTS

8.21.2 INSTRUMENTS

8.22 KSA IMPLANTS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 KNEE IMPLANTS

8.22.2 HIP IMPLANTS

8.23 KSA SURGICAL DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.23.1 GENERAL SURGERY DEVICES

8.23.2 MINIMALLY INVASIVE SURGICAL INSTRUMENTS

8.23.3 ROBOTIC SURGICAL SYSTEMS

8.24 KSA SURGICAL DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.24.1 GENERAL SURGERY DEVICES

8.24.2 MINIMALLY INVASIVE SURGICAL INSTRUMENTS

8.24.3 ROBOTIC SURGICAL SYSTEMS

8.25 KSA SURGICAL DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNIT)

8.25.1 GENERAL SURGERY DEVICES

8.25.2 MINIMALLY INVASIVE SURGICAL INSTRUMENTS

8.25.3 ROBOTIC SURGICAL SYSTEMS

8.26 KSA DURABLE MEDICAL EQUIPMENT IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.26.1 HOSPITAL BEDS

8.26.2 PATIENT MOBILITY DEVICES

8.26.3 HOMECARE EQUIPMENT

8.27 KSA DURABLE MEDICAL EQUIPMENT IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.27.1 HOSPITAL BEDS

8.27.2 PATIENT MOBILITY DEVICES

8.27.3 HOMECARE EQUIPMENT

8.28 KSA DURABLE MEDICAL EQUIPMENT IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNIT)

8.28.1 HOSPITAL BEDS

8.28.2 PATIENT MOBILITY DEVICES

8.28.3 HOMECARE EQUIPMENT

8.29 KSA PATIENT MOBILITY DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.29.1 WHEELCHAIRS

8.29.2 WALKERS

8.3 KSA PATIENT MOBILITY DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.30.1 WHEELCHAIRS

8.30.2 WALKERS

8.31 KSA PATIENT MOBILITY DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNIT)

8.31.1 WHEELCHAIRS

8.31.2 WALKERS

9 KSA MEDICAL DEVICE, BY TECHNOLOGY

9.1 OVERVIEW

9.2 TRADITIONAL MECHANICAL/ELECTRONIC DEVICES

9.3 DIGITAL HEALTH TECHNOLOGY

9.4 3D PRINTING AND ADDITIVE MANUFACTURING

9.5 ADVANCED MATERIALS & NANOTECHNOLOGY

9.6 KSA DIGITAL HEALTH TECHNOLOGY IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.6.1 WEARABLE DEVICES

9.6.2 TELEHEALTH

9.6.3 MOBILE HEALTH APPS

9.7 KSA WEARABLE DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.7.1 FITNESS TRACKERS

9.7.2 REMOTE MONITORING DEVICES

10 KSA MEDICAL DEVICE, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS & CLINICS

10.3 DIAGNOSTIC CENTERS

10.4 AMBULATORY SURGICAL CENTERS

10.5 HOMECARE SETTINGS

10.6 OTHERS

11 KSA MEDICAL DEVICE, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 KSA MEDICAL DEVICE MARKET COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: KSA

13 SWOT ANALYSIS

14 MANUFACTURER COMPANY PROFILE

14.1 SIEMENS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT/NEWS

14.2 GE HEALTHCARE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 KONINKLIJKE PHILIPS N.V.,

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT/NEWS

14.4 MEDTRONIC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT/NEWS

14.5 ABBOTT.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT/NEWS

14.6 BAXTER INTERNATIONAL INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BECTON, DICKINSON AND COMPANY (BD)

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 BOSTON SCIENTIFIC CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT/NEWS

14.9 CARDINAL HEALTH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 SMITH & NEPHEW PLC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 STRYKER CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 TERUMO CORPORATION

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 ZIMMER BIOMET HOLDINGS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

15 DISTRIBUTORS COMPANY PROFILE

15.1 CARDINAL HEALTH INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 HALOXYLON AMMODENDRON MEDICAL EQUIPMENT CO., LTD

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 HENRY SCHEIN, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 MEDLINE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 RAQWANI MEDICALS

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 KEY TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DEVICES AND THEIR IMPACT

TABLE 2 SAUDI ARABIA MEDICAL DEVICE MARKET: TIMELINES AND KEY MILESTONES OF DEVELOPMENT

TABLE 3 RISK ASSESSMENT AND MITIGATION FRAMEWORK FOR SAUDI ARABIA MEDICAL DEVICE MARKET

TABLE 4 MAJOR DEALS OF KEY MEDICAL DEVICE PLAYERS

TABLE 5 TYPICAL APPLIED DUTY RATES

TABLE 6 VENDOR SELECTION CRITERIA DYNAMICS IN THE SAUDI ARABIA MEDICAL DEVICE MARKET

TABLE 7 FACTORS INFLUENCING MEDICAL DEVICE PRICING IN SAUDI ARABIA

TABLE 8 MEDICAL DEVICE PRODUCT CODES AND DESCRIPTIONS

TABLE 9 CERTIFIED STANDARDS FOR MEDICAL DEVICES

TABLE 10 KSA MEDICAL DEVICE MARKET, BY PRODUCT CATEGORY, 2018-2033 (USD THOUSAND)

TABLE 11 KSA DIAGNOSTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 KSA DIAGNOSTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 13 KSA DIAGNOSTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

TABLE 14 KSA IMAGING DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 KSA IMAGING DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 16 KSA IMAGING DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

TABLE 17 KSA X-RAY SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 KSA X-RAY SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 19 KSA X-RAY SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

TABLE 20 KSA MRI SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 KSA MRISYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 22 KSA MRI SYSTEMS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNITS)

TABLE 23 KSA THERAPEUTIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 KSA CARDIOVASCULAR DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 KSA ORTHOPEDIC DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 KSA IMPLANTS IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 KSA SURGICAL DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 KSA SURGICAL DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 29 KSA SURGICAL DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNIT)

TABLE 30 KSA DURABLE MEDICAL EQUIPMENT IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 KSA DURABLE MEDICAL EQUIPMENT IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 32 KSA DURABLE MEDICAL EQUIPMENT IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNIT)

TABLE 33 KSA PATIENT MOBILITY DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 KSA PATIENT MOBILITY DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 35 KSA PATIENT MOBILITY DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (ASP) (USD/UNIT)

TABLE 36 KSA MEDICAL DEVICE MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 37 KSA DIGITAL HEALTH TECHNOLOGY IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 KSA WEARABLE DEVICES IN MEDICAL DEVICE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 KSA MEDICAL DEVICE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 40 KSA MEDICAL DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 KSA MEDICAL DEVICE MARKET: SEGMENTATION

FIGURE 2 KSA MEDICAL DEVICE MARKET: DATA TRIANGULATION

FIGURE 3 KSA MEDICAL DEVICE MARKET: DROC ANALYSIS

FIGURE 4 KSA MEDICAL DEVICE MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 KSA MEDICAL DEVICE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA MEDICAL DEVICE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA MEDICAL DEVICE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA MEDICAL DEVICE MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 KSA MEDICAL DEVICE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 KSA MEDICAL DEVICE MARKET: SEGMENTATION

FIGURE 11 FIEVE SEGMENTS COMPRISE THE KSA MEDICAL DEVICE MARKET, BY PRODUCT CATEGORY (2025)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING GOVERNMENT HEALTHCARE INVESTMENTS IS EXPECTED TO DRIVE THE GROWTH OF THE KSA MEDICAL DEVICE MARKET FROM 2026 TO 2033

FIGURE 14 THE DIAGNOSTIC DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA MEDICAL DEVICE MARKET IN 2026 - 2032

FIGURE 15 KSA MEDICAL DEVICE MARKET, 2018-2033, AVERAGE SELLING PRICE (AVERAGE USD/UNIT)

FIGURE 16 DROC ANALYSIS

FIGURE 17 MOH ALLOCATED BUDGET TO HEALTH SECTOR FROM 2020–2025

FIGURE 18 KSA MEDICAL DEVICE MARKET: BY PRODUCT TYPE, 2025

FIGURE 19 KSA MEDICAL DEVICE MARKET, BY PRODUCT TYPE, 2026-2033 (USD THOUSANDS)

FIGURE 20 KSA MEDICAL DEVICE MARKET, BY PRODUCT TYPE, CAGR, 2026-2033

FIGURE 21 KSA MEDICAL DEVICE MARKET, BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 KSA MEDICAL DEVICE MARKET: BY TECHNOLOGY, 2025

FIGURE 23 KSA MEDICAL DEVICE MARKET, BY TECHNOLOGY, 2026-2033 (USD THOUSANDS)

FIGURE 24 KSA MEDICAL DEVICE MARKET, BY TECHNOLOGY, CAGR, 2026-2033

FIGURE 25 KSA MEDICAL DEVICE MARKET, BY TECHNOLOGY, LIFELINE CURVE

FIGURE 26 KSA MEDICAL DEVICE MARKET: BY END USER, 2025

FIGURE 27 KSA MEDICAL DEVICE MARKET, BY END USER, 2026-2033 (USD THOUSANDS)

FIGURE 28 KSA MEDICAL DEVICE MARKET, BY END USER, CAGR, 2026-2033

FIGURE 29 KSA MEDICAL DEVICE MARKET, BY END USER, LIFELINE CURVE

FIGURE 30 KSA MEDICAL DEVICE MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 31 KSA MEDICAL DEVICE MARKET, BY DISTRIBUTION CHANNEL, 2026-2033 (USD THOUSANDS)

FIGURE 32 KSA MEDICAL DEVICE MARKET, BY DISTRIBUTION CHANNEL, CAGR, 2026-2033

FIGURE 33 KSA MEDICAL DEVICE MARKET, BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 KSA MEDICAL DEVICE MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.