Ksa Surface Disinfectant Market

Market Size in USD Million

CAGR :

%

USD

333.44 Million

USD

570.75 Million

2025

2033

USD

333.44 Million

USD

570.75 Million

2025

2033

| 2026 –2033 | |

| USD 333.44 Million | |

| USD 570.75 Million | |

|

|

|

|

KSA Surface Disinfectant Market Size

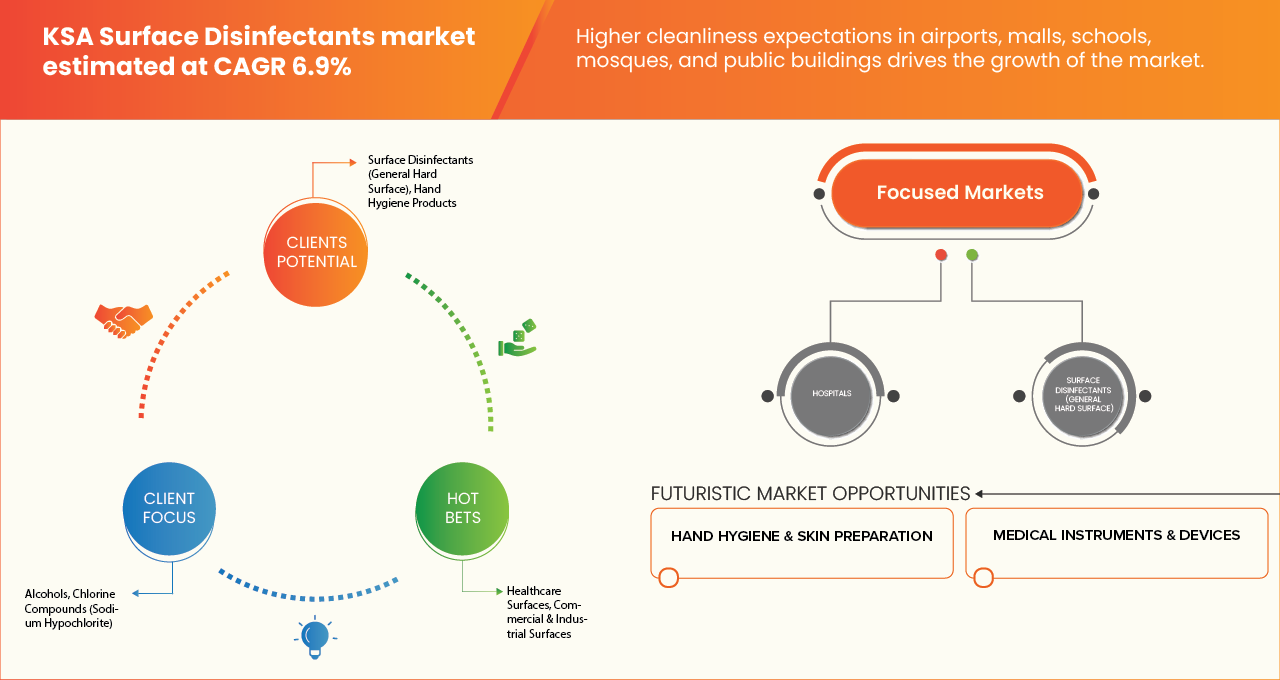

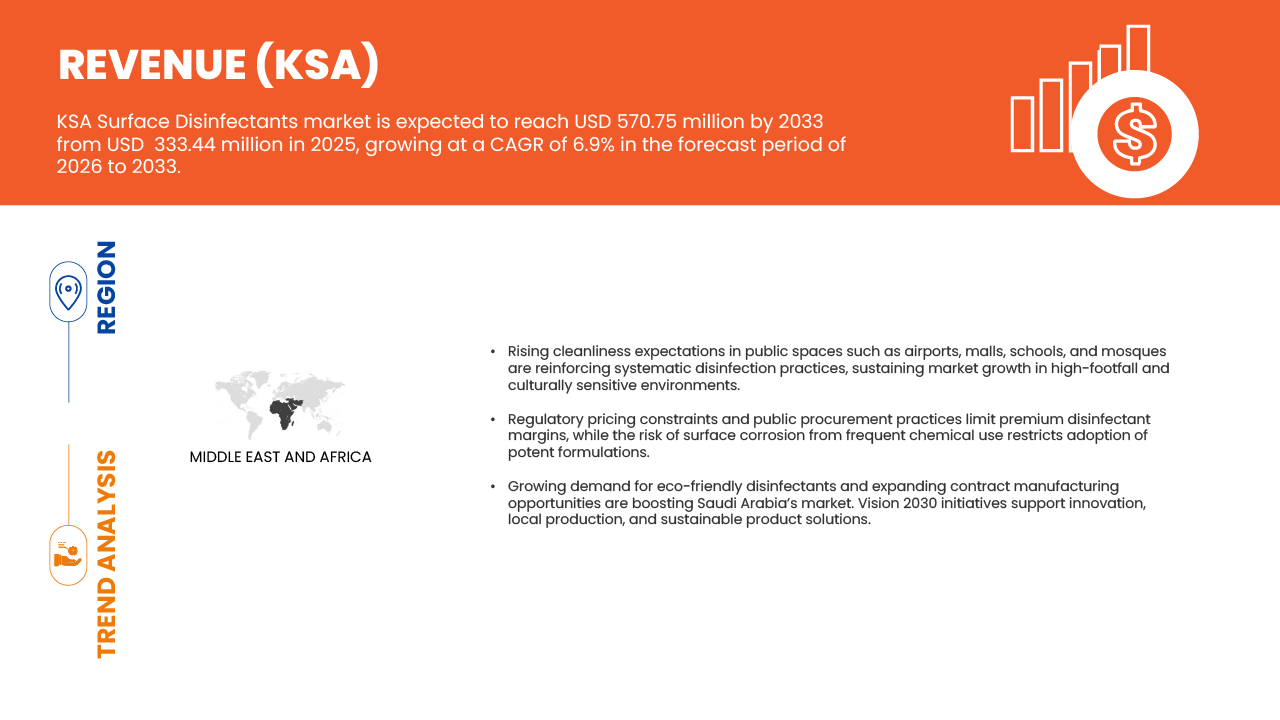

- The KSA Surface Disinfectant Market size was valued at USD 333.44 million in 2025 and is expected to reach USD 570.75 million by 2033, at a CAGR of 6.9% during the forecast period.

- "Surface disinfectants play a critical role in maintaining hygiene and preventing the spread of infections across residential, commercial, and institutional environments. Their ability to rapidly eliminate a broad spectrum of microorganisms from frequently touched surfaces reduces the risk of cross-contamination and healthcare associated infections. Regular use of surface disinfectants supports safer living and working environments, particularly in high-traffic settings such as hospitals, offices, retail spaces, and public facilities.

- The availability of fast-acting, easy-to-use, and cost-effective disinfectant formulations enhances operational efficiency and ensures consistent sanitation practices. Liquid disinfectants, sprays, and wipes allow for quick application and broad surface coverage, supporting routine and emergency cleaning requirements. In healthcare and institutional settings, reliable disinfection improves patient safety, staff protection, and compliance with stringent hygiene regulations.

- As hygiene awareness continues to rise in Saudi Arabia, surface disinfectants are increasingly viewed as an essential component of infection prevention strategies. Their role in reducing disease transmission, improving public health outcomes, and supporting government-led sanitation and healthcare quality initiatives strengthens long-term market adoption. Additionally, growing emphasis on sustainable, low-toxicity, and surface-compatible formulations aligns with evolving environmental and safety standards, further reinforcing market growth prospects."

KSA Surface Disinfectant Market Analysis

- The KSA Surface Disinfectant Market is experiencing significant growth, fueled by rapid expansion of healthcare facilities and increased government investment under Vision 2030. The Kingdom’s efforts to modernize healthcare infrastructure—including the construction of new hospitals, specialty clinics, and diagnostic centers—are driving heightened demand for high-quality surface disinfectants to maintain hygiene standards and prevent hospital-acquired infections. Rising awareness of infectious diseases and hygiene practices among the population is further boosting adoption of disinfectant solutions across hospitals, clinics, and public spaces.

- Surface disinfectants in Saudi Arabia are commonly formulated using active ingredients such as quaternary ammonium compounds, alcohols, chlorine compounds, hydrogen peroxide, and phenolics. Among these, alcohol based and quaternary ammonium disinfectants are widely preferred due to their fast-acting efficacy, broad antimicrobial spectrum, and compatibility with a wide range of surfaces. Concentrated disinfectants are gaining traction in institutional and commercial segments owing to cost efficiency and bulk usage advantages.

- Regulation by the Saudi Food and Drug Authority (SFDA) ensures that disinfectants meet stringent quality, safety, and efficacy standards, creating a structured and transparent business environment. The expanding private healthcare sector is further driving demand for effective surface disinfectants, encouraging adoption of innovative and high-performance cleaning solutions.

- Emerging trends such as digital hygiene monitoring systems, automated disinfectant dispensers, and AI-driven sanitization technologies are beginning to shape the market landscape. Overall, the Saudi KSA Surface Disinfectant Market is evolving into a technologically advanced and competitive sector, supporting improved hygiene practices and infection control across the country.

- In 2026, the Surface Disinfectants (General Hard Surface) segment is projected to dominate the KSA Surface Disinfectant Market, capturing a 28.66% share. This growth is driven by increasing demand for advanced diagnostic technologies, rising healthcare investments, and the adoption of innovative medical solutions across the region.

Report Scope and KSA Surface Disinfectant Market Segmentation

|

Attributes |

KSA Surface disinfectant Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

KSA Surface Disinfectant Market Trends

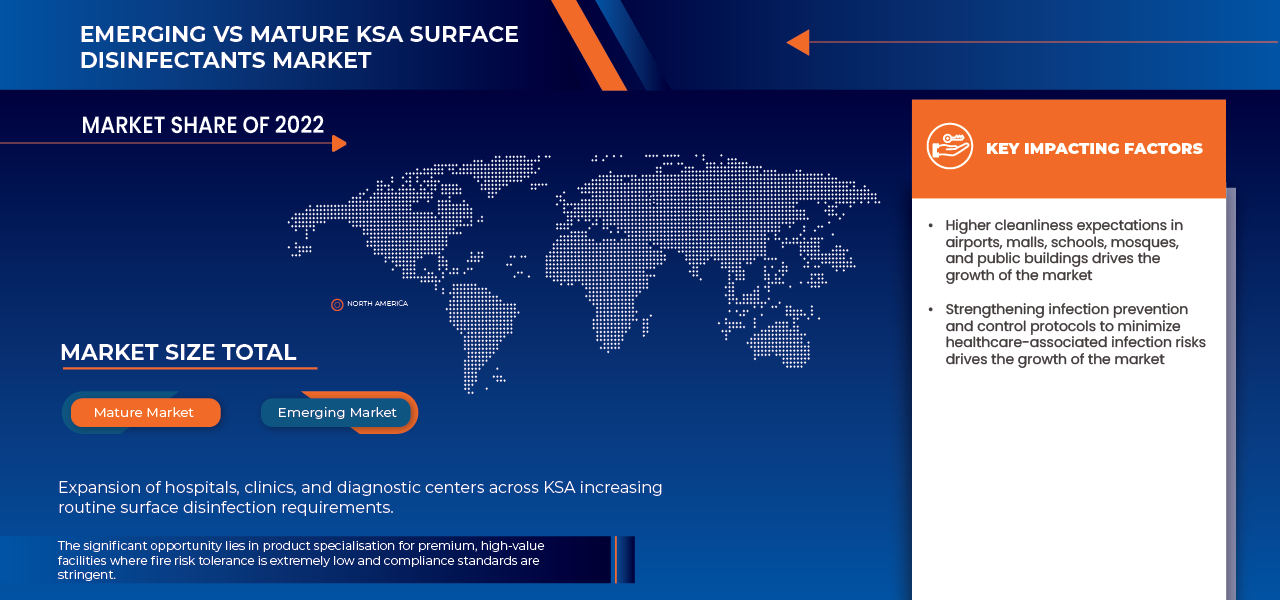

“Expansion of hospitals, clinics, and diagnostic centers across KSA increasing routine surface disinfection requirements”

- The expansion of hospitals, clinics, and diagnostic centers across the Kingdom of Saudi Arabia is a key driver for the surface disinfectants market, as healthcare infrastructure growth directly increases the frequency and scale of routine surface disinfection activities.

- Ongoing investments under national healthcare transformation initiatives are accelerating the establishment of new medical facilities while expanding capacity within existing hospitals. As these facilities scale operations, adherence to stringent infection prevention and control protocols becomes operationally critical, positioning surface disinfectants as essential consumables within daily clinical workflows.

- Regulatory emphasis on patient safety, accreditation compliance, and healthcare-associated infection mitigation further reinforces consistent and standardized surface disinfection practices. Consequently, the widening footprint of healthcare delivery in Saudi Arabia is structurally strengthening demand for surface disinfectant products across hospitals, outpatient clinics, laboratories, and diagnostic centers.

- For instance, inJanuary 2026, Dynamic Health Staff. analyses of Saudi Arabia’s healthcare expansion highlighted extensive Government investment in building new hospitals, medical cities, and state-of-the-art diagnostic centres, a trend that inherently increases the routine need for surface disinfection across diverse clinical environments.

- The continued expansion of hospitals, clinics, and diagnostic centers across the Kingdom of Saudi Arabia is structurally reinforcing demand for surface disinfectants, as increasing healthcare capacity necessitates consistent and large-scale adherence to infection prevention and control standards.

KSA Surface Disinfectant Market Dynamics

Driver

Higher cleanliness expectations in airports, malls, schools, mosques, and public buildings

- Higher cleanliness expectations in airports, malls, schools, mosques, and public buildings constitute a significant driver of the surface disinfectants market in the Kingdom of Saudi Arabia, as both government and private stakeholders intensify efforts to maintain hygienic environments in high-footfall and culturally sensitive location.

- Saudi authorities have progressively instituted policies, urban regulations, and operational standards that elevate hygiene and facility management practices as part of broader agendas to enhance quality of life, public safety, and visitor experience.

- Airports and transit hubs increasingly adopt advanced sanitation protocols to align with global travel expectations, while municipal authorities and facility operators in malls, educational institutions, and religious sites uphold stringent cleanliness standards to meet regulatory expectations and community norms.

- These heightened cleanliness demands translate into greater procurement and systematic utilization of surface disinfectants, reinforcing their role as indispensable tools for infection prevention and the maintenance of public health across diverse public settings.

- The adoption of advanced sanitation measures in transit hubs, the enforcement of operational standards in educational and religious institutions, and municipal regulations for commercial and public spaces collectively reinforce the essential role of surface disinfectants in maintaining hygienic conditions, thereby supporting sustained market growth in diverse public settings.

Restraint/Challenge

Limited pricing flexibility for branded and premium disinfectant solutions

- In the Kingdom of Saudi Arabia, limited pricing flexibility for branded and premium surface disinfectant solutions constitutes a significant restraint on market expansion. Regulatory frameworks governing pharmaceutical and related healthcare products, administered through the Saudi Food and Drug Authority (SFDA) and associated pricing rules, create a structured environment wherein pricing adjustments are subject to periodic review, constraints and ceiling mechanisms that often restrict the ability of manufacturers to command premium pricing.

- Furthermore, public procurement and tendering procedures generally emphasize cost-effective sourcing through unified procurement systems, thereby exerting downward pressure on prices and compressing margins for branded disinfectant offerings.

- This constrained pricing landscape diminishes incentives for product innovation and premium positioning, particularly when compared to generic or lower-cost alternatives, thus limiting the overall growth potential of the surface disinfectants market within the Kingdom.

- In January 2025, The Ministry of Health’s Recent Rules and Regulations portal reaffirmed updated procedural guides for licensing and market operations within the health sector, underscoring that health product regulation and compliance—including pricing—remain under ongoing review and formal processes administered by government authorities.

- Limited pricing flexibility for branded and premium surface disinfectant solutions represents a notable constraint on the growth of the Kingdom of Saudi Arabia’s market. Regulatory oversight by authorities such as the Saudi Food and Drug Authority enforces structured pricing mechanisms, including ceiling limits and periodic reviews, which restrict the ability of manufacturers to set premium prices.

KSA Surface Disinfectant Market Scope

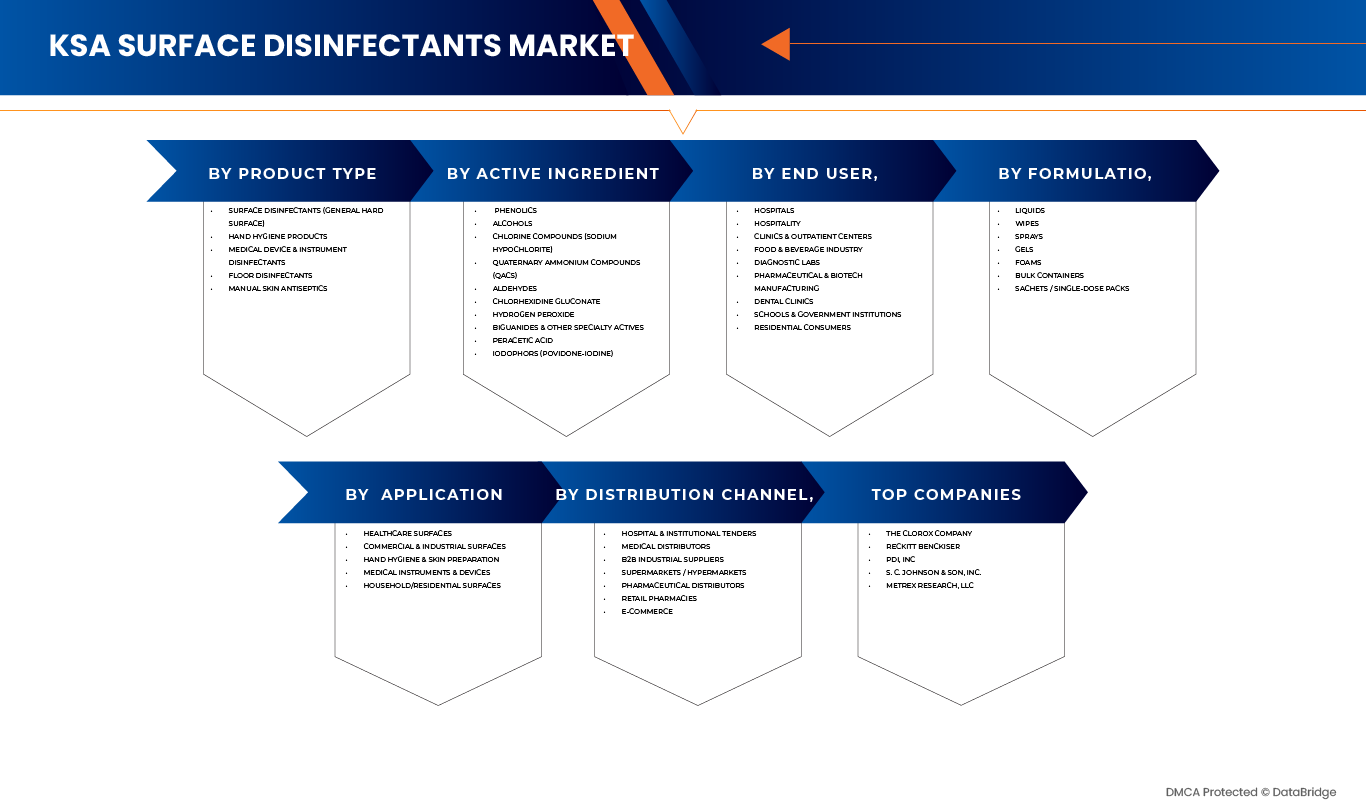

KSA Surface Disinfectants Market is segmented into six notable segments based on product type, active ingredient, formulation, application, end user, and distribution channel.

By Product Category

On the basis of product type, the market is segmented into surface disinfectants (general hard surface), hand hygiene products, surface disinfectant & instrument disinfectants, floor disinfectants, and manual skin antiseptics. In 2026, the surface disinfectants (general hard surface) segment is anticipated to dominate the market with the share of 28.66% in 2025 due to its critical role in maintaining hygiene across hospitals, clinics, and public spaces, as well as increasing awareness of infection prevention and cross-contamination control.

The surface disinfectant & instrument disinfectants segment in the market is expected to grow the fastest with a CAGR of 7.5% from 2026 to 2033, driven by rising medical procedures, stricter regulatory compliance for infection control, and increasing adoption of advanced sterilization and disinfection solutions in healthcare facilities.

By Active Ingredient

On the basis of active ingredient, the Saudi KSA Surface Disinfectant Market is segmented into alcohols, chlorine compounds (sodium hypochlorite), quaternary ammonium compounds (QACs), aldehydes, chlorhexidine gluconate, hydrogen peroxide, biguanides & other specialty actives, peracetic acid, iodophors (povidone-iodine), and phenolics.

In 2026, the Alcohols segment is anticipated to dominate the market by holding a market share of 18.64% in 2025 due to its broad-spectrum antimicrobial efficacy, safety profile, and widespread use in hospitals, laboratories, and high-risk healthcare environments

The peracetic acid segment is expected to grow the fastest with a CAGR of 7.9% from 2026 to 2033, driven by rising adoption in surface disinfectant sterilization, environmental disinfection, and regulatory preference for environmentally friendly, high-efficacy disinfectants.

By Formulation

On the basis of formulation, the Saudi KSA Surface Disinfectant Market is segmented into liquids, wipes, sprays, gels, foams, bulk containers, and sachets/single-dose packs

In 2026, the liquids segment is anticipated to dominate the market with the share of 32.71% in 2025 due to its versatility, ease of use in hospitals and clinics, and wide adoption for surface and equipment disinfection

The wipes segment is expected to grow the fastest with a CAGR of 7.4% from 2026 to 2033, driven by rising demand for convenient, ready-to-use disinfectant solutions in healthcare, homecare, and high-traffic public environments.

By Distribution Channel

On the basis of distribution channel, the Saudi KSA Surface Disinfectant Market is segmented into hospital & institutional tenders, medical distributors, B2B industrial suppliers, supermarkets/hypermarkets, pharmaceutical distributors, retail pharmacies, and e-commerce.

In 2026, the hospital & institutional tenders segment is anticipated to dominate the market with the share of 34.74% in 2025 due to large-volume procurement by hospitals, clinics, and healthcare institutions, ensuring consistent supply of disinfectants for infection control and hygiene maintenance.

The e-commerce segment is expected to grow the fastest with a CAGR of 7.7% from 2026 to 2033, driven by rising online adoption, convenience-based purchasing, and increasing demand for home-use disinfectants and hygiene products among residential consumers.

By Application

On the basis of application, the Saudi KSA Surface Disinfectant Market is segmented into healthcare surfaces, commercial & industrial surfaces, hand hygiene & skin preparation, medical instruments & devices, and household/residential surfaces.

In 2026, the healthcare surfaces segment is anticipated to dominate the market with the share of 28.46% in 2025 due to its critical role in preventing hospital-acquired infections and maintaining high hygiene standards in hospitals, clinics, and diagnostic centers.

The medical instruments & devices segment is expected to grow the fastest with a CAGR of 7.3% from 2026 to 2033, driven by increasing medical procedures, adoption of minimally invasive surgeries, and strict regulatory requirements for sterilization and infection control.

By End User

On the basis of end user, the Saudi KSA Surface Disinfectant Market is segmented into hospitals, hospitality, clinics & outpatient centers, food & beverage industry, diagnostic labs, pharmaceutical & biotech manufacturing, dental clinics, schools & government institutions, and residential consumers.

In 2026, the hospitals segment is anticipated to dominate the market with the market share of 31.84% in 2025 due to its critical role in infection prevention, high patient traffic, and strict regulatory requirements for maintaining hygienic environments.

The pharmaceutical & biotech manufacturing segment is expected to grow the fastest with a CAGR of 7.3% from 2026 to 2033, driven by the need for sterile manufacturing environments, regulatory compliance, and growing production capacities in the Kingdom.

The Major Market Leaders Operating in the Market Are:

- The Clorox Company (U.S.)

- Reckitt Benckiser (United Kingdom)

- PDI, Inc (U.S.)

- S. C. Johnson & Son, Inc. (U.S.)

- Metrex Research, LLC (U.S.)

- SIDCO (Saudi Arabia)

- Al Arfaj Medical Services (Saudi Arabia)

- United Industrial Chemicals (Saudi Arabia)

- Knooz Al-Ardh Detergent Manufacturing CO. LLC (Saudi Arabia)

- ADVANCE HYGIENE (Saudi Arabia)

- 3M (U.S.)

- GULF HYGIENE CO LTD (Saudi Arabia)

Latest Developments in KSA Surface Disinfectant Market

- In December 2025, Reckitt completed the divestment of its Essential Home business to private equity firm Arcline Investment Management. The transaction marked the exit of Reckitt’s cleaning category branded portfolio—such as Lysol and Finish—and aligned with its strategic focus on higher-growth health, hygiene, and nutrition segments.

- In November 2025, a new report by the Ellen MacArthur Foundation highlighted SC Johnson’s progress in advancing circular economy solutions, emphasizing the company’s innovations in recyclable packaging design, material reuse, and partnerships that support scalable systemic change toward reduced plastic waste.

- In November 2025, The Clorox Company announced it will present at the Morgan Stanley Global Consumer & Retail Conference, highlighting its strategic priorities, portfolio performance, and growth initiatives to institutional investors and analysts as part of its investor-relations engagement cycle.

- In January 2025 , DHL Supply Chain acquired Inmar Supply Chain Solutions, adding 14 return centers and ~800 staff to become the largest provider of reverse logistics in North America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE KSA SURFACE DISINFECTANTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END USER COVERAGE GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 REGULATORY STANDARDS

4.2.1 NATIONAL REGULATORY FRAMEWORK

4.2.1.1 REGULATORY AUTHORITIES & MANDATES

4.2.1.2 PRODUCT CLASSIFICATION & REGULATED CATEGORIES

4.2.2 PRODUCT REGISTRATION, CERTIFICATION & MARKET ACCESS

4.2.2.1 SFDA REGISTRATION & CLAIMS GOVERNANCE

4.2.2.2 SASO/SABER CONFORMITY ASSESSMENT

4.2.3 LABELING, PACKAGING & CLAIM REQUIREMENTS

4.2.3.1 LABELING & LANGUAGE REQUIREMENTS

4.2.4 SAFETY, TESTING & QUALITY STANDARDS

4.2.4.1 TECHNICAL STANDARDS & RISK MANAGEMENT

4.2.5 POST-MARKET SURVEILLANCE & ENFORCEMENT

4.2.6 REGULATORY INTERACTIONS & BORDER CONTROLS

4.2.6.1 CUSTOMS & IMPORT OVERSIGHT

4.2.7 REGULATORY GAPS & MARKET IMPLICATIONS

4.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.3.1 STRATEGIC CONTEXT AND MARKET PURPOSE

4.3.2 DEMAND FUNDAMENTALS AND END-USE CONCENTRATION

4.3.3 REGULATORY AND COMPLIANCE ENVIRONMENT

4.3.4 INNOVATION DIRECTIONS SHAPING THE CATEGORY

4.3.5 FUTURISTIC SCENARIO (2026–2030): HOW THE MARKET IS LIKELY TO EVOLVE

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.4.1 MARKET PENETRATION LANDSCAPE BY END-USE SECTOR

4.4.1.1 HEALTHCARE AND LONG-TERM CARE — HIGHEST PENETRATION AND STRONGEST PROTOCOL INTENSITY

4.4.1.2 HOSPITALITY (HOTELS AND SERVICED ACCOMMODATION) — HIGH AND EXPANDING PENETRATION

4.4.1.3 EDUCATION AND PUBLIC FACILITIES — MODERATE PENETRATION WITH VARIABILITY BY OPERATOR MATURITY

4.4.1.4 TRANSPORTATION NODES AND MASS GATHERING VENUES — MODERATE-TO-HIGH GROWTH PENETRATION

4.4.1.5 RESIDENTIAL/CONSUMER RETAIL — BROAD REACH, LOWER PROTOCOL INTENSITY

4.4.2 PENETRATION MAPPING BY PRODUCT TYPE AND FORMAT

4.4.2.1 LIQUIDS AND CONCENTRATES (INSTITUTIONAL BACKBONE)

4.4.2.2 READY-TO-USE SPRAYS AND TRIGGERS (SPEED AND OPERATIONAL CONVENIENCE)

4.4.2.3 DISINFECTANT WIPES (WORKFLOW SIMPLIFICATION AND TOUCHPOINT COVERAGE)

4.4.3 CHANNEL PENETRATION AND PROCUREMENT DRIVERS

4.4.3.1 INSTITUTIONAL PROCUREMENT AND TENDER ECOSYSTEMS

4.4.3.2 FACILITY MANAGEMENT CONTRACTORS AND HYGIENE SOLUTION INTEGRATORS

4.4.3.3 MODERN TRADE, PHARMACIES, AND E-COMMERCE

4.4.4 REGULATORY AND CLAIMS GOVERNANCE AS A PENETRATION FILTER

4.4.4.1 CLASSIFICATION CLARITY AFFECTS MARKET ACCESS AND MESSAGING

4.4.5 GROWTH ENGINES EXPECTED TO EXPAND PENETRATION

4.4.5.1 INSTITUTIONALIZATION OF IPC-ALIGNED ENVIRONMENTAL HYGIENE BEYOND HOSPITALS

4.4.5.2 TOURISM AND HOSPITALITY QUALITY ASSURANCE

4.4.5.3 PROCUREMENT QUALIFICATION AND LOCALIZATION-LINKED COMPETITIVENESS

4.5 NEW BUSINESS AND EMERGING BUSINESSES’ REVENUE OPPORTUNITIES

4.5.1 SHIFT FROM PRODUCT SALES TO “PRODUCT PLUS PROGRAM” REVENUE MODELS

4.5.1.1 SOLUTION-LED OFFERINGS REPLACING COMMODITY DISINFECTANTS

4.5.1.2 DOCUMENTATION-AS-A-SERVICE AS A MONETIZABLE CAPABILITY

4.5.2 HIGH-VALUE REVENUE OPPORTUNITIES BY END-USE SEGMENT

4.5.2.1 GOVERNMENT HEALTHCARE PROCUREMENT ECOSYSTEMS

4.5.2.2 HOSPITALS, LONG-TERM CARE, AND REHABILITATION FACILITIES

4.5.2.3 HOSPITALITY AND TOURISM INFRASTRUCTURE

4.5.2.4 FACILITY MANAGEMENT CONTRACTORS AND MULTI-SITE OPERATORS

4.5.3 REGULATORY ALIGNMENT AS A COMMERCIAL DIFFERENTIATOR

4.5.4 LOCALIZATION-DRIVEN REVENUE PATHWAYS

4.5.4.1 LOCAL MANUFACTURING, FILLING, AND PACKAGING ADVANTAGES

4.5.4.2 MARKET-ACCESS SERVICES FOR INTERNATIONAL BRANDS

4.5.5 SUSTAINABILITY AND SAFER-USE POSITIONING AS EMERGING REVENUE STREAMS

4.5.6 PRODUCT-FORMAT OPPORTUNITIES WITH STRONG ADOPTION LOGIC

4.5.7 GO-TO-MARKET STRATEGIES WITH STRONG REVENUE LEVERAGE

4.6 TECHNOLOGY ANALYSIS

4.6.1 KEY TECHNOLOGIES

4.6.2 COMPLEMENTARY TECHNOLOGIES

4.6.3 ADJACENT TECHNOLOGIES

4.7 COMPANY COMPETITIVE ANALYSIS

4.7.1 STRATEGIC DEVELOPMENT

4.7.2 TECHNOLOGY IMPLEMENTATION PROCESS

4.7.2.1 CHALLENGES

4.7.2.2 IN-HOUSE IMPLEMENTATION / OUTSOURCED (THIRD-PARTY) IMPLEMENTATION

4.7.3 CUSTOMER BASE

4.7.4 SERVICE POSITIONING

4.7.5 CUSTOMER FEEDBACK / RATING (B2B OR B2C)

4.7.6 APPLICATION REACH

4.7.7 SERVICE PLATFORM MATRIX

4.8 USE CASES & ITS ANALYSIS

4.8.1 HEALTHCARE FACILITIES

4.8.2 COMMERCIAL AND INSTITUTIONAL BUILDINGS

4.8.3 HOSPITALITY AND TOURISM SECTOR

4.8.4 FOOD PROCESSING AND RETAIL

4.8.5 TRANSPORTATION AND PUBLIC INFRASTRUCTURE

4.8.6 INDUSTRIAL AND MANUFACTURING FACILITIES

4.8.7 USE CASE ANALYSIS SUMMARY

4.9 ROLE AND IMPACT OF SFDA IN THE KSA SURFACE DISINFECTANTS MARKET

4.9.1 SFDA AS A CENTRAL MARKET GATEKEEPER FOR SURFACE DISINFECTANTS IN KSA

4.9.2 SFDA REGISTRATION REQUIREMENTS

4.9.3 IMPACT OF SFDA COMPLIANCE ON COST STRUCTURE AND PRICING

4.9.4 ROLE OF SFDA IN THE KSA SURFACE DISINFECTANTS MARKET

4.9.4.1 KEY RESPONSIBILITIES OF SFDA IN THE SURFACE DISINFECTANTS MARKET

4.9.4.1.1 PRODUCT REGISTRATION AND APPROVAL

4.9.4.1.2 EVALUATION OF SAFETY, EFFICACY, AND LABELING CLAIMS

4.9.4.1.3 REGULATION OF ACTIVE INGREDIENTS AND FORMULATIONS

4.9.4.1.4 MONITORING COMPLIANCE FOR IMPORTED AND LOCALLY MANUFACTURED PRODUCTS

4.9.4.1.5 POST-MARKET SURVEILLANCE

4.9.5 STRATEGIC IMPLICATIONS FOR MARKET PARTICIPANTS

4.9.6 FUTURE OUTLOOK OF SFDA IN THE SURFACE DISINFECTANTS MARKET

4.1 TARIFFS & IMPACT

4.10.1 OVERVIEW

4.10.2 TARIFF STRUCTURES

4.10.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.10.2.2 UNITED STATES: TARIFF POLICIES

4.10.2.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

4.10.2.4 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON SERVICES PROVIDED

4.10.3 INCREASED COSTS OF PRODUCTION

4.10.3.1 RAW MATERIALS AND COMPONENTS

4.10.3.2 FINISHED PRODUCTS

4.10.4 DISRUPTION OF GLOBAL SUPPLY CHAINS

4.10.4.1 MANUFACTURING SHIFTS

4.10.4.2 TRADE CONFLICTS

4.10.5 IMPACT ON R&D AND INNOVATION

4.10.6 PRICE VOLATILITY

4.10.6.1 FLUCTUATING PRICES

4.10.6.2 END-CONSUMER COSTS

4.10.7 GEOPOLITICAL TENSIONS AND MARKET SHIFTS

4.10.7.1 SHIFTS IN PRODUCTION LOCATIONS

4.10.7.2 REGIONAL SUPPLY CHAINS

4.10.8 IMPACT ON SMALLER AND DEVELOPING MARKETS

4.10.8.1 DISADVANTAGES FOR SMALLER PLAYERS

4.10.8.2 EXCLUSION FROM GLOBAL TRADE

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 EXPANSION OF HOSPITALS, CLINICS, AND DIAGNOSTIC CENTERS ACROSS KSA INCREASING ROUTINE SURFACE DISINFECTION REQUIREMENTS

5.1.2 HIGHER CLEANLINESS EXPECTATIONS IN AIRPORTS, MALLS, SCHOOLS, MOSQUES, AND PUBLIC BUILDINGS

5.1.3 STRENGTHENING INFECTION PREVENTION AND CONTROL PROTOCOLS TO MINIMIZE HEALTHCARE-ASSOCIATED INFECTION RISKS

5.2 RESTRAINT

5.2.1 LIMITED PRICING FLEXIBILITY FOR BRANDED AND PREMIUM DISINFECTANT SOLUTIONS

5.2.2 RISK OF SURFACE CORROSION OR DISCOLORATION FROM FREQUENT CHEMICAL EXPOSURE

5.3 OPPORTUNITIES

5.3.1 SHIFTING CONSUMERS' PREFERENCE TOWARDS USE OF BIO-BASED AND NATURE FRIENDLY DISINFECTANT

5.3.2 OPPORTUNITIES FOR CONTRACT MANUFACTURING AND PRIVATE BRANDING

5.4 CHALLENGES

5.4.1 INCREASED COMPLIANCE MONITORING BY AUTHORITIES

5.4.2 GROWING SCRUTINY OF CHEMICAL EXPOSURE FOR CLEANING PERSONNEL

6 KSA SURFACE DISINFECTANTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD MILLION)

6.1 OVERVIEW

6.2 SURFACE DISINFECTANTS (GENERAL HARD SURFACE)

6.3 HAND HYGIENE PRODUCTS

6.4 MEDICAL DEVICE & INSTRUMENT DISINFECTANTS

6.5 FLOOR DISINFECTANTS

6.6 MANUAL SKIN ANTISEPTICS

6.7 KSA SURFACE DISINFECTANTS (GENERAL HARD SURFACE) IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.7.1 MULTI-SURFACE DISINFECTANT LIQUIDS

6.7.2 READY-TO-USE SPRAYS

6.7.3 MULTI-PURPOSE CLEANERS WITH DISINFECTANT CLAIMS

6.7.4 DISINFECTANT WIPES

6.8 KSA SURFACE DISINFECTANTS (GENERAL HARD SURFACE) IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

6.8.1 500 ML

6.8.2 5 L

6.8.3 1 L

6.8.4 2 L

6.8.5 750 ML

6.8.6 OTHERS

6.9 KSA HAND HYGIENE PRODUCTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.9.1 ALCOHOL-BASED HAND SANITIZERS

6.9.2 ANTISEPTIC HAND WASHES

6.9.3 NON-ALCOHOL HAND SANITIZERS

6.9.4 CHLORHEXIDINE-BASED HAND RUBS & HAND WASHES

6.1 KSA ALCOHOL-BASED HAND SANITIZERS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.10.1 GEL

6.10.2 LIQUID

6.10.3 SPRAY

6.11 KSA CHLORHEXIDINE-BASED HAND RUBS & HAND WASHES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.11.1 2% SOLUTIONS

6.11.2 4% SOLUTIONS

6.12 KSA HAND HYGIENE PRODUCTS IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

6.12.1 500 ML

6.12.2 1 L

6.12.3 5 L

6.12.4 2 L

6.12.5 750 ML

6.12.6 OTHERS

6.13 KSA MEDICAL DEVICE & INSTRUMENT DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.13.1 HIGH-LEVEL DISINFECTANTS

6.13.2 INTERMEDIATE / LOW-LEVEL DISINFECTANTS

6.13.3 ENZYMATIC DISINFECTANT CLEANERS

6.13.4 SOAKING SOLUTIONS FOR SURGICAL INSTRUMENTS

6.14 KSA HIGH-LEVEL DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.14.1 GLUTARALDEHYDE

6.14.2 OPA

6.15 KSA ENZYMATIC DISINFECTANT CLEANERS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.15.1 CONCENTRATED ENZYMATIC CLEANERS

6.15.2 READY-TO-USE ENZYMATIC CLEANERS

6.16 KSA MEDICAL DEVICE & INSTRUMENT DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY REPROCESSING METHOD, 2018-2033 (USD MILLION)

6.16.1 MANUAL REPROCESSING

6.16.2 AUTOMATED REPROCESSING

6.17 KSA MANUAL REPROCESSING IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

6.17.1 500 ML

6.17.2 1 L

6.17.3 750 ML

6.17.4 2 L

6.17.5 5 L

6.17.6 OTHERS

6.18 KSA AUTOMATED REPROCESSING IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

6.18.1 1 L

6.18.2 5 L

6.18.3 2 L

6.18.4 10 L

6.18.5 20 L

6.18.6 OTHERS

6.19 KSA FLOOR DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.19.1 CONCENTRATED FLOOR DISINFECTANT LIQUIDS

6.19.2 INDUSTRIAL/COMMERCIAL HEAVY-DUTY FLOOR DISINFECTANTS

6.19.3 READY-TO-USE FLOOR CLEANERS

6.2 KSA MANUAL SKIN ANTISEPTICS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.20.1 CHLORHEXIDINE GLUCONATE

6.20.2 PRE-OPERATIVE & PRE-INJECTION ANTISEPTICS

6.20.3 WOUND CARE ANTISEPTIC SOLUTIONS

6.20.4 POVIDONE-IODINE SOLUTIONS

6.21 KSA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

6.21.1 2% SOLUTIONS

6.21.2 4% SOLUTIONS

7 KSA SURFACE DISINFECTANTS MARKET, BY ACTIVE INGREDIENT, 2018-2033 (USD MILLION)

7.1 OVERVIEW

7.2 ALCOHOLS

7.3 CHLORINE COMPOUNDS (SODIUM HYPOCHLORITE)

7.4 QUATERNARY AMMONIUM COMPOUNDS (QACS)

7.5 ALDEHYDES

7.6 CHLORHEXIDINE GLUCONATE

7.7 HYDROGEN PEROXIDE

7.8 BIGUANIDES & OTHER SPECIALTY ACTIVES

7.9 PERACETIC ACID

7.1 IODOPHORS (POVIDONE-IODINE)

7.11 PHENOLICS

7.12 KSA ALCOHOLS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

7.12.1 ETHANOL

7.12.2 ISOPROPANOL

7.13 KSA ALDEHYDES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

7.13.1 GLUTARALDEHYDE

7.13.2 OPA

7.14 KSA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

7.14.1 2% SOLUTIONS

7.14.2 4% SOLUTIONS

8 KSA SURFACE DISINFECTANTS MARKET, BY FORMULATION, 2018-2033 (USD MILLION)

8.1 OVERVIEW

8.2 LIQUIDS

8.3 WIPES

8.4 SPRAYS

8.5 GELS

8.6 FOAMS

8.7 BULK CONTAINERS

8.8 SACHETS / SINGLE-DOSE PACKS

9 KSA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

9.1 OVERVIEW

9.2 HEALTHCARE SURFACES

9.3 COMMERCIAL & INDUSTRIAL SURFACES

9.4 HAND HYGIENE & SKIN PREPARATION

9.5 MEDICAL INSTRUMENTS & DEVICES

9.6 HOUSEHOLD / RESIDENTIAL SURFACES

9.7 KSA HEALTHCARE SURFACES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

9.7.1 BED SURFACES, TABLES, TROLLEYS

9.7.2 ICU/OT SURFACES

9.7.3 HOSPITAL FLOORS

9.8 KSA COMMERCIAL & INDUSTRIAL SURFACES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

9.8.1 OFFICES, MALLS, HOSPITALITY

9.8.2 FOOD PROCESSING AREAS

9.8.3 PHARMA MANUFACTURING

9.9 KSA HAND HYGIENE & SKIN PREPARATION IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

9.9.1 HEALTHCARE WORKER HAND SANITIZATION

9.9.2 PATIENT SKIN PREP

9.9.3 SURGICAL HAND SCRUB

9.1 KSA MEDICAL INSTRUMENTS & DEVICES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

9.10.1 REUSABLE SURGICAL INSTRUMENTS

9.10.2 ENDOSCOPES

9.10.3 DENTAL INSTRUMENTS

10 KSA SURFACE DISINFECTANTS MARKET, BY END USER, 2018-2033 (USD MILLION)

10.1 OVERVIEW

10.2 HOSPITALS

10.3 HOSPITALITY

10.4 CLINICS & OUTPATIENT CENTERS

10.5 FOOD & BEVERAGE INDUSTRY

10.6 DIAGNOSTIC LABS

10.7 PHARMACEUTICAL & BIOTECH MANUFACTURING

10.8 DENTAL CLINICS

10.9 SCHOOLS & GOVERNMENT INSTITUTIONS

10.1 RESIDENTIAL CONSUMERS

10.11 KSA HOSPITALS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

10.11.1 PUBLIC

10.11.2 PRIVATE

10.12 KSA HOSPITALITY IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

10.12.1 HOTELS

10.12.2 MALLS

10.12.3 AIRPORTS

10.12.4 OTHERS

11 KSA SURFACE DISINFECTANTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

11.1 OVERVIEW

11.2 HOSPITAL & INSTITUTIONAL TENDERS

11.3 MEDICAL DISTRIBUTORS

11.4 B2B INDUSTRIAL SUPPLIERS

11.5 SUPERMARKETS / HYPERMARKETS

11.6 PHARMACEUTICAL DISTRIBUTORS

11.7 RETAIL PHARMACIES

11.8 E-COMMERCE

12 GLOBAL INTEROPERABILITY MARKET: COMPANY LANDSCAPE

12.1 MANUFACTURER COMPANY SHARE ANALYSIS: KSA

13 SWOT ANALYSIS

14 COMAPANY PROFILES

14.1 RECKITT BENCKISER

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 S. C. JOHNSON & SON, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 THE CLOROX COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 3M

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 PDI, INC

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 ADVANCE HYGIENE

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 AL ARFAJ MEDICAL SERVICES

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GULF HYGIENE CO LTD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 KNOOZ AL-ARDH DETERGENT MANUFACTURING CO. LLC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 METREX RESEARCH, LLC

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 SIDCO

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 UNITED INDUSTRIAL CHEMICALS.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 COMPANY SERVICE PLATFORM MATRIX

TABLE 4 KSA SURFACE DISINFECTANTS MARKET, BY PRODUCT TYPE, 2018-2033 (USD MILLION)

TABLE 5 KSA SURFACE DISINFECTANTS (GENERAL HARD SURFACE) IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 6 KSA SURFACE DISINFECTANTS (GENERAL HARD SURFACE) IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

TABLE 7 KSA HAND HYGIENE PRODUCTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 8 KSA ALCOHOL-BASED HAND SANITIZERS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 9 KSA CHLORHEXIDINE-BASED HAND RUBS & HAND WASHES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 10 KSA HAND HYGIENE PRODUCTS IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

TABLE 11 KSA MEDICAL DEVICE & INSTRUMENT DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 12 KSA HIGH-LEVEL DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 13 KSA ENZYMATIC DISINFECTANT CLEANERS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 14 KSA MEDICAL DEVICE & INSTRUMENT DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY REPROCESSING METHOD, 2018-2033 (USD MILLION)

TABLE 15 KSA MANUAL REPROCESSING IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

TABLE 16 KSA AUTOMATED REPROCESSING IN SURFACE DISINFECTANTS MARKET, BY PRODUCT SIZE, 2018-2033 (USD MILLION)

TABLE 17 KSA FLOOR DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 18 KSA MANUAL SKIN ANTISEPTICS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 19 KSA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 20 KSA SURFACE DISINFECTANTS MARKET, BY ACTIVE INGREDIENT, 2018-2033 (USD MILLION)

TABLE 21 KSA ALCOHOLS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 22 KSA ALDEHYDES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 23 KSA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 24 KSA SURFACE DISINFECTANTS MARKET, BY FORMULATION, 2018-2033 (USD MILLION)

TABLE 25 KSA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 26 KSA HEALTHCARE SURFACES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 27 KSA COMMERCIAL & INDUSTRIAL SURFACES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 28 KSA HAND HYGIENE & SKIN PREPARATION IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 29 KSA MEDICAL INSTRUMENTS & DEVICES IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 30 KSA SURFACE DISINFECTANTS MARKET, BY END USER, 2018-2033 (USD MILLION)

TABLE 31 KSA HOSPITALS IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 32 KSA HOSPITALITY IN SURFACE DISINFECTANTS MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 33 KSA SURFACE DISINFECTANTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

List of Figure

FIGURE 1 KSA SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 2 KSA SURFACE DISINFECTANTS MARKET: DATA TRIANGULATION

FIGURE 3 KSA SURFACE DISINFECTANTS MARKET: DROC ANALYSIS

FIGURE 4 KSA SURFACE DISINFECTANTS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 KSA SURFACE DISINFECTANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA SURFACE DISINFECTANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA SURFACE DISINFECTANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA SURFACE DISINFECTANTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 KSA SURFACE DISINFECTANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 KSA SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 FIVE SEGMENTS COMPRISE THE KSA SURFACE DISINFECTANTS MARKET, BY PRODUCT TYPE (2025)

FIGURE 13 HIGHER CLEANLINESS EXPECTATIONS IN AIRPORTS, MALLS, SCHOOLS, MOSQUES, AND PUBLIC BUILDINGS IS EXPECTED TO DRIVE THE GROWTH OF THE KSA SURFACE DISINFECTANTS MARKET FROM 2026 TO 2033

FIGURE 14 THE SURFACE DISINFECTANTS (GENERAL HARD SURFACE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA SURFACE DISINFECTANTS MARKET IN 2026 - 2033

FIGURE 15 DROC ANALYSIS

FIGURE 16 KSA SURFACE DISINFECTANTS MARKET: BY PRODTUCT TYPE, 2025

FIGURE 17 KSA SURFACE DISINFECTANTS MARKET, MARKET SHARE ANALYSIS, BY PRODUCT TYPE

FIGURE 18 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS, BY PRODUCT TYPE

FIGURE 19 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS, BY PRODUCT TYPE

FIGURE 20 KSA SURFACE DISINFECTANTS MARKET: BY ACTIVE INGREDIENT, 2025

FIGURE 21 KSA SURFACE DISINFECTANTS MARKET, MARKET SHARE ANALYSIS, BY ACTIVE INGREDIENTS

FIGURE 22 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY ACTIVE INGREDIENTS

FIGURE 23 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY ACTIVE INGREDIENTS

FIGURE 24 KSA SURFACE DISINFECTANTS MARKET: BY FORMULATION, 2025

FIGURE 25 KSA SURFACE DISINFECTANTS MARKET, MARKET SHARE ANALYSIS BY FORMULATION

FIGURE 26 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY FORMULATION

FIGURE 27 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY FORMULATION

FIGURE 28 KSA SURFACE DISINFECTANTS MARKET: BY APPLICATION, 2025

FIGURE 29 KSA SURFACE DISINFECTANTS MARKET, MARKET SHARE ANALYSIS BY APPLICATION

FIGURE 30 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY APPLICATION

FIGURE 31 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY APPLICATION

FIGURE 32 KSA SURFACE DISINFECTANTS MARKET: BY END USER, 2025

FIGURE 33 KSA SURFACE DISINFECTANTS MARKET, MARKET SHARE ANALYSIS BY END USER

FIGURE 34 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY END USER

FIGURE 35 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY END USER

FIGURE 36 KSA SURFACE DISINFECTANTS MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 37 KSA SURFACE DISINFECTANTS MARKET, MARKET SHARE ANALYSIS BY DISTRIBUTION CHANNEL

FIGURE 38 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY DISTRIBUTION CHANNEL

FIGURE 39 KSA SURFACE DISINFECTANTS MARKET, GROWTH ANALYSIS BY DISTRIBUTION CHANNEL

FIGURE 40 GLOBAL INTEROPERABILITY MARKET: COMPANY SHARE 2025 (%)

Ksa Surface Disinfectant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Ksa Surface Disinfectant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Ksa Surface Disinfectant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.